Will Australia’s 2025 Election Solve the Housing Crisis? What Homebuyers Need to Know

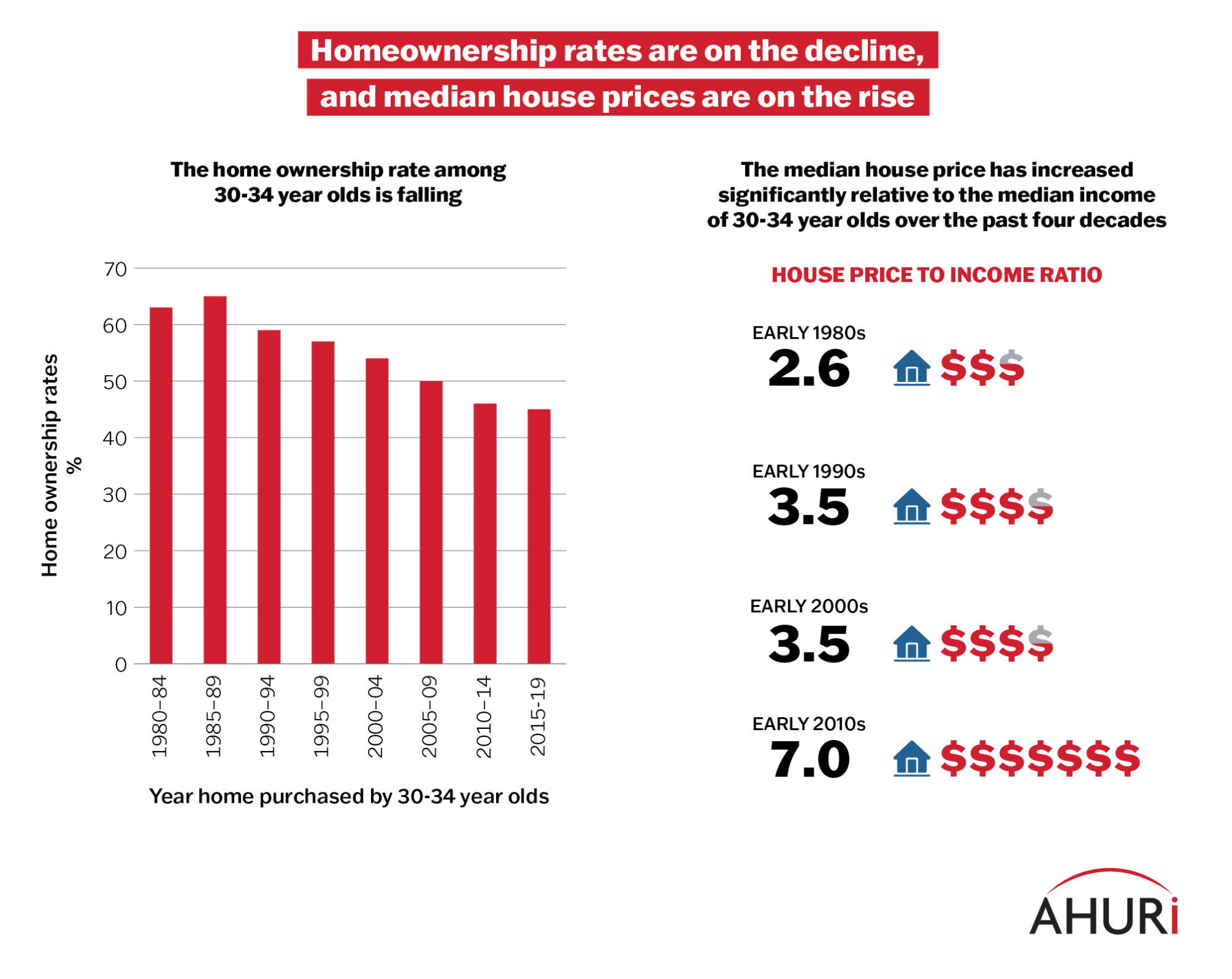

In 2024, only 22% of Australians expressed satisfaction with the availability of affordable housing—a record low, according to Gallup polling. This discontent reflects a housing market under immense strain, where the house price-to-income ratio has nearly doubled since 2002. Despite government initiatives like the Housing Australia Future Fund, which pledged $10 billion to construct 30,000 affordable homes over five years, critics argue these measures barely scratch the surface of a crisis decades in the making.

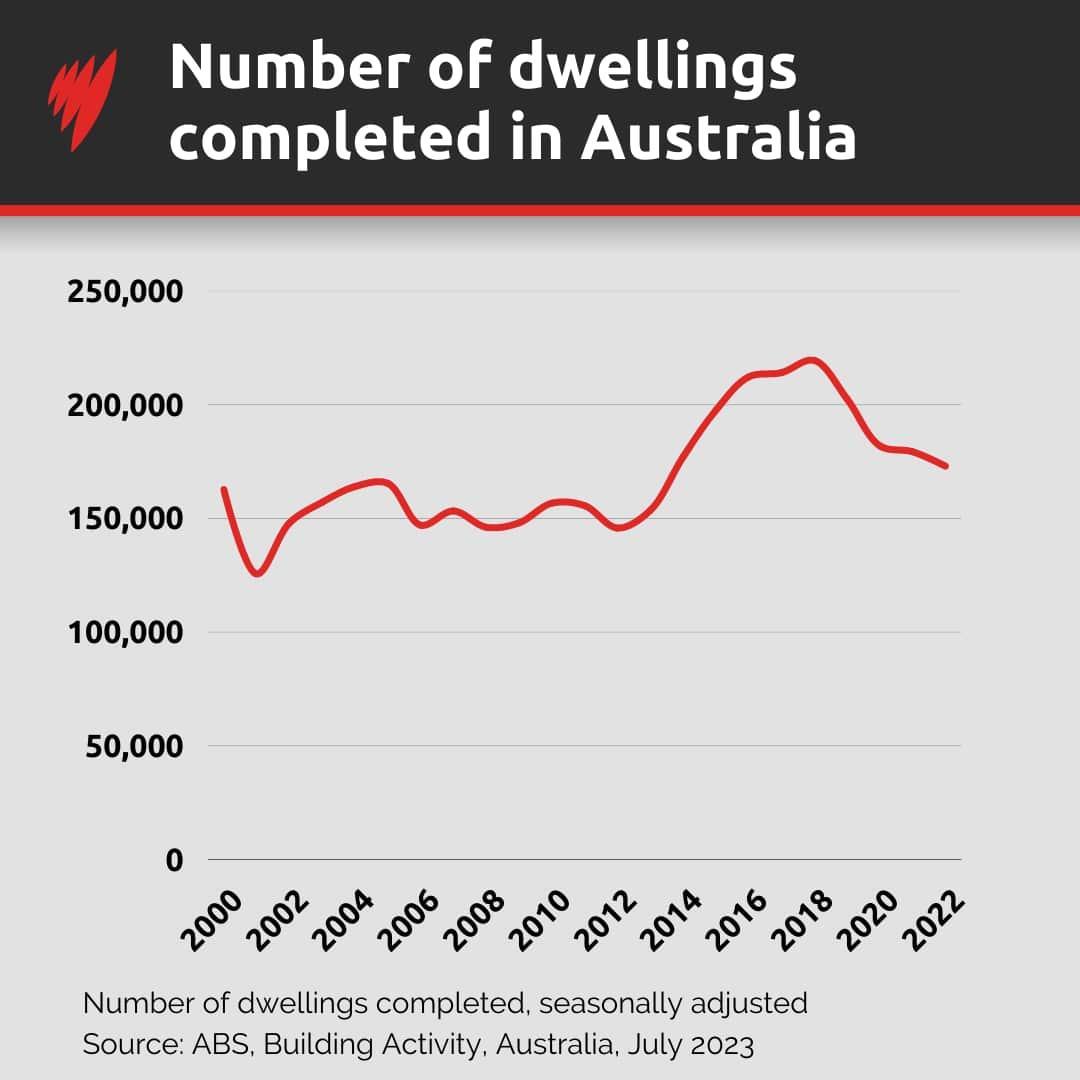

The roots of the issue are multifaceted. High immigration rates—adding one million people in just two years—have intensified demand, while construction approvals fell to 168,000 in 2024, far below targets. Compounding this, construction costs have surged 40% since the pandemic, rendering many projects financially unviable.

As Australia approaches its 2025 federal election, housing policy has become a political battleground. Whether proposed reforms can address systemic imbalances remains an open question.

Image source: ahuri.edu.au

Key Factors Driving the Crisis

A critical yet underexplored driver of Australia’s housing crisis is the rigidity of zoning laws, which severely restrict the availability of development-ready land in urban centers. These regulations, often designed to preserve neighborhood character, inadvertently limit housing density in areas with high demand. This scarcity inflates land prices, making new developments financially prohibitive for many builders.

The mechanics of zoning restrictions reveal their disproportionate impact on housing supply. For instance, medium- and high-density projects face prolonged approval timelines, often exceeding two years, compared to detached housing developments. This delay not only increases costs but also deters investment in urban densification. According to the Urban Development Institute of Australia, such inefficiencies contribute to a shortfall of 400,000 dwellings in metropolitan areas.

Comparatively, cities like Tokyo, which have adopted flexible zoning policies, demonstrate the potential for increased housing supply without compromising urban livability. However, replicating this model in Australia faces political resistance and entrenched local opposition.

“Without addressing zoning rigidity, even the most ambitious housing targets will remain out of reach,”

— Dr. Helen Martins, Urban Planning Specialist

This analysis highlights that resolving the crisis requires not just more housing but systemic reform to unlock urban land potential, ensuring sustainable growth.

Impact on Homebuyers and Renters

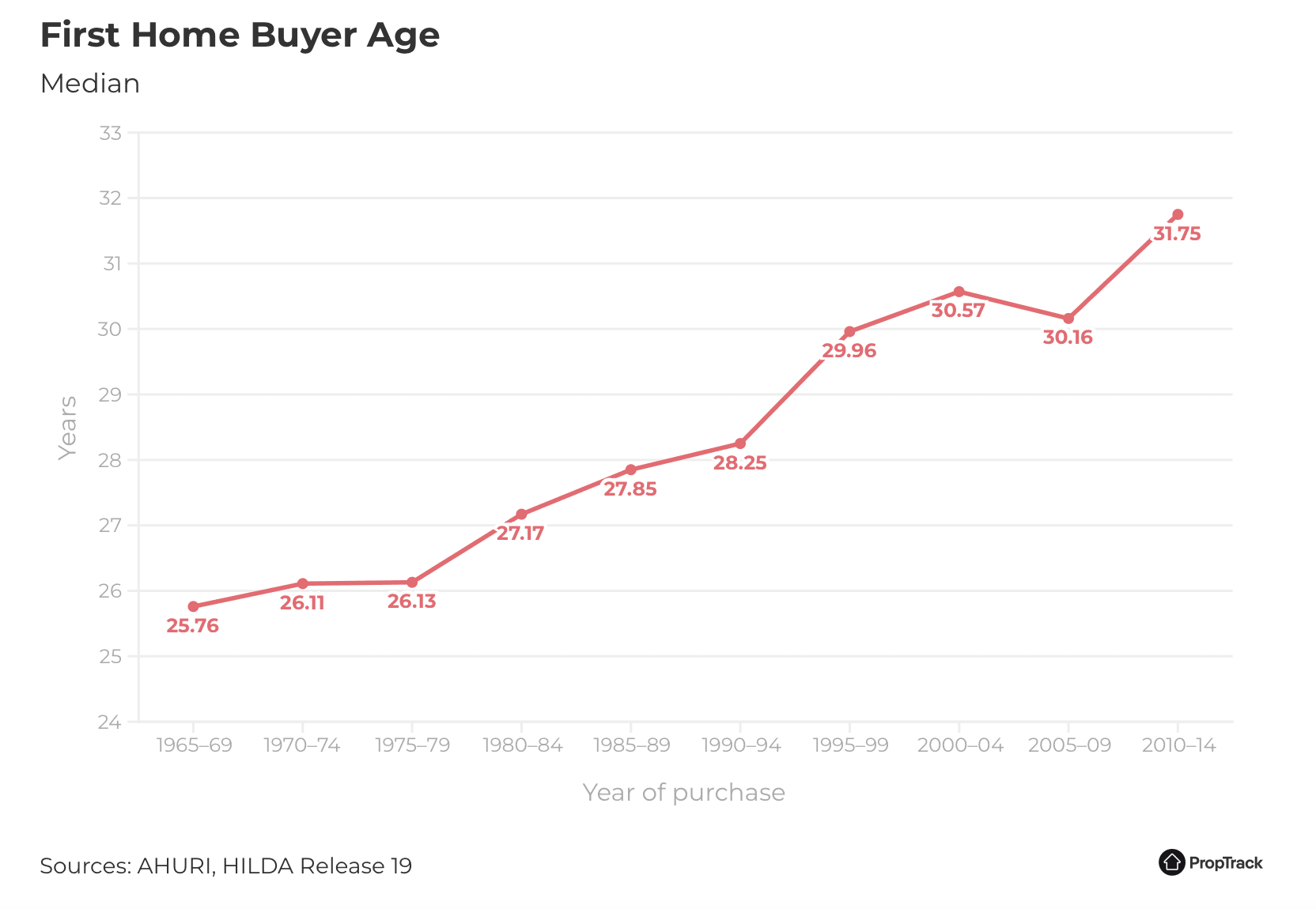

The interplay between restrictive lending policies and escalating property prices has created a significant barrier for first-time homebuyers. Stricter lending rules, introduced to curb risky borrowing, have inadvertently excluded many potential buyers from the market. This exclusion reduces demand for new housing developments, further stagnating supply and exacerbating affordability challenges.

One overlooked dynamic is how these policies disproportionately affect younger buyers. With limited savings and rising interest rates, many are forced to remain in the rental market, intensifying competition and driving rents higher. According to JLL reports, rental vacancy rates in cities like Sydney have hit historic lows, leaving renters vulnerable to price surges and displacement.

A comparative analysis reveals that while countries like Germany have implemented tenant protections to stabilize rental markets, Australia’s reliance on market-driven solutions leaves renters exposed. This highlights a critical limitation: financial interventions alone cannot resolve structural imbalances.

“Addressing affordability requires aligning lending policies with broader housing reforms,”

— Dr. Sarah Holden, Housing Economist

This underscores the need for integrated strategies that balance financial regulation with supply-side solutions.

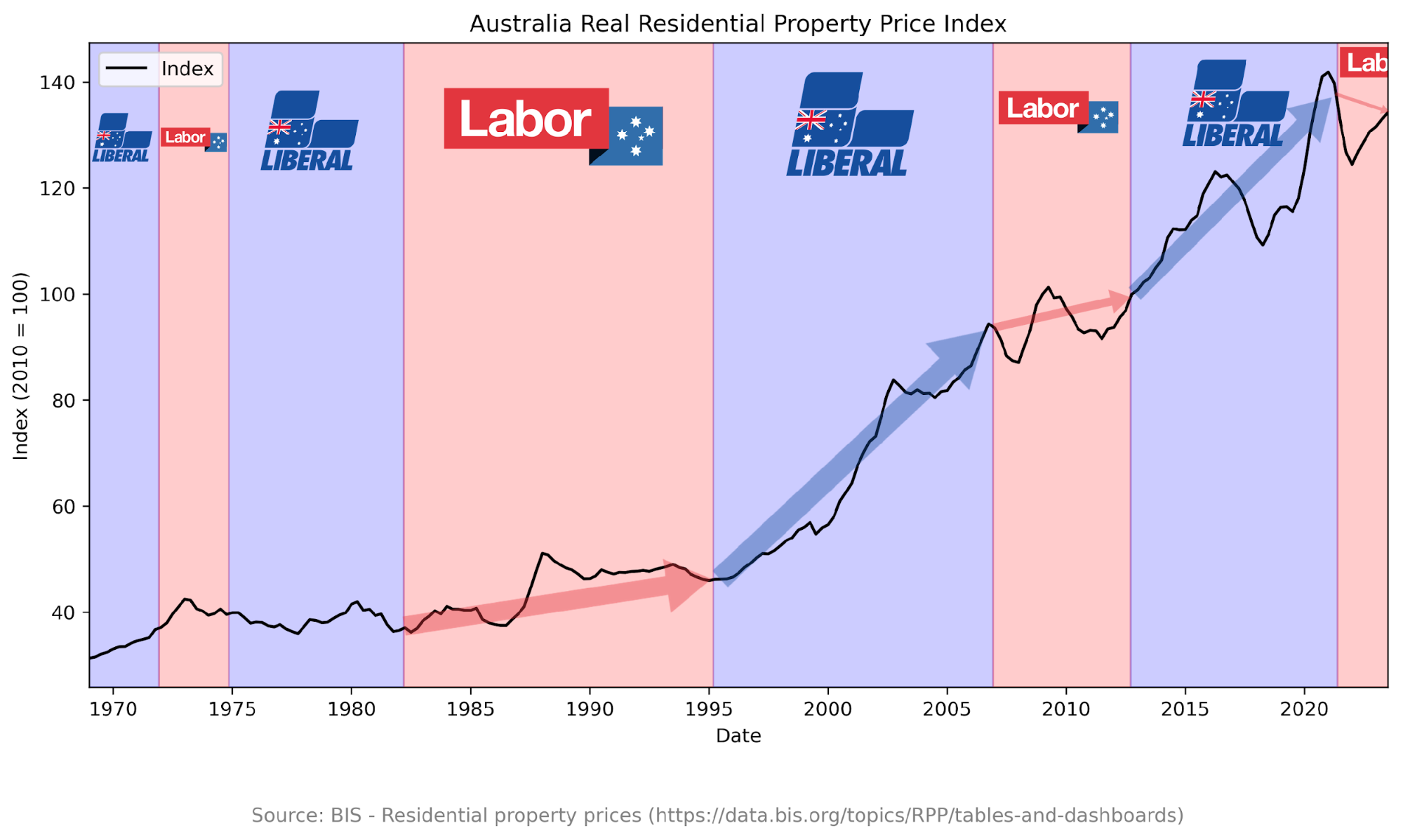

Policy Proposals from Major Parties

Labor’s housing platform for 2025 centers on expanding affordable housing supply through direct government investment and regulatory reform. Their flagship proposal, the “National Housing Accelerator,” pledges $15 billion over a decade to fund 50,000 new affordable homes, prioritizing urban infill projects. This approach aims to address the chronic shortfall of well-located housing, a gap estimated at 500,000 units by the now-defunct National Housing Supply Council. However, critics, including Dr. Nicole Gurran of the University of Sydney, caution that without parallel efforts to streamline zoning laws, these investments may face delays and cost overruns.

The Coalition, by contrast, advocates market-driven mechanisms. Their plan includes a two-year ban on foreign investment in existing properties and a $5 billion infrastructure fund to support housing developments. While these measures could ease pressure on demand, experts like Alan Kohler argue they fail to address speculative investment, which has inflated prices by 20% in key markets over the past decade. This divergence highlights a fundamental debate: whether affordability is best tackled through direct intervention or by incentivizing private sector solutions.

The implications of these strategies extend beyond affordability, shaping urban density, economic equity, and long-term market stability.

Image source: reddit.com

Labor’s Housing Initiatives

Labor’s commitment to urban infill projects under the “National Housing Accelerator” represents a pivotal strategy in addressing Australia’s housing shortfall. However, the success of this $15 billion initiative hinges on its ability to navigate entrenched regulatory barriers. Urban infill, while efficient in utilizing existing infrastructure, often encounters resistance due to restrictive zoning laws and community opposition. These factors can significantly delay project timelines, undermining the initiative’s intended impact.

A critical component of this approach is the integration of universal design principles, which aim to create adaptable and inclusive housing. This design philosophy not only enhances accessibility but also future-proofs developments against demographic shifts. Yet, implementing such standards can increase upfront costs, posing challenges for developers operating within tight financial margins.

“The interplay between regulatory reform and financial investment is crucial. Without synchronized efforts, even well-funded projects risk stagnation,”

— Dr. Helen Martins, Urban Planning Specialist

Comparatively, cities like Vienna have demonstrated the efficacy of combining public investment with streamlined approval processes, achieving faster project completions. For Labor’s plan to succeed, it must adopt similar efficiencies, ensuring that financial resources translate into tangible housing outcomes. This alignment is essential to deliver timely relief to a market under immense strain.

Coalition’s Housing Strategies

The Coalition’s housing strategy emphasizes market-driven mechanisms, with a notable focus on a two-year ban on foreign investment in existing properties. This measure aims to reduce speculative demand, particularly in high-value urban markets, where foreign buyers have historically concentrated. However, the effectiveness of this approach hinges on its interplay with broader market dynamics and local planning frameworks.

A critical limitation lies in the absence of mechanisms to ensure that reduced foreign demand translates into increased affordability. Historical data from similar policies in Canada and New Zealand reveal that while such bans temporarily cool demand, they often fail to address underlying supply constraints. Without parallel reforms to expedite housing approvals or incentivize affordable developments, the policy risks merely displacing speculative activity to other segments, such as new-build properties.

The Coalition’s $5 billion infrastructure fund, designed to support housing developments, introduces another layer of complexity. While infrastructure investment can unlock new land for development, its impact is contingent on local governments’ capacity to implement projects efficiently. Variations in planning regulations across states further complicate outcomes, as delays in approvals can erode the fund’s intended benefits.

“Market-based solutions must be paired with structural reforms to achieve meaningful affordability gains,”

— Dr. Alan Kohler, Urban Economist

This underscores the necessity of integrating demand-side measures with systemic supply-side reforms.

Structural Challenges in the Housing Market

Australia’s housing market is constrained by deeply embedded structural issues that extend beyond cyclical economic factors. A primary challenge lies in the geographic mismatch between housing demand and supply. Urban centers like Sydney and Melbourne, which account for over 40% of the nation’s population, face acute shortages due to limited land availability and restrictive zoning laws. According to the Australian Bureau of Statistics, only 132,000 new dwellings were completed in the first nine months of 2024, far below the estimated annual demand of 200,000 units.

Compounding this issue is the inefficiency of the planning approval process. Research from the Urban Development Institute of Australia highlights that medium- and high-density projects often face delays exceeding two years, inflating costs and deterring investment. This bottleneck is exacerbated by labor shortages, with only 5% of recent migrants employed in construction, despite record immigration levels.

These systemic barriers create a feedback loop: constrained supply drives up prices, which in turn limits accessibility for low- and middle-income households. Addressing these challenges requires not incremental adjustments but comprehensive reform to align urban planning with market realities.

Image source: sbs.com.au

Supply-Demand Imbalance

A critical yet underexplored factor in Australia’s housing supply-demand imbalance is the economic disincentive for landowners to expedite development. While zoning laws and planning delays are often cited as primary culprits, the financial calculus of landowners plays an equally significant role. Landowners frequently delay development to capitalize on rising land values, a phenomenon known as “land banking.” This practice reduces the effective supply of developable land, exacerbating shortages even in areas with approved projects.

The mechanics of land banking are rooted in speculative behavior. By holding land during periods of high demand, owners benefit from appreciating values without incurring the risks or costs of construction. This strategy is particularly prevalent in metropolitan regions like Sydney, where land values have historically outpaced inflation. Research from the Australian Housing and Urban Research Institute (AHURI) highlights that such speculative delays can extend project timelines by up to five years, compounding supply constraints.

“The interplay between speculative landholding and planning inefficiencies creates a perfect storm for housing shortages,”

— Dr. Nicole Gurran, Housing Policy Expert

Addressing this issue requires targeted policy interventions, such as land value taxes or “use-it-or-lose-it” regulations, to incentivize timely development. Without these measures, even streamlined planning processes may fail to resolve the underlying supply bottlenecks, leaving the market perpetually out of balance.

Role of Urban Planning and Regulations

Urban planning’s influence on housing affordability is often reduced to debates over zoning laws, yet the nuanced role of inclusionary zoning (IZ) reveals deeper complexities. This policy mandates developers to allocate a portion of new housing for affordable units, directly addressing supply gaps for low-income households. While widely adopted in cities like Melbourne, its implementation varies significantly, shaping its effectiveness.

The mechanics of IZ hinge on balancing developer incentives with affordability goals. For instance, Melbourne’s IZ framework offers density bonuses, allowing developers to build additional units in exchange for meeting affordability quotas. However, critics argue that without standardized guidelines, outcomes remain inconsistent. A 2023 study by the Australian Housing and Urban Research Institute (AHURI) found that municipalities with clear IZ benchmarks achieved 15% higher compliance rates compared to those with vague or discretionary policies.

Contextual factors, such as land values and market demand, further complicate IZ’s impact. In high-demand areas, developers may absorb costs, but in weaker markets, IZ requirements can deter investment altogether.

“Inclusionary zoning succeeds when paired with robust incentives and transparent criteria,”

— Dr. Nicole Gurran, Housing Policy Expert

This underscores the need for tailored IZ frameworks that adapt to local market conditions, ensuring equitable and sustainable housing outcomes.

Implications for First-Time Homebuyers

First-time homebuyers in Australia face a market where affordability is increasingly elusive, with the median house price now exceeding seven times the median income, according to the Australian Bureau of Statistics. This disparity, compounded by stricter lending criteria introduced post-2020, has raised the average age of first-time buyers to 35, up from 25 two decades ago.

A critical challenge lies in navigating the interplay between government assistance programs and market volatility. For instance, while the First Home Loan Deposit Scheme reduces the required deposit to 5%, rising interest rates—projected to average 6% in 2025—significantly inflate long-term repayment costs. This creates a paradox where short-term accessibility may lead to long-term financial strain.

The concept of “mortgage stress,” defined as spending over 30% of income on housing, now affects 40% of new buyers. Addressing this requires not only financial literacy but also policy reforms that align assistance programs with sustainable lending practices.

Image source: realestate.com.au

Navigating the Market as a New Buyer

First-time buyers entering Australia’s housing market in 2025 face a complex interplay of financial incentives and market risks. A critical yet underappreciated factor is the impact of property price caps tied to government schemes, such as the First Home Guarantee. While these caps aim to make housing accessible, they often limit buyers to properties in less desirable locations or with lower long-term value appreciation. This trade-off underscores the importance of strategic property selection.

The mechanics of these schemes reveal a nuanced challenge: as price caps are adjusted annually, they can lag behind market trends, inadvertently excluding properties in rapidly appreciating areas. For instance, a 2024 study by the Australian Housing and Urban Research Institute (AHURI) found that 30% of eligible buyers struggled to find properties within capped limits in metropolitan regions, forcing them to compromise on location or property quality.

“Price caps must reflect real-time market dynamics to avoid marginalizing buyers in competitive areas,”

— Dr. Nicole Gurran, Housing Policy Expert

To navigate these constraints, experts recommend leveraging tools like borrowing power calculators and consulting local market specialists. This approach ensures buyers align their financial capacity with realistic property options, mitigating risks tied to fluctuating interest rates and market volatility.

Financial Assistance and Risks

Lower deposit schemes, such as the First Home Guarantee, offer immediate accessibility but often mask significant long-term risks. These programs, by reducing upfront financial barriers, inadvertently amplify demand in already constrained markets. This dynamic can lead to price inflation, particularly in metropolitan areas, as observed in Sydney where increased participation in such schemes has coincided with escalating property values.

A critical issue lies in the disconnect between short-term affordability and long-term financial sustainability. Buyers leveraging these schemes frequently underestimate the impact of rising interest rates on their repayment capacity. For instance, a 2024 analysis by the Australian Housing and Urban Research Institute (AHURI) highlighted that 35% of participants in low-deposit programs experienced “mortgage stress” within three years, defined as spending over 30% of income on housing costs.

“Reducing deposit thresholds without addressing supply constraints risks perpetuating affordability challenges,”

— Dr. Sarah Holden, Housing Economist

To mitigate these risks, experts recommend integrating financial literacy initiatives with assistance programs. This approach ensures buyers not only qualify for schemes but also make informed decisions aligned with market conditions and personal financial resilience.

FAQ

What are the key housing policies proposed by major parties in Australia’s 2025 election?

The 2025 election sees Labor emphasizing expanded government investment, including the “Help to Buy” scheme and a $10 billion housing fund targeting affordable housing supply. Their policies also propose extending deposit guarantees for first-time buyers. The Coalition focuses on market-driven solutions, such as allowing superannuation withdrawals for home purchases and tax-deductible mortgage interest for new builds. Both parties advocate a two-year ban on foreign investment in existing properties. However, experts argue these measures may exacerbate price inflation without addressing systemic issues like zoning reform, land banking, and construction delays, which are critical to resolving Australia’s housing affordability crisis.

How will the 2025 election impact housing affordability for first-time homebuyers?

The 2025 election could shape housing affordability for first-time homebuyers through targeted policies. Labor’s expanded “Help to Buy” scheme and increased affordable housing investments aim to reduce entry barriers, while the Coalition’s superannuation withdrawal policy offers immediate purchasing power. However, these measures risk inflating demand without addressing supply constraints like restrictive zoning laws and land banking. Rising interest rates and limited housing stock further complicate affordability. Experts emphasize that systemic reforms, including streamlined planning approvals and incentives for urban densification, are essential to ensure these policies deliver sustainable benefits for first-time buyers in Australia’s competitive housing market.

What role do zoning laws and urban planning reforms play in solving Australia’s housing crisis?

Zoning laws and urban planning reforms are pivotal in addressing Australia’s housing crisis by unlocking land for development and increasing housing density in high-demand areas. Restrictive zoning often limits affordable housing supply, inflating property prices. Streamlined planning approvals and rezoning underutilized land, such as industrial sites, can expedite construction and reduce costs. Inclusionary zoning policies, mandating affordable housing quotas in new developments, further bridge supply gaps. Experts highlight that without reforming these frameworks, even substantial investments in housing initiatives may face delays, undermining their impact. Effective urban planning is essential for sustainable growth and long-term housing affordability.

How might proposed foreign investment restrictions affect property prices and availability?

Proposed foreign investment restrictions, including a two-year ban on purchasing existing properties and stricter development timelines for vacant land, aim to reduce speculative demand and prioritize local buyers. While these measures may temporarily ease competition, experts suggest their impact on overall property prices and availability will be limited, as foreign buyers represent a small market share. Policies like vacancy fees for underutilized properties could increase rental stock, but without addressing broader supply constraints, such as zoning rigidity and construction delays, these restrictions alone are unlikely to significantly improve housing affordability or availability for Australian homebuyers.

What financial assistance programs are available for homebuyers in 2025, and how do they compare?

In 2025, homebuyers can access programs like the First Home Guarantee, allowing purchases with a 5% deposit without Lenders Mortgage Insurance, and the First Home Super Saver Scheme, enabling tax-advantaged savings for deposits. Labor’s “Help to Buy” offers shared equity contributions of up to 40% for new homes, while state-level grants, such as the First Home Owner Grant, provide cash incentives. Comparatively, Coalition policies emphasize superannuation withdrawals for deposits. While these initiatives lower entry barriers, their effectiveness varies by region and eligibility criteria. Experts stress that aligning these programs with supply-side reforms is crucial for sustainable affordability improvements.