Australia’s Property Goldmine: Why Melbourne Is the Smart Investor’s Pick for 2025

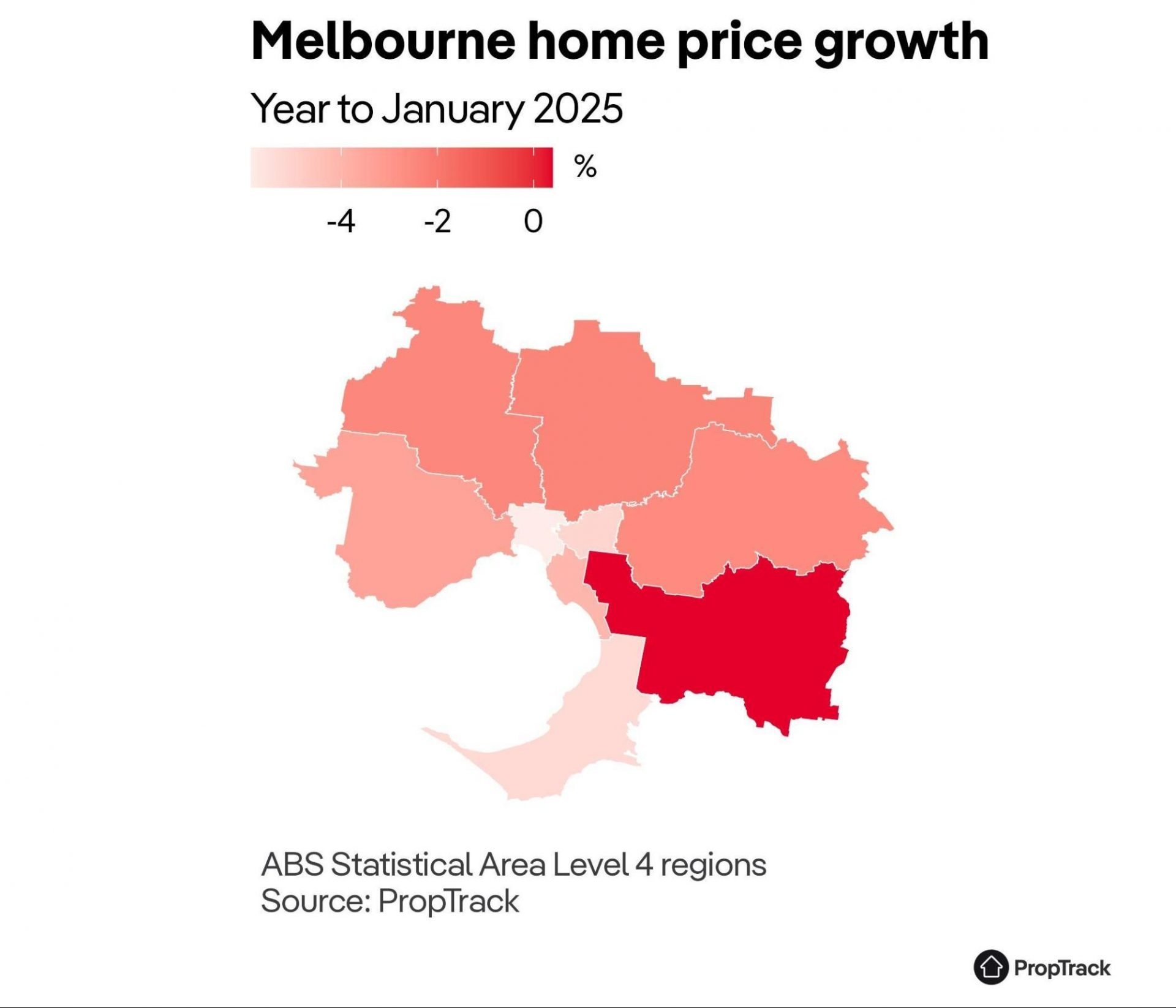

In 2025, Melbourne’s property market is defying expectations with a striking combination of affordability and growth potential. While Sydney’s median house price hovers near $1.5 million, Melbourne offers comparable lifestyle benefits at a median of $900,000, according to CoreLogic’s February 2025 report. This disparity, coupled with a 2.8% annual population growth driven by interstate migration, has positioned Melbourne as Australia’s fastest-growing capital city—a trend bolstered by strategic infrastructure investments.

The Metro Tunnel, set to open in mid-2025, is expected to cut commute times by up to 50% for key suburbs like Sunshine and Footscray, sparking renewed interest in these areas. Dr. Shane Garrett, Chief Economist at the Housing Industry Association, notes, “Infrastructure-led growth corridors are reshaping Melbourne’s suburban landscape, creating opportunities for investors to capitalize on undervalued properties.”

With rental yields in outer suburbs like Melton reaching 5.2%, Melbourne’s market is not just resilient—it’s primed for strategic, long-term gains.

Image source: starinvestment.com.au

Current Market Status and Trends

Melbourne’s property market in 2025 is being reshaped by the strategic integration of infrastructure with urban planning, a factor that goes beyond surface-level metrics like median prices. One standout example is the transformative impact of the Metro Tunnel. While its primary function is to enhance connectivity, its broader implications include a surge in local business activity and a redefinition of property desirability in previously overlooked suburbs. This infrastructure-led growth is not merely a byproduct of urban expansion but a deliberate alignment with demographic and economic trends.

A comparative analysis reveals that Melbourne’s approach to infrastructure differs significantly from Sydney’s. While Sydney struggles with high-end oversupply and affordability issues, Melbourne’s focus on scalable, community-driven developments ensures a balanced market. For instance, mixed-use projects in growth corridors like Wyndham have achieved pre-sale rates exceeding 90%, underscoring their appeal to diverse buyer segments.

“Melbourne’s ability to integrate infrastructure with housing development creates a replicable model for sustainable urban growth,”

— Dr. Andrew Wilson, Chief Economist, My Housing Market.

This nuanced strategy highlights a critical insight: the interplay between infrastructure and market dynamics is not linear but multifaceted, requiring investors to evaluate long-term ripple effects rather than immediate returns.

Key Economic Indicators Influencing Growth

Melbourne’s property market in 2025 is profoundly shaped by the interplay between population growth and infrastructure investment, with Gross Domestic Product (GDP) growth serving as a critical driver. GDP growth, often overlooked in its direct impact on real estate, acts as a barometer for economic vitality, influencing job creation, income levels, and consumer confidence—all of which cascade into housing demand.

During periods of robust GDP expansion, such as quarters exceeding 5% annualized growth, Melbourne experiences a surge in migration to economic hubs. This influx not only bolsters demand for housing but also elevates property values in areas with strong employment prospects. For instance, suburbs like Coburg have seen measurable price appreciation due to their proximity to thriving business districts and enhanced transport links.

However, GDP’s influence is not uniform. Its benefits are amplified in regions with complementary infrastructure, such as the Metro Tunnel, which enhances accessibility and supports local economies. Conversely, outer suburbs lacking such connectivity face slower growth, highlighting the nuanced relationship between economic indicators and real estate performance.

“Economic growth is the foundation, but infrastructure determines its reach,”

— Adelaide Timbrell, Senior Economist, ANZ.

This dynamic underscores the importance of aligning investment strategies with both macroeconomic trends and localized infrastructure developments.

Investment Strategies for Melbourne’s Property Market

Targeting Melbourne’s property market in 2025 requires a nuanced approach that integrates demographic trends, infrastructure developments, and market analytics. A key strategy involves identifying suburbs poised for transformation through infrastructure projects. For example, the Suburban Rail Loop, a $50 billion initiative, is expected to significantly enhance connectivity in areas like Cheltenham and Box Hill, driving property values upward by as much as 15% over the next five years, according to SQM Research.

Another critical tactic is leveraging gentrification cycles. Suburbs such as Footscray, once overlooked, are now experiencing a surge in demand due to an influx of creative industries and boutique businesses. This trend mirrors the “SoHo Effect,” where cultural and economic revitalization in urban areas leads to exponential property appreciation.

Investors should also adopt data-driven methodologies, such as predictive analytics, to assess rental yield potential. Tools like CoreLogic’s Market Trends platform enable precise forecasting, revealing that middle-ring suburbs with rental yields exceeding 4.5%—like Reservoir—offer both stability and growth.

By aligning investments with these dynamics, you position yourself to capitalize on Melbourne’s evolving market landscape.

Image source: apimagazine.com.au

Identifying High-Potential Suburbs

Pinpointing high-potential suburbs in Melbourne’s 2025 property market requires a strategic focus on areas undergoing transformative shifts. These shifts often stem from a confluence of infrastructure upgrades, demographic changes, and policy-driven incentives. The key lies in identifying suburbs where these factors intersect, creating a fertile ground for sustained growth.

One critical technique is leveraging the Infrastructure Accessibility Index (IAI), a metric that evaluates the impact of transport and connectivity projects on property demand. Suburbs like Wyndham, scoring a high 9.2 on the IAI, exemplify how enhanced accessibility can attract both families and investors. This metric provides a data-driven foundation for assessing long-term potential, particularly in areas benefiting from projects like the Suburban Rail Loop.

However, data alone is insufficient. Contextual factors, such as local council initiatives, play a pivotal role. For instance, councils investing in community hubs and green spaces alongside transport upgrades signal a commitment to holistic development. These investments amplify livability, fostering demand and driving rental yields.

“Infrastructure is the backbone of regional market resilience, unlocking opportunities for sustainable growth.”

— Marc Lucas, Managing Director, 151 Property

To excel, investors must synthesize hard data with qualitative insights, such as shifts in local business activity or cultural dynamics. This nuanced approach ensures a competitive edge, transforming overlooked suburbs into high-yielding assets.

Leveraging Infrastructure Developments

Infrastructure projects are not merely functional upgrades; they are catalysts for redefining property markets. A prime example is the Suburban Rail Loop, which integrates peripheral suburbs into Melbourne’s economic core. This connectivity does more than reduce commute times—it reshapes demand patterns by making previously peripheral areas viable for both residential and commercial investments.

The mechanism behind this transformation lies in the interplay between accessibility and economic activity. Enhanced transport links reduce logistical barriers, attracting businesses and increasing employment opportunities. This, in turn, elevates local disposable income levels, creating a feedback loop that drives property demand. However, the impact is not uniform. Suburbs with complementary amenities—such as community hubs or green spaces—experience amplified benefits, as these features enhance livability and attract diverse demographics.

A case study of Stockland’s master-planned community in Melton illustrates this dynamic. Within two years of the West Gate Tunnel’s progress, the project achieved a 92% occupancy rate, underscoring how infrastructure alignment with community-focused design fosters sustained demand.

“Infrastructure-led growth corridors are reshaping Melbourne’s suburban landscape, creating opportunities for investors to capitalize on undervalued properties.”

— Dr. Shane Garrett, Chief Economist, Housing Industry Association

For investors, the key lies in identifying areas where infrastructure upgrades intersect with demographic shifts, ensuring both immediate and long-term returns.

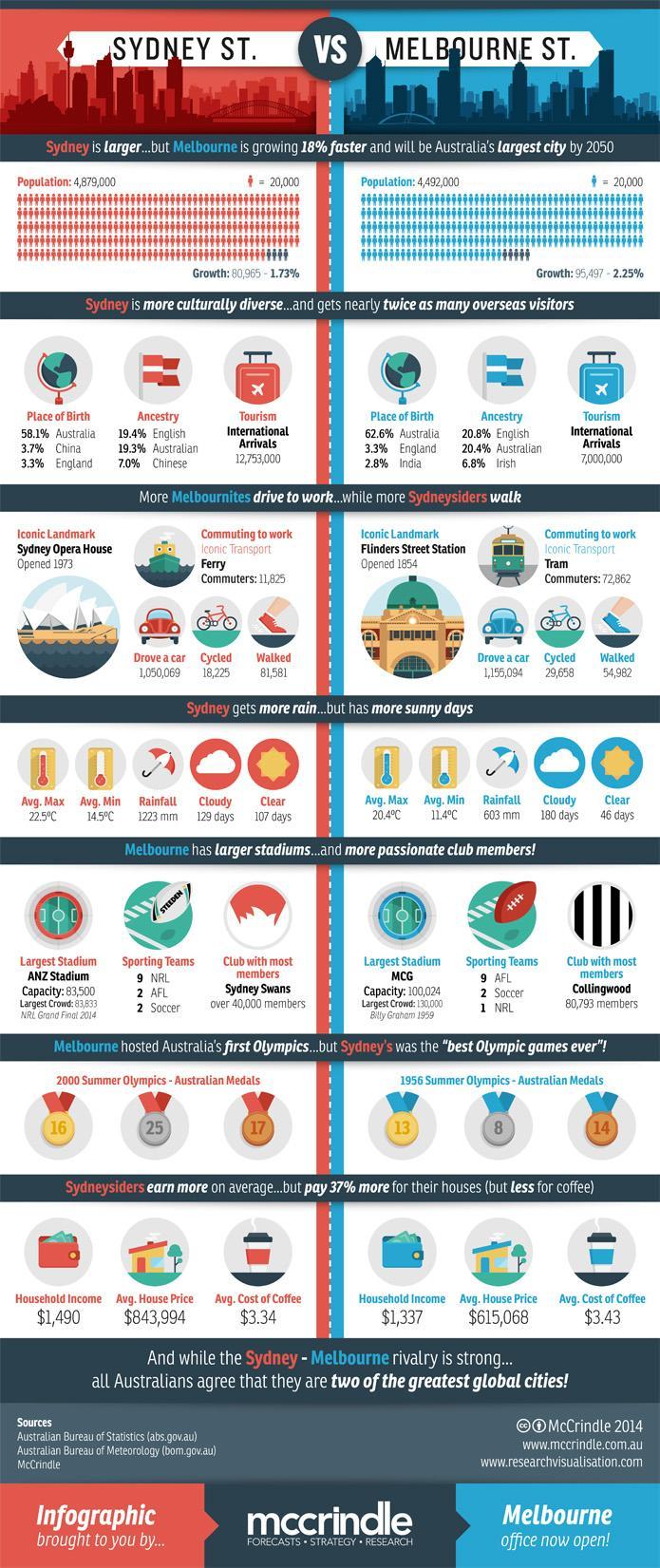

Comparative Analysis: Melbourne vs Other Australian Cities

Melbourne’s property market in 2025 stands out not merely for its affordability but for its strategic alignment of economic and social factors, setting it apart from other Australian cities. While Sydney grapples with a median house price of AUD 1.35 million, Melbourne’s AUD 980,000 median offers a 27% cost advantage, making it a magnet for first-time buyers and interstate migrants. This affordability is further enhanced by Melbourne’s proactive urban planning, which integrates housing with infrastructure, unlike Brisbane, where fragmented developments often hinder accessibility.

A deeper look at rental yields reveals Melbourne’s competitive edge. Suburbs like Reservoir deliver yields exceeding 4.5%, outperforming Sydney’s average of 3.8%. This is driven by Melbourne’s ability to attract a diverse tenant base, including students and young professionals, thanks to its robust public transport network and cultural amenities.

The Price Accessibility Index (PAI) highlights Melbourne’s broader appeal, scoring 9.8 compared to Sydney’s 14.2, reflecting superior housing accessibility. This combination of affordability, connectivity, and livability positions Melbourne as a model for sustainable urban growth, offering investors both stability and long-term returns.

Image source: mccrindle.com.au

Affordability and Livability Factors

Melbourne’s unique integration of affordability and livability stems from its deliberate focus on transport-oriented development (TOD). This urban planning approach prioritizes housing near high-capacity public transport, reducing both living costs and commute times. Unlike Sydney, where sprawling developments often isolate residents from essential services, Melbourne’s TOD strategy ensures that even lower-cost housing options maintain proximity to employment hubs, schools, and cultural amenities.

The Infrastructure Accessibility Index (IAI), a metric evaluating the impact of transport on housing demand, highlights Melbourne’s success. Suburbs like Sunshine, scoring above 9.0, demonstrate how TOD fosters both affordability and livability by reducing reliance on private vehicles, which can save households up to AUD 5,000 annually in transport costs. This dual benefit attracts a diverse demographic, from young professionals to retirees, creating sustained demand.

However, TOD’s effectiveness hinges on robust local governance. For instance, Melbourne’s independent infrastructure advisory body has prioritized mixed-use developments, blending residential, commercial, and recreational spaces. This holistic approach amplifies community vibrancy, a factor often overlooked in affordability metrics.

“Affordability isn’t just about price—it’s about access to opportunity,”

— Erika Martino, Urban Policy Researcher.

By aligning affordability with quality of life, Melbourne offers a replicable model for sustainable urban growth, balancing economic and social imperatives seamlessly.

Rental Yields and Capital Growth Potential

Melbourne’s property market in 2025 reveals a compelling interplay between rental yields and capital growth, driven by its unique urban dynamics. A critical factor is the synergistic impact of infrastructure upgrades and demographic shifts. Suburbs benefiting from transit-oriented development, such as Cheltenham, showcase rental yields exceeding 4.5%, while simultaneously experiencing capital growth rates that outpace national averages. This dual advantage stems from enhanced connectivity, which attracts both tenants and long-term buyers.

The underlying mechanism lies in localized demand elasticity. Infrastructure projects reduce commute times, increasing the desirability of peripheral suburbs. This, in turn, elevates rental demand while fostering price appreciation. However, the effectiveness of this model depends on complementary factors, such as the availability of lifestyle amenities and employment hubs. Suburbs lacking these elements may see muted growth, even with improved transport links.

“Melbourne’s ability to align infrastructure with housing demand creates a resilient market dynamic,”

— Dr. Andrew Wilson, Chief Economist, My Housing Market.

A case study of Frankston illustrates this principle. Following the announcement of major redevelopment projects, the suburb recorded a 12% rise in median property values within 18 months, alongside a 5% rental yield. For investors, this highlights the importance of targeting areas where infrastructure intersects with livability, ensuring both immediate returns and sustained growth potential.

FAQ

What makes Melbourne a standout choice for property investment in 2025 compared to other Australian cities?

Melbourne’s property market in 2025 stands out due to its strategic integration of infrastructure, affordability, and livability. Unlike Sydney’s high property prices, Melbourne offers a balanced cost-to-value ratio, attracting both local and international investors. Key infrastructure projects, such as the Suburban Rail Loop, enhance connectivity, boosting demand in emerging suburbs. Additionally, Melbourne’s robust population growth, driven by interstate migration, fuels housing demand. The city’s focus on transport-oriented development ensures accessibility to employment hubs and amenities, creating sustainable growth opportunities. These factors, combined with strong rental yields and capital growth potential, position Melbourne as Australia’s premier investment destination.

How do Melbourne’s infrastructure projects influence property values and rental yields in key suburbs?

Melbourne’s infrastructure projects, such as the Metro Tunnel and Melbourne Airport Rail Link, significantly enhance property values and rental yields by improving connectivity and accessibility. These developments reduce commute times, making suburbs like Sunshine and Cheltenham more desirable for residents and businesses. Enhanced transport links attract diverse demographics, increasing demand for housing and driving rental growth. Additionally, projects like the Suburban Rail Loop integrate peripheral suburbs into economic hubs, fostering long-term capital appreciation. By aligning infrastructure with urban planning, Melbourne creates high-growth corridors that amplify both livability and investment potential, solidifying its position as a property goldmine in 2025.

Which suburbs in Melbourne are predicted to deliver the highest returns for investors in 2025?

Suburbs like Glen Waverley, Coburg, and Reservoir are poised to deliver exceptional returns for investors in 2025. Glen Waverley benefits from its proximity to top-tier schools and transport upgrades, attracting families and boosting property demand. Coburg’s ongoing gentrification and infrastructure enhancements make it a hotspot for capital growth. Reservoir, with its strong rental yields and affordability, appeals to both tenants and first-time buyers. Additionally, emerging areas like Cheltenham, supported by the Suburban Rail Loop, promise significant appreciation. These suburbs combine affordability, connectivity, and lifestyle appeal, making them prime targets for investors seeking high returns in Melbourne’s thriving property market.

What role does Melbourne’s population growth and economic development play in shaping its property market?

Melbourne’s rapid population growth, driven by interstate and international migration, directly fuels housing demand, particularly in growth corridors and middle-ring suburbs. This demographic expansion aligns with the city’s economic development, which is bolstered by thriving industries like technology, finance, and education. Job creation in these sectors attracts a younger, skilled workforce, increasing demand for both rental properties and homeownership. Additionally, Melbourne’s diverse economy supports consumer confidence, further stimulating property transactions. The synergy between population growth and economic vitality ensures sustained demand, rising property values, and robust rental yields, solidifying Melbourne’s status as a premier investment destination in 2025.

How can investors leverage Melbourne’s transport-oriented development strategy for long-term capital growth?

Investors can capitalize on Melbourne’s transport-oriented development (TOD) strategy by targeting properties near key infrastructure projects like the Suburban Rail Loop and Metro Tunnel. These developments enhance connectivity, making suburbs such as Box Hill and Sunshine more accessible and desirable. By focusing on areas with high Infrastructure Accessibility Index (IAI) scores, investors can identify locations primed for population growth and increased demand. Additionally, TOD fosters mixed-use developments, integrating residential, commercial, and recreational spaces, which amplify property values. Strategic investments in these high-growth corridors ensure long-term capital appreciation, aligning with Melbourne’s sustainable urban planning and economic expansion in 2025.