What No One Tells You About Buying Your First Home in Australia

Buying your first home in Australia isn’t just about saving a deposit—it’s navigating hidden costs, fierce competition, and emotional stress. Why is no one talking about this?

Image source: linkedin.com

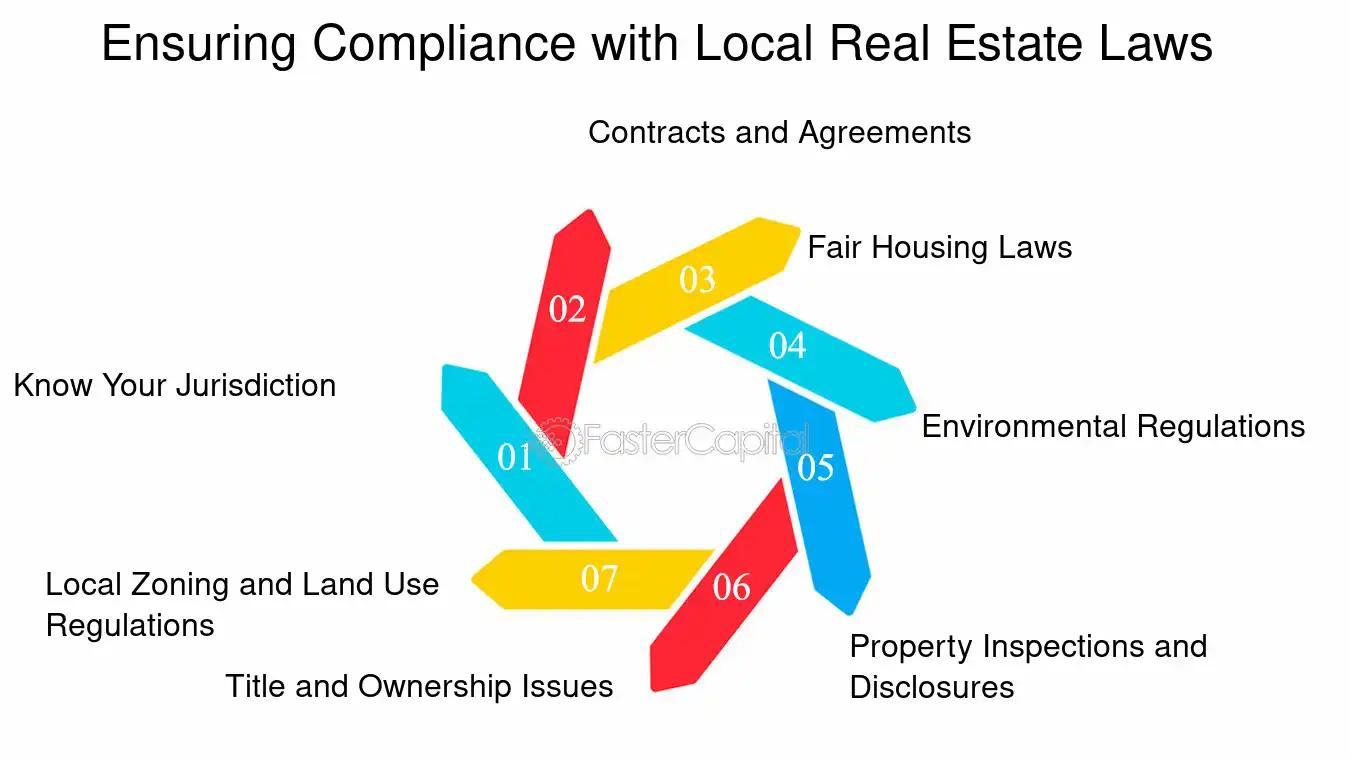

The Hidden Challenges of First-Time Home Buying in Australia

Understanding opportunity cost is crucial. Many first-time buyers overlook how delaying purchase for savings can backfire as property prices outpace their efforts, eroding affordability further.

Image source: borro.com.au

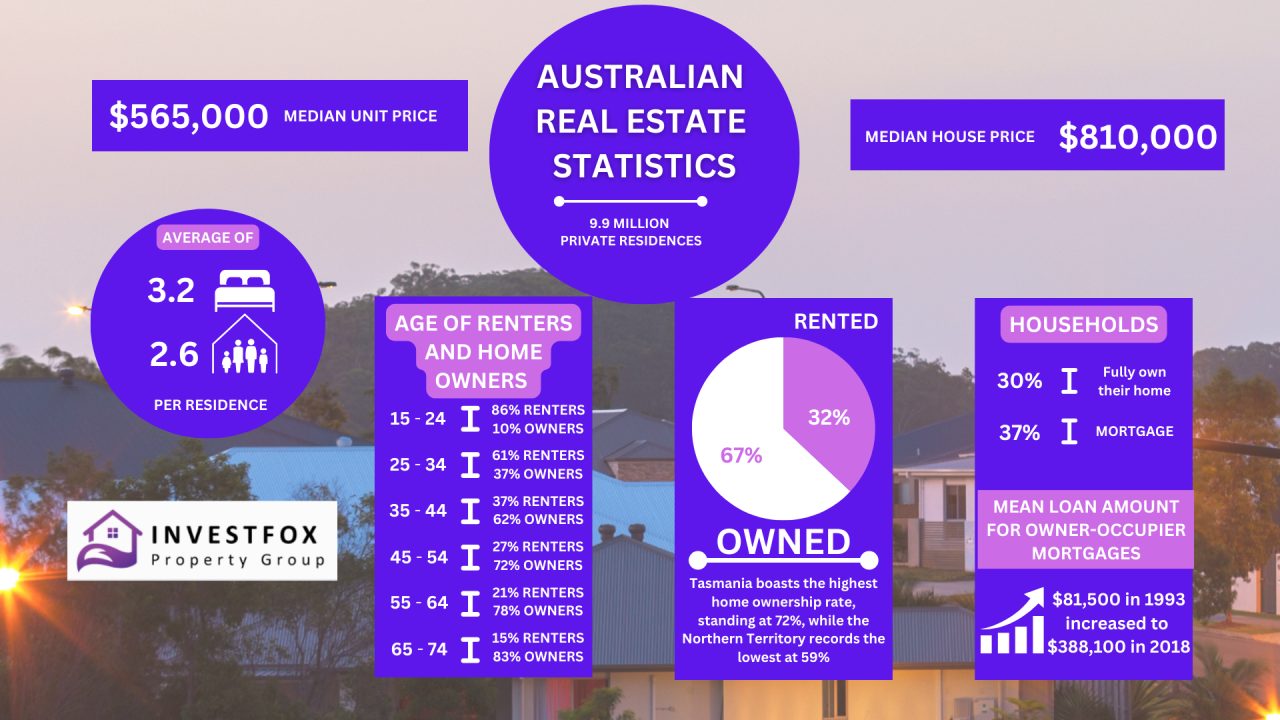

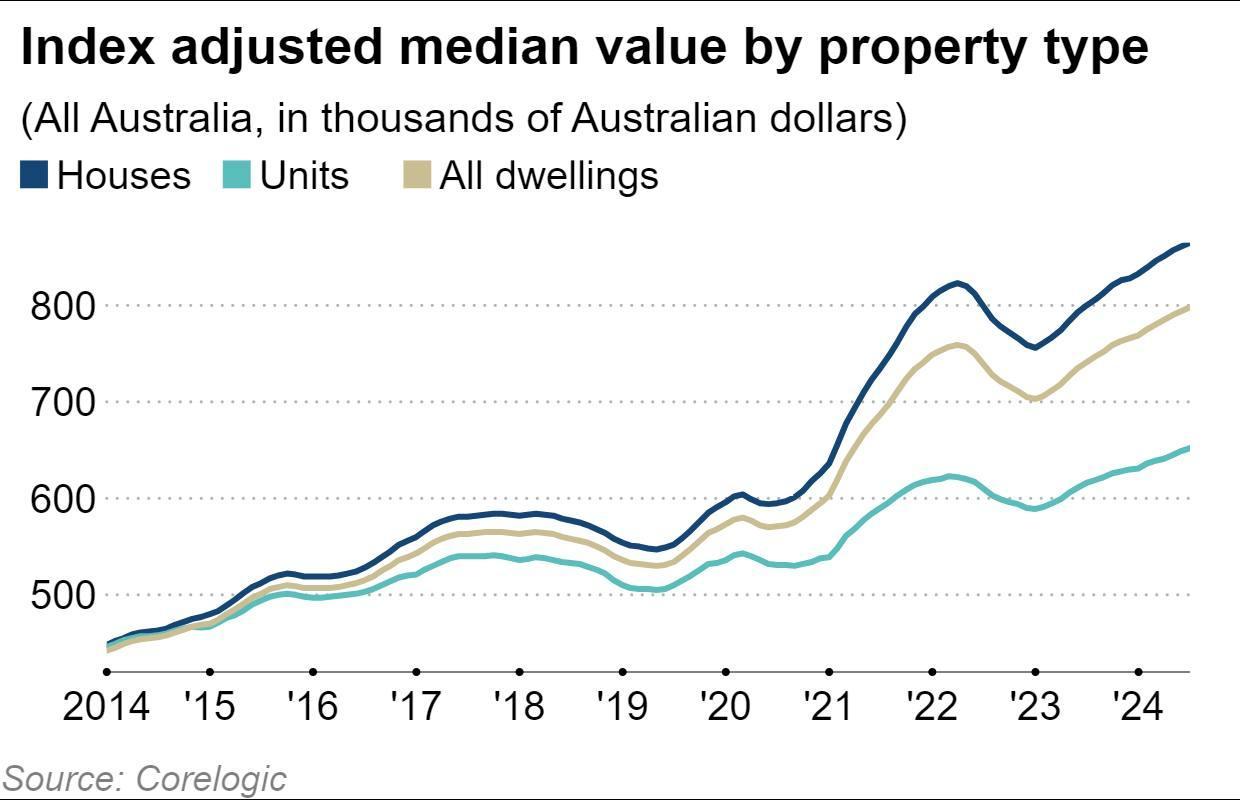

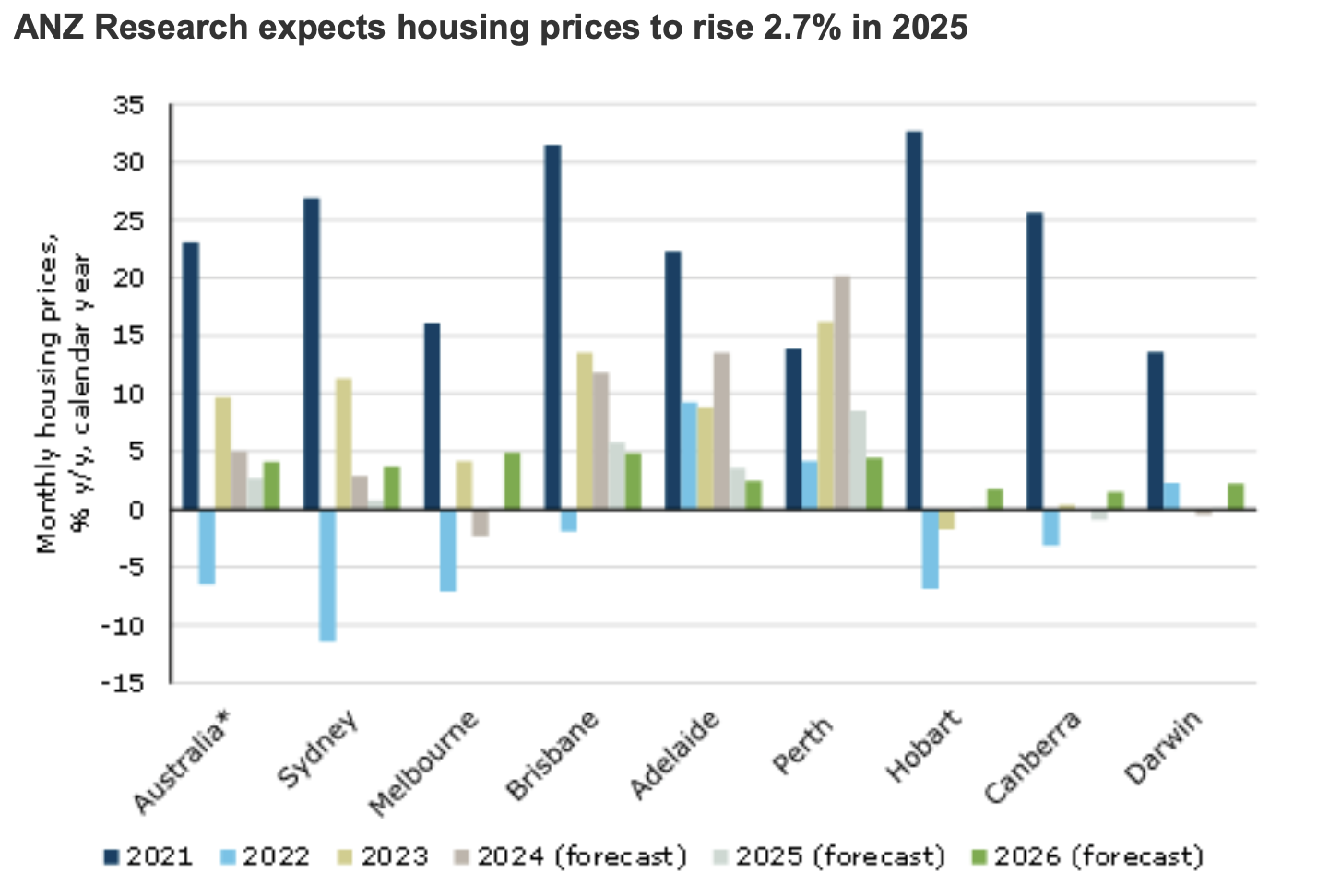

Understanding the Australian Property Market Landscape

Rising interest rates have reduced borrowing power, shifting demand toward affordable properties. Savvy buyers should monitor mid-tier markets, where competition remains fierce, but opportunities for value still exist.

Unforeseen Financial Considerations

Beyond deposits, hidden costs like stamp duty, legal fees, and inspections can derail budgets. For instance, Sydney buyers face stamp duties averaging $40,000—often underestimated, causing financial strain.

Image source: realestate.com.au

Beyond the Deposit: Hidden Costs and Fees

Settlement adjustments—covering council rates, water charges, and land taxes—often surprise buyers. For example, unexpected prorated fees can add thousands, emphasizing the need for meticulous pre-purchase financial planning.

Government Grants and Incentives: Eligibility and Limitations

Grants like the First Home Owner Grant often exclude established homes, limiting options. Combining state and federal schemes can maximize benefits, but eligibility hinges on strict income and property value caps.

Mortgage Types and Their Long-Term Implications

Split-rate mortgages balance stability and flexibility, mitigating risks from fluctuating interest rates. This hybrid approach suits buyers seeking predictable repayments while leveraging potential savings during economic downturns or rate cuts.

Navigating the Property Market

Focus on mid-tier suburbs with growth potential. For example, Sydney’s western suburbs saw 12% price increases in 2024, driven by infrastructure projects. Research local trends to uncover hidden opportunities.

Image source: realestate.com.au

Identifying Growth Areas and Suburbs

Prioritize 20-minute neighborhoods offering diverse amenities and connectivity. For instance, Brisbane’s inner suburbs outperformed outer areas by 15% in 2024, driven by infrastructure upgrades and lifestyle appeal.

The Impact of Supply and Demand on Property Prices

Australia’s skilled labor shortage delays housing projects, intensifying supply gaps. For example, January 2024 approvals were 25% below the 10-year average, driving prices higher amid persistent demand.

Working Effectively with Real Estate Agents

Ask agents targeted questions like property history or seller motivations. This builds trust, uncovers negotiation leverage, and ensures informed decisions, especially in competitive markets with multiple offers.

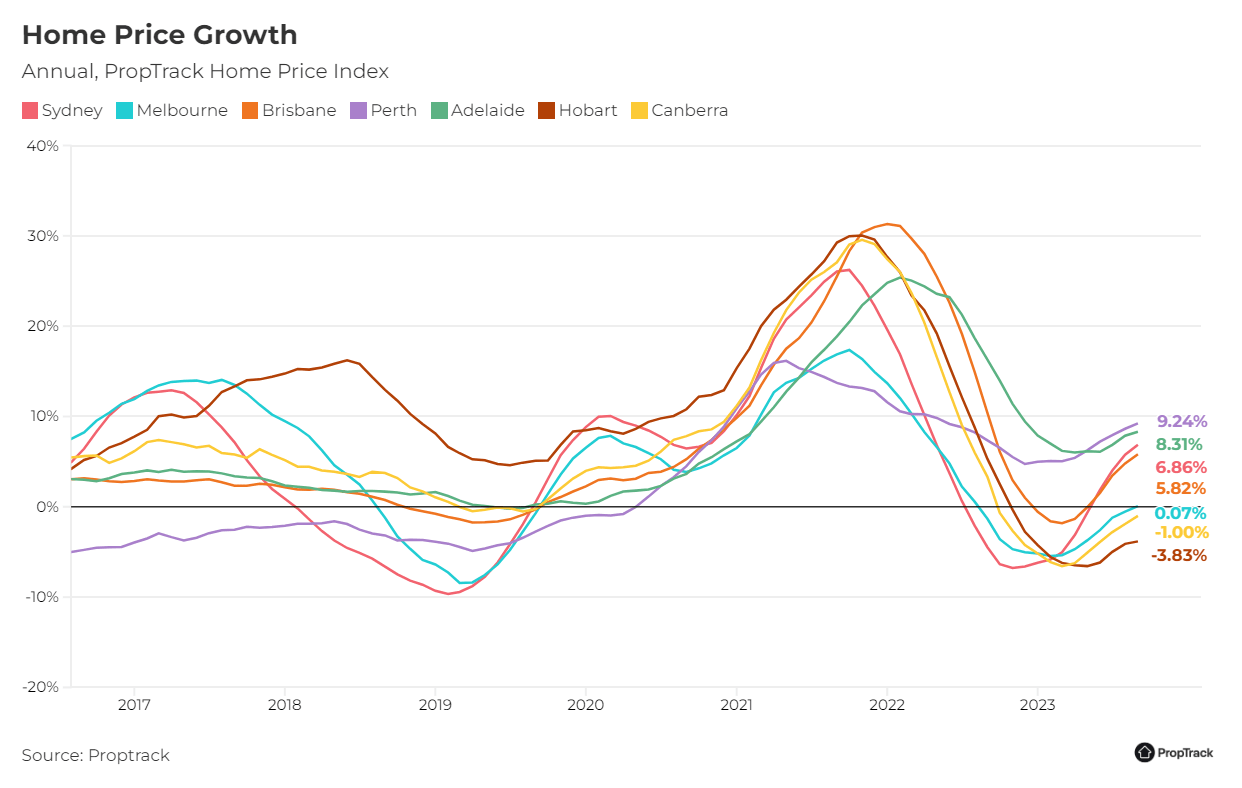

Legal and Regulatory Complexities

Navigating zoning laws and building codes often surprises buyers. For instance, misinterpreting zoning restrictions can derail renovation plans. Expert legal advice ensures compliance, avoiding costly disputes or project delays.

Image source: fastercapital.com

The Intricacies of Property Contracts

Special conditions in contracts, like repair obligations or financing clauses, often go unnoticed. Mismanagement can void agreements. Proactive reviews by legal experts ensure clarity, protecting buyers from unforeseen liabilities.

Understanding Stamp Duty and Tax Obligations

Stamp duty exemptions often hinge on property value thresholds. For example, in Tasmania, first-home buyers save thousands on homes under $750,000. Researching state-specific rules unlocks significant financial advantages.

Conveyancing: Navigating the Legal Process

Title searches reveal hidden risks like unpaid debts or easements. Engaging a conveyancer ensures these issues are addressed early, preventing costly disputes and safeguarding your property investment.

Due Diligence and Property Inspections

Skipping independent inspections risks costly surprises. For instance, termite infestations unnoticed in agent reports can lead to structural collapse. Always hire qualified inspectors to uncover hidden issues and ensure compliance.

The Importance of Building and Pest Inspections

Thermal imaging detects hidden termite activity, often missed by visual checks. This advanced method prevents structural damage, saving buyers thousands in repairs and ensuring long-term property stability.

Evaluating Strata Reports and Property Titles

Reviewing strata minutes reveals disputes or costly repairs, like sinking funds shortfalls. Cross-check property titles for easements or covenants to avoid future legal or financial complications.

Assessing Future Development Plans in the Area

Analyze council zoning changes and infrastructure projects, like new transport links, which can boost property value. Overlooked risks include noise pollution or overcrowding from high-density developments.

Financing Your First Home

Explore offset accounts to reduce interest payments while maintaining liquidity. Case studies show saving $20,000 in interest over 10 years. Avoid misconceptions like over-relying on fixed-rate loans.

Image source: lifesherpa.com.au

Choosing the Right Lender and Loan Product

Prioritize lenders offering flexible repayment options and redraw facilities. Studies reveal borrowers save thousands by adjusting repayments during financial shifts, ensuring long-term affordability and stability.

The Role of Mortgage Brokers

Mortgage brokers access non-traditional lenders offering tailored solutions. For example, niche lenders often approve loans for freelancers, bypassing rigid bank criteria. This flexibility ensures broader options for diverse financial situations.

Interest Rates and Their Long-Term Effects

Opt for split-rate mortgages to balance stability and flexibility. This strategy mitigates risks from rate hikes while leveraging potential savings during economic downturns, ensuring sustainable financial planning over time.

Long-Term Ownership Implications

Owning property builds generational wealth, but neglecting maintenance can erode value. For instance, deferred repairs cost Sydney homeowners 20% more annually. Proactive upkeep ensures stability and maximizes long-term returns.

Image source: asia.nikkei.com

Maintenance Costs and Responsibilities

Investing in preventative maintenance—like annual roof inspections—saves up to 30% on long-term repair costs. Ignoring small issues, such as leaks, often leads to expensive structural damage over time.

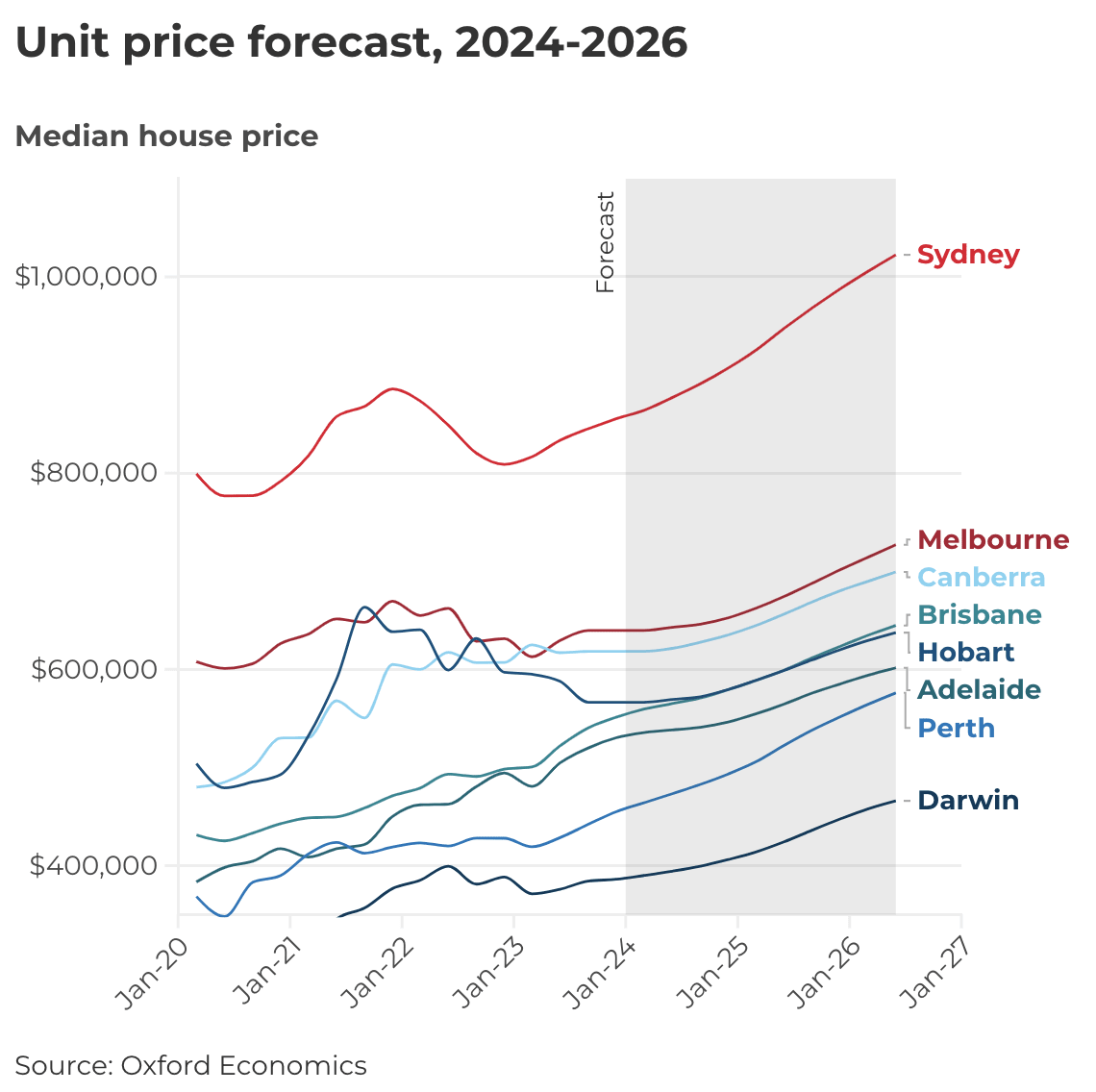

Property Value Appreciation and Market Trends

Properties near infrastructure projects—like Sydney’s Metro expansion—often see 15-20% faster appreciation. Tracking local council plans helps identify undervalued areas poised for significant long-term growth.

Insurance and Risk Management Strategies

Opt for replacement cost coverage over market value insurance to fully rebuild after disasters. Regularly updating policies ensures protection against inflation and evolving risks like climate-related events.

Emerging Trends and Future Considerations

Remote work fuels demand for regional properties, reshaping affordability. For example, Ballarat’s housing market grew 12% in 2024. Buyers should monitor lifestyle-driven shifts and evolving infrastructure plans.

Image source: propertyupdate.com.au

Sustainability and Energy Efficiency in Homes

Homes with 7-star energy ratings cut energy bills by 25%. Features like passive solar design and greywater systems reduce costs while boosting resale value, aligning with eco-conscious buyer preferences.

Technological Advancements in Property Buying

AI-powered platforms streamline property searches by analyzing buyer preferences. For instance, PropTech tools like virtual tours and blockchain-based contracts enhance transparency, saving time and reducing transaction complexities.

Economic Factors Influencing the Housing Market

Rising construction costs, driven by global supply chain disruptions, inflate property prices. Strategic pre-purchase agreements with builders can mitigate risks, ensuring cost predictability amidst economic volatility.

FAQ

What are the hidden costs first-time buyers often overlook in Australia?

First-time buyers in Australia often overlook costs such as stamp duty, legal fees, and settlement adjustments. Additionally, expenses like building inspections, body corporate fees, and ongoing maintenance can significantly impact budgets. Careful financial planning and thorough research are essential to avoid unexpected financial strain.

How do government grants and incentives impact first-home buyers?

Government grants and incentives provide financial relief, reducing upfront costs like deposits or stamp duty. However, they can inflate property prices by increasing demand, potentially offsetting the benefits for buyers.

What strategies can help navigate competitive property markets effectively?

Effective strategies include targeting mid-tier suburbs with growth potential, building rapport with real estate agents for insights, and securing pre-approval to act quickly. Staying informed on local trends is crucial.

Why is understanding zoning laws crucial for first-time homebuyers?

Understanding zoning laws is crucial as they dictate property use, renovation possibilities, and future developments. Overlooking these can lead to compliance issues, limiting property value and long-term plans.

How can emerging trends like PropTech simplify the home-buying process?

Emerging trends like PropTech simplify the home-buying process by offering virtual tours, streamlining property searches, and providing data analytics for informed decision-making. These tools save time and enhance transparency for buyers.

Conclusion

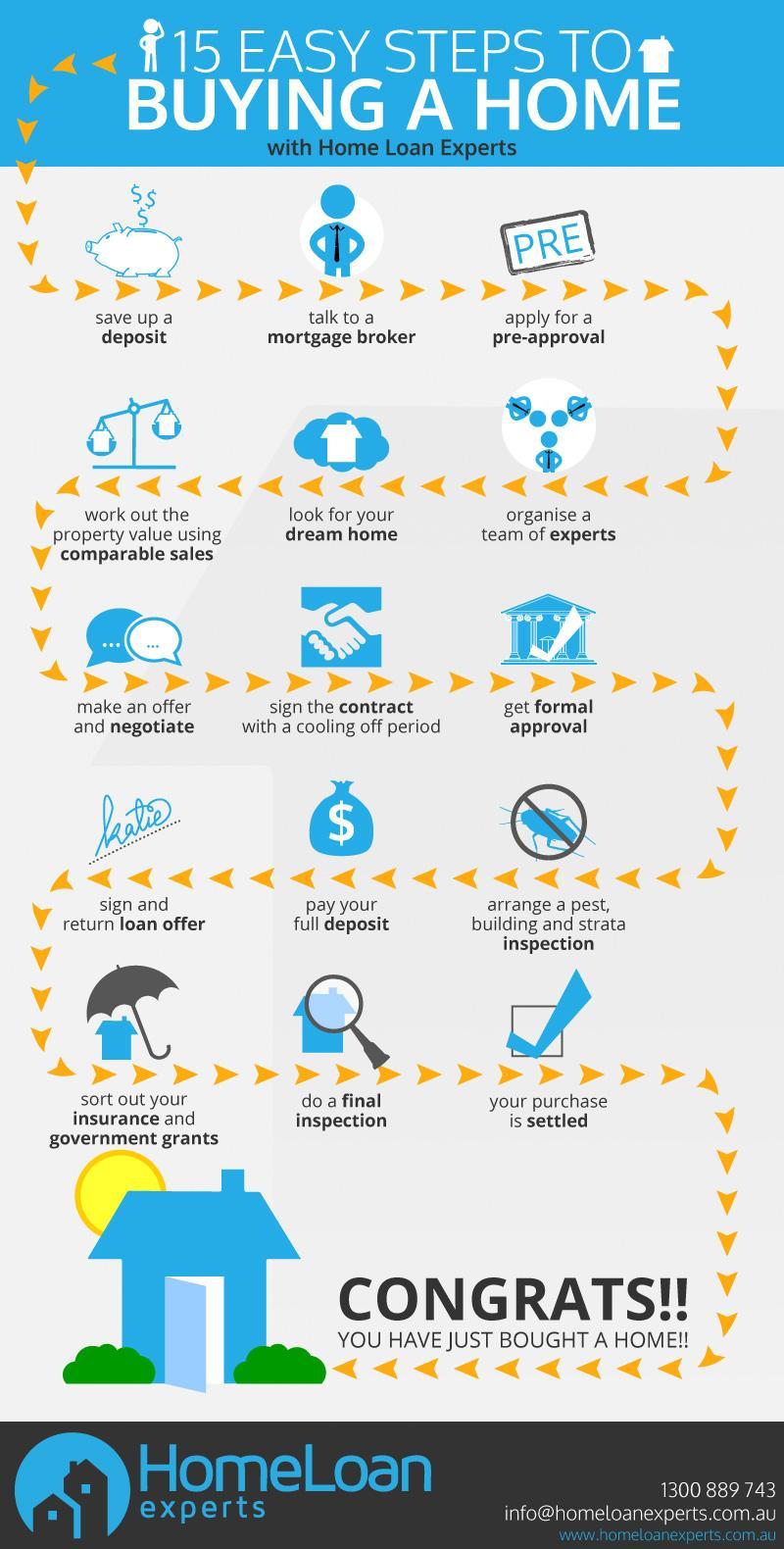

Buying your first home in Australia is a journey filled with hidden complexities and opportunities. Beyond the excitement, it requires navigating unexpected costs, understanding legal frameworks, and leveraging emerging tools like PropTech. For instance, while government grants can ease financial burdens, they may inadvertently inflate property prices, creating a paradox for buyers. Similarly, zoning laws, often overlooked, can significantly impact future property value and usability.

Consider the case of Sydney’s western suburbs, where mid-tier markets have shown growth due to infrastructure investments. This highlights the importance of researching local trends to uncover hidden gems. Expert advice, such as working with mortgage brokers or real estate agents, can provide tailored insights, ensuring informed decisions.

Think of the process as assembling a puzzle—each piece, from financial planning to legal due diligence, contributes to the bigger picture of homeownership. By addressing misconceptions and staying proactive, first-time buyers can turn challenges into stepping stones, making the dream of owning a home both achievable and rewarding.

Image source: homeloanexperts.com.au

Synthesizing Insights for Future Homeowners

Focusing on offset accounts as a financial tool can significantly reduce interest payments while maintaining liquidity. For example, pairing this with split-rate mortgages balances risk and adaptability.

Additionally, understanding local infrastructure developments—like new transport links—can reveal undervalued areas poised for growth. This approach combines financial strategy with market foresight, empowering buyers to make smarter, future-proof investments.

Preparing for a Successful Property Investment Journey

Leverage data-driven tools like PropTech platforms to analyze market trends and identify undervalued properties. Combining this with zoning law insights ensures compliance while maximizing long-term investment potential.