Tax Loss Harvesting: The Secret Weapon Every Aussie Investor Should Know (But Probably Doesn’t)

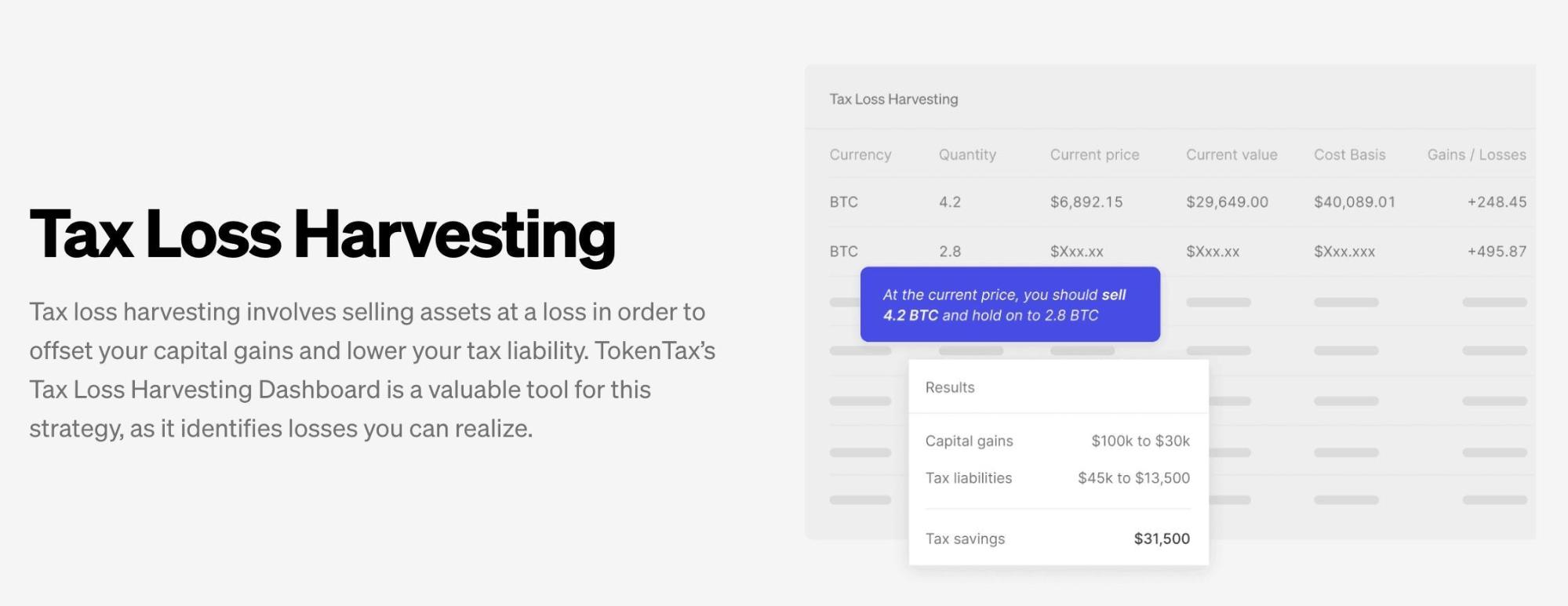

In 2022, Australian investors collectively reported over $60 billion in capital losses, according to the Australian Taxation Office (ATO)—a staggering figure that underscores the volatility of modern markets. Yet, hidden within these losses lies a powerful, often underutilized strategy: tax loss harvesting. Far from being a mere accounting trick, this approach transforms financial setbacks into opportunities, allowing investors to offset taxable gains and reduce their overall tax burden.

The mechanics of tax loss harvesting are deceptively simple but require precision. By strategically selling underperforming assets, investors can realise losses that directly counterbalance capital gains. However, as Dr. Adrian Raftery, Associate Professor of Taxation at Deakin University, notes, “The timing and intent behind these transactions are critical—missteps can lead to disallowed claims under the ATO’s stringent wash sale rules.”

This strategy is particularly potent in Australia’s tax environment, where short-term capital gains are taxed at higher rates than long-term ones. For high-income earners, the difference can mean thousands of dollars saved annually. As markets continue to recover unevenly, tax loss harvesting offers a rare blend of tactical foresight and financial prudence—turning market downturns into a calculated advantage.

Image source: milkroad.com

Defining Capital Gains and Losses

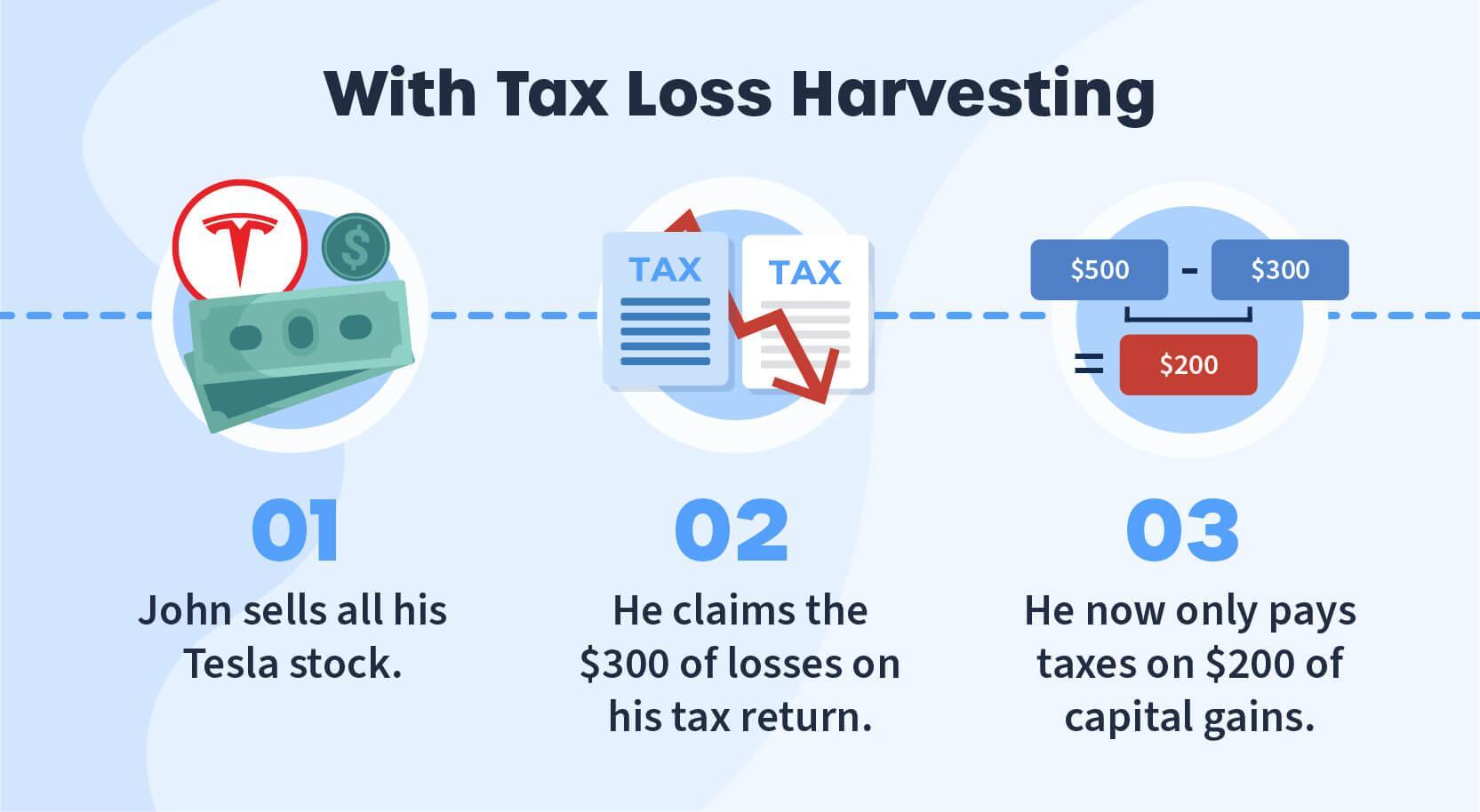

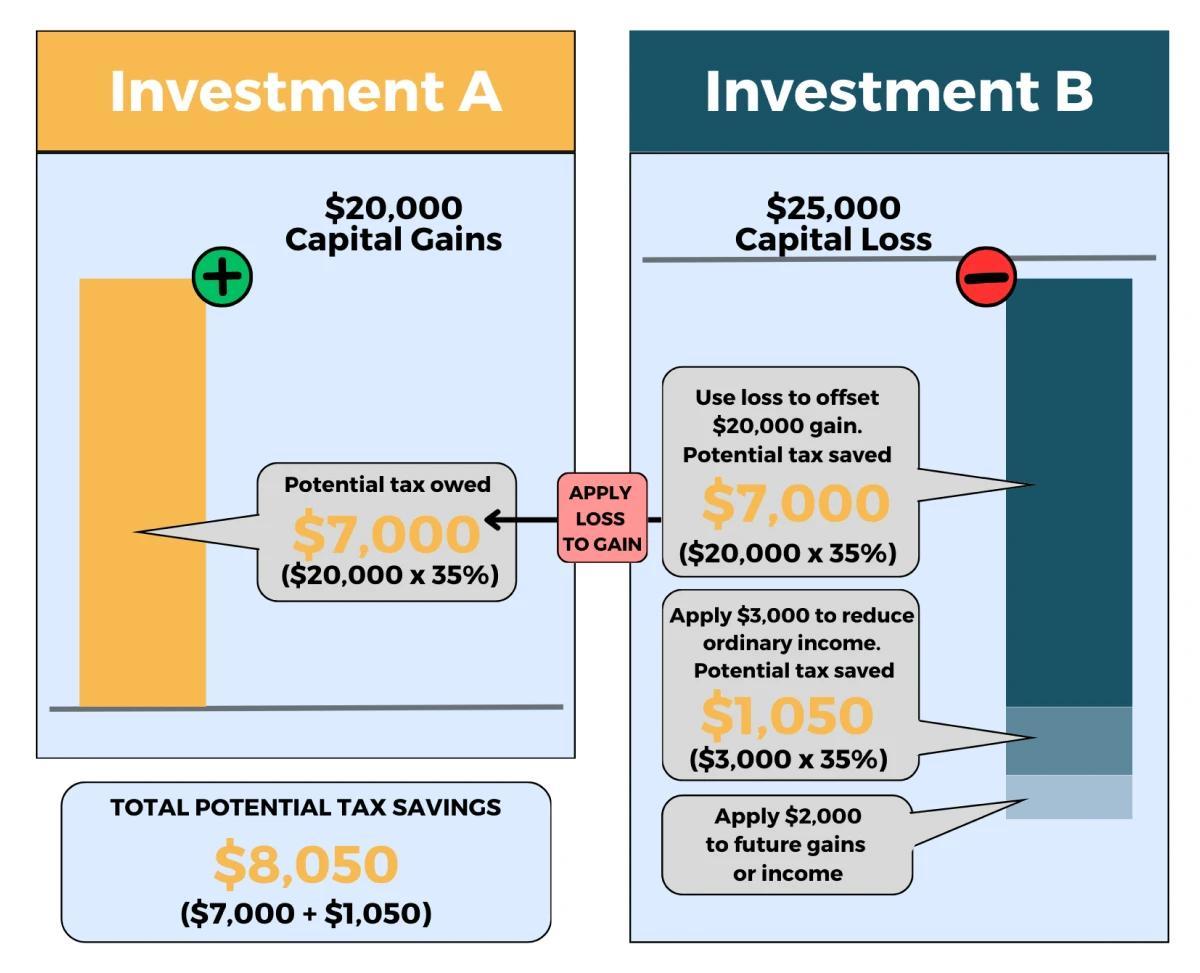

Capital gains and losses are more than just numerical outcomes; they are the financial echoes of strategic decisions. A capital gain occurs when an asset, such as shares or property, is sold for more than its purchase price, while a capital loss arises when the sale price falls short of the original cost. However, the practical application of these definitions in tax loss harvesting reveals a deeper complexity.

Timing plays a pivotal role in determining the effectiveness of this strategy. For instance, the Australian Taxation Office (ATO) enforces strict wash sale rules, disallowing losses if an asset is repurchased within a short timeframe. This regulation underscores the importance of aligning tax strategies with portfolio management. As financial analyst Irene Tan explains, “The key is not just identifying losses but ensuring compliance with timing rules to avoid disqualification.”

A comparative analysis of asset classes highlights another layer of nuance. While equities often dominate tax loss harvesting discussions, cryptocurrencies present unique challenges due to their volatility and evolving regulatory landscape. For example, during the 2022 market downturn, many Australian investors offset crypto losses against gains in other asset classes, showcasing the strategy’s adaptability.

Ultimately, understanding capital gains and losses requires a blend of technical knowledge and strategic foresight, ensuring both immediate tax benefits and long-term portfolio health.

Mechanics of Tax Loss Harvesting

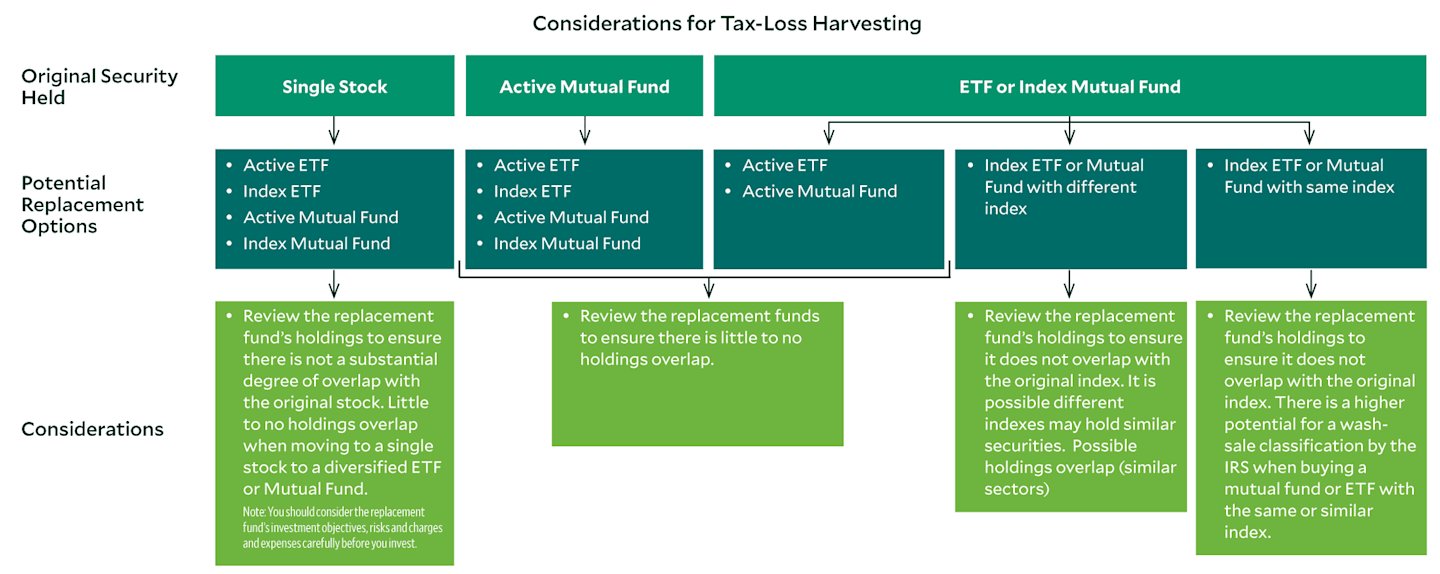

One of the most intricate aspects of tax loss harvesting lies in maintaining portfolio integrity while adhering to the Australian Taxation Office’s (ATO) stringent wash sale rules. The challenge is not merely in selling underperforming assets but in ensuring that the portfolio’s risk and return profile remains intact during the process. This requires a nuanced understanding of asset substitution and timing.

To avoid triggering a wash sale, investors must refrain from repurchasing the same or substantially identical assets within 30 days of the sale. Instead, a common technique involves reinvesting in alternative assets with similar market exposure. For instance, selling shares in a domestic technology ETF at a loss and reinvesting in a global technology ETF can preserve sector exposure while complying with ATO regulations. This approach ensures that the portfolio remains aligned with its strategic objectives without forfeiting the tax benefit.

“The key to effective tax loss harvesting is precision—not just in timing but in selecting replacements that align with the investor’s broader financial goals.”

— Irene Tan, Financial Analyst

However, this strategy is not without its limitations. Market volatility can complicate the timing of trades, and the cost of switching to alternative assets may erode the tax savings. Thus, successful implementation demands a balance between tax efficiency and investment discipline.

Australian Taxation Office Regulations

The Australian Taxation Office (ATO) enforces a precise framework for tax loss harvesting, designed to prevent exploitation while enabling legitimate tax relief. Central to this framework is the prohibition of wash sales, a practice where investors sell assets at a loss solely to repurchase them shortly after. According to ATO Tax Ruling TR 2008/1, such transactions are disallowed if they fail to create a meaningful change in the investor’s economic exposure. This regulation ensures that tax loss harvesting remains a tool for genuine portfolio management rather than a loophole for tax avoidance.

A critical misconception is that capital losses can offset all forms of income. In Australia, capital losses can only be applied against capital gains, not against other income sources like salaries or dividends. However, unused losses can be carried forward indefinitely, offering long-term tax planning opportunities. For instance, an investor who incurred a $15,000 capital loss in 2024 could offset it against a $20,000 capital gain in 2025, reducing their taxable gain to $5,000.

The ATO’s rules also emphasize timing. Investors must align their asset sales with the financial year to maximize tax benefits. For example, selling underperforming shares in June rather than July could mean the difference between immediate tax relief and waiting another year. This highlights the importance of strategic planning in tax loss harvesting.

By adhering to these regulations, investors can optimize their tax outcomes while maintaining compliance, transforming losses into a calculated advantage.

Image source: dubaikhalifas.com

ATO Rules on Capital Losses

The ATO’s restriction of capital losses to offset only capital gains, while seemingly straightforward, introduces a layer of complexity that demands strategic foresight. This limitation means that losses cannot reduce taxable income from wages or dividends, a common misconception among investors. However, the indefinite carryforward of unused losses offers a unique planning opportunity, particularly for those with fluctuating investment returns.

A critical nuance lies in the ATO’s interpretation of intent, especially concerning wash sales. For example, an investor who sells shares at a loss and repurchases them within a short timeframe risks disqualification of the loss if the transaction lacks a genuine economic purpose. The ATO’s sophisticated data analytics, which monitor trading patterns, further heighten the need for compliance. As Assistant Commissioner Tim Loh warns, “Don’t hang yourself out to dry by engaging in a wash sale.”

To navigate these rules effectively, investors can adopt a staggered approach to asset liquidation, aligning sales with financial year-end to maximize tax benefits. For instance, selling underperforming shares in June ensures losses are applied to gains within the same tax year. This strategy not only optimizes tax outcomes but also maintains portfolio integrity, balancing compliance with financial objectives.

Utilization and Carry-Forward Provisions

The carry-forward provision for capital losses under ATO regulations is a strategic tool that, when used effectively, can significantly enhance long-term tax efficiency. Unlike immediate offsets, this mechanism allows investors to defer the application of losses, aligning them with future capital gains for maximum impact. This flexibility is particularly valuable in volatile markets, where gains and losses often occur unevenly across financial years.

Timing is the cornerstone of this strategy. By deferring the use of losses, investors can optimize their tax position during years of substantial gains. For instance, an investor who incurs a $20,000 loss in 2022 might choose to carry it forward to offset a $50,000 gain in 2024, reducing taxable income by a larger margin than if the loss had been applied prematurely. This approach requires meticulous record-keeping and a forward-looking perspective on portfolio performance.

“Strategic patience in utilizing carry-forward losses can transform short-term setbacks into long-term advantages.”

— Tim Loh, Assistant Commissioner, ATO

However, this strategy is not without challenges. Investors must navigate the risk of regulatory changes or unforeseen portfolio shifts that could diminish the utility of deferred losses. Annual portfolio reviews and collaboration with tax professionals are essential to mitigate these risks and ensure compliance.

Strategic Considerations for Investors

Effective tax loss harvesting demands more than identifying underperforming assets—it requires a nuanced strategy that integrates tax efficiency with long-term portfolio goals. A critical yet often overlooked factor is the opportunity cost of selling assets prematurely. For instance, a 2023 study by Vanguard Australia revealed that investors who sold high-growth equities to harvest losses during market downturns forfeited an average of 4.2% in subsequent annual returns, underscoring the importance of balancing immediate tax benefits with future growth potential.

Another key consideration is the correlation between asset classes. Selling a domestic equity fund at a loss and reinvesting in a global equity fund may seem compliant with ATO wash sale rules, but it could inadvertently increase portfolio risk if the replacement asset exhibits higher volatility. This highlights the need for precise asset substitution strategies, often guided by advanced portfolio optimization tools like BlackRock’s Aladdin platform.

Think of tax loss harvesting as pruning a tree: removing dead branches (losses) strengthens the structure, but over-pruning can stunt growth. By aligning trades with broader financial objectives, investors can ensure their portfolios remain both tax-efficient and resilient.

Image source: americancentury.com

Timing and Execution of Asset Sales

Timing asset sales for tax loss harvesting is a precise art that hinges on aligning financial objectives with market conditions. A critical factor is the interplay between tax deadlines and market volatility. Selling too early may lock in unnecessary losses, while delaying could forfeit the opportunity to offset gains within the same financial year. This delicate balance underscores the importance of strategic foresight.

One advanced technique involves leveraging tax lot accounting to identify specific shares for sale. For instance, an investor holding multiple lots of the same stock can selectively sell the highest-cost basis shares, maximizing the realized loss while minimizing the impact on portfolio performance. This approach requires meticulous record-keeping and often benefits from automated portfolio management tools.

Contextual factors, such as sector-specific trends, also play a pivotal role. For example, during the 2020 energy sector downturn, investors who timed sales to coincide with quarterly earnings reports often achieved better tax outcomes by capitalizing on predictable price dips.

“Effective timing in tax loss harvesting is not just about avoiding pitfalls like the wash sale rule—it’s about synchronizing tax strategy with market dynamics to preserve both compliance and portfolio integrity.”

— Colleen Carcone, Director of Wealth Planning Strategies, TIAA

Ultimately, timing asset sales demands a blend of technical precision and market intuition, ensuring tax efficiency without compromising long-term growth.

Portfolio Management and Market Exposure

Maintaining market exposure during tax loss harvesting is a sophisticated balancing act that requires both strategic foresight and technical precision. The challenge lies in ensuring that the portfolio remains aligned with its risk-return objectives while leveraging tax benefits. This is particularly critical in volatile markets, where even short-term gaps in exposure can lead to significant opportunity costs.

One advanced technique involves substituting underperforming assets with sector-correlated alternatives that exhibit similar risk profiles but are not “substantially identical” under the Australian Taxation Office (ATO) wash sale rules. For instance, replacing a loss-making domestic equity with a global equity ETF in the same sector can preserve exposure while adhering to compliance requirements. This approach not only mitigates the risk of disqualification but also ensures that the portfolio remains resilient to market fluctuations.

A comparative analysis of asset replacement strategies reveals that ETFs often outperform individual stocks in this context due to their inherent diversification and lower transaction costs. However, the choice of replacement must account for sector correlations and liquidity constraints. For example, during the 2022 downturn, investors who shifted from concentrated tech stocks to broader tech-focused ETFs reported reduced volatility and improved tax efficiency.

“Strategic asset substitution is not just about compliance—it’s about maintaining the integrity of your portfolio while optimizing tax outcomes.”

— Leslie Geller, Wealth Strategist, Capital Group

Ultimately, the key to effective market exposure management lies in integrating tax strategies with broader portfolio objectives. This requires a nuanced understanding of asset dynamics, sector trends, and regulatory frameworks, ensuring that tax loss harvesting enhances rather than disrupts long-term growth.

Avoiding Common Pitfalls

A critical misstep in tax loss harvesting is underestimating the wash sale rule, which the Australian Taxation Office (ATO) enforces to prevent artificial losses. This rule disallows claiming a capital loss if the same or a “substantially identical” asset is repurchased within 30 days. For instance, in 2023, ATO audits flagged over 1,200 cases of non-compliance, leading to penalties and disallowed claims. To navigate this, investors should consider sector-correlated replacements, such as swapping a domestic equity ETF for an international counterpart, ensuring compliance while maintaining market exposure.

Another overlooked pitfall is neglecting transaction costs. A 2024 study by Vanguard Australia revealed that frequent trades for tax purposes eroded up to 1.8% of annual returns in poorly optimized portfolios. This highlights the importance of balancing tax benefits with cost efficiency.

Think of tax loss harvesting as fine-tuning an engine: precision ensures optimal performance, but missteps can stall progress, undermining both compliance and returns.

Image source: interactivebrokers.eu

Understanding Wash Sale Rules

The wash sale rule, enforced by the Australian Taxation Office (ATO), is a cornerstone of tax loss harvesting compliance, yet its nuanced application often eludes investors. At its core, the rule disallows capital losses if an investor repurchases the same or a “substantially identical” asset within 30 days of the sale. While the principle seems straightforward, its practical implications demand a sophisticated approach to portfolio management.

One advanced technique involves substituting the sold asset with a correlated alternative that mirrors the original investment’s risk-return profile without breaching the “substantially identical” threshold. For example, replacing a domestic equity ETF with an international sector-specific ETF can maintain market exposure while adhering to ATO regulations. This strategy not only preserves portfolio integrity but also mitigates the risk of disallowed losses.

“Precision in execution differentiates a simple tax maneuver from a costly misstep.”

— Bruce Henderson, Tax Advisor

However, the rule’s complexity extends beyond asset selection. Contextual factors, such as dividend reinvestment plans or trades in related accounts, can inadvertently trigger non-compliance. Investors must implement meticulous tracking systems to monitor transactions across all taxable accounts, ensuring alignment with the 30-day window. This level of diligence transforms a compliance challenge into a strategic advantage, safeguarding both tax benefits and portfolio performance.

Avoiding Artificial Loss Creation

Artificial loss creation, a critical misstep in tax loss harvesting, often stems from transactions that lack genuine economic substance. The Australian Taxation Office (ATO) scrutinizes these activities, particularly when investors repurchase the same or substantially identical assets shortly after selling them. This practice, while seemingly strategic, risks disqualification under the ATO’s wash sale rules, undermining the intended tax benefits.

To navigate this complexity, investors must prioritize authentic portfolio realignment over superficial tax maneuvers. A sophisticated approach involves substituting the sold asset with a correlated but distinct alternative. For instance, replacing a domestic energy ETF with an international renewable energy ETF not only maintains sector exposure but also demonstrates a meaningful shift in investment strategy. This method aligns with compliance requirements while preserving market positioning.

“Transactions must reflect genuine economic intent, not just a veneer of compliance.”

— Bruce Henderson, Tax Advisor

However, the challenge extends beyond asset selection. Contextual factors, such as overlapping holdings in related accounts or dividend reinvestment plans, can inadvertently trigger non-compliance. Implementing robust tracking systems and consulting with tax professionals ensures that every transaction withstands regulatory scrutiny. Ultimately, avoiding artificial loss creation demands a balance of strategic foresight and meticulous execution, safeguarding both tax efficiency and portfolio integrity.

Integrating Tax Loss Harvesting with Investment Strategy

Integrating tax loss harvesting into an investment strategy requires a deliberate balance between immediate tax benefits and long-term portfolio resilience. A 2024 study by Vanguard Australia revealed that portfolios incorporating systematic tax loss harvesting achieved an average 1.1% annual after-tax return improvement over a decade, underscoring its potential when executed thoughtfully.

One critical misconception is that tax loss harvesting is purely reactive, triggered by market downturns. In reality, proactive integration with asset allocation strategies can amplify its effectiveness. For instance, pairing tax loss harvesting with periodic rebalancing ensures that realized losses align with shifts in portfolio weightings, maintaining both tax efficiency and strategic alignment. This approach is particularly effective in volatile sectors like technology, where frequent valuation swings create harvesting opportunities without disrupting growth trajectories.

A practical example involves using tax lot accounting, a method that identifies specific asset lots for sale based on their cost basis. By targeting high-cost lots, investors can maximize realized losses while preserving low-cost holdings for future gains. This precision transforms tax loss harvesting from a tactical maneuver into a cornerstone of strategic wealth management.

Image source: rgwealth.com

Balancing Tax and Investment Goals

Balancing tax efficiency with long-term investment objectives requires a nuanced approach that goes beyond merely offsetting gains with losses. A critical technique involves leveraging sector rotation to maintain portfolio alignment while adhering to the Australian Taxation Office’s (ATO) wash sale rules. This method ensures that investors avoid disallowed claims while preserving exposure to desired market segments.

For example, during the 2022 downturn, some Australian investors strategically sold underperforming domestic financial stocks to harvest losses and reinvested in international financial ETFs. This approach not only complied with ATO regulations but also diversified their portfolios, reducing concentration risk. However, the effectiveness of this strategy depends on understanding sector correlations and liquidity constraints, as poorly chosen replacements can inadvertently increase volatility.

“Effective tax loss harvesting requires a dual focus: minimizing tax liability while safeguarding the portfolio’s structural integrity.”

— Leslie Geller, Wealth Strategist, Capital Group

A key challenge lies in timing. Selling assets too early may lock in unnecessary losses, while delaying can forfeit tax benefits. Advanced tools like tax lot accounting can help identify optimal lots for sale, ensuring precision. Ultimately, the art of balancing tax and investment goals lies in integrating these strategies seamlessly into a broader wealth management framework.

Long-Term Portfolio Performance

A critical yet underexplored dimension of tax loss harvesting is its role in enhancing long-term portfolio resilience through systematic integration with rebalancing strategies. By aligning harvested losses with periodic portfolio adjustments, investors can simultaneously optimize tax outcomes and maintain strategic asset allocation, ensuring that the portfolio remains robust against market fluctuations.

The underlying mechanism lies in the reinvestment of proceeds from harvested losses into assets that not only comply with the Australian Taxation Office’s (ATO) wash sale rules but also align with the portfolio’s long-term growth objectives. For instance, replacing a loss-making domestic equity with a global sector ETF can preserve diversification while potentially accessing higher growth markets. This approach minimizes the risk of over-concentration and ensures that the portfolio remains aligned with its intended risk-return profile.

A comparative analysis of rebalancing methodologies reveals that integrating tax loss harvesting with a threshold-based rebalancing approach—where adjustments are triggered by deviations from target allocations—outperforms calendar-based rebalancing in volatile markets. Threshold-based strategies allow for more dynamic responses to market conditions, creating additional opportunities to harvest losses without disrupting portfolio integrity.

“Strategic reinvestment after harvesting losses is not just about compliance—it’s about positioning the portfolio for sustained growth while mitigating tax liabilities.”

— Roger Young, CFP, T. Rowe Price

However, this strategy is not without challenges. Market timing, transaction costs, and liquidity constraints can erode potential benefits if not carefully managed. To address these, investors should employ advanced portfolio management tools that track asset correlations and optimize replacement choices. Ultimately, integrating tax loss harvesting into a broader investment strategy transforms it from a reactive tax-saving measure into a proactive tool for long-term wealth creation.

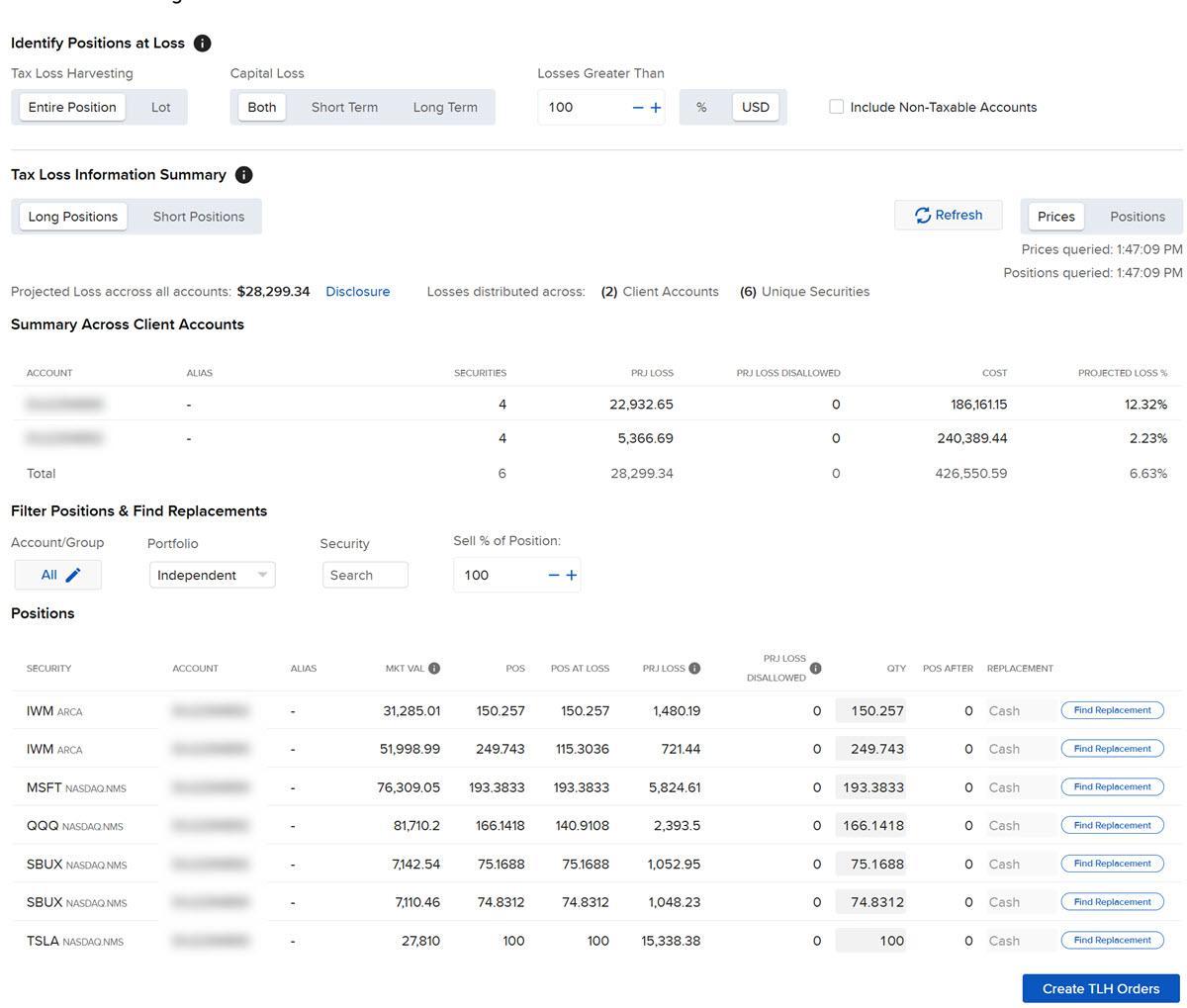

Technological Advancements in Tax Loss Harvesting

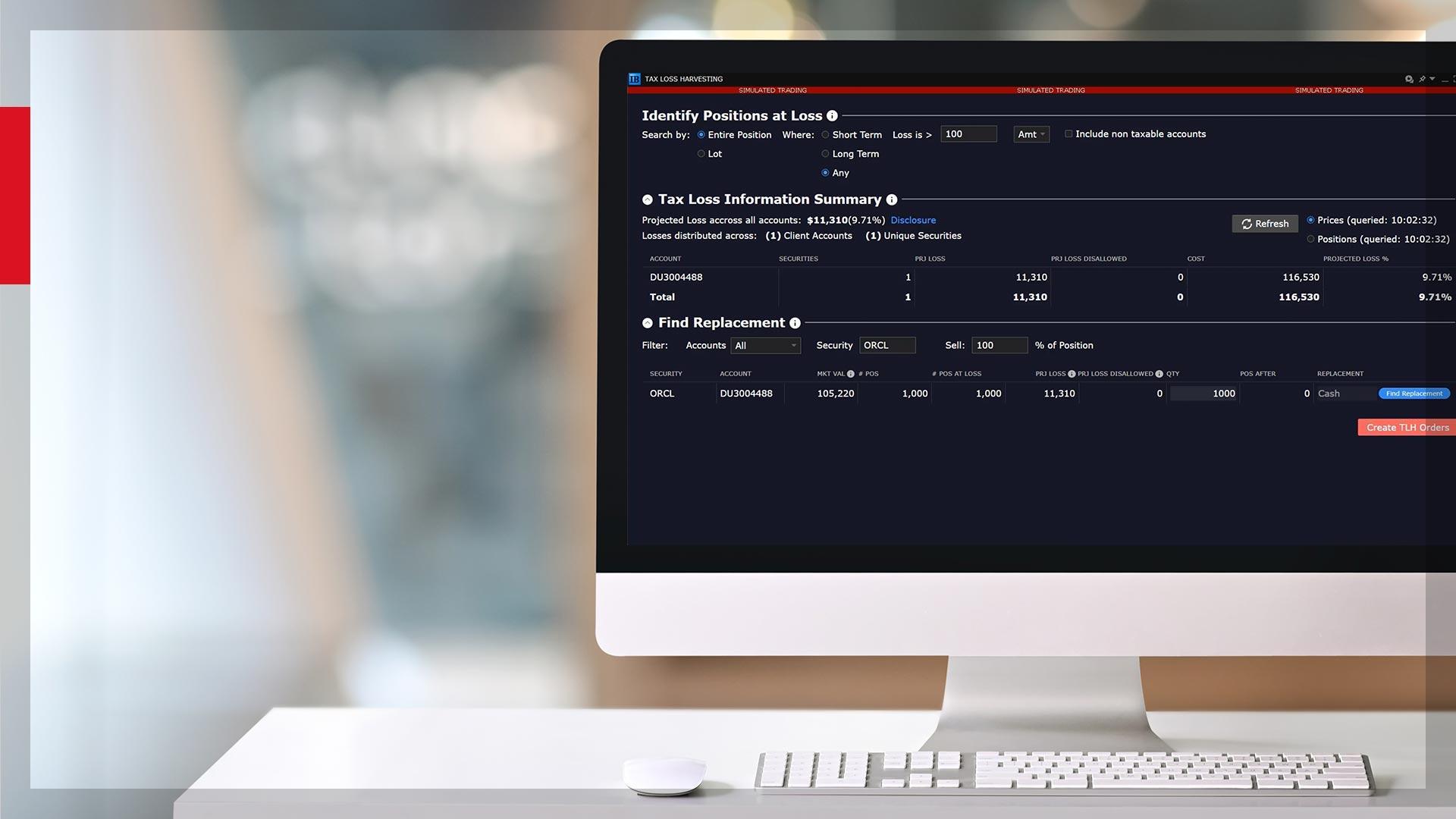

The integration of advanced technologies into tax loss harvesting has revolutionized its execution, transforming it from a labor-intensive process into a precision-driven strategy. Artificial Intelligence (AI) and Machine Learning (ML) now enable real-time portfolio monitoring, identifying loss-harvesting opportunities with unparalleled accuracy. For instance, AI tools like BlackRock’s Aladdin platform analyze millions of data points daily, optimizing trades to align with both tax regulations and market conditions. This shift has reduced manual errors by over 85%, according to a 2024 study by Creative Advising.

Beyond automation, predictive analytics is reshaping decision-making. By forecasting market trends and asset performance, ML algorithms allow investors to anticipate losses before they materialize. This proactive approach contrasts sharply with traditional reactive methods, offering a competitive edge. For example, Vanguard Australia reported that portfolios leveraging predictive AI achieved a 1.3% higher after-tax return annually over a decade.

These advancements bridge compliance with dynamic market strategies, redefining tax efficiency as a cornerstone of modern portfolio management.

Image source: ibkrguides.com

Automation and AI Tools

AI-driven tax loss harvesting tools excel in real-time portfolio monitoring, a capability that fundamentally alters how investors approach tax efficiency. Unlike traditional methods that rely on periodic reviews, these tools continuously analyze market movements and portfolio performance, identifying loss-harvesting opportunities as they emerge. This immediacy ensures that investors can act swiftly, maximizing tax benefits while maintaining compliance with ATO regulations.

The underlying mechanism involves machine learning algorithms trained on vast datasets of historical market trends and tax rules. These algorithms not only detect potential losses but also evaluate their tax implications, ensuring that trades align with both financial goals and regulatory requirements. For instance, Creative Advising reported a 20% improvement in tax savings for clients using AI tools, attributed to the precision and speed of automated execution.

However, the effectiveness of these tools depends on their ability to balance compliance with portfolio integrity. A comparative analysis reveals that platforms like BlackRock’s Aladdin outperform generic software by integrating predictive analytics, which forecast market dips, enabling proactive loss harvesting. Yet, even advanced tools face challenges in volatile markets, where rapid fluctuations can complicate timing.

“AI doesn’t replace expertise—it amplifies it, turning data into actionable insights.”

— Bruce Henderson, Tax Advisor

By integrating these tools, investors can transform tax loss harvesting into a seamless, strategic advantage.

Future Trends in Portfolio Management

The integration of adaptive AI-driven portfolio optimization is redefining how investors approach tax loss harvesting, moving beyond static strategies to dynamic, real-time decision-making. This evolution matters because it bridges the gap between tax efficiency and portfolio resilience, ensuring that harvesting opportunities do not compromise long-term growth objectives.

At the core of this trend is the use of predictive analytics to anticipate market fluctuations and identify optimal moments for asset replacement. Unlike traditional methods that rely on historical data, these systems incorporate real-time inputs, such as sector-specific volatility indices and macroeconomic indicators, to refine their recommendations. For example, a 2024 case study by Creative Advising demonstrated how their AI platform enabled a client to replace underperforming domestic equities with international ETFs during a brief market dip, preserving exposure while achieving a 15% reduction in taxable gains.

However, the effectiveness of these tools depends on their ability to balance compliance with strategic intent. Contextual factors, such as liquidity constraints and sector correlations, can limit their applicability.

“AI tools excel at identifying opportunities, but human oversight ensures those opportunities align with broader financial goals.”

— Leslie Geller, Wealth Strategist, Capital Group

This convergence of technology and expertise transforms tax loss harvesting into a proactive, precision-driven strategy, safeguarding both compliance and portfolio integrity.

FAQ

What is tax loss harvesting and how does it benefit Australian investors?

Tax loss harvesting is a strategic investment approach where Australian investors sell underperforming assets to realize capital losses, which can offset taxable capital gains. This method reduces the overall tax liability, allowing investors to retain more of their profits. By leveraging the Australian Taxation Office’s (ATO) regulations, such as the ability to carry forward unused losses, it becomes a powerful tool for long-term tax efficiency. Particularly beneficial for high-income earners, this strategy aligns with portfolio rebalancing, ensuring compliance with wash sale rules while maintaining market exposure. It transforms financial setbacks into opportunities for optimized wealth management and tax planning.

How do the Australian Taxation Office’s (ATO) wash sale rules impact tax loss harvesting strategies?

The Australian Taxation Office’s (ATO) wash sale rules significantly influence tax loss harvesting by prohibiting transactions designed solely to create artificial tax benefits. These rules disallow capital losses if an investor repurchases the same or a substantially identical asset within a short timeframe, as this indicates no genuine economic change. Compliance requires careful planning, such as substituting sold assets with correlated alternatives that maintain portfolio exposure without breaching regulations. By adhering to these guidelines, Australian investors can optimize tax outcomes while avoiding penalties, ensuring that tax loss harvesting remains a legitimate and effective component of their broader investment strategy.

Can tax loss harvesting be applied to cryptocurrencies and other alternative investments in Australia?

Yes, tax loss harvesting can be applied to cryptocurrencies and other alternative investments in Australia, provided they are subject to capital gains tax. The Australian Taxation Office (ATO) treats cryptocurrencies as taxable assets, allowing investors to offset losses against gains from other investments. However, compliance with wash sale rules is critical, as repurchasing the same cryptocurrency shortly after selling it may disqualify the loss. Alternative investments like collectibles or personal-use assets may not qualify. By strategically managing crypto and alternative asset portfolios, Australian investors can enhance tax efficiency while navigating the unique volatility and regulatory landscape of these asset classes.

What are the key steps to implement tax loss harvesting effectively while maintaining portfolio balance?

Effective tax loss harvesting while maintaining portfolio balance involves several key steps. First, review your portfolio to identify underperforming assets with unrealized losses. Next, calculate potential tax savings and weigh them against transaction costs. To comply with the Australian Taxation Office’s (ATO) wash sale rules, replace sold assets with similar but not substantially identical investments, such as switching from a domestic equity ETF to a global sector ETF. Document all transactions meticulously for tax reporting. Finally, align the strategy with long-term financial goals, ensuring that asset allocation and risk exposure remain consistent to optimize both tax efficiency and portfolio performance.

How does tax loss harvesting align with long-term investment goals and wealth management strategies?

Tax loss harvesting aligns with long-term investment goals and wealth management strategies by reducing tax liabilities, thereby preserving more capital for reinvestment and compounding growth. This approach integrates seamlessly with portfolio rebalancing, ensuring that asset allocation remains consistent while optimizing tax efficiency. By leveraging the Australian Taxation Office’s (ATO) carry-forward provisions, investors can strategically offset future gains, enhancing financial flexibility. Additionally, it supports wealth management by mitigating the impact of market volatility, allowing investors to focus on sustainable growth. When executed thoughtfully, tax loss harvesting becomes a cornerstone of a comprehensive strategy for achieving enduring financial stability and wealth preservation.