Tax Deductions 101: How to Make the ATO Your New BFF (Spoiler: It’s Not What You Think)

In 2023, the Australian Taxation Office (ATO) flagged over $1.5 billion in questionable tax deduction claims, a staggering 20% increase from the previous year. This surge wasn’t driven by corporate giants but by everyday taxpayers misinterpreting the rules. According to Dr. Adrian Sawyer, a taxation law professor at the University of Canterbury, “The complexity of Australia’s tax code often leads individuals to overestimate what they can claim, particularly in areas like home office expenses and travel.”

The ATO’s scrutiny has intensified, leveraging AI systems to cross-check deductions against industry benchmarks. For instance, a 2024 audit revealed that 35% of flagged claims for work-related car expenses exceeded allowable thresholds. This shift underscores a critical reality: tax deductions are less about loopholes and more about precision. Understanding these nuances isn’t just compliance—it’s strategy.

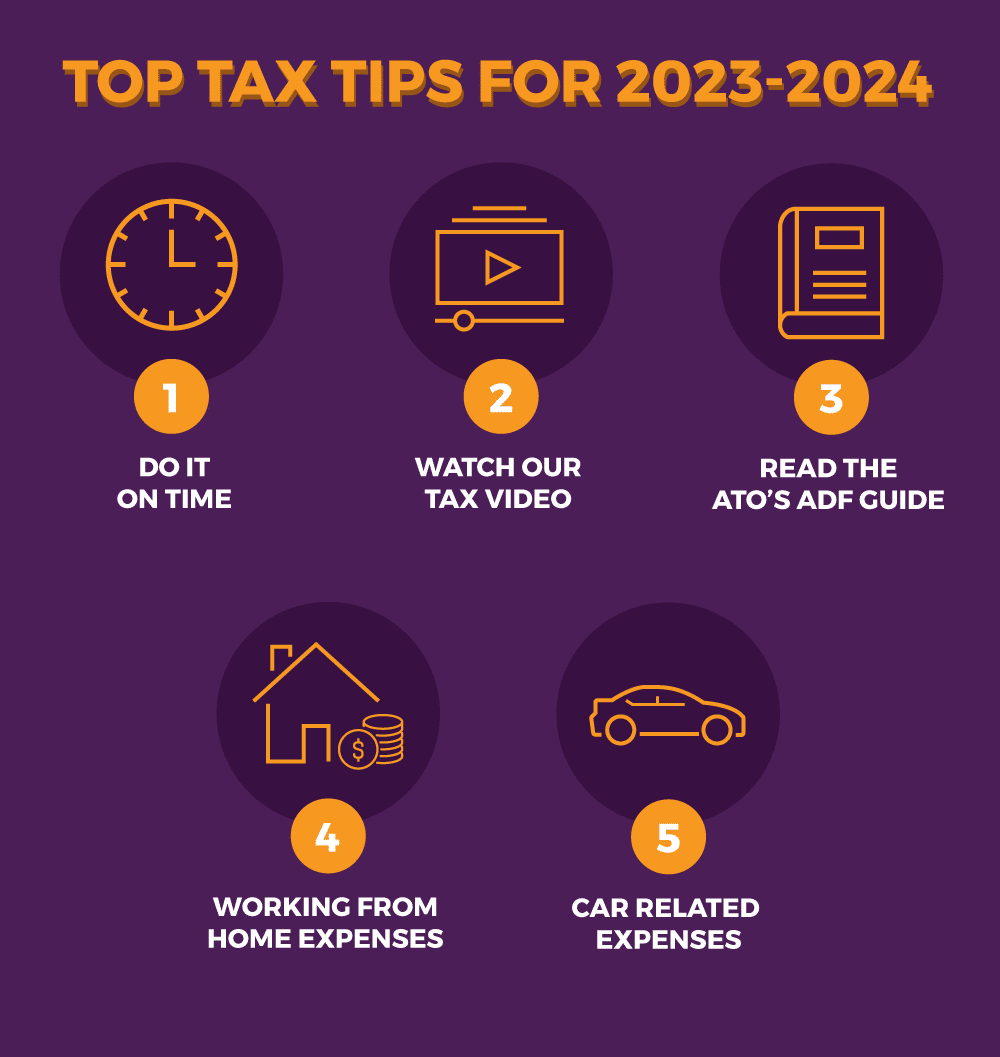

Image source: adfconsumer.gov.au

The Structure of the Australian Tax System

Australia’s progressive tax system operates on a deceptively simple principle: the more you earn, the higher your tax rate. But here’s the catch—this structure isn’t just about taxing income; it’s about defining what counts as taxable income after deductions. This distinction is where the real complexity lies.

At its core, the system hinges on the relationship between assessable income and allowable deductions. For a deduction to qualify, it must meet strict criteria: the expense must be directly related to earning income, not reimbursed, and substantiated with records. For instance, while a self-employed graphic designer can claim software subscriptions, claiming a portion of their Netflix account for “creative inspiration” would likely fail the ATO’s scrutiny.

“The ATO’s focus isn’t on volume but on the integrity of claims. A single, well-documented deduction carries more weight than a dozen vague ones.”

— Sarah Chen, Chartered Tax Advisor

This precision-driven approach underscores the importance of understanding the system’s nuances. Missteps, even unintentional ones, can lead to audits or penalties, making meticulous record-keeping and professional advice indispensable.

How Tax Deductions Work

Claiming tax deductions isn’t just about listing expenses—it’s about aligning them with income generation in a way that withstands scrutiny. The ATO’s framework demands that every deduction meet three critical criteria: the expense must directly relate to earning income, not be reimbursed, and be substantiated with records. This triad forms the backbone of compliance, yet its application often reveals hidden complexities.

Consider the principle of apportioning expenses. For mixed-use items like a home internet plan, only the business-related portion is deductible. Misjudging this split can lead to over-claims, triggering audits. A 2024 case involving a Melbourne-based consultant highlighted this: their claim for 80% of internet costs was reduced to 40% after the ATO reviewed usage logs.

“Precision in apportioning expenses is non-negotiable. It’s not just about compliance—it’s about credibility.”

— Dr. Emily Hart, Tax Policy Analyst

Ultimately, mastering deductions requires not just adherence to rules but strategic foresight in documentation and justification.

Exploring Key Categories of Deductions

Work-related expenses, investment deductions, and personal claims form the backbone of tax strategies, yet their nuances often elude even seasoned taxpayers. For instance, while union fees and professional memberships are deductible, claiming them without proper documentation can lead to ATO scrutiny. A 2023 ATO report revealed that 18% of flagged deductions stemmed from insufficient evidence, underscoring the importance of meticulous record-keeping.

Investment-related deductions, such as those for rental properties, demand a strategic approach. Did you know that pest control costs and garden maintenance for rental properties are deductible? Yet, many landlords overlook these, leaving potential savings untapped. The ATO estimates that 25% of eligible property owners fail to claim such expenses annually.

Misconceptions also abound. A common error is assuming cash expenses without receipts are claimable. The ATO’s data-matching systems, however, can easily flag discrepancies, making accurate documentation non-negotiable. By mastering these categories, taxpayers can transform compliance into a strategic advantage.

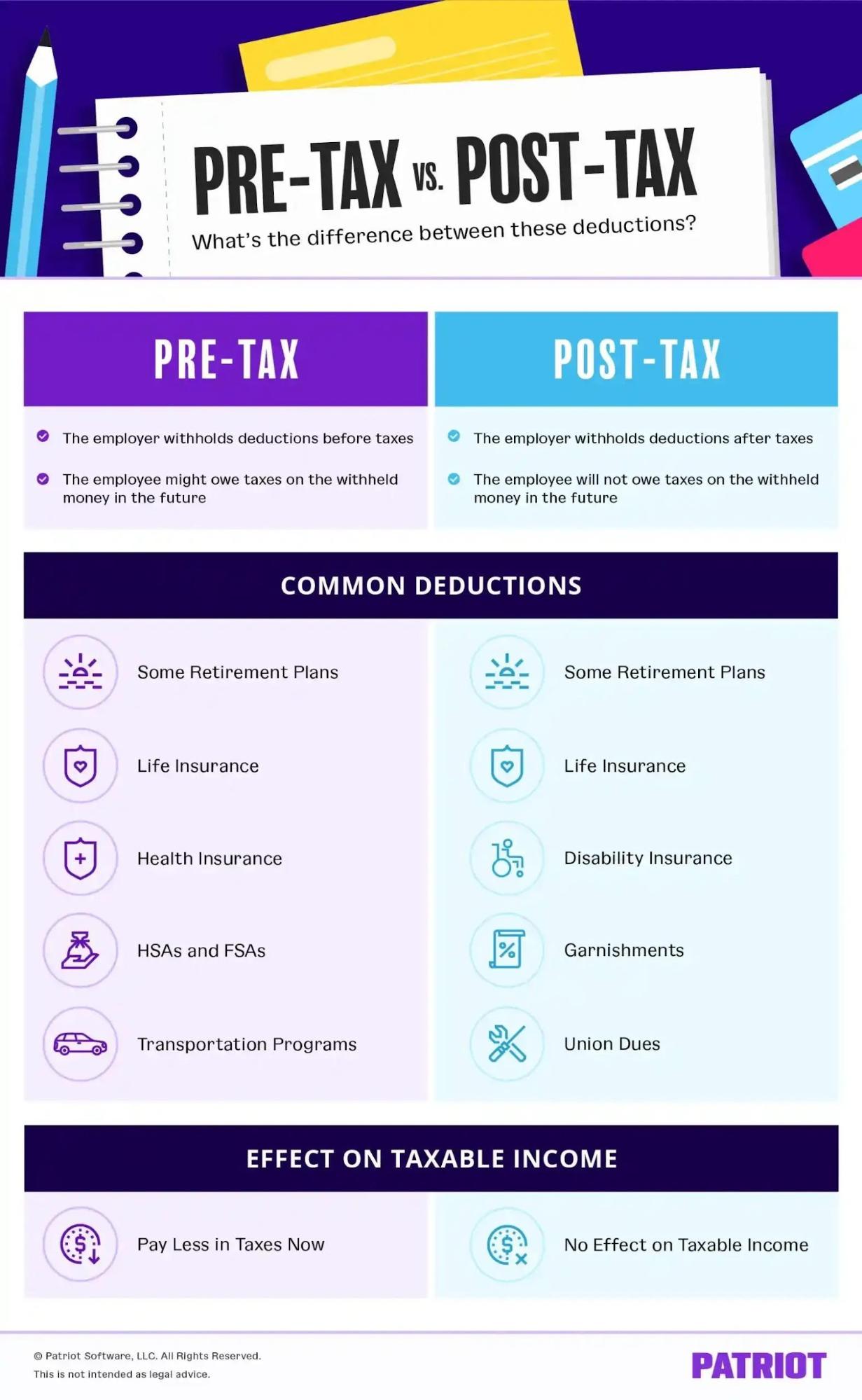

Image source: patriotsoftware.com

Work-Related Expenses

Here’s a little-known nuance: the ATO’s focus on work-related expenses isn’t just about receipts—it’s about the narrative your claims tell. Take apportioning expenses, for example. If you use your personal vehicle for work, the ATO allows claims based on a cents-per-kilometre method or actual costs. But here’s the catch: without a detailed logbook, even legitimate claims can fall apart under scrutiny.

Consider a case where a marketing consultant claimed 70% of their car expenses. The ATO reduced it to 30% after reviewing their incomplete logbook. Why? The consultant failed to document the purpose of each trip. This highlights the importance of precision in substantiating claims.

“The ATO values transparency over assumptions. A well-maintained logbook can be your strongest ally in defending vehicle-related deductions.”

— Alex McFarlane, Chartered Tax Advisor

To simplify, treat your logbook like a journal: record dates, destinations, and purposes. This approach not only ensures compliance but also strengthens your credibility, turning tax time into an opportunity rather than a challenge.

Investment and Personal Deductions

Let’s talk about a hidden gem in tax deductions: depreciation on investment property assets. Many landlords overlook this, but it’s a game-changer. Depreciation allows you to claim the wear and tear on items like carpets, appliances, and even the building structure itself. Here’s the kicker: you don’t need to have spent money recently to claim it—these deductions are based on the asset’s original value and lifespan.

Why does this matter? Because it’s one of the few deductions that doesn’t require an out-of-pocket expense during the tax year. A detailed depreciation schedule, prepared by a qualified quantity surveyor, can unlock thousands in deductions annually. For example, a Sydney-based property investor reduced their taxable income by $8,000 in one year simply by leveraging a comprehensive schedule.

“Depreciation is often misunderstood, but it’s one of the most powerful tools for property investors to maximize returns.”

— Sarah Blake, Certified Property Tax Specialist

The takeaway? Don’t underestimate the value of professional advice and meticulous documentation. It’s the difference between leaving money on the table and optimizing your tax strategy.

Common Misconceptions About Deductions

Here’s a surprising truth: not all work-related expenses are created equal. A persistent misconception is that any cost vaguely tied to your job is deductible. The reality? The ATO demands a direct, measurable link between the expense and income generation, backed by meticulous records.

Take the example of claiming clothing expenses. Many assume that purchasing professional attire qualifies, but unless it’s a uniform or protective gear explicitly required for your role, it’s considered personal. This distinction often trips up even experienced taxpayers. A 2023 review by Chartered Accountants ANZ highlighted that over 15% of flagged claims stemmed from such misinterpretations.

“The ATO’s scrutiny isn’t just about compliance—it’s about ensuring fairness in the system.”

— Dr. Emily Hart, Tax Policy Analyst

The lesson? Avoid assumptions. Instead, focus on understanding the nuanced criteria for deductions, ensuring your claims are both legitimate and defensible.

Advanced Strategies for Maximizing Deductions

Strategic tax planning is less about reacting and more about anticipating. One advanced approach involves leveraging prepaid expenses. By prepaying up to 12 months of deductible costs—such as insurance or subscriptions—you can shift deductions into the current tax year, reducing taxable income strategically. This method is particularly effective for high-income earners aiming to manage tax brackets.

Another overlooked tactic is depreciation pooling. Instead of tracking individual low-cost assets, group them into a general small business pool. This allows accelerated depreciation, maximizing deductions earlier. For instance, businesses using this method often claim up to 57.5% of an asset’s value in the first year, significantly improving cash flow.

“Tax efficiency isn’t about shortcuts; it’s about foresight and precision,” notes Sarah Blake, Certified Tax Strategist.their tax liability but also freed up resources for reinvestment. By aligning deductions

Image source: bench.co

Record-Keeping and Documentation

Effective record-keeping is the backbone of maximizing deductions, yet its true power lies in its strategic application. One often-overlooked technique is real-time categorization of expenses. By tagging each transaction with its purpose—business, personal, or mixed-use—at the moment it occurs, you create a robust, audit-ready system. This approach not only ensures compliance but also streamlines deduction calculations, particularly for complex categories like home office or vehicle expenses.

A comparative analysis reveals that manual systems, while cost-effective, often falter under scrutiny due to human error. In contrast, cloud-based tools like Xero or QuickBooks automate categorization and provide real-time analytics, significantly reducing the risk of discrepancies. However, these tools require consistent input, making user discipline a critical factor in their effectiveness.

“Documentation isn’t just about compliance; it’s about building a defensible narrative for every claim,” notes Karen L. Jones, CPA, Director at PwC.

Unexpectedly, even the best systems can fail if contextual factors—like unclear business-purpose notes—are ignored. To mitigate this, integrating periodic reviews ensures accuracy and strengthens your position during audits.

Timing and Planning for Future Tax Years

Timing deductions isn’t just about saving money—it’s about strategically positioning your finances for long-term benefits. One advanced technique involves prepaying deductible expenses up to 12 months in advance. This approach allows taxpayers to shift deductions into a high-income year, effectively reducing taxable income when it matters most. For instance, expenses like insurance premiums, professional subscriptions, or even loan interest can be prepaid, provided they directly relate to income generation.

The mechanics of this strategy hinge on the ATO’s acceptance of prepaid expenses as legitimate deductions. However, the effectiveness depends on precise timing and documentation. A comparative analysis reveals that while this method works well for individuals with fluctuating incomes, it may offer limited benefits for those with stable earnings. Additionally, businesses can leverage this approach to manage cash flow, particularly during periods of anticipated growth or investment.

“Expense timing isn’t about bending rules—it’s about using the rules smartly to maximize cash flow.”

— Sarah Blake, Certified Tax Strategist

One notable case involved a small business owner who prepaid $15,000 in expenses, reducing their taxable income by 20% in a high-revenue year. This not only lowered their tax liability but also freed up resources for reinvestment. By aligning deductions with income patterns, taxpayers can transform compliance into a proactive financial strategy.

FAQ

What are the most overlooked tax deductions that can significantly reduce your taxable income?

Overlooked deductions include rental property expenses like pest control, garden maintenance, and bookkeeping fees, which many landlords miss. Charitable donations to Deductible Gift Recipients (DGRs) are another underutilized area, provided receipts are kept. Additionally, union fees and costs for managing tax affairs, such as hiring an accountant, are often forgotten. These deductions, when properly documented, can significantly reduce taxable income. By understanding these categories and maintaining thorough records, taxpayers can unlock substantial savings while ensuring compliance with ATO guidelines.

How does the ATO define work-related expenses, and what documentation is required to claim them?

Work-related expenses, as defined by the ATO, must directly relate to earning your income, not be reimbursed by your employer, and be substantiated with records. Eligible costs include tools, uniforms, and travel between work sites. Documentation is critical: receipts must detail the supplier, amount, and purpose, while logbooks or usage records are essential for mixed-use items like vehicles or internet. Digital receipts are acceptable if they accurately represent the original. By aligning claims with ATO criteria and maintaining precise records, taxpayers can ensure compliance and maximize deductions, reinforcing the importance of meticulous documentation in tax strategies.

Can you claim deductions for home office expenses, and how do you calculate the business-use percentage accurately?

Yes, home office expenses are deductible if your workspace is used exclusively or primarily for work. The ATO offers two methods: the fixed-rate method ($0.67/hour) covering utilities, phone, and internet, or the actual cost method, requiring detailed records. To calculate the business-use percentage accurately, measure the workspace area relative to your home’s total size and document work hours. For mixed-use items like internet, apportion costs based on work-related usage. Precise records, such as timesheets and bills, are essential to substantiate claims. This ensures compliance while optimizing deductions, aligning with ATO guidelines for home office expense claims.

What are the key differences between investment property deductions and personal tax deductions?

Investment property deductions focus on expenses directly tied to generating rental income, such as loan interest, property management fees, and depreciation of assets. These deductions aim to offset taxable rental income and are governed by strict ATO guidelines. In contrast, personal tax deductions relate to individual income generation, including work-related expenses, charitable donations, and self-education costs. The key distinction lies in purpose: investment deductions target income-producing assets, while personal deductions address employment or personal financial activities. Accurate documentation, such as receipts and depreciation schedules, is essential for both, ensuring compliance and maximizing tax benefits under ATO regulations.

How can strategic timing of deductions help you optimize your tax bracket and maximize refunds?

Strategic timing of deductions allows taxpayers to align expenses with high-income years, effectively reducing taxable income and optimizing their tax bracket. Prepaying up to 12 months of eligible costs, such as insurance or subscriptions, shifts deductions into the current financial year, lowering immediate tax liabilities. For capital gains, deferring asset sales to a lower-income year minimizes tax exposure. This approach is particularly beneficial for individuals with fluctuating earnings. Accurate forecasting and meticulous documentation are critical to leveraging this strategy, ensuring compliance with ATO guidelines while maximizing refunds and enhancing overall tax efficiency.