CLYDE NORTH

CRANBOURNE EAST

NAB cuts fixed rates official interest rates decrease next year

NAB Cuts Fixed Rates as Official Interest Rates Set to Decrease Next Year Big four bank NAB has cut its fixed rates for customers by up to 0.65 percentage points, as lenders anticipate a cash rate cut next year. The bank has chopped its owner-occupier principal and fixed interest rates by up to 0.5 percentage points, and investor and owner-occupier interest-only fixed rates by up to 0.65 percentage points, according to rate tracking by Canstar. It follows Macquarie Bank’s move last week to slash a range of fixed rates by up to 0.4 percentage points to 5.39 per cent — and could be a sign more rate cuts are to come. Homeowners are anxiously awaiting the Reserve Bank of Australia (RBA) to drop interest rates from the 13-year high of 4.35 per cent. Central banks in the United States, Canada and New Zealand are among those that have reduced interest rates, but the RBA maintains Australia is in a different boat. The minutes from its September meeting confirmed there was no explicit discussion of the case to hike interest rates. Read our blog on: Interest Rates ANZ head of Australian economics Adam Boyton said the minutes represented a “clear step down in the RBA board’s hawkishness”. “This leaves the door open to a shift to neutral by the end of this year and then easing in early 2025,” he said. NAB’s owner-occupied loans have fallen between 0.55 and 0.1 percentage points. The most significant change was for the bank’s two-year fixed loan, which dropped from 6.59 per cent to 6.04 per cent. The bank’s lowest three-year fixed rate of 5.89 per cent is now in line with Commonwealth Bank and Westpac, while ANZ’s offers above 6 per cent. More than 37 lenders have dropped at least one fixed rate over the last month, according to Canstar research. Australian Bureau of Statistics lending data shows just two per cent of new and refinanced loans in August opted for a fixed rate. Read Full Article at: 7 News Australia

Investor surge pushes Australian housing loans to two-year high

Investor surge pushes Australian housing loans to two-year high Australia’s housing market continued its upward trend in August 2024, reaching the highest level of new lending since May 2022. According to the latest data from the Australian Bureau of Statistics (ABS), the total value of new housing loans increased by 1.0% to $30.4 billion, with investor activity leading the charge. Canstar’s analysis of the ABS data showed that investor loans saw a significant boost, rising 1.4% in August to $11.71 billion – a 34.2% increase from the same period last year. This surge in investor lending marked the second-highest monthly value on record. Loans to owner-occupiers also grew, increasing by 0.7% to $18.7 billion, reflecting a 16.5% rise year-on-year. However, first-home buyers faced a slight dip, with loans for this group dropping by 1.5% from July to August. Despite the monthly decline, first-home buyer activity was still 9.2% higher than in August 2023. Tindall pointed out that while first-home buyers remain active, they face stiff competition from investors who can use rental income to offset the burden of higher mortgage payments. Breaking down the data by state, Queensland emerged as a key driver of the national rise. Housing loan commitments in the state soared by 40% over the past year, adding $2 billion in value, more than any other state. In contrast, the average national loan size for owner-occupiers dropped by 1% in August, falling to $636,208. Although most states saw decreases, Queensland and Tasmania bucked the trend, with Queensland posting a record high loan size of $603,988. Learn more about: Australia’s housing market

Fixed rates drop amidst predictions

Fixed rates drop amidst predictions Variable and fixed home loan rates saw both increases and cuts this week, with fixed rates outperforming variable, and a potential cash rate cut anticipated by February, Canstar reported. Home loan rate changes Aussie Home Loans raised interest rates on two variable owner-occupier and investor loans by 0.05%, while five other lenders reduced rates across 50 variable loans for both owner-occupiers and investors. Meanwhile, twelve lenders slashed fixed rates on 322 loans, with an average decrease of 0.24%. Fixed rates outperform variable options Abal Banking continues to offer the lowest variable rate at 5.75%, although a surge in rate cuts means that 112 fixed rates now sit below this, a significant increase from last week’s 64. “There was yet another downpour of fixed rate cuts this week,” said Sally Tindall (pictured above), Canstar’s data insights director. Major institutions like Bendigo Bank and Teachers Mutual Group are among those offering reduced rates. Read Full Article here at: Broker News

Unlock Higher Returns: Proven Tips to Maximize Rental Yield In Australia

To unlock higher returns from your investment property, it’s essential to grasp the intricacies of the market and implement effective strategies to maximize rental yield in Australia. Begin by enhancing your property’s value through strategic upgrades and desirable amenities that appeal to high-quality tenants. By improving your property’s attractiveness, you can justify premium rental prices and reduce vacancies. Next, consider essential property management tips for landlords that can elevate your rental yield. Efficient management practices, such as proactive maintenance and timely communication with tenants, help maintain your property’s condition and foster tenant satisfaction. A well-managed property often leads to longer tenant retention, minimizing turnover costs and ensuring a steady rental income stream. Moreover, you can take specific steps to maximize property value for rental income. Explore options like furnishing the property, offering flexible lease terms, or considering short-term rental opportunities. Implementing these strategies not only boosts your rental yield but also positions your property as a prime choice in competitive markets. For more insights on navigating the Australian Property Market, check out our detailed guide here. Top Tips to Boost Your Returns: Proven Ways to Increase Rental Income Strategies for Investors Boosting your rental income requires strategic planning and a proactive approach to property management. As a property investor, adopting increase rental income strategies can help you maximize your returns and enhance your property’s appeal to potential tenants. It’s crucial to stay informed about market trends and continuously seek ways to improve your property’s value, ensuring that it remains a competitive option in the rental market. Here are some effective strategies to increase your rental income: ● Upgrade Property Amenities: Enhance your property’s features, such as modern kitchens or energy-efficient appliances, to attract higher-paying tenants. ● Consider Short-Term Rentals: If your property is in a prime location, offering short-term leases or holiday rentals can yield higher returns. ● Offer Added Value Services: Including amenities like secure parking, high-speed internet, or even utility bills in rent can justify higher rental prices. ● Review Rent Regularly: Regularly assess and adjust your rent based on market trends and comparable properties to ensure you’re not undercharging. ● Time in the Market is a key factor to consider when planning your investment strategy.For more on this, check out our detailed article on the Melbourne Property Market. By implementing these increase rental income strategies, you can unlock the full potential of your investment property, ensuring consistent returns and long-term profitability. Explore the Best Rental Yield Suburbs Australia: Top Locations for Maximizing Your Property Returns When exploring the best rental yield suburbs in Australia, it’s important to understand the balance between rental yield vs. capital growth. While rental yield focuses on the income generated from your property, capital growth refers to the increase in property value over time. Investors must assess which strategy aligns with their financial goals and market conditions. To effectively maximize property value for rental income, consider implementing targeted real estate strategies for better yield. This may include enhancing property features, optimizing rental agreements, or strategically choosing properties that naturally offer higher yields. Properties located in high-demand areas often lead to a high rental yield property Australia, providing the potential for increased returns. Additionally, understanding the type of property you invest in plays a crucial role in your success. Each property type comes with its unique benefits and challenges, which can significantly affect your investment outcome. For more insights on selecting the right property, check out our guide on the types of property to consider. By making informed decisions, you can enhance your rental income and maximize your investment potential. Key Differences Between Rental Yield vs. Capital Growth: What Every Investor Should Know Understanding the key differences between rental yield vs. capital growth is crucial for making informed investment decisions. Rental yield measures the annual rental income generated by a property relative to its value, while capital growth refers to the increase in property value over time. Investors should balance both factors to optimize returns, as focusing solely on rental yield might limit long-term appreciation, whereas prioritizing capital growth can reduce immediate cash flow. To maximize returns, it’s essential to manage costs effectively and optimize rental property expenses. Start by monitoring maintenance costs, property management fees, and other operational expenses that impact your rental yield. This will allow you to keep your property profitable and attractive to potential tenants. Additionally, consider exploring how effective tenant management and finding a tenant promptly can minimize vacancy rates and improve your overall yield. For more tips on handling tenant-related challenges, read our detailed guide on finding a tenant. By understanding the interplay between rental yield vs. capital growth and actively managing your property expenses, you can create a balanced investment strategy that aligns with both short-term cash flow and long-term wealth accumulation. Essential Rental Property Investment Tips for Maximizing Your Rental Income and ROI When maximizing rental income and ROI, understanding rental property investment tips is essential for property owners looking to make the most of their investments. Start by thoroughly researching the top investment property locations Australia has to offer. Selecting properties in high-demand areas with strong rental yields can significantly boost your returns and provide long-term capital growth. Consider suburbs with planned infrastructure developments, proximity to amenities, and low vacancy rates to ensure a steady rental income. Additionally, keeping up with the latest trends in property investment Australia 2024 can help you stay ahead of the market. Monitor changes in rental demand, government policies, and economic factors that may impact property values and rental yields. Adjusting your investment strategies based on these trends will position you to achieve better returns in a dynamic market. For more in-depth guidance on choosing the right properties and implementing effective strategies, read our comprehensive guide on Successful Property Investment. By applying these rental property investment tips, you can optimize your property’s performance and enhance your overall investment portfolio. Final Thoughts on Maximizing Rental Yield for Australian Property Investors Maximizing your rental yield as an Australian property investor requires a

Werribee

Get to own a House and Land Package in Werribee for only $646,030! The advantages of residing in Werribee include several positive aspects, such as the abundance of parks and recreation facilities available. Werribee boasts several parks, including the Werribee River Park and the Werribee Open Range Zoo, which offer ample opportunities for families to enjoy the great outdoors. Land Size: 263 sqm House Size: 168.89 sqm 4 Bedrooms 1 Living Room 2 Bathrooms 2 Car for Garage Land Settlement: February 2025 𝗪𝗵𝘆 𝗖𝗵𝗼𝗼𝘀𝗲 Werribee Safe and Family-Orientated Community Reasonable and Affordable Housing Prices Surrounded by a Broad Range of Educational Institutions Walking Distance to Shopping Centres and Train Stations Numbers of Major Attractions to Visit Easy and Full Accessible to All Amenities Client’s review: “great place”Werribee South is very peaceful. Not alot of people live here, it’s away from the traffic and chaos of the world. You can’t beat this place for peace and quiet. It is so close to the city and should have a different name as it is so different to Werribee, its not funny. The only thing missing is shops which the marina will bring. The marina will also bring more people to this great place which is not a good thing but the marina won’t be that big as to spoil the “serenity” as one great man once said. We also provide a rental guarantee with a minimum of 1 year and a maximum of 3 years. 𝗙𝗼𝗿 𝗺𝗼𝗿𝗲 𝗱𝗲𝘁𝗮𝗶𝗹𝘀, 𝗷𝘂𝘀𝘁 𝗰𝗮𝗹𝗹 𝘂𝘀: 1300 074 675 or send us a message on Whatsapp +61 488 859 637 For more updates, follow us on social media:Facebook: Simply WealthInstagram: @simplywealthgroupWebsite: simplywealthgroup.com.auTwitter: @SimplyWealthGrp

Truganina

Get to own a House and Land Package in Truganina for only $656,744! Welcome to Truganina, a charming suburb that beautifully balances convenience with tranquility. Located in the heart of Melbourne’s expanding west, Truganina offers a serene escape from the city’s hustle and bustle, while still providing easy access to urban amenities. With its welcoming community, lush green spaces, and well-planned infrastructure, it’s an ideal place for those seeking a peaceful retreat without compromising on modern conveniences. Land Size: 281 sqm House Size: 157.25 sqm 4 Bedrooms 1 Living Room 2 Bathrooms 2 Car for Garage Land Settlement: Titled 𝗪𝗵𝘆 𝗖𝗵𝗼𝗼𝘀𝗲 Truganina Safe and Family-Orientated Community Reasonable and Affordable Housing Prices Surrounded by a Broad Range of Educational Institutions Walking Distance to Shopping Centres and Train Stations Numbers of Major Attractions to Visit Easy and Full Accessible to All Amenities We also provide a rental guarantee with a minimum of 1 year and a maximum of 3 years. 𝗙𝗼𝗿 𝗺𝗼𝗿𝗲 𝗱𝗲𝘁𝗮𝗶𝗹𝘀, 𝗷𝘂𝘀𝘁 𝗰𝗮𝗹𝗹 𝘂𝘀: 1300 074 675 or send us a message on Whatsapp +61 488 859 637 For more updates, follow us on social media:Facebook: Simply WealthInstagram: @simplywealthgroupWebsite: simplywealthgroup.com.auTwitter: @SimplyWealthGrp

Wyndham Vale

Get to own a House and Land Package in Wyndham Vale for only $646,161! Wyndham Vale is a rapidly growing suburb located in the southwestern part of Melbourne, Victoria. Known for its family-friendly atmosphere and abundant green spaces, it offers residents a tranquil lifestyle with easy access to urban amenities. The suburb features modern housing developments, excellent schools, and convenient transport links, making it an attractive destination for young families and professionals. With its blend of suburban comfort and proximity to the city, Wyndham Vale continues to thrive as a vibrant and welcoming community. Land Size: 263 sqm House Size: 157.25 sqm 4 Bedrooms 1 Living Room 2 Bathrooms 2 Car for Garage Land Settlement: Titled 𝗪𝗵𝘆 𝗖𝗵𝗼𝗼𝘀𝗲 Wyndham Vale Safe and Family-Orientated Community Reasonable and Affordable Housing Prices Surrounded by a Broad Range of Educational Institutions Walking Distance to Shopping Centres and Train Stations Numbers of Major Attractions to Visit Easy and Full Accessible to All Amenities We also provide a rental guarantee with a minimum of 1 year and a maximum of 3 years. 𝗙𝗼𝗿 𝗺𝗼𝗿𝗲 𝗱𝗲𝘁𝗮𝗶𝗹𝘀, 𝗷𝘂𝘀𝘁 𝗰𝗮𝗹𝗹 𝘂𝘀: 1300 074 675 or send us a message on Whatsapp +61 488 859 637 For more updates, follow us on social media:Facebook: Simply WealthInstagram: @simplywealthgroupWebsite: simplywealthgroup.com.auTwitter: @SimplyWealthGrp

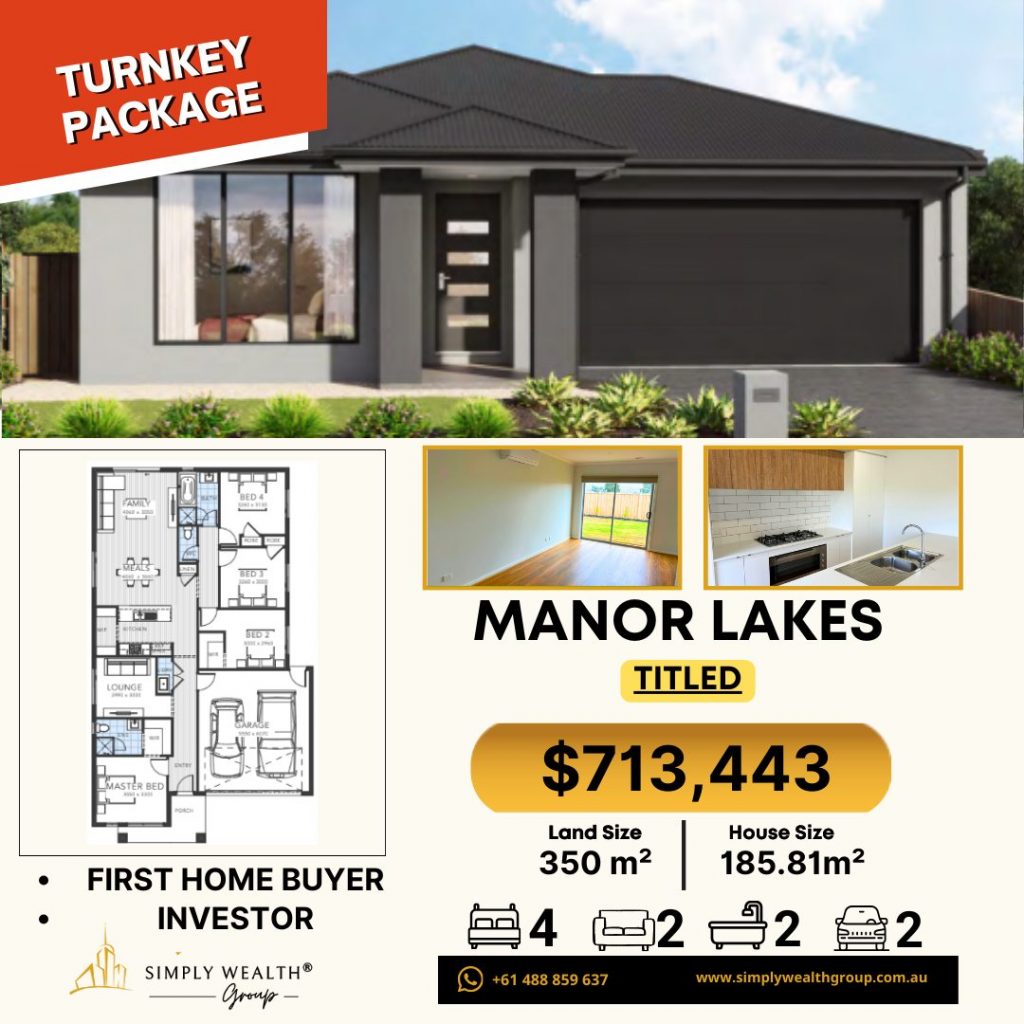

Manor Lakes

Get to own a House and Land Package in Manor Lakes for only $713,443! Manor Lakes, a charming suburb in Melbourne’s west, perfectly blends modern living with natural beauty. Famous for its expansive lakes and lush parks, this community provides a serene environment for residents. The suburb features well-maintained walking trails, scenic picnic spots, and family-friendly recreational areas, making it a paradise for nature enthusiasts. With its thoughtful urban planning, Manor Lakes seamlessly integrates contemporary amenities with the tranquility of its natural surroundings, offering a peaceful and attractive lifestyle. Land Size: 350 sqm House Size: 185.81 sqm 4 Bedrooms 2 Living Room 2 Bathrooms 2 Car for Garage Land Settlement: Titled 𝗪𝗵𝘆 𝗖𝗵𝗼𝗼𝘀𝗲 Manor Lakes Safe and Family-Orientated Community Reasonable and Affordable Housing Prices Surrounded by a Broad Range of Educational Institutions Walking Distance to Shopping Centres and Train Stations Numbers of Major Attractions to Visit Easy and Full Accessible to All Amenities We also provide a rental guarantee with a minimum of 1 year and a maximum of 3 years. 𝗙𝗼𝗿 𝗺𝗼𝗿𝗲 𝗱𝗲𝘁𝗮𝗶𝗹𝘀, 𝗷𝘂𝘀𝘁 𝗰𝗮𝗹𝗹 𝘂𝘀: 1300 074 675 or send us a message on Whatsapp +61 488 859 637 For more updates, follow us on social media:Facebook: Simply WealthInstagram: @simplywealthgroupWebsite: simplywealthgroup.com.auTwitter: @SimplyWealthGrp