Home Warranty vs. Home Insurance: What are the Differences?

If you own a home or are planning to purchase one, understanding the difference between a homeowners appliance warranty and home insurance is essential. These two types of protection both help secure your investment and provide peace of mind for unexpected issues. Yet, they serve distinct purposes in covering different aspects of homeownership. A home warranty focuses on protecting essential appliances and systems, such as your HVAC, refrigerator, or plumbing. When these critical items break down due to normal wear and tear, a home warranty covers the repair or replacement, saving you the stress and cost of sudden repairs. In contrast, home insurance covers structural damage to your home caused by unforeseen events, like fires, storms, or theft. It’s designed to protect your entire property from natural disasters or unexpected incidents, ensuring your home and belongings are secure from major financial loss. Understanding these distinctions can help you decide if having both types of protection is necessary. While home insurance is often required by mortgage lenders, a homeowners appliance warranty is optional yet beneficial, providing coverage that home insurance typically doesn’t include. Ultimately, having both a homeowners appliance warranty and home insurance can offer a more comprehensive safety net, securing your finances and keeping your home comfortable and functioning smoothly year-round. What Is a Home Warranty? A home warranty is a service contract that helps pay for repairs and replacements of covered household appliances and home systems. In exchange for a monthly or annual fee, you get a flat rate on service calls. If an appliance or system covered by your plan breaks down, your home warranty company sends out a technician to diagnose and fix the problem—and you pay just the service call fee. Of course, these plans have coverage limits: A contract may cover up to, say, $1,500 per year for each eligible appliance, with an annual claim limit of $15,000. If you receive a home warranty as part of a real estate transaction, the coverage usually starts as soon as you close on the home. However, if you buy a warranty for a house you already own, you may have to wait 15 to 30 days before the coverage takes effect. What Does a Home Warranty Cover? Home warranties cover appliances and systems in both new and pre-owned homes. Most home warranty companies offer three types of plans: 1.Appliance Plans (e.g., washer/dryer, dishwasher, and refrigerator) 2.System Plans (e.g., HVAC, plumbing, and electrical systems) 3.Combination Plan (everything included in the appliance and system plans) Most companies let you add coverage (for an extra fee) for specific items that are excluded from the standard plans. Common “add-ons” include pools, spas, septic systems, wells, lawn sprinkler systems, and additional appliances (e.g., a second dishwasher or air conditioner). How Much Does a Home Warranty Cost? Home warranty costs are based on two fees: 1. A monthly or annual fee. This is what you pay to access the discounted service calls. Depending on where you live and the plan you buy, you might pay anywhere from $350 to more than $1,100 per year. 2. A service fee. This is the amount you pay each time you request repairs for a covered appliance or system. Most companies offer several service fee “levels,” which might range from about $55 to $150 per service call. In general, the lower the service fee, the higher your monthly or annual fee will be, and vice versa. What Is Homeowners Insurance? Home insurance (aka homeowners insurance) is a type of property insurance that protects against losses and damages caused by covered perils. According to the Insurance Information Institute (III), a standard homeowners insurance policy includes four essential types of coverage: 1. Coverage for the structure of the home: This pays to repair or rebuild the house if it’s damaged or destroyed by a covered peril. Most policies cover other structures on the property, too, such as garages, tool sheds, decks, and gazebos. 2. Coverage for personal belongings: This covers your furniture, clothes, sports equipment, and other personal belongings if they are stolen or destroyed by a covered peril. If you have expensive items, you may need a special personal property endorsement or a floater to ensure you’re adequately protected. 3. Liability protection: Liability coverage protects against lawsuits for injuries and property damage that policyholders, their family members, and their pets cause to other people. 4. Additional living expenses: This pays for hotels, meals, and other living expenses if your house is uninhabitable due to a covered peril. What Does Homeowners Insurance Cover? The most popular home insurance policy is the HO-3, which covers your home, belongings, and liability. According to the III, HO-3 policies provide broad coverage and protect against 16 disasters and perils: 1. Fire or lightning 2. Windstorm or hail 3. Explosion 4. Riot or civil commotion 5. Damage caused by aircraft 6. Damage caused by vehicles 7. Smoke 8. Vandalism or malicious mischief 9. Theft 10. Volcanic eruption 11. Falling object 12. Weight of ice, snow, or sleet 13. Accidental discharge or overflow of water or steam from a plumbing, heating air conditioning, or automatic fire-protective sprinkler system, or from a household appliance 14. Sudden and accidental tearing apart, cracking, burning, or bulging of a steam or hot water heating system, an air conditioner, or an automatic fire-protective system 15. Freezing of a plumbing, HVAC, or automatic fire-protective sprinkler system, or of a household appliance 16. Sudden and accidental damage from an artificially generated electrical current Homeowners insurance also covers your personal liability for injuries to other people (those who don’t live with you) and their property while they are on your property. The most common liability claims involve dog bites, home accidents, falling trees, intoxicated guests, and injured domestic workers. Standard home insurance policies don’t cover damage or losses caused by floods (whether natural or human-related) and earthquakes. Depending on where you live, it may be a good idea to add—or buy a separate policy for—flood or earthquake coverage. Ask your insurance agent

Melbourne Auction Results: How They Shape the Future of Real Estate Investment

Melbourne Auction Results: Understanding Their Impact on Market Trends The auction results Melbourne serves as a crucial indicator for investors and stakeholders within the real estate market. Each auction reflects the prevailing demand and supply dynamics, giving insights into how properties are valued at a given moment. By analyzing these Melbourne auction results, investors can gauge market sentiment, helping them make informed decisions about their investments. For instance, a significant uptick in successful auction sales could suggest a booming market, while a decline might indicate buyer hesitation or economic uncertainty. Understanding these trends is essential for anyone looking to navigate the complex landscape of real estate investment. Moreover, the auction results Melbourne provide valuable data that can be compared over time, allowing investors to spot emerging trends in buyer behavior and property preferences. The patterns observed in recent Melbourne auction results can reveal shifting demographics, popular neighborhoods, and the types of properties that are attracting the most interest. Investors can use this information to refine their strategies, focusing on areas with high demand or unique property features that align with current market trends. This proactive approach to investment, informed by auction outcomes, can lead to more successful ventures and higher returns. Finally, staying updated on auction results Melbourne is vital for those looking to seize opportunities as they arise. By monitoring these results, investors can identify the optimal timing for buying or selling properties, taking advantage of favorable market conditions. Additionally, understanding the context behind the auction results—such as economic factors, government policies, or even seasonal trends—can provide a comprehensive view of the market landscape. Ultimately, leveraging the insights gained from Melbourne auction results can empower investors to make strategic choices that align with their long-term goals in the ever-evolving real estate market. Melbourne Auction Results: Insights into Buyer Behavior and Investment Opportunities The Melbourne auction results offer a treasure trove of insights into buyer behavior, shedding light on the motivations and preferences of potential investors and homebuyers. Analyzing these results allows stakeholders to discern trends such as the types of properties that are in demand, the average bidding prices, and the speed at which properties are selling. For instance, a surge in competitive bidding for a specific neighborhood may indicate that buyers are increasingly drawn to the area’s amenities, schools, or lifestyle offerings. Understanding auction results Melbourne not only helps investors make informed decisions but also provides sellers with the knowledge needed to market their properties effectively. Moreover, the auction results serve as a barometer for investment opportunities Melbourne presents. Investors keen on maximizing their returns can identify undervalued properties or emerging neighborhoods where bidding activity is increasing. For example, if the Melbourne auction results show a consistent rise in sales for a particular suburb, it may signal a growing interest from buyers, thereby enhancing its potential for future price appreciation. Investors who stay attuned to these signals can position themselves strategically, capitalizing on opportunities before they become widely recognized. Additionally, understanding buyer behavior as revealed by the Melbourne auction results can enhance an investor’s ability to anticipate market shifts. Factors such as economic trends, interest rates, and changes in consumer preferences can significantly impact bidding patterns. For instance, if data from recent auction results indicates that first-time buyers are increasingly participating in auctions, it may suggest a shift in market dynamics that investors should consider when planning their strategies. By closely monitoring these insights, investors can adapt their approaches, ensuring they remain competitive and ready to seize investment opportunities Melbourne has to offer. Analyzing Melbourne Auction Results: What They Mean for Investors Analyzing the Melbourne auction results is crucial for investors aiming to gain a competitive edge in the bustling real estate market. Each auction provides a snapshot of current demand and pricing trends, revealing valuable data on which properties are attracting bids and how much buyers are willing to pay. By examining these results, investors can identify high-performing neighborhoods, recognize patterns in buyer activity, and determine the overall health of the market. Understanding these dynamics enables investors to make informed decisions about where to allocate their resources for maximum returns. The insights gained from the auction results Melbourne can help investors refine their strategies, particularly when it comes to timing and property selection. For instance, if the Melbourne auction results indicate a rise in sales for a specific type of property—such as family homes versus apartments—investors can pivot their focus to align with buyer preferences. Additionally, by analyzing past auction results today, investors can spot trends over time, identifying seasonal variations and shifts in market demand. This historical perspective is invaluable for making predictions about future performance and timing investment decisions accordingly. Furthermore, staying informed about the auction results today not only helps investors make strategic choices but also enhances their ability to negotiate effectively. Understanding the current market landscape allows investors to set realistic expectations for property valuations and bid accordingly during auctions. If the Melbourne auction results reveal a competitive market with multiple bidders, investors may choose to adjust their bidding strategies or explore alternative properties. Ultimately, by thoroughly analyzing auction results, investors can position themselves for success in a dynamic real estate environment, maximizing their investment potential while minimizing risks. The Influence of Auction Results on the Melbourne Real Estate Market The auction results Melbourne plays a pivotal role in shaping the Melbourne real estate market, serving as a barometer for current trends and buyer sentiment. Each auction reflects the competitive nature of the market, providing crucial insights into how properties are valued at any given time. When auction clearance rates are high, it typically signals strong demand, which can lead to increased property prices. Conversely, low clearance rates may indicate a cooling market, prompting both buyers and sellers to reevaluate their strategies. Understanding these dynamics is essential for anyone looking to navigate the complexities of property investment in Melbourne. Moreover, the impact of auction results extends beyond individual transactions; they can influence broader market trends and investor confidence. When investors observe consistently

Understanding Tax Depreciation Deductions: Your Guide to the ATO Depreciation Schedule

Disclaimer: The information provided here is general in nature and should not be considered as professional tax advice. For specific tax guidance, please consult a qualified tax professional or visit the ATO website. Tax depreciation is a vital tool for property investors, allowing them to claim deductions on the wear and tear of their investment property over time. Properly understanding and applying these deductions can lead to significant tax savings. The investment property depreciation schedule is an essential resource that outlines the allowable depreciation deductions for your property. This schedule breaks down the value of your property’s structural elements and fittings, guiding you on how to claim depreciation over time. By staying organized and informed, you can ensure you’re fully utilizing the deductions available to you. Navigating ATO regulations for depreciation claims can be complex, but it’s crucial for compliance and maximizing your tax benefits. The ATO has clear guidelines on how to calculate and document depreciation. Familiarizing yourself with these guidelines will help you make accurate claims and avoid any potential issues. Consulting with a tax professional or a specialist in property depreciation is highly recommended. They can help you create a detailed depreciation schedule, choose the best depreciation methods, and ensure that your claims are aligned with ATO requirements. Professional advice can save you time and maximize your deductions, enhancing your overall financial outcome. In summary, understanding the ATO depreciation schedule and applying the appropriate strategies can greatly benefit your financial planning. Staying informed and seeking professional guidance when necessary will help you make the most of your investment. Maximizing Your Tax Depreciation Deductions: A Guide to the ATO Process Understanding how to maximize your tax depreciation deductions can significantly improve the financial performance of your investment property. Making a depreciation claim in accordance with ATO guidelines reduces your taxable income and can lead to higher returns. Key considerations for maximizing your depreciation deductions include: ● ATO regulations allow you to claim deductions on both the building structure (capital works) and the assets within (plant and equipment). ● Renovated properties may also qualify for depreciation, even if they are not newly built. ● Engaging a quantity surveyor can help ensure that all eligible deductions areaccurately recorded and claimed. ● Keeping detailed records of all expenses and property updates is essential forsupporting your depreciation claims. By properly leveraging tax depreciation deductions, you can improve your property’s cash flow and reduce the costs associated with owning an investment property. Consulting a tax professional is advisable to ensure that you are making the most of the deductions available to you while adhering to ATO requirements. Navigating ATO Tax Depreciation Rules: Claiming Depreciation on Your Rental Property Successfully claiming depreciation on a rental property requires a good understanding of the ATO’s tax depreciation rules. These rules are designed to help investors offset the natural wear and tear on their properties, ultimately reducing taxable income. Creating a detailed investment property depreciation schedule is crucial for accurately claiming these deductions. This schedule, which includes both capital works and plant and equipment, ensures that you don’t miss out on potential tax benefits. Adhering to ATO guidelines is essential for compliance and maximizing your financial advantages. Incorporating an organized depreciation schedule into your tax strategy not only helps with claiming depreciation but also ensures that you’re fully leveraging the tax benefits available under ATO rules. With the right approach, you can increase your investment’s profitability while staying compliant with tax laws. Understanding Division 43 Deductions: A Guide to ATO Capital Works Deductions Division 43 deductions allow property investors to claim capital works deductions for the construction costs of their buildings. These deductions apply to structural elements like walls, floors, and roofs and are claimed over several years as per the ATO’s depreciation rules.Accurately calculating your Division 43 deductions is important for maximizing your return. This involves maintaining detailed records of construction costs and ensuring that they align with ATO guidelines. Additionally, being aware of the ATO’s instant asset write-off provisions can help you claim immediate deductions on eligible items, further optimizing your tax strategy. How an ATO Depreciation Schedule and Depreciation Calculator Can Enhance Your InvestmentStrategy Understanding how an ATO depreciation schedule and a property depreciation calculator work together is essential for maximizing your investment property tax depreciation. The ATO depreciation schedule outlines the depreciation rates for various assets within your property, enabling accurate calculation of your deductions. Using a depreciation calculator can help estimate your potential deductions, including options like the low-value pool depreciation and the ATO’s instant asset write-off. These tools allow you to group smaller assets and accelerate their depreciation, maximizing the deductions you can claim. Aligning your tax strategy with a precise ATO depreciation schedule ensures that you are fully compliant with ATO regulations while maximizing your tax benefits. This approach can improve cash flow and increase the profitability of your investment property. Conclusion: Leveraging ATO Depreciation Rules for Your Investment Property In conclusion, effectively navigating the ATO’s depreciation rules can significantly enhance your investment property’s financial performance. Obtaining an investment property tax depreciation schedule is one of the first steps to ensure you’re maximizing your deductions. Consulting with a quantity surveyor can provide invaluable assistance in creating a compliant depreciation schedule that accurately reflects the value of your property. Their expertise ensures that your claims are precise and in line with ATO guidelines. Finally, understanding how to apply tax depreciation schedules will help you better grasp the potential benefits. With the right knowledge and tools, you can manage tax depreciation effectively, leading to improved cash flow and a more profitable investment.

Investor surge pushes Australian housing loans to two-year high

Investor surge pushes Australian housing loans to two-year high Australia’s housing market continued its upward trend in August 2024, reaching the highest level of new lending since May 2022. According to the latest data from the Australian Bureau of Statistics (ABS), the total value of new housing loans increased by 1.0% to $30.4 billion, with investor activity leading the charge. Canstar’s analysis of the ABS data showed that investor loans saw a significant boost, rising 1.4% in August to $11.71 billion – a 34.2% increase from the same period last year. This surge in investor lending marked the second-highest monthly value on record. Loans to owner-occupiers also grew, increasing by 0.7% to $18.7 billion, reflecting a 16.5% rise year-on-year. However, first-home buyers faced a slight dip, with loans for this group dropping by 1.5% from July to August. Despite the monthly decline, first-home buyer activity was still 9.2% higher than in August 2023. Tindall pointed out that while first-home buyers remain active, they face stiff competition from investors who can use rental income to offset the burden of higher mortgage payments. Breaking down the data by state, Queensland emerged as a key driver of the national rise. Housing loan commitments in the state soared by 40% over the past year, adding $2 billion in value, more than any other state. In contrast, the average national loan size for owner-occupiers dropped by 1% in August, falling to $636,208. Although most states saw decreases, Queensland and Tasmania bucked the trend, with Queensland posting a record high loan size of $603,988. Learn more about: Australia’s housing market

Werribee

Get to own a House and Land Package in Werribee for only $646,030! The advantages of residing in Werribee include several positive aspects, such as the abundance of parks and recreation facilities available. Werribee boasts several parks, including the Werribee River Park and the Werribee Open Range Zoo, which offer ample opportunities for families to enjoy the great outdoors. Land Size: 263 sqm House Size: 168.89 sqm 4 Bedrooms 1 Living Room 2 Bathrooms 2 Car for Garage Land Settlement: February 2025 𝗪𝗵𝘆 𝗖𝗵𝗼𝗼𝘀𝗲 Werribee Safe and Family-Orientated Community Reasonable and Affordable Housing Prices Surrounded by a Broad Range of Educational Institutions Walking Distance to Shopping Centres and Train Stations Numbers of Major Attractions to Visit Easy and Full Accessible to All Amenities Client’s review: “great place”Werribee South is very peaceful. Not alot of people live here, it’s away from the traffic and chaos of the world. You can’t beat this place for peace and quiet. It is so close to the city and should have a different name as it is so different to Werribee, its not funny. The only thing missing is shops which the marina will bring. The marina will also bring more people to this great place which is not a good thing but the marina won’t be that big as to spoil the “serenity” as one great man once said. We also provide a rental guarantee with a minimum of 1 year and a maximum of 3 years. 𝗙𝗼𝗿 𝗺𝗼𝗿𝗲 𝗱𝗲𝘁𝗮𝗶𝗹𝘀, 𝗷𝘂𝘀𝘁 𝗰𝗮𝗹𝗹 𝘂𝘀: 1300 074 675 or send us a message on Whatsapp +61 488 859 637 For more updates, follow us on social media:Facebook: Simply WealthInstagram: @simplywealthgroupWebsite: simplywealthgroup.com.auTwitter: @SimplyWealthGrp

Truganina

Get to own a House and Land Package in Truganina for only $656,744! Welcome to Truganina, a charming suburb that beautifully balances convenience with tranquility. Located in the heart of Melbourne’s expanding west, Truganina offers a serene escape from the city’s hustle and bustle, while still providing easy access to urban amenities. With its welcoming community, lush green spaces, and well-planned infrastructure, it’s an ideal place for those seeking a peaceful retreat without compromising on modern conveniences. Land Size: 281 sqm House Size: 157.25 sqm 4 Bedrooms 1 Living Room 2 Bathrooms 2 Car for Garage Land Settlement: Titled 𝗪𝗵𝘆 𝗖𝗵𝗼𝗼𝘀𝗲 Truganina Safe and Family-Orientated Community Reasonable and Affordable Housing Prices Surrounded by a Broad Range of Educational Institutions Walking Distance to Shopping Centres and Train Stations Numbers of Major Attractions to Visit Easy and Full Accessible to All Amenities We also provide a rental guarantee with a minimum of 1 year and a maximum of 3 years. 𝗙𝗼𝗿 𝗺𝗼𝗿𝗲 𝗱𝗲𝘁𝗮𝗶𝗹𝘀, 𝗷𝘂𝘀𝘁 𝗰𝗮𝗹𝗹 𝘂𝘀: 1300 074 675 or send us a message on Whatsapp +61 488 859 637 For more updates, follow us on social media:Facebook: Simply WealthInstagram: @simplywealthgroupWebsite: simplywealthgroup.com.auTwitter: @SimplyWealthGrp

Wyndham Vale

Get to own a House and Land Package in Wyndham Vale for only $646,161! Wyndham Vale is a rapidly growing suburb located in the southwestern part of Melbourne, Victoria. Known for its family-friendly atmosphere and abundant green spaces, it offers residents a tranquil lifestyle with easy access to urban amenities. The suburb features modern housing developments, excellent schools, and convenient transport links, making it an attractive destination for young families and professionals. With its blend of suburban comfort and proximity to the city, Wyndham Vale continues to thrive as a vibrant and welcoming community. Land Size: 263 sqm House Size: 157.25 sqm 4 Bedrooms 1 Living Room 2 Bathrooms 2 Car for Garage Land Settlement: Titled 𝗪𝗵𝘆 𝗖𝗵𝗼𝗼𝘀𝗲 Wyndham Vale Safe and Family-Orientated Community Reasonable and Affordable Housing Prices Surrounded by a Broad Range of Educational Institutions Walking Distance to Shopping Centres and Train Stations Numbers of Major Attractions to Visit Easy and Full Accessible to All Amenities We also provide a rental guarantee with a minimum of 1 year and a maximum of 3 years. 𝗙𝗼𝗿 𝗺𝗼𝗿𝗲 𝗱𝗲𝘁𝗮𝗶𝗹𝘀, 𝗷𝘂𝘀𝘁 𝗰𝗮𝗹𝗹 𝘂𝘀: 1300 074 675 or send us a message on Whatsapp +61 488 859 637 For more updates, follow us on social media:Facebook: Simply WealthInstagram: @simplywealthgroupWebsite: simplywealthgroup.com.auTwitter: @SimplyWealthGrp

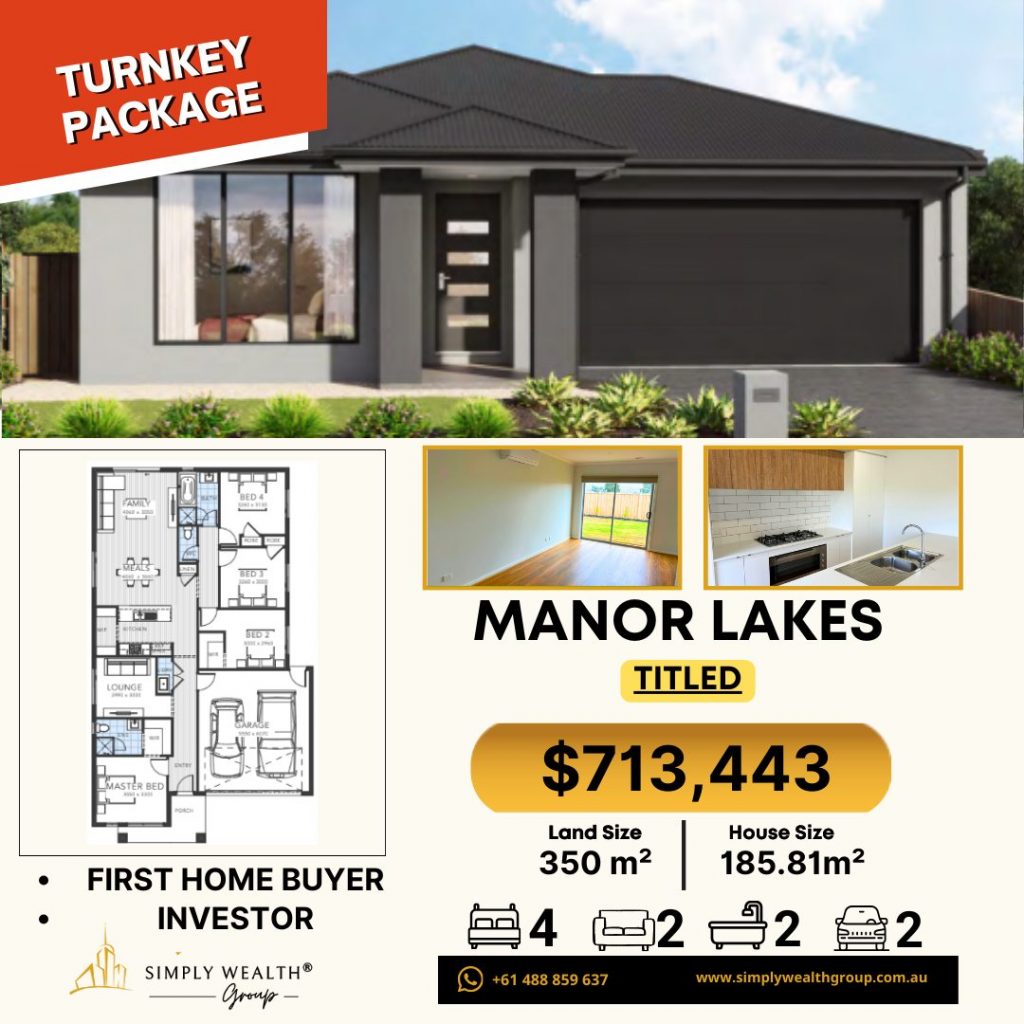

Manor Lakes

Get to own a House and Land Package in Manor Lakes for only $713,443! Manor Lakes, a charming suburb in Melbourne’s west, perfectly blends modern living with natural beauty. Famous for its expansive lakes and lush parks, this community provides a serene environment for residents. The suburb features well-maintained walking trails, scenic picnic spots, and family-friendly recreational areas, making it a paradise for nature enthusiasts. With its thoughtful urban planning, Manor Lakes seamlessly integrates contemporary amenities with the tranquility of its natural surroundings, offering a peaceful and attractive lifestyle. Land Size: 350 sqm House Size: 185.81 sqm 4 Bedrooms 2 Living Room 2 Bathrooms 2 Car for Garage Land Settlement: Titled 𝗪𝗵𝘆 𝗖𝗵𝗼𝗼𝘀𝗲 Manor Lakes Safe and Family-Orientated Community Reasonable and Affordable Housing Prices Surrounded by a Broad Range of Educational Institutions Walking Distance to Shopping Centres and Train Stations Numbers of Major Attractions to Visit Easy and Full Accessible to All Amenities We also provide a rental guarantee with a minimum of 1 year and a maximum of 3 years. 𝗙𝗼𝗿 𝗺𝗼𝗿𝗲 𝗱𝗲𝘁𝗮𝗶𝗹𝘀, 𝗷𝘂𝘀𝘁 𝗰𝗮𝗹𝗹 𝘂𝘀: 1300 074 675 or send us a message on Whatsapp +61 488 859 637 For more updates, follow us on social media:Facebook: Simply WealthInstagram: @simplywealthgroupWebsite: simplywealthgroup.com.auTwitter: @SimplyWealthGrp

Truganina

Get to own a House and Land Package in Truganina for only $680,461! Nestled in the heart of Melbourne’s western suburbs, Truganina offers a serene and picturesque escape from the hustle and bustle of city life. With its lush green parks, tranquil walking trails, and welcoming community, Truganina is a hidden gem that combines modern living with natural beauty. Discover the peace and charm that make this suburb an ideal place to call home. Land Size: 321sqm House Size: 157.25sqm 4 Bedrooms 1 Living Room 2 Bathrooms 2 Car for Garage Land Settlement: Jan-Feb 2025 𝗪𝗵𝘆 𝗖𝗵𝗼𝗼𝘀𝗲 Truganina Safe and Family-Orientated Community Reasonable and Affordable Housing Prices Surrounded by a Broad Range of Educational Institutions Walking Distance to Shopping Centres and Train Stations Numbers of Major Attractions to Visit Easy and Full Accessible to All Amenities We also provide a rental guarantee with a minimum of 1 year and a maximum of 3 years. 𝗙𝗼𝗿 𝗺𝗼𝗿𝗲 𝗱𝗲𝘁𝗮𝗶𝗹𝘀, 𝗷𝘂𝘀𝘁 𝗰𝗮𝗹𝗹 𝘂𝘀: 1300 074 675 or send us a message on Whatsapp +61 488 859 637 For more updates, follow us on social media:Facebook: Simply WealthInstagram: @simplywealthgroupWebsite: simplywealthgroup.com.auTwitter: @SimplyWealthGrp

Manor Lakes

Get to own this House and Land Package in Manor Lakes for only $713,443! Manor Lakes embodies natural beauty, with lush landscapes and well-maintained parks creating a picturesque setting. Blending modern amenities with traditional charm, it offers an ideal home environment. Its strategic location ensures easy access to essential facilities such as schools, shopping centers, and healthcare services, catering to various lifestyles. Strong community bonds and regular social gatherings foster a welcoming atmosphere and lasting friendships. Choosing to buy a house in Manor Lakes promises tranquility, convenience, and a fulfilling suburban lifestyle for both individuals and families. Land Size: 350 sqm House Size: 185.81 sqm 4 Bedrooms 2 Bathrooms 2 Living Room 2 Car for Garage Land Settlement: Titled 𝗪𝗵𝘆 𝗖𝗵𝗼𝗼𝘀𝗲 Manor Lakes Safe and Family-Orientated Community Reasonable and Affordable Housing Prices Surrounded by a Broad Range of Educational Institutions Walking Distance to Shopping Centres and Train Stations Numbers of Major Attractions to Visit Easy and Full Accessible to All Amenities We also provide a rental guarantee with a minimum of 1 year and a maximum of 3 years. 𝗙𝗼𝗿 𝗺𝗼𝗿𝗲 𝗱𝗲𝘁𝗮𝗶𝗹𝘀, 𝗷𝘂𝘀𝘁 𝗰𝗮𝗹𝗹 𝘂𝘀: 1300 074 675 or send us a message on Whatsapp +61 488 859 637 For more updates, follow us on social media:Facebook: Simply WealthInstagram: @simplywealthgroupWebsite: simplywealthgroup.com.auTwitter: @SimplyWealthGrp