Bunch Walk

𝗘𝘃𝗲𝗿𝘆 𝗼𝗻𝗲 𝗼𝗳 𝘆𝗼𝘂 𝗺𝗶𝗴𝗵𝘁 𝗮𝘀𝗸 𝗵𝗼𝘄 𝗽𝗿𝗼𝗽𝗲𝗿𝘁𝘆 𝗶𝗻𝘃𝗲𝘀𝘁𝗼𝗿𝘀 𝘀𝗲𝗲𝗺 𝗹𝗶𝗸𝗲 𝗵𝗮𝘃𝗶𝗻𝗴 𝘁𝗵𝗲 𝗯𝗲𝘀𝘁 𝗼𝗳 𝘁𝗵𝗲𝗶𝗿 𝗹𝗶𝗳𝗲 𝘄𝗶𝘁𝗵𝗼𝘂𝘁 𝗺𝘂𝗰𝗵 𝗳𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝘄𝗼𝗿𝗿𝗶𝗲𝘀. 𝗪𝗲𝗹𝗹, 𝘁𝗵𝗶𝘀 𝗳𝗶𝗴𝘂𝗿𝗲𝘀 𝗳𝗿𝗼𝗺 𝗼𝘂𝗿 𝗰𝗹𝗶𝗲𝗻𝘁’𝘀 𝗽𝗿𝗼𝗽𝗲𝗿𝘁𝘆 𝗰𝗮𝗻 𝗮𝗻𝘀𝘄𝗲𝗿 𝘆𝗼𝘂𝗿 𝗾𝘂𝗲𝘀𝘁𝗶𝗼𝗻 It generate a $132,000 𝗰𝗮𝗽𝗶𝘁𝗮𝗹 𝗴𝗿𝗼𝘄𝘁𝗵 within just 31 months! It holds approximately $604,000 𝗰𝘂𝗿𝗿𝗲𝗻𝘁 𝗺𝗮𝗿𝗸𝗲𝘁 𝘃𝗮𝗹𝘂𝗲 of all time! Reliable tenants since property settlement without one day vacancy Come and sit down with our professional advisor to find out where to invest for the next hotspot. They can definitely show you how to achieve: Strong rental yields Low vacancy rates Influx of interstate and international migration High growth locations with cash flow positive properties What are you waiting for? Get in touch with Simply Wealth, and learn more about your options today by calling us at 1300 074 675 or +61 488 859 637.

Truganina

This beautiful property is already making someone’s dreams come true, and it could be yours next! Its prime location and affordable price make it the perfect place to start a new chapter. Key Features: Spacious living area Modern kitchen Comfortable bedrooms Beautiful backyard Close to essential amenities Whether you’re looking for a cozy space or a place for your family to thrive, this home has everything. Interested? Feel free to reach out for more information or to schedule a viewing. This could be the home you’ve been searching for. Contact us today at 1300 074 675 or on WhatsApp at +61 488 859 637 / +61 483 902 416 for a free financial consultation session.

Beveridge

This beautiful property is already making someone’s dreams come true, and it could be yours next! With a prime location and a comfortable price, it’s the perfect place to start a new chapter. Key Features: Spacious living area Modern kitchen Comfortable bedrooms Beautiful backyard Close to essential amenities Whether you’re looking for a cozy space or a place for your family to thrive, this home has everything. Interested? Feel free to reach out for more information or to schedule a viewing. This could be the home you’ve been searching for. Contact us today at 1300 074 675 or on WhatsApp at +61 488 859 637 for a free financial consultation session.

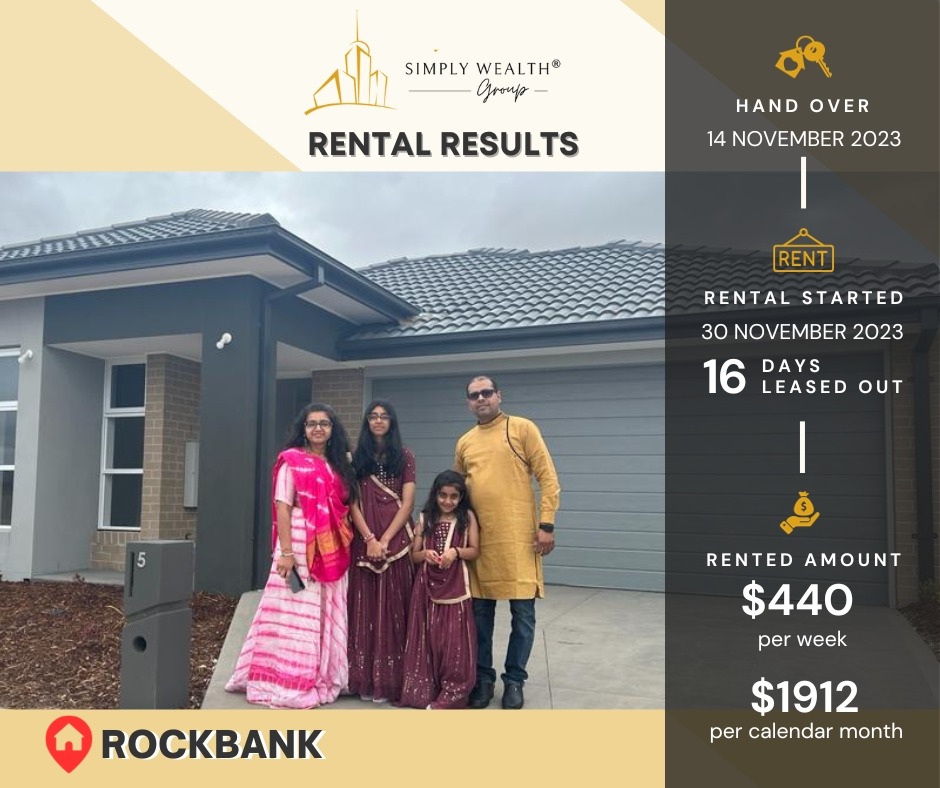

Rockbank

We extend our heartfelt gratitude to our new tenants who have chosen our remarkable property as their new residence. We’re thrilled to welcome you aboard and trust that your stay in Rockbank will be an enjoyable one! For those still in search of the perfect rental property, rest assured that we have a variety of exceptional listings available. Whether you’re in the market for a snug apartment or a spacious family home, we have options to cater to your every requirement. Key Highlights: Expansive living space Contemporary kitchen Cozy bedrooms Scenic backyard Proximity to essential amenities This home has something for everyone, whether you’re seeking a cozy haven or a place for your family to thrive. If you’re interested, please don’t hesitate to get in touch for further details or to arrange a viewing. This may very well be the home you’ve been in search of. Reach out to us today at 1300 074 675 or on WhatsApp at +61 488 859 637 to schedule a complimentary financial consultation session.

Truganina

This beautiful property is already making someone’s dreams come true, and it could be yours next! With a prime location and a comfortable price, it’s the perfect place to start a new chapter. Key Features: Spacious living area Modern kitchen Comfortable bedrooms Beautiful backyard Close to essential amenities Whether you’re looking for a cozy space or a place for your family to thrive, this home has everything. Interested? Feel free to reach out for more information or to schedule a viewing. This could be the home you’ve been searching for. Contact us today at 1300 074 675 or on WhatsApp at +61 488 859 637 for a free financial consultation session.

Truganina

This beautiful property is already making someone’s dreams come true, and it could be yours next! With a prime location and a comfortable price, it’s the perfect place to start a new chapter. Key Features: Spacious living area Modern kitchen Comfortable bedrooms Beautiful backyard Close to essential amenities Whether you’re looking for a cozy space or a place for your family to thrive, this home has everything. Interested? Feel free to reach out for more information or to schedule a viewing. This could be the home you’ve been searching for. Contact us today at 1300 074 675 or on WhatsApp at +61 488 859 637 for a free financial consultation session.

Rockbank

This beautiful property is already making someone’s dreams come true, and it could be yours next! With a prime location and a comfortable price, it’s the perfect place to start a new chapter. Key Features: Spacious living area Modern kitchen Comfortable bedrooms Beautiful backyard Close to essential amenities Whether you’re looking for a cozy space or a place for your family to thrive, this home has everything. Interested? Feel free to reach out for more information or to schedule a viewing. This could be the home you’ve been searching for. Contact us today at 1300 074 675 or on WhatsApp at +61 488 859 637 for a free financial consultation session.

What Happens If You Can’t Pay Your Taxes?

What happens if you complete your tax return and find that you can’t pay the amount you owe? The IRS will attempt to collect, using measures such as interest charges on unpaid amounts or fines and jail time ( in extreme cases). This isn’t supposed to happen. You’re supposed to pay income taxes gradually throughout the year so that you won’t owe much in April or will even be entitled to a refund of overpaid taxes. Employees have income tax withheld from their paychecks. Self-employed taxpayers pay quarterly estimated taxes directly to the Internal Revenue Service (IRS). But sometimes your life situation changes, or an unusual one-time event occurs during the year. When you prepare your annual return and haven’t paid throughout the year, you may get an ugly surprise—you could owe hundreds or thousands of dollars that you didn’t expect and might not have the money to pay. What Happens If You Don’t File or Don’t Pay If you find yourself in trouble, you do not want to skip filing your tax return or fail to pay your taxes altogether. The government has the authority to forcibly seize your assets if you don’t try to make good on your income tax liability. In the most extreme situations, you may be subject to jail time. Filing Your Taxes Late If you are not going to be able to file your tax return by the deadline, you should file an extension of time by submitting Form 4868 to the IRS by the due date (typically April 15th). It is important to note that filing this form does not give you an extension on the time to pay your tax liability. You’re still expected to send any money you owe by the deadline. If you file your tax return late—or fail to file at all—you will be subject to failure-to-file penalties. These charges accrue on returns that have not been filed by the due date (or extended due date if you’ve filed a Form 4868). The charges accrue at a rate of 5% of the unpaid taxes for each month or part of a month that a tax return is late. The charges max out after five months, at which point the failure-to-file penalty is 25% of the unpaid tax liability. If your return is filed more than 60 days after the due date (or extended due date), the minimum failure-to-file penalty is $450 or 100% of your total tax liability, whichever is smaller. As you can see, filing late does not pay off, with or without an extension. Even if you do not have the funds to pay your outstanding tax liability by the due date, you should still file your tax return, so you don’t incur extra failure-to-file penalties on top of failure-to-pay penalties and interest. The Bottom Line Whatever you do, don’t ignore the problem. The government can forcibly seize your assets if you don’t try to make good on your income tax liability. The IRS can freeze your bank accounts, garnish your wages, seize physical assets, and place a lien on any assets you own, including your home. If you find you can’t pay what you owe, go ahead and file your return and pay what you can. Then work with the IRS, perhaps with the assistance of a tax professional, to formulate a plan for paying the balance of your tax bill over time.

What Is a Tax Return, and How Long Should You Keep It?

What Is a Tax Return? A tax return is a form or form filed with a tax authority that reports income, expenses, and other pertinent tax information. Tax returns allow taxpayers to calculate their tax liability, schedule tax payments, or request refunds for the overpayment of taxes. In most countries, tax returns must be filed annually for an individual or business with reportable income, including wages, interest, dividends, capital gains, or other profits. Understanding Tax Returns In the United States, tax returns are filed with the Internal Revenue Service (IRS) or with the state or local tax collection agency (Massachusetts Department of Revenue, for example) containing information used to calculate taxes. Tax returns are generally prepared using forms prescribed by the IRS or other relevant authorities. In the U.S., individuals use variations of the Internal Revenue System’s Form 1040 to file federal income taxes. Corporations will use Form 1120 and partnerships will use Form 1065 to file their annual returns. A variety of 1099 forms are used to report income from non-employment-related sources. Application for automatic extension of time to file U.S. individual income tax return is through Form 4868. Typically, a tax return begins with the taxpayer providing personal information, which includes their filing status, and dependent information. What Documents Do I Need to Keep for My Tax Returns? For accurate tax filing, it’s crucial to retain various documents such as W-2s, 1099s, and receipts for deductions. These documents serve as evidence of your income, expenses, and eligibility for tax credits. The Sections of a Tax Return In general, tax returns have three major sections where you can report your income, and determine deductions and tax credits for which you are eligible: Income The income section of a tax return lists all sources of income. The most common method of reporting is a W-2 form. Wages, dividends, self-employment income, royalties, and, in many countries, capital gains must also be reported. Deductions Deductions decrease tax liability. Tax deductions vary considerably among jurisdictions, but typical examples include contributions to retirement savings plans, alimony paid, and interest deductions on some loans. For businesses, most expenses directly related to business operations are deductible. Taxpayers may itemize deductions or use the standard deduction for their filing status. Once the subtraction of all deductions is complete, the taxpayer can determine their tax rate on their adjusted gross income (AGI). Tax Credits Tax credits are amounts that offset tax liabilities or the taxes owed. Like deductions, these vary widely among jurisdictions. However, there are often credits attributed to the care of dependent children, individuals aged 65 or older, or those with permanent and total disability. Note that there may be income limitations or restrictions to these credits. After reporting income, deductions, and credits, the end of the return identifies the amount the taxpayer owes in taxes or the amount of tax overpayment. Overpaid taxes may be refunded or rolled into the next tax year. Taxpayers may remit payment as a single sum or schedule tax payments periodically. Similarly, most self-employed individuals may make advance payments every quarter to reduce their tax burden. The Bottom Line A tax return is a document filed with the tax authorities that reports income, expenses, and other relevant financial information to calculate and pay taxes. It is recommended to keep tax returns for at least three to seven years to comply with potential audit requirements and the period of limitations for tax amendments.

Manor Lakes

This area has an established reputation and a good sense of community. It is also an affordable area to buy property in. It has good transport options and is within a short drive of the Manor Lakes Shopping Centre and the Great Ocean Road. It has a train station that is close to Melbourne and Geelong. It is also near the Open Range Zoo and the Werribee Park and Mansion. The area is also close to the University of Melbourne campuses, and Monash University’s Vet school. Get to own this House and Land Package in Manor Lakes for only $703,135! Land Size: 350.00 sqm House Size: 157.25 sqm 4 Bedrooms 1 Living Room 2 Bathrooms 2 Cars for Garage Land Settlement: Q2-2025 𝗟𝗼𝗰𝗮𝗹 𝗥𝗲𝘃𝗶𝗲𝘄𝘀 𝘁𝗼 Manor Lakes“Lakeside and parks for kids”Wow amazing kids like splash water park and lake to walk around and greenery,looking forward to live there,just bought land there gonna built next year 𝗙𝗼𝗿 𝗺𝗼𝗿𝗲 𝗱𝗲𝘁𝗮𝗶𝗹𝘀, 𝗷𝘂𝘀𝘁 𝗰𝗮𝗹𝗹 𝘂𝘀: 1300 074 675 or send us a message on Whatsapp +61 488 859 637 For more updates, follow us on social media:Facebook: Simply WealthInstagram: @simplywealthgroupWebsite: simplywealthgroup.com.auTwitter: @SimplyWealthGrp