Shocking Rate Changes Last Week: What You Need To Know!

In the latest round of home loan rate adjustments, the Bank of Sydney increased several owner-occupier and investor variable rates, while multiple lenders adjusted fixed rates, Canstar reported. According to Canstar, these changes reflect broader trends in the market and economic impacts from recent policy decisions. Here’s a closer look at the latest movements in home loan rates and what they mean for borrowers. Rate adjustments across lendersThe Bank of Sydney increased four owner-occupier and investor variable rates by an average of 0.08%. Additionally, three lenders increased 77 owner-occupier and investor fixed rates by an average of 0.20%, while Me Bank cut 10 fixed rates by an average of 0.07%. You may read the whole article here:https://shorturl.at/uLTal

5 Tips for Finding the Best Mortgage Lender

1. Get your finances in good shape The credit score required to get a mortgage varies by the type of loan and the lender. With a higher score, you’ll have more choices of loan programs, and you’ll qualify for lower interest rates. Before shopping for lenders, find out your credit score and make sure your credit reports are accurate. NerdWallet offers a free credit score and report, updated weekly, using TransUnion data. You can receive free copies of your reports from each of the three major credit bureaus through the government-mandated AnnualCreditReport.com website. Check the reports carefully and dispute any errors. Next, work on improving your credit. Pay bills on time and work on paying off credit card balances. Lowering your debt will also improve your debt-to-income ratio, or DTI, another key element that lenders evaluate. An ideal DTI ratio for a mortgage is under 36%. Reducing your debt payments will also free up money to save for a home down payment. 2. Learn what kind of mortgage is right for you A variety of home loans are available to satisfy different needs. For example: Home loans also vary by term length, such as 15 or 30 years, and by how the interest rate works. With fixed-rate mortgages, the interest rate stays the same for the entire loan term; with an adjustable-rate mortgage, the interest rate periodically increases or decreases after an initial fixed-rate period. Some lenders offer a broad mix of mortgages; others specialize in certain types. Once you understand the general options, you can seek out the lenders that offer what you need. 3. Compare rates from multiple mortgage lenders Search for the best mortgage rates online from lenders that offer the types of loans you want. Keep in mind that the rate quote you see is an estimate. A lender will have to pull your credit information and process a loan application to provide an accurate rate, which you can then lock in if you’re satisfied with the product. Once you have several quotes from lenders, narrow the list to those with the lowest rates. The total interest you pay over the life of the loan is a big figure, and a lower rate can save you thousands of dollars. 4. Get preapproved Apply for mortgage preapproval with more than one lender before you start shopping for a home. A mortgage preapproval letter shows sellers and real estate agents that you’re a serious buyer. It’s evidence that a lender has evaluated your finances and figured out how much you can afford to borrow. Getting preapproved now will also save time later. When you’re ready to make an offer on a home, lenders will have the information they need to process your home loan. To get pre-approved, you’ll have to provide information about your income, debts, and assets. Lenders typically require: 5. Compare loan estimates and choose the best deal A loan estimate is a document a lender must provide after you’ve applied for a loan and have provided certain information, including the address of the property you want to buy. The document will spell out important details about your loan, including the interest rate, monthly payment, fees, and estimated closing costs. Compare loan estimates from at least three lenders. Read each line to make sure the details match what you expected, and ask questions about anything you don’t understand. Then, carefully compare costs and terms to choose the best deal for you.

Housing Market Sees Increase in Vacant Rentals: Report

Australia’s housing market saw an increase in the number of vacant rental properties in April, according to a report by PropTrack.In its Rental Vacancy Rates report for April 2024, it was found that the national vacancy rate increased by 0.09%, reaching a total of 1.21%. “While vacancy eased in April, conditions remain incredibly tough for renters, with just 1.21% of rental properties sitting vacant over the month. This is less than half the level that is considered a healthy rate of vacancy,” said Anne Flaherty, an economist at PropTrack. You may read the whole article here:https://bit.ly/3WOjhsj

More Help Needed for Housing-Goal – Ray White

The Australian government has launched the $11.3 billion Homes for Australia initiative to tackle housing challenges, but a Ray White economist believes more action is needed to meet the goal of building 1.2 million new homes. Homes for Australia: Major funding allocationsThe plan allocates $9.3bn over five years to tackle homelessness, enhance crisis support, and fund the construction and repair of social housing. An additional $1bn is earmarked for essential infrastructure like roads and sewers, which are crucial for new housing developments. Another $1bn will go towards crisis and transitional accommodation for women and children escaping domestic violence. “Fundamentally, the role of the federal government is to provide housing for our most vulnerable, and this is what the budget does,” said Nerida Conisbee, chief economist at Ray White. You may read the whole article here:https://shorturl.at/dqOR0

Australians Planning to Save Tax-Cut Earnings

More than a third of Australians are planning on using the income earned from the stage 3 tax cuts to pad their savings accounts, new data says. Major bank National Australia Bank (NAB) has released its NAB Australian Wellbeing Survey Q1 report, revealing that 36 per cent of Australians are planning on saving the extra income they will be earning from stage 3 tax cuts rather than spending. NAB surveyed more than 2,000 Australians in its NAB Australian Wellbeing Survey for the first quarter of the calendar year (ended 31 March) and found that 29 per cent of respondents believed that the tax cuts would support them with the increased cost of living. You may read the whole article here:https://bit.ly/4dC2izr

Multi-Billion-Dollar Housing Boost Announced

The Albanese Labor government has announced a multi-billion-dollar investment plan as part of next week’s Budget to accelerate its comprehensive Homes for Australia plan. The initiative aims to significantly increase the housing supply across the nation, with the Prime Minister highlighting the government’s commitment to keeping the Australian dream within reach. You may read the whole article here:https://bit.ly/4biDRoY

Home Loan Rates Trend Upward

Canstar has reported on the various movements in home loan rates among Australian lenders for the week of May 6 to 13. Great Southern Bank raised two owner-occupier and investor variable rates by an average of 0.05%. Across the industry, no variable rate reductions were reported. In terms of fixed rates, nine lenders increased a significant 183 owner-occupier and investor fixed rates by an average of 0.40%. Conversely, four lenders cut 64 owner-occupier and investor fixed rates by an average of 0.23%. You may read the whole article here:https://bit.ly/4aiFbqL

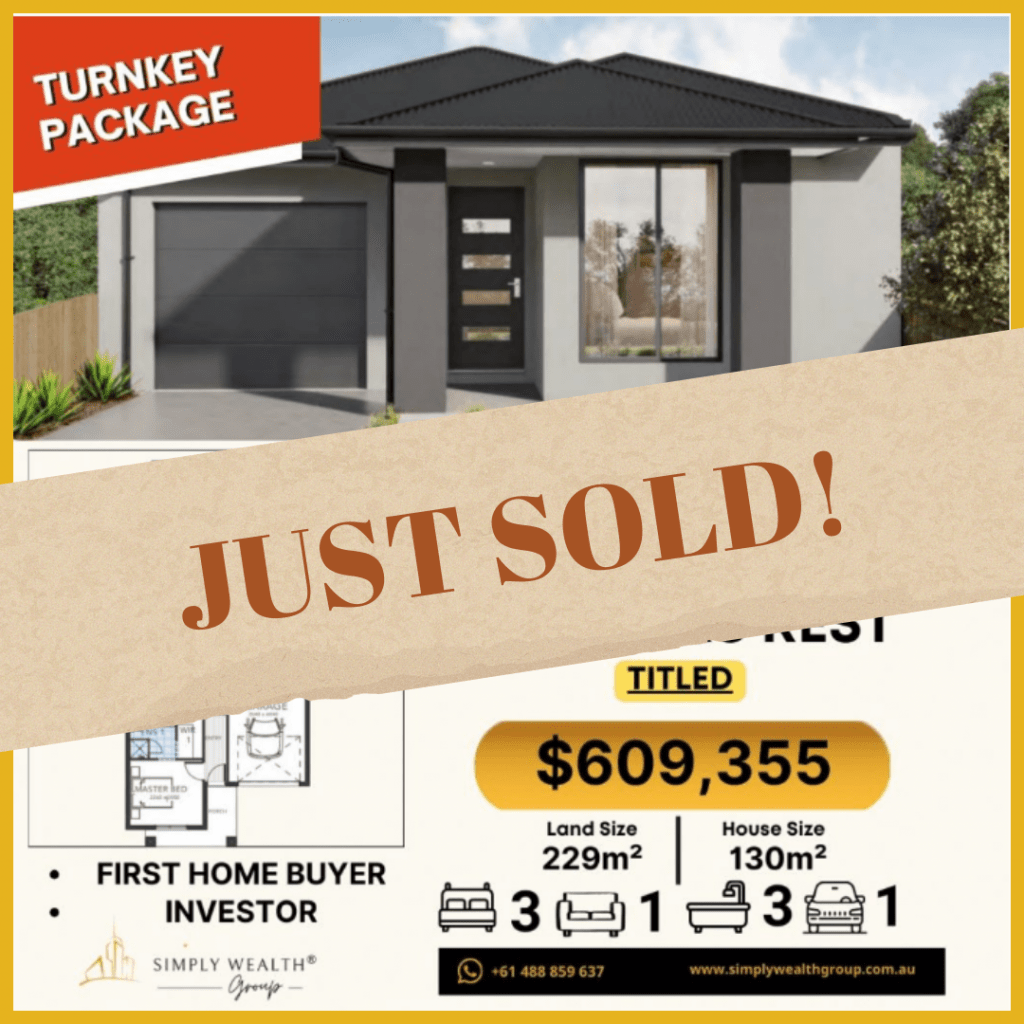

Diggers Rest

Diggers Rest embodies the charm of rural living with the convenience of urban amenities. Nestled within the historic Macedon Ranges, this quaint suburb offers a serene escape from the bustling city life while maintaining easy accessibility to Melbourne’s vibrant cultural scene. Boasting a rich heritage dating back to the gold rush era, Diggers Rest seamlessly blends its historic roots with modern-day comforts, making it an idyllic destination for both residents and visitors alike. From its lush green landscapes to its welcoming community spirit, Diggers Rest invites you to explore its unique blend of old-world charm and contemporary allure. Get to own this House and Land Package in Diggers Rest for only $609,355! Land Size: 229 sqm House Size: 130 sqm 3 Bedrooms 3 Bathrooms 1 Living Room 1 Car for Garage Land Settlement: TITLED 𝗟𝗼𝗰𝗮𝗹 𝗥𝗲𝘃𝗶𝗲𝘄𝘀 𝘁𝗼 Diggers Rest“Best suburb in the west”I have lived in and around the western suburbs of Melbourne for my entire life and never considered living in diggers rest. This was mainly due to the misconception that it was far away. Ive lived here for a little over year now and honestly wouldnt live anywhere else. The community and neighbours are unbelievable, happy to lend a hand and say hello, im yet to have a bad experience! Its been the most relaxing and peaceful year of my life and only 5-10 minutes further out compared to suburbs that cost twice as much to buy. 𝗙𝗼𝗿 𝗺𝗼𝗿𝗲 𝗱𝗲𝘁𝗮𝗶𝗹𝘀, 𝗷𝘂𝘀𝘁 𝗰𝗮𝗹𝗹 𝘂𝘀: 1300 074 675 or send us a message on Whatsapp +61 488 859 637 For more updates, follow us on social media:Facebook: Simply WealthInstagram: @simplywealthgroupWebsite: simplywealthgroup.com.auTwitter: @SimplyWealthGrp

Truganina

Truganina flourishes as a vibranthub teeming with potential and promise, enticinghomebuyers with its convenient location nearMelbourne’s CBD, spacious yet affordable properties,and a rich tapestry of natural beauty, includingmeandering creeks and the inviting Federation Trail,while also offering a bustling array of shopping anddining experiences for all tastes. Get to own this House and Land Package inTruganina for only $702,280! Land Size: 312 sqm House Size: 170.59 sqm 4 Bedrooms 3 Bathrooms 1 Living Room 2 Car for Garage Land Settlement: Q1-Q2 2025 𝗟𝗼𝗰𝗮𝗹 𝗥𝗲𝘃𝗶𝗲𝘄𝘀 𝘁𝗼 Truganina:“Best Suburb to grow a family”Truganina is very close to the city, very affordable andeasy access to all amenities in the West. This suburboffers great access to primary schools. Truganina is afast growing suburb with lots of employmentopportunities so people living here won’t have to travelfar. 𝗙𝗼𝗿 𝗺𝗼𝗿𝗲 𝗱𝗲𝘁𝗮𝗶𝗹𝘀, 𝗷𝘂𝘀𝘁 𝗰𝗮𝗹𝗹 𝘂𝘀: 1300 074 675 or send us a message on Whatsapp +61488 859 637 For more updates, follow us on social media:Facebook: Simply WealthInstagram: @simplywealthgroupWebsite: simplywealthgroup.com.auTwitter: @SimplyWealthGrp

Fraser Rise

Seeking your ideal residence in one of Melbourne’s most coveted neighborhoods? Explore our newest property offerings in Fraser Rise Nestled amidst urban convenience and natural splendor, our Fraser Rise properties boast contemporary designs tailored to your preferences. Whether you crave a spacious family abode or a snug apartment, we cater to every lifestyle and budget. Our amiable team is poised to assist you in discovering the perfect property. Don’t delay—reach out today to schedule a viewing of our latest Fraser Rise property selection and commence your dream lifestyle. Seize this extraordinary chance to own a piece of Melbourne’s vibrant suburban charm! Get to own this House and Land Package in Fraser Rise for only $619,772! Land Size: 213 sqm House Size: 130 sqm 3 Bedrooms 3 Bathrooms 1 Car for Garage 1 Living Room Land Settlement: October 2024 𝗟𝗼𝗰𝗮𝗹 𝗥𝗲𝘃𝗶𝗲𝘄𝘀 𝘁𝗼 Fraser Rise:“Family Rental Opportunity”Came into looking at the suburb for a possibility of family rental, found the prices soaring up and the families coming in. A lot of close by established infrastructure as well as a lot on the way. Would recommend 𝗙𝗼𝗿 𝗺𝗼𝗿𝗲 𝗱𝗲𝘁𝗮𝗶𝗹𝘀, 𝗷𝘂𝘀𝘁 𝗰𝗮𝗹𝗹 𝘂𝘀: 1300 074 675 or send us a message on Whatsapp +61 488 859 637 For more updates, follow us on social media:Facebook: Simply WealthInstagram: @simplywealthgroupWebsite: simplywealthgroup.com.auTwitter: @SimplyWealthGrp