Auction Results Melbourne: What Recent Data Reveals About the City’s Property Market

Missed the Memo? Auction Clearance Results Are Here to Surprise, Delight, and Terrify!Fortnightly Tax Table: Key Insights for Property Investors to Optimize Cash Flow in AustraliaMelbourne Auction Results: How They Shape the Future of Real Estate Investment Auction Results Melbourne: Key Insights for Investors Tracking Property Trends Keeping a close eye on auction results Melbourne is critical for any investor aiming to succeed in the city’s dynamic property market. Auctions are a strong indicator of property demand, revealing trends in buyer behavior, popular suburbs, and the types of properties fetching high bids. By analyzing Melbourne auction results, investors can spot opportunities where competition is low or identify high-growth areas that consistently see strong bidding activity. It’s an invaluable resource for making data-driven decisions. Investors benefit greatly from monitoring auction results as these results offer real-time insights into price fluctuations, helping to predict market changes. High clearance rates, for example, signal a seller’s market, where properties are selling quickly at or above reserve prices. On the flip side, low clearance rates could point to a buyer’s market, offering better entry points for investors. Beyond clearance rates, details like median sale prices and the number of auctions held provide further depth in analyzing the market. By consistently reviewing Melbourne auction results, you’ll be able to track property performance across various suburbs, comparing historic and current data to predict future market behavior. This knowledge helps investors develop a tailored strategy that aligns with their investment goals, whether it’s capital growth, rental yields, or long-term property appreciation. Using reliable data from auction platforms, investors can plan effectively, making confident choices in Melbourne’s fast-moving real estate market. How Melbourne Property Auctions Influence Smart Investment Strategies Melbourne property auctions play a pivotal role in shaping smart investment strategies, providing real-time data on market demand, price trends, and buyer behavior. Investors who closely monitor these auctions can adapt their tactics based on current conditions in the Melbourne property market. Understanding how auctions impact Melbourne house prices give investors an advantage when identifying high-yield opportunities and making informed decisions about when and where to invest. Key strategies for investors based on auction insights: ● Analyse auction clearance rates to assess buyer demand. ● Track Melbourne house prices to identify growth areas. ● Compare auction data across suburbs for high-return investments. ● Evaluate auction outcomes to time market entry and exit effectively. Monitoring auction results also provides broader insights into the Australian property market, helping investors to navigate both local and national trends. By aligning investment goals with current auction data, investors can secure properties in high-demand areas, benefiting from capital growth and long-term returns. Discover the top auction results and key insights into the Melbourne property market trends The Melbourne property market continues to be a dynamic space for investors, with auction results offering key insights into buyer sentiment and market trends. In recent months, Melbourne’s auction clearance rates have remained steady, reflecting a strong demand in certain suburbs despite broader challenges in the Australian housing market. Investors closely track these results to gauge the health of the market and identify potential growth areas. According to data from CoreLogic, Melbourne recently recorded an auction clearance rate of 67.2%, which indicates a resilient market even amidst economic uncertainties. Popular suburbs such as Hawthorn, St Kilda, and Carlton continue to see competitive bidding, with many properties selling above reserve prices. These auction results provide invaluable insight for investors looking to make strategic decisions in the Melbourne property market. For investors, tracking auction results is essential not only to understand immediate trends but also to predict future performance in the Australian housing market. With market fluctuations and economic conditions affecting buyer activity, staying updated with Melbourne’s latest auction outcomes can help investors refine their strategies and target high-potential properties. Uncover the Latest Property Report: Melbourne Auction Insights for Investors The latest Property Report on Melbourne’s auction results offers valuable insights for investors looking to navigate the ever-changing Australian housing market. With auction clearance rates providing a clear snapshot of buyer demand, this data is crucial for understanding current market dynamics. Investors can analyze these results alongside broader economic indicators, such as the market index ASX, to make informed decisions on their next move. In recent weeks, Melbourne’s auction clearance rates have demonstrated steady performance, suggesting continued interest in key suburbs. By reviewing this Property Report, investors can compare auction outcomes with trends reflected in the ASX graph, offering a comprehensive view of how real estate is performing against other investment markets. This approach can help pinpoint potential opportunities for long-term growth in the Australian housing market. Tracking auction data alongside the market index ASX is becoming an increasingly popular strategy for property investors. The Property Report not only highlights high-demand areas in Melbourne but also reveals trends that could influence the broader housing market. By staying updated on both property trends and economic indicators, investors can better position themselves for success in a competitive market. How Auction Results Impact Real Estate Melbourne Rent Prices and Investor Decisions Auction results play a significant role in shaping real estate Melbourne rent prices and guiding investor decisions. As house prices fluctuate based on demand at auctions, rental markets often adjust accordingly. When auction clearance rates are high and house prices rise, rental demand can increase, driving up rent prices. This makes it essential for investors to keep an eye on auction outcomes to anticipate shifts in the real estate Melbourne rent market and make timely decisions. Understanding auction results also aids in accurate property valuation. For investors, knowing how much properties are selling for at auction gives a clearer picture of the market’s current state. When Australian house prices are rising, especially in competitive areas like Melbourne, it signals growth potential. This can not only affect the property’s rental yield but also influence the overall investment strategy for those looking to maximize returns in the real estate Melbourne rent market. Additionally, tracking auction data alongside trends in house prices Australia helps investors make

Home Warranty vs. Home Insurance: What are the Differences?

If you own a home or are planning to purchase one, understanding the difference between a homeowners appliance warranty and home insurance is essential. These two types of protection both help secure your investment and provide peace of mind for unexpected issues. Yet, they serve distinct purposes in covering different aspects of homeownership. A home warranty focuses on protecting essential appliances and systems, such as your HVAC, refrigerator, or plumbing. When these critical items break down due to normal wear and tear, a home warranty covers the repair or replacement, saving you the stress and cost of sudden repairs. In contrast, home insurance covers structural damage to your home caused by unforeseen events, like fires, storms, or theft. It’s designed to protect your entire property from natural disasters or unexpected incidents, ensuring your home and belongings are secure from major financial loss. Understanding these distinctions can help you decide if having both types of protection is necessary. While home insurance is often required by mortgage lenders, a homeowners appliance warranty is optional yet beneficial, providing coverage that home insurance typically doesn’t include. Ultimately, having both a homeowners appliance warranty and home insurance can offer a more comprehensive safety net, securing your finances and keeping your home comfortable and functioning smoothly year-round. What Is a Home Warranty? A home warranty is a service contract that helps pay for repairs and replacements of covered household appliances and home systems. In exchange for a monthly or annual fee, you get a flat rate on service calls. If an appliance or system covered by your plan breaks down, your home warranty company sends out a technician to diagnose and fix the problem—and you pay just the service call fee. Of course, these plans have coverage limits: A contract may cover up to, say, $1,500 per year for each eligible appliance, with an annual claim limit of $15,000. If you receive a home warranty as part of a real estate transaction, the coverage usually starts as soon as you close on the home. However, if you buy a warranty for a house you already own, you may have to wait 15 to 30 days before the coverage takes effect. What Does a Home Warranty Cover? Home warranties cover appliances and systems in both new and pre-owned homes. Most home warranty companies offer three types of plans: 1.Appliance Plans (e.g., washer/dryer, dishwasher, and refrigerator) 2.System Plans (e.g., HVAC, plumbing, and electrical systems) 3.Combination Plan (everything included in the appliance and system plans) Most companies let you add coverage (for an extra fee) for specific items that are excluded from the standard plans. Common “add-ons” include pools, spas, septic systems, wells, lawn sprinkler systems, and additional appliances (e.g., a second dishwasher or air conditioner). How Much Does a Home Warranty Cost? Home warranty costs are based on two fees: 1. A monthly or annual fee. This is what you pay to access the discounted service calls. Depending on where you live and the plan you buy, you might pay anywhere from $350 to more than $1,100 per year. 2. A service fee. This is the amount you pay each time you request repairs for a covered appliance or system. Most companies offer several service fee “levels,” which might range from about $55 to $150 per service call. In general, the lower the service fee, the higher your monthly or annual fee will be, and vice versa. What Is Homeowners Insurance? Home insurance (aka homeowners insurance) is a type of property insurance that protects against losses and damages caused by covered perils. According to the Insurance Information Institute (III), a standard homeowners insurance policy includes four essential types of coverage: 1. Coverage for the structure of the home: This pays to repair or rebuild the house if it’s damaged or destroyed by a covered peril. Most policies cover other structures on the property, too, such as garages, tool sheds, decks, and gazebos. 2. Coverage for personal belongings: This covers your furniture, clothes, sports equipment, and other personal belongings if they are stolen or destroyed by a covered peril. If you have expensive items, you may need a special personal property endorsement or a floater to ensure you’re adequately protected. 3. Liability protection: Liability coverage protects against lawsuits for injuries and property damage that policyholders, their family members, and their pets cause to other people. 4. Additional living expenses: This pays for hotels, meals, and other living expenses if your house is uninhabitable due to a covered peril. What Does Homeowners Insurance Cover? The most popular home insurance policy is the HO-3, which covers your home, belongings, and liability. According to the III, HO-3 policies provide broad coverage and protect against 16 disasters and perils: 1. Fire or lightning 2. Windstorm or hail 3. Explosion 4. Riot or civil commotion 5. Damage caused by aircraft 6. Damage caused by vehicles 7. Smoke 8. Vandalism or malicious mischief 9. Theft 10. Volcanic eruption 11. Falling object 12. Weight of ice, snow, or sleet 13. Accidental discharge or overflow of water or steam from a plumbing, heating air conditioning, or automatic fire-protective sprinkler system, or from a household appliance 14. Sudden and accidental tearing apart, cracking, burning, or bulging of a steam or hot water heating system, an air conditioner, or an automatic fire-protective system 15. Freezing of a plumbing, HVAC, or automatic fire-protective sprinkler system, or of a household appliance 16. Sudden and accidental damage from an artificially generated electrical current Homeowners insurance also covers your personal liability for injuries to other people (those who don’t live with you) and their property while they are on your property. The most common liability claims involve dog bites, home accidents, falling trees, intoxicated guests, and injured domestic workers. Standard home insurance policies don’t cover damage or losses caused by floods (whether natural or human-related) and earthquakes. Depending on where you live, it may be a good idea to add—or buy a separate policy for—flood or earthquake coverage. Ask your insurance agent

Melbourne Auction Results: How They Shape the Future of Real Estate Investment

Melbourne Auction Results: Understanding Their Impact on Market Trends The auction results Melbourne serves as a crucial indicator for investors and stakeholders within the real estate market. Each auction reflects the prevailing demand and supply dynamics, giving insights into how properties are valued at a given moment. By analyzing these Melbourne auction results, investors can gauge market sentiment, helping them make informed decisions about their investments. For instance, a significant uptick in successful auction sales could suggest a booming market, while a decline might indicate buyer hesitation or economic uncertainty. Understanding these trends is essential for anyone looking to navigate the complex landscape of real estate investment. Moreover, the auction results Melbourne provide valuable data that can be compared over time, allowing investors to spot emerging trends in buyer behavior and property preferences. The patterns observed in recent Melbourne auction results can reveal shifting demographics, popular neighborhoods, and the types of properties that are attracting the most interest. Investors can use this information to refine their strategies, focusing on areas with high demand or unique property features that align with current market trends. This proactive approach to investment, informed by auction outcomes, can lead to more successful ventures and higher returns. Finally, staying updated on auction results Melbourne is vital for those looking to seize opportunities as they arise. By monitoring these results, investors can identify the optimal timing for buying or selling properties, taking advantage of favorable market conditions. Additionally, understanding the context behind the auction results—such as economic factors, government policies, or even seasonal trends—can provide a comprehensive view of the market landscape. Ultimately, leveraging the insights gained from Melbourne auction results can empower investors to make strategic choices that align with their long-term goals in the ever-evolving real estate market. Melbourne Auction Results: Insights into Buyer Behavior and Investment Opportunities The Melbourne auction results offer a treasure trove of insights into buyer behavior, shedding light on the motivations and preferences of potential investors and homebuyers. Analyzing these results allows stakeholders to discern trends such as the types of properties that are in demand, the average bidding prices, and the speed at which properties are selling. For instance, a surge in competitive bidding for a specific neighborhood may indicate that buyers are increasingly drawn to the area’s amenities, schools, or lifestyle offerings. Understanding auction results Melbourne not only helps investors make informed decisions but also provides sellers with the knowledge needed to market their properties effectively. Moreover, the auction results serve as a barometer for investment opportunities Melbourne presents. Investors keen on maximizing their returns can identify undervalued properties or emerging neighborhoods where bidding activity is increasing. For example, if the Melbourne auction results show a consistent rise in sales for a particular suburb, it may signal a growing interest from buyers, thereby enhancing its potential for future price appreciation. Investors who stay attuned to these signals can position themselves strategically, capitalizing on opportunities before they become widely recognized. Additionally, understanding buyer behavior as revealed by the Melbourne auction results can enhance an investor’s ability to anticipate market shifts. Factors such as economic trends, interest rates, and changes in consumer preferences can significantly impact bidding patterns. For instance, if data from recent auction results indicates that first-time buyers are increasingly participating in auctions, it may suggest a shift in market dynamics that investors should consider when planning their strategies. By closely monitoring these insights, investors can adapt their approaches, ensuring they remain competitive and ready to seize investment opportunities Melbourne has to offer. Analyzing Melbourne Auction Results: What They Mean for Investors Analyzing the Melbourne auction results is crucial for investors aiming to gain a competitive edge in the bustling real estate market. Each auction provides a snapshot of current demand and pricing trends, revealing valuable data on which properties are attracting bids and how much buyers are willing to pay. By examining these results, investors can identify high-performing neighborhoods, recognize patterns in buyer activity, and determine the overall health of the market. Understanding these dynamics enables investors to make informed decisions about where to allocate their resources for maximum returns. The insights gained from the auction results Melbourne can help investors refine their strategies, particularly when it comes to timing and property selection. For instance, if the Melbourne auction results indicate a rise in sales for a specific type of property—such as family homes versus apartments—investors can pivot their focus to align with buyer preferences. Additionally, by analyzing past auction results today, investors can spot trends over time, identifying seasonal variations and shifts in market demand. This historical perspective is invaluable for making predictions about future performance and timing investment decisions accordingly. Furthermore, staying informed about the auction results today not only helps investors make strategic choices but also enhances their ability to negotiate effectively. Understanding the current market landscape allows investors to set realistic expectations for property valuations and bid accordingly during auctions. If the Melbourne auction results reveal a competitive market with multiple bidders, investors may choose to adjust their bidding strategies or explore alternative properties. Ultimately, by thoroughly analyzing auction results, investors can position themselves for success in a dynamic real estate environment, maximizing their investment potential while minimizing risks. The Influence of Auction Results on the Melbourne Real Estate Market The auction results Melbourne plays a pivotal role in shaping the Melbourne real estate market, serving as a barometer for current trends and buyer sentiment. Each auction reflects the competitive nature of the market, providing crucial insights into how properties are valued at any given time. When auction clearance rates are high, it typically signals strong demand, which can lead to increased property prices. Conversely, low clearance rates may indicate a cooling market, prompting both buyers and sellers to reevaluate their strategies. Understanding these dynamics is essential for anyone looking to navigate the complexities of property investment in Melbourne. Moreover, the impact of auction results extends beyond individual transactions; they can influence broader market trends and investor confidence. When investors observe consistently

Investor surge pushes Australian housing loans to two-year high

Investor surge pushes Australian housing loans to two-year high Australia’s housing market continued its upward trend in August 2024, reaching the highest level of new lending since May 2022. According to the latest data from the Australian Bureau of Statistics (ABS), the total value of new housing loans increased by 1.0% to $30.4 billion, with investor activity leading the charge. Canstar’s analysis of the ABS data showed that investor loans saw a significant boost, rising 1.4% in August to $11.71 billion – a 34.2% increase from the same period last year. This surge in investor lending marked the second-highest monthly value on record. Loans to owner-occupiers also grew, increasing by 0.7% to $18.7 billion, reflecting a 16.5% rise year-on-year. However, first-home buyers faced a slight dip, with loans for this group dropping by 1.5% from July to August. Despite the monthly decline, first-home buyer activity was still 9.2% higher than in August 2023. Tindall pointed out that while first-home buyers remain active, they face stiff competition from investors who can use rental income to offset the burden of higher mortgage payments. Breaking down the data by state, Queensland emerged as a key driver of the national rise. Housing loan commitments in the state soared by 40% over the past year, adding $2 billion in value, more than any other state. In contrast, the average national loan size for owner-occupiers dropped by 1% in August, falling to $636,208. Although most states saw decreases, Queensland and Tasmania bucked the trend, with Queensland posting a record high loan size of $603,988. Learn more about: Australia’s housing market

Werribee

Get to own a House and Land Package in Werribee for only $646,030! The advantages of residing in Werribee include several positive aspects, such as the abundance of parks and recreation facilities available. Werribee boasts several parks, including the Werribee River Park and the Werribee Open Range Zoo, which offer ample opportunities for families to enjoy the great outdoors. Land Size: 263 sqm House Size: 168.89 sqm 4 Bedrooms 1 Living Room 2 Bathrooms 2 Car for Garage Land Settlement: February 2025 𝗪𝗵𝘆 𝗖𝗵𝗼𝗼𝘀𝗲 Werribee Safe and Family-Orientated Community Reasonable and Affordable Housing Prices Surrounded by a Broad Range of Educational Institutions Walking Distance to Shopping Centres and Train Stations Numbers of Major Attractions to Visit Easy and Full Accessible to All Amenities Client’s review: “great place”Werribee South is very peaceful. Not alot of people live here, it’s away from the traffic and chaos of the world. You can’t beat this place for peace and quiet. It is so close to the city and should have a different name as it is so different to Werribee, its not funny. The only thing missing is shops which the marina will bring. The marina will also bring more people to this great place which is not a good thing but the marina won’t be that big as to spoil the “serenity” as one great man once said. We also provide a rental guarantee with a minimum of 1 year and a maximum of 3 years. 𝗙𝗼𝗿 𝗺𝗼𝗿𝗲 𝗱𝗲𝘁𝗮𝗶𝗹𝘀, 𝗷𝘂𝘀𝘁 𝗰𝗮𝗹𝗹 𝘂𝘀: 1300 074 675 or send us a message on Whatsapp +61 488 859 637 For more updates, follow us on social media:Facebook: Simply WealthInstagram: @simplywealthgroupWebsite: simplywealthgroup.com.auTwitter: @SimplyWealthGrp

Truganina

Get to own a House and Land Package in Truganina for only $656,744! Welcome to Truganina, a charming suburb that beautifully balances convenience with tranquility. Located in the heart of Melbourne’s expanding west, Truganina offers a serene escape from the city’s hustle and bustle, while still providing easy access to urban amenities. With its welcoming community, lush green spaces, and well-planned infrastructure, it’s an ideal place for those seeking a peaceful retreat without compromising on modern conveniences. Land Size: 281 sqm House Size: 157.25 sqm 4 Bedrooms 1 Living Room 2 Bathrooms 2 Car for Garage Land Settlement: Titled 𝗪𝗵𝘆 𝗖𝗵𝗼𝗼𝘀𝗲 Truganina Safe and Family-Orientated Community Reasonable and Affordable Housing Prices Surrounded by a Broad Range of Educational Institutions Walking Distance to Shopping Centres and Train Stations Numbers of Major Attractions to Visit Easy and Full Accessible to All Amenities We also provide a rental guarantee with a minimum of 1 year and a maximum of 3 years. 𝗙𝗼𝗿 𝗺𝗼𝗿𝗲 𝗱𝗲𝘁𝗮𝗶𝗹𝘀, 𝗷𝘂𝘀𝘁 𝗰𝗮𝗹𝗹 𝘂𝘀: 1300 074 675 or send us a message on Whatsapp +61 488 859 637 For more updates, follow us on social media:Facebook: Simply WealthInstagram: @simplywealthgroupWebsite: simplywealthgroup.com.auTwitter: @SimplyWealthGrp

Wyndham Vale

Get to own a House and Land Package in Wyndham Vale for only $646,161! Wyndham Vale is a rapidly growing suburb located in the southwestern part of Melbourne, Victoria. Known for its family-friendly atmosphere and abundant green spaces, it offers residents a tranquil lifestyle with easy access to urban amenities. The suburb features modern housing developments, excellent schools, and convenient transport links, making it an attractive destination for young families and professionals. With its blend of suburban comfort and proximity to the city, Wyndham Vale continues to thrive as a vibrant and welcoming community. Land Size: 263 sqm House Size: 157.25 sqm 4 Bedrooms 1 Living Room 2 Bathrooms 2 Car for Garage Land Settlement: Titled 𝗪𝗵𝘆 𝗖𝗵𝗼𝗼𝘀𝗲 Wyndham Vale Safe and Family-Orientated Community Reasonable and Affordable Housing Prices Surrounded by a Broad Range of Educational Institutions Walking Distance to Shopping Centres and Train Stations Numbers of Major Attractions to Visit Easy and Full Accessible to All Amenities We also provide a rental guarantee with a minimum of 1 year and a maximum of 3 years. 𝗙𝗼𝗿 𝗺𝗼𝗿𝗲 𝗱𝗲𝘁𝗮𝗶𝗹𝘀, 𝗷𝘂𝘀𝘁 𝗰𝗮𝗹𝗹 𝘂𝘀: 1300 074 675 or send us a message on Whatsapp +61 488 859 637 For more updates, follow us on social media:Facebook: Simply WealthInstagram: @simplywealthgroupWebsite: simplywealthgroup.com.auTwitter: @SimplyWealthGrp

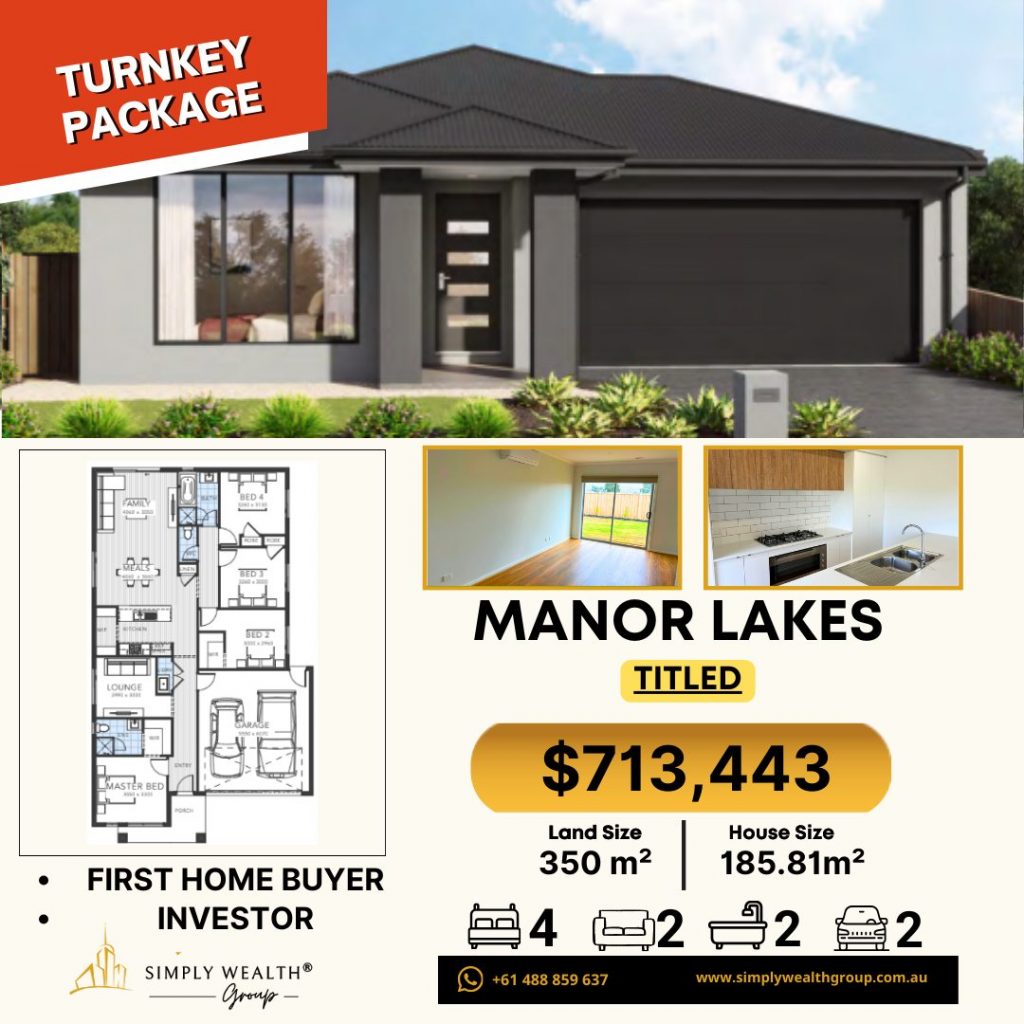

Manor Lakes

Get to own a House and Land Package in Manor Lakes for only $713,443! Manor Lakes, a charming suburb in Melbourne’s west, perfectly blends modern living with natural beauty. Famous for its expansive lakes and lush parks, this community provides a serene environment for residents. The suburb features well-maintained walking trails, scenic picnic spots, and family-friendly recreational areas, making it a paradise for nature enthusiasts. With its thoughtful urban planning, Manor Lakes seamlessly integrates contemporary amenities with the tranquility of its natural surroundings, offering a peaceful and attractive lifestyle. Land Size: 350 sqm House Size: 185.81 sqm 4 Bedrooms 2 Living Room 2 Bathrooms 2 Car for Garage Land Settlement: Titled 𝗪𝗵𝘆 𝗖𝗵𝗼𝗼𝘀𝗲 Manor Lakes Safe and Family-Orientated Community Reasonable and Affordable Housing Prices Surrounded by a Broad Range of Educational Institutions Walking Distance to Shopping Centres and Train Stations Numbers of Major Attractions to Visit Easy and Full Accessible to All Amenities We also provide a rental guarantee with a minimum of 1 year and a maximum of 3 years. 𝗙𝗼𝗿 𝗺𝗼𝗿𝗲 𝗱𝗲𝘁𝗮𝗶𝗹𝘀, 𝗷𝘂𝘀𝘁 𝗰𝗮𝗹𝗹 𝘂𝘀: 1300 074 675 or send us a message on Whatsapp +61 488 859 637 For more updates, follow us on social media:Facebook: Simply WealthInstagram: @simplywealthgroupWebsite: simplywealthgroup.com.auTwitter: @SimplyWealthGrp

Truganina

Get to own a House and Land Package in Truganina for only $680,461! Nestled in the heart of Melbourne’s western suburbs, Truganina offers a serene and picturesque escape from the hustle and bustle of city life. With its lush green parks, tranquil walking trails, and welcoming community, Truganina is a hidden gem that combines modern living with natural beauty. Discover the peace and charm that make this suburb an ideal place to call home. Land Size: 321sqm House Size: 157.25sqm 4 Bedrooms 1 Living Room 2 Bathrooms 2 Car for Garage Land Settlement: Jan-Feb 2025 𝗪𝗵𝘆 𝗖𝗵𝗼𝗼𝘀𝗲 Truganina Safe and Family-Orientated Community Reasonable and Affordable Housing Prices Surrounded by a Broad Range of Educational Institutions Walking Distance to Shopping Centres and Train Stations Numbers of Major Attractions to Visit Easy and Full Accessible to All Amenities We also provide a rental guarantee with a minimum of 1 year and a maximum of 3 years. 𝗙𝗼𝗿 𝗺𝗼𝗿𝗲 𝗱𝗲𝘁𝗮𝗶𝗹𝘀, 𝗷𝘂𝘀𝘁 𝗰𝗮𝗹𝗹 𝘂𝘀: 1300 074 675 or send us a message on Whatsapp +61 488 859 637 For more updates, follow us on social media:Facebook: Simply WealthInstagram: @simplywealthgroupWebsite: simplywealthgroup.com.auTwitter: @SimplyWealthGrp

Manor Lakes

Get to own this House and Land Package in Manor Lakes for only $713,443! Manor Lakes embodies natural beauty, with lush landscapes and well-maintained parks creating a picturesque setting. Blending modern amenities with traditional charm, it offers an ideal home environment. Its strategic location ensures easy access to essential facilities such as schools, shopping centers, and healthcare services, catering to various lifestyles. Strong community bonds and regular social gatherings foster a welcoming atmosphere and lasting friendships. Choosing to buy a house in Manor Lakes promises tranquility, convenience, and a fulfilling suburban lifestyle for both individuals and families. Land Size: 350 sqm House Size: 185.81 sqm 4 Bedrooms 2 Bathrooms 2 Living Room 2 Car for Garage Land Settlement: Titled 𝗪𝗵𝘆 𝗖𝗵𝗼𝗼𝘀𝗲 Manor Lakes Safe and Family-Orientated Community Reasonable and Affordable Housing Prices Surrounded by a Broad Range of Educational Institutions Walking Distance to Shopping Centres and Train Stations Numbers of Major Attractions to Visit Easy and Full Accessible to All Amenities We also provide a rental guarantee with a minimum of 1 year and a maximum of 3 years. 𝗙𝗼𝗿 𝗺𝗼𝗿𝗲 𝗱𝗲𝘁𝗮𝗶𝗹𝘀, 𝗷𝘂𝘀𝘁 𝗰𝗮𝗹𝗹 𝘂𝘀: 1300 074 675 or send us a message on Whatsapp +61 488 859 637 For more updates, follow us on social media:Facebook: Simply WealthInstagram: @simplywealthgroupWebsite: simplywealthgroup.com.auTwitter: @SimplyWealthGrp