Sydney vs Melbourne: Which City Offers the Best property Investment Opportunities in 2025 ?

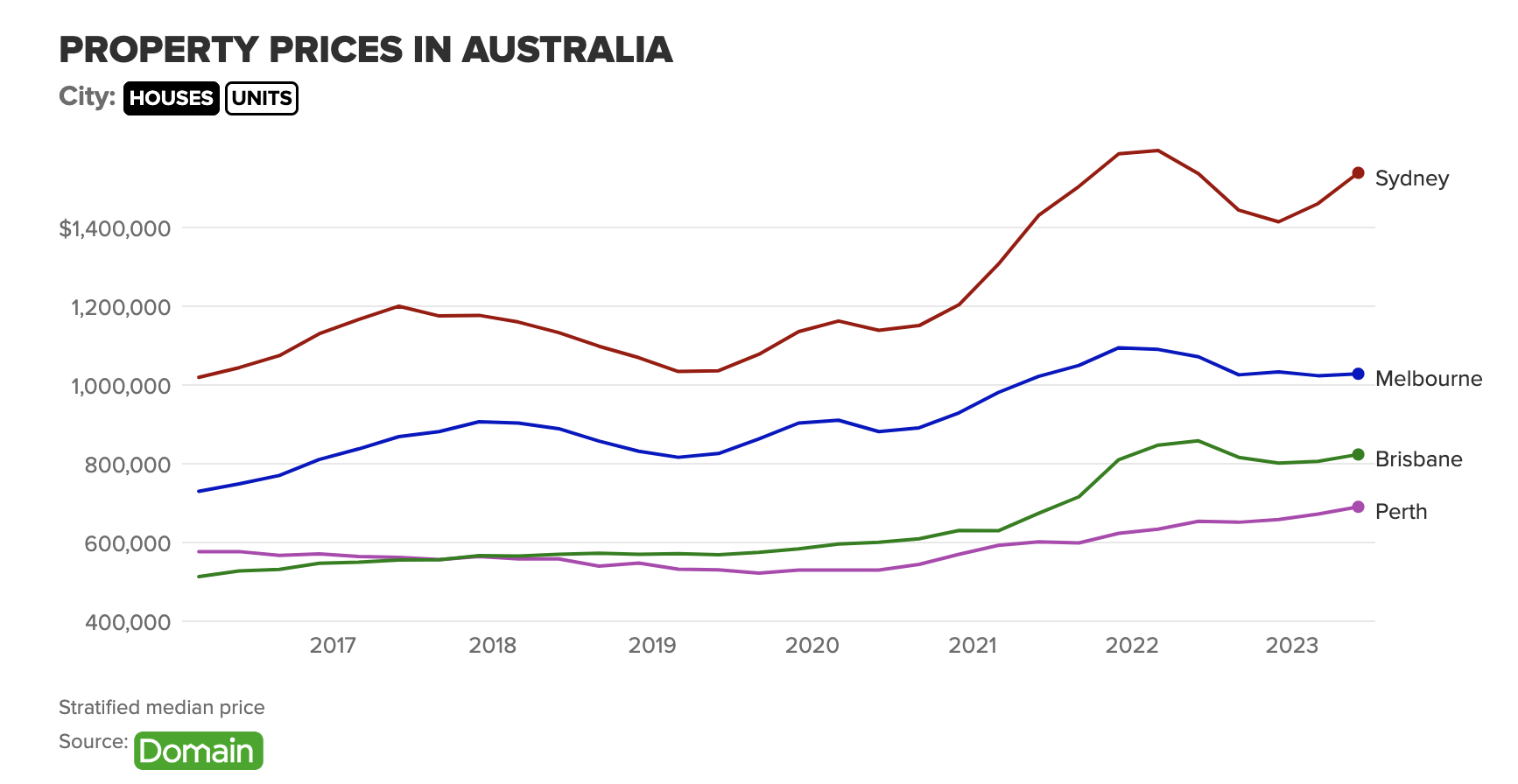

In 2025, Melbourne’s median house price of AUD 980,000 remains nearly 30% lower than Sydney’s AUD 1.35 million—a gap that has widened over the past decade despite Melbourne’s faster population growth and infrastructure expansion. This disparity challenges the long-held assumption that Sydney’s market dominance is unassailable, particularly as Melbourne’s affordability attracts a surge of first-time buyers and interstate migrants.

The dynamics of these two cities reveal a deeper complexity. Sydney’s reliance on high-end demand has created a paradox: while luxury properties thrive, middle-tier markets stagnate under the weight of high borrowing costs and a construction shortfall of 100,000 homes annually. Meanwhile, Melbourne’s middle-ring suburbs, such as Coburg and Reservoir, are experiencing unprecedented demand, fueled by large-scale projects like the Metro Tunnel, which has cut commute times by up to 20%.

Dr. Andrew Wilson, Chief Economist at My Housing Market, notes, “Melbourne’s adaptability and affordability position it as a magnet for sustainable growth, while Sydney faces structural inefficiencies that limit its broader market potential.” The contrast underscores a pivotal moment in Australia’s property landscape.

Image source: reddit.com

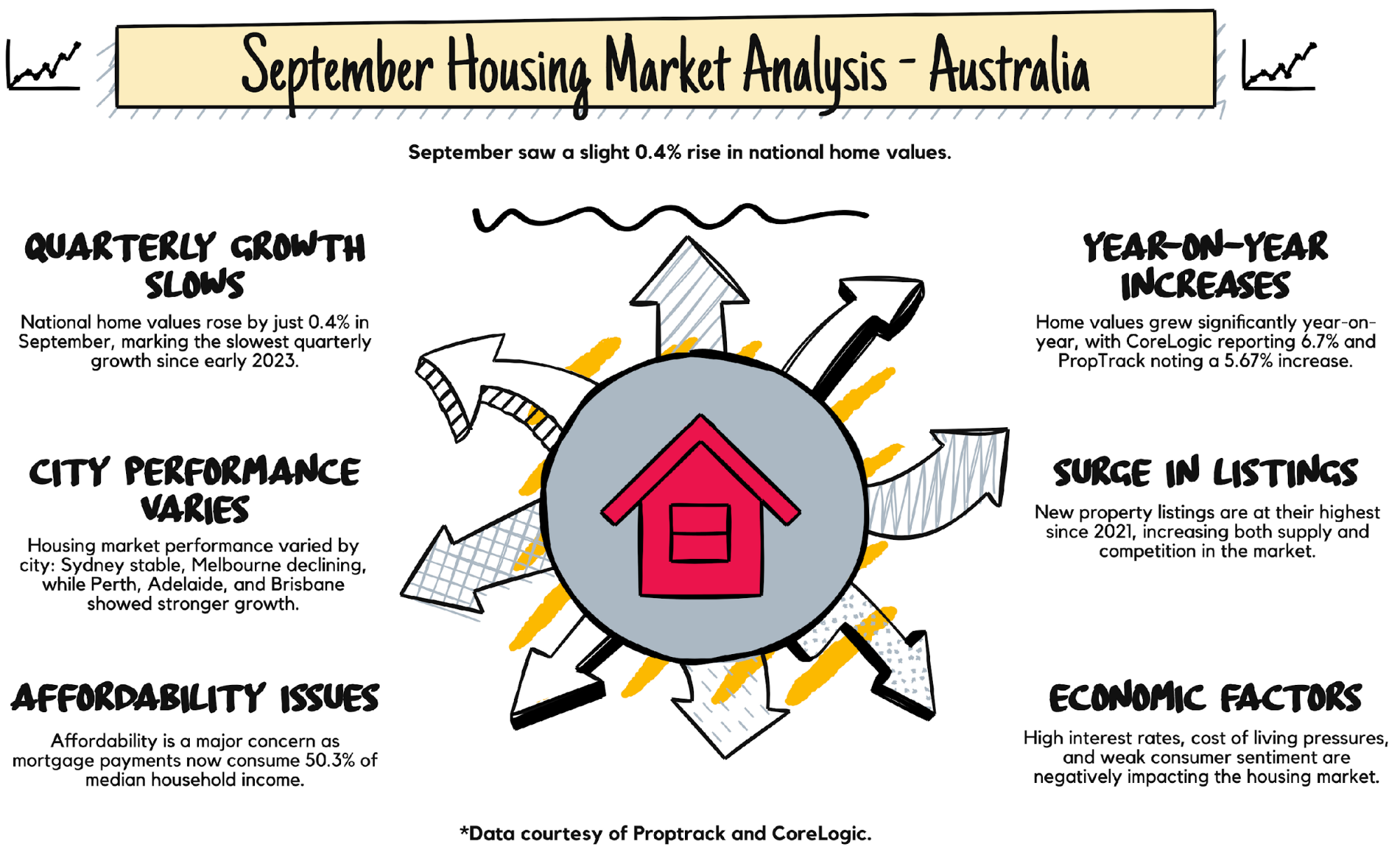

Overview of the Australian Property Market

A critical yet underexplored aspect of the Australian property market in 2025 is the role of infrastructure-driven growth corridors in shaping regional demand. These corridors, particularly in Melbourne’s outer suburbs, exemplify how targeted investments in connectivity can catalyze property value appreciation. For instance, the West Gate Tunnel and Metro Tunnel projects have significantly reduced commute times, enhancing the appeal of areas like Wyndham and Melton.

The underlying mechanism driving this trend is the “Infrastructure Accessibility Index” (IAI), a metric that quantifies the impact of transport and community infrastructure on property desirability. Suburbs with high IAI scores have consistently outperformed in price growth, as improved accessibility attracts both buyers and renters. This dynamic is particularly pronounced in Melbourne, where proactive urban planning aligns housing supply with infrastructure upgrades.

However, the effectiveness of such projects varies. While Melbourne’s coordinated approach has yielded measurable benefits, Sydney’s fragmented planning has led to uneven outcomes. For example, oversupply in Sydney’s Inner West contrasts sharply with the high demand in underserviced areas, highlighting the importance of balanced development.

“Infrastructure investment is not just about connectivity; it’s about creating livable, integrated communities that sustain long-term growth.”

— Eliza Owen, Head of Research, CoreLogic

This analysis underscores the necessity of aligning infrastructure with demographic trends, offering a replicable model for sustainable urban development.

Historical Performance of Sydney and Melbourne Markets

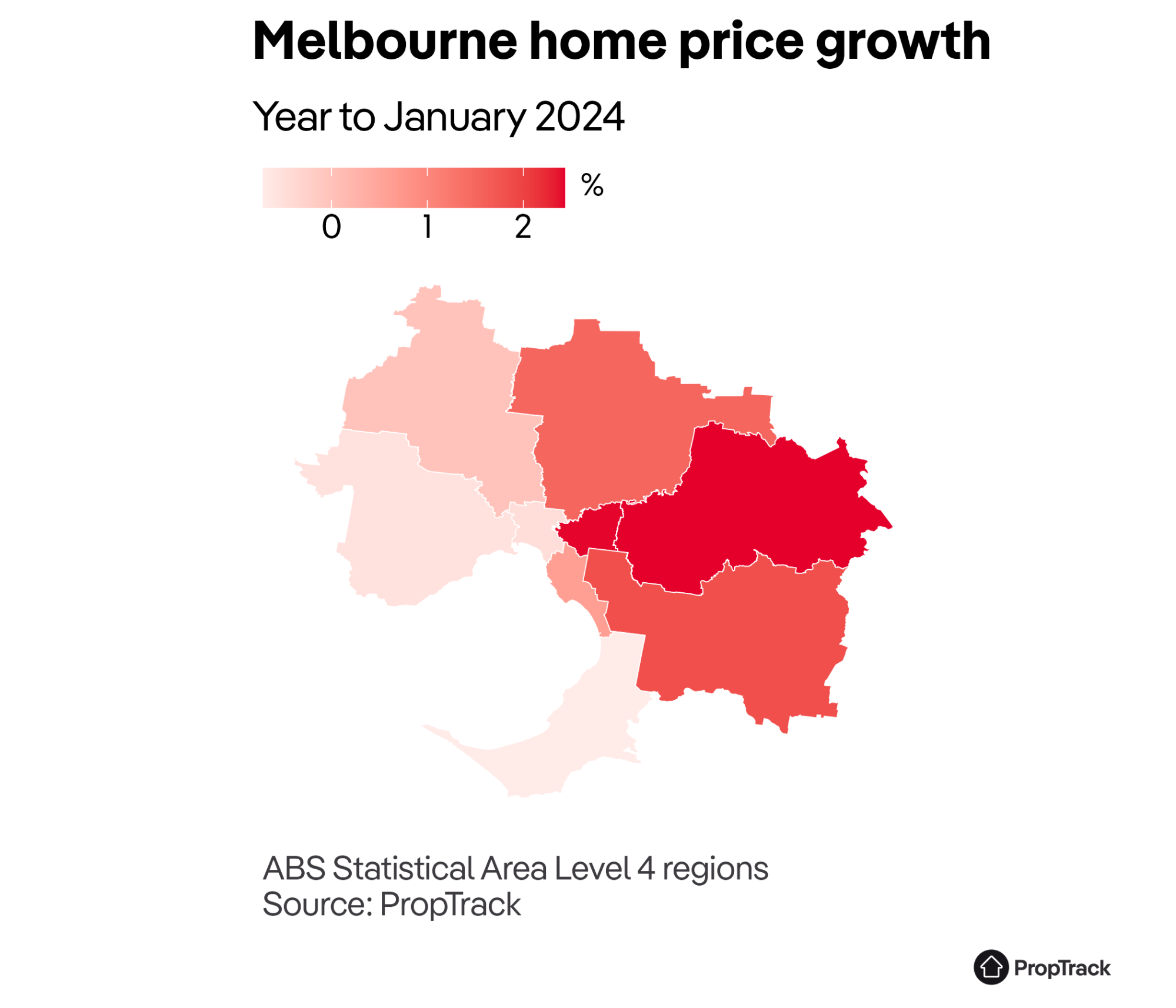

The historical performance of Sydney and Melbourne’s property markets reveals a fundamental divergence in how each city has balanced growth across different market segments. Sydney’s high-end market has historically thrived, driven by international investment and limited supply, yet this focus has often left its middle-tier market vulnerable to stagnation. In contrast, Melbourne’s more diversified approach has fostered consistent growth across multiple segments, supported by adaptive policies and infrastructure alignment.

A key mechanism behind Melbourne’s steadier performance is its ability to absorb external shocks. For example, during the 2020-2022 economic disruptions, Melbourne’s middle-ring suburbs demonstrated resilience, with capital growth rates averaging 6.5% annually. This was attributed to a combination of affordable entry points and proactive urban planning. Sydney, however, saw a sharper decline in mid-market activity, reflecting its reliance on high borrowing capacities and premium property demand.

“Melbourne’s diversified market structure provides a buffer against volatility, unlike Sydney’s concentrated reliance on high-value properties,”

— Eliza Owen, Head of Research, CoreLogic.

This contrast underscores the importance of scalability and affordability in sustaining long-term market health. While Sydney’s luxury segment offers high returns, Melbourne’s balanced growth model presents a more reliable framework for investors seeking stability and scalability.

Economic and Demographic Drivers

Melbourne’s younger demographic profile, with a median age of 36 compared to Sydney’s 38, has created a distinct demand for affordable, lifestyle-oriented housing. This trend is amplified by Melbourne’s net interstate migration gains, which reached 18,000 in 2024, driven by its lower cost of living and robust job market in technology and finance. In contrast, Sydney’s population growth, while steady, is increasingly reliant on international migration, which often skews demand toward high-end properties, leaving middle-tier markets underserved.

Economic indicators further differentiate the two cities. Melbourne’s unemployment rate of 3.8% in early 2025, bolstered by its expanding knowledge economy, contrasts with Sydney’s 4.2%, where wage stagnation has tempered consumer confidence. This divergence is reflected in housing affordability: Melbourne’s median house price-to-income ratio stands at 7.5, significantly lower than Sydney’s 9.3, making Melbourne more accessible to first-time buyers.

A critical yet underappreciated factor is the “demographic elasticity” of Melbourne’s housing market. This concept, which measures a city’s ability to adapt its housing supply to population shifts, highlights Melbourne’s proactive construction policies. For instance, the West Gate Tunnel project has unlocked new growth corridors, aligning housing availability with demand—a stark contrast to Sydney’s chronic undersupply. These dynamics underscore Melbourne’s strategic advantage in fostering sustainable growth.

Image source: apimagazine.com.au

Population Growth and Migration Trends

Melbourne’s population growth trajectory in 2025 reveals a nuanced interplay between migration patterns and housing market dynamics. While net migration figures often dominate discussions, the critical driver lies in the redistribution of demand across suburban zones. This phenomenon is particularly evident in Melbourne’s outer growth corridors, where infrastructure projects like the West Gate Tunnel have catalyzed localized population surges. These areas, characterized by affordable housing and improved connectivity, are absorbing a significant share of new arrivals, reshaping the city’s demographic and economic landscape.

In contrast, Sydney’s reliance on international migration has created a bifurcated market. High-end property demand remains robust, but middle-tier segments face stagnation due to affordability constraints and limited housing supply. This divergence underscores the importance of demographic elasticity—a city’s ability to align housing supply with shifting population needs. Melbourne’s proactive urban planning, which integrates housing development with infrastructure upgrades, exemplifies this principle, offering a replicable model for sustainable growth.

“Localized migration trends, when paired with strategic urban planning, can redefine market dynamics, creating pockets of resilience even in broader economic downturns.”

— Eliza Owen, Head of Research, CoreLogic

However, challenges persist. Melbourne’s rapid suburban expansion risks outpacing essential services, while Sydney’s fragmented planning exacerbates disparities between high-demand and underserviced areas. These limitations highlight the need for adaptive policies that balance growth with livability. Ultimately, the interplay between migration and urban planning will determine the long-term viability of these cities’ housing markets, offering critical lessons for policymakers and investors alike.

Economic Indicators Influencing Property Values

One critical yet underexplored economic indicator shaping property values in 2025 is the Lending Affordability Ratio (LAR), which measures the proportion of household income required to service a mortgage. This metric has emerged as a pivotal determinant of market activity, particularly in Melbourne and Sydney, where borrowing conditions diverge significantly.

In Melbourne, a lower LAR—driven by moderate house prices and incremental wage growth—has fostered broader market participation. This dynamic is particularly evident in middle-income segments, where affordability improvements have translated into a 15% increase in mortgage approvals for first-time buyers, as reported by ANZ in early 2025. Conversely, Sydney’s higher LAR, exacerbated by stagnant wages and elevated property prices, has constrained borrowing capacity, limiting market fluidity and suppressing mid-tier demand.

The interplay between LAR and policy interventions further underscores its significance. Melbourne’s targeted incentives, such as the Help to Buy scheme, amplify the impact of affordability metrics, creating a feedback loop that bolsters consumer confidence. In contrast, Sydney’s fragmented policy landscape has struggled to mitigate the strain of high borrowing costs.

“Affordability metrics like the LAR are not just financial indicators; they are behavioral drivers that dictate market sentiment and participation.”

— Eliza Owen, Head of Research, CoreLogic

This nuanced understanding of LAR highlights its role as a barometer for market resilience, offering a lens through which policymakers and investors can anticipate shifts in property values.

Market Characteristics and Trends

Melbourne’s property market in 2025 demonstrates a unique interplay between affordability and strategic urban planning, creating opportunities that defy traditional investment paradigms. For instance, the city’s outer growth corridors, such as Wyndham, have seen property values rise by 12% year-on-year, driven by infrastructure projects like the West Gate Tunnel. This contrasts sharply with Sydney, where high borrowing costs and a 14% Price Accessibility Index (PAI) have constrained mid-tier market activity, leaving investors to focus on high-end properties with limited scalability.

A critical misconception is that rental yields and capital growth are mutually exclusive. In reality, Melbourne’s middle-ring suburbs, supported by a younger demographic and proactive housing policies, achieve a balance between the two. Suburbs like Melton report rental yields of 4.8%, outperforming Sydney’s average of 3.6%, while also maintaining steady capital appreciation. This dual advantage underscores Melbourne’s adaptability to shifting market conditions.

By aligning housing supply with infrastructure and demographic trends, Melbourne offers a replicable model for sustainable growth, challenging Sydney’s reliance on high-value segments. This divergence highlights the importance of integrating affordability metrics with long-term planning for resilient investment strategies.

Image source: eliteagent.com

Housing Supply and Demand Dynamics

Sydney’s housing supply–demand imbalance in 2025 is deeply influenced by its fragmented planning processes, which exacerbate disparities between high-demand and underserviced areas. A critical factor is the prolonged approval timelines for medium-density developments, which average 18 months compared to Melbourne’s streamlined 9-month process under the Precinct Structure Planning (PSP) system. This delay not only restricts supply but also inflates costs, further limiting affordability for middle-income buyers.

Melbourne’s PSP system, by contrast, exemplifies how strategic sequencing of land development can mitigate supply bottlenecks. By pre-zoning land and aligning infrastructure delivery with projected demand, Melbourne has achieved a more responsive housing market. For instance, the PSP-led expansion in Wyndham resulted in a 15% increase in housing completions within two years, directly addressing population growth in the area.

“Efficient planning frameworks like Melbourne’s PSP system are pivotal in reducing supply constraints and stabilizing market dynamics,”

— Dr. Andrew Wilson, Chief Economist, My Housing Market.

However, Sydney’s reliance on high-value developments creates a paradox: while luxury projects thrive, the broader market remains undersupplied. This imbalance is further compounded by rising construction costs, which are 35% higher than Melbourne’s due to regulatory inefficiencies and land scarcity.

The divergence highlights the importance of adaptive planning systems that prioritize scalability and affordability, offering a replicable model for sustainable urban growth.

Rental Yields and Capital Growth Projections

Melbourne’s property market in 2025 demonstrates a rare synergy between rental yields and capital growth, particularly in its middle-ring suburbs. These areas, supported by infrastructure projects like the Metro Tunnel, report average rental yields of 4.8%, significantly outperforming Sydney’s 3.6%. This performance is underpinned by Melbourne’s affordability and strategic urban planning, which align housing supply with demographic trends. The result is a market where rental returns and capital appreciation coexist, defying the traditional trade-off between these metrics.

The underlying mechanism lies in Melbourne’s ability to attract a younger, mobile demographic seeking affordable housing near employment hubs. This demand is amplified by targeted government incentives, such as the Help to Buy scheme, which lower entry barriers for first-time buyers. These factors create a feedback loop: increased demand drives rental yields, while infrastructure-led growth ensures sustained capital appreciation.

In contrast, Sydney’s high property prices and fragmented planning limit its ability to replicate this balance. The city’s reliance on high-end developments skews the market, leaving mid-tier properties with weaker rental performance and slower capital growth. This disparity is further exacerbated by Sydney’s higher Lending Affordability Ratio (LAR), which constrains borrowing capacity and suppresses broader market participation.

“Melbourne’s market exemplifies how affordability and infrastructure investment can harmonize rental yields with capital growth, offering a replicable model for sustainable urban development.”

— Dr. Andrew Wilson, Chief Economist, My Housing Market

This nuanced interplay highlights Melbourne’s strategic advantage, positioning it as a compelling choice for investors seeking both steady income and long-term value appreciation.

Suburb-Specific Investment Opportunities

In 2025, Melbourne’s outer growth corridors, such as Tarneit and Cranbourne, exemplify the transformative impact of infrastructure-led development. The West Gate Tunnel project, for instance, has reduced commute times by up to 20%, directly correlating with a 12% year-on-year increase in property values in these areas. This demonstrates how targeted connectivity improvements can unlock latent demand, making these suburbs prime candidates for long-term capital growth.

Conversely, Sydney’s Marrickville and Petersham highlight the potential of gentrifying inner suburbs. These areas, benefiting from rezoning initiatives and cultural revitalization, have seen rental yields rise to 4.2%, outperforming the city’s average. This trend underscores the importance of identifying suburbs where demographic shifts align with urban renewal efforts, creating dual opportunities for rental income and appreciation.

By focusing on metrics like transport accessibility indices and zoning changes, investors can anticipate shifts in demand, ensuring their strategies align with both immediate returns and sustainable growth trajectories.

Image source: propertydollar.com.au

Identifying Emerging Investment Hotspots

Emerging investment hotspots often materialize where infrastructure upgrades intersect with demographic shifts, creating a fertile ground for property value appreciation. A critical yet underutilized technique in identifying these areas involves analyzing pre-construction activity metrics, such as permit approvals and rezoning applications. These indicators often precede visible market changes, offering a predictive edge for investors.

For instance, Melbourne’s outer suburbs like Tarneit have demonstrated how early infrastructure investments, such as the West Gate Tunnel, correlate with a surge in housing demand. Pre-construction permits in the area increased by 18% in 2024, signaling heightened developer interest. This activity directly aligned with a 12% rise in property values over the following year, underscoring the predictive power of such metrics.

In contrast, Sydney’s Marrickville showcases a different dynamic. Here, gentrification trends are reflected in subtle shifts, such as increased local business registrations and higher tenant turnover rates. These micro-level changes often signal broader demographic transitions, which, when paired with rezoning initiatives, create dual opportunities for rental yield and capital growth.

“Investors who monitor granular indicators like planning applications and demographic shifts can identify value before it becomes apparent in broader market data.”

— Dr. Andrew Wilson, Chief Economist, My Housing Market

By focusing on these nuanced, early signals, investors can strategically position themselves to capitalize on both immediate and long-term market transformations. This approach emphasizes the importance of localized analysis over reliance on aggregated data.

Family-Friendly and Gentrifying Suburbs

The transformation of family-friendly and gentrifying suburbs hinges on a delicate interplay between infrastructure, community dynamics, and demographic shifts. In Melbourne, suburbs like Wantirna exemplify how low vacancy rates and high owner-occupier ratios create a perception of safety and stability, essential for attracting families. These factors are amplified by proximity to quality schools, parks, and amenities, which collectively enhance long-term demand. The underlying mechanism here is the “Community Stability Index” (CSI), a metric that evaluates the balance between rental and owner-occupied properties, correlating higher CSI scores with sustained property value growth.

In Sydney, gentrifying suburbs such as Marrickville reveal a contrasting dynamic. Here, cultural revitalization and rezoning initiatives drive incremental changes that often go unnoticed in broader market analyses. For instance, a rise in local business registrations and tenant turnover rates signals demographic shifts that precede significant property value appreciation. These micro-level indicators, while less visible than Melbourne’s infrastructure-led growth, offer a predictive edge for investors attuned to subtle market transformations.

“Localized metrics like tenant turnover and business activity provide early signals of gentrification, enabling investors to act ahead of broader market trends.”

— Miriam Patterson, Fund Manager, Charter Hall

This nuanced understanding highlights the importance of tailored investment strategies that align with the unique growth trajectories of family-oriented and gentrifying suburbs.

Regulatory Environment and Financing Options

Melbourne’s streamlined regulatory framework, exemplified by its Precinct Structure Planning (PSP) system, has reduced land development approval times to an average of nine months, compared to Sydney’s 18 months. This efficiency not only accelerates housing supply but also stabilizes costs, creating a more predictable investment landscape. In contrast, Sydney’s fragmented planning processes exacerbate supply bottlenecks, inflating property prices and deterring mid-tier investors.

Financing options further amplify these disparities. Melbourne’s lower Lending Affordability Ratio (LAR) of 7.5, compared to Sydney’s 9.3, enables broader market participation. Tailored loan products, such as ANZ’s flexible repayment schemes, have driven a 12% increase in mortgage approvals in Melbourne’s growth corridors. Meanwhile, Sydney’s higher borrowing costs, compounded by stagnant wage growth, limit access to financing, particularly for first-time buyers.

This interplay between regulatory efficiency and financing accessibility underscores Melbourne’s strategic advantage, positioning it as a model for scalable, investor-friendly growth.

Image source: createvic.com.au

Impact of Government Policies on Investments

One critical yet underappreciated aspect of government policies in 2025 is their role in shaping zoning flexibility to address housing supply constraints. Melbourne’s Precinct Structure Planning (PSP) system exemplifies how pre-zoning land for development, combined with infrastructure alignment, reduces approval timelines and enhances project feasibility. This approach contrasts sharply with Sydney’s fragmented planning, where protracted approvals often deter developers from pursuing medium-density projects.

The underlying mechanism lies in Melbourne’s integration of zoning reforms with financial incentives, such as reduced stamp duties for off-the-plan purchases. This dual strategy not only accelerates housing supply but also attracts investors by lowering entry barriers. For instance, the streamlined PSP framework has enabled a 15% increase in housing completions in Melbourne’s growth corridors, as reported by the National Housing Supply and Affordability Council.

However, challenges persist. While Melbourne’s policies foster scalability, they risk over-reliance on outer suburban developments, potentially straining essential services. Sydney, on the other hand, faces inefficiencies that inflate costs and limit mid-tier market participation.

“Zoning reforms are not just regulatory tools; they are economic levers that dictate market fluidity and investor confidence.”

— Dr. Andrew Wilson, Chief Economist, My Housing Market

This analysis underscores the importance of harmonizing zoning policies with financial frameworks to create sustainable, investor-friendly markets.

Financing Options and Interest Rate Implications

The interplay between financing structures and interest rate dynamics in 2025 reveals a critical divergence in how Melbourne and Sydney investors navigate property markets. Melbourne’s lower Lending Affordability Ratio (LAR) of 7.5 fosters access to innovative financing products, such as shared equity schemes and flexible repayment loans. These options mitigate the impact of rate fluctuations, enabling broader market participation. In contrast, Sydney’s higher LAR of 9.3 amplifies the strain of rising rates, disproportionately affecting middle-income buyers and constraining mid-tier market liquidity.

A key mechanism driving this disparity is the alignment of Melbourne’s regulatory framework with tailored lending practices. For instance, ANZ’s flexible repayment schemes have seen a 12% increase in mortgage approvals in Melbourne’s growth corridors, reflecting the city’s ability to adapt financing to demographic needs. Conversely, Sydney’s fragmented planning and reliance on high-value developments limit the scalability of such solutions, leaving mid-tier investors exposed to rate volatility.

“Interest rate shifts reveal deeper market fissures that numbers alone can’t capture.”

— Dr. Andrew Wilson, Chief Economist, My Housing Market

This analysis underscores that financing success hinges not merely on interest rates but on the synergy between regulatory efficiency and adaptive lending products, a nuance often overlooked in conventional market evaluations.

FAQ

What are the key differences in property market dynamics between Sydney and Melbourne in 2025?

Sydney’s property market in 2025 is characterized by high borrowing costs, stagnant wage growth, and a reliance on high-end developments, which limits accessibility for middle-income buyers. In contrast, Melbourne offers a more balanced market, driven by affordability, proactive urban planning, and infrastructure projects like the West Gate Tunnel. Sydney faces supply constraints and uneven demand, while Melbourne’s growth corridors, such as Wyndham, benefit from aligned housing supply and demographic trends. These dynamics position Melbourne as a model for sustainable growth, attracting first-time buyers and investors, whereas Sydney’s fragmented planning exacerbates affordability challenges and market stagnation.

How do infrastructure projects influence property investment opportunities in Sydney and Melbourne?

Infrastructure projects significantly shape property investment opportunities by enhancing connectivity and accessibility. In Melbourne, transformative developments like the Metro Tunnel and West Gate Tunnel drive demand in growth corridors such as Wyndham and Melton, aligning housing supply with demographic trends. These projects boost property values and attract both families and investors. Conversely, Sydney’s transport upgrades, while improving select areas, are hindered by fragmented planning and prolonged approval processes, limiting their broader impact. Melbourne’s integrated approach to infrastructure fosters sustainable growth and affordability, whereas Sydney’s challenges in balancing supply and demand create disparities in investment potential across its property market.

Which suburbs in Sydney and Melbourne are considered hotspots for property investment in 2025?

In Melbourne, suburbs like Tarneit and Cranbourne stand out as investment hotspots in 2025, driven by infrastructure projects such as the West Gate Tunnel, which enhances connectivity and boosts property values. Middle-ring suburbs like Werribee also attract attention due to their affordability and rental yield potential. In Sydney, areas like Summer Hill and Dulwich Hill benefit from the Light Rail extension, making them appealing for their proximity to the CBD and lifestyle amenities. Additionally, emerging suburbs along the Parramatta Light Rail corridor, such as Rydalmere, show promise due to improved transport links and growing commercial precincts, supporting long-term growth.

What role do government policies and lending practices play in shaping property investment potential in Sydney and Melbourne?

Government policies and lending practices are pivotal in shaping property investment potential. Melbourne benefits from streamlined zoning regulations, such as the Precinct Structure Planning system, which accelerates housing supply in growth corridors. Incentives like the Help to Buy scheme and lower Lending Affordability Ratios (LAR) enhance market accessibility for first-time buyers. In Sydney, fragmented planning and prolonged approval timelines hinder medium-density developments, exacerbating supply constraints. Higher LARs and stagnant wage growth further limit borrowing capacity, reducing mid-tier market activity. These contrasting approaches highlight Melbourne’s advantage in fostering affordability and scalability, while Sydney struggles with systemic inefficiencies impacting investment opportunities.

How do rental yields and capital growth prospects compare between Sydney and Melbourne for investors in 2025?

In 2025, Melbourne offers higher rental yields, averaging 4.8% in middle-ring suburbs, compared to Sydney’s 3.6%, driven by affordability and strategic urban planning. Melbourne’s infrastructure projects, such as the Metro Tunnel, enhance connectivity, supporting both rental demand and capital growth. Conversely, Sydney’s high property prices and reliance on luxury developments limit rental yield potential, with mid-tier markets facing stagnation. While Sydney’s historical capital growth remains strong, Melbourne’s balanced approach to affordability and infrastructure positions it for sustained appreciation. These dynamics make Melbourne more attractive for investors seeking a combination of steady income and long-term value growth.