SMSF Property Rules: Where ‘Creative Accounting’ Meets ‘Please Don’t Audit Us’

In 2023, the Australian Taxation Office (ATO) reported a 22% increase in compliance audits targeting self-managed super funds (SMSFs) investing in property—a sharp rise attributed to widespread breaches of the sole purpose test. This foundational rule, which mandates that SMSF assets serve only to provide retirement benefits, has become a flashpoint for regulatory scrutiny. Yet, the allure of property investment within SMSFs persists, driven by the promise of long-term capital growth and tax advantages.

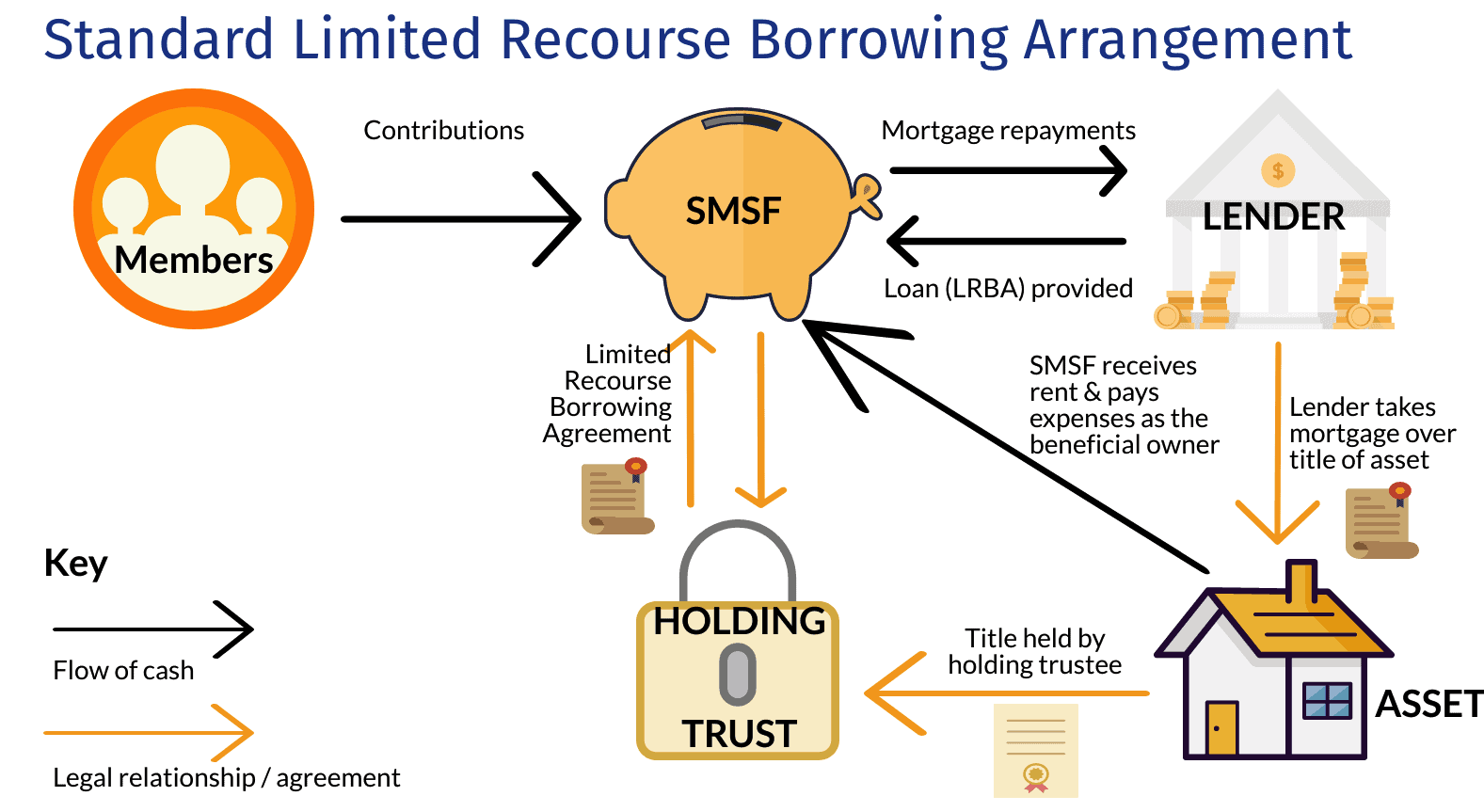

The complexity lies in the fine print. For instance, Limited Recourse Borrowing Arrangements (LRBAs), a mechanism allowing SMSFs to borrow for property purchases, restrict lenders’ claims to the property itself, shielding other fund assets. However, as financial consultant Sarah McMahon of Accario notes, “Missteps in structuring these arrangements can lead to severe penalties, including the loss of tax concessions.”

The stakes are high: non-compliance risks not only financial penalties but also the erosion of retirement savings—a sobering reality in an era of heightened regulatory vigilance.

Image source: growsmsf.com.au

The Basics of SMSFs and Property Investment

A critical yet underexplored aspect of SMSF property investment is the arm’s length transaction principle, which ensures all dealings are conducted at market value without preferential treatment. This rule is particularly significant when transactions involve related parties, as even minor deviations can trigger non-arm’s length income (NALI) provisions, leading to punitive tax rates.

The principle’s complexity lies in its practical application. For instance, leasing a commercial property owned by an SMSF to a trustee’s business requires meticulous documentation, including independent valuations and market-rate lease agreements. Failure to meet these standards can result in severe penalties, as highlighted by the Australian Taxation Office’s (ATO) recent focus on compliance audits.

“The arm’s length rule is not just a guideline; it’s a safeguard against conflicts of interest that could undermine the fund’s integrity.”

— Sarah McMahon, Financial Consultant at Accario

To navigate these challenges, trustees must adopt a proactive approach, integrating regular audits and professional advice into their strategy. This ensures compliance while optimizing the fund’s performance. However, the inherent tension between maximizing returns and adhering to strict regulations underscores the need for a nuanced, well-informed investment strategy.

The Sole Purpose Test and Its Implications

The sole purpose test is a cornerstone of SMSF compliance, yet its nuanced application often eludes trustees. A critical yet underappreciated aspect is the prohibition of indirect personal benefits, which extends beyond obvious breaches like personal use of SMSF-owned property. For instance, leasing a property to a related party at below-market rates, even with good intentions, constitutes a violation. This subtlety underscores the test’s uncompromising nature.

A comparative analysis reveals that while some trustees attempt to navigate these restrictions through creative structuring, such as fractional property investments, these approaches often fail under scrutiny. The 2018 Aussiegolfa Pty Ltd v Commissioner of Taxation case exemplifies this, where the court ruled that indirect benefits, even if incidental, breached the test. This highlights the importance of aligning every transaction with both the letter and spirit of the law.

“The sole purpose test isn’t just a guideline—it’s the foundation of SMSF integrity.”

— Paul Delahunty, ATO Director of SMSF Auditors Segment

To mitigate risks, trustees must adopt robust investment strategies, conduct regular compliance reviews, and seek expert guidance. This proactive approach ensures not only adherence but also the preservation of retirement assets.

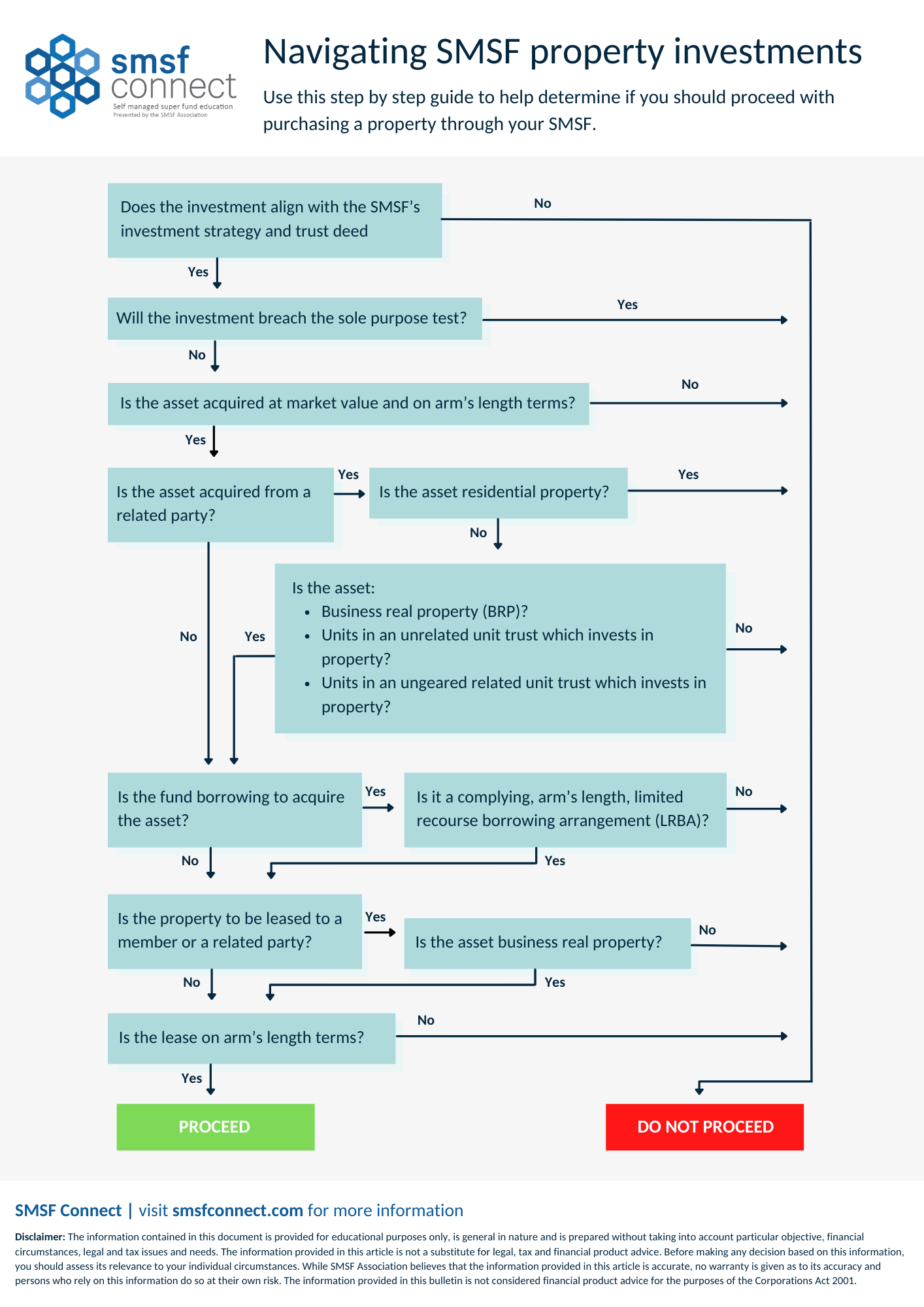

Navigating Residential and Commercial Property Regulations

Residential and commercial property investments within SMSFs operate under fundamentally different regulatory frameworks, each presenting unique challenges and opportunities. Residential properties are tightly regulated to prevent personal use or indirect benefits, as outlined in the Superannuation Industry (Supervision) Act 1993 (SIS Act). For instance, trustees cannot purchase a residential property from a related party, even if the transaction occurs at market value. This restriction ensures compliance with the sole purpose test, safeguarding retirement assets from misuse.

In contrast, commercial property investments offer greater flexibility but demand meticulous adherence to compliance standards. A notable example is the arm’s length requirement, which mandates that lease agreements, such as renting a business premise to a trustee’s company, must reflect market rates. Failure to meet this standard can trigger non-arm’s length income (NALI) provisions, resulting in punitive tax rates of up to 45%.

A 2024 study by Simply Wealth Group revealed that SMSFs holding commercial properties with long-term leases to national tenants achieved 30% higher returns over a decade compared to residential investments. This underscores the importance of strategic foresight and professional guidance in navigating these complex regulations.

Image source: smsfconnect.com

Residential Property Restrictions in SMSFs

The prohibition against SMSFs acquiring residential property from related parties is a cornerstone of compliance, yet its practical implications extend far beyond this basic rule. A critical yet often overlooked nuance involves the concept of indirect benefits. For instance, even when a property is leased at market rates, if the tenant is a related party, the arrangement may still fail the sole purpose test if it provides incidental advantages, such as convenience or reduced housing search costs.

A detailed analysis of the 2018 Aussiegolfa Pty Ltd v Commissioner of Taxation case illustrates this complexity. The court scrutinized whether leasing student accommodation to a trustee’s daughter at market rates constituted a breach. While the arrangement technically adhered to market value principles, the ATO argued that the indirect benefit of housing a related party undermined the fund’s compliance. This case underscores the importance of evaluating not just the financial terms but also the broader context of trustee decisions.

“The sole purpose test demands a holistic assessment of trustee behavior, not just transactional compliance.”

— Paul Delahunty, Former ATO SMSF Auditor

To navigate these challenges, trustees must implement rigorous documentation practices, including independent valuations and legal reviews, ensuring every decision withstands regulatory scrutiny. This approach safeguards both compliance and the integrity of retirement savings.

Opportunities in Commercial Property Investments

A pivotal opportunity in SMSF commercial property investments lies in leveraging long-term leases with high-credit tenants to stabilize cash flow. Unlike residential properties, where tenant turnover can disrupt income, commercial leases often span 5 to 10 years, with built-in rent escalations tied to inflation. This structure not only ensures predictable income but also aligns with the SMSF’s objective of preserving and growing retirement savings.

The mechanism behind this stability is the contractual nature of commercial leases. These agreements frequently include clauses that transfer maintenance responsibilities to tenants, reducing operational costs for the SMSF. For instance, a 2024 case study by Simply Wealth Group highlighted an SMSF that leased a warehouse to a logistics company under a triple-net lease. This arrangement required the tenant to cover property taxes, insurance, and maintenance, resulting in a net rental yield 20% higher than comparable residential investments.

However, the success of such strategies hinges on rigorous tenant vetting and market analysis. Factors like tenant creditworthiness, industry stability, and location dynamics significantly influence outcomes. According to SMSF specialist Lauren Hall, “The right tenant can transform a commercial property from a liability into a cornerstone of your retirement strategy.”

While these opportunities are compelling, trustees must also navigate challenges such as liquidity constraints and market volatility. Balancing these risks with professional guidance ensures compliance and maximizes returns.

Complexities of Borrowing and Compliance

The intricate nature of Limited Recourse Borrowing Arrangements (LRBAs) lies in their dual role as both a financial tool and a compliance challenge. A 2023 report by the Australian Taxation Office (ATO) revealed that 18% of SMSFs audited for LRBA compliance faced penalties due to non-commercial loan terms or improperly established bare trusts. These findings highlight the critical need for trustees to align borrowing structures with regulatory standards.

One overlooked complexity is the requirement for a single acquirable asset. For example, purchasing a property with multiple titles is permissible only if the titles are inseparable and collectively represent one asset. Misinterpreting this rule can invalidate the LRBA, exposing the fund to tax penalties. Additionally, trustees must ensure that repairs, not improvements, are funded through borrowed money, as altering the asset’s character breaches compliance.

According to Peter Burgess, Technical Director at the SMSF Association, “The intersection of borrowing and compliance demands precision. Trustees must integrate legal, financial, and strategic expertise to navigate these challenges effectively.” Failure to do so risks eroding retirement savings and undermining fund integrity.

Understanding Limited Recourse Borrowing Arrangements

A critical yet underexplored aspect of Limited Recourse Borrowing Arrangements (LRBAs) is the precise definition and application of the single acquirable asset rule. This principle, while seemingly straightforward, often becomes a stumbling block for trustees due to its nuanced requirements. For instance, properties spanning multiple titles can only qualify if the titles are inseparable and collectively represent one asset. Missteps in this area can invalidate the LRBA, exposing the SMSF to significant tax penalties and compliance risks.

The complexity deepens when distinguishing between permissible repairs and prohibited improvements. Repairs, such as fixing a damaged roof, are allowable under LRBA rules, as they restore the asset’s original function. However, upgrades that alter the asset’s character, like converting a warehouse into residential apartments, must be funded through non-borrowed SMSF funds. This distinction is vital to maintaining compliance with the Superannuation Industry (Supervision) Act 1993 (SIS Act).

“The single acquirable asset rule is not just a technicality; it’s a cornerstone of LRBA compliance that demands meticulous attention to detail.”

— Peter Burgess, Technical Director, SMSF Association

To navigate these challenges, trustees must integrate rigorous due diligence, including independent valuations and legal reviews. This proactive approach ensures that the LRBA structure aligns with both regulatory standards and the SMSF’s long-term investment strategy, safeguarding retirement savings from avoidable pitfalls.

Compliance Challenges and ATO Scrutiny

A critical compliance challenge for SMSF trustees lies in the nuanced application of the single acquirable asset rule under Limited Recourse Borrowing Arrangements (LRBAs). This rule requires that assets acquired through borrowing must be indivisible, both legally and functionally. For instance, purchasing a property with multiple titles is permissible only if the titles are inseparable and collectively represent one asset. Misinterpretation of this principle has led to significant penalties, as highlighted in recent ATO audits.

The ATO’s scrutiny extends to the classification of expenses. Repairs, such as replacing a damaged roof, are allowable under LRBA rules, while improvements, like adding a new structure, must be funded through non-borrowed SMSF resources. This distinction is critical but often misunderstood, leading to compliance breaches.

“The ATO’s focus on LRBA compliance underscores the importance of precise documentation and adherence to legal definitions.”

— Peter Burgess, Technical Director, SMSF Association

To mitigate risks, trustees must adopt rigorous processes, including independent valuations and detailed expense tracking. A 2023 ATO report revealed that 18% of SMSFs audited for LRBA compliance faced penalties due to improper structuring. This highlights the need for professional guidance to navigate these complexities effectively.

Strategic Considerations and Expert Insights

The allure of SMSF property investment often overshadows a critical reality: over-concentration in property can destabilize a fund’s financial health. A 2024 report by the SMSF Association revealed that 65% of funds with property-dominated portfolios underperformed during periods of market volatility, underscoring the importance of diversification. Diversification not only mitigates risk but also ensures liquidity, a vital factor when unexpected expenses arise.

A common misconception is that high-value property investments inherently secure long-term returns. However, according to Dr. Emily Carter, Senior Economist at the Australian Institute of Superannuation, “Properties in oversaturated markets often yield diminishing returns, even with strong initial growth projections.” This highlights the need for rigorous market analysis, including demographic trends and infrastructure developments.

To illustrate, consider a trustee who balanced a $1.2M SMSF portfolio with 40% in property, 30% in equities, and 30% in cash reserves. This strategy not only safeguarded liquidity but also optimized returns, achieving a 12% annualized growth rate over five years.

Image source: legalconsolidated.com.au

Balancing Property Investments with Diversification

Over-reliance on property within SMSFs often creates a liquidity trap, particularly during economic downturns. Diversification mitigates this risk by balancing illiquid assets like property with liquid investments such as equities and bonds. The principle lies in spreading exposure across asset classes to stabilize returns and ensure cash flow for obligations like pension payments or unexpected expenses.

A comparative analysis highlights the strengths and weaknesses of diversification strategies. For instance, pairing commercial property with dividend-yielding shares provides both stable income and growth potential. However, trustees must carefully assess market conditions; equities may underperform during recessions, while property values can stagnate in oversaturated markets. This interplay underscores the importance of dynamic portfolio management.

A 2024 case study by Simply Wealth Group demonstrated the effectiveness of diversification. An SMSF trustee reallocated 50% of their property-heavy portfolio into a mix of international ETFs and government bonds. This shift reduced volatility by 18% and improved liquidity, enabling timely pension payments without asset liquidation.

“Diversification isn’t just a strategy—it’s a safeguard against the unpredictable nature of markets.”

— Dr. Emily Carter, Senior Economist, Australian Institute of Superannuation

This nuanced approach ensures compliance, preserves capital, and aligns with long-term retirement goals.

Expert Opinions on Avoiding Common Pitfalls

A critical yet underappreciated pitfall in SMSF property investments is the failure to maintain sufficient liquidity while adhering to compliance requirements. Property, as an inherently illiquid asset, poses unique challenges when unexpected expenses arise or when pension payments need to be met. This issue is compounded by the strict regulatory framework governing SMSFs, which demands precise adherence to rules like the sole purpose test and arm’s length transaction principles.

One advanced strategy to mitigate this risk involves integrating staggered property acquisitions with a robust liquidity buffer. By spacing out purchases, trustees allow cash reserves to replenish, ensuring the fund remains agile. For example, a 2023 case study highlighted an SMSF that allocated 20% of its portfolio to liquid assets, enabling it to cover unforeseen costs without breaching compliance.

“Liquidity planning isn’t just about meeting obligations—it’s about preserving the fund’s operational integrity under all conditions.”

— Dr. Emily Carter, Senior Economist, Australian Institute of Superannuation

This approach underscores the importance of dynamic portfolio management. Trustees must balance compliance with market realities, leveraging professional advice to align investment strategies with both regulatory demands and long-term financial goals.

FAQ

What are the key compliance rules for SMSF property investments to avoid triggering an ATO audit?

To avoid triggering an ATO audit, SMSF property investments must strictly adhere to the sole purpose test, ensuring assets serve only retirement benefits. Transactions must comply with the arm’s length principle, reflecting market value to prevent non-arm’s length income (NALI) penalties. Trustees must avoid acquiring residential property from related parties and ensure compliance with Limited Recourse Borrowing Arrangements (LRBAs), particularly the single acquirable asset rule. Detailed record-keeping, including independent valuations and signed agreements, is mandatory. Regular audits and alignment with the Superannuation Industry (Supervision) Act 1993 (SIS Act) safeguard compliance, reducing risks of penalties or fund disqualification.

How does the sole purpose test impact creative strategies in SMSF property acquisitions?

The sole purpose test restricts SMSF property acquisitions to strategies that exclusively benefit members’ retirement savings, disallowing personal or pre-retirement advantages. Creative approaches, such as leasing to related parties or fractional ownership, must align with strict compliance rules to avoid breaching this test. For instance, properties cannot be used for personal purposes, even indirectly, and all transactions must reflect market value to prevent non-arm’s length income (NALI) issues. Trustees must document investment strategies meticulously, ensuring alignment with the Superannuation Industry (Supervision) Act 1993 (SIS Act) and avoiding penalties, tax concessions loss, or fund disqualification under ATO scrutiny.

What are the risks of non-arm’s length income (NALI) in SMSF property transactions involving related parties?

Non-arm’s length income (NALI) in SMSF property transactions with related parties poses significant risks, including taxation at the highest marginal rate of 45%, eroding fund returns. Common triggers include acquiring property below market value, offering non-commercial loan terms, or discounted rental agreements. The ATO scrutinizes these arrangements to ensure compliance with the arm’s length principle under Section 295-550 of the ITAA 1997. Trustees must maintain robust documentation, such as independent valuations and market-rate agreements, to demonstrate compliance. Failure to address NALI risks can lead to severe penalties, jeopardizing the fund’s integrity and long-term retirement objectives.

Can SMSFs use Limited Recourse Borrowing Arrangements (LRBAs) for property improvements without breaching regulations?

SMSFs cannot use Limited Recourse Borrowing Arrangements (LRBAs) for property improvements, as regulations under the Superannuation Industry (Supervision) Act 1993 (SIS Act) prohibit altering an asset’s character through borrowed funds. However, trustees may use SMSF cash reserves for improvements, provided these do not transform the property into a new asset. Repairs and maintenance, which restore functionality without changing the asset’s identity, are permissible under LRBA rules. Compliance requires meticulous documentation, including expense tracking and legal reviews, to ensure adherence. Breaching these rules risks penalties, tax concessions loss, and ATO scrutiny, undermining the fund’s long-term financial stability.

How does the 5% in-house asset rule affect SMSF property investments in joint ventures or related party dealings?

The 5% in-house asset rule limits SMSF property investments in joint ventures or related party dealings to ensure fund independence and compliance. Under Section 71 of the Superannuation Industry (Supervision) Act 1993 (SIS Act), in-house assets, including loans or investments involving related parties, must not exceed 5% of the fund’s total market value. Breaching this cap triggers mandatory divestment plans and potential penalties. For joint ventures, SMSFs must maintain proprietary interest in the property, avoiding arrangements where returns depend solely on related parties. Regular audits and strategic planning are essential to align with ATO guidelines and safeguard fund integrity.