Renting Vs. Buying In Australia: An In-Depth Analysis

Australia’s housing market is a paradox wrapped in brick and mortar. While the “Great Australian Dream” of homeownership remains a cultural cornerstone, the financial realities of this aspiration have grown increasingly complex. Over the past three decades, real house prices in cities like Sydney and Melbourne have surged more than fourfold, outpacing income growth and reshaping the economic calculus of buying versus renting. Yet, despite this meteoric rise, renting is often dismissed with phrases like “rent money is dead money,” leaving many to wonder: is homeownership truly the superior financial choice?

This question is more urgent than ever. With fluctuating property cycles, rising interest rates, and generational shifts in wealth accumulation, the decision to rent or buy transcends personal preference—it reflects broader economic and social dynamics. Could renting, often seen as a temporary compromise, actually offer a strategic advantage in today’s volatile market?

Let’s explore.

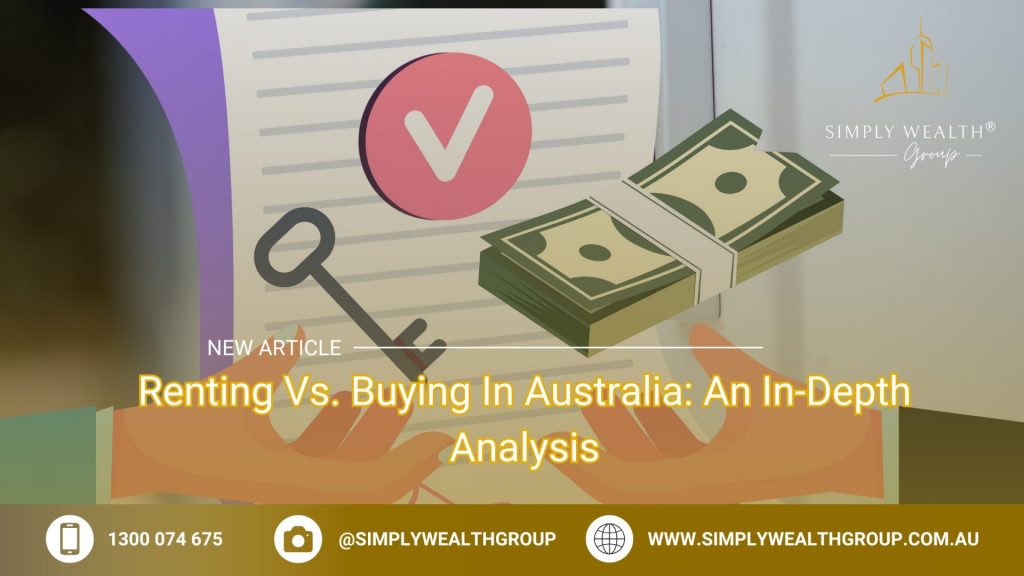

Image source: mccrindle.com.au

Context And Key Concepts

One critical yet underexplored aspect of the rent-versus-buy debate in Australia is the opportunity cost of capital. For prospective buyers, the funds allocated toward a home deposit—often tens or even hundreds of thousands of dollars—represent a significant financial commitment. This capital, if invested elsewhere, could yield returns that rival or even surpass the long-term appreciation of property values. For instance, Australian equities have historically delivered average annual returns of approximately 9.6% over the past three decades, a figure that challenges the assumption of property as the default wealth-building vehicle.

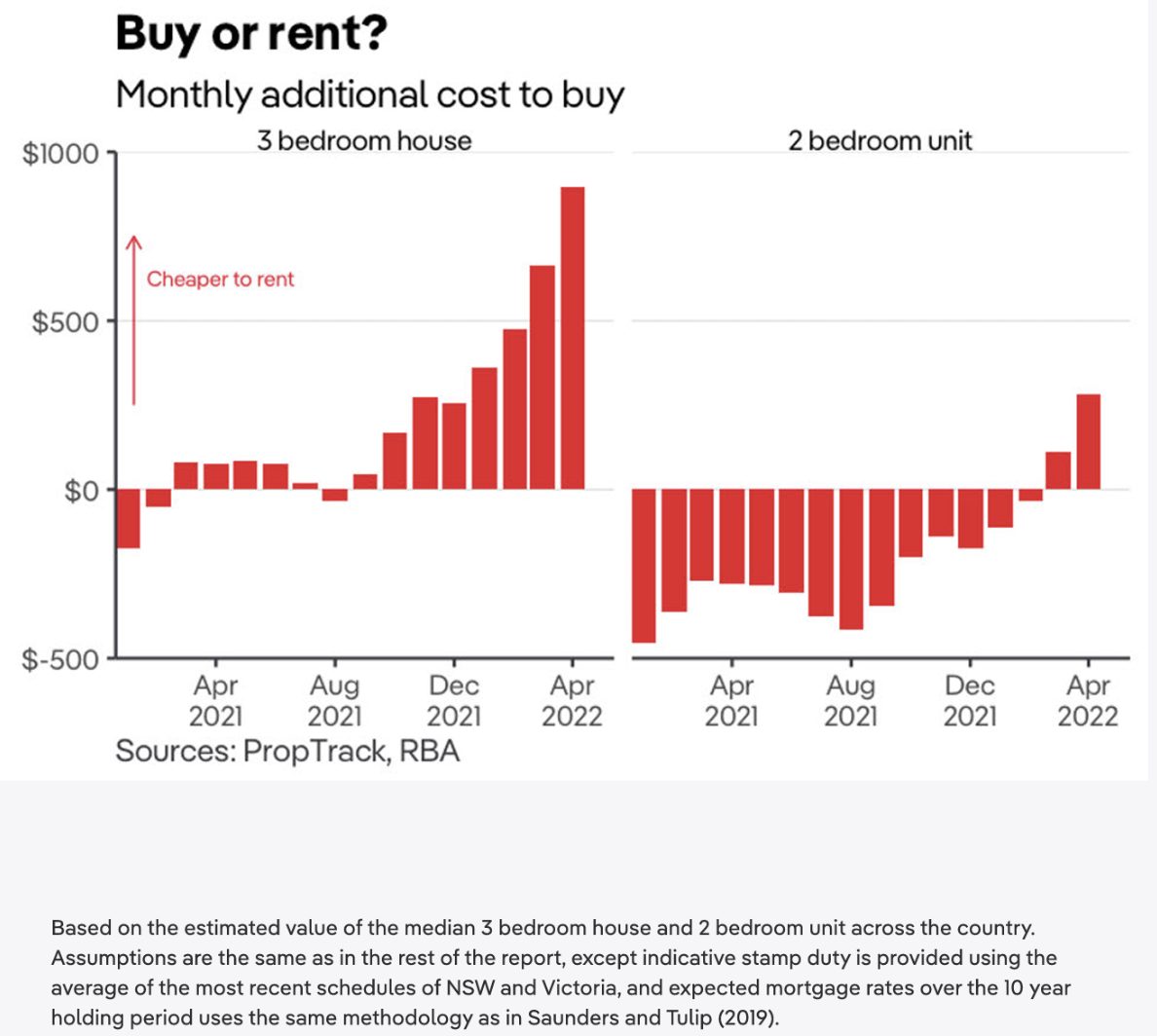

Moreover, the interplay between rental yield and mortgage servicing costs deserves closer scrutiny. In high-demand urban areas like Sydney, rental yields often hover around 2-3%, while mortgage interest rates, even in a relatively low-rate environment [5], can exceed this figure. This disparity suggests that renting, coupled with strategic investment of surplus funds, may outperform homeownership in terms of net financial gain.

However, these calculations hinge on variables such as inflation, tax incentives, and market timing. For example, the Australian government’s capital gains tax exemptions for primary residences tilt the scales in favor of ownership [3], [4], particularly for long-term holders [1], [2]. Understanding these nuances is essential for making informed decisions.

Looking ahead, integrating these financial dynamics with personal goals and market conditions could redefine how Australians approach housing as both a necessity and an investment.

Australia’s Housing Landscape

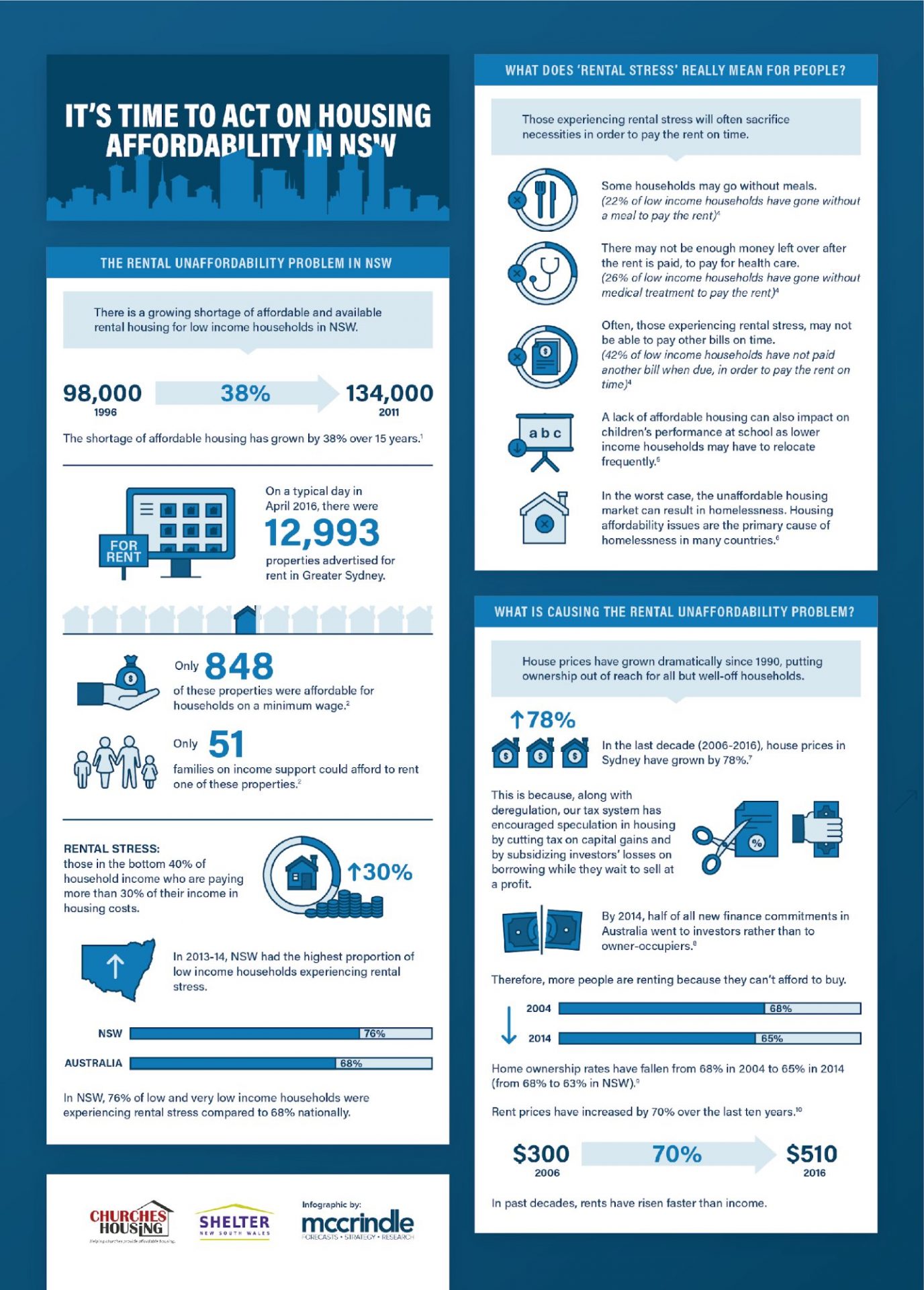

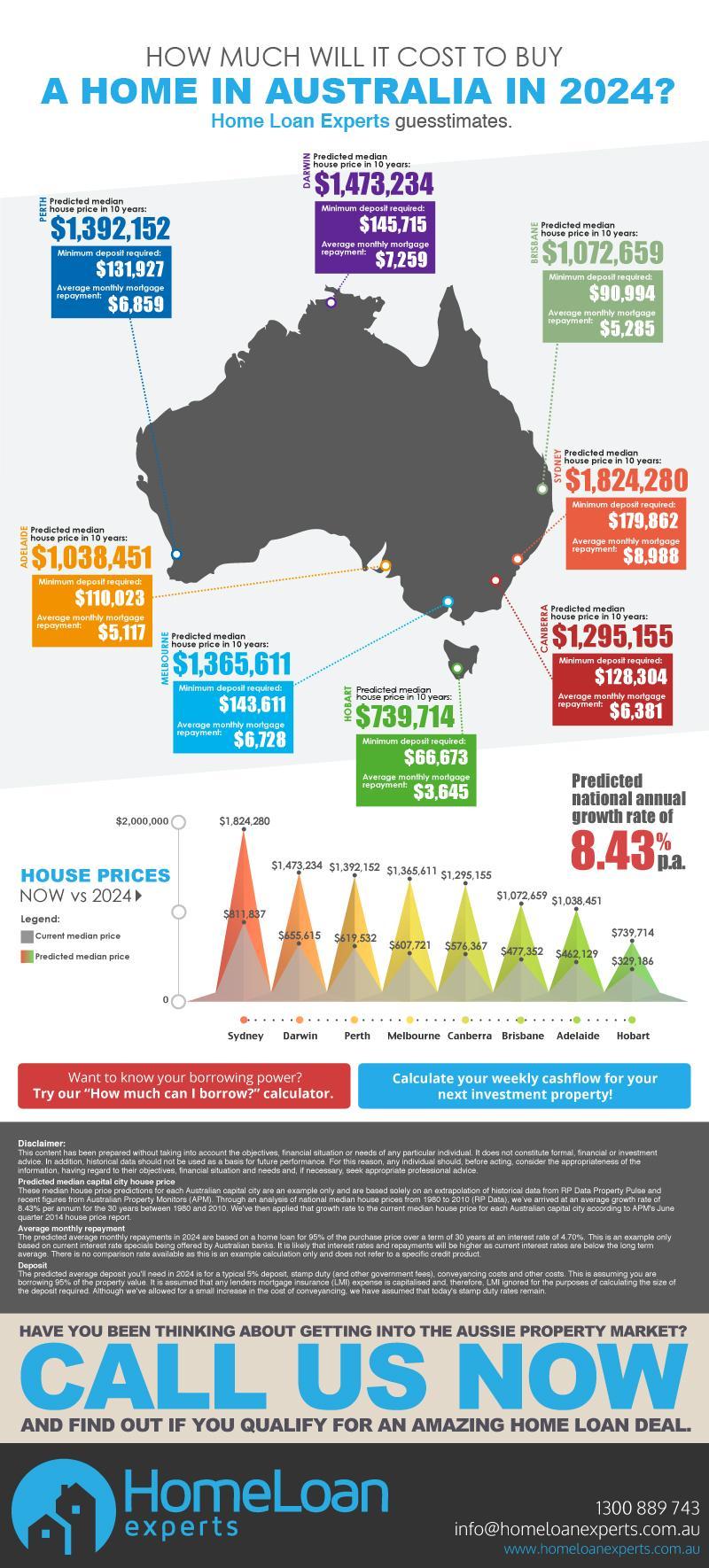

A pivotal yet underappreciated factor shaping Australia’s housing landscape is the regional disparity in affordability and growth potential. While Sydney and Melbourne dominate discussions due to their high property prices and rental yields, smaller capitals like Brisbane, Perth, and Adelaide are emerging as more favorable markets for both buyers and renters. According to CoreLogic, these cities benefit from lower entry costs, higher rental yields, and strong interstate migration, which [6], [5] collectively drive demand and price stability.

For instance, Brisbane’s median house price remains significantly lower than Sydney’s, yet its rental yields are comparatively higher, often exceeding 4%. This dynamic creates a dual advantage for investors and renters alike. Renters can access more affordable housing options, while investors can achieve better returns relative to mortgage servicing costs. Additionally, Perth and Adelaide are experiencing tight supply conditions, which, coupled with robust population growth [4], [2], are expected to sustain price appreciation in the medium term.

Another critical element is the impact of government policies and infrastructure investment. For example, large-scale projects like Western Australia’s Metronet and Queensland’s Olympic infrastructure are enhancing regional connectivity and livability [7], further boosting property demand in these areas. These developments highlight the importance of aligning housing decisions with broader economic and urban planning trends.

Looking forward, prospective buyers and renters should consider these regional dynamics alongside personal financial goals. By leveraging data-driven insights and understanding localized market conditions, individuals can navigate Australia’s housing landscape more strategically, optimizing both short-term affordability and long-term financial outcomes.

Key Considerations For Renting And Buying

When evaluating whether to rent or buy, the time horizon emerges as a critical yet often overlooked factor. For short-term horizons, renting offers unparalleled flexibility, allowing individuals to adapt to career changes or lifestyle shifts without the financial burden of selling a property. For instance, in high-demand cities like Sydney [4], where transaction costs such as stamp duty can exceed 4% of the property value [3], [7], short-term ownership may erode potential gains.

Conversely, for long-term horizons, buying can provide stability and the opportunity to build equity. However, the opportunity cost of capital must be weighed carefully. A $100,000 deposit invested in Australian equities, which have historically delivered 9.6% annual returns, could outperform property appreciation in certain markets [2], [5]. This challenges the conventional wisdom that homeownership is always the superior wealth-building strategy.

Additionally, lifestyle alignment plays a pivotal role. Renters benefit from reduced maintenance responsibilities and the ability to live in premium locations that may be unaffordable to purchase. Buyers, however, gain autonomy over their living space, which can be invaluable for families or those seeking long-term roots.

Ultimately, decisions should integrate financial metrics with personal priorities, leveraging tools like cost analysis calculators to align choices with individual goals.

Image source: homeloanexperts.com.au

Financial Factors And Upfront Costs

A critical yet underappreciated financial factor in the rent-versus-buy decision is the hidden multiplier effect of upfront costs. For buyers, the initial outlay—comprising a deposit, stamp duty, and legal fees—can exceed 20% of the property’s value in some Australian states. For instance, purchasing a $750,000 home in Sydney could require over $150,000 upfront, a sum that could otherwise be invested. Assuming a 9.6% annual return in equities [8], [5], this capital could grow to approximately $235,000 in five years, significantly altering the financial calculus.

Renters, on the other hand, face lower upfront costs, typically limited to a bond and initial rent payments. However, the opportunity cost of renting—paying to build a landlord’s equity—can accumulate over time. For example, renting a $600-per-week property equates to $31,200 annually [3], which could instead contribute to a deposit.

Moreover, transactional friction in buying, such as stamp duty, often locks buyers into longer time horizons to recoup costs [1], [2]. This contrasts with renters’ flexibility to reallocate savings or pivot investments based on market conditions.

Actionable insight: Prospective buyers should leverage tools like rent-versus-buy calculators to model scenarios, incorporating investment returns and market volatility, ensuring decisions align with both financial goals and risk tolerance.

Lifestyle Implications And Flexibility

A nuanced yet underexplored dimension of lifestyle flexibility is the impact of career mobility on housing decisions. In an era where remote work and globalized job markets are reshaping professional trajectories, renting offers unparalleled adaptability. For instance, lease agreements in Australia, typically spanning six to twelve months, allow individuals to relocate swiftly in response to career opportunities or economic shifts. This flexibility is particularly advantageous in industries like technology or consulting, where job relocations are frequent.

Conversely, homeownership often imposes geographic immobility due to the high transactional costs of selling [10], such as stamp duty and agent fees, which can exceed 6% of a property’s value. For a $750,000 home [4], [9], these costs could amount to $45,000, creating a financial disincentive to move. This rigidity can hinder career progression, especially in dynamic markets like Sydney or Melbourne, where job clusters are dispersed.

Additionally, renting enables access to premium locations that may be unaffordable to purchase. For example, living in Sydney’s CBD as a renter might cost $800 per week, compared to a median property price exceeding $1.5 million [8], [2]. This access can enhance quality of life and networking opportunities, critical for career growth.

Actionable insight: Individuals with uncertain career trajectories should prioritize renting to maintain flexibility. Meanwhile, leveraging savings from reduced upfront costs into diversified investments can offset the lack of equity building. As job markets evolve, aligning housing choices with professional goals will be pivotal in optimizing both financial and lifestyle outcomes.

Market Dynamics And Government Incentives

Australia’s housing market operates as a dynamic interplay of supply-demand imbalances and policy interventions [7], [4]. A critical driver is the persistent housing supply deficit, particularly in urban centers like Sydney and Melbourne [1], [2], where vacancy rates remain near record lows. For instance, CoreLogic data highlights that rental demand has surged due to high overseas migration, while new housing approvals lag behind [8], exacerbating affordability challenges.

Government incentives, such as the First Home Owner Grant (FHOG) and stamp duty concessions, aim to alleviate barriers for first-time buyers. However, these measures often have unintended consequences. By increasing purchasing power without addressing supply constraints, they can inflate property prices, disproportionately benefiting sellers. For example, a 2023 analysis revealed that FHOG recipients in New South Wales paid an average of 5% more for comparable properties than non-recipients.

An unexpected connection lies in the ripple effect of regional migration. As affordability in major cities declines, smaller capitals like Brisbane and Perth experience population inflows, driving localized price growth. This underscores the importance of aligning incentives with regional housing strategies.

Actionable insight: Policymakers should prioritize supply-side solutions, such as accelerating zoning reforms and incentivizing new developments. For individuals, understanding how incentives interact with market dynamics can inform more strategic decisions, particularly in emerging growth areas.

Image source: bambooroutes.com

Interest Rates, Property Prices, And Rental Yields

The interplay between interest rates, property prices, and rental yields reveals a nuanced dynamic often overlooked in conventional analyses. While rising interest rates typically suppress property demand by increasing borrowing costs [11], [12], their impact on rental yields is less direct but equally significant [15]. For instance, landlords facing higher mortgage repayments may attempt to offset costs by raising rents. However, recent Reserve Bank of Australia (RBA) data suggests that rent increases are more closely tied to supply constraints than interest rate fluctuations.

A lesser-known factor is the inverse relationship between property prices and rental yields. As property values rise, rental yields often decline unless rents increase proportionally. In cities like Sydney, where median house prices surged by 0.4% in January 2025, rental yields remain compressed at 2-3%, limiting their appeal to investors reliant on cash flow [13], [14].

Interestingly, regional markets like Brisbane and Perth, with higher yields exceeding 4%, offer a compelling alternative. These areas benefit from affordability, population inflows, and lower entry costs, creating a more balanced equation for investors.

Actionable insight: Prospective investors should evaluate markets where rental yields align with borrowing costs, leveraging tools like yield calculators. For renters, understanding these dynamics can inform negotiations and timing decisions in competitive markets.

Notable Schemes And Policies For Buyers And Renters

One underexplored yet impactful policy is the First Home Loan Deposit Scheme (FHLDS), which allows eligible first-time buyers to purchase a property with as little as a 5% deposit, with the government guaranteeing up to 15% of the loan. This reduces the need for costly Lenders Mortgage Insurance (LMI), potentially saving buyers tens of thousands of dollars [8]. However, the scheme’s effectiveness is geographically uneven. In high-demand markets like Sydney, where median house prices exceed $1.5 million, the 5% deposit threshold still represents a significant financial barrier, limiting accessibility for lower-income buyers.

For renters, the National Rental Affordability Scheme (NRAS) has aimed to address affordability by offering financial incentives to property owners who rent below market rates. While successful in increasing rental stock in some regions [2], [1], the scheme’s limited scale and expiration of incentives for many properties have constrained its long-term impact. Additionally, NRAS properties are often concentrated in specific areas, potentially limiting renters’ geographic flexibility [16], [17].

A lesser-known factor influencing these policies is the interaction with macroprudential regulations. For instance, limits on loan-to-value (LTV) ratios and debt-to-income (DTI) caps can indirectly affect the uptake of schemes like FHLDS by restricting borrowing capacity, particularly in volatile markets.

Actionable insight: Policymakers should consider expanding schemes like FHLDS to include higher thresholds in expensive markets while coupling them with supply-side measures to prevent price inflation. For renters, reintroducing or scaling up NRAS with broader geographic coverage could enhance affordability and flexibility, aligning with evolving housing needs.

Advanced Strategies And Long-Term Planning

A sophisticated approach to navigating the rent-versus-buy dilemma involves rentvesting, where individuals rent in desirable locations while investing in properties in more affordable [19], high-growth areas [5], [18]. For instance, a professional renting in Sydney’s CBD at $800 per week could invest in a property in Brisbane, where median house prices are significantly lower, and rental yields exceed 4%. This strategy allows for lifestyle flexibility while building equity in a market with strong growth potential.

Another advanced strategy is leveraging property cycles to time market entry. Historical data from CoreLogic indicates that purchasing during downturns can yield substantial long-term gains, as property prices typically recover and appreciate over time. For example, buyers who entered the Perth market during its 2017 downturn have seen median prices rise by over 15% by 2024, outperforming many equities.

A common misconception is that renting equates to financial stagnation. However, renters who strategically invest surplus funds in diversified portfolios [7], [6], such as Australian equities with historical returns of 9.6% annually, can often outperform property owners in net wealth accumulation.

Actionable insight: Combining rentvesting with disciplined investment in high-return assets offers a dual pathway to financial growth and lifestyle optimization. By aligning strategies with market cycles and personal goals, individuals can maximize both flexibility and long-term wealth creation.

Image source: yourinvestmentpropertymag.com.au

Rentvesting And Alternative Investment Approaches

A critical yet underexplored dimension of rentvesting is its synergy with diversified investment strategies. By redirecting surplus funds—saved from renting rather than purchasing a high-cost property—into diversified portfolios, rentvestors can mitigate risks associated with property market volatility. For instance, allocating 50% of savings into Australian equities [24], which have historically delivered 9.6% annual returns, and 50% into fixed-income securities can create a balanced risk-return profile. This approach not only builds wealth but also provides liquidity, a key advantage over property investments.

Moreover, geographic arbitrage within rentvesting amplifies returns. For example, investing in regional markets like Perth [22], [23], where rental yields exceed 4%, while renting in premium urban areas, allows individuals to capitalize on both lifestyle and financial growth [20], [21]. This contrasts with conventional wisdom that prioritizes ownership in high-demand cities, which often compresses rental yields to 2-3%.

A lesser-known factor is the psychological flexibility rentvesting offers. Unlike traditional homeownership, it enables investors to pivot strategies based on market conditions, such as reallocating funds during economic downturns.

Actionable insight: Rentvestors should adopt a dual-pronged approach—leveraging geographic arbitrage for property investments while maintaining a diversified financial portfolio. This framework ensures resilience against market fluctuations and maximizes long-term wealth creation.

Projecting Future Market Trends

A pivotal yet underexamined aspect of projecting future market trends is the impact of demographic shifts on housing demand. Australia’s population growth, driven by high levels of overseas migration, is expected to concentrate in urban centers like Sydney [8], [25], Melbourne [26], and Brisbane. However, regional areas such as Perth and Adelaide are increasingly attracting younger demographics due to affordability and improved infrastructure. This migration pattern could reshape demand dynamics, with smaller capitals experiencing sustained price growth and higher rental yields.

Another critical factor is the evolution of remote work. As hybrid work models become entrenched, demand for properties in suburban and regional areas is likely to rise. For instance, CoreLogic data indicates that regional housing markets outperformed capital cities in price growth during 2020-2022, a trend that could persist as workers prioritize space and affordability over proximity to CBDs.

Additionally, climate resilience is emerging as a key determinant of property value. Areas prone to natural disasters [5], [4], such as bushfires or flooding, may face declining demand, while regions investing in climate-adaptive infrastructure could see increased interest. For example, Queensland’s flood mitigation projects are expected to bolster property values in previously high-risk areas.

Actionable insight: Investors should integrate demographic data, remote work trends, and climate risk assessments into their market analyses. Leveraging predictive tools like GIS mapping for climate impact and migration patterns can provide a competitive edge. By aligning investments with these evolving trends, individuals can position themselves for long-term financial gains while mitigating emerging risks.

FAQ

What are the key financial factors to consider when deciding between renting and buying in Australia?

Key financial factors include upfront costs like deposits and stamp duty [5], [3], ongoing expenses such as mortgage repayments or rent [8], [2], and potential investment returns. Assess opportunity costs, tax benefits, and market conditions [7]. Use tools like cost analysis calculators to compare scenarios and align decisions with financial capacity and long-term goals.

How do government incentives impact the decision to rent or buy a property?

Government incentives like the First Home Owner Grant and stamp duty concessions reduce upfront costs for buyers, making ownership more accessible [28]. However, these can inflate property prices in high-demand areas [2], [8]. Renters benefit less directly [27], [3], though schemes like NRAS offer affordability. Aligning incentives with personal goals is crucial for informed decisions.

What role does the opportunity cost of capital play in the rent-versus-buy equation?

The opportunity cost of capital highlights potential returns from investing a home deposit elsewhere [30], [31], such as equities [32], which historically yield higher returns than property appreciation. This challenges the assumption of homeownership as the default wealth-building strategy [1], [29], emphasizing the importance of comparing investment alternatives when evaluating financial outcomes in the rent-versus-buy equation.

How do regional disparities in property prices and rental yields influence housing decisions?

Regional disparities reveal lower entry costs and higher rental yields in cities like Brisbane and Perth compared to Sydney and Melbourne [33], [34]. These dynamics favor investors seeking better returns and renters pursuing affordability [35], [2]. Understanding localized market conditions enables strategic decisions aligned with financial goals and lifestyle preferences in Australia’s diverse housing landscape.

What advanced strategies, such as rentvesting, can optimize financial outcomes in Australia’s housing market?

Advanced strategies like rentvesting allow individuals to rent in desirable locations while investing in high-growth, affordable areas. Combining this with diversified investments [23], [24], geographic arbitrage [5], and timing property cycles enhances financial flexibility and wealth creation [36], [20]. Aligning these strategies with market trends and personal goals maximizes long-term financial outcomes in Australia’s housing market.