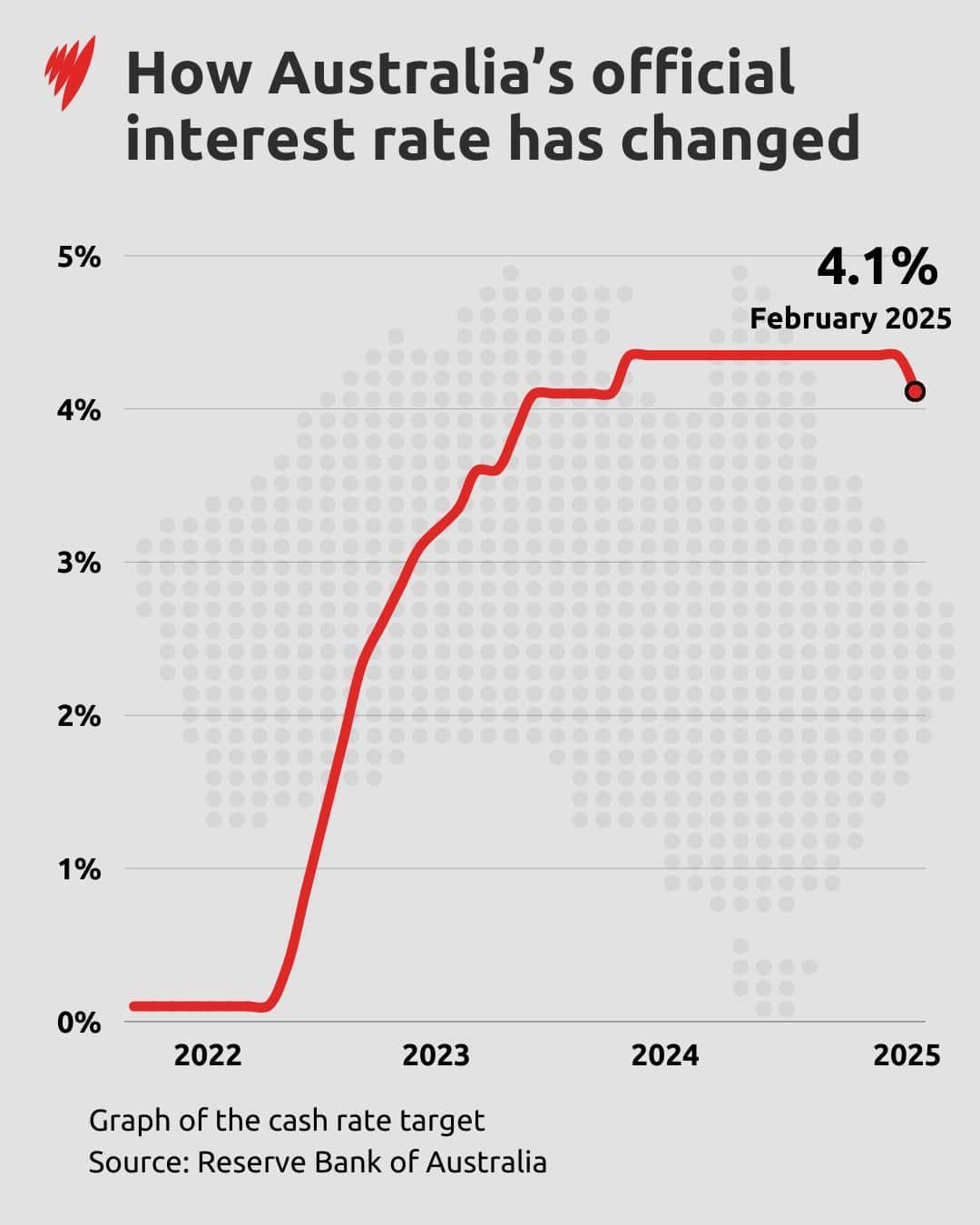

RBAs First Rate Cut In Four Years What It Means For Your Mortgage In 2025

On February 18, 2025, the Reserve Bank of Australia cut its cash rate to 4.10%, the first reduction in over four years. For a household with a $600,000 mortgage, this translates to $92 less in monthly repayments. Yet, as banks rush to adjust rates, the broader implications for borrowers and the economy remain far from straightforward.

Image source: sbs.com.au

Understanding the RBA’s Role in Monetary Policy

The RBA’s recent rate cut highlights its dual mandate: stabilizing inflation and fostering employment. By lowering borrowing costs, it aims to stimulate investment and consumer spending. However, structural factors, such as skill mismatches in the labor market, often limit monetary policy’s long-term effectiveness. Integrating fiscal measures could amplify outcomes, ensuring sustainable economic growth amidst evolving challenges.

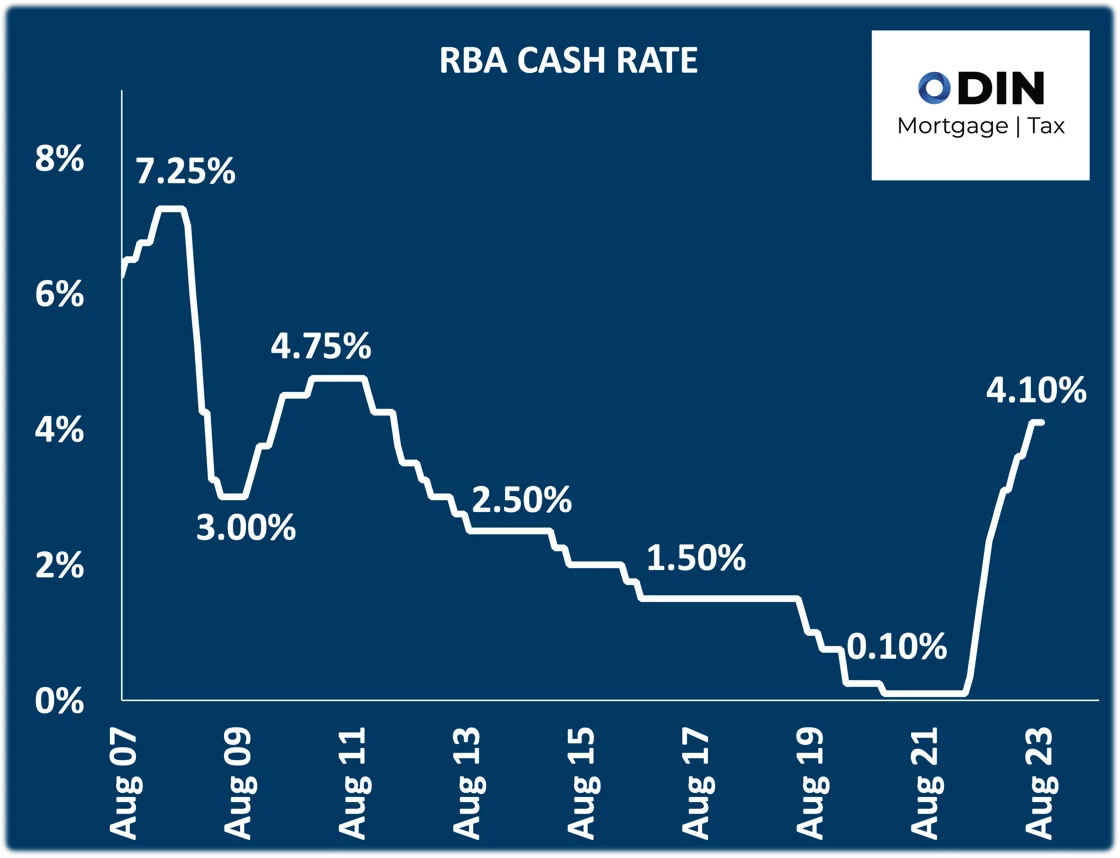

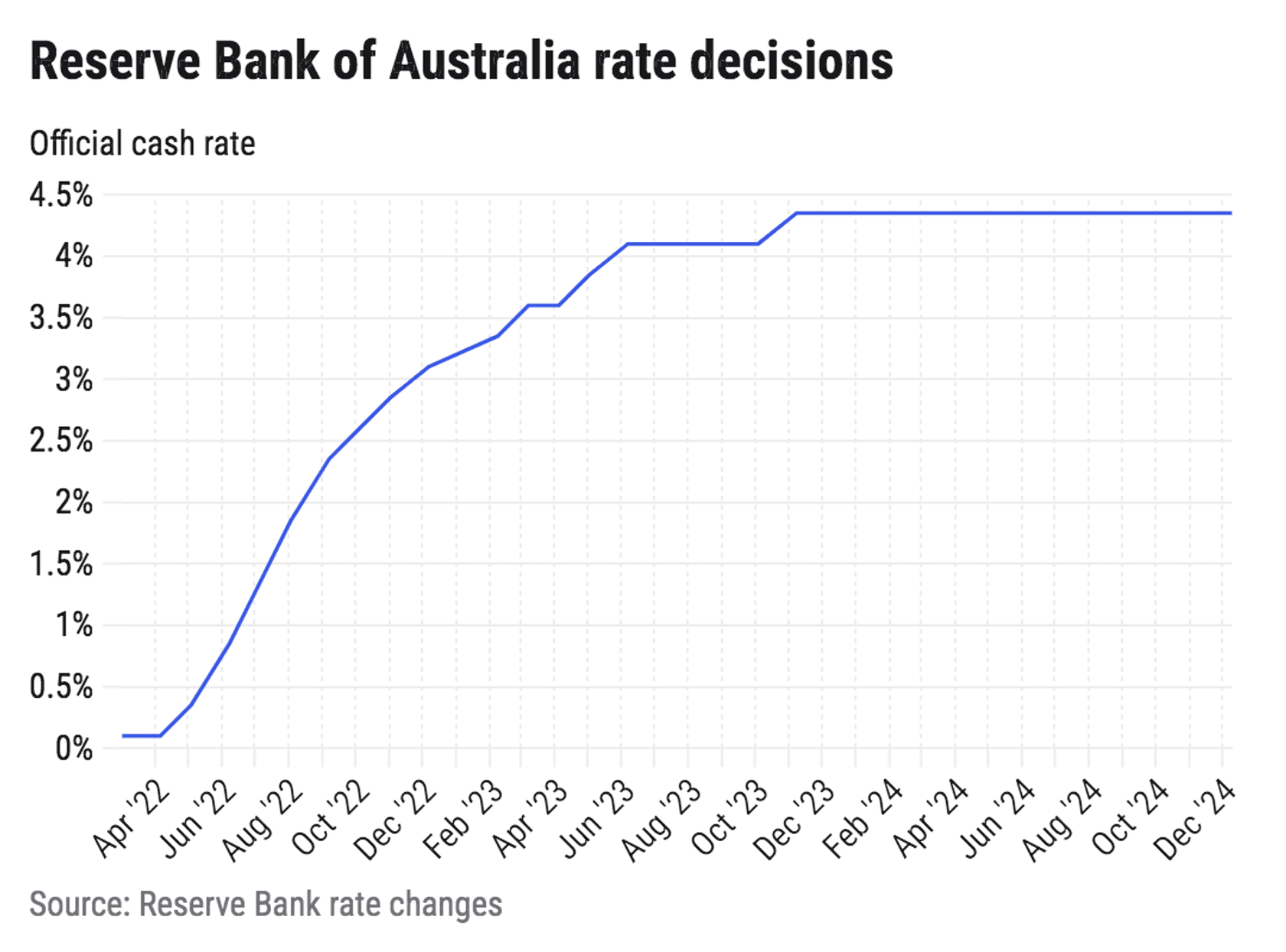

Historical Context of Rate Changes

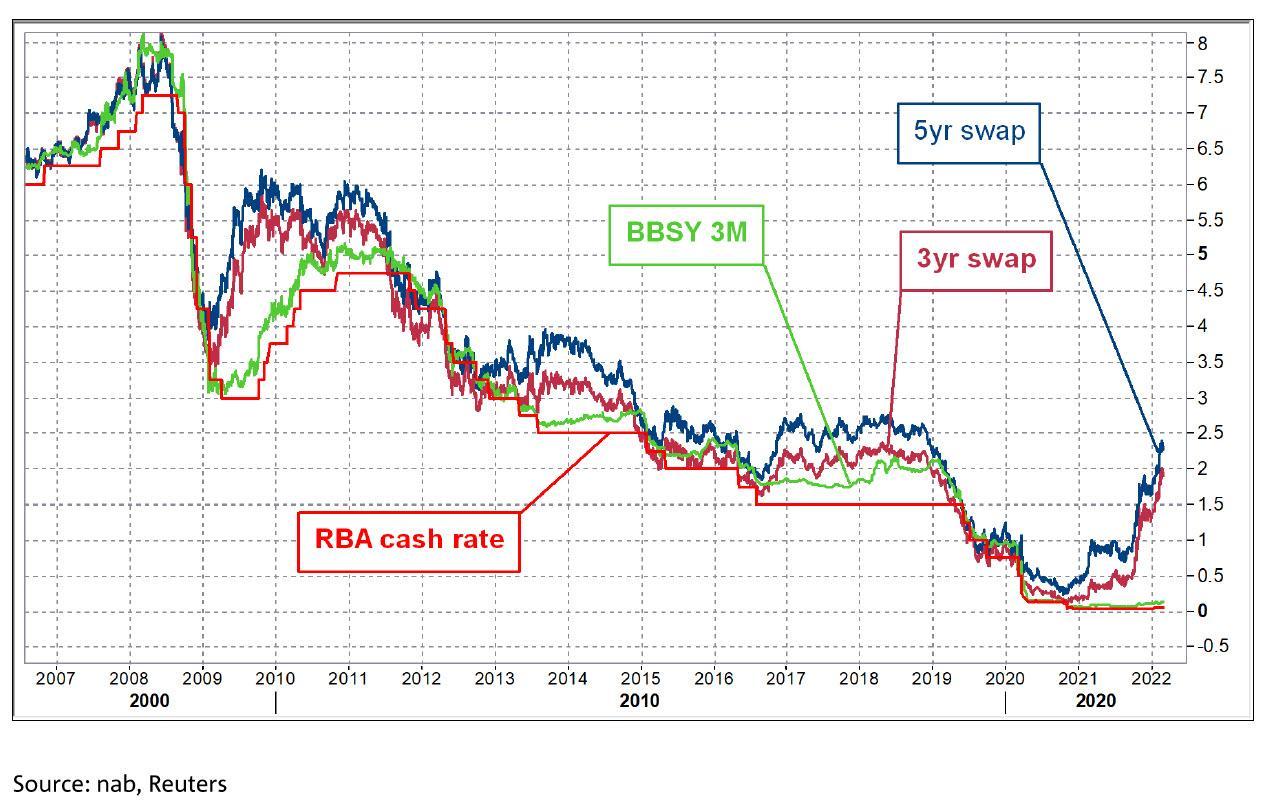

The RBA’s shift from record-low rates in 2021 to a peak of 4.35% by 2024 underscores its response to inflationary pressures. This trajectory reflects a balancing act between curbing inflation and avoiding economic stagnation. Lesser-known influences, such as global monetary trends and domestic wage growth, shaped these decisions, offering insights into how future rate adjustments might align with evolving economic dynamics.

Immediate Impact on Mortgage Holders

For a $600,000 mortgage, the RBA’s 0.25% rate cut reduces monthly repayments by $92, offering immediate relief to strained budgets. However, timing varies: while Westpac delays changes until March 4, others like NAB act faster. This disparity highlights a critical misconception—rate cuts don’t uniformly benefit borrowers, emphasizing the need for proactive refinancing strategies to maximize savings.

Image source: linkedin.com

Changes in Mortgage Repayments

The variability in banks’ responses to rate cuts reveals a hidden opportunity: timing your refinancing strategically. For instance, NAB’s faster implementation benefits borrowers sooner, while Westpac’s delay may prompt customers to explore competitive offers. Additionally, borrowers with larger loans, such as $750,000, could save $115 monthly, amplifying the importance of proactive financial planning to capitalize on these shifts.

Variable vs. Fixed Rate Mortgages

Borrowers on variable rates benefit immediately from rate cuts, but uncertainty looms as future hikes could erase savings. Fixed rates, while offering stability, risk locking borrowers out of potential reductions. A hybrid approach—splitting loans into fixed and variable portions—balances flexibility with predictability, enabling households to hedge against market volatility while capitalizing on favorable rate movements.

Banks’ Responses to the Rate Cut

The rate cut triggered divergent timelines among banks: NAB acted swiftly, implementing changes by February 28, while Westpac delayed until March 4. This staggered approach underscores a key misconception—rate cuts don’t benefit all borrowers equally. Strategic refinancing during such windows can unlock savings, as proactive borrowers leverage competitive offers to outpace slower-responding institutions, reshaping their financial outcomes.

Image source: capitalbrief.com

How Major Banks Are Adjusting Rates

Banks’ rate adjustments reveal strategic prioritization: NAB’s swift action by February 28 reflects a competitive push to retain borrowers, while Westpac’s delay until March 4 suggests a focus on internal cost management. Lesser-known factors, like wholesale funding costs and customer retention analytics, shape these timelines. Borrowers should monitor such patterns to time refinancing for maximum savings.

Impact on Other Financial Products

The rate cut’s ripple effects extend to savings accounts, with Westpac reducing rates on its Life and E-Saver accounts by 25 basis points. This shift highlights a trade-off: while borrowers gain relief, savers face diminished returns. Proactive savers might explore term deposits or alternative investments to offset losses, leveraging tools like laddering strategies to maintain liquidity and optimize yields.

Long-term Implications for the Housing Market

The rate cut may exacerbate supply constraints, as increased borrowing power fuels demand without addressing construction bottlenecks. For instance, Sydney’s 1.7% value decline since September could reverse, intensifying affordability challenges. Experts warn that structural issues, like labor shortages in construction, will persist, requiring policy interventions beyond monetary adjustments to ensure sustainable growth and equitable access to housing.

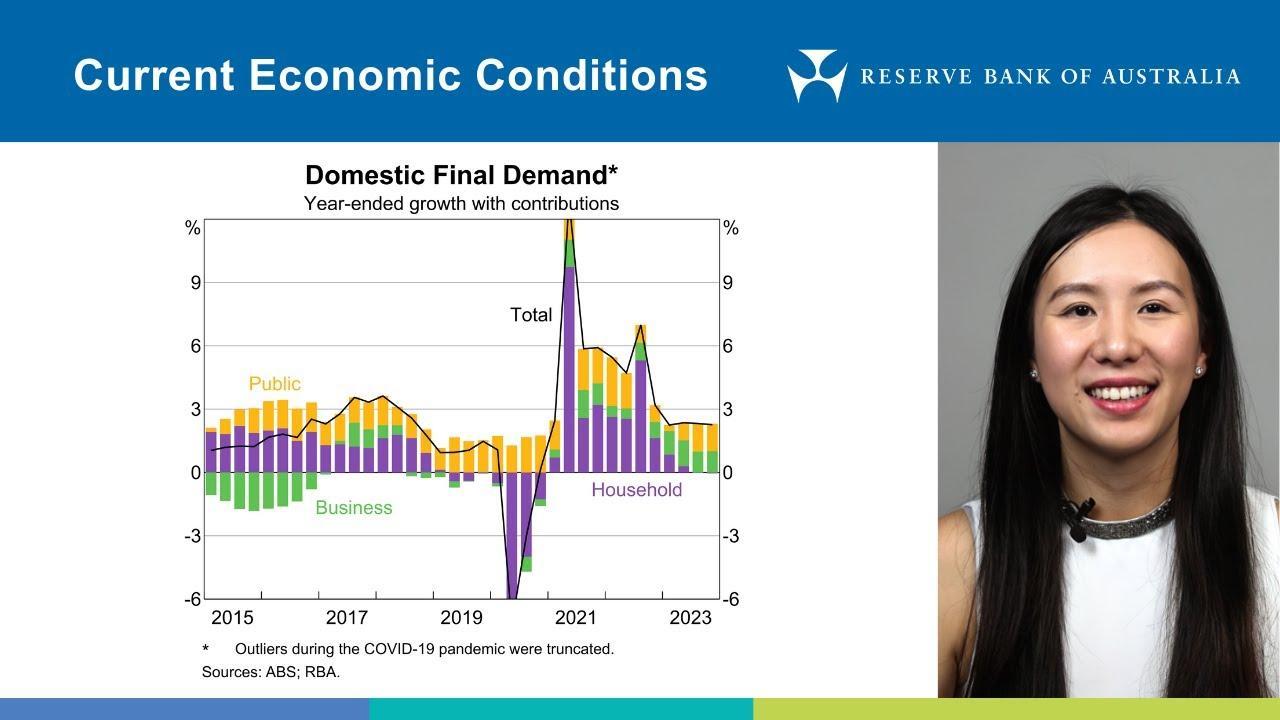

Image source: youtube.com

Potential Stimulus to the Property Market

Lower rates could reignite investor activity, particularly in high-demand rental areas like Sydney, where reduced financing costs improve cash flow. However, supply-side constraints, such as material shortages and rising construction costs, may limit new developments. Addressing these bottlenecks through targeted incentives, like subsidies for builders, could amplify the rate cut’s impact, fostering balanced growth and mitigating affordability pressures.

Borrowing Capacity and Refinancing Opportunities

The rate cut enhances borrowing capacity, enabling buyers to qualify for larger loans. Yet, credit assessment buffers—typically 3% above the loan rate—still limit over-leveraging. Refinancing offers a strategic edge: borrowers locked into higher fixed rates can save thousands by switching. Leveraging tools like loan comparison platforms ensures optimal outcomes, fostering financial agility amid evolving market conditions.

Economic Factors Influencing Future Rate Decisions

Global trends, such as commodity price volatility and shifting trade dynamics, heavily influence RBA decisions. For instance, rising energy costs could pressure inflation, necessitating tighter policy. Domestically, wage growth disparities and labor market mismatches complicate forecasts. Experts suggest integrating predictive analytics to better anticipate shocks, ensuring rate adjustments align with both short-term stability and long-term economic resilience.

Image source: ledge.com.au

Interplay Between Interest Rates, Inflation, and Growth

The RBA’s rate cuts aim to balance disinflation risks with growth stimulation, yet lag effects complicate outcomes. For example, delayed impacts on consumer spending can mask inflationary pressures. Integrating real-time economic indicators, like retail sales and wage growth, could refine policy timing. This approach fosters adaptive strategies, ensuring sustainable growth without overshooting inflation targets.

Global Economic Influences

Geopolitical tensions, such as potential disruptions in the Red Sea trade routes, could elevate energy costs, amplifying inflationary pressures in Australia. Additionally, China’s property sector instability poses indirect risks to export demand. By leveraging scenario planning models, policymakers can anticipate cascading effects, ensuring monetary strategies remain agile amidst global uncertainties, ultimately safeguarding domestic economic resilience.

FAQ

What are the immediate benefits of the RBA’s first rate cut in four years for mortgage holders in 2025?

The RBA’s rate cut reduces monthly mortgage repayments, offering immediate financial relief to households. For instance, a $600,000 loan sees savings of $92 monthly, while larger loans like $750,000 save $115. Enhanced borrowing power allows buyers to qualify for higher loans, boosting affordability. Variable-rate borrowers benefit directly, while fixed-rate holders may explore refinancing opportunities. Additionally, the cut stimulates property market activity, potentially increasing demand and prices. However, timing is crucial as banks implement changes at varying speeds, emphasizing the importance of proactive financial planning to capitalize on these benefits effectively.

How does the RBA’s interest rate cut impact borrowing capacity and home loan affordability?

The RBA’s rate cut enhances borrowing capacity by lowering interest rates, enabling buyers to qualify for larger loans under existing credit assessment buffers, typically 3% above the loan rate. This improves home loan affordability, reducing monthly repayments and easing financial strain. First-home buyers and investors benefit from increased purchasing power, fostering greater market participation. However, rising property demand may offset affordability gains through higher prices. Strategic refinancing during this period can unlock significant savings, while leveraging loan comparison platforms ensures optimal outcomes. These dynamics underscore the interconnectedness of monetary policy, housing affordability, and market behavior.

What strategies can homeowners use to maximize savings from the 2025 RBA rate cut?

Homeowners can maximize savings by refinancing to secure competitive rates, especially with lenders implementing the RBA cut at different speeds. Utilizing loan comparison platforms helps identify the best deals across over 50 lenders. Splitting loans into fixed and variable portions balances stability with flexibility, allowing borrowers to benefit from current reductions while hedging against future rate hikes. Proactive financial planning, such as negotiating with existing lenders or consolidating debts, further optimizes savings. Monitoring market trends and leveraging tools like mortgage calculators ensures informed decisions, aligning repayment strategies with evolving economic conditions for sustained financial benefits.

How might the 2025 RBA rate cut influence property market trends in major Australian cities?

The 2025 RBA rate cut is likely to stimulate property market trends in major Australian cities like Sydney, Melbourne, and Brisbane by increasing buyer demand and investor activity. Reduced borrowing costs enhance affordability, encouraging market re-entry and competition for properties. This could accelerate price growth, particularly in high-demand areas, reversing recent declines such as Sydney’s 1.7% drop since September. However, supply-side constraints, including labor shortages and rising construction costs, may exacerbate affordability challenges. Strategic policy interventions addressing these bottlenecks are essential to balance demand-driven growth with sustainable housing availability, ensuring equitable market dynamics across urban centers.

What are the long-term economic implications of the RBA’s rate cut for inflation and housing supply?

The RBA’s rate cut may drive long-term economic implications by balancing inflation and housing supply dynamics. While lower rates stimulate consumer spending and investment, they risk reigniting inflation if demand outpaces supply. In housing, increased borrowing capacity could exacerbate supply constraints, intensifying affordability challenges in high-demand areas. Structural issues, such as labor shortages and material costs, hinder new construction, limiting supply growth. Addressing these bottlenecks through targeted fiscal policies, like subsidies for builders, is critical to ensuring sustainable housing availability. Integrating predictive analytics can help policymakers align monetary strategies with inflation control and equitable housing market development.