RBA Slashes Rates: How Aussies Can Take Advantage

On February 18, 2025, the Reserve Bank of Australia (RBA) cut its cash rate by 25 basis points to 4.10%, marking its first reduction in over four years. For mortgage holders, this translates to immediate relief, with major banks already passing on the cut. Yet, beneath the surface, this move reveals a delicate balancing act between economic stimulus and inflation control.

Overview of RBA Rate Decision

The RBA’s rate cut reflects a strategic pivot to counteract inflationary stickiness, particularly in housing markets driven by record migration. By lowering borrowing costs, the policy aims to stimulate consumer spending and investment. However, this approach risks exacerbating asset bubbles, necessitating vigilant fiscal coordination. Traders should monitor inflation reports and housing trends to anticipate further policy adjustments.

Context and Significance for Australians

The rate cut’s impact on household budgets extends beyond mortgages, potentially alleviating financial stress for renters as landlords face reduced financing costs. However, tight lending standards and persistent cost-of-living pressures may limit immediate benefits. Policymakers must address these constraints to ensure equitable economic relief, fostering sustainable growth while mitigating risks of inflation resurgence and housing market imbalances.

Understanding the RBA and Interest Rates

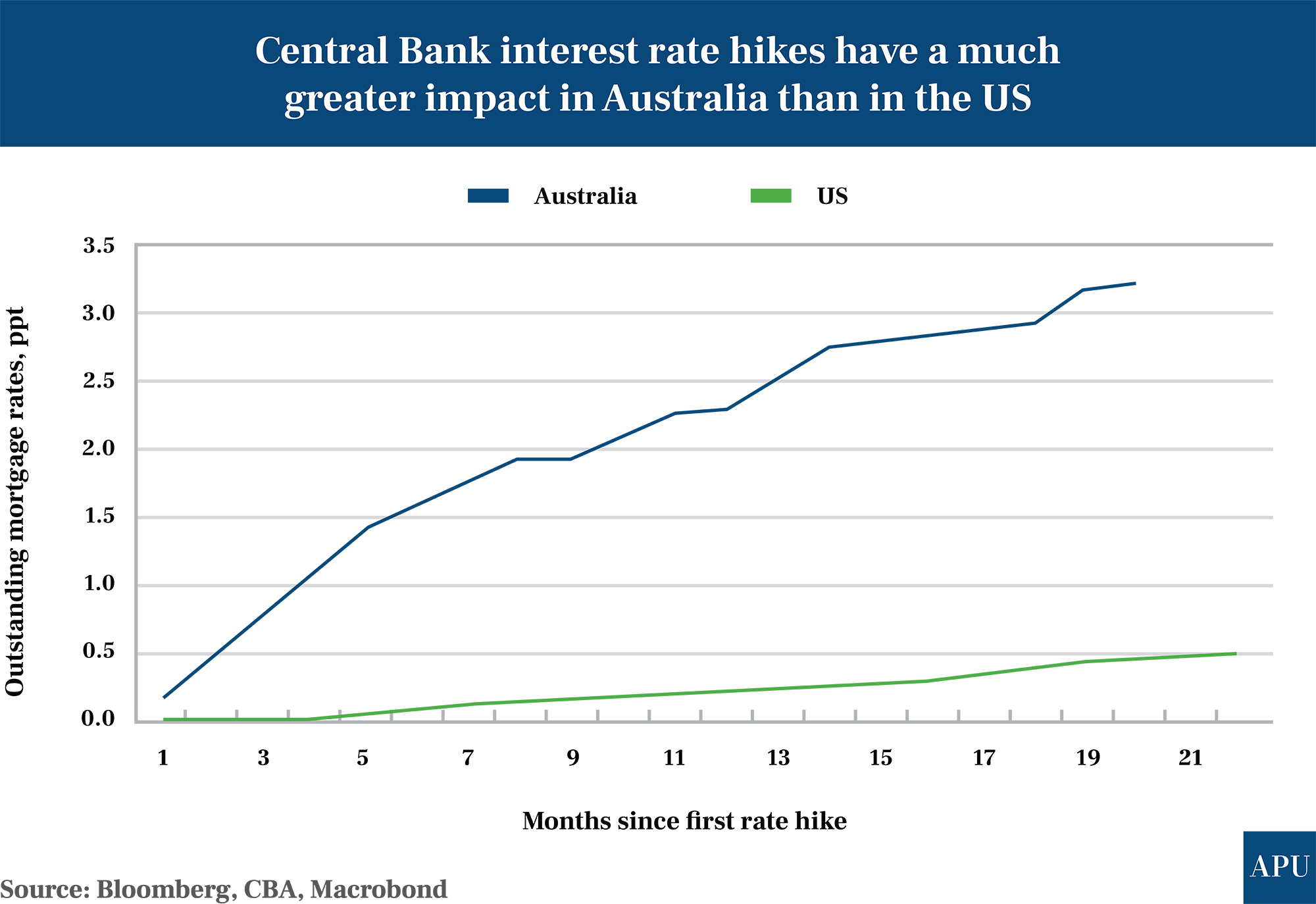

The RBA’s interest rate decisions hinge on balancing inflation control with economic growth. For instance, its recent cut aims to counteract inflationary pressures while stimulating investment. A lesser-known factor is the sensitivity of Australia’s variable-rate mortgages, amplifying policy impacts. This underscores the need for adaptive fiscal strategies to complement monetary policy, ensuring sustainable economic stability.

Image source: australianpropertyupdate.com.au

RBA’s Mandate and Monetary Policy Tools

The RBA’s dual mandate—price stability and full employment—relies on its primary tool, the cash rate, but extends to unconventional measures like quantitative easing during crises. Notably, fiscal coordination enhances these tools’ efficacy, as seen during the COVID-19 pandemic. Future strategies must integrate regulatory frameworks to address structural challenges, such as housing affordability and supply chain resilience, ensuring long-term stability.

Core Principles of Interest Rate Adjustments

Interest rate adjustments hinge on managing economic cycles, but their impact extends beyond immediate borrowing costs. For example, lower rates can amplify risk-taking behaviors, inflating asset bubbles. Evidence from the 2016-2019 period highlights this trade-off. Integrating macroprudential policies alongside rate changes can mitigate systemic risks, ensuring that monetary easing fosters sustainable growth without destabilizing financial markets.

Economic Impact of Rate Cuts

Rate cuts stimulate borrowing and investment but can distort savings behavior, as seen in Australia’s 2019 response. While mortgage holders benefit, savers face diminished returns, potentially reducing consumption. Expert analysis highlights the reversal rate, where further cuts become contractionary. Addressing this requires integrating fiscal measures to balance short-term relief with long-term economic stability, avoiding systemic imbalances.

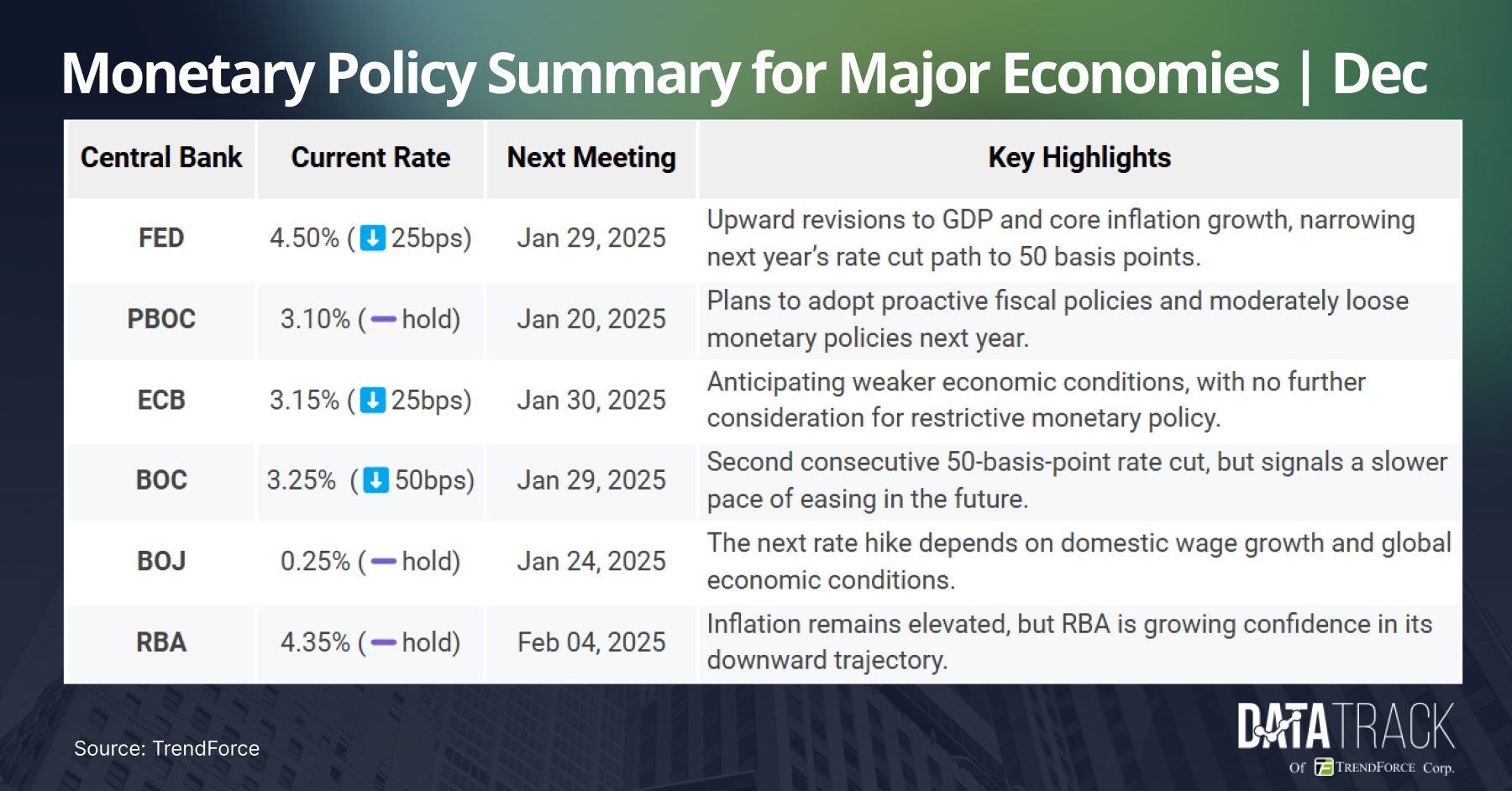

Image source: datatrack.trendforce.com

Immediate Effects on Borrowers and Savers

Borrowers on variable rates see immediate relief, with savings of up to $122 monthly on a $750,000 mortgage. However, savers face reduced returns as banks lower deposit rates, eroding income streams for retirees. This duality underscores the need for diversified financial strategies, such as reallocating savings into higher-yield investments, to mitigate the adverse effects of rate cuts.

Broader Ramifications on the Economy

Lower rates can weaken the Australian dollar, boosting export competitiveness but increasing import costs, potentially fueling inflation. This dynamic benefits sectors like agriculture and tourism while straining industries reliant on foreign goods. Policymakers must balance these effects by fostering domestic production and supply chain resilience, ensuring rate cuts drive sustainable growth without exacerbating trade imbalances or inflationary pressures.

How Aussies Can Take Advantage

Australians can leverage lower rates by refinancing mortgages to secure better terms, potentially saving thousands annually. Investors might explore undervalued property markets or equities poised for growth in a low-rate environment. Additionally, reallocating savings into diversified, higher-yield assets can offset reduced deposit returns. Strategic financial planning ensures individuals capitalize on opportunities while mitigating risks of inflation or asset bubbles.

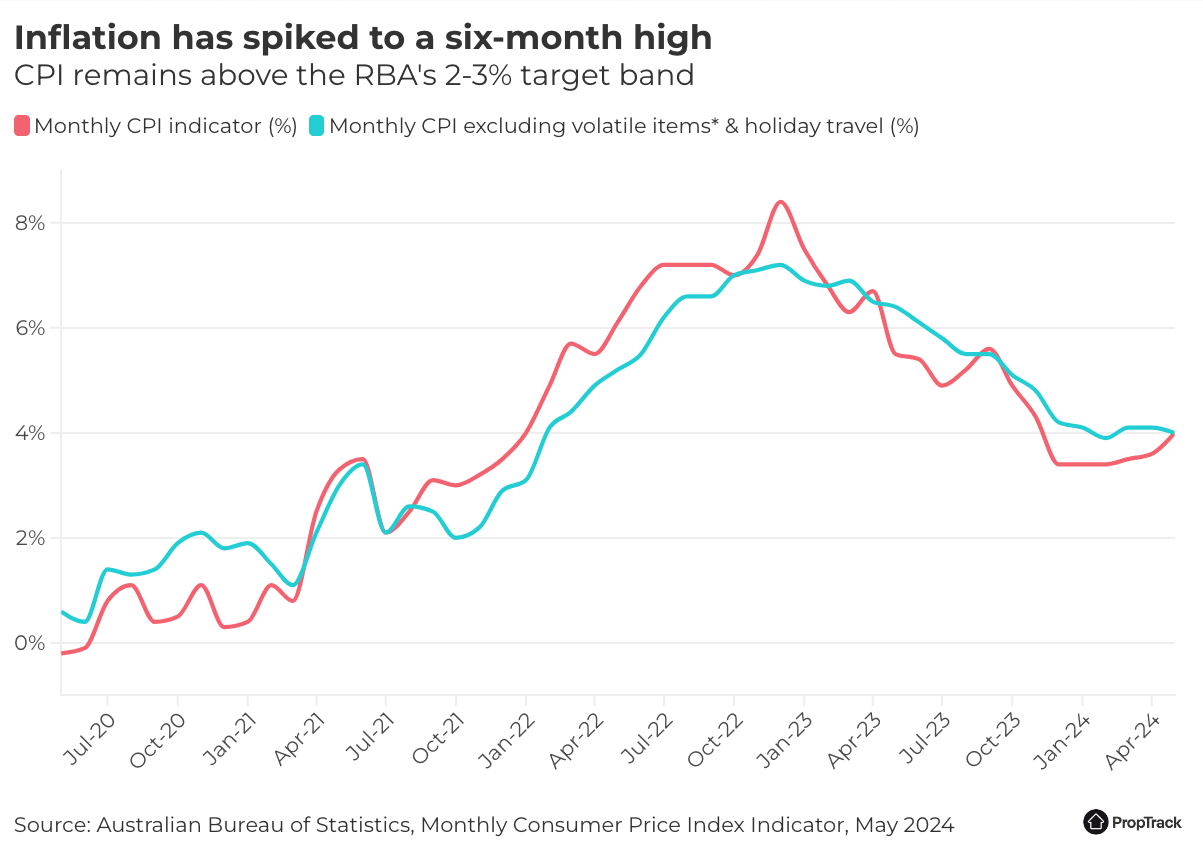

Image source: realestate.com.au

Mortgage Refinancing and Homeownership

Refinancing during rate cuts can reduce long-term interest costs, but timing is critical. Borrowers should assess break fees and switching costs against potential savings. For instance, a 0.5% rate reduction on a $500,000 loan could save $25,000 over 30 years. Exploring offset accounts or fixed-rate options can further optimize outcomes, fostering financial resilience amid market volatility.

Business Expansion and Investment Strategies

Lower borrowing costs enable businesses to fund growth initiatives, such as scaling operations or adopting advanced technologies. For example, a 1% reduction in loan rates on a $1 million investment could save $10,000 annually, enhancing cash flow. Prioritizing sectors with high growth potential, like renewable energy or tech, can amplify returns while mitigating risks tied to economic uncertainty.

Possible Pitfalls and Misconceptions

A common misconception is that rate cuts uniformly benefit all borrowers. However, fixed-rate loan holders may see no immediate relief, while savers face diminished returns. Additionally, over-leveraging during low-rate periods can amplify financial vulnerability if rates rise again. Policymakers caution against assuming prolonged cuts, emphasizing the importance of prudent financial planning to mitigate long-term risks.

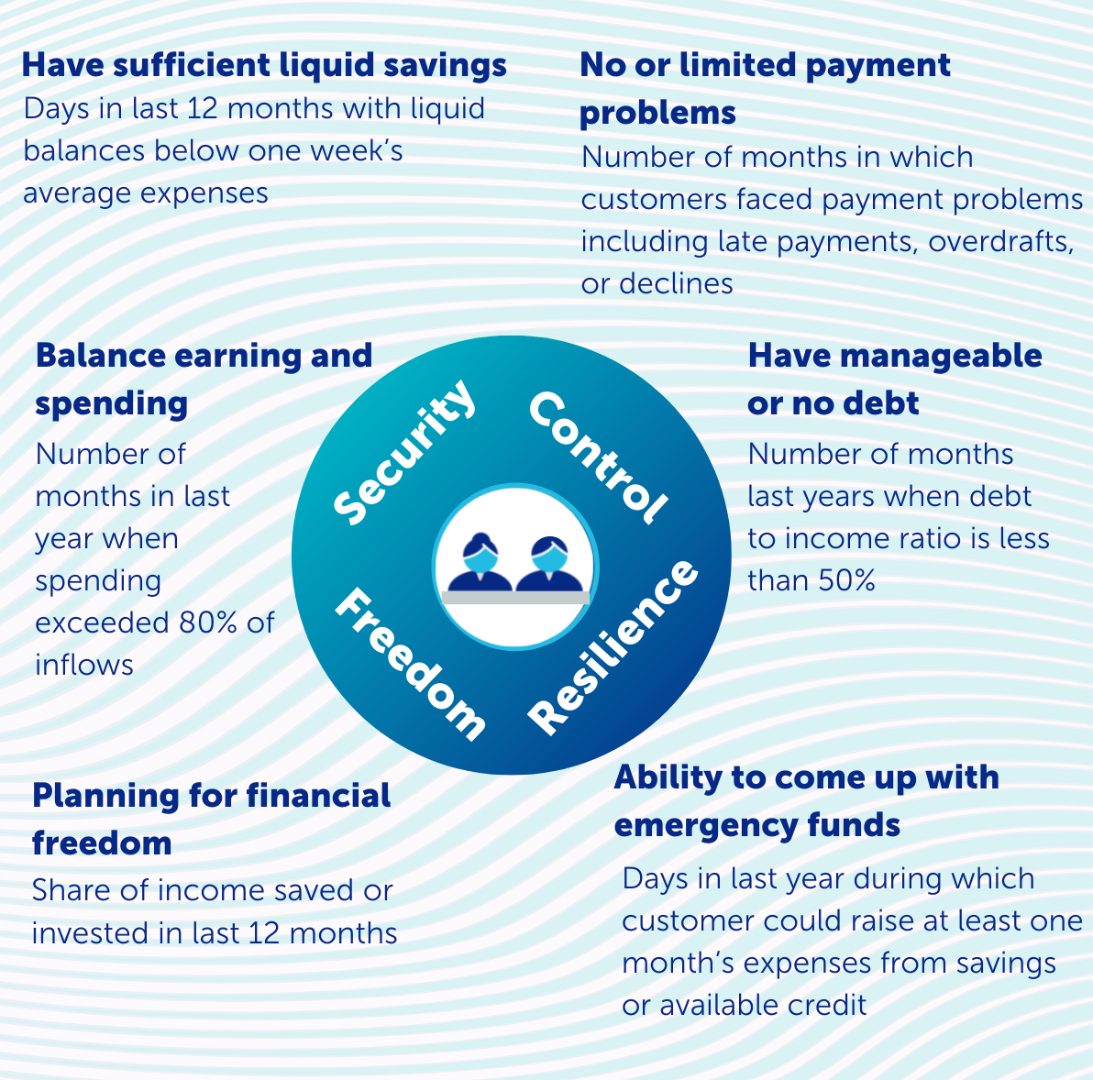

Image source: uncdf.org

Risks to Savers and Retirees

Declining rates push retirees toward higher-risk assets to maintain income, exposing them to market volatility. For instance, reallocating term deposits into equities may yield higher returns but increases exposure to downturns. Diversified conservative portfolios, blending bonds and ETFs, can mitigate risks. Policymakers must address structural imbalances to ensure savers’ financial security without forcing excessive risk-taking.

Misunderstandings about Currency Fluctuations

Many assume a weaker Australian dollar solely benefits exporters. However, industries reliant on imported goods face rising costs, eroding profit margins. For example, manufacturing sectors dependent on foreign components may struggle to remain competitive. Businesses can mitigate risks by diversifying supply chains or hedging currency exposure, ensuring resilience against exchange rate volatility and fostering long-term stability.

Future Outlook and Emerging Trends

As the RBA signals further easing, sectors like renewable energy and technology may see accelerated investment due to lower borrowing costs. However, rising global protectionism and China’s economic slowdown could offset gains. Policymakers must balance domestic stimulus with external risks, leveraging fiscal tools to complement monetary policy and ensure sustainable growth amid evolving global dynamics.

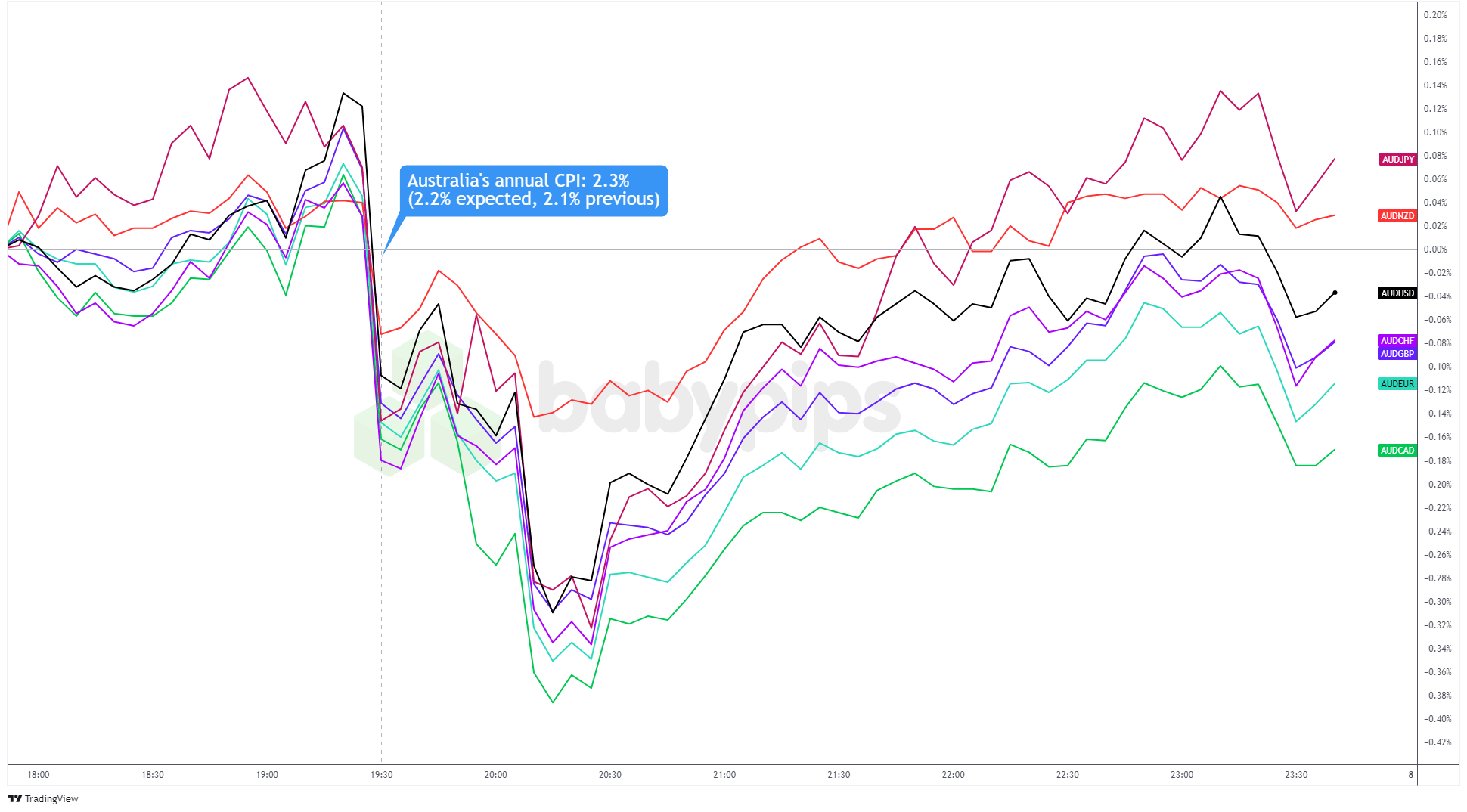

Image source: babypips.com

Potential Further Rate Adjustments

Future rate cuts may hinge on inflation trends and global economic shifts, such as China’s property sector challenges. A prolonged easing cycle risks reaching the reversal rate, where further reductions harm growth. Policymakers could integrate macroprudential tools, like stricter lending caps, to mitigate financial instability while maintaining monetary flexibility, ensuring sustainable economic recovery without exacerbating systemic vulnerabilities.

Global Influences and Digital Finance Innovations

The rise of central bank digital currencies (CBDCs) could reshape monetary policy transmission, enhancing efficiency in rate adjustments. For instance, CBDCs may allow the RBA to directly influence consumer spending by targeting specific sectors. Coupled with global economic shifts, such as de-dollarization trends, these innovations demand adaptive frameworks to ensure financial stability while leveraging technological advancements for economic resilience.

FAQ

What are the immediate benefits of the RBA rate cut for Australian homeowners?

The RBA rate cut offers Australian homeowners reduced monthly mortgage repayments, improving cash flow and easing financial stress. Variable-rate borrowers benefit immediately as lenders adjust rates, potentially saving hundreds annually. Homeowners can leverage this opportunity to refinance, secure better loan terms, or accelerate debt repayment. Additionally, lower rates enhance borrowing capacity, enabling access to larger loans for renovations or investments. However, the impact varies based on individual circumstances, lender policies, and market conditions. Proactive financial planning, such as consulting mortgage brokers or exploring offset accounts, ensures homeowners maximize these benefits while mitigating risks of future rate fluctuations or inflationary pressures.

How does the RBA’s rate decision impact the Australian dollar and international trade?

Lower RBA rates typically weaken the Australian dollar, making exports more competitive globally while increasing the cost of imports. This dynamic benefits export-driven sectors like agriculture and mining but challenges industries reliant on foreign goods due to higher input costs. A weaker currency can attract foreign investment in equities and real estate, boosting capital inflows. However, prolonged depreciation risks inflationary pressures from pricier imports. Businesses can mitigate these effects by diversifying supply chains or employing currency hedging strategies. Policymakers must balance these trade-offs to ensure rate cuts stimulate economic growth without exacerbating trade imbalances or undermining financial stability.

What strategies can investors use to capitalize on lower interest rates in property markets?

Investors can capitalize on lower interest rates by refinancing existing loans to reduce costs and improve cash flow, enabling reinvestment into property upgrades or portfolio expansion. Exploring high-demand areas, such as Adelaide Hills or Fleurieu Peninsula, offers opportunities for capital growth and strong rental yields. Diversifying into undervalued markets or lifestyle properties can mitigate risks tied to market volatility. Leveraging increased borrowing capacity allows investors to acquire higher-value assets or expand portfolios strategically. Monitoring market trends, such as supply-demand dynamics and RBA rate forecasts, ensures informed decisions. Partnering with local experts enhances property selection and maximizes returns in a competitive environment.

How do RBA rate cuts influence savings accounts and retirement planning for Australians?

RBA rate cuts reduce interest earnings on savings accounts, impacting Australians relying on deposit income, particularly retirees. Savers may need to reassess strategies, such as shifting funds into high-yield savings accounts or diversified investment portfolios blending bonds, ETFs, and equities. Retirement planning must adapt to lower returns by exploring annuities or income-focused funds to maintain financial stability. Proactive measures, like comparing competitive rates or consulting financial advisors, can mitigate income erosion. Policymakers emphasize balancing short-term relief for borrowers with savers’ long-term security, urging Australians to align retirement goals with evolving economic conditions and interest rate trends for sustainable financial outcomes.

What are the potential risks of refinancing during a period of reduced interest rates?

Refinancing during reduced interest rates carries risks such as incurring break fees or switching costs that may outweigh potential savings. Borrowers locking in low rates could miss future rate cuts, limiting long-term benefits. Over-leveraging due to increased borrowing capacity may heighten financial vulnerability if rates rise again. Additionally, subprime borrowers may face higher rates despite overall reductions, limiting affordability improvements. Market volatility and fluctuating property values can also impact refinancing outcomes. Careful evaluation of loan terms, costs, and individual financial circumstances, alongside professional advice, ensures borrowers mitigate these risks while optimizing refinancing benefits in a low-rate environment.