Changes in Mortgage Rates and Borrowing Capacity

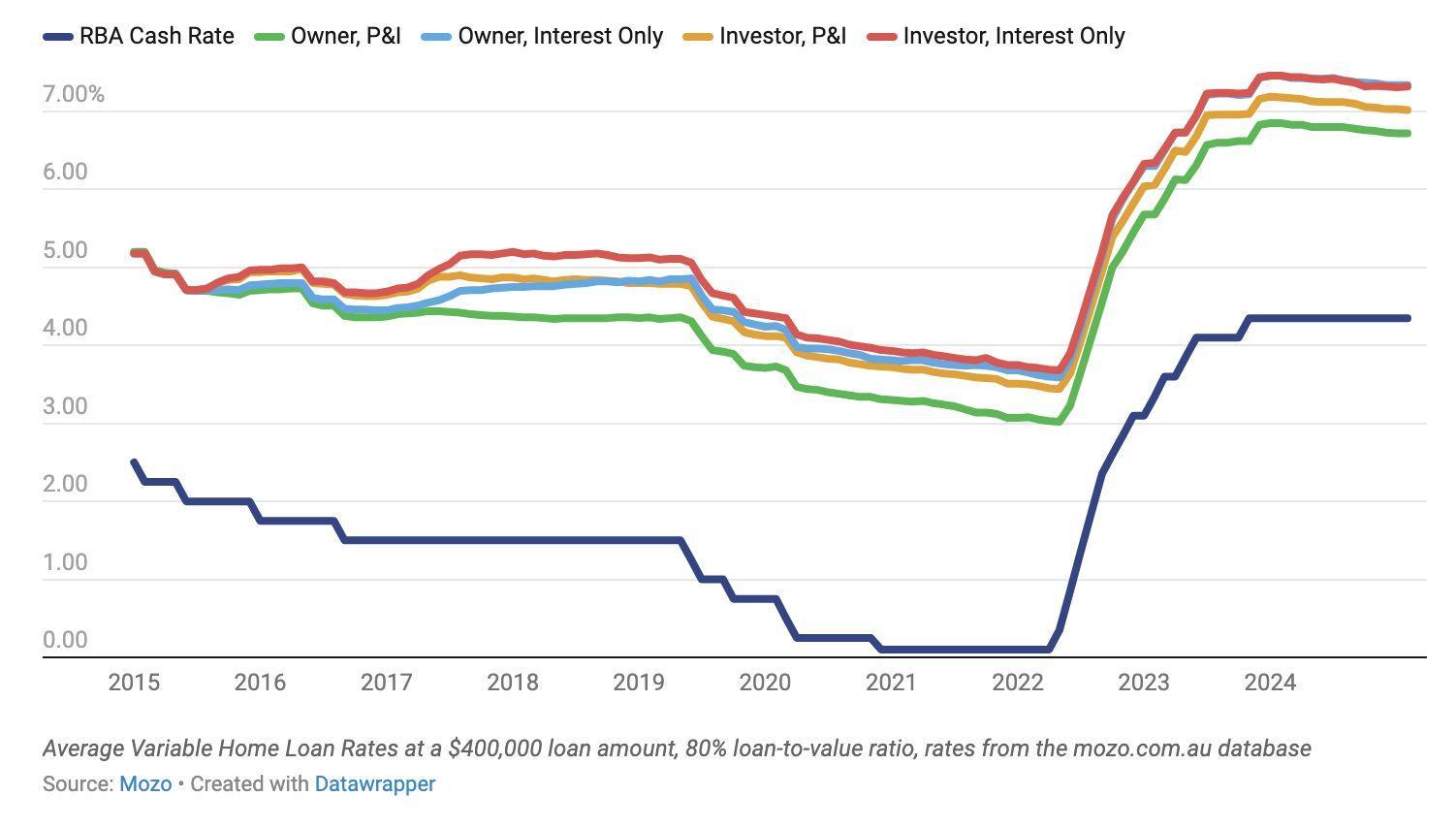

The RBA’s February 2025 rate cut has reshaped the borrowing landscape, but its effects are far from uniform. While lower rates reduce monthly repayments—saving $92 on a $600,000 loan—borrowing capacity has emerged as the real game-changer. By lowering serviceability buffers, banks now allow buyers to qualify for larger loans, amplifying their purchasing power. For instance, a borrower previously capped at $500,000 may now access up to $520,000, depending on the lender’s policies.

However, this newfound capacity comes with caveats. Credit assessment buffers, typically 3% above the loan rate, still act as a safeguard against over-leveraging. Yet, as competition intensifies, first-home buyers often find themselves outbid by investors leveraging equity gains. Developers like Stockland and Mirvac have reported surges in buyer inquiries, but supply-side constraints—ranging from labor shortages to zoning delays—limit new housing stock, exacerbating affordability pressures.

A potential solution lies in a “Borrowing Affordability Index”, combining metrics like income growth, loan-to-value ratios, and regional housing supply elasticity. This tool could help policymakers anticipate market imbalances and guide targeted interventions.

Looking ahead, integrating fiscal measures such as subsidies for first-home buyers or incentives for developers could balance the scales. Without such strategies, the rate cut risks fueling a cycle where increased borrowing power paradoxically deepens the affordability crisis.

Initial Reactions from the Real Estate Sector

The February 2025 rate cut triggered immediate ripples across the real estate sector, with developers and agencies recalibrating strategies to capitalise on renewed buyer interest. Companies like Stockland and Mirvac reported a sharp uptick in inquiries, particularly for off-the-plan properties, as lower borrowing costs expanded purchasing power. However, this surge exposed a critical bottleneck: supply-side constraints.

A deeper analysis reveals that while rate cuts stimulate demand, they fail to address systemic issues like zoning delays and labour shortages. For instance, Mirvac’s planned developments in Sydney’s western suburbs have faced approval delays of up to six months, limiting their ability to meet rising demand. This mismatch between demand and supply exacerbates price pressures, particularly in high-demand urban areas.

To quantify these dynamics, a “Real Estate Demand-Supply Index” could be developed, integrating metrics such as buyer inquiries, approval timelines, and construction completions. This tool would provide stakeholders with actionable insights to anticipate market imbalances.

Looking forward, the sector must adopt a dual approach: leveraging rate cuts to drive short-term sales while advocating for policy reforms to streamline approvals and incentivise construction. Without such measures, the risk of perpetuating affordability crises looms large, particularly for first-home buyers.

Long-term Consequences for Property Prices

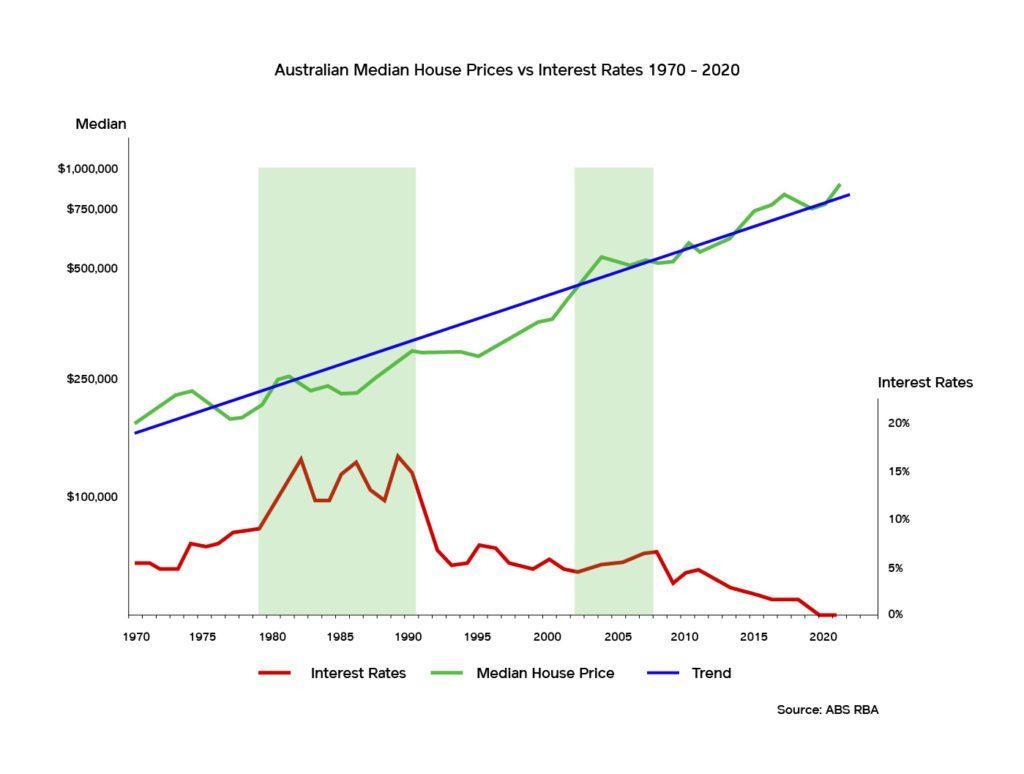

The long-term trajectory of property prices following the February 2025 rate cut reveals a paradox: while lower rates are intended to ease financial strain, they often entrench affordability challenges. Historically, rate cuts have acted as a double-edged sword. For instance, during the 2020–2021 ultra-low rate period, property prices surged over 20% in some regions, driven by heightened demand but constrained by limited supply.

A key misconception is that rate cuts inherently improve affordability. While they reduce borrowing costs, they also inflate purchasing power, intensifying competition. This dynamic disproportionately benefits investors leveraging equity gains, as seen with Sydney’s premium suburbs rebounding faster than affordable areas.

Experts like David Khalil, Director at DPN, warn that prolonged low rates could exacerbate land scarcity and inflate build costs, further straining supply. Additionally, systemic issues—labour shortages, zoning delays, and rising material costs—compound these pressures.

To mitigate these risks, policymakers must integrate fiscal measures, such as subsidies for affordable housing, alongside monetary policy. Without such interventions, Australia risks perpetuating a cycle where rate cuts fuel price growth, leaving first-home buyers further behind.

Rate Cuts? More Like Fuel for the Housing Inferno – Thanks, RBA!

On February 18, 2025, the Reserve Bank of Australia (RBA) trimmed its cash rate by 25 basis points to 4.10%, a move that shaved $77 off monthly repayments for a typical $500,000 mortgage. For many, it was a welcome reprieve after years of relentless rate hikes. But within days, the real story began to unfold: Sydney’s property prices jumped 0.5%, their sharpest rise in nearly a year, while Melbourne and Brisbane followed suit, reigniting fears of an overheated market.

This wasn’t just a blip. CoreLogic data revealed a 0.3% national increase in home values for February, reversing months of stagnation. The cut, intended to ease financial pressure, has instead poured fuel on a housing market already stretched by supply shortages and surging demand.

For first-time buyers and renters, the implications are stark. What was framed as relief for households may instead deepen the affordability crisis, leaving many to wonder: who really benefits?

Understanding the Role of the RBA in Monetary Policy

The Reserve Bank of Australia (RBA) wields significant influence over the nation’s economic trajectory through its monetary policy decisions, particularly interest rate adjustments. While rate cuts are often celebrated as a tool to stimulate economic activity, their unintended consequences—such as inflating housing markets—deserve closer scrutiny.

A key factor lies in the interplay between monetary policy and housing supply constraints. For instance, the February 2025 rate cut, which reduced mortgage repayments, inadvertently spurred a 0.5% surge in Sydney property prices within days. This reaction highlights how monetary easing can amplify demand in markets already constrained by limited housing stock and zoning restrictions.

Real-world examples underscore this dynamic. Developers like Stockland and Mirvac have reported increased buyer interest following rate cuts, yet supply-side bottlenecks, such as delays in approvals, prevent meaningful inventory growth. This imbalance exacerbates affordability challenges, particularly for first-time buyers.

Emerging trends suggest the need for a more nuanced approach. Integrating fiscal measures, such as targeted subsidies for affordable housing, alongside monetary policy could mitigate these effects. As the RBA continues to refine its strategies, collaboration with government bodies on housing reforms may prove essential to balancing economic growth with equity.

Historical Context of Interest Rate Adjustments

The RBA’s history of interest rate adjustments reveals a complex balancing act between economic stimulation and financial stability. A notable example is the period between September 2008 and April 2009, when the RBA slashed the cash rate by 4.25 percentage points to counter the global financial crisis. While this move spurred a 10% rise in housing loan approvals by March 2009, it also highlighted the unintended consequence of fueling housing demand without addressing supply-side constraints.

This pattern resurfaced in 2020, as the RBA reduced rates to historic lows during the COVID-19 pandemic. Developers like Stockland saw increased buyer activity, yet approvals for new housing lagged due to zoning restrictions and labor shortages. The result? A surge in house prices, exacerbating affordability issues for first-time buyers.

To quantify these dynamics, a “Housing Affordability Stress Index” could be developed, combining metrics like mortgage-to-income ratios and housing supply elasticity. Such a tool would help policymakers anticipate the broader impacts of rate changes.

Looking forward, the RBA must consider integrating monetary policy with targeted fiscal measures, such as subsidies for affordable housing. By addressing both demand and supply, Australia can mitigate the cyclical risks of rate adjustments while fostering long-term housing market stability.

Immediate Impacts on the Housing Market

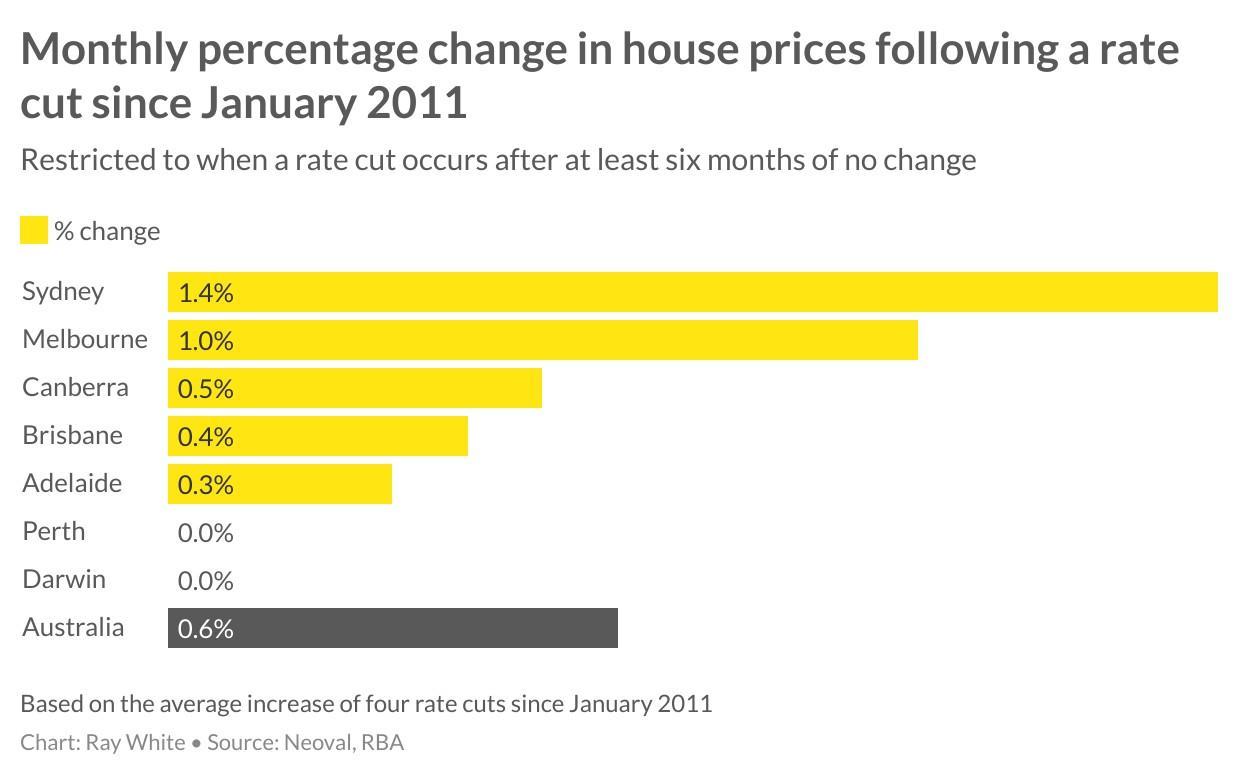

The February 2025 rate cut by the RBA, reducing the cash rate to 4.1%, acted as a catalyst for a rapid surge in housing demand. Within days, Sydney property prices rose by 0.5%, marking the sharpest monthly increase in nearly a year. Melbourne followed closely, leading national growth for the first time in five years, while Brisbane’s median house price edged closer to $1 million. These shifts underscore how even modest rate adjustments can ripple through an already constrained market.

A key misconception is that lower rates universally improve affordability. While reduced borrowing costs expand purchasing power, they also intensify competition, driving prices higher. For instance, CoreLogic data revealed a 0.3% national increase in home values for February, reversing months of stagnation. This dynamic disproportionately benefits investors and existing homeowners, leaving first-time buyers struggling to keep pace.

Experts like Nerida Conisbee, Chief Economist at Ray White, emphasize that supply-side bottlenecks—such as labor shortages and zoning delays—exacerbate these challenges. Without addressing these structural issues, rate cuts risk perpetuating a cycle of rising prices and deepening affordability crises, particularly in high-demand urban centers like Sydney and Melbourne.

Image source: raywhitewestend.com.au

Changes in Mortgage Rates and Borrowing Capacity

The RBA’s February 2025 rate cut has reshaped the borrowing landscape, but its effects are far from uniform. While lower rates reduce monthly repayments—saving $92 on a $600,000 loan—borrowing capacity has emerged as the real game-changer. By lowering serviceability buffers, banks now allow buyers to qualify for larger loans, amplifying their purchasing power. For instance, a borrower previously capped at $500,000 may now access up to $520,000, depending on the lender’s policies.

However, this newfound capacity comes with caveats. Credit assessment buffers, typically 3% above the loan rate, still act as a safeguard against over-leveraging. Yet, as competition intensifies, first-home buyers often find themselves outbid by investors leveraging equity gains. Developers like Stockland and Mirvac have reported surges in buyer inquiries, but supply-side constraints—ranging from labor shortages to zoning delays—limit new housing stock, exacerbating affordability pressures.

A potential solution lies in a “Borrowing Affordability Index”, combining metrics like income growth, loan-to-value ratios, and regional housing supply elasticity. This tool could help policymakers anticipate market imbalances and guide targeted interventions.

Looking ahead, integrating fiscal measures such as subsidies for first-home buyers or incentives for developers could balance the scales. Without such strategies, the rate cut risks fueling a cycle where increased borrowing power paradoxically deepens the affordability crisis.

Initial Reactions from the Real Estate Sector

The February 2025 rate cut triggered immediate ripples across the real estate sector, with developers and agencies recalibrating strategies to capitalise on renewed buyer interest. Companies like Stockland and Mirvac reported a sharp uptick in inquiries, particularly for off-the-plan properties, as lower borrowing costs expanded purchasing power. However, this surge exposed a critical bottleneck: supply-side constraints.

A deeper analysis reveals that while rate cuts stimulate demand, they fail to address systemic issues like zoning delays and labour shortages. For instance, Mirvac’s planned developments in Sydney’s western suburbs have faced approval delays of up to six months, limiting their ability to meet rising demand. This mismatch between demand and supply exacerbates price pressures, particularly in high-demand urban areas.

To quantify these dynamics, a “Real Estate Demand-Supply Index” could be developed, integrating metrics such as buyer inquiries, approval timelines, and construction completions. This tool would provide stakeholders with actionable insights to anticipate market imbalances.

Looking forward, the sector must adopt a dual approach: leveraging rate cuts to drive short-term sales while advocating for policy reforms to streamline approvals and incentivise construction. Without such measures, the risk of perpetuating affordability crises looms large, particularly for first-home buyers.

Long-term Consequences for Property Prices

The long-term trajectory of property prices following the February 2025 rate cut reveals a paradox: while lower rates are intended to ease financial strain, they often entrench affordability challenges. Historically, rate cuts have acted as a double-edged sword. For instance, during the 2020–2021 ultra-low rate period, property prices surged over 20% in some regions, driven by heightened demand but constrained by limited supply.

A key misconception is that rate cuts inherently improve affordability. While they reduce borrowing costs, they also inflate purchasing power, intensifying competition. This dynamic disproportionately benefits investors leveraging equity gains, as seen with Sydney’s premium suburbs rebounding faster than affordable areas.

Experts like David Khalil, Director at DPN, warn that prolonged low rates could exacerbate land scarcity and inflate build costs, further straining supply. Additionally, systemic issues—labour shortages, zoning delays, and rising material costs—compound these pressures.

To mitigate these risks, policymakers must integrate fiscal measures, such as subsidies for affordable housing, alongside monetary policy. Without such interventions, Australia risks perpetuating a cycle where rate cuts fuel price growth, leaving first-home buyers further behind.

Image source: opencorp.com.au

Potential for a Housing Market Boom

The February 2025 rate cut has set the stage for what could become a housing market boom, but the dynamics at play suggest a more nuanced trajectory. Historically, rate cuts have triggered rapid price escalations, as seen during the 2020–2021 period when ultra-low rates fueled a 23.7% surge in home values. However, the current environment introduces unique variables that could amplify or temper this effect.

One critical factor is the role of investor activity. Companies like Mirvac and Stockland have already reported increased inquiries, particularly for off-the-plan developments. Yet, supply-side bottlenecks—ranging from zoning delays to labour shortages—continue to constrain new housing stock. This imbalance creates a fertile ground for speculative investment, driving prices higher in premium suburbs while leaving affordable areas stagnant.

To quantify this dynamic, a “Housing Market Volatility Index” could be developed, integrating metrics such as investor-to-owner-occupier ratios, construction approval timelines, and regional price elasticity. This tool would help policymakers and stakeholders anticipate market imbalances and implement targeted interventions.

Experts like Tim Lawless of CoreLogic emphasize that improved buyer sentiment, rather than borrowing capacity, is the primary driver of recent price rebounds. This suggests that psychological factors, such as fear of missing out (FOMO), may play a larger role than economic fundamentals.

Looking ahead, integrating fiscal policies—such as tax incentives for first-home buyers or subsidies for affordable housing—could temper speculative pressures. Without such measures, the risk of an overheated market looms, potentially exacerbating long-term affordability challenges.

Risks of Increased Household Debt

The February 2025 rate cut has reignited concerns about household debt, a long-standing vulnerability in Australia’s economy. With the household debt-to-income ratio already at 189.6%, the potential for further borrowing raises red flags. Lower interest rates may reduce repayment burdens, but they also encourage riskier borrowing behaviors, particularly among first-time buyers and investors leveraging equity gains.

A critical issue lies in debt sustainability. Historical data from the 2020–2021 rate cuts revealed that while borrowing surged, wage growth stagnated, leaving households more exposed to economic shocks. For instance, during that period, mortgage debt ballooned to A$1.7 trillion, surpassing the nation’s GDP. This imbalance underscores the fragility of relying on low rates to fuel economic activity.

To better assess these risks, a “Debt Vulnerability Index” could be introduced, combining metrics like debt-to-income ratios, loan-to-value ratios, and regional income growth disparities. Such a tool would enable policymakers to identify at-risk demographics and regions, guiding targeted interventions.

Experts like Shane Oliver of AMP Capital warn that prolonged low rates may create a “debt trap,” where households overextend financially, leaving them vulnerable to future rate hikes or economic downturns.

Looking forward, integrating stricter lending standards with fiscal measures—such as wage subsidies or targeted debt relief—could mitigate these risks. Without such safeguards, Australia risks compounding its household debt crisis, undermining long-term financial stability.

Image source: gensqueeze.ca

The Dilemma of Cheap Money and Asset Bubbles

Cheap money, while a lifeline for economic stimulus, often acts as a double-edged sword, fueling speculative asset bubbles. The February 2025 rate cut exemplifies this, as lower borrowing costs amplified demand in already constrained housing markets. This dynamic mirrors historical patterns, such as the 2020–2021 ultra-low rate period, where property prices surged over 20% in some regions, driven by speculative buying rather than fundamental value.

A critical factor is the feedback loop: rising prices attract more buyers, further inflating values. Case and Shiller’s research highlights how such cycles are perpetuated by optimistic narratives and fear of missing out (FOMO). For instance, Sydney’s premium suburbs rebounded faster post-rate cut, benefiting investors leveraging equity gains, while first-home buyers were priced out.

To quantify this, a “Speculative Pressure Index” could integrate metrics like investor-to-owner-occupier ratios, price-to-income ratios, and regional supply elasticity. This tool would help policymakers identify overheating markets and implement targeted cooling measures.

Experts like Tim Lawless of CoreLogic emphasize that addressing supply-side constraints—zoning delays, labor shortages—is crucial to breaking this cycle. Moving forward, integrating fiscal policies, such as subsidies for affordable housing, alongside monetary measures, could temper speculative pressures and foster sustainable growth.

Policy Alternatives and Their Implications

A promising policy alternative lies in targeted fiscal measures that address both demand and supply-side challenges. For instance, subsidies for affordable housing construction, particularly in job-rich areas, could alleviate pressure on urban markets. A 2021 study by the City Futures Research Centre found that 82% of experts supported prioritizing affordable housing investments in such regions, citing potential economic benefits and reduced housing cost burdens for low-income workers.

Real-world applications underscore this approach. Developers like Stockland have successfully leveraged government incentives to fast-track affordable housing projects, yet systemic bottlenecks—such as zoning delays—remain a hurdle. Addressing these requires streamlined approval processes and public-private partnerships to ensure timely delivery.

To quantify the impact of such measures, a “Housing Equity Index” could be developed, integrating metrics like regional income disparities, housing supply elasticity, and subsidy effectiveness. This tool would provide policymakers with actionable insights to optimize resource allocation.

Experts like Lisa Magnani of Macquarie University advocate for complementary reforms, such as replacing stamp duty with a land tax, to reduce speculative pressures. Moving forward, a dual-policy framework combining fiscal incentives with regulatory reforms could foster a more equitable housing market, ensuring affordability without compromising economic growth.

Expert Opinions and Market Projections

Experts are increasingly divided on the long-term implications of the February 2025 rate cut. While some, like Tim Lawless of CoreLogic, argue that improved buyer sentiment is driving short-term price rebounds, others caution against overlooking systemic risks. Shane Oliver of AMP Capital warns that prolonged low rates may create a “debt trap,” where households overextend financially, leaving them vulnerable to future economic shocks.

A striking contrast emerges when examining investor activity. Developers like Mirvac report surging inquiries for off-the-plan properties, yet supply-side constraints—zoning delays, labor shortages—continue to stifle new stock. This imbalance fuels speculative pressures, disproportionately benefiting investors while sidelining first-home buyers.

An unexpected insight lies in the psychological impact of rate cuts. Fear of missing out (FOMO) often amplifies demand beyond economic fundamentals, creating a feedback loop of rising prices. Addressing this requires not just fiscal reforms but also public education to temper speculative behavior, ensuring sustainable market growth.

Economic stimulus and housing affordability often pull in opposite directions, creating a policy paradox. Rate cuts, like the RBA’s February 2025 decision, aim to ease financial strain but inadvertently inflate housing demand, driving prices higher. This dynamic disproportionately benefits investors while sidelining first-time buyers—a phenomenon vividly illustrated by Sydney’s 0.5% price surge within days of the cut.

A key misconception is that monetary easing alone can resolve affordability issues. However, as experts like Nerida Conisbee of Ray White highlight, supply-side bottlenecks—zoning delays, labor shortages—amplify price pressures. For instance, Mirvac’s six-month approval delays in Sydney’s west have stymied new housing stock, exacerbating the crisis.

To bridge this gap, a dual-policy framework is essential. Fiscal measures, such as subsidies for affordable housing or tax incentives for developers, must complement rate cuts. Without this balance, Australia risks perpetuating a cycle where stimulus fuels inequality rather than economic equity.

Image source: azurafinancial.com.au

Insights from Industry Experts

The February 2025 rate cut has reignited debates on the interplay between monetary policy and housing market dynamics, with industry experts offering nuanced perspectives. A key insight comes from Nerida Conisbee, Chief Economist at Ray White, who highlights that supply-side bottlenecks—such as zoning delays and labor shortages—are amplifying price pressures. For instance, Mirvac’s developments in Sydney’s western suburbs have faced approval delays of up to six months, limiting their ability to meet surging demand.

A deeper analysis reveals that investor behavior is a critical driver of market volatility. Developers like Stockland report a 15% increase in inquiries for off-the-plan properties post-rate cut, yet first-home buyers are increasingly outbid by investors leveraging equity gains. This imbalance underscores the need for targeted interventions.

To address these challenges, a “Housing Market Resilience Index” could be introduced, integrating metrics like approval timelines, investor-to-owner-occupier ratios, and regional supply elasticity. Such a tool would enable policymakers to anticipate imbalances and implement preemptive measures.

Experts like Shane Oliver of AMP Capital warn that prolonged low rates risk creating a “debt trap,” where households overextend financially. Moving forward, integrating fiscal policies—such as subsidies for affordable housing and streamlined approval processes—could temper speculative pressures while fostering sustainable growth. Without such measures, Australia risks perpetuating a cycle of rising prices and deepening inequality.

Future Trends in the Australian Housing Market

One emerging trend in the Australian housing market is the growing divergence between premium and affordable housing segments. Historical data shows that during periods of rate cuts, such as 2020–2021, premium suburbs rebounded faster due to investor activity, while affordable areas lagged. This pattern is resurfacing in 2025, with affluent inner-ring suburbs in Sydney and Melbourne outperforming outer regions.

A critical driver is the wealth effect, where rising property values in premium areas attract equity-rich investors. For example, Stockland has reported a 20% increase in inquiries for high-end developments, particularly in lifestyle-focused suburbs. However, this trend exacerbates affordability challenges for first-home buyers, who are increasingly priced out of these markets.

To quantify this disparity, a “Housing Equity Divergence Index” could be developed, integrating metrics like price-to-income ratios, regional wage growth, and investor-to-owner-occupier ratios. This tool would provide policymakers with actionable insights to address imbalances.

Experts like Michael Yardney of Metropole Property Strategists suggest that targeted fiscal measures, such as subsidies for family-friendly apartments in middle-ring suburbs, could bridge this gap. Additionally, streamlining zoning approvals could unlock supply in underutilised areas.

Looking ahead, addressing these disparities requires a dual approach: incentivising affordable housing while curbing speculative pressures in premium markets. Without such interventions, Australia risks deepening the divide between housing haves and have-nots, perpetuating long-term inequality.

FAQ

How do RBA rate cuts influence property prices in Australia’s major cities?

RBA rate cuts lower borrowing costs, increasing buyer demand and competition, which drives property prices higher, particularly in major cities like Sydney, Melbourne, and Brisbane. This dynamic is amplified by limited housing supply, as zoning delays and labor shortages restrict new developments. Investors often capitalize on these conditions, leveraging equity gains to outbid first-home buyers. For instance, Sydney saw a 0.5% price surge in February 2025, the sharpest in 10 months. Such trends highlight the interplay between monetary policy, market psychology, and structural constraints, underscoring the need for integrated fiscal measures to mitigate affordability challenges in high-demand urban areas.

What are the long-term implications of rate cuts on housing affordability for first-time buyers?

Rate cuts enhance borrowing capacity, enabling first-time buyers to access larger loans, but this often intensifies competition, driving property prices higher and eroding affordability. Investors leveraging equity gains further exacerbate this dynamic, sidelining new entrants. Structural issues like labor shortages and zoning delays compound the problem by limiting housing supply. Over time, these factors create a cycle where affordability worsens despite lower interest rates. For example, Sydney’s premium suburbs rebound faster, leaving affordable areas stagnant. Addressing these challenges requires targeted fiscal policies, such as subsidies for affordable housing, to balance demand-driven growth with equitable access for first-time buyers.

Why do rate cuts disproportionately benefit investors over owner-occupiers in the Australian housing market?

Rate cuts reduce borrowing costs, enabling investors to leverage existing equity for additional purchases, often outbidding owner-occupiers. This advantage is amplified in high-demand markets like Sydney and Melbourne, where investors target premium suburbs with strong rental yields. Structural constraints, such as limited housing supply and zoning delays, further skew benefits toward investors, as they can act faster and absorb higher costs. For instance, developers like Stockland report increased investor inquiries post-rate cuts. Without targeted fiscal measures, such as first-home buyer subsidies, this imbalance perpetuates affordability challenges, sidelining owner-occupiers in favor of equity-rich investors capitalizing on market dynamics.

What role do supply-side constraints play in amplifying the effects of RBA rate cuts on housing demand?

Supply-side constraints, such as zoning delays, labor shortages, and rising construction costs, limit the availability of new housing, intensifying the impact of RBA rate cuts on demand. Lower borrowing costs boost buyer activity, but restricted supply creates a competitive market, driving prices higher. For example, developers like Mirvac face approval delays of up to six months, stalling projects in high-demand areas like Sydney. This imbalance disproportionately benefits investors, who capitalize on limited stock, while first-home buyers struggle with affordability. Addressing these constraints through streamlined approvals and targeted subsidies is essential to balance demand-driven growth with sustainable housing availability.

How can policymakers balance economic stimulus with housing market stability following rate adjustments?

Policymakers can balance economic stimulus with housing market stability by integrating fiscal measures alongside rate adjustments. Subsidies for affordable housing, streamlined zoning approvals, and incentives for developers can address supply-side constraints, mitigating price surges. For instance, targeted tax incentives for first-home buyers can curb speculative pressures from investors. Tools like a “Housing Market Resilience Index,” combining metrics such as supply elasticity and buyer demographics, can guide interventions. Collaboration between the RBA and government bodies is crucial to align monetary policy with structural reforms, ensuring that economic growth does not exacerbate affordability challenges or fuel speculative asset bubbles.