Rate Cuts vs Tariffs: Australia’s Property Market Faces Its Most Unpredictable Year Yet

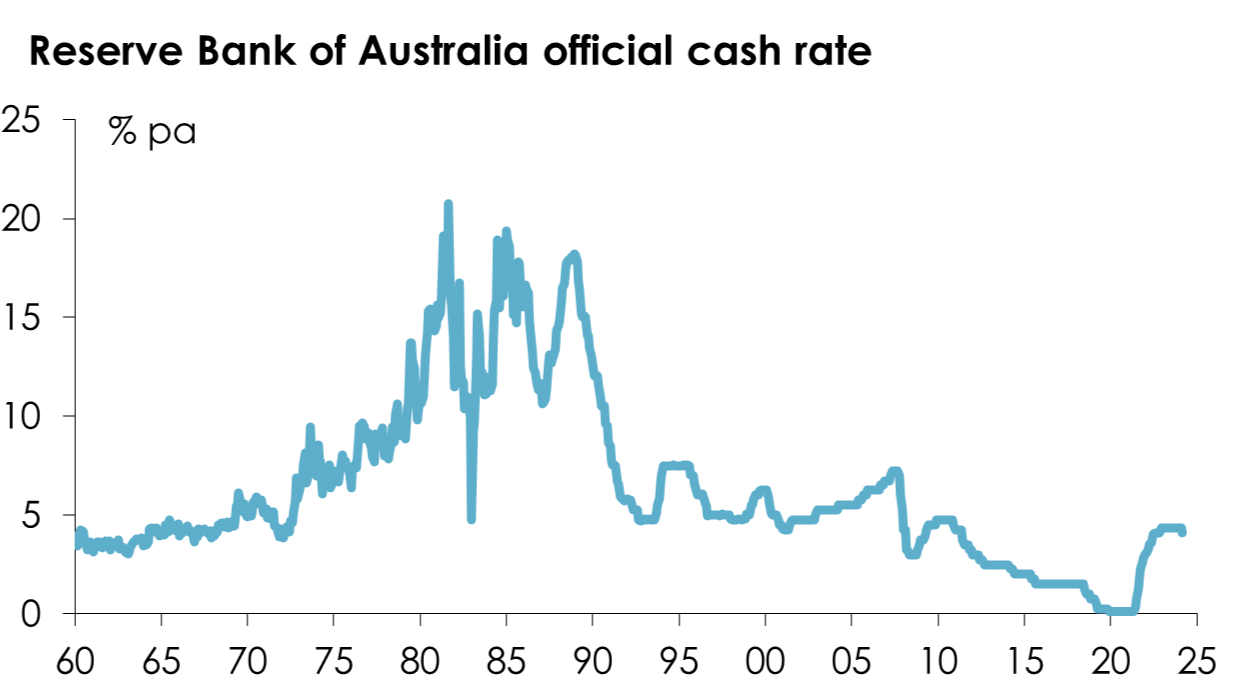

In February 2025, the Reserve Bank of Australia (RBA) slashed the cash rate by 25 basis points to 4.10%, marking the first reduction in over a year. While historically such moves have spurred property market activity, this time the backdrop is far from typical. Simultaneously, escalating global trade tensions—fueled by U.S. tariffs targeting key commodities—have sent shockwaves through Australia’s export-reliant economy. Coal, iron ore, and natural gas, which collectively accounted for over $200 billion in export revenue in 2024, now face uncertain demand, particularly from China, Australia’s largest trading partner.

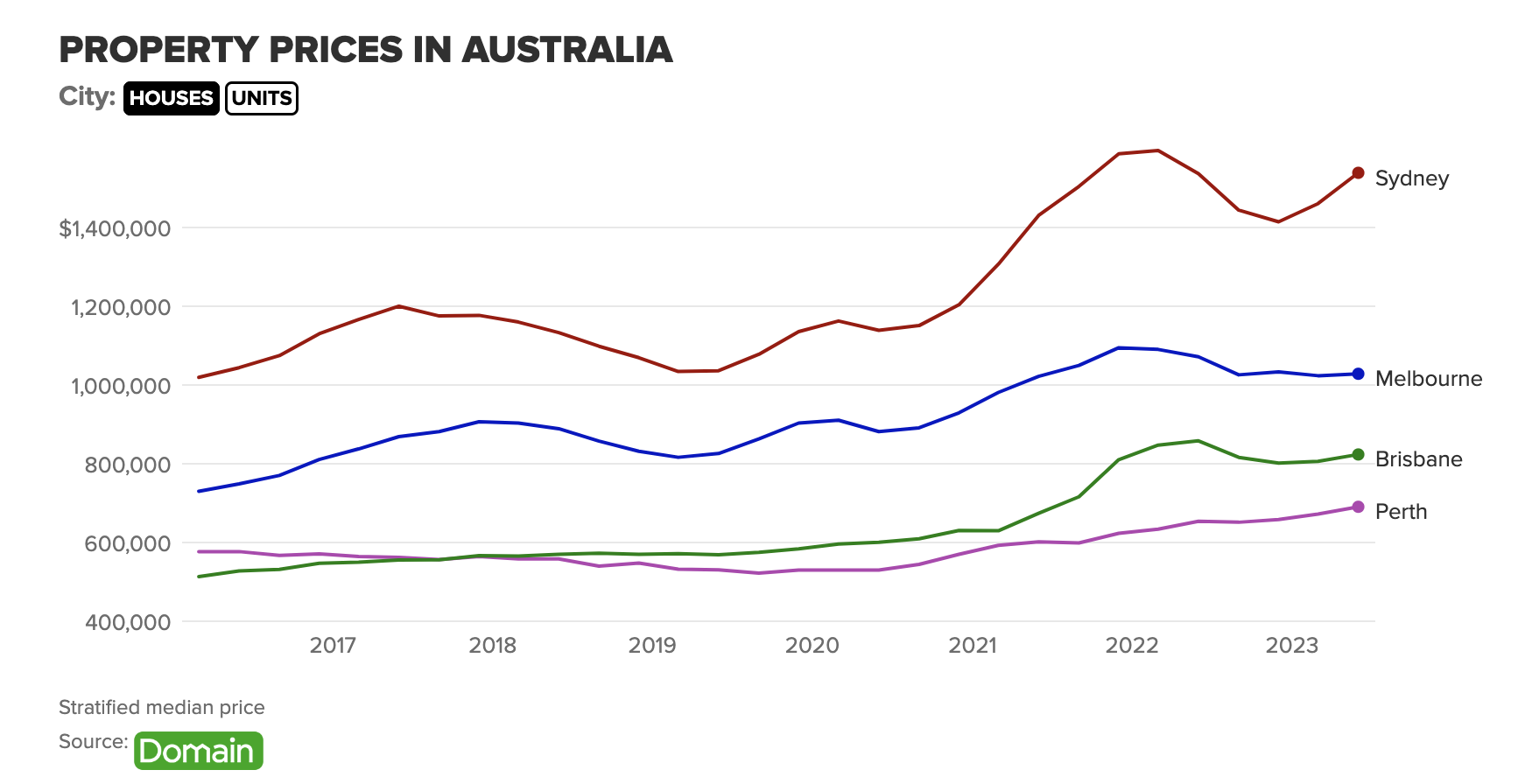

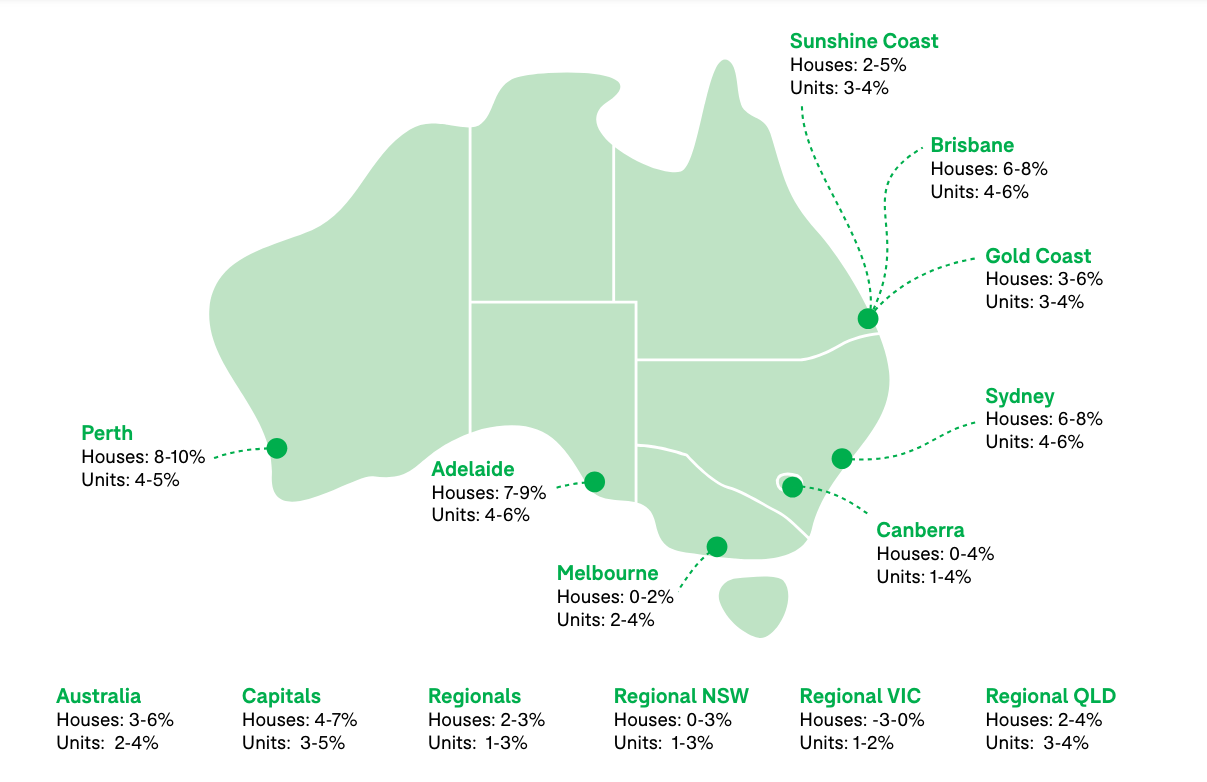

Economist Eleanor Creagh warns that “the interplay between domestic monetary easing and external trade pressures could create unprecedented volatility.” Early indicators suggest a bifurcated market: urban centers like Sydney and Melbourne show resilience, while mining-dependent regions brace for potential downturns. With inflation risks looming and consumer confidence wavering, Australia’s property market stands at a precarious crossroads—its trajectory shaped by forces both local and global.

Image source: linkedin.com

The Role of Rate Cuts in Economic Stimulation

Rate cuts influence economic activity not only by reducing borrowing costs but also by altering the psychological landscape of market participants. This dual

mechanism—economic and behavioral—creates a ripple effect that extends beyond immediate affordability improvements.

At the core, lower interest rates decrease the cost of debt servicing, enabling households and businesses to allocate more resources toward consumption and investment. However, the less visible yet equally critical impact lies in the boost to consumer and investor confidence. Historical data from CoreLogic reveals that during previous rate-cut cycles, national dwelling values increased by an average of 6.1% for every 1% reduction in the cash rate, underscoring the interplay between affordability and sentiment.

“Rate cuts tend to invigorate the market not solely by reducing costs but by rekindling investor sentiment,” notes Eliza Owen, Head of Research at CoreLogic.

This dynamic is particularly pronounced in high-value markets like Sydney and Melbourne, where confidence-driven bidding often amplifies price growth. Yet, the effectiveness of rate cuts is context-dependent. Structural challenges, such as housing supply bottlenecks and regulatory delays, can dampen their impact, as evidenced by Mirvac’s modest 3% increase in new housing starts despite lower financing costs in Q1 2025.

Ultimately, rate cuts act as a catalyst, but their success hinges on complementary fiscal measures and market conditions.

Global Tariffs and Their Impact on Trade

Tariffs disrupt trade dynamics by introducing cost volatility and reshaping supply chains, with cascading effects on dependent industries. In Australia, the imposition of U.S. tariffs on steel and aluminum has amplified input costs for construction and manufacturing, sectors already grappling with supply chain constraints. This cost inflation not only erodes profit margins but also delays project timelines, exacerbating the housing supply shortage.

The mechanism driving these disruptions lies in the tariff’s dual impact: direct cost increases for imported materials and indirect effects on export-dependent industries. For instance, Australia’s reliance on China as a primary export market for commodities like iron ore and coal makes it particularly vulnerable to retaliatory trade measures. A slowdown in Chinese demand, triggered by U.S. tariffs, could reduce export revenues, weakening economic growth and consumer confidence.

“Tariffs create a ripple effect that extends beyond immediate trade relationships, influencing domestic markets in unexpected ways,”

— Dr. Sarah Liu, Trade Economist, University of Sydney.

A nuanced challenge emerges when juxtaposing tariffs with monetary policy. While rate cuts aim to stimulate demand, tariffs inject uncertainty, deterring investment and complicating fiscal planning. This interplay underscores the need for adaptive strategies that mitigate trade-induced risks while leveraging monetary tools effectively.

Impact of Rate Cuts on Australia’s Property Market

The influence of rate cuts on Australia’s property market is neither uniform nor entirely predictable, as it hinges on a complex interplay of economic, regional, and behavioral factors. Historically, rate reductions have catalyzed property price growth, with CoreLogic data showing a 6.1% average increase in national dwelling values for every 1% cut in the cash rate. However, this broad trend masks significant regional and market-specific variations.

In high-value urban markets like Sydney and Melbourne, rate cuts often amplify price growth due to heightened buyer competition and greater leverage sensitivity. For example, a 1% rate cut in Sydney’s affluent Leichhardt suburb has previously driven house values up by 19%, underscoring the disproportionate impact on premium markets. Conversely, resource-dependent regions such as Perth exhibit muted responses, as local economic conditions—like commodity price fluctuations—often overshadow monetary policy shifts.

A critical yet underappreciated factor is the psychological effect of rate cuts. Beyond affordability improvements, lower rates bolster consumer confidence, creating a feedback loop where perceived stability accelerates market activity. This dynamic highlights the necessity for policymakers to consider both quantitative and qualitative impacts when crafting monetary strategies.

Image source: createvic.com.au

Historical Precedents and Current Trends

The uneven impact of rate cuts across Australia’s property market underscores the importance of understanding regional dynamics and psychological factors. While affordability improvements are often cited as the primary driver of market activity, historical data reveals that sentiment and market structure play equally critical roles. For

instance, during the 2013 rate-cut cycle, Sydney’s inner-city neighborhoods experienced a 9% price surge within six months, while regional areas like Townsville saw negligible changes. This divergence highlights how urban markets, characterized by higher leverage and demand density, are more sensitive to monetary policy shifts.

A key mechanism behind this disparity is the amplification of buyer confidence in competitive markets. Lower rates not only reduce borrowing costs but also create a perception of stability, encouraging speculative activity. This phenomenon was evident in 2020 when rate cuts coincided with a 15% increase in auction clearance rates in Melbourne, driven by heightened investor participation.

“The psychological impact of rate cuts often outweighs their direct financial benefits, particularly in high-demand markets,”

— Dr. Michael Yardney, Property Investment Strategist.

However, this dynamic is not without limitations. In resource-dependent regions, external factors such as commodity price volatility can overshadow the effects of rate cuts, dampening their influence. These nuances suggest that policymakers must tailor strategies to address both economic fundamentals and behavioral responses, ensuring balanced market outcomes.

Regional Variations in Property Market Responses

The response of regional property markets to rate cuts is deeply influenced by localized economic conditions, often diverging significantly from urban trends. In resource-dependent areas like Perth, the interplay between commodity price cycles and employment stability frequently overshadows the effects of monetary policy. For instance, while rate cuts improve borrowing affordability, their impact is diluted when local industries face declining export revenues or workforce reductions.

A critical factor is the disparity in market liquidity and buyer behavior. Urban centers such as Sydney and Melbourne exhibit heightened sensitivity to rate adjustments due to their dense populations and higher leverage ratios. In contrast, regional markets prioritize long-term stability, with buyers often constrained by limited access to credit and fewer speculative opportunities. This divergence is particularly evident in towns like Gladstone, Queensland, where recent rate cuts coincided with a 9.2% rise in property values, driven by localized industrial growth rather than broader monetary trends.

“Rate cuts alone cannot stimulate regional markets; their effectiveness depends on complementary factors like employment growth and infrastructure investment,”

— Dr. Sarah Liu, Trade Economist, University of Sydney.

This nuanced dynamic underscores the necessity for policymakers to integrate regional economic strategies with monetary tools, ensuring equitable market stimulation across diverse geographies.

Tariffs and Their Influence on Economic Stability

Tariffs disrupt economic stability by introducing cost volatility and reshaping trade dynamics, often in ways that defy conventional expectations. For instance, the 25% tariff on Australian steel and 10% on aluminum, implemented by the U.S. in March 2025, has already inflated input costs for key industries. According to the Australian Bureau of Statistics, construction material prices surged by 8.3% in Q1 2025, exacerbating housing supply shortages and delaying infrastructure projects.

This inflationary pressure extends beyond direct costs. Tariffs create a cascading effect, where higher import expenses ripple through supply chains, ultimately burdening consumers. Dr. Nerida Conisbee, Chief Economist at Ray White, highlights that “tariffs act as a hidden tax, eroding purchasing power and dampening consumer confidence.” This dynamic complicates monetary policy, as central banks must balance inflation control with economic growth.

A counterintuitive outcome emerges when tariffs inadvertently boost domestic industries. For example, Australian timber exports to Asia rose by 12% in February 2025, as global buyers sought alternatives to U.S.-sourced materials. This underscores the dual-edged nature of tariffs, which can simultaneously destabilize and create opportunities within interconnected economies.

Image source: vocal.media

Tariffs’ Effect on Construction Costs and Housing Supply

Tariffs on imported construction materials, such as steel and aluminum, have introduced a persistent cost burden that extends beyond immediate price increases. These tariffs, averaging 10-25%, have forced developers to reassess project budgets and timelines, with cascading effects on housing supply. For instance, in Sydney, several mid-tier residential projects have reported cost overruns exceeding 12% in Q1 2025, primarily due to the increased expense of sourcing domestic alternatives.

The underlying mechanism is multifaceted. Tariffs not only inflate material costs but also disrupt supply chains, leading to delays in procurement and construction schedules. This dynamic is particularly evident in regions like Brisbane, where developers have faced lead times for structural steel that are 20% longer than pre-tariff periods. Such delays exacerbate housing shortages, as fewer projects reach completion within planned timelines.

“Tariffs create a compounding effect—raising costs while simultaneously slowing supply chain efficiency,”

— Dr. Nerida Conisbee, Chief Economist, Ray White.

While monetary policy tools like rate cuts aim to stimulate demand, they fail to address these structural inefficiencies. The mismatch between reduced borrowing costs and elevated construction expenses underscores a critical limitation in policy responses. This tension highlights the need for integrated strategies that combine fiscal incentives with targeted supply chain interventions, ensuring that housing supply can meet demand without unsustainable cost escalations.

Balancing Inflation and Economic Growth

Tariff-induced cost pressures complicate the delicate balance between inflation control and economic growth, particularly in sectors like construction. When tariffs inflate material costs by 10-25%, they create a lag in the effectiveness of monetary policy. While rate cuts reduce borrowing costs and stimulate demand, they cannot immediately offset the inflationary impact of higher input prices. This disconnect is especially pronounced in housing markets, where developers face both rising costs and extended project timelines due to disrupted supply chains.

A critical factor is the interplay between speculative activity and cautious investment. Lower interest rates often encourage speculative bidding in high-demand areas, yet the hidden inflation from tariffs forces developers to reassess project feasibility. For instance, in regions reliant on imported materials, delays in procurement can extend construction timelines by up to 20%, further exacerbating housing shortages.

“Tariffs create cost volatility that monetary policy alone cannot mitigate,”

— Dr. Sarah Liu, Trade Economist, University of Sydney.

To address these challenges, integrated strategies are essential. Fiscal incentives, such as subsidies for domestic material production, combined with targeted supply chain interventions, can help bridge the gap. This approach ensures that monetary easing translates into tangible economic growth without fueling unsustainable inflation.

Navigating Uncertainty in the Property Market

Australia’s property market in 2025 is a battleground of competing forces, where strategic foresight is paramount. While the Reserve Bank of Australia’s recent rate cut to 4.10% aims to stimulate borrowing, global tariff disruptions are simultaneously inflating construction costs by up to 25%, according to the Australian Bureau of Statistics. This duality forces market participants to recalibrate their approaches.

Investors are increasingly leveraging risk-adjusted return models, prioritizing regions with robust infrastructure pipelines and economic diversification. For instance, Brisbane’s property market, buoyed by a 6% projected growth in 2025, exemplifies how local economies can counterbalance national volatility. Conversely, Melbourne faces a forecasted 1% decline, driven by housing supply constraints and interstate migration trends.

A critical misconception is that rate cuts alone drive market recovery. Instead, market liquidity and supply-demand elasticity play pivotal roles. As Dr. Nerida Conisbee, Chief Economist at Ray White, asserts, “Strategic diversification, not reactionary moves, defines resilience in uncertain times.”

Image source: darkhorsefinancial.com.au

Investor Strategies in a Volatile Environment

In volatile markets, the integration of risk-adjusted return models with localized economic insights has emerged as a critical strategy for property investors. This approach prioritizes regions where infrastructure development and economic diversification mitigate the dual pressures of rate cuts and tariff-induced cost inflation. For instance, Brisbane’s infrastructure pipeline has enabled investors to counterbalance rising construction costs, a challenge exacerbated by tariffs on imported materials.

The underlying mechanism lies in aligning macroeconomic signals, such as monetary easing, with micro-level market dynamics. While rate cuts improve liquidity, their benefits are often diluted by inflationary pressures stemming from disrupted supply chains. Investors who focus solely on borrowing cost reductions risk overlooking these compounding factors. Instead, strategies that incorporate localized metrics—such as employment growth and housing supply elasticity—yield more resilient outcomes.

“Investors must view monetary easing and tariff impacts as parallel forces rather than sequential events,”

— Dr. Sarah Liu, Trade Economist, University of Sydney.

A comparative analysis reveals that regions with robust infrastructure and diversified economies outperform those reliant on single industries. This nuanced approach underscores the importance of blending macroeconomic trends with granular market intelligence, ensuring that investment decisions remain adaptive to evolving conditions.

Long-term Implications for Homebuyers and Investors

The interplay between rate cuts and tariff-induced cost pressures creates a complex environment for homebuyers and investors, where affordability gains are often counterbalanced by structural challenges. While lower interest rates enhance borrowing capacity, their long-term effectiveness is undermined by rising construction costs and supply chain disruptions, particularly in regions reliant on imported materials.

A critical dynamic lies in the timing and scale of these opposing forces. Rate cuts typically boost buyer sentiment and market liquidity, but tariffs inflate material costs, delaying project completions and constraining housing supply. For instance, data from the Australian Bureau of Statistics highlights a 12% increase in construction costs in tariff-affected sectors during Q1 2025, directly impacting housing affordability.

“The long-term winners will be those who align monetary easing with strategies that mitigate supply-side constraints,”

— Dr. Sarah Liu, Trade Economist, University of Sydney.

Investors are increasingly adopting region-specific strategies, focusing on areas with robust infrastructure and diversified economies. This approach minimizes exposure to tariff-related risks while leveraging the benefits of rate cuts. However, the effectiveness of such strategies depends on policymakers addressing supply-side inefficiencies, ensuring that monetary stimulus translates into sustainable market growth.

FAQ

How do rate cuts influence borrowing capacity and property affordability in Australia’s housing market?

Rate cuts directly enhance borrowing capacity by reducing interest rates, allowing buyers to secure larger loans with lower monthly repayments. This improvement in affordability opens access to previously unattainable property markets, particularly in high-demand urban areas. According to Confidence Finance, a 0.25% rate cut can increase borrowing power by approximately 2.5%, with a 1% reduction potentially boosting it by 10%. Additionally, lower rates stimulate buyer confidence, driving demand and competition. However, affordability gains may be tempered by rising construction costs, influenced by tariffs on imported materials, which can offset the benefits of reduced borrowing costs in certain regions.

What are the direct and indirect impacts of tariffs on construction costs and housing supply in 2025?

Tariffs on imported construction materials, such as steel and aluminum, directly increase costs for developers, inflating project budgets by up to 25%. Indirectly, these tariffs disrupt supply chains, causing procurement delays and extending construction timelines. This exacerbates Australia’s housing supply shortage, with completions falling short of targets by 25.2% in 2024. Rising costs also deter new developments, further constraining supply. Additionally, higher material expenses are often passed on to buyers, driving up property prices. These compounded effects highlight the critical need for policy interventions to stabilize costs and ensure timely project completions amidst ongoing global trade tensions.

How do global trade tensions and monetary policy shifts interact to shape Australia’s property market trends?

Global trade tensions, driven by tariffs, elevate construction costs and disrupt supply chains, creating inflationary pressures that challenge monetary policy effectiveness. Simultaneously, rate cuts by the Reserve Bank of Australia aim to stimulate borrowing and market activity, yet their impact is diluted by rising costs and economic uncertainty. This interaction creates a duality where affordability gains from lower rates are offset by higher material expenses, particularly in urban markets. Additionally, weakened export revenues from trade disruptions reduce consumer confidence, further complicating property market dynamics. Policymakers must balance these forces to stabilize housing trends and support sustainable economic growth.

What strategies can investors adopt to navigate the dual pressures of rate cuts and tariff-induced cost inflation?

Investors can mitigate the dual pressures by focusing on regions with robust infrastructure pipelines and diversified economies, which are less vulnerable to tariff-induced cost inflation. Leveraging risk-adjusted return models allows for better alignment of borrowing benefits from rate cuts with localized market conditions. Prioritizing investments in areas with strong employment growth and housing demand elasticity can offset rising construction costs. Additionally, partnering with developers utilizing domestic materials or innovative supply chain solutions can reduce exposure to tariff-related disruptions. Diversifying portfolios across multiple property types and geographies further enhances resilience against the unpredictable interplay of monetary and trade policy shifts.

How do regional property markets in Australia respond differently to the combined effects of rate cuts and tariffs?

Regional property markets in Australia exhibit varied responses to the interplay of rate cuts and tariffs, shaped by local economic conditions. Urban centers like Sydney and Melbourne, with high leverage ratios and dense demand, benefit significantly from rate cuts, driving price growth despite tariff-induced cost pressures. Conversely, resource-dependent regions such as Perth experience muted impacts, as commodity price volatility and employment trends overshadow monetary policy benefits. In areas like Adelaide, steady market dynamics buffer against these dual forces. Tailored strategies addressing regional disparities, such as infrastructure investment and localized fiscal policies, are essential to balance these contrasting market responses.