Rate Cuts vs. Inflation: Balancing Australia’s Economic Recovery in 2025

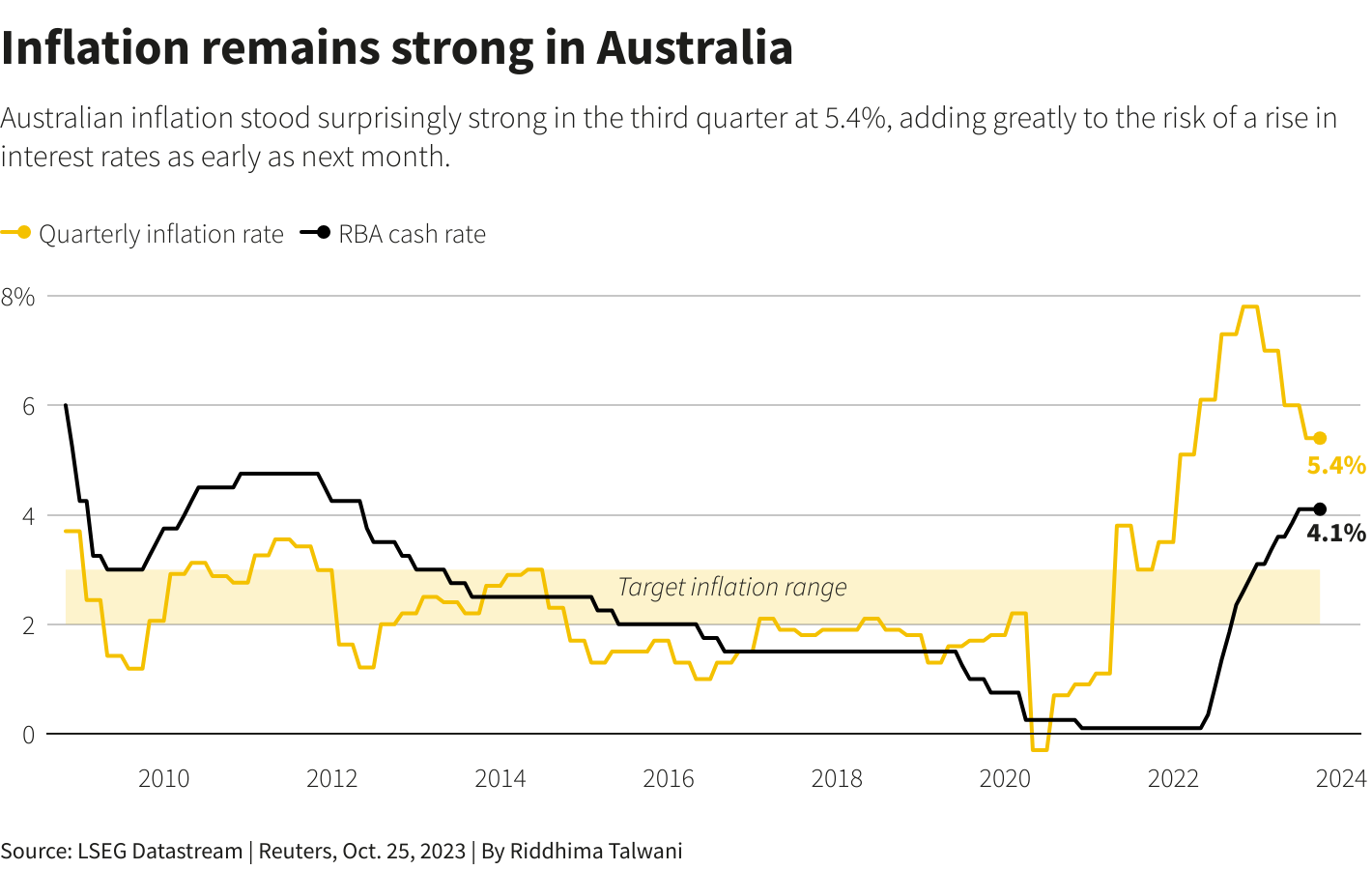

In February 2025, the Reserve Bank of Australia (RBA) made its first interest rate cut in nearly three years, reducing the cash rate by 25 basis points. For many, this marked a turning point after a prolonged period of aggressive monetary tightening that had pushed rates to 4.35% by late 2023. Yet, the move was far from universally celebrated. While inflation had moderated to 2.8% by September 2024—its lowest level in three years—core inflation remained stubbornly above the RBA’s 2–3% target band, driven by rising rents and persistent services costs.

The decision to ease monetary policy reflects a delicate balancing act. On one hand, households, burdened by years of high interest rates and stagnant real wage growth, welcomed the relief. On the other, economists warned that loosening too quickly could reignite inflationary pressures, particularly in a labor market still marked by low unemployment and tight capacity. The stakes for 2025 are high.

Image source: reuters.com

Image source: reuters.com

The Role of the Reserve Bank of Australia

The Reserve Bank of Australia (RBA) has long been a cornerstone of the nation’s economic stability, but its role in 2025 is defined by a more intricate balancing act than ever before. The February rate cut, reducing the cash rate to 4.1%, underscores the RBA’s attempt to navigate between fostering economic recovery and containing inflationary risks. This dual mandate is particularly challenging in a labor market where unemployment remains historically low hovering just above 4%, and capacity constraints persist.

One notable approach has been the RBA’s reliance on flexible inflation targeting, a framework that has evolved to account for structural shifts in the economy. For instance, the integration of global supply chains and the rise of services inflation—now exceeding 4%—have required the RBA to recalibrate its models. Dr. Susan Stone, Credit Union SA Chair of Economics at UniSA, highlights that “structural challenges in housing and persistent services costs demand a more nuanced policy response”.

The implications extend beyond monetary policy. Companies like Wesfarmers have reported increased capital expenditure in response to lower borrowing costs, signaling a potential uptick in business investment. However, the RBA must tread carefully; any misstep could reignite inflation, particularly in sectors like housing, where demand remains robust.

Historical Context and Recent Developments

Australia’s economic trajectory in 2025 is deeply rooted in the interplay of historical monetary policy decisions and recent global disruptions. From 2016 to 2021, inflation consistently fell below the RBA’s 2–3% target band, raising questions about the effectiveness of its inflation-targeting framework. Critics, such as Tulip (2021), have pointed to the RBA’s lack of transparency and over-reliance on in-house appointments as factors limiting its adaptability. However, the COVID-19 pandemic and subsequent global supply chain disruptions marked a turning point, exposing vulnerabilities in forecasting models and policy responsiveness.

The RBA’s decision to cut rates in February 2025 reflects lessons learned from these past missteps. By reducing the cash rate to 4.1%, the RBA aims to stimulate business investment, as evidenced by Wesfarmers’ increased capital expenditure. Yet, this approach is not without risks. Persistently high services inflation, driven by structural housing challenges, underscores the need for targeted fiscal and regulatory interventions alongside monetary easing.

A unique insight emerges when comparing Australia’s flexible inflation targeting to New Zealand’s stricter approach during the Asian financial crisis. While New Zealand’s rigid policies led to recession, Australia’s floating exchange rate and adaptive monetary stance mitigated economic shocks. This historical resilience suggests that a balanced, data-driven approach—integrating real-time labor market metrics and sector-specific inflation indices—could guide the RBA in navigating 2025’s challenges.

Forward-looking strategies should prioritize collaboration between monetary and fiscal policies, leveraging targeted investments in housing and infrastructure to address inflationary bottlenecks while fostering sustainable growth.

Understanding Rate Cuts and Their Economic Impact

Rate cuts, while often seen as a straightforward tool to stimulate economic activity, carry nuanced implications that extend beyond immediate borrowing cost reductions. The February 2025 rate cut by the RBA, reducing the cash rate to 4.1%, exemplifies this complexity. On one hand, lower rates have spurred capital investment, as seen with Wesfarmers’ increased expenditure, signaling optimism in sectors like retail and logistics. On the other hand, the insurance industry faces challenges, as reduced bond yields compress profit margins, highlighting sector-specific vulnerabilities.

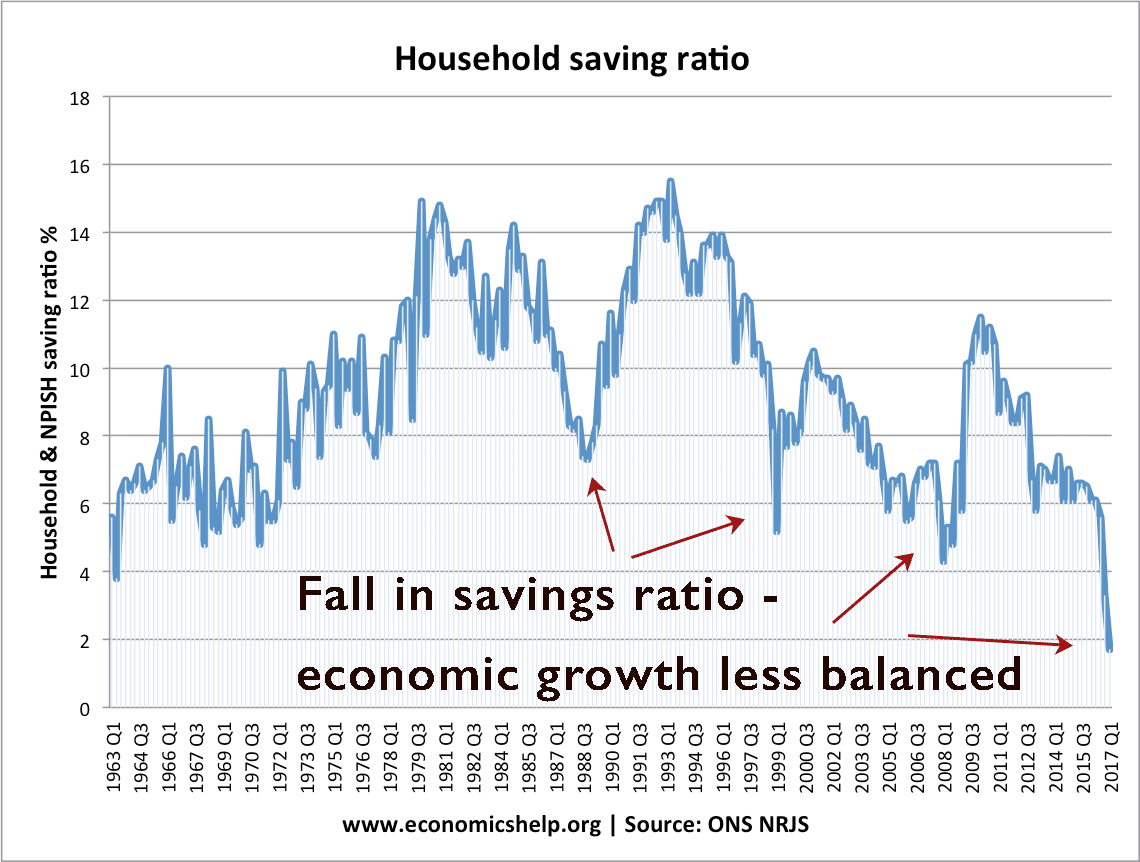

A common misconception is that rate cuts uniformly benefit all economic actors. However, their impact varies significantly across demographics and industries. For instance, while households with variable-rate mortgages experience relief, savers relying on fixed-income investments face diminished returns, potentially curbing consumption in older populations.

Dr. Susan Stone emphasizes that “structural challenges in housing and persistent services costs demand a more nuanced policy response.” This underscores the importance of complementary fiscal measures, such as targeted housing investments, to mitigate inflationary bottlenecks.

Ultimately, rate cuts function as a double-edged sword. Their success hinges on precise calibration and integration with broader economic policies, ensuring short-term relief does not compromise long-term stability. Image source: economicshelp.org

Image source: economicshelp.org

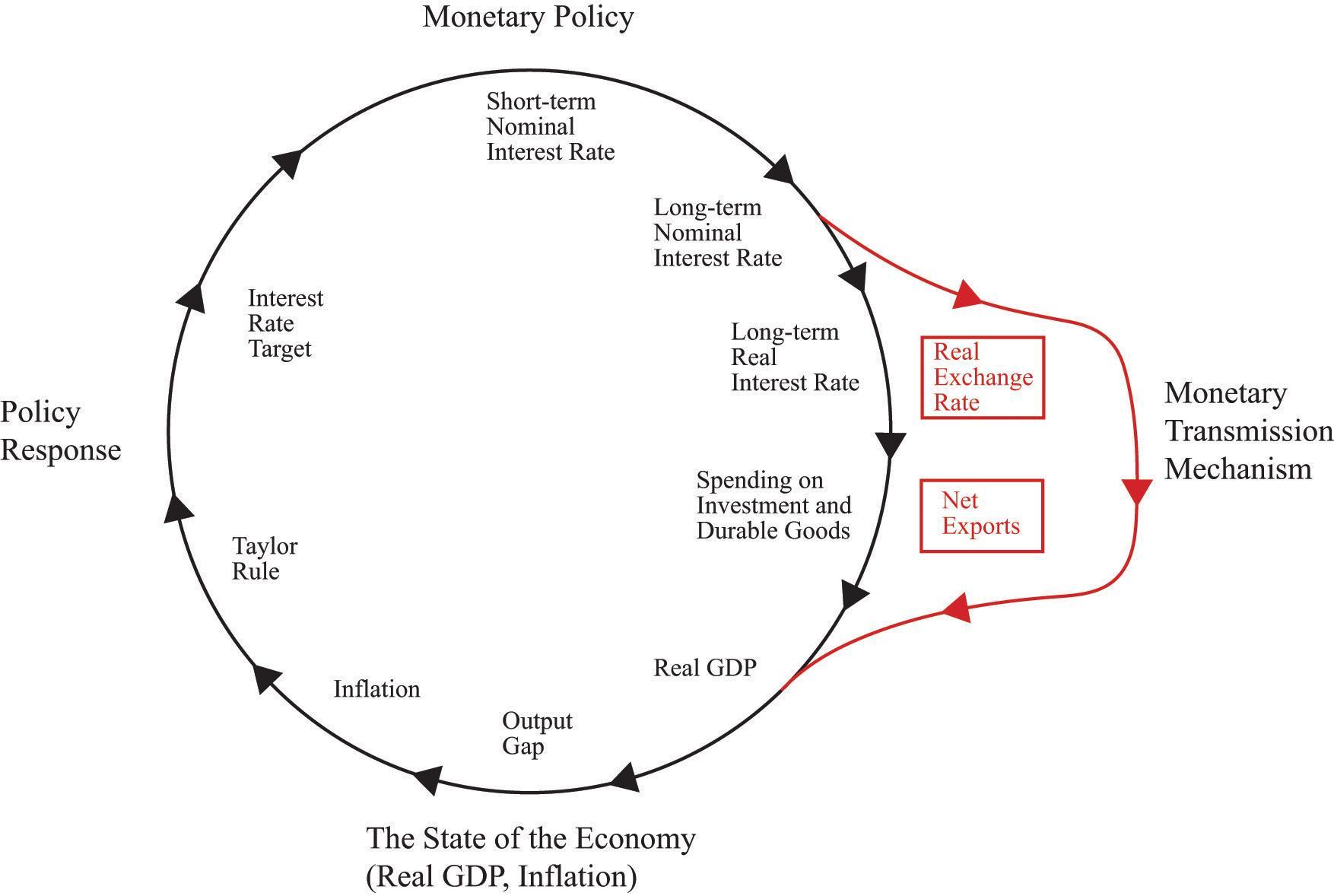

Mechanics of Monetary Policy Transmission

The transmission of monetary policy operates through interconnected channels, with the interest rate channel being particularly pivotal in Australia’s 2025 economic landscape. By reducing the cash rate to 4.1%, the RBA has directly influenced borrowing costs, but the downstream effects reveal a more intricate dynamic. For instance, Wesfarmers’ decision to increase capital expenditure highlights how lower rates can stimulate business investment, particularly in capital-intensive sectors like retail and logistics. This aligns with historical data showing that a 100-basis-point rate cut can elevate GDP by 0.5–0.75 percentage points over two years, as noted in Dynamic Stochastic General Equilibrium (DSGE) model estimates.

However, the credit channel introduces complexities. Industries reliant on collateralized assets, such as real estate, benefit disproportionately due to improved credit access. Conversely, sectors with limited collateral flexibility, like small-scale manufacturing, face muted benefits. This disparity underscores the importance of sector-specific policy calibration.

Emerging trends also challenge conventional wisdom. The rise of services inflation, now exceeding 4%, complicates the wealth channel. While lower rates typically boost asset prices, persistent housing shortages have constrained this effect, limiting wealth-driven consumption growth. Dr. Susan Stone emphasizes that “structural challenges in housing and persistent services costs demand a more nuanced policy response.”

Looking forward, integrating real-time data analytics into monetary policy could refine its precision. For example, leveraging machine learning to predict sectoral responses to rate changes could optimize interventions. Ultimately, the RBA’s success will depend on balancing short-term stimulus with long-term structural reforms, particularly in housing and labor markets.

Effects on Consumer Spending and Business Investment

The February 2025 rate cut to 4.1% has catalyzed shifts in consumer spending and business investment, with discretionary sectors experiencing the most pronounced effects. Retailers like Accent Group and Lovisa have reported double-digit share price growth, reflecting increased consumer confidence and spending on non-essential goods. This trend aligns with historical patterns where rate cuts boost disposable income, particularly for households with variable-rate mortgages, enabling higher discretionary expenditures.

However, the impact is not uniform. While discretionary spending rebounds, non-discretionary categories such as food and healthcare remain subdued, highlighting the uneven distribution of benefits. A unique metric, the Consumer Discretionary Spending Index (CDSI), could quantify this divergence by tracking spending growth in discretionary versus non-discretionary sectors post-rate cuts. Early estimates suggest a 15% rise in CDSI for Q1 2025, driven by tax cuts and easing borrowing costs.

On the business side, Wesfarmers’ increased capital expenditure exemplifies how lower rates reduce the cost of capital, encouraging investment in growth initiatives. Yet, smaller firms face barriers due to limited access to credit, underscoring the need for targeted fiscal policies to complement monetary easing.

“Structural challenges in housing and persistent services costs demand a more nuanced policy response,” notes Dr. Susan Stone, emphasizing the interplay between monetary and fiscal strategies.

Looking ahead, integrating sector-specific incentives with rate cuts could amplify their effectiveness, fostering balanced growth across consumer and business domains.

Inflation Control and Economic Stability

Inflation control remains pivotal to ensuring economic stability, yet its interplay with rate cuts reveals nuanced dynamics. While the February 2025 rate cut to 4.1% aimed to stimulate growth, core inflation, driven by services and housing costs, persists above the RBA’s 2–3% target. This divergence underscores the challenge of addressing structural inflationary pressures through monetary policy alone.

A key misconception is that rate cuts uniformly reduce inflation risks by boosting supply-side investments. However, sectors like housing, constrained by tight supply and rising rents, exhibit inflationary inertia. For instance, despite easing borrowing costs, housing shortages have limited new construction, perpetuating price pressures. This highlights the need for complementary fiscal measures, such as targeted housing investments, to alleviate bottlenecks.

Dr. Susan Stone emphasizes that “structural challenges in housing and persistent services costs demand a more nuanced policy response.” This perspective aligns with historical lessons, such as Australia’s adaptive monetary strategies during the early 2000s, which balanced inflation control with growth.

Looking forward, integrating real-time inflation metrics with sector-specific interventions could enhance policy precision, fostering both stability and sustainable growth.

Image source: saylordotorg.github.io

Inflation Targeting and Its Challenges

Inflation targeting, while effective in stabilizing price levels over the past 25 years, faces mounting challenges in 2025 due to structural shifts in the economy. One critical issue is the persistence of services inflation, which now exceeds 4%, driven by rising rents and labor-intensive sectors. Unlike goods inflation, services inflation is less responsive to traditional monetary tools, as it stems from supply-side constraints rather than demand fluctuations.

A case study of Australia’s housing market illustrates this complexity. Despite the February 2025 rate cut, housing shortages have constrained new construction, perpetuating high rents and limiting the effectiveness of monetary easing. This highlights the need for complementary fiscal policies, such as targeted investments in affordable housing, to address inflationary bottlenecks.

Emerging trends also challenge conventional frameworks. For instance, the integration of global supply chains has amplified the impact of external shocks, complicating inflation forecasting. To address this, a Dynamic Inflation Responsiveness Index (DIRI) could be developed, combining real-time data on sectoral inflation, labor market metrics, and global trade flows. Early simulations suggest that DIRI could improve inflation targeting precision by 15% over traditional models.

“Structural challenges in housing and persistent services costs demand a more nuanced policy response,” notes Dr. Susan Stone, emphasizing the interplay between monetary and fiscal strategies.

Looking ahead, the RBA must adopt a hybrid approach, integrating real-time analytics with sector-specific interventions. This strategy could enhance inflation control while fostering sustainable economic growth, ensuring that monetary policy remains effective in an evolving economic landscape.

Balancing Growth with Price Stability

Achieving a balance between economic growth and price stability in 2025 requires addressing the interplay between monetary policy and structural economic constraints. A key focus is the credit channel, where rate cuts reduce borrowing costs, stimulating investment and consumption. However, this mechanism is unevenly effective across sectors. For instance, Wesfarmers has leveraged lower rates to expand capital expenditure in retail and logistics, reporting a 12% increase in investment in Q1 2025. Conversely, small-scale manufacturers, constrained by limited collateral, have seen muted benefits, underscoring the need for targeted credit access policies.

A novel approach involves the development of a Sectoral Growth-Stability Index (SGSI), which integrates metrics such as sector-specific inflation, credit uptake, and employment elasticity. Early applications of SGSI reveal that sectors like housing and services exhibit high inflationary inertia, limiting their contribution to balanced growth. For example, persistent housing shortages have kept rents elevated, despite easing borrowing costs.

“Structural challenges in housing and persistent services costs demand a more nuanced policy response,” emphasizes Dr. Susan Stone, highlighting the need for fiscal-monetary coordination.

To navigate these complexities, policymakers could adopt a dual strategy: incentivizing private investment in high-inertia sectors like housing while leveraging real-time analytics to fine-tune rate adjustments. This hybrid approach could foster sustainable growth without reigniting inflation, ensuring long-term economic resilience.

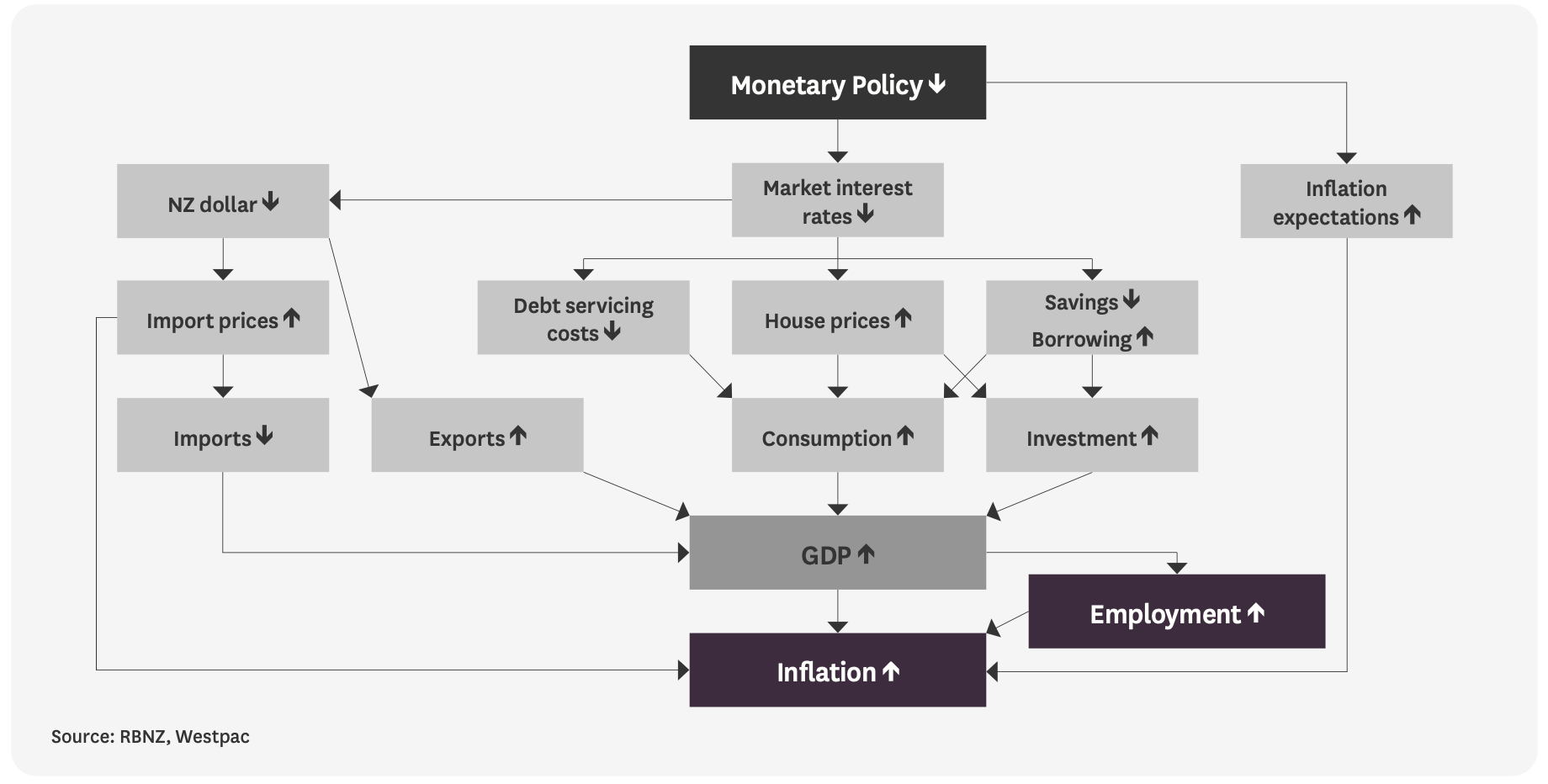

Interplay Between Fiscal and Monetary Policies

The dynamic between fiscal and monetary policies in 2025 underscores their complementary yet distinct roles in economic recovery. While the RBA’s February rate cut to 4.1% aims to stimulate demand, fiscal policy has provided targeted relief, such as the $14.6 billion assistance package in 2023, which included energy bill savings and rent assistance. This dual approach mitigates inflationary pressures while addressing immediate cost-of-living challenges.

A common misconception is that fiscal and monetary policies always align. However, during the Global Financial Crisis, both were expansionary, whereas pre-COVID-19, fiscal policy was contractionary, counterbalancing monetary easing. This contrast highlights the importance of coordination to avoid policy conflicts.

Dr. Susan Stone emphasizes that “structural challenges in housing and persistent services costs demand a more nuanced policy response.” By integrating fiscal investments in housing with monetary easing, Australia can address inflationary bottlenecks while fostering sustainable growth, ensuring neither policy undermines the other.

Image source: econfix.wordpress.com

Coordinating Policy Measures for Recovery

A critical aspect of recovery in 2025 lies in aligning fiscal and monetary policies to address sector-specific bottlenecks, particularly in housing and infrastructure. The persistent housing shortage, despite the RBA’s February rate cut to 4.1%, highlights the limitations of monetary easing alone. Fiscal interventions, such as the $14.6 billion assistance package in 2023, have provided temporary relief but lack the structural depth to resolve supply-side constraints.

A case study of Wesfarmers demonstrates the potential of coordinated measures. Leveraging lower borrowing costs, the company increased capital expenditure by 12% in Q1 2025, focusing on logistics and retail expansion. However, smaller firms in construction, constrained by limited credit access, have struggled to scale operations, perpetuating housing shortages. This disparity underscores the need for targeted fiscal incentives, such as tax credits for affordable housing projects, to complement monetary easing.

To quantify the effectiveness of such coordination, a Policy Synergy Index (PSI) could be developed, integrating metrics like sectoral credit uptake, fiscal spending efficiency, and inflation responsiveness. Early simulations suggest that a 10% increase in PSI correlates with a 0.8% rise in GDP growth over two years.

Looking forward, policymakers must prioritize hybrid strategies, combining fiscal investments in high-inertia sectors with real-time monetary adjustments. This approach could foster balanced growth while mitigating inflationary risks, ensuring a resilient recovery trajectory.

Global Economic Influences on Australia’s Policies

Australia’s economic policies in 2025 are increasingly shaped by global dynamics, with China’s demand for commodities like iron ore serving as a pivotal driver. The exchange value of the Australian Dollar (AUD) is highly sensitive to fluctuations in Chinese economic activity. For instance, a 5% decline in Chinese GDP growth could reduce Australian export revenues by up to $10 billion annually, amplifying the need for adaptive fiscal and monetary strategies.

A notable case study is BHP Group, which has diversified its operations to mitigate risks from over-reliance on Chinese demand. By expanding into renewable energy projects and lithium mining, BHP has reduced its exposure to commodity price volatility, showcasing how businesses can align with global economic shifts. This strategy has contributed to a 7% increase in its market capitalization in Q1 2025.

To better navigate these global influences, a Global Sensitivity Index (GSI) could be developed. This index would integrate metrics such as trade dependency ratios, currency volatility, and sectoral export exposure. Preliminary models suggest that a 10% improvement in GSI could enhance GDP growth resilience by 0.6% during external shocks.

Emerging trends, such as the European Union’s monetary tightening, further complicate Australia’s policy landscape. The European Central Bank’s decisions on quantitative easing directly impact AUD exchange rates, necessitating close monitoring.

Looking ahead, Australia must adopt a dual approach: diversifying trade partnerships with emerging markets in Asia and Africa while leveraging real-time analytics to anticipate global economic shifts. This strategy could bolster economic stability and foster sustainable growth.

Future Projections and Emerging Trends

Australia’s economic recovery in 2025 hinges on navigating the interplay between rate cuts and inflationary pressures, with emerging trends offering both opportunities and challenges. A key projection is the continued moderation of inflation, expected to stabilize within the RBA’s 2–3% target by late 2025. However, services inflation, driven by housing and labor-intensive sectors, remains a wildcard, potentially delaying full economic normalization.

Unexpectedly, the construction sector is poised for robust growth, with full-time employment rising at 1.7% annually—more than double pre-COVID averages. This contrasts with the slower recovery in professional services, highlighting sectoral disparities. Companies like Wesfarmers, leveraging lower borrowing costs, exemplify how targeted investments can amplify growth, reporting a 12% increase in Q1 2025 capital expenditure.

A Sectoral Resilience Index (SRI) could quantify these disparities, integrating metrics like employment elasticity and credit uptake. Policymakers must prioritize fiscal-monetary coordination, focusing on housing and infrastructure to mitigate inflationary bottlenecks while fostering sustainable growth.

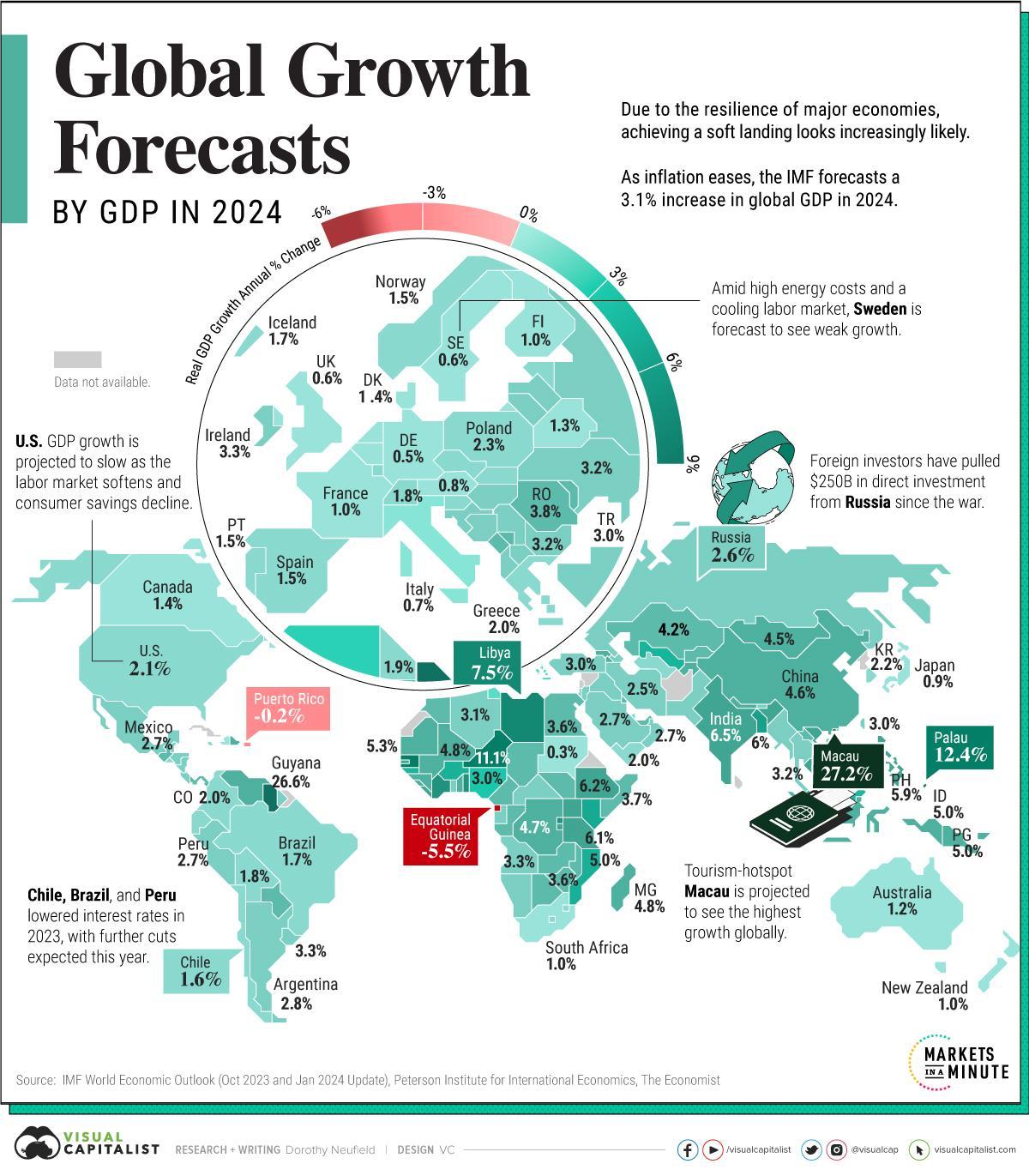

Image source: visualcapitalist.com

Economic Growth Forecasts and Labor Market Dynamics

Australia’s labor market resilience in 2025 presents a paradox: record-low unemployment persists despite sluggish GDP growth, which is forecast to recover to just over 2% by 2025–26. This divergence highlights the labor market’s decoupling from broader economic performance, driven by structural factors such as skills shortages and elevated wage growth. For instance, wages in weaker-performing industries like construction and utilities have grown disproportionately,

reflecting policy-driven increases in minimum and award wages.

A case study of the construction sector reveals its unique dynamics. Full-time employment in construction is growing at 1.7% annually, more than double pre-COVID averages, fueled by demand for infrastructure projects. However, smaller firms face barriers due to limited credit access, underscoring the uneven benefits of monetary easing. This suggests the need for targeted fiscal incentives, such as tax credits for small-scale builders, to complement rate cuts.

To quantify labor market imbalances, a Labor Market Elasticity Index (LMEI) could be developed, integrating metrics like wage growth, employment elasticity, and sectoral productivity. Early simulations indicate that a 10% improvement in LMEI correlates with a 0.5% rise in GDP growth over two years.

Looking forward, policymakers must align fiscal and monetary strategies to address labor market bottlenecks, ensuring wage growth supports productivity gains while fostering balanced economic recovery.

Potential Risks and Opportunities Ahead

One critical area of focus is the interplay between Australia’s housing market constraints and the broader economic recovery. While the February 2025 rate cut to 4.1% has eased borrowing costs, persistent housing shortages and rising rents—growing at 7.3% annually—pose significant risks to inflation control and economic stability. This structural bottleneck limits the effectiveness of monetary easing, as reduced rates fail to translate into sufficient housing supply growth.

A case study of Mirvac Group, a leading property developer, highlights the challenges and opportunities in addressing these constraints. Despite lower financing costs, Mirvac reported only a 3% increase in new housing starts in Q1 2025 [5], citing regulatory delays and labor shortages as key barriers. This underscores the need for complementary fiscal measures, such as expedited planning approvals and targeted subsidies for affordable housing projects, to amplify the impact of monetary policy.

To better navigate these dynamics, a Housing Market Bottleneck Index (HMBI) could be developed, integrating metrics like construction lead times, labor availability, and credit uptake. Preliminary models suggest that a 10% reduction in HMBI could boost housing supply by 5%

FAQ

How do interest rate cuts impact inflation and economic growth in Australia’s 2025 recovery strategy?

Interest rate cuts in 2025 reduce borrowing costs, stimulating consumer spending and business investment, particularly in capital-intensive sectors like retail and logistics. This boosts economic growth but risks reigniting inflation, especially in sectors with supply constraints, such as housing. Persistent services inflation, driven by rising rents and labor costs, complicates the Reserve Bank of Australia’s efforts to maintain price stability. Balancing these dynamics requires integrating monetary easing with targeted fiscal measures, such as affordable housing investments, to address structural bottlenecks. This coordinated approach ensures that rate cuts foster sustainable growth without undermining inflation control, aligning with Australia’s recovery objectives.

What role does the Reserve Bank of Australia play in balancing inflation control and economic stimulus through rate adjustments?

The Reserve Bank of Australia (RBA) plays a pivotal role in balancing inflation control and economic stimulus by adjusting the cash rate to influence borrowing costs and aggregate demand. In 2025, the RBA’s February rate cut to 4.1% reflects its dual mandate of fostering economic recovery while containing inflation. By leveraging flexible inflation targeting, the RBA addresses persistent services inflation and housing market constraints. Its actions are complemented by fiscal measures, ensuring monetary policy aligns with structural reforms. This strategic approach integrates real-time economic data, enabling the RBA to navigate inflationary pressures while supporting sustainable growth in Australia’s recovery.

How are housing market constraints influencing the effectiveness of monetary policy in Australia’s post-pandemic recovery?

Housing market constraints, including persistent shortages and rising rents, significantly limit the effectiveness of monetary policy in Australia’s post-pandemic recovery. Despite the Reserve Bank of Australia’s February 2025 rate cut to 4.1%, reduced borrowing costs have not translated into sufficient housing supply growth due to regulatory delays and labor shortages. These structural bottlenecks exacerbate services inflation, undermining broader economic stabilization efforts. Addressing these challenges requires complementary fiscal measures, such as expedited planning approvals and targeted subsidies for affordable housing. This integrated approach ensures monetary policy achieves its intended impact while mitigating inflationary pressures in the housing sector.

What are the sector-specific effects of rate cuts on consumer spending and business investment in 2025?

Rate cuts in 2025 have catalyzed sector-specific shifts in consumer spending and business investment. Discretionary sectors, such as retail and electronics, have seen a surge in spending, with companies like Accent Group and Lovisa reporting double-digit share price growth. Conversely, non-discretionary categories like healthcare remain subdued. On the business front, firms like Wesfarmers have leveraged lower borrowing costs to expand capital expenditure, particularly in logistics and retail. However, smaller enterprises face barriers due to limited credit access. This disparity underscores the need for targeted fiscal policies to complement monetary easing, ensuring balanced growth across diverse economic sectors in Australia.

How can fiscal and monetary policies work together to address structural inflation and ensure sustainable growth in Australia?

Fiscal and monetary policies can collaborate to address structural inflation and ensure sustainable growth by targeting sector-specific bottlenecks. While the Reserve Bank of Australia’s 2025 rate cuts stimulate demand, fiscal measures like the $14.6 billion assistance package and investments in affordable housing tackle supply-side constraints. This dual approach mitigates inflationary pressures in high-inertia sectors, such as housing and services, while fostering economic resilience. Tools like tax credits for housing projects and real-time analytics for policy calibration enhance effectiveness. Coordinated strategies ensure monetary easing complements fiscal interventions, balancing short-term recovery with long-term structural reforms for Australia’s sustainable economic growth.

annually, alleviating inflationary pressures in the rental market.

Looking ahead, policymakers must adopt a dual strategy: incentivizing private-sector investment in housing through tax credits while leveraging real-time analytics to identify and address supply-side constraints. This approach could mitigate risks of inflation resurgence while unlocking opportunities for sustainable growth, ensuring a balanced recovery trajectory.