Building A Property Portfolio In Australia On An Average Salary

In 2018, Ricky Chiu, a Melbourne-based IT professional earning an average salary, purchased his first investment property in Ballarat, a regional city often overlooked by investors chasing metropolitan growth. Five years later, his portfolio had grown to $3.5 million, spanning multiple properties across regional and suburban markets. Chiu’s success wasn’t the result of windfalls or extraordinary risk-taking but a disciplined approach to financial planning, strategic borrowing, and meticulous market research. His story challenges the pervasive myth that property investment in Australia is reserved for high-income earners.

For many Australians, the idea of building a property portfolio on an average salary feels unattainable, constrained by rising property prices and stagnant wage growth. Yet, as Chiu’s case illustrates, the right combination of tax strategies, market insights, and financial discipline can unlock opportunities that seem out of reach. The key lies in understanding how to make the system work for you.

Image source: bambooroutes.com

Why Property Investment Is Accessible For The Average Earner

One critical yet underexplored factor enabling average earners to invest in property is the strategic use of equity leverage. By leveraging the equity in an existing property, investors can fund deposits for additional purchases without relying solely on savings. This approach accelerates portfolio growth while minimizing upfront financial strain. For instance, an investor in a high-yield regional area like Townsville could use rising property values, driven by post-mining recovery, to unlock equity and reinvest in another growth-focused suburb.

Another key enabler is the tax advantages available to property investors. Negative gearing, for example, allows investors to offset property-related losses against taxable income, improving cash flow and reducing financial pressure. Additionally, capital gains tax concessions for long-term ownership further enhance returns, making property a more viable option compared to other asset classes.

To maximize these benefits, investors should adopt a data-driven approach. Tools like CoreLogic or HtAG Analytics can identify undervalued suburbs with strong growth potential, ensuring informed decisions. By combining equity leverage, tax strategies, and precise market research, average earners can sustainably scale their portfolios, challenging the misconception that property investment is exclusive to high-income earners.

Key Factors Defining Australia’s Real Estate Market

A pivotal yet often overlooked factor shaping Australia’s real estate market is the impact of infrastructure development. Suburbs undergoing significant infrastructure upgrades—such as new transport links, schools, or hospitals—frequently experience a 10–15% price uplift within five years, as revealed by CoreLogic data. This growth stems from increased accessibility and enhanced livability, which attract both buyers and renters.

For example, Geelong’s transformation post-2010 demonstrates how improved transport connectivity to Melbourne spurred demand, driving both capital growth and rental yields. Investors who identified this trend early capitalized on substantial returns, highlighting the importance of aligning property acquisitions with infrastructure timelines.

Another critical yet lesser-known influence is government policy. Initiatives like the Housing Accord aim to address supply shortages, but delays in implementation can create short-term opportunities for investors to benefit from constrained markets. Monitoring policy developments ensures investors remain agile and informed.

To navigate these dynamics, investors should integrate predictive analytics into their strategy. Tools that analyze infrastructure projects and demographic shifts can pinpoint emerging hotspots. By leveraging these insights, investors can position themselves for long-term success in a rapidly evolving market.

Fundamentals Of Financial Planning

Effective financial planning is the cornerstone of building a property portfolio on an average salary. A disciplined approach begins with setting SMART financial goals—specific, measurable, achievable, relevant, and time-bound. For instance, a couple earning $120,000 annually could save $30,000 in two years by automating 20% of their income into a high-interest account, as demonstrated in a Simply Wealth Group case study.

A critical yet underappreciated step is accounting for hidden costs. Beyond deposits and mortgage repayments, investors must budget for maintenance, vacancies, and unexpected expenses. Tools like PocketSmith can help track these variables, ensuring cash flow stability.

Another key insight is the importance of lifestyle inflation control. Redirecting salary increases toward savings rather than discretionary spending accelerates deposit accumulation. This contrasts with the common misconception that higher income alone guarantees investment readiness.

Finally, leveraging professional advice—from financial planners to tax specialists—ensures alignment with market conditions and tax benefits, such as negative gearing. This structured approach transforms financial planning into a launchpad for sustainable portfolio growth.

Image source: stockhead.com.au

Establishing A Realistic Budget For Investment

A realistic investment budget is not merely a financial constraint—it’s a strategic tool that aligns resources with long-term goals. The foundation lies in accurately estimating total cost of ownership (TCO). Beyond the purchase price, TCO includes stamp duty, legal fees, insurance, maintenance, and potential vacancy periods. For example, a $400,000 property in Adelaide’s outer suburbs may incur an additional $20,000–$30,000 in upfront costs, underscoring the need for precise calculations.

One overlooked factor is the buffer for contingencies. Experts recommend setting aside 5–10% of the property value to cover unexpected repairs or market downturns. This proactive measure prevents financial strain and ensures liquidity during challenging periods.

To optimize cash flow, focus on positive cash flow properties. These generate surplus rental income after expenses, creating a self-sustaining investment. For instance, properties in high-demand regional areas often outperform metropolitan counterparts in rental yield, offering a practical entry point for average earners.

Finally, leveraging digital tools like Rentastic or PocketSmith enhances budget tracking, enabling real-time adjustments and fostering disciplined financial management. This approach transforms budgeting into a dynamic, forward-looking process.

Optimizing Savings And Managing Expenses

A critical yet underutilized strategy for optimizing savings is the automation of financial discipline. By setting up automatic transfers of a fixed percentage of income into a high-interest savings account, individuals can eliminate the temptation to overspend. For instance, allocating 20% of monthly earnings to a dedicated property fund ensures consistent progress toward deposit goals without relying on willpower.

Another overlooked aspect is expense categorization. Using tools like PocketSmith or YNAB (You Need A Budget), investors can identify discretionary spending patterns and redirect funds toward investment objectives. For example, reallocating $200 monthly from non-essential subscriptions to savings can accelerate deposit accumulation by $2,400 annually.

A lesser-known but impactful approach is leveraging tax-efficient savings vehicles. Salary sacrificing into superannuation or utilizing offset accounts linked to home loans can reduce taxable income while simultaneously building wealth. This dual benefit enhances cash flow and long-term financial stability.

Finally, adopting a zero-based budgeting framework ensures every dollar is assigned a purpose, minimizing waste. This disciplined approach not only optimizes savings but also fosters a mindset of intentional financial management, positioning investors for sustainable portfolio growth.

Strategic Borrowing And Financing

Strategic borrowing transforms property investment from a capital-intensive endeavor into an accessible pathway for average earners. A key tactic is leveraging interest-only loans during the initial years of ownership. This approach minimizes repayments, freeing cash flow for reinvestment or unexpected costs. For example, an investor with a $400,000 property could save $5,000 annually compared to a principal-and-interest loan, enabling faster portfolio expansion.

Another underappreciated strategy is debt recycling. By converting non-deductible debt, such as a home loan, into tax-deductible investment debt, investors can optimize their financial structure. This method not only reduces taxable income but also accelerates wealth accumulation.

A common misconception is that higher borrowing equates to higher risk. However, loan-to-value ratio (LVR) management mitigates this. Maintaining an LVR below 80% avoids lender’s mortgage insurance (LMI) and provides a safety buffer against market fluctuations.

Finally, partnering with a specialist mortgage broker ensures access to tailored financing solutions, enhancing both flexibility and scalability.

Image source: simplywealthgroup.com.au

Understanding Borrowing Capacity And Loan Structures

Borrowing capacity is not static; it evolves with financial behavior, market conditions, and loan structuring choices. A critical yet underutilized approach is optimizing the loan-to-value ratio (LVR). By maintaining an LVR below 80%, investors avoid lender’s mortgage insurance (LMI), preserving capital for future investments. For instance, a $500,000 property with a 20% deposit saves approximately $10,000 in LMI costs, which can be redirected toward property improvements or additional purchases.

Another advanced tactic is leveraging offset accounts. These accounts reduce interest payable on loans by offsetting the loan balance with deposited funds. For example, a $50,000 offset balance on a $400,000 loan at 5% interest saves $2,500 annually, enhancing cash flow without altering repayment schedules.

Cross-collateralization, while common, often limits flexibility. Instead, structuring loans individually for each property ensures independent equity access and reduces risk exposure. This approach is particularly effective when paired with debt recycling, converting personal debt into tax-deductible investment debt.

Finally, understanding lender-specific policies—such as income assessment criteria or acceptable income streams—can significantly influence borrowing outcomes. Partnering with a mortgage broker ensures alignment with lenders offering favorable terms, maximizing both borrowing capacity and portfolio scalability.

Leveraging Tax Benefits Like Negative Gearing

A nuanced yet impactful aspect of negative gearing is its ability to offset non-property-related income, such as salaries, creating a cascading tax advantage. For instance, an investor incurring a $15,000 annual loss on a negatively geared property can reduce taxable income by the same amount. For high-income earners in the 37% tax bracket, this translates to a $5,550 tax saving, effectively subsidizing the property’s holding costs.

However, the true power of negative gearing lies in its synergy with capital gains tax (CGT) concessions. Properties held for over 12 months qualify for a 50% CGT discount, amplifying long-term profitability. This dual benefit incentivizes investors to prioritize high-growth assets, even if they generate short-term losses.

A lesser-known factor is the role of depreciation schedules. Claiming depreciation on assets like fixtures or structural elements can further reduce taxable income. For example, a $10,000 depreciation claim could yield an additional $3,700 in tax savings for high earners.

To maximize these benefits, investors should consult tax specialists to tailor strategies, ensuring alignment with evolving regulations and individual financial goals. This proactive approach transforms tax liabilities into wealth-building opportunities.

Property Selection And Market Research

Effective property selection hinges on aligning investment goals with market dynamics. A critical yet overlooked insight is the importance of demographic alignment. For instance, a family-oriented suburb with strong school zones may favor three-bedroom homes over studio apartments, ensuring consistent demand and rental stability. Tools like CoreLogic can identify such demographic trends, enabling data-driven decisions.

Another key factor is infrastructure-led growth. Suburbs with planned transport upgrades or commercial developments often experience significant value appreciation. For example, Perth’s rail expansions boosted nearby property values by 15%, underscoring the transformative impact of accessibility improvements.

Challenging the misconception that metropolitan areas always outperform, regional markets like Ballarat demonstrate higher rental yields due to lower entry costs and stable employment hubs. This balance of yield and growth potential offers a compelling alternative for average earners.

To mitigate risks, investors should adopt a layered research approach: combine macroeconomic data with on-ground insights, such as vacancy rates and local employment trends. This comprehensive strategy ensures informed, resilient property acquisitions.

Image source: ironfish.com.au

Identifying Growth Areas And Rental Hotspots

Pinpointing growth areas and rental hotspots requires a multi-dimensional analysis that goes beyond surface-level trends. One critical yet underutilized factor is the role of employment hubs. Areas with diverse industries—such as Newcastle, which balances mining, education, and healthcare—tend to exhibit stable rental demand and reduced vacancy risks. This diversification acts as a buffer against economic downturns, ensuring consistent returns.

Another overlooked aspect is seasonal demand fluctuations. For instance, coastal towns like Byron Bay experience rental surges during peak tourist seasons, offering short-term profitability but requiring careful cash flow management during off-peak periods. Investors can mitigate this by blending such properties with year-round rental markets.

Emerging technologies, such as AI-driven platforms like CoreLogic, now enable investors to predict suburb growth with precision. These tools analyze variables like infrastructure projects, population growth, and rezoning plans, identifying undervalued areas poised for appreciation.

To act effectively, investors should adopt a tiered research framework: prioritize suburbs with low vacancy rates, track government infrastructure plans, and consult local property managers. This approach not only identifies hotspots but also positions portfolios for long-term resilience.

Tools And Techniques For Data-Driven Decisions

A pivotal yet underexplored tool for data-driven decisions is predictive analytics. By leveraging machine learning algorithms, platforms like MRI Software can forecast property value trends, rental demand, and market shifts. For example, analyzing historical data alongside real-time metrics enables investors to anticipate suburb growth trajectories, reducing reliance on outdated or anecdotal information.

One effective technique is geospatial analysis. Tools such as GIS (Geospatial Information Systems) overlay demographic, infrastructure, and zoning data onto interactive maps, revealing hidden opportunities like underutilized land near planned transport hubs. This approach connects property selection with urban planning, ensuring alignment with long-term growth patterns.

A lesser-known but impactful strategy involves customized KPIs. Tracking metrics like cash-on-cash return or time-on-market provides granular insights into portfolio performance. For instance, automated KPI dashboards can highlight underperforming assets, prompting timely adjustments.

To maximize these tools, investors should integrate cross-verified data sources—such as ABS statistics and local council plans—into their analysis. This layered methodology not only enhances decision accuracy but also positions investors to capitalize on emerging trends with confidence and precision.

Scaling And Diversifying Your Portfolio

Scaling a property portfolio requires balancing growth-focused investments with cash-flow stability. A practical approach is leveraging equity from high-growth properties to fund acquisitions in high-yield regional markets. For instance, an investor in Sydney could unlock $200,000 in equity from a metropolitan property to purchase two positively geared properties in Townsville, ensuring both capital growth and immediate cash flow.

Diversification extends beyond geography. Combining residential and commercial assets mitigates risk. For example, while residential properties offer steady demand, commercial investments like retail spaces provide higher yields but require longer tenant leases. This balance creates resilience against market-specific downturns.

A common misconception is that diversification dilutes returns. However, studies show that portfolios blending urban and regional properties outperform single-market investments by 15% over five years, as noted in Simply Wealth Group’s insights.

To scale effectively, adopt a dynamic rebalancing strategy: reassess asset performance quarterly, reinvest in underperforming sectors, and align with evolving market trends. This ensures sustainable growth and adaptability.

Mitigating Risks Through Regional And Metropolitan Mix

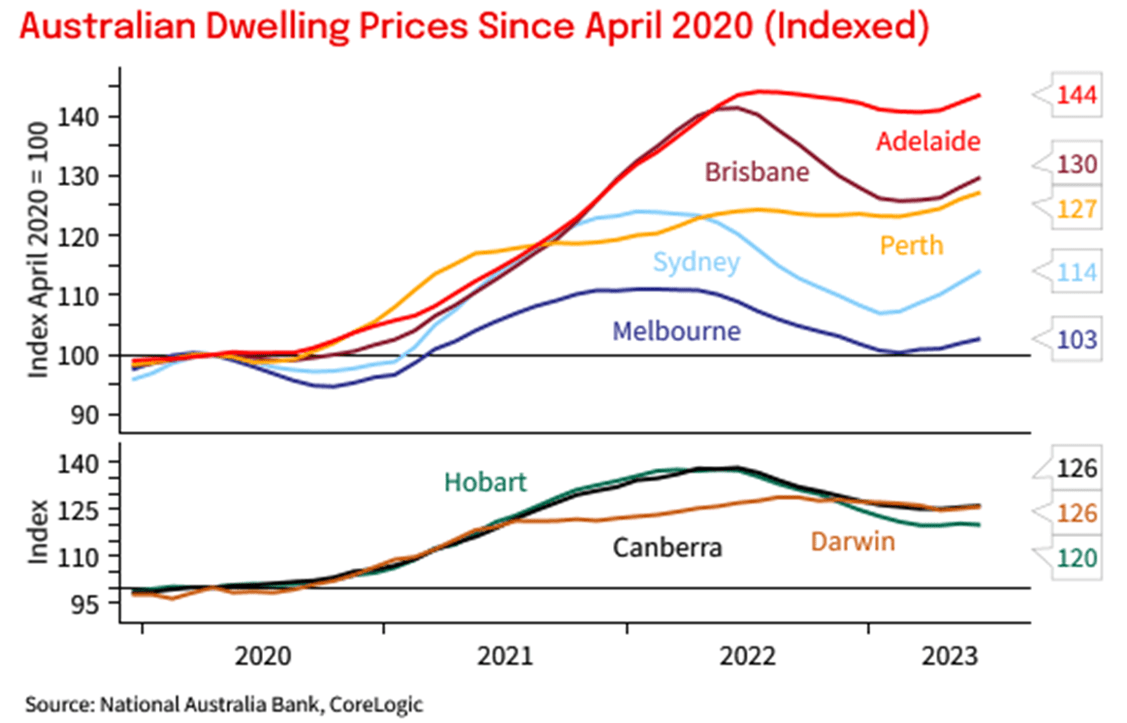

Balancing regional and metropolitan investments mitigates risks by leveraging their complementary strengths. Regional properties often deliver higher rental yields due to lower entry costs and strong tenant demand in employment hubs like Ballarat, where vacancy rates remain below 2%. Conversely, metropolitan areas, such as Sydney or Melbourne, typically offer superior capital growth driven by population density and infrastructure development.

A lesser-known factor is the counter-cyclicality of these markets. Regional areas often remain stable during metropolitan downturns, providing a financial buffer. For instance, during the 2020 pandemic, regional markets like Geelong outperformed major cities, as remote work trends increased demand for affordable housing outside urban centers.

To optimize this mix, investors should adopt a tiered allocation strategy: allocate 60% of capital to metropolitan properties for growth and 40% to regional assets for yield. Tools like CoreLogic can identify suburbs with low vacancy rates and upcoming infrastructure projects, ensuring data-driven decisions.

This approach not only diversifies income streams but also positions portfolios to weather economic fluctuations, creating a resilient foundation for long-term growth.

Long-Term Management And Expansion Strategies

A critical yet underutilized strategy for long-term portfolio management is the active reallocation of underperforming assets. By periodically reviewing property performance metrics—such as rental yield, capital growth, and vacancy rates—investors can identify stagnating properties and reallocate equity to higher-growth opportunities. For example, reallocating funds from a property in a saturated metropolitan market to a regional area with emerging infrastructure can boost returns by up to 15% within two years, as noted in Simply Wealth Group’s insights.

Another advanced approach is leveraging portfolio segmentation. By categorizing properties based on their primary function—cash flow generation, capital growth, or equity leverage—investors can tailor strategies for each segment. For instance, high-yield properties can fund maintenance or reinvestment, while growth-focused assets build long-term wealth.

A lesser-known factor influencing expansion is credit optimization. Maintaining a strong credit profile and diversifying lenders reduces dependency on a single institution, enhancing borrowing capacity. Tools like borrowing capacity calculators can help align credit strategies with expansion goals.

By integrating these techniques, investors can create a dynamic, adaptable portfolio that evolves with market conditions, ensuring sustainable growth and resilience over time.

FAQ

What are the essential steps to start building a property portfolio in Australia on an average salary?

To begin, define clear financial goals, such as prioritizing rental income or capital growth. Assess financial health by evaluating savings, income, and borrowing capacity, ensuring alignment with investment objectives. Conduct thorough market research using tools like CoreLogic to identify high-demand areas with growth potential. Leverage equity from existing properties or savings to fund deposits strategically. Incorporate tax benefits like negative gearing to optimize cash flow. Engage professionals, including mortgage brokers and financial advisors, to tailor strategies and navigate complexities. Finally, adopt a disciplined approach to budgeting, accounting for hidden costs and contingencies, ensuring sustainable portfolio growth on an average salary.

How can average earners leverage equity to expand their property investments effectively?

Average earners can unlock equity by refinancing properties with increased market value, using the funds as deposits for new investments. This approach amplifies purchasing power without requiring significant cash savings. Maintaining a loan-to-value ratio (LVR) below 80% avoids lender’s mortgage insurance, preserving capital. Strategic equity recycling enables reinvestment in high-growth or high-yield areas, balancing portfolio diversification. Tools like offset accounts can further optimize cash flow by reducing interest costs. Partnering with mortgage brokers ensures tailored loan structures, while regular property revaluations identify untapped equity. This disciplined strategy accelerates portfolio expansion while minimizing financial strain for average earners.

What role do tax benefits like negative gearing and depreciation play in property investment strategies?

Tax benefits like negative gearing and depreciation significantly enhance property investment strategies by improving cash flow and reducing taxable income. Negative gearing allows investors to offset property-related losses against other income, lowering tax liabilities and supporting long-term asset holding. Depreciation schedules enable deductions for wear and tear on property structures and assets, further boosting cash flow. These benefits incentivize investments in high-growth areas, even with short-term losses, while capital gains tax concessions reward long-term ownership. Engaging tax advisors ensures compliance and maximizes deductions, aligning tax strategies with financial goals to make property investment viable for average earners in Australia.

How do regional and metropolitan property markets compare for portfolio diversification and risk management?

Regional markets offer affordability and higher rental yields, making them ideal for cash flow-focused strategies, while metropolitan areas provide superior capital growth due to population density and infrastructure development. Regional properties, like those in Ballarat, often exhibit resilience during economic downturns, balancing the volatility of metropolitan markets. Diversifying across both markets mitigates risks by leveraging their complementary strengths. A strategic allocation, such as 60% in metropolitan growth assets and 40% in high-yield regional properties, ensures stability and scalability. Tools like CoreLogic and demographic analysis help identify opportunities, enabling average earners to build resilient, diversified portfolios with balanced risk exposure.

What tools and techniques can help identify high-growth areas and maximize returns on a limited budget?

Tools like CoreLogic and HtAG Analytics provide data-driven insights into high-growth areas by analyzing vacancy rates, rental yields, and infrastructure developments. Geospatial analysis through GIS tools reveals opportunities near planned transport hubs or employment centers. Predictive analytics platforms, such as MRI Software, forecast suburb growth trajectories, reducing reliance on anecdotal data. Techniques like demographic alignment ensure property features match local demand, enhancing rental stability. Budget-conscious investors can focus on emerging suburbs with affordable entry points and strong growth drivers, such as infrastructure upgrades. Combining these tools and techniques maximizes returns while optimizing limited budgets for sustainable portfolio growth.