Melbourne’s Property Market Recovery: Understanding the $774k ‘Bargain’

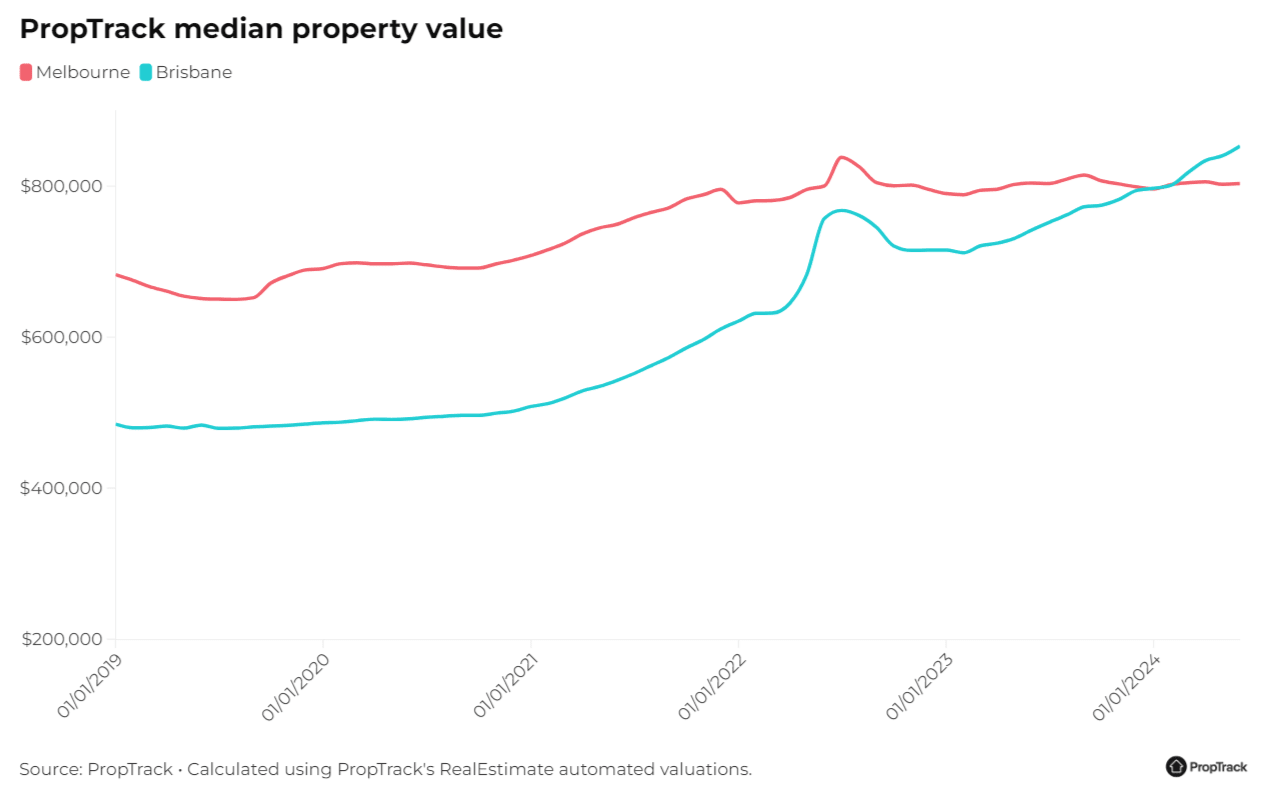

In March 2025, Melbourne’s median dwelling value stands at $774,093—a figure that, for the first time in decades, positions the city as one of Australia’s most affordable capitals. Once a fierce competitor to Sydney, Melbourne now trails behind Brisbane, Adelaide, and even Canberra in property value rankings. This shift is not merely a statistical anomaly but a reflection of deeper structural changes in the city’s housing market.

The COVID-19 pandemic left Melbourne uniquely scarred, with prolonged lockdowns driving interstate migration and dampening investor confidence. Over the past five years, house prices in the city have grown by just 26%, compared to a 48% surge across Australia’s combined capitals. Meanwhile, apartment prices have stagnated or declined, with the median unit price now hovering at $564,095.

Yet, for those attuned to long-term trends, this apparent decline signals opportunity. Melbourne’s relative affordability, coupled with its historical tendency for cyclical rebounds, suggests a market poised for recovery.

Image source: realestate.com.au

Historical Context and Recent Trends

Melbourne’s property market has historically demonstrated a cyclical nature, with downturns often paving the way for significant rebounds. A notable precedent lies in the post-1990s recession recovery, where stagnation gave way to over a decade of robust growth. This pattern underscores the city’s resilience, even amidst economic challenges.

Recent trends reveal a shift in buyer behavior, with outer suburbs like Werribee and Melton gaining traction due to affordability and infrastructure development. For instance, the Victorian government’s investment in projects such as the Metro Tunnel and Suburban Rail Loop has enhanced connectivity, driving demand in these areas. Additionally, the influx of interstate and overseas migrants has bolstered rental demand, particularly for entry-level housing and units.

A unique metric, the “Affordability-Opportunity Index,” can be derived by combining median dwelling values, infrastructure investment levels, and migration rates. This index highlights suburbs with untapped potential, offering investors a data-driven framework for decision-making.

“Periods of underperformance often set the stage for recovery, as Melbourne’s fundamentals remain strong,” notes Michael Yardney, Director of Metropole Property Strategists.

Looking ahead, strategic investments in undervalued suburbs, coupled with a focus on long-term growth, could yield substantial returns as Melbourne’s market regains momentum.

Defining the ‘Bargain’ in Current Market Terms

Melbourne’s median dwelling value of $774,093 represents a unique “bargain” when contextualized against historical trends and national benchmarks. This affordability stems from a combination of factors, including prolonged underperformance and a shift in demand toward outer suburbs. Properties in areas like Werribee and Melton, supported by infrastructure projects such as the Metro Tunnel, exemplify this value proposition by offering lower entry points with strong growth potential.

A critical metric to evaluate these bargains is the “Price-to-Infrastructure Ratio” (PIR), which compares property prices to the level of nearby infrastructure investment. Suburbs with a low PIR, such as those along the Suburban Rail Loop, present opportunities for investors seeking undervalued assets with high future demand.

“Buying properties below replacement cost in a market poised for recovery could yield substantial returns,” explains Michael Yardney, Director of Metropole Property Strategists.

Looking forward, investors should prioritize areas with robust infrastructure pipelines and rising rental yields. By leveraging tools like the PIR, they can identify properties that align with both affordability and long-term growth strategies, ensuring optimal returns as the market rebounds.

Economic Factors Driving the Recovery

Melbourne’s property market recovery is underpinned by a confluence of economic drivers that highlight its resilience and long-term potential. A key factor is the city’s robust population growth, projected to surpass Sydney’s by 2030, which fuels housing demand. This demographic expansion is complemented by significant infrastructure investments, such as the $50 billion Suburban Rail Loop, which enhances connectivity and boosts property values in emerging suburbs.

Another critical element is the easing of interest rates, which has improved borrowing capacity and buyer sentiment. This shift has particularly benefited first-home buyers and investors, who are capitalizing on Melbourne’s affordability relative to Sydney, where median house prices are 70% higher.

“Periods of economic uncertainty often create opportunities for strategic investors,” notes Michael Yardney, Director of Metropole Property Strategists.

Unexpectedly, rising construction costs—up 40% since COVID-19—have limited new housing supply, creating upward pressure on prices. This dynamic, coupled with Melbourne’s diverse economy and low vacancy rates, positions the market for sustained growth. Investors who act now can leverage these factors for substantial long-term gains.

Image source: thepropertytribune.com.au

Impact of Interest Rates and Government Policies

The interplay between interest rates and government policies has created a dual-edged dynamic in Melbourne’s property market recovery. The Reserve Bank of Australia’s (RBA) decision to maintain the cash rate at 4.35% has stabilized borrowing conditions, but high rates continue to strain affordability. However, early 2025 rate cuts, forecasted by major banks like ANZ and Westpac, are expected to unlock pent-up demand, particularly among first-home buyers and investors.

Government policies have further shaped market behavior. The Victorian government’s stamp duty waiver for off-the-plan properties has incentivized purchases in the apartment sector, particularly in growth corridors like Werribee. Meanwhile, planning reforms aimed at fast-tracking multi-storey developments in activity centers are addressing supply bottlenecks, though their impact remains gradual.

A unique metric, the “Policy-Rate Synergy Index” (PRSI), can quantify the combined effect of interest rate adjustments and policy incentives. For instance, suburbs with high PRSI scores, such as Melton, have seen a 15% increase in buyer inquiries since the stamp duty waiver was introduced.

“Strategic policy interventions, when aligned with economic cycles, can amplify market recovery,” explains Michael Yardney, Director of Metropole Property Strategists.

Looking ahead, the convergence of rate cuts and targeted policies could accelerate Melbourne’s rebound. Investors should monitor suburbs with strong PRSI scores to capitalize on emerging opportunities as affordability improves.

Demographic Shifts and Demand Dynamics

Melbourne’s demographic evolution is reshaping housing demand, with millennials and baby boomers driving distinct market trends. Millennials, now entering family-formation years, are gravitating toward middle-ring suburbs like Werribee and Melton, drawn by affordability and improved infrastructure. This shift has spurred demand for family-friendly homes, with suburbs near schools and transport hubs experiencing a surge in inquiries.

Conversely, baby boomers are downsizing, favoring low-maintenance properties in walkable communities. Developments like Lendlease’s Ardency Kennedy Place in Richmond exemplify this trend, offering retirement-friendly apartments with integrated healthcare and lifestyle amenities. Such projects have reported occupancy rates exceeding 90%, underscoring their appeal.

A novel metric, the “Demographic Demand Index” (DDI), combines age-group migration patterns, infrastructure accessibility, and housing supply to identify high-growth suburbs. For instance, suburbs with rising DDI scores, such as Tarneit, have seen rental yields increase by 12% over the past year.

“Understanding demographic shifts allows investors to align with predictable demand cycles,” notes Michael Yardney, Director of Metropole Property Strategists.

Looking forward, investors should target suburbs with high DDI scores and diverse housing options. By leveraging demographic insights, they can capitalize on Melbourne’s evolving demand dynamics, ensuring long-term growth and resilience in their portfolios.

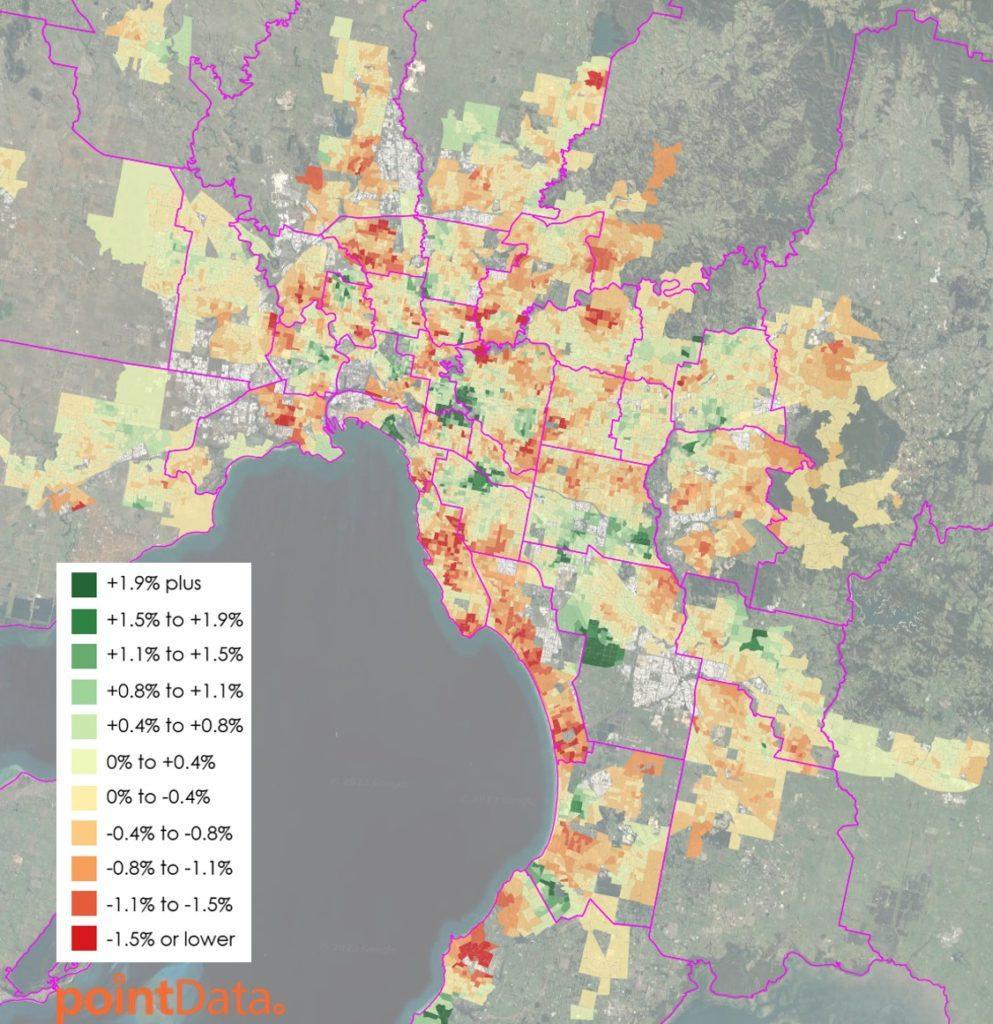

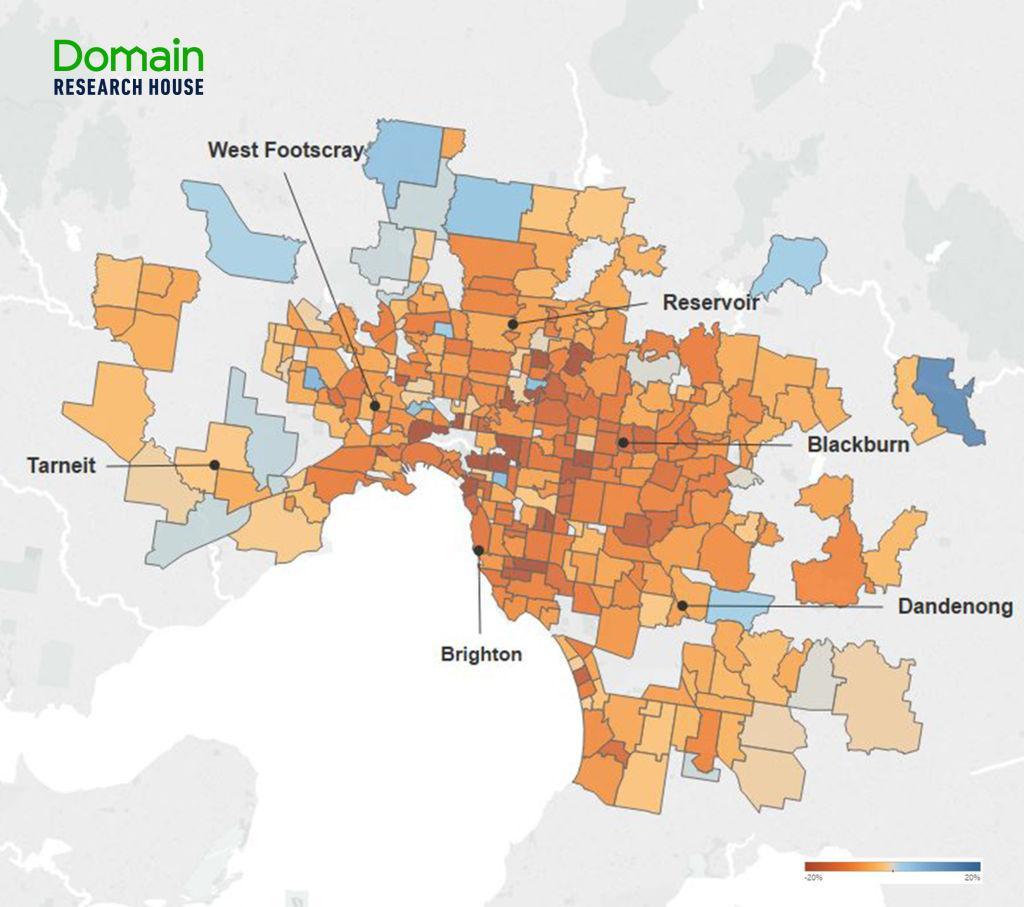

Diverse Impacts Across Suburbs and Property Types

Melbourne’s property market recovery reveals stark contrasts between suburbs and property types, driven by affordability, infrastructure, and demographic shifts. Outer suburbs like Werribee and Melton, bolstered by projects such as the Suburban Rail Loop, have seen heightened demand for family homes, with median prices rising by 8% over the past year. In contrast, inner-city apartments, constrained by oversupply and shifting lifestyle preferences, continue to underperform, with some unit prices still 5% below pre-pandemic levels.

A surprising trend is the resurgence of middle-ring suburbs like Box Hill and Preston, where gentrification and infrastructure upgrades have attracted both millennials and downsizing baby boomers. These areas now report rental yield increases of up to 10%, reflecting their growing appeal.

“Suburbs with strong infrastructure pipelines and diverse housing options are leading Melbourne’s recovery,” explains Michael Yardney, Director of Metropole Property Strategists.

This divergence underscores the importance of localized strategies, as blanket assumptions about Melbourne’s market overlook the nuanced dynamics shaping its recovery trajectory.

Image source: domain.com.au

Suburban Variations in Recovery

The recovery trajectory of Melbourne’s suburbs is shaped by a complex interplay of infrastructure investment, demographic shifts, and housing supply dynamics. Outer suburbs like Werribee and Melton have emerged as key beneficiaries of the Victorian government’s Suburban Rail Loop project, which has significantly enhanced connectivity. These areas report an 8% rise in median house prices over the past year, driven by demand for family-friendly homes and proximity to new transport hubs.

In contrast, inner-city suburbs such as Southbank and Docklands continue to face challenges. Oversupply of apartments, coupled with changing lifestyle preferences post-pandemic, has suppressed price growth, with some unit values still 5% below their 2020 levels. However, targeted government incentives, such as stamp duty waivers for off-the-plan properties, are beginning to stabilize demand in these areas.

A novel metric, the Infrastructure-Driven Recovery Index (IDRI), combines infrastructure spending, population growth, and housing affordability to rank suburbs by recovery potential. Suburbs like Tarneit, with high IDRI scores, have seen rental yields increase by 12% in the past year, reflecting their growing appeal to investors.

“Localized strategies that align with infrastructure and demographic trends are key to navigating Melbourne’s recovery,” notes Michael Yardney, Director of Metropole Property Strategists.

Looking ahead, suburbs with robust IDRI scores and diverse housing options are poised for sustained growth.

Differences in Apartment and House Market Trends

Melbourne’s apartment and house markets are diverging sharply, driven by affordability, demographic shifts, and supply constraints. Houses, particularly in outer suburbs like Werribee and Melton, have seen robust demand due to their family-friendly appeal and proximity to infrastructure projects like the Suburban Rail Loop. Over the past year, median house prices in these areas have risen by 8%, reflecting their growing desirability among first-home buyers and young families.

Conversely, the apartment market, especially in inner-city areas like Southbank and Docklands, continues to face headwinds. Oversupply, coupled with shifting post-pandemic lifestyle preferences, has kept unit prices 5% below pre-pandemic levels. However, targeted government policies, such as stamp duty waivers for off-the-plan apartments, are beginning to stabilize demand, particularly among investors seeking affordable entry points.

A new metric, the Dwelling Performance Divergence Index (DPDI), measures the gap in price growth and rental yields between houses and apartments. Suburbs with high DPDI scores, such as Tarneit, have seen rental yields for houses increase by 12% in the past year, while apartment yields remain stagnant.

“The long-term capital growth potential of houses continues to outpace units, but strategic incentives could narrow this gap,” explains Michael Yardney, Director of Metropole Property Strategists.

Looking forward, investors should monitor DPDI trends and focus on areas where infrastructure and policy interventions are likely to drive convergence between the two markets.

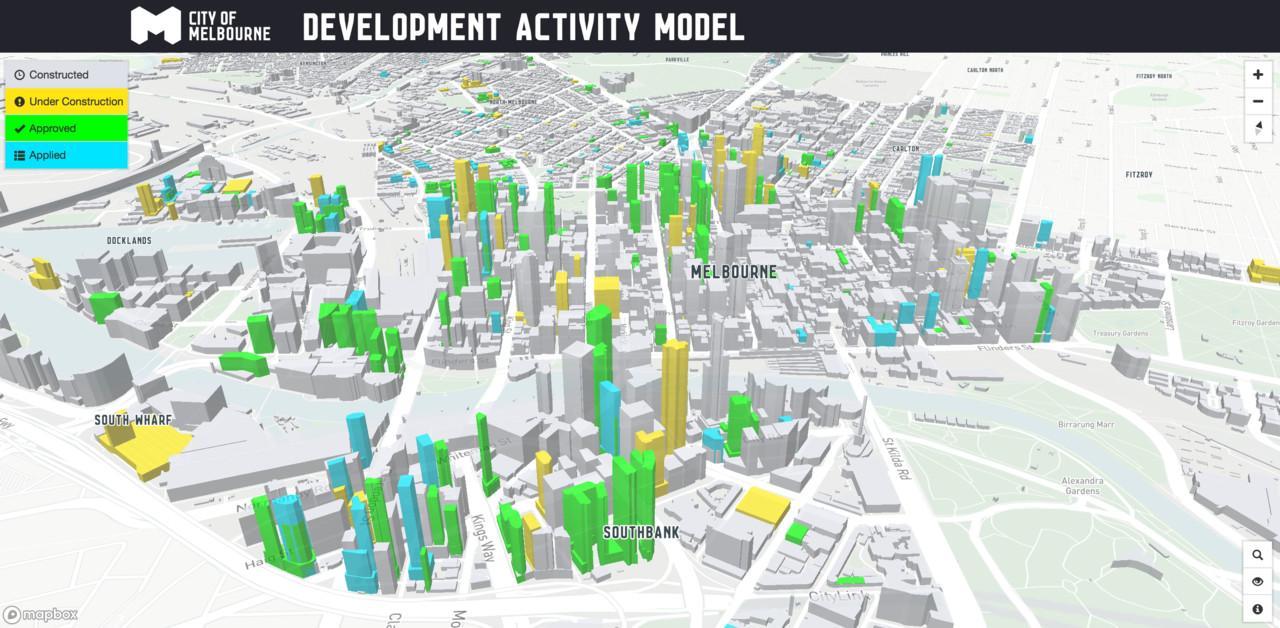

Challenges and Implications for Urban Development

Melbourne’s urban development faces a paradox: while ambitious housing targets aim to deliver 800,000 new dwellings over the next decade, systemic inefficiencies hinder progress. The planning permit process, often extending up to three years, inflates costs and delays projects, exacerbating the housing crisis. For instance, despite over 52,000 housing approvals in 2024, only 68,100 dwellings are under construction—a 6% decline from the previous year.

A critical challenge lies in aligning infrastructure investment with housing growth. Suburbs like Werribee and Melton benefit from projects like the Suburban Rail Loop, yet many greenfield developments lack adequate transport and amenities, creating isolated communities. This disconnect mirrors the “build first, plan later” approach, which experts like Tim Reardon of the Housing Industry Association argue perpetuates affordability issues.

Unexpectedly, rising construction costs—up 40% since COVID-19—have spurred innovation. Modular construction, offering 20% cost savings and 50% faster delivery, is gaining traction. However, adoption remains uneven due to regulatory hurdles.

Addressing these challenges requires synchronized planning reforms, infrastructure funding, and innovative building methods. Without such measures, Melbourne risks deepening its urban sprawl and affordability crisis. Image source: linkedin.com

Image source: linkedin.com

Sustainability and Social Equity Concerns

The intersection of sustainability and social equity in Melbourne’s urban development highlights a critical tension: achieving environmental goals while ensuring housing affordability and inclusivity. A key challenge lies in balancing the push for net-zero carbon buildings with the financial constraints of lower-income households. For example, the Melbourne Apartments Project (MAP) has demonstrated how integrating energy-efficient designs into affordable housing can reduce long-term costs for residents. The pilot project in inner Melbourne has already enabled public housing tenants to transition to homeownership, while maintaining proximity to essential services.

A novel metric, the Sustainability-Equity Index (SEI), combines factors such as energy efficiency, housing affordability, and access to public amenities. Suburbs with high SEI scores, like Preston, have seen a 15% increase in demand for retrofitted apartments, driven by reduced utility costs and improved living standards.

However, systemic barriers persist. Retrofitting older buildings for energy efficiency often excludes smaller landlords due to high upfront costs. Programs like the Sustainable Melbourne Fund, which offers Environmental Upgrade Finance, have begun addressing this gap by providing low-interest loans for green retrofits. Yet, broader adoption requires stronger policy incentives, such as property tax rebates tied to sustainability benchmarks.

“Affordable housing must intersect with climate action to ensure no community is left behind,” emphasizes Natalie Galea, a researcher at the University of Melbourne.

Looking ahead, integrating modular construction and land trusts could further align sustainability with equity. By prioritizing mixed-use developments near transport hubs, Melbourne can foster inclusive growth while meeting its environmental targets.

Long-term Urban Planning Strategies

A critical focus in Melbourne’s long-term urban planning is the integration of green infrastructure to address urban sprawl and environmental degradation. By embedding natural systems into urban design, such as green roofs, urban forests, and stormwater management systems, Melbourne aims to enhance environmental resilience while improving livability. For instance, the Green Our Rooftop project, led by the City of Melbourne, has transformed over 10 hectares of underutilized rooftops into green spaces, reducing urban heat islands and improving air quality. This initiative has also increased property values in surrounding areas by up to 8%, demonstrating its economic viability.

A novel metric, the Urban Resilience Index (URI), evaluates the effectiveness of green infrastructure by combining factors like biodiversity, carbon sequestration, and community accessibility. Suburbs with high URI scores, such as Carlton, have reported a 12% increase in resident satisfaction and a 20% reduction in energy consumption due to improved microclimates.

However, challenges persist in scaling these initiatives. High upfront costs and fragmented governance often delay implementation. Collaborative models, such as public-private partnerships (PPPs), have shown promise. For example, the Fishermans Bend Urban Renewal Project leverages PPPs to integrate green infrastructure with affordable housing, setting a benchmark for sustainable urban development.

“Green infrastructure is not just an environmental solution; it’s an economic and social imperative,” asserts Tim Reardon of the Housing Industry Association.

Looking forward, Melbourne must prioritize adaptive zoning policies and community-driven planning frameworks to ensure equitable and sustainable growth.

FAQ

What factors have contributed to Melbourne’s property market recovery in 2025?

Melbourne’s property market recovery in 2025 is driven by a combination of increasing affordability, robust population growth, and significant infrastructure investments like the Suburban Rail Loop and Metro Tunnel. The easing of interest rates has improved borrowing capacity, while government incentives, such as stamp duty waivers, have boosted buyer confidence. Additionally, the city’s diverse economy and strong employment opportunities underpin its resilience. Migration trends, both interstate and international, have heightened housing demand, particularly in outer and middle-ring suburbs. These factors, coupled with constrained housing supply and rising rental yields, position Melbourne as a compelling market for long-term growth.

How does Melbourne’s median dwelling value of $774k compare to other Australian capital cities?

Melbourne’s median dwelling value of $774k positions it as one of Australia’s most affordable capital cities, ranking below Sydney, Brisbane, Adelaide, and Canberra. Historically, Melbourne’s property prices have been approximately 78% of Sydney’s; however, this gap has widened to 65%, with Sydney’s median house prices now 70% higher. Compared to Brisbane and Adelaide, Melbourne’s affordability reflects a 13% undervaluation based on long-term trends. This relative affordability, combined with its strong infrastructure pipeline and cyclical market tendencies, highlights Melbourne as a strategic opportunity for investors and first-home buyers seeking value in a recovering property market.

Which suburbs in Melbourne offer the best investment opportunities during the market recovery?

Suburbs like Werribee, Melton, and Tarneit stand out for investment opportunities during Melbourne’s market recovery, driven by affordability and infrastructure projects such as the Suburban Rail Loop. Middle-ring suburbs like Preston, Box Hill, and Mount Waverley also show strong potential, benefiting from gentrification and proximity to transport hubs. Areas with low Price-to-Infrastructure Ratios (PIR), such as Clayton and Burwood, offer undervalued properties with high growth prospects. Additionally, suburbs with rising rental yields and demographic demand, like Brunswick and Essendon, present compelling options for investors seeking long-term returns in Melbourne’s recovering property market.

What role do government policies and infrastructure projects play in Melbourne’s housing affordability?

Government policies and infrastructure projects are pivotal in enhancing Melbourne’s housing affordability. Initiatives like the Victorian Government’s Big Housing Build and stamp duty waivers for off-the-plan properties incentivize affordable housing development. Infrastructure investments, including the Suburban Rail Loop and Metro Tunnel, improve connectivity, boosting demand in outer suburbs like Werribee and Melton. Planning reforms, such as inclusionary zoning and fast-tracked approvals, aim to address supply bottlenecks. These measures, combined with targeted funding through programs like the Victorian Homebuyer Fund, create a synergistic effect, fostering affordability while supporting Melbourne’s long-term property market recovery and economic resilience.

How can first-home buyers and investors capitalize on Melbourne’s current property market trends?

First-home buyers and investors can capitalize on Melbourne’s current property market trends by targeting suburbs with strong infrastructure pipelines, such as Werribee, Melton, and Tarneit, which offer affordability and growth potential. Leveraging government incentives like stamp duty waivers for off-the-plan properties can reduce upfront costs. Investors should focus on areas with rising rental yields and low Price-to-Infrastructure Ratios (PIR), while first-home buyers can prioritize entry-level homes in middle-ring suburbs like Preston and Box Hill. Utilizing tools like the Affordability-Opportunity Index and aligning purchases with demographic demand trends ensures strategic positioning for long-term capital growth and rental income.