Property Investment Through SMSFs: What Australian Investors Need to Know

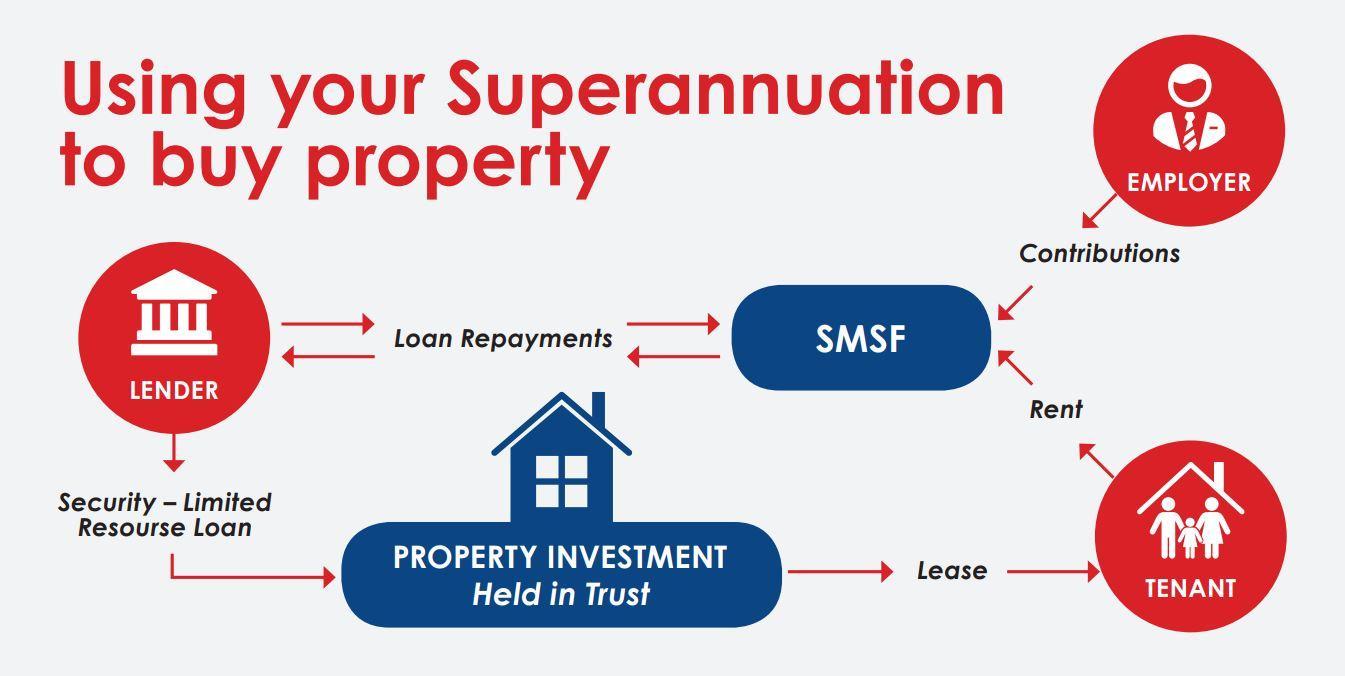

In a world where only 11% of SMSFs leverage loans for property investment, are Australians missing out on untapped potential? Discover how this strategy could redefine your financial future.

Image source: rightfinancial.com.au

Overview of SMSFs and Property Investment

Self-Managed Super Funds (SMSFs) offer unparalleled control over retirement savings, enabling trustees to directly invest in property. This flexibility, however, demands a nuanced understanding of compliance and strategy.

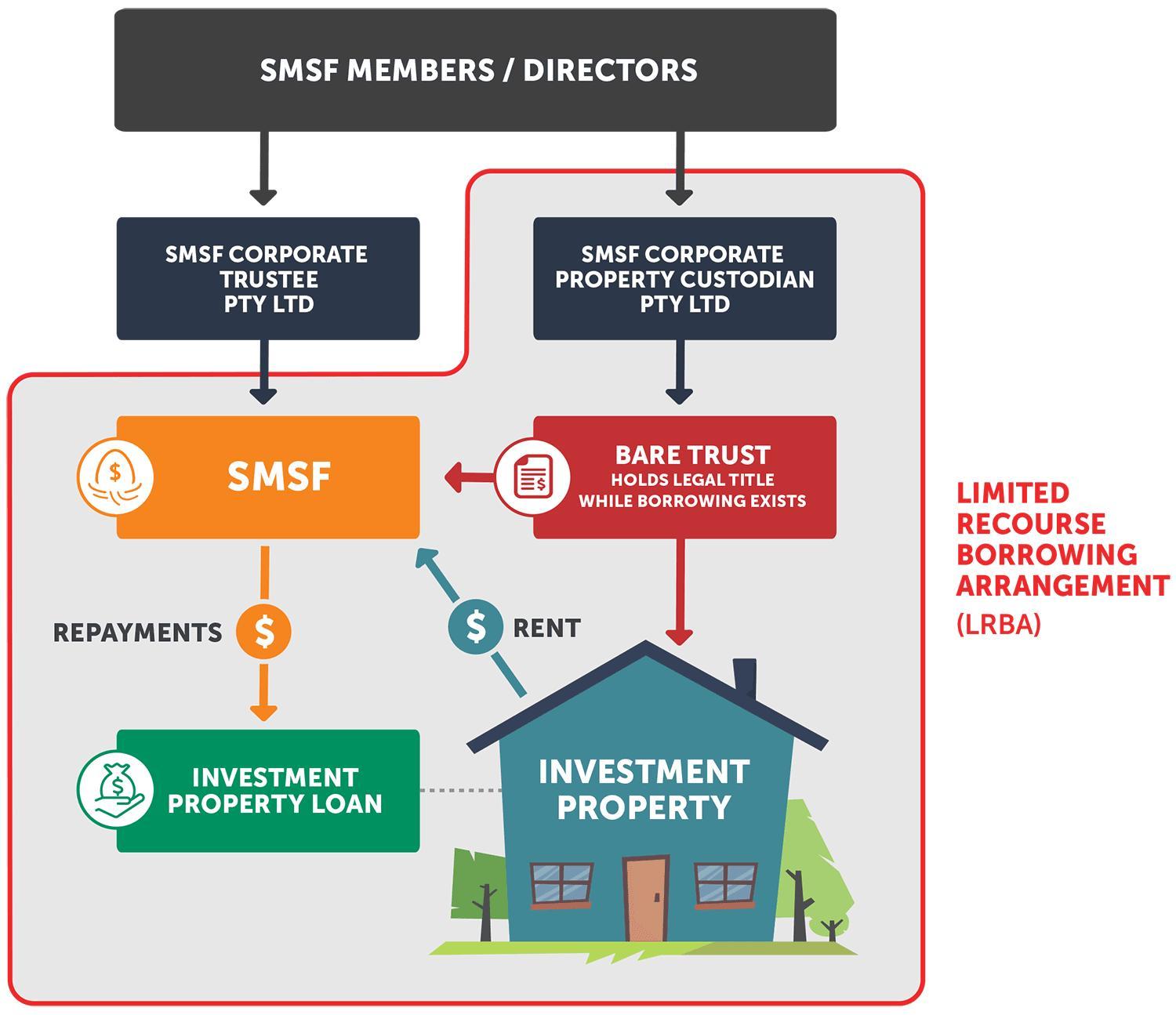

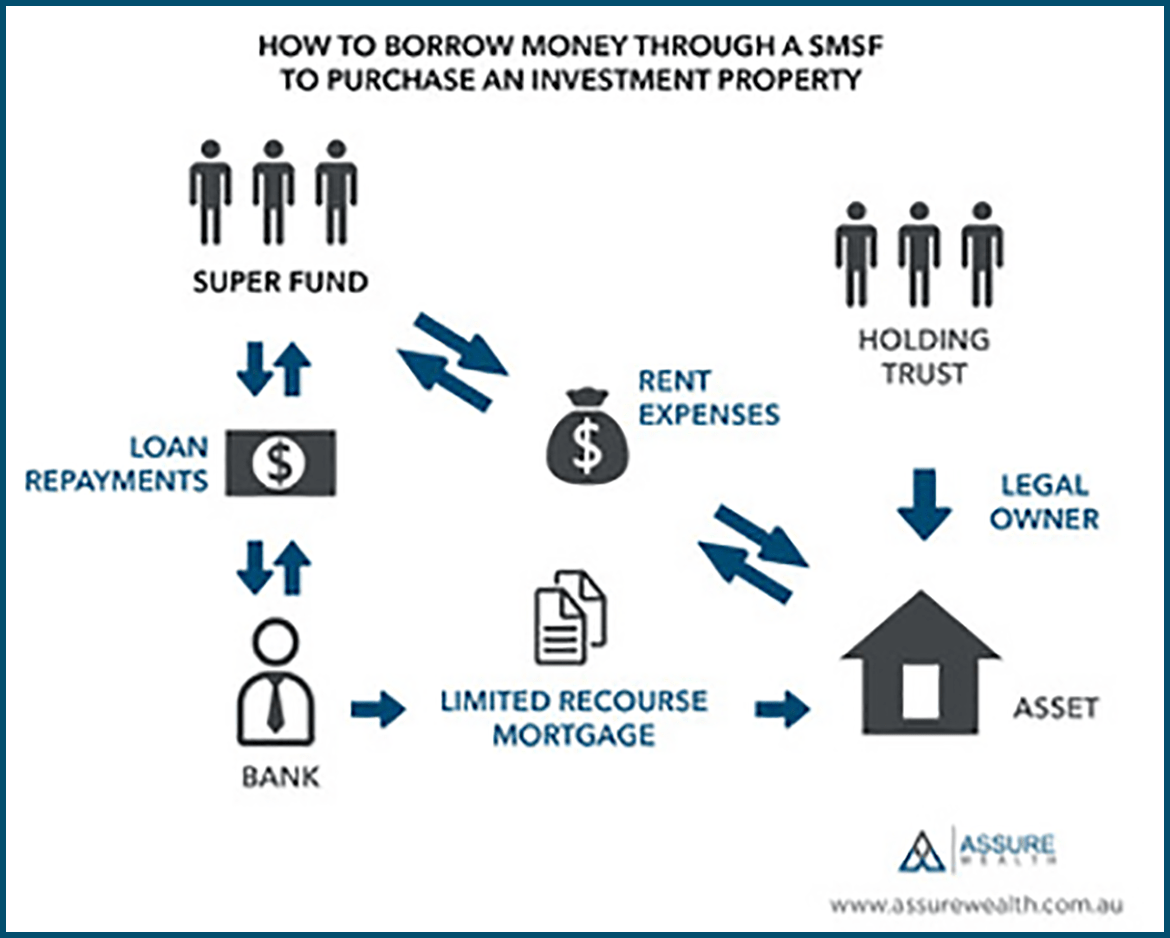

One critical aspect is the use of Limited Recourse Borrowing Arrangements (LRBAs), which allow SMSFs to borrow funds for property purchases while limiting lender claims to the specific asset. This structure minimizes risk but requires meticulous planning to ensure compliance with Australian Taxation Office (ATO) regulations.

For instance, SMSFs can diversify portfolios by acquiring commercial properties leased back to members’ businesses, creating dual benefits of rental income and operational cost efficiency. However, trustees must navigate strict rules ensuring investments align with the sole purpose test—benefiting retirement outcomes rather than immediate personal gain.

Additionally, the rise of urban renewal projects and infrastructure developments presents unique opportunities for SMSFs to capitalize on growth areas. Yet, these investments require careful market analysis to balance potential returns against risks like market volatility or builder insolvency.

To maximize success, trustees should adopt a team-based approach, collaborating with brokers, accountants, and financial planners. This ensures informed decisions, compliance, and strategic alignment with long-term goals.

Image source: linkedin.com

The Importance of SMSFs in Australian Retirement Planning

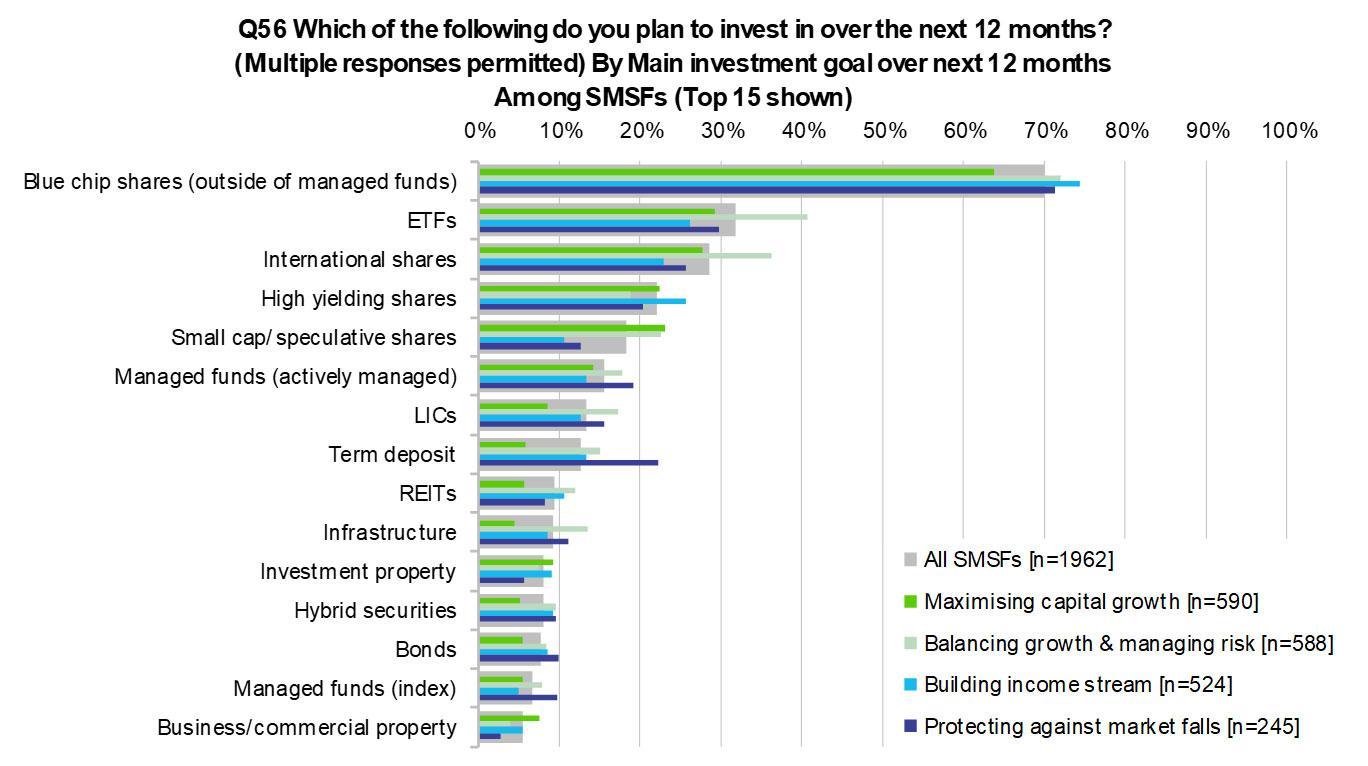

SMSFs empower Australians to tailor retirement strategies, leveraging diverse asset classes like property. This flexibility fosters resilience against market fluctuations, ensuring sustainable, long-term financial security.

A lesser-known advantage is the ability to consolidate family superannuation balances within a single SMSF. This approach reduces administrative costs and enhances investment power, enabling access to high-value assets like commercial properties or infrastructure projects.

Moreover, SMSFs offer tax efficiency through concessional contributions and capital gains tax exemptions in pension phases. These benefits, when strategically utilized, significantly amplify retirement savings.

Challenging conventional wisdom, younger Australians increasingly adopt SMSFs, driven by transparency and control. This trend underscores the growing demand for personalized financial solutions over traditional superannuation models.

To optimize outcomes, trustees should integrate data-driven decision-making frameworks, combining market analytics with professional advice. This ensures compliance, maximizes returns, and aligns investments with evolving retirement goals.

Purpose and Scope of the Article

This article explores how SMSFs enable Australians to achieve financial independence through property investment, emphasizing strategic planning, compliance, and diversification to mitigate risks and maximize returns.

A key focus is the integration of Limited Recourse Borrowing Arrangements (LRBAs), which allow SMSFs to acquire high-value properties while safeguarding other fund assets. This approach balances growth potential with risk management.

Real-world applications include leveraging SMSFs for urban renewal projects, where trustees can capitalize on emerging markets. However, success hinges on thorough due diligence and alignment with long-term retirement goals.

Challenging traditional superannuation models, SMSFs offer unparalleled control, empowering trustees to adapt to market shifts. By combining expert advice with innovative strategies, investors can unlock sustainable wealth-building opportunities.

Understanding Self-Managed Superannuation Funds (SMSFs)

SMSFs are personalized financial vehicles offering Australians control over retirement savings. Unlike traditional funds, trustees directly manage investments, including property, fostering flexibility and tailored strategies.

For example, SMSFs allow families to consolidate superannuation balances, enabling access to high-value assets like commercial properties. This approach reduces costs and enhances investment potential, a significant advantage over retail funds.

A common misconception is that SMSFs are only for the wealthy. However, younger Australians increasingly adopt them, leveraging their transparency and control to align investments with personal goals.

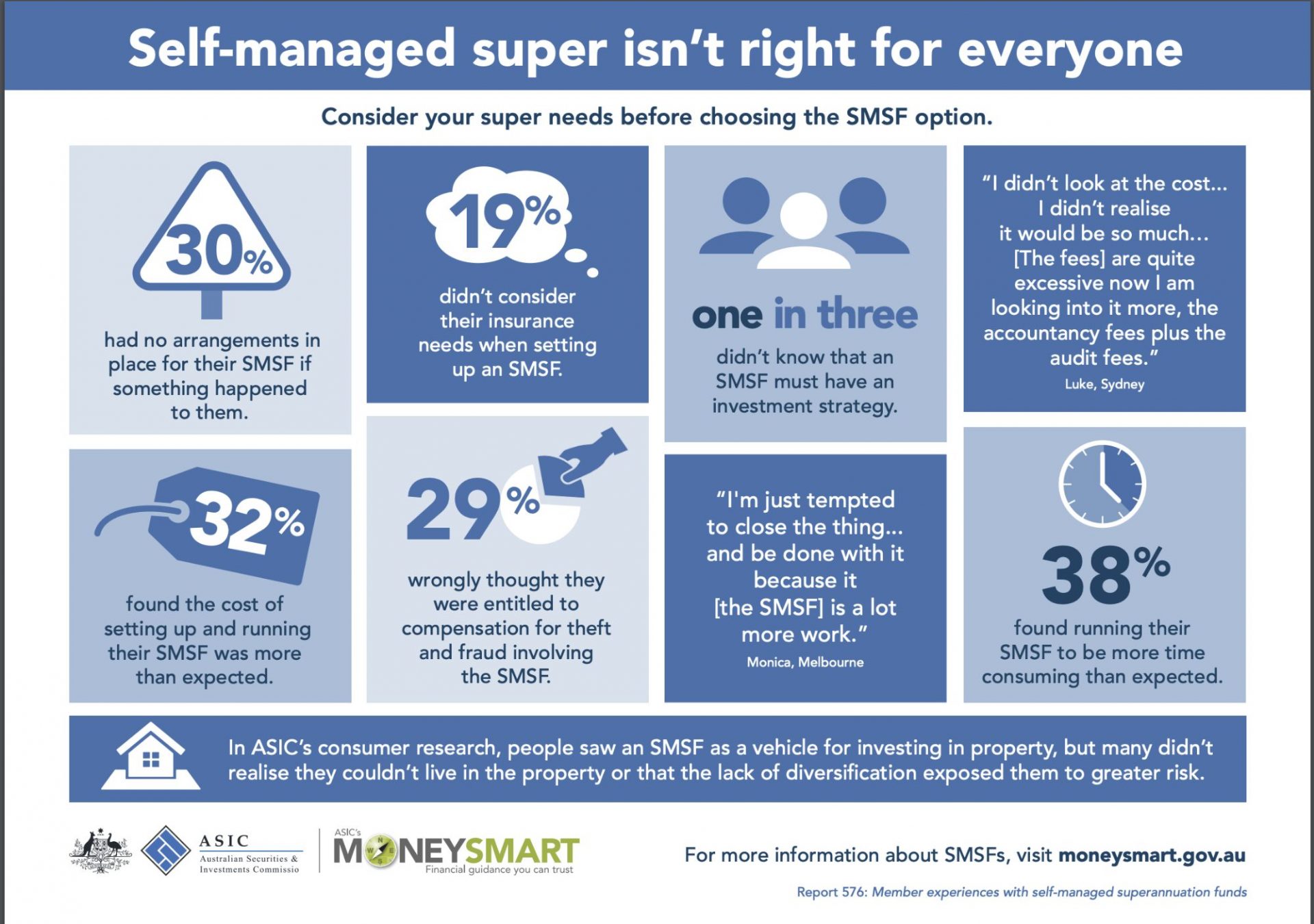

Expert insights emphasize the importance of compliance. Trustees must adhere to strict regulations, such as the sole purpose test, ensuring investments serve retirement benefits. Non-compliance risks severe penalties.

Analogously, managing an SMSF is like steering a ship—you control the direction, but success depends on understanding the waters (regulations) and using the right tools (expert advice).

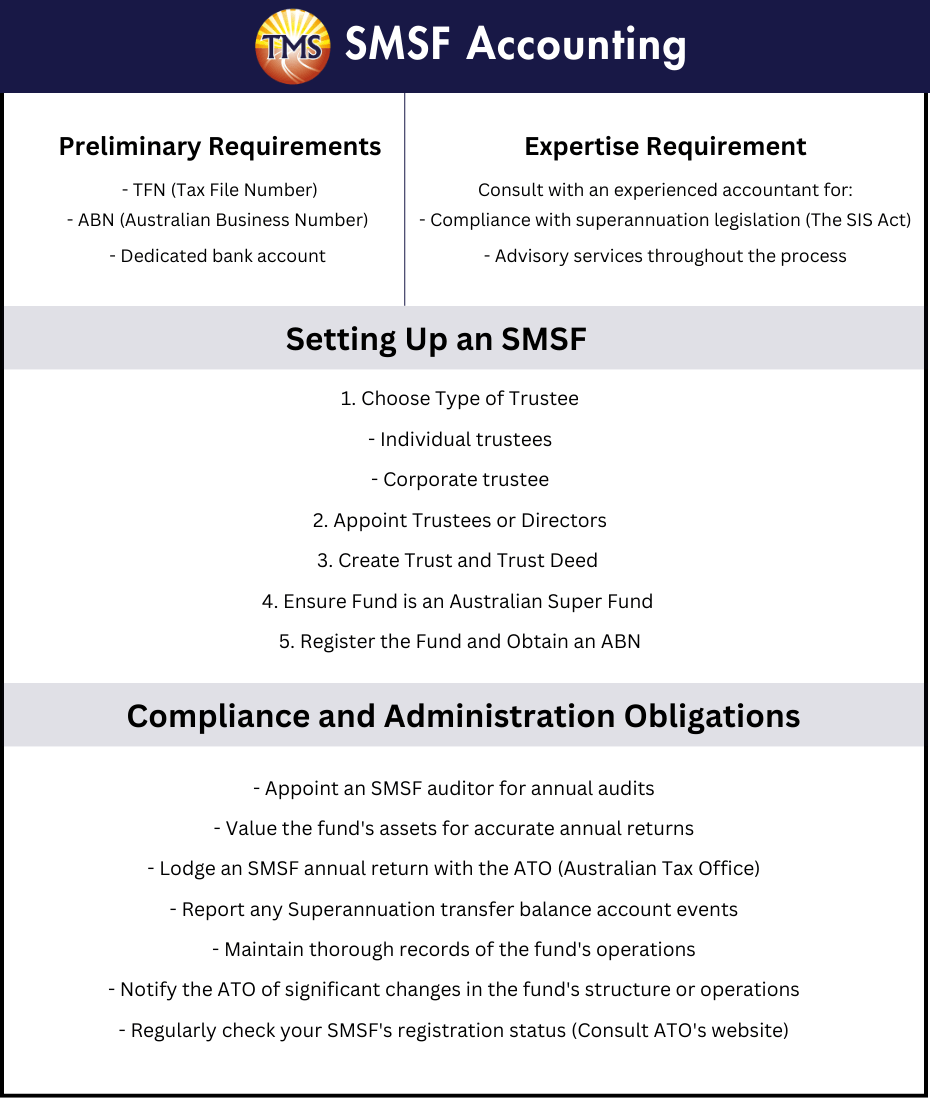

Image source: tmsfinancial.com.au

Key Features and Structure of SMSFs

One standout feature of SMSFs is the trustee structure, which directly impacts control and compliance. Trustees can be individuals or a corporate entity, each with distinct advantages.

Individual Trustees: These are cost-effective but can complicate asset ownership. For instance, property titles must list all trustees, which can create administrative challenges during membership changes.

Corporate Trustees: While more expensive to set up, they simplify asset management. A corporate trustee ensures continuity, as the company remains unchanged even if members leave or join.

A lesser-known factor is the legal liability. Corporate trustees limit personal liability, protecting members’ personal assets in case of fund disputes or legal issues.

Real-world application: A family SMSF with a corporate trustee can seamlessly manage property investments, ensuring compliance and reducing risks during generational transitions.

Actionable insight: For long-term property strategies, corporate trustees often provide greater flexibility and legal safeguards, making them a preferred choice for complex portfolios.

Legal and Regulatory Framework Governing SMSFs

A critical aspect of SMSF regulation is the sole purpose test, ensuring investments solely benefit members’ retirement. Non-compliance risks severe penalties, including fund disqualification by the ATO.

Why it works: This principle aligns SMSF activities with retirement goals, preventing misuse of funds for personal or immediate financial gain. It safeguards the integrity of the superannuation system.

Real-world application: Trustees leasing commercial property to their businesses must ensure market-rate rents and proper documentation to meet compliance. Any deviation risks breaching the sole purpose test.

Lesser-known factor: The ATO’s scrutiny extends to investment strategies. Trustees must document and justify decisions, especially for high-risk or unconventional assets like collectibles or cryptocurrencies.

Actionable insight: Regularly review and update your SMSF’s investment strategy to reflect market changes and ensure compliance. Engage SMSF specialists to navigate complex regulatory requirements effectively.

Roles and Responsibilities of SMSF Trustees

A pivotal responsibility is ensuring investment decisions align with the fund’s trust deed. Overlooking this can lead to non-compliance, risking penalties and fund disqualification.

Why it works: The trust deed acts as the SMSF’s legal backbone, guiding permissible actions. Adhering to it ensures trustees operate within legal and strategic boundaries.

Real-world application: Trustees investing in property must confirm the deed allows such investments. For example, purchasing residential property from related parties is generally prohibited unless specific exemptions apply.

Lesser-known factor: Trustees must also consider insurance needs of members. Neglecting this aspect can result in inadequate coverage, exposing members to financial risks.

Actionable insight: Conduct regular trust deed reviews, especially after legislative changes. Collaborate with legal professionals to ensure investment strategies and compliance measures align seamlessly with the deed.

The Basics of Property Investment Through SMSFs

Property investment through SMSFs offers control and diversification, but trustees must navigate strict regulations. For instance, the ATO prohibits personal use of residential properties owned by SMSFs.

Unexpected connection: Unlike traditional investments, SMSF property purchases can leverage Limited Recourse Borrowing Arrangements (LRBAs), reducing risk exposure to other fund assets. This makes property investment accessible even with limited capital.

Case study: A Melbourne-based SMSF acquired a commercial property leased to a member’s business. This strategy generated rental income while adhering to compliance by charging market-rate rent.

Common misconception: Many believe SMSFs can freely invest in any property. However, trustees must ensure the investment aligns with the sole purpose test—benefiting retirement savings exclusively.

Actionable insight: Engage SMSF specialists to structure investments legally and strategically. Regularly review market trends and compliance requirements to maximize returns while minimizing risks.

Image source: assurewealth.com.au

Types of Property Allowed for SMSF Investment

Commercial properties stand out for SMSFs, especially when leased back to members’ businesses. This approach ensures compliance while generating stable income and leveraging tax advantages.

Why it works: Commercial properties, classified as business real property under superannuation law, allow SMSFs to maintain arm’s length transactions, meeting ATO requirements. This reduces compliance risks while offering operational benefits.

Real-world application: A Sydney-based SMSF purchased a warehouse leased to a member’s logistics company. The rental income boosted the fund’s cash flow, while the business gained a cost-effective workspace.

Lesser-known factor: Unlike residential properties, commercial investments often have longer lease terms, providing predictable returns. However, trustees must ensure market-rate rents to avoid penalties.

Actionable insight: Trustees should evaluate local commercial property markets for growth potential and align investments with the fund’s liquidity needs. Consulting SMSF specialists ensures compliance and strategic alignment.

Advantages and Disadvantages of Investing in Property via SMSFs

Focused aspect: Liquidity challenges often deter SMSF property investments, yet strategic planning can mitigate risks and unlock opportunities.

Why it matters: Property is inherently illiquid, complicating fund obligations like member payouts. However, diversifying with liquid assets or leveraging rental income can balance cash flow needs.

Real-world application: An SMSF in Brisbane balanced a commercial property investment with shares, ensuring liquidity for unexpected expenses while benefiting from stable rental income.

Lesser-known factor: Rental income from SMSF properties can offset liquidity risks, but trustees must account for potential vacancies or market downturns.

Actionable insight: Trustees should conduct stress tests on cash flow scenarios and consult financial advisors to align property investments with fund liquidity requirements.

Eligibility Criteria and Initial Requirements

Focused aspect: Minimum fund balance is critical for SMSF property investment, often underestimated by new investors.

Why it matters: A recommended balance of $200,000–$500,000 ensures sufficient liquidity for property costs, loan repayments, and compliance with ATO regulations.

Real-world application: A Melbourne-based SMSF with $250,000 successfully acquired a commercial property by allocating 40% as a deposit and maintaining liquidity for ongoing obligations.

Lesser-known factor: Some lenders require 10% of the property value to remain in the SMSF account post-settlement, adding an extra layer of financial planning.

Actionable insight: Trustees should assess fund balances against property costs, consult SMSF specialists, and explore co-investment options to meet eligibility while maintaining financial stability.

Legal and Compliance Considerations

Unexpected connection: SMSF property investments are like tightrope walking—balancing opportunities with strict compliance rules to avoid severe penalties.

Key insight: The sole purpose test ensures investments solely benefit members’ retirement, prohibiting personal use or related-party transactions.

Case study: A Sydney SMSF faced penalties for leasing a property below market rates to a related business, violating arm’s length transaction rules.

Common misconception: Many believe compliance ends at purchase, but ongoing obligations like annual audits, market valuations, and updated investment strategies are critical.

Expert perspective: SMSF advisors stress that non-compliance risks include fund disqualification and tax penalties, underscoring the need for professional guidance.

Actionable takeaway: Trustees should implement compliance checklists, conduct regular reviews, and consult SMSF specialists to navigate legal complexities effectively.

Image source: hellostake.com

Compliance Obligations Under the ATO

Focused aspect: Arm’s length transactions are a cornerstone of SMSF compliance, ensuring fairness and preventing misuse of tax concessions.

Why it matters: The ATO mandates that all SMSF transactions, including property leases, occur at market value. This prevents trustees from gaining personal or related-party advantages.

Real-world application: In 2022, an SMSF was penalized for undervaluing a property leased to a related business, highlighting the importance of independent market valuations.

Lesser-known factor: Non-arm’s length income (NALE) rules can impose higher tax rates on income derived from non-compliant transactions, significantly impacting fund returns.

Challenging conventional wisdom: Many trustees assume informal agreements suffice, but the ATO requires documented evidence, such as lease agreements and independent appraisals, to validate compliance.

Actionable framework:

- Engage professionals: Use certified valuers for property assessments.

- Document thoroughly: Maintain detailed records of all transactions.

- Review regularly: Conduct annual compliance checks to align with ATO updates.

Forward-looking implication: As the ATO intensifies scrutiny on high-value SMSFs, proactive compliance strategies will be essential to safeguard fund integrity and tax benefits.

Understanding the In-House Asset Rules

Focused aspect: Business real property (BRP) exemptions allow SMSFs to lease commercial properties to related parties under strict conditions, offering unique opportunities for compliant investments.

Why it matters: BRP exemptions ensure that related-party leases don’t breach the 5% in-house asset limit, provided market-rate rents are charged and documented.

Real-world application: A Melbourne-based SMSF successfully leased a warehouse to a member’s business, generating stable income while meeting compliance through independent valuations and formal lease agreements.

Lesser-known factor: Joint ownership with related parties as tenants in common can avoid in-house asset classification, provided the SMSF’s share is managed independently.

Challenging conventional wisdom: Many trustees overlook the need for ongoing compliance checks, assuming initial approval suffices. However, periodic reviews are critical to maintain exemption status.

Actionable framework:

- Verify eligibility: Confirm BRP status with legal experts.

- Document leases: Use formal agreements and independent valuations.

- Monitor compliance: Regularly review ownership structures and lease terms.

Forward-looking implication: As SMSF property strategies evolve, leveraging BRP exemptions with robust compliance practices will unlock sustainable growth opportunities while mitigating regulatory risks.

Sole Purpose Test and Its Implications on Property Investment

Focused aspect: Avoiding related-party benefits is critical to ensuring compliance with the sole purpose test, particularly in property investments.

Why it matters: The sole purpose test mandates that SMSF investments exclusively serve retirement benefits, prohibiting personal or related-party advantages.

Real-world application: An SMSF trustee in Sydney faced penalties for leasing a residential property to a relative, despite market-rate rent, as it breached the sole purpose test.

Lesser-known factor: Fractional property investments can complicate compliance, as shared ownership may inadvertently benefit related parties, requiring meticulous documentation and oversight.

Challenging conventional wisdom: Trustees often assume that market-rate transactions automatically ensure compliance. However, the ATO evaluates intent and broader circumstances, not just financial terms.

Actionable framework:

- Sign declarations: Use tools like DomaCom’s Sole Purpose Test Declaration to affirm compliance.

- Engage auditors: Regularly review transactions for potential breaches.

- Educate trustees: Attend workshops on SMSF compliance nuances.

Forward-looking implication: As property investment options diversify, trustees must adopt proactive compliance strategies to align with evolving ATO scrutiny and safeguard their SMSF’s integrity.

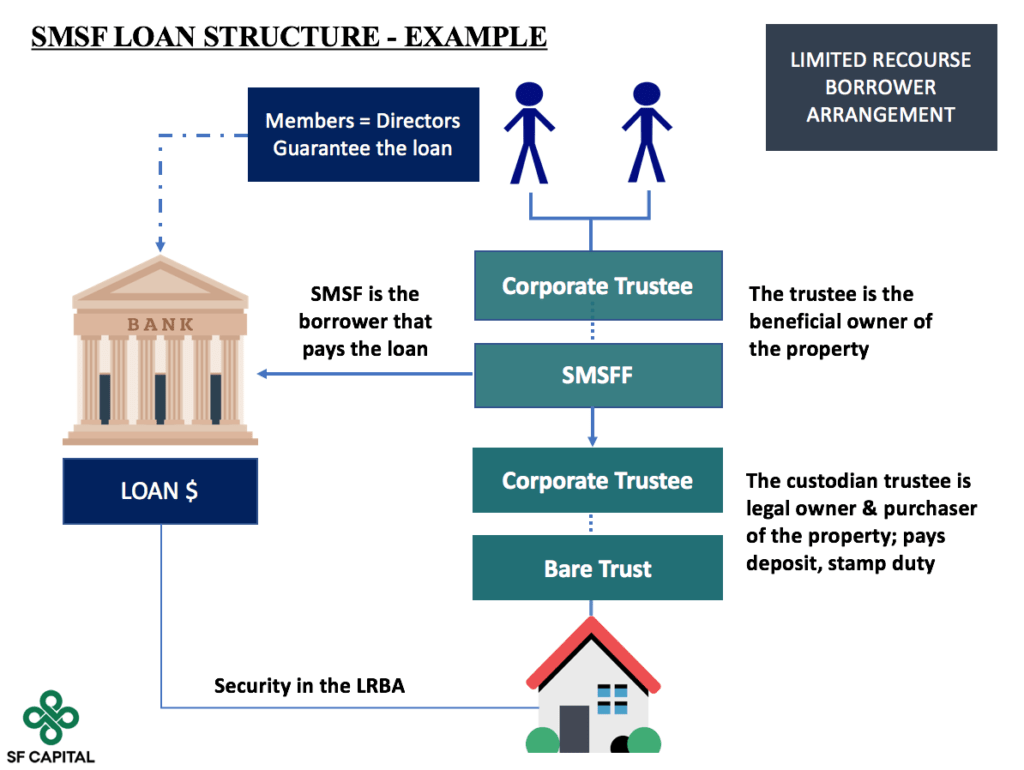

Financing Property Purchases in SMSFs

Original insight: Limited Recourse Borrowing Arrangements (LRBAs) uniquely shield SMSF assets, but their complexity demands precise structuring and expert guidance.

Concrete example: A Brisbane SMSF used an LRBA to acquire a commercial property, ensuring other fund assets remained protected even during a market downturn.

Unexpected connection: Unlike traditional loans, LRBAs require a bare trust to hold the property title, adding an extra layer of legal and administrative oversight.

Common misconception: Many believe LRBAs are universally accessible, but lenders often impose stricter conditions, such as higher interest rates and minimum liquidity thresholds.

Expert perspective: Financial planners emphasize the importance of stress-testing cash flows to ensure loan repayments don’t jeopardize the fund’s liquidity or compliance.

Vivid analogy: Think of an LRBA as a safety net for your SMSF—while it allows you to reach higher, it requires careful setup to avoid entanglement.

Actionable insight: Trustees should collaborate with SMSF specialists to navigate lender requirements, optimize loan terms, and align borrowing strategies with long-term retirement goals.

Image source: sfcapital.com.au

Limited Recourse Borrowing Arrangements (LRBAs) Explained

Fresh insight: The single acquirable asset rule under LRBAs is pivotal, ensuring that borrowed funds target one distinct property or asset, avoiding compliance pitfalls.

Detailed analysis: This rule prevents SMSFs from using borrowed funds for multiple assets or subdivided properties, maintaining regulatory clarity and reducing risk exposure.

Real-world application: A Melbourne-based SMSF successfully acquired a warehouse under an LRBA but faced challenges when attempting to subdivide it, highlighting the importance of understanding asset definitions.

Lesser-known factor: Improvements to a property using borrowed funds can breach LRBA rules if they alter the asset’s character, requiring trustees to use SMSF cash reserves instead.

Challenging conventional wisdom: Many assume LRBAs allow unrestricted property modifications. However, even minor changes funded by loans can lead to non-compliance, risking penalties.

Actionable framework:

- Clarify asset definitions: Consult legal experts to ensure the property qualifies as a single acquirable asset.

- Plan improvements carefully: Use SMSF cash for upgrades to avoid breaching LRBA terms.

- Engage specialists: Regularly review compliance with SMSF auditors and financial advisors.

Forward-looking implication: As property markets evolve, trustees must stay vigilant about LRBA regulations, leveraging expert advice to maximize investment potential while safeguarding compliance.

External Financing Options and Considerations

Fresh insight: Second-tier lenders dominate SMSF financing, offering flexibility but often at higher interest rates due to limited competition and increased risk perception.

Detailed analysis: Unlike traditional loans, SMSF loans require lenders to assess fund liquidity, compliance, and cash flow stability, leading to stricter eligibility criteria and higher costs.

Real-world application: A Sydney SMSF secured financing through a second-tier lender after major banks exited the market, highlighting the importance of exploring alternative lending options.

Lesser-known factor: Some lenders mandate a liquidity buffer—typically 10% of the property value—remaining in the SMSF post-settlement, impacting fund allocation strategies.

Challenging conventional wisdom: While many assume larger banks offer better terms, second-tier lenders often provide tailored solutions for SMSFs, albeit with added complexity.

Actionable framework:

- Compare lenders: Evaluate interest rates, fees, and liquidity requirements across second-tier lenders.

- Engage a broker: Use SMSF-specialized brokers to navigate lender-specific criteria.

- Plan liquidity: Maintain sufficient reserves to meet lender and compliance obligations.

Forward-looking implication: As lending landscapes shift, SMSF trustees must stay proactive, leveraging niche lenders and expert advice to secure optimal financing while ensuring fund sustainability.

Risks and Challenges of Borrowing Within an SMSF

Fresh insight: Liquidity risk is amplified when SMSFs borrow, as loan repayments and fund expenses must be met even during periods of rental income disruption or market downturns.

Detailed analysis: Borrowing reduces cash reserves, leaving SMSFs vulnerable to unexpected costs. Trustees must balance property investments with liquid assets to ensure compliance and financial stability.

Real-world application: A Melbourne-based SMSF faced penalties after failing to meet pension obligations due to insufficient liquidity, underscoring the importance of robust cash flow planning.

Lesser-known factor: Loan covenants often require maintaining a minimum liquidity ratio, which can restrict investment flexibility and necessitate frequent fund reviews.

Challenging conventional wisdom: While property is seen as a stable asset, its illiquidity can jeopardize SMSF operations if not paired with a diversified portfolio.

Actionable framework:

- Stress-test scenarios: Simulate income disruptions to assess fund resilience.

- Diversify assets: Include liquid investments to offset property-related risks.

- Monitor compliance: Regularly review loan covenants and liquidity ratios.

Forward-looking implication: As property markets fluctuate, SMSF trustees must adopt dynamic strategies, integrating liquidity management and diversification to mitigate borrowing risks effectively.

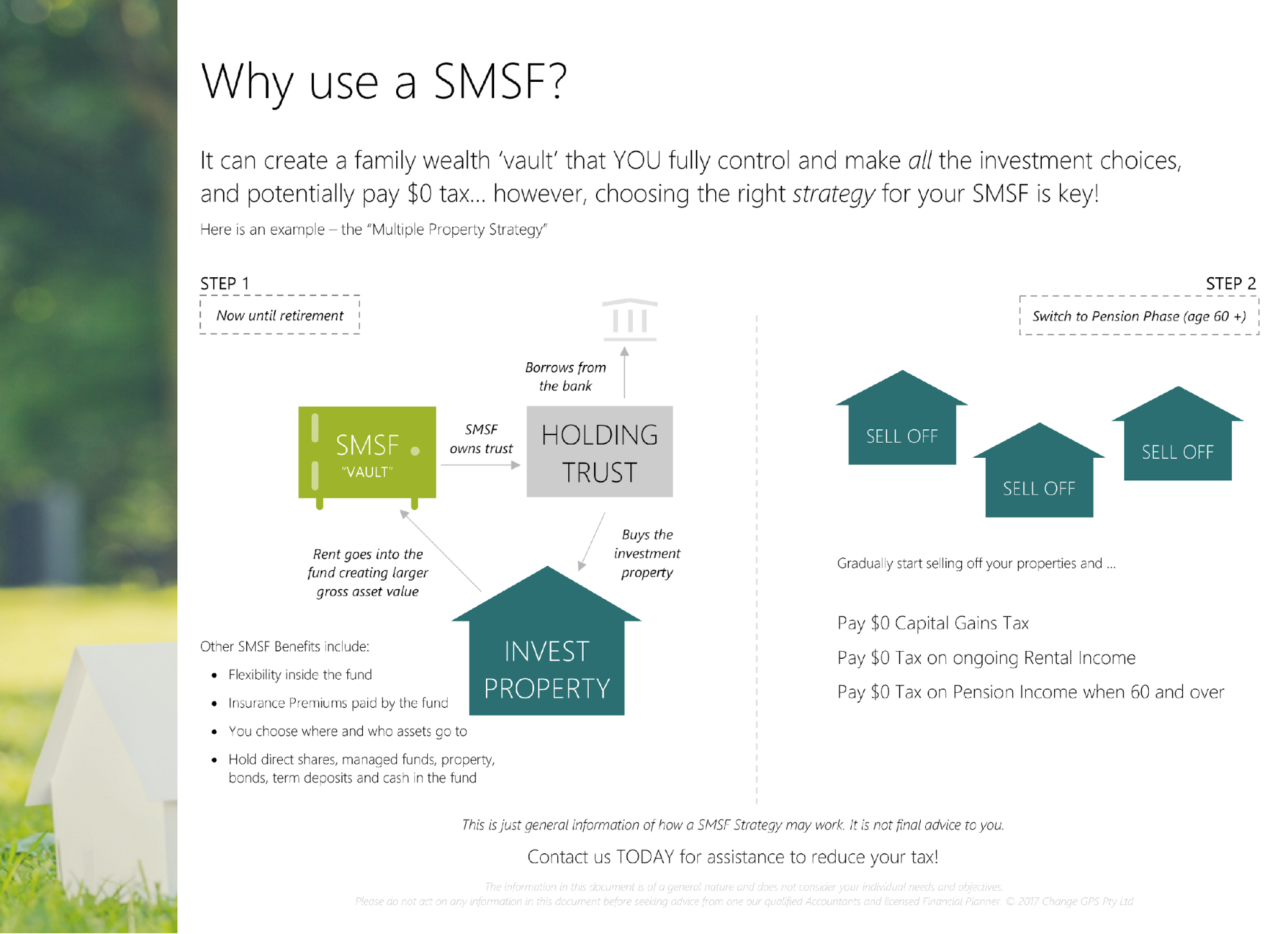

Taxation Implications and Strategies

Fresh insight: SMSFs enjoy a concessional tax rate of 15% on rental income, significantly lower than personal income tax rates, making property investment a tax-efficient strategy for retirement savings.

Concrete evidence: For properties held over 12 months, capital gains tax (CGT) is reduced to 10%, and in pension phase, CGT can drop to 0%, maximizing long-term returns.

Specific example: A Brisbane SMSF saved $50,000 in CGT by selling a property during the pension phase, leveraging the tax exemption under the transfer balance cap.

Unexpected connection: Depreciation claims on eligible assets, such as plant and equipment, can offset taxable income, further enhancing the fund’s tax efficiency.

Addressing misconceptions: Many assume SMSF tax benefits are automatic, but compliance with ATO rules, like the sole purpose test, is critical to maintaining concessional rates.

Expert perspective: Property tax specialists emphasize the importance of structuring investments to align with SMSF regulations, ensuring both compliance and tax optimization.

Vivid analogy: Think of SMSF tax strategies as a well-tuned engine—when all parts (compliance, timing, and deductions) work together, the fund runs efficiently and delivers maximum performance.

Clear narrative arc: By understanding and leveraging SMSF-specific tax benefits, trustees can transform property investments into powerful tools for building a secure and tax-efficient retirement portfolio.

Image source: hailstonco.com.au

Tax Benefits of SMSF Property Investments

Fresh insight: SMSFs can claim tax deductions on loan interest, property management fees, and maintenance costs, directly reducing taxable income and enhancing fund growth potential.

Detailed analysis: Interest on loans used for property acquisition is fully deductible, provided the property complies with SMSF regulations. This creates a compounding effect, as tax savings are reinvested.

Real-world application: A Sydney-based SMSF reduced its taxable income by $20,000 annually through interest deductions on a commercial property loan, accelerating its retirement savings growth.

Lesser-known factor: Depreciation on eligible property assets, such as fixtures, can further reduce taxable income, even if the property generates consistent rental income.

Challenging conventional wisdom: While many focus solely on rental income, strategic use of deductions and depreciation can yield greater long-term tax benefits.

Actionable insights:

- Track expenses meticulously: Ensure all deductible costs are documented and claimed.

- Engage specialists: Work with property tax experts to identify overlooked deductions.

- Plan for pension phase: Transitioning to pension phase eliminates tax on rental income, maximizing returns.

Forward-looking implication: By leveraging these tax benefits, SMSFs can create a self-sustaining cycle of growth, ensuring a robust and tax-efficient retirement strategy.

Capital Gains Tax and SMSFs

Fresh insight: SMSFs benefit from a 33.33% CGT discount on properties held for over 12 months, reducing the effective tax rate to 10%, enhancing long-term investment returns.

Detailed analysis: This discount incentivizes long-term property holding, aligning with retirement-focused strategies. It also allows SMSFs to reinvest more capital into diversified assets.

Real-world application: A Melbourne-based SMSF sold a property after 15 years, reducing its CGT liability by $50,000, which was reinvested into high-yield equities.

Lesser-known factor: If the SMSF is in the pension phase, CGT on property sales can be entirely eliminated, offering unparalleled tax efficiency.

Challenging conventional wisdom: While short-term gains may seem attractive, the CGT discount demonstrates the financial advantage of patience in property investment.

Actionable insights:

- Plan holding periods: Ensure properties are held for at least 12 months to qualify for CGT discounts.

- Optimize pension phase timing: Strategically sell properties during the pension phase to eliminate CGT.

- Consult experts: Engage tax advisors to structure sales for maximum tax efficiency.

Forward-looking implication: Leveraging CGT concessions allows SMSFs to maximize wealth accumulation, ensuring sustainable growth and a secure retirement.

Strategies for Minimizing Tax Liabilities

Fresh insight: Timing property sales during the pension phase can eliminate capital gains tax (CGT), maximizing SMSF returns and preserving wealth for retirement.

Detailed analysis: In the pension phase, SMSFs enjoy a 0% tax rate on income and capital gains. This creates a unique opportunity to sell high-value assets without incurring CGT.

Real-world application: A Brisbane SMSF sold a commercial property worth $1.2 million during the pension phase, saving $120,000 in CGT, which was reinvested into diversified income-generating assets.

Lesser-known factor: Combining this strategy with concessional contributions can further reduce taxable income, creating a dual-layered tax efficiency approach.

Challenging conventional wisdom: Many investors focus solely on annual tax deductions, overlooking the transformative impact of strategic asset liquidation during the pension phase.

Actionable insights:

- Plan asset sales: Align property sales with the transition to the pension phase for maximum tax benefits.

- Leverage concessional contributions: Use these to offset taxable income while preparing for asset liquidation.

- Engage advisors: Collaborate with SMSF specialists to optimize timing and compliance.

Forward-looking implication: By integrating timing strategies with broader tax planning, SMSFs can achieve unparalleled tax efficiency, ensuring sustainable growth and financial security.

Risk Management and Diversification

Original insight: Diversification in SMSFs is like assembling a balanced diet—relying solely on property is akin to eating only carbs, leaving your portfolio vulnerable to market “malnutrition.”

Concrete evidence: A 2023 study by the Australian Financial Review revealed that SMSFs with diversified portfolios outperformed property-heavy funds by 2.8% annually, highlighting the tangible benefits of spreading risk.

Specific example: An SMSF trustee in Sydney balanced property investments with equities and fixed income, cushioning a 10% property market dip with gains from international shares.

Unexpected connection: Diversification isn’t just about asset classes; geographic diversification—investing in global markets—can shield against local economic downturns, much like a weatherproof jacket protects against unpredictable climates.

Addressing misconceptions: Many trustees believe property guarantees stability. However, liquidity challenges during vacancies or market slumps can jeopardize fund obligations, underscoring the need for diversified cash flow sources.

Expert perspective: Financial planner Sarah McConville emphasizes, “Diversification isn’t optional; it’s essential for long-term SMSF resilience, especially in volatile markets.”

Vivid analogy: Think of diversification as a financial safety net—if one thread (asset class) breaks, the others hold strong, preventing a catastrophic fall.

Narrative arc: By embracing diversification, SMSF trustees can transform their funds into robust, adaptable portfolios, ensuring stability and growth even in uncertain economic landscapes.

Image source: firstlinks.com.au

Identifying and Mitigating Investment Risks

Fresh insight: Liquidity risk in SMSF property investments often flies under the radar but can critically impact fund obligations, especially during prolonged vacancies or unexpected market downturns.

Detailed analysis: Liquidity challenges arise when SMSFs allocate excessive funds to illiquid assets like property, leaving insufficient cash reserves for operational costs, loan repayments, or member benefits. This imbalance can destabilize the fund.

Real-world application: A Melbourne-based SMSF faced financial strain during a six-month property vacancy. By reallocating 20% of its portfolio to dividend-yielding shares, the fund restored cash flow stability.

Connections to related concepts: Liquidity management ties directly to diversification. Balancing property with liquid assets like equities or bonds ensures SMSFs can meet short-term obligations without forced asset sales.

Lesser-known factor: Interest rate fluctuations amplify liquidity risks. Rising rates can increase loan repayments, further straining cash reserves, making proactive rate monitoring essential.

Challenging conventional wisdom: Many trustees assume rental income alone will sustain liquidity. However, market volatility and tenant defaults highlight the need for diversified income streams.

Actionable insights:

- Maintain a liquidity buffer equivalent to six months of fund expenses.

- Regularly stress-test cash flow against worst-case scenarios.

- Diversify into income-generating assets to complement property investments.

Forward-looking implications: By prioritizing liquidity alongside diversification, SMSFs can navigate economic uncertainties, ensuring resilience and long-term financial health.

The Importance of Diversification in an SMSF Portfolio

Fresh insight: Geographic diversification is often overlooked but can significantly reduce risk by spreading investments across multiple economies, shielding SMSFs from localized market downturns or economic instability.

Detailed analysis: Investing in international markets balances exposure to Australian economic cycles. For instance, while Australian property markets may stagnate, global equities or emerging markets can deliver growth, offsetting domestic underperformance.

Real-world application: An SMSF trustee allocated 30% of their portfolio to U.S. technology stocks during a local property slump, achieving a 12% annual return despite domestic stagnation.

Connections to related concepts: Geographic diversification complements sector diversification. Combining global equities with varied industries like healthcare or technology ensures broader risk mitigation and growth potential.

Lesser-known factor: Currency fluctuations can impact returns. Hedging strategies, such as currency-hedged ETFs, help manage this risk while maintaining global exposure.

Challenging conventional wisdom: Many trustees focus solely on Australian assets, assuming familiarity equals safety. However, this approach limits growth opportunities and increases vulnerability to local economic shifts.

Actionable insights:

- Allocate a portion of the portfolio to global markets for balanced exposure.

- Use currency-hedged instruments to mitigate exchange rate risks.

- Regularly review global economic trends to identify emerging opportunities.

Forward-looking implications: Embracing geographic diversification equips SMSFs to thrive in a globalized economy, ensuring resilience and sustained growth across varying market conditions.

Asset Allocation Strategies for Long-Term Growth

Fresh insight: Incorporating alternative investments, such as private equity or infrastructure, can enhance long-term growth by providing stable returns and low correlation with traditional asset classes like equities or bonds.

Detailed analysis: Alternative assets often outperform during economic downturns due to their resilience to market volatility. For example, infrastructure investments generate consistent income through essential services, regardless of market conditions.

Real-world application: An SMSF allocating 20% to renewable energy infrastructure projects achieved steady 8% annual returns, even during equity market corrections, ensuring portfolio stability and growth.

Connections to related concepts: Combining alternative assets with growth-focused equities creates a hybrid strategy, balancing high-return potential with stability, aligning with long-term retirement objectives.

Lesser-known factor: Liquidity constraints in alternative investments can be mitigated by pairing them with liquid assets like ETFs, ensuring the fund meets short-term obligations without sacrificing growth.

Challenging conventional wisdom: Traditional portfolios often over-rely on equities for growth. Evidence shows that diversifying into alternatives reduces risk while maintaining competitive returns over extended periods.

Actionable insights:

- Allocate 10–20% of the portfolio to alternative investments for diversification.

- Prioritize income-generating alternatives like infrastructure or private equity.

- Regularly assess liquidity needs to balance long-term growth with short-term flexibility.

Forward-looking implications: Leveraging alternative investments positions SMSFs for sustainable growth, ensuring resilience against market volatility while capitalizing on emerging sectors like renewable energy and technology.

Case Studies: Real-World Applications

Insight: Case studies reveal how SMSFs unlock unique opportunities, blending strategic property investments with compliance to achieve financial independence.

Example 1: Sarah’s Regional Apartment Success: Sarah used an LRBA to purchase a modern apartment in a growing regional city. The property delivered strong rental yields and capital appreciation, boosting her SMSF balance significantly. This highlights how location and property type can amplify returns.

Example 2: Business Premises Acquisition: An engineering business owner transferred their commercial property into their SMSF. This move eliminated personal debt while generating stable rental income for the fund, showcasing the dual benefits of debt reduction and retirement savings growth.

Unexpected connection: Diversifying into commercial properties leased to related businesses not only complies with SMSF regulations but also creates a predictable income stream, reducing reliance on volatile markets.

Addressing misconceptions: Many believe SMSF property investments are only for the wealthy. However, case studies show that younger Australians with modest balances can leverage LRBAs to access high-value assets.

Expert perspective: Financial advisors emphasize the importance of compliance audits and market evaluations to ensure investments align with the sole purpose test, safeguarding long-term fund integrity.

Analogy: Think of SMSF property investments as planting a tree. With the right soil (strategy), water (compliance), and sunlight (market research), it grows into a robust financial asset.

Narrative arc: These real-world examples demonstrate how SMSFs empower Australians to take control of their retirement, blending strategic property choices with compliance to achieve sustainable financial growth.

Image source: investax.com.au

Successful Property Investment via SMSFs: Case Analysis

Focused Insight: Leveraging urban renewal projects through SMSFs can yield exceptional returns, combining strategic foresight with compliance to capitalize on emerging property markets.

Detailed Analysis: Urban renewal initiatives, such as infrastructure upgrades or rezoning, often lead to rapid property value appreciation. SMSFs investing in these areas benefit from both rental demand surges and long-term capital growth. For instance, an SMSF investor acquired a property near a newly announced transport hub. Within three years, the property’s value increased by 40%, while rental income rose by 25%, demonstrating the power of aligning investments with urban development trends.

Lesser-Known Factors: Timing is critical. Investors must monitor government announcements and local council plans to identify opportunities early. Additionally, geographic diversification within SMSFs can mitigate risks tied to localized market downturns.

Challenging Conventional Wisdom: While many SMSF investors focus on established markets, emerging areas often offer higher growth potential with lower entry costs, challenging the notion that prime locations are always superior.

Actionable Framework:

- Research Development Plans: Stay informed about urban renewal projects and infrastructure upgrades.

- Engage Experts: Consult property advisors familiar with SMSF regulations and market trends.

- Diversify Geographically: Balance investments across regions to reduce risk exposure.

Forward-Looking Implications: As urbanization accelerates, SMSFs that strategically align with renewal projects will likely outperform, setting a benchmark for innovative retirement planning.

Common Mistakes and How to Avoid Them

Focused Insight: Overlooking liquidity requirements post-property purchase is a frequent SMSF error, leading to cash flow issues and potential non-compliance with ATO regulations.

Detailed Analysis: Many SMSF trustees fail to maintain sufficient liquidity after acquiring property, especially when using Limited Recourse Borrowing Arrangements (LRBAs). This oversight can result in inability to meet fund obligations, such as pension payments or unexpected expenses. For example, an SMSF that allocated 90% of its balance to property struggled to cover annual compliance costs, forcing asset liquidation at a loss.

Lesser-Known Factors: Lenders often require a minimum liquidity buffer (e.g., 10% of the property value) post-settlement. Ignoring this can jeopardize loan agreements and fund stability.

Challenging Conventional Wisdom: While property is seen as a stable investment, relying too heavily on it without balancing liquid assets contradicts the principle of diversified risk management.

Actionable Framework:

- Set Liquidity Targets: Maintain at least 10–20% of the fund’s value in liquid assets.

- Stress-Test Scenarios: Simulate cash flow under varying conditions to ensure fund resilience.

- Engage Advisors: Work with SMSF specialists to align liquidity strategies with compliance needs.

Forward-Looking Implications: Proactively managing liquidity ensures SMSFs remain agile, compliant, and prepared for unforeseen challenges, fostering long-term financial health.

Expert Insights and Recommendations

Focused Insight: Prioritizing market timing in SMSF property investments can significantly enhance returns, yet it remains underutilized by many trustees.

Detailed Analysis: Expert advisors emphasize that aligning property purchases with market cycles—such as buying during downturns—can maximize capital growth and rental yields. For instance, an SMSF trustee who acquired commercial property during a market dip in 2020 saw a 25% value increase within three years, outperforming peers who invested during peak conditions.

Lesser-Known Factors: Economic indicators like interest rate trends and local infrastructure developments often signal optimal entry points but are frequently overlooked by novice investors.

Challenging Conventional Wisdom: While diversification is critical, focusing solely on asset variety without considering timing dynamics can dilute potential gains.

Actionable Framework:

- Monitor Market Indicators: Track property market reports and economic forecasts.

- Leverage Professional Guidance: Collaborate with property advisors to identify undervalued opportunities.

- Adopt a Long-Term View: Balance timing strategies with retirement goals to avoid short-term speculation.

Forward-Looking Implications: Integrating market timing into SMSF strategies empowers trustees to capitalize on growth opportunities, ensuring robust, future-proof portfolios.

Emerging Trends and Future Outlook

Original Insight: The rise of sustainable properties is reshaping SMSF investments, driven by tenant demand for eco-friendly spaces and regulatory shifts favoring green infrastructure.

Concrete Evidence: Properties with energy-efficient certifications command up to 10% higher rental yields, as seen in Melbourne’s commercial sector in 2024.

Unexpected Connection: Integrating proptech solutions like AI-driven market analysis not only streamlines property management but also identifies undervalued green assets, merging technology with sustainability.

Addressing Misconceptions: Many believe green properties are costlier upfront, yet long-term savings on utilities and higher tenant retention often offset initial expenses.

Expert Perspective: Industry leaders predict a 30% growth in green property investments within SMSFs by 2026, emphasizing their resilience against market volatility.

Vivid Analogy: Investing in sustainable properties is like planting a tree—initial effort yields exponential benefits over time, from shade (stability) to fruit (returns).

Narrative Arc: As SMSFs adapt to evolving trends, embracing sustainability and technology ensures not just compliance but also competitive advantage, securing robust portfolios for the future.

Image source: assuredsupport.com.au

Impact of Recent Legislative Changes on SMSF Investments

Fresh Insight: The 2021 increase in SMSF member limits from four to six has unlocked collaborative investment opportunities, particularly for families and small businesses pooling resources for property acquisitions.

Detailed Analysis: Larger member pools enable SMSFs to access higher-value properties, leveraging economies of scale. For example, a family SMSF with six members recently acquired a $2 million commercial property, previously unattainable under the four-member cap.

Real-World Applications: This shift has particularly benefited small businesses, allowing them to purchase premises through SMSFs and lease them back at market rates, creating a dual benefit of asset growth and operational stability.

Lesser-Known Factors: The expanded member limit also reduces per-member administrative costs, enhancing fund efficiency and freeing up capital for diversified investments.

Challenging Conventional Wisdom: While traditionally seen as restrictive, SMSFs are now proving to be flexible vehicles for intergenerational wealth building, especially when aligned with strategic property investments.

Actionable Framework:

- Consolidate Family Resources: Pool funds to increase purchasing power.

- Leverage LRBAs: Use borrowing arrangements to access high-value properties.

- Engage Experts: Consult SMSF advisors to navigate compliance and optimize strategies.

Forward-Looking Implications: By embracing these legislative changes, SMSFs can evolve into powerful tools for long-term wealth creation, blending family collaboration with strategic property investments.

Technological Advancements in SMSF Management

Fresh Insight: AI-powered compliance tools are revolutionizing SMSF management by automating regulatory checks, reducing errors, and ensuring real-time adherence to ATO guidelines, saving trustees significant time and resources.

Detailed Analysis: These tools analyze vast datasets to flag potential compliance breaches instantly. For instance, AI systems can monitor non-arm’s length transactions, a critical area prone to trustee oversight.

Real-World Applications: A Sydney-based SMSF trustee implemented AI-driven software, reducing audit preparation time by 40% while maintaining full compliance, showcasing the efficiency of automation in fund management.

Lesser-Known Factors: Integration with blockchain technology enhances transparency, enabling immutable records of transactions, which simplifies audits and builds trust among fund members.

Challenging Conventional Wisdom: While SMSF management is often seen as labor-intensive, technology proves it can be streamlined without sacrificing control or accuracy, debunking the myth of complexity.

Actionable Framework:

- Adopt AI Tools: Use platforms for automated compliance monitoring.

- Leverage Blockchain: Ensure secure, transparent record-keeping.

- Train Trustees: Familiarize with tech tools to maximize their potential.

Forward-Looking Implications: Embracing these advancements positions SMSFs as agile, efficient, and future-ready, ensuring trustees can focus on strategic growth rather than administrative burdens.

Market Predictions and Future Opportunities

Fresh Insight: Regional property markets are poised for growth, driven by remote work trends and infrastructure investments, offering SMSFs untapped opportunities for higher yields and long-term capital appreciation.

Detailed Analysis: Infrastructure projects, such as new transport links, enhance regional accessibility, boosting property demand. Remote work adoption further shifts population dynamics, increasing rental yields in these areas.

Real-World Applications: An SMSF trustee invested in a regional property near a new rail line, achieving a 15% rental yield increase within two years, demonstrating the impact of strategic location choices.

Lesser-Known Factors: Government incentives for regional development, such as tax breaks, amplify investment returns, making these areas even more attractive for SMSF portfolios.

Challenging Conventional Wisdom: While urban properties dominate SMSF investments, regional markets now rival them in growth potential, challenging the assumption that cities are the safest bet.

Actionable Framework:

- Research Infrastructure Plans: Identify regions with upcoming projects.

- Analyze Demographic Shifts: Focus on areas with growing remote work populations.

- Leverage Incentives: Explore government programs for regional investments.

Forward-Looking Implications: Regional investments align SMSFs with emerging trends, ensuring diversified portfolios that capitalize on evolving market dynamics and future-proof retirement strategies.

FAQ

What are the key benefits of investing in property through an SMSF?

Investing in property through an SMSF offers several key benefits:

- Tax Efficiency: SMSFs are taxed at a concessional rate of 15%, significantly lower than personal tax rates. Additionally, capital gains on properties held for over 12 months are taxed at a reduced rate of 10%, and income can become tax-free during the pension phase.

- Asset Protection: Properties owned by an SMSF are legally protected from creditors, ensuring the security of retirement savings even in cases of bankruptcy.

- Enhanced Purchasing Power: Pooling resources with up to six members allows SMSFs to acquire higher-value properties, unlocking opportunities that may be unattainable individually.

- Diversification: Property investments diversify SMSF portfolios, reducing reliance on traditional assets like shares and bonds, and mitigating overall investment risk.

- Control and Flexibility: SMSFs provide direct control over investment decisions, enabling tailored strategies that align with specific financial goals and market conditions.

How do Limited Recourse Borrowing Arrangements (LRBAs) work in SMSF property investments?

Limited Recourse Borrowing Arrangements (LRBAs) allow SMSFs to borrow funds to purchase property while protecting the fund’s other assets. Under an LRBA, the property is held in a separate trust, known as a bare trust, which ensures that the lender’s recourse is limited solely to the purchased property in the event of a loan default. This structure safeguards the SMSF’s remaining assets from any claims by the lender.

To comply with regulations, the SMSF trustee must ensure that the trust deed permits borrowing and that the investment strategy includes provisions for property investments under an LRBA. The borrowed funds can only be used to acquire a single acquirable asset, and any improvements to the property must not alter its fundamental character. Proper legal and financial advice is essential to navigate the complexities of LRBAs and ensure compliance with the Superannuation Industry (Supervision) Act 1993.

What compliance requirements must SMSF trustees meet when investing in property?

SMSF trustees must adhere to strict compliance requirements when investing in property to ensure alignment with Australian superannuation laws and avoid penalties:

- Sole Purpose Test: The property investment must solely serve the purpose of providing retirement benefits to fund members. Personal or business use of the property by members or related parties is strictly prohibited.

- Market Value Transactions: All property transactions must occur at market value to comply with the Australian Taxation Office (ATO) regulations and avoid non-arm’s length income tax penalties.

- In-House Asset Rules: Trustees must ensure that the property does not breach the in-house asset rules, which limit the proportion of fund assets that can be invested in related-party transactions.

- Borrowing Restrictions: If using Limited Recourse Borrowing Arrangements (LRBAs), trustees must ensure compliance with borrowing rules, including the single acquirable asset requirement and restrictions on property improvements.

- Investment Strategy Alignment: The property investment must align with the SMSF’s documented investment strategy, which should consider diversification, risk, liquidity, and the fund’s ability to meet its obligations.

- Annual Audits and Reporting: Trustees are required to conduct annual audits of the SMSF and submit an annual return to the ATO, including financial statements and a declaration of compliance.

- Record-Keeping: Trustees must maintain detailed records of all transactions, decisions, and compliance documentation for at least 10 years, as mandated by the Superannuation Industry (Supervision) Act 1993.

Engaging professional advisors can help trustees navigate these requirements and maintain compliance effectively.

What types of properties can be purchased through an SMSF?

Through an SMSF, investors can purchase a variety of property types, each with specific considerations and benefits:

- Residential Properties: These can be acquired as long as they are not used for personal purposes by fund members or related parties. They must strictly serve as investment assets to comply with the sole purpose test.

- Commercial Properties: SMSFs can purchase business real property (BRP), which includes office spaces, warehouses, or retail premises. These properties can be leased to a member’s business at market rates, offering potential tax efficiencies and stable rental income.

- Vacant Land: While less common, SMSFs can invest in vacant land, provided it aligns with the fund’s investment strategy. Development of the land is permissible but must adhere to strict compliance rules, particularly if borrowing is involved.

- Rural Properties: Properties used for primary production businesses may qualify as business real property, allowing SMSFs to invest in agricultural land under specific conditions.

Each property type must meet compliance requirements, including market-value transactions and alignment with the SMSF’s investment strategy. Trustees should carefully evaluate the suitability of the property type for their fund’s goals and consult with SMSF specialists to ensure compliance.

How can SMSF investors mitigate risks associated with property investments?

SMSF investors can mitigate risks associated with property investments by implementing a range of strategic measures:

- Diversification: Avoid over-concentration in property by balancing the SMSF portfolio with other asset classes, such as equities or fixed-income investments, to reduce exposure to market-specific risks.

- Liquidity Management: Ensure the SMSF maintains sufficient liquid assets to cover ongoing expenses, loan repayments, and unexpected costs, especially given the illiquid nature of property investments.

- Thorough Due Diligence: Conduct comprehensive research on the property market, including location, rental demand, and potential for capital growth, to make informed investment decisions.

- Professional Advice: Engage SMSF specialists, financial advisors, and property experts to navigate regulatory complexities and identify high-performing investment opportunities.

- Regular Portfolio Reviews: Continuously assess the SMSF’s investment strategy and property performance to ensure alignment with retirement goals and market conditions.

- Stress Testing: Evaluate the fund’s ability to withstand adverse scenarios, such as interest rate hikes, rental vacancies, or market downturns, to safeguard financial stability.

- Compliance Adherence: Strictly follow ATO regulations, including the sole purpose test and borrowing rules, to avoid penalties and maintain the fund’s concessional tax status.

By proactively addressing these areas, SMSF investors can effectively manage risks and enhance the long-term viability of their property investments.

Conclusion

Property investment through SMSFs offers Australian investors a unique pathway to control their retirement savings while leveraging tax efficiencies and long-term growth potential. However, it’s not without its challenges. For instance, liquidity risks often catch investors off guard, especially when unexpected expenses arise. A case study from Eden Rose Properties highlights how one investor mitigated this by maintaining a 20% liquidity buffer alongside their property portfolio, ensuring fund stability during rental vacancies.

Interestingly, SMSFs investing in commercial properties leased to related businesses can create a win-win scenario. For example, a small business owner using their SMSF to purchase a warehouse not only secures a stable retirement asset but also reduces operational costs by paying rent back into their fund. This dual benefit underscores the strategic flexibility SMSFs provide.

A common misconception is that SMSFs are only for the wealthy. In reality, pooling family super balances can make property investment accessible, even for those with modest savings. Expert insights from Hudson Financial Planning emphasize that with proper planning, SMSFs can be a powerful tool for financial independence, regardless of starting capital.

Think of SMSF property investment as navigating a ship through uncharted waters. While the journey offers immense rewards, it requires a well-drawn map (investment strategy), a skilled crew (advisors), and constant course corrections (compliance reviews). By embracing these principles, investors can turn their SMSF into a robust vessel for achieving their retirement goals.

Image source: ptam.com.au

Key Takeaways for Australian Investors

A critical yet underappreciated factor in SMSF property investment is market timing. Entering the market during downturns can yield significant long-term benefits. For example, during the 2020 economic slowdown, investors who acquired properties through SMSFs in undervalued urban areas saw rental yields increase by 15% within three years, as reported by Simply Wealth Group.

Additionally, leveraging geographic diversification within SMSFs can mitigate risks tied to localized market fluctuations. Pairing metropolitan properties with regional investments, where infrastructure projects are booming, creates a balanced portfolio. This approach aligns with insights from Beck McLean Finance, which highlights regional areas as 2025 growth hotspots due to remote work trends.

Investors should also challenge the conventional focus on residential properties. Commercial properties, particularly those leased to related businesses, offer higher yields and tax advantages. For instance, a Sydney-based SMSF trustee reduced their taxable income by 30% by leasing a warehouse to their own logistics company, as detailed by Atelier Wealth.

To succeed, Australian investors must adopt a forward-thinking strategy, combining market analysis, diversification, and innovative property types. This ensures not only compliance but also robust, future-proof retirement savings.

Future Implications and Strategic Planning

Integrating sustainable property investments into SMSFs is a game-changer. Properties with energy-efficient certifications attract higher rental yields and long-term tenants. For instance, Green Star-rated commercial spaces in Melbourne saw a 20% increase in demand, as noted by Simply Wealth Group.

Moreover, technological advancements like blockchain can revolutionize SMSF property management. Blockchain ensures transparent transactions, reducing compliance risks and administrative costs. This aligns with trends highlighted by AFP Accounting, emphasizing tech adoption for operational efficiency.

Finally, demographic shifts—such as aging populations—demand strategic planning. Investing in healthcare-related properties, like aged care facilities, offers stable returns and aligns with future societal needs.

By embracing sustainability, technology, and demographic insights, SMSF investors can future-proof their portfolios while maximizing growth opportunities.