The Top 5 Property Investment Mistakes (and How to Avoid Them!)

Did you know that nearly 60% of property investors lose money due to avoidable mistakes? In today’s volatile market, understanding these pitfalls could mean the difference between profit and failure.

Image source: fastercapital.com

Understanding the Importance of Smart Property Investment

Smart property investment hinges on data-driven decisions. Investors who leverage tools like AI-powered market predictors or big data analytics uncover hidden opportunities, outperforming those relying solely on intuition or outdated methods.

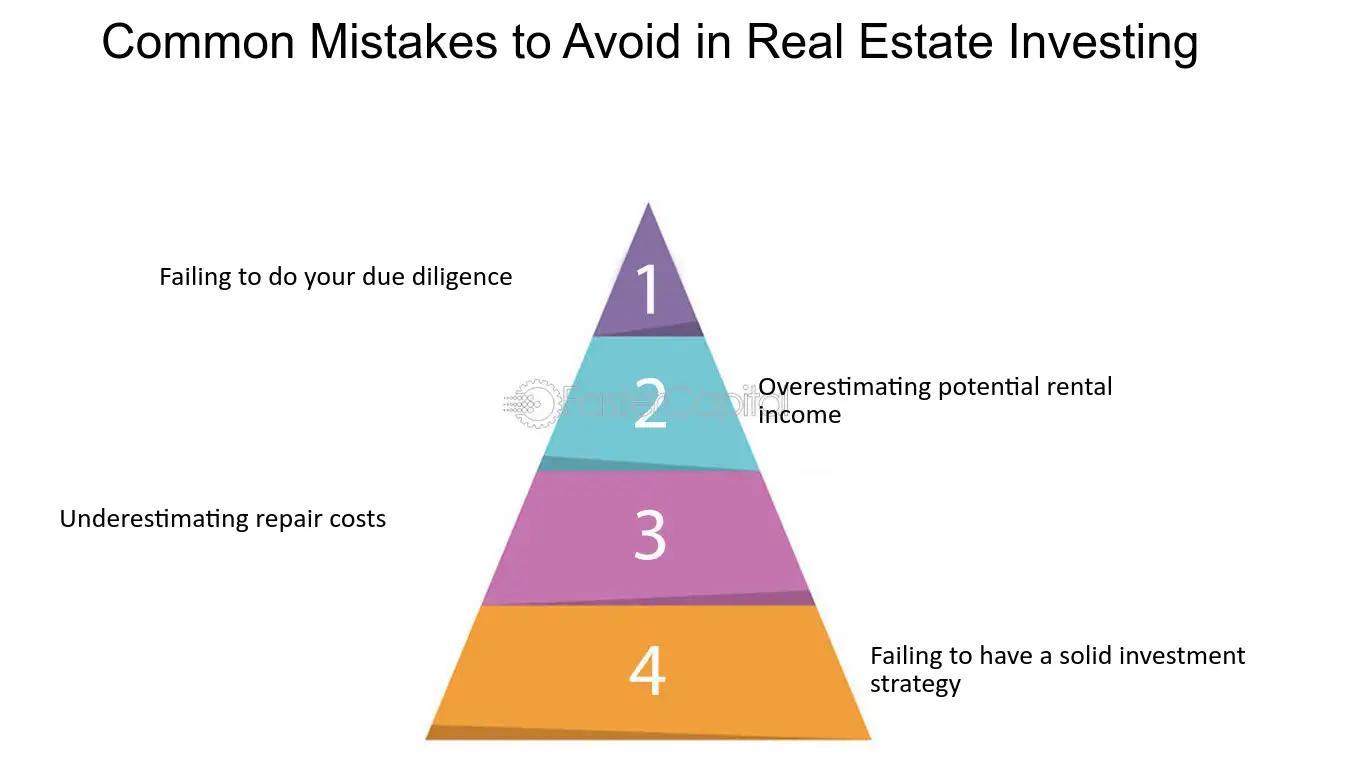

Overview of Common Mistakes in Property Investment

Overleveraging is a critical yet overlooked mistake. Excessive debt limits flexibility during market downturns. Instead, balancing financing with cash reserves ensures resilience and long-term portfolio stability.

Purpose and Structure of This Guide

This guide simplifies complex property investment challenges by combining expert insights and practical frameworks. It empowers investors to avoid pitfalls, optimize strategies, and achieve sustainable financial growth.

Mistake #1: Inadequate Market Research

Skipping thorough market research is like navigating without a map. For example, ignoring local trends led investors in 2008 to overvalue properties, amplifying losses during the crash.

Image source: investmentnews.com

Consequences of Neglecting Market Analysis

Overlooking market analysis can lead to misaligned investments. For instance, purchasing in oversaturated areas often results in prolonged vacancies, reduced cash flow, and diminished long-term property value.

Key Market Indicators to Evaluate

Focus on absorption rates—the speed at which properties are rented or sold. High absorption signals demand, while low rates warn of oversupply, guiding smarter investment timing and location choices.

Strategies for Effective Market Research

Leverage geo-specific data tools to analyze neighborhood-level trends. Combining demographic insights with predictive analytics uncovers hidden opportunities, ensuring investments align with future demand and market shifts.

Real-World Example: Profiting from Market Insights

A developer identified underserved rental demand using absorption rate analysis. By targeting mid-tier apartments in a growing suburb, they achieved 95% occupancy within six months, maximizing ROI.

Mistake #2: Overextending Financial Capacity

Overleveraging resembles building a house on sand—unstable and risky. Case studies show balanced portfolios, blending debt and liquidity, weather market downturns better, ensuring long-term financial resilience.

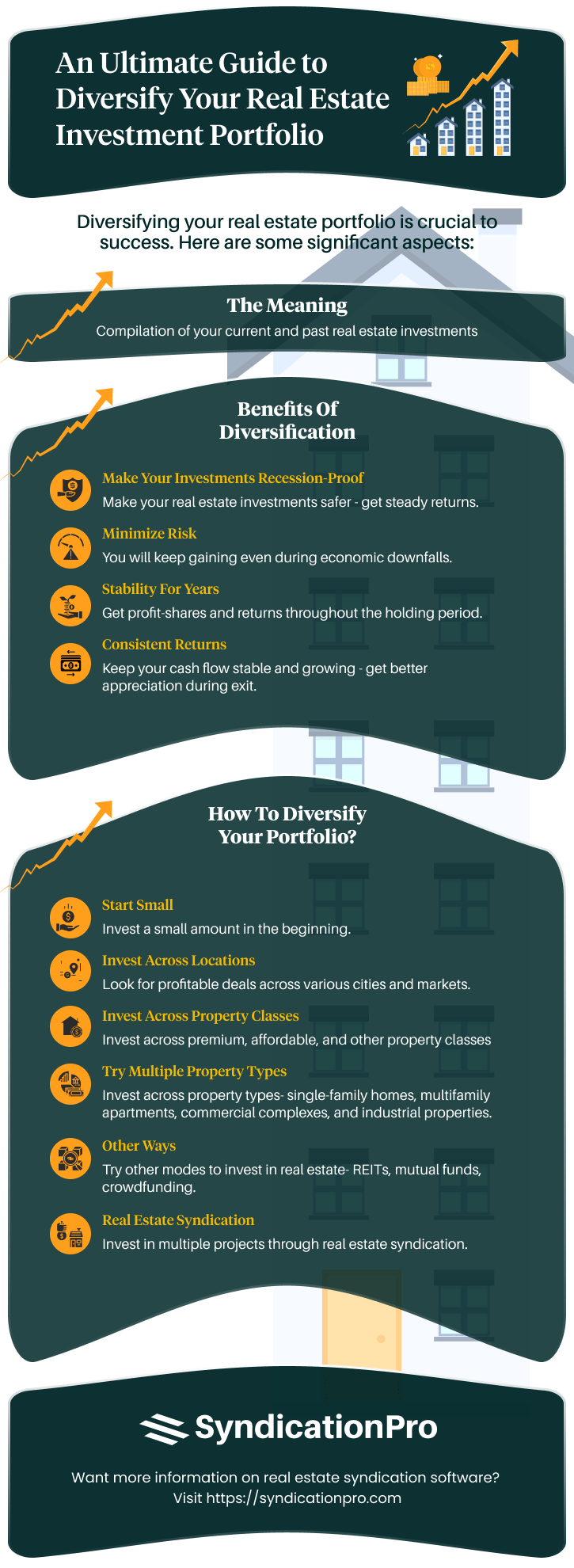

Image source: syndicationpro.com

Risks of Over-leverage in Property Investment

Excessive leverage magnifies losses during downturns. For instance, 2008’s crisis saw over-leveraged investors face foreclosures. Maintaining a healthy debt-to-equity ratio ensures stability and mitigates financial shocks.

Developing a Sustainable Financial Plan

Prioritize cash flow buffers over aggressive expansion. For example, allocating 20% of rental income to reserves cushions unexpected costs, ensuring flexibility. Diversify funding sources to reduce dependency on volatile markets.

Understanding Mortgage Options and Interest Rates

Opt for fixed-rate mortgages in volatile markets to stabilize costs. Leverage rate buy-downs for lower initial payments. Monitor economic trends to refinance strategically, maximizing long-term savings and flexibility.

Case Study: Financial Pitfalls and Recovery Strategies

An investor overleveraged during a downturn, risking foreclosure. By restructuring loans and liquidating underperforming assets, they restored cash flow, highlighting the importance of proactive financial management and diversification.

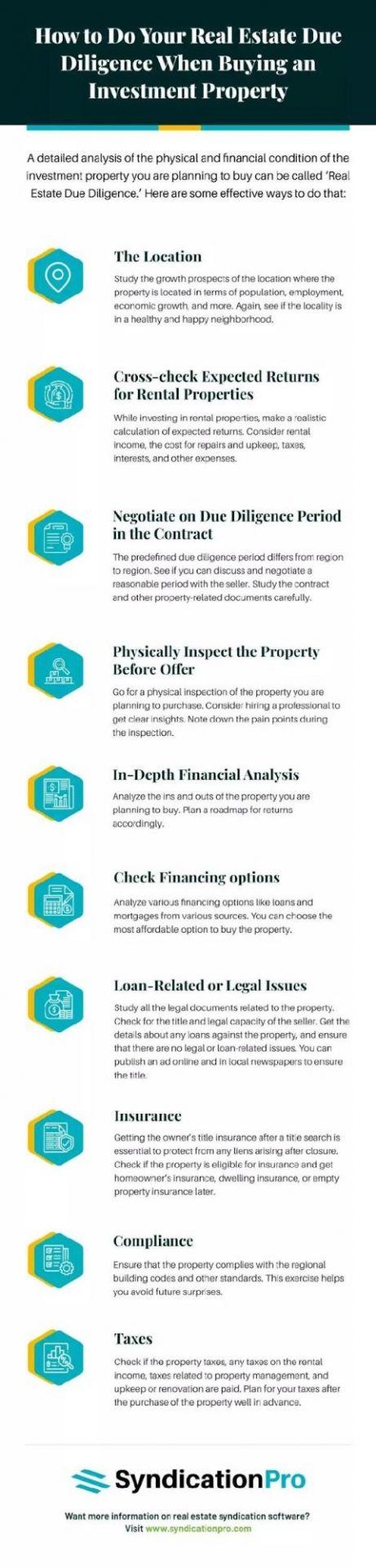

Mistake #3: Neglecting Property Inspection and Due Diligence

Skipping inspections is like buying a car without checking the engine. Hidden issues—like structural damage or zoning violations—can derail investments. Always hire experts to uncover unseen risks early.

Image source: syndicationpro.com

The Importance of Thorough Property Evaluation

Overlooking environmental hazards, like flood zones or soil instability, can inflate costs. Leveraging geotechnical surveys and local climate data ensures investments align with long-term safety and profitability goals.

Identifying Potential Red Flags

Unseen risks like unrecorded easements or outdated zoning laws can cripple investments. Use title searches and legal reviews to uncover hidden liabilities before committing to a purchase.

Best Practices in Conducting Due Diligence

Engage a multidisciplinary team—lawyers, inspectors, and accountants—to uncover hidden risks. Use predictive analytics to assess future market trends, ensuring informed decisions and maximizing investment potential.

Case Study: Uncovering Hidden Property Issues

A buyer discovered costly structural flaws through thermal imaging inspections. This advanced method revealed moisture damage invisible to the naked eye, saving thousands in unexpected repairs and renegotiating terms.

Mistake #4: Ignoring Legal Obligations and Compliance

Overlooking zoning laws is like building on quicksand—unstable and risky. A developer faced demolition after ignoring local permits, underscoring the need for proactive legal reviews.

Image source: secureframe.com

Legal Aspects of Property Investment

Failing to verify easements can derail projects. For instance, hidden utility easements blocked a developer’s plans, emphasizing the need for legal audits to uncover overlooked restrictions early.

Navigating Zoning Laws and Regulations

Securing rezoning permits can unlock hidden property value. For example, converting industrial land to mixed-use zoning boosted ROI by 40%. Engage local officials early to streamline approvals.

Ensuring Proper Documentation and Contracts

Overlooking force majeure clauses can expose investors to unforeseen risks. For instance, pandemic-related delays voided contracts without these clauses. Always consult legal experts to draft resilient agreements.

Case Study: Legal Challenges in Property Investment

A developer faced zoning violations after misinterpreting local laws, halting construction. Proactive legal audits and early municipal consultations could have prevented delays, saving $500,000 in penalties and lost time.

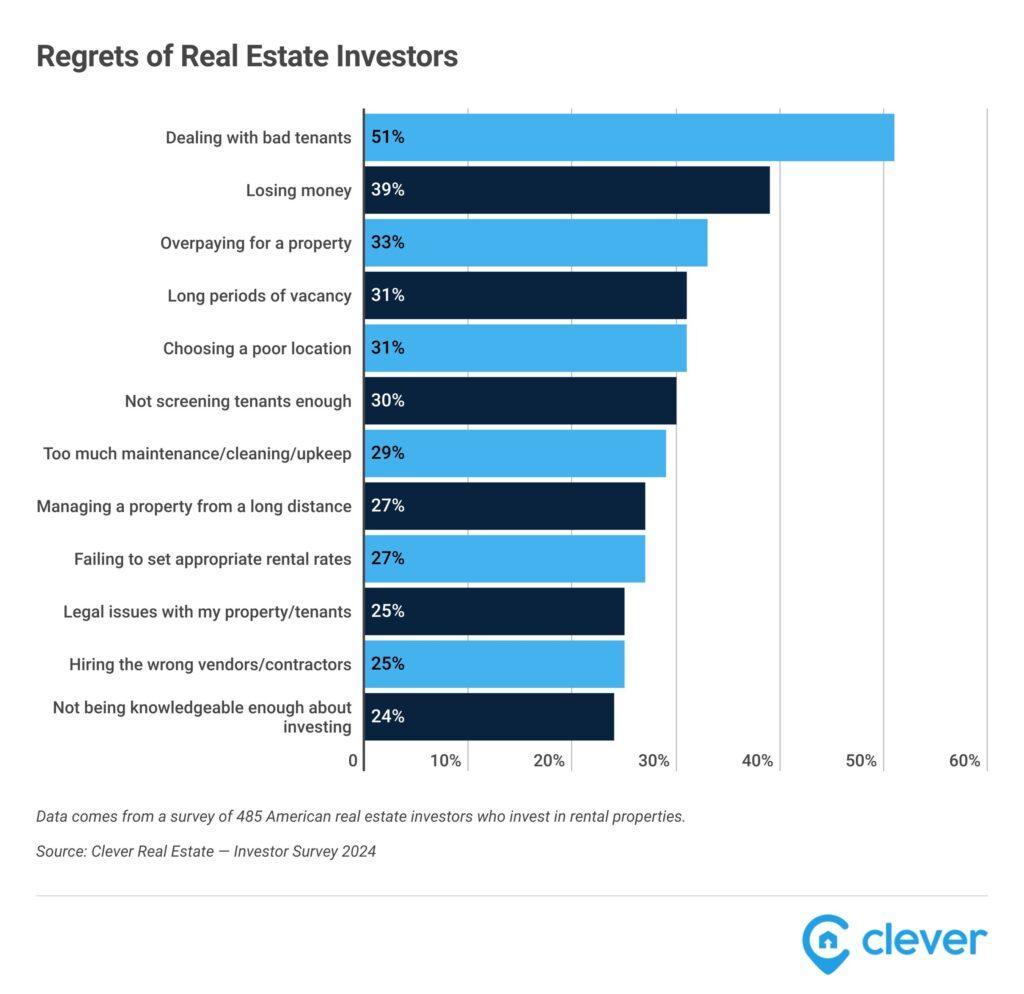

Mistake #5: Underestimating Property Management Responsibilities

Neglecting tenant screening is like skipping a background check for a business partner. Poor management leads to evictions, costly repairs, and vacancies. Professional managers reduce risks and maximize returns.

Image source: ipacommercial.com

Impact of Poor Property Management on Returns

Inefficient maintenance escalates repair costs by 30%, while unresolved tenant issues increase turnover. Leveraging predictive analytics ensures proactive care, reducing expenses and boosting tenant retention for sustained profitability.

Options for Managing Investment Properties

Self-management saves costs but demands time and expertise. Professional property managers offer scalability, legal compliance, and tenant satisfaction. Hybrid models, combining tech tools with oversight, balance efficiency and control effectively.

Leveraging Professional Property Management Services

Expert managers optimize rental pricing using market analytics, reducing vacancies. Their legal expertise prevents costly compliance errors, while proactive maintenance strategies enhance property value, ensuring long-term profitability and tenant satisfaction.

Case Study: Enhancing ROI Through Effective Management

A property manager reduced vacancies by 20% using targeted marketing and tenant screening. Proactive maintenance cut repair costs by 15%, boosting ROI while ensuring tenant retention and satisfaction.

Advanced Strategies for Successful Property Investment

Leverage AI-driven analytics to predict market trends, optimize property selection, and reduce risks. For example, machine learning tools identified undervalued neighborhoods, yielding 25% higher ROI for early investors.

Image source: linkedin.com

Utilizing Technology for Investment Decisions

AI-powered tools analyze crime rates, economic indicators, and demographic shifts, revealing hidden opportunities. For instance, predictive analytics identified a 30% appreciation potential in overlooked urban areas, reshaping investment strategies.

Diversification and Portfolio Management

Balancing asset classes like residential, commercial, and REITs reduces risk. A mixed portfolio during 2020’s market shifts outperformed single-asset investments by 18%, proving resilience through diversification.

Staying Ahead of Market Trends

Tracking migration patterns and remote work adoption reveals untapped markets. For example, suburban rental demand surged 25% post-2020, highlighting opportunities in adapting to evolving lifestyle preferences.

FAQ

What are the most common mistakes property investors make and how can they be avoided?

The most common mistakes include inadequate market research, overleveraging, neglecting property inspections, ignoring legal obligations, and poor property management. Avoid these by conducting thorough research, maintaining financial balance, performing due diligence, ensuring compliance, and leveraging professional management services.

How does inadequate market research impact property investment success?

Inadequate market research can lead to misaligned investments, reduced cash flow, and diminished property values. By neglecting key indicators like absorption rates or demographic trends, investors risk financial losses and missed opportunities.

What strategies can help prevent overleveraging in property investment?

Strategies to prevent overleveraging include maintaining a healthy debt-to-equity ratio, establishing cash flow buffers, diversifying funding sources, and opting for fixed-rate mortgages to manage interest rate risks effectively.

Why is due diligence critical before purchasing an investment property?

Due diligence is critical as it uncovers hidden issues such as structural defects, legal complications, or financial inconsistencies. It ensures informed decision-making, minimizes risks, and helps secure a property that aligns with investment goals.

How can effective property management improve investment returns?

Effective property management improves investment returns by optimizing rental pricing, reducing vacancy periods, ensuring timely maintenance, and enhancing tenant satisfaction. Professional management also streamlines operations, mitigates risks, and preserves long-term property value.

Conclusion

Avoiding property investment mistakes is like navigating a maze—success lies in preparation and strategy. For instance, a 2023 study revealed that investors leveraging predictive analytics saw 20% higher returns compared to those relying on intuition alone. Similarly, balancing debt with liquidity acts as a financial safety net, much like a tightrope walker using a balancing pole. Misconceptions, such as assuming all property managers are equally effective, can lead to costly oversights; instead, vetting professionals ensures optimized returns. By combining due diligence, market insights, and expert guidance, investors can transform potential pitfalls into stepping stones for long-term success.

Image source: syndicationpro.com

Recap of Key Lessons Learned

Focusing on data-driven decision-making transforms property investment outcomes. For example, leveraging AI tools like CoStar can predict market shifts, reducing vacancy risks by 15%. This approach bridges real estate with tech innovation, ensuring smarter, future-proof investments.

The Path Forward for Savvy Investors

Integrating geographic diversification with AI-driven tools like Mashvisor uncovers undervalued markets. This strategy minimizes location-specific risks, aligns with economic trends, and ensures resilient, scalable portfolio growth.

Final Thoughts on Avoiding Investment Pitfalls

Adopting scenario planning prepares investors for market volatility. For instance, stress-testing portfolios against economic downturns ensures liquidity, protecting assets and enabling strategic pivots during unpredictable market shifts.