The Property Goldmine: Uncover the Next Big Investment Hotspots of Australia!

Australia’s property market is full of surprises—did you know some of the fastest-growing suburbs aren’t in bustling cities but in overlooked regional hubs? With shifting lifestyle trends, booming infrastructure, and untapped opportunities, the stakes have never been higher. Where should savvy investors look next? Let’s uncover the hidden gems shaping tomorrow’s real estate landscape.

Image source: abrealtywa.com

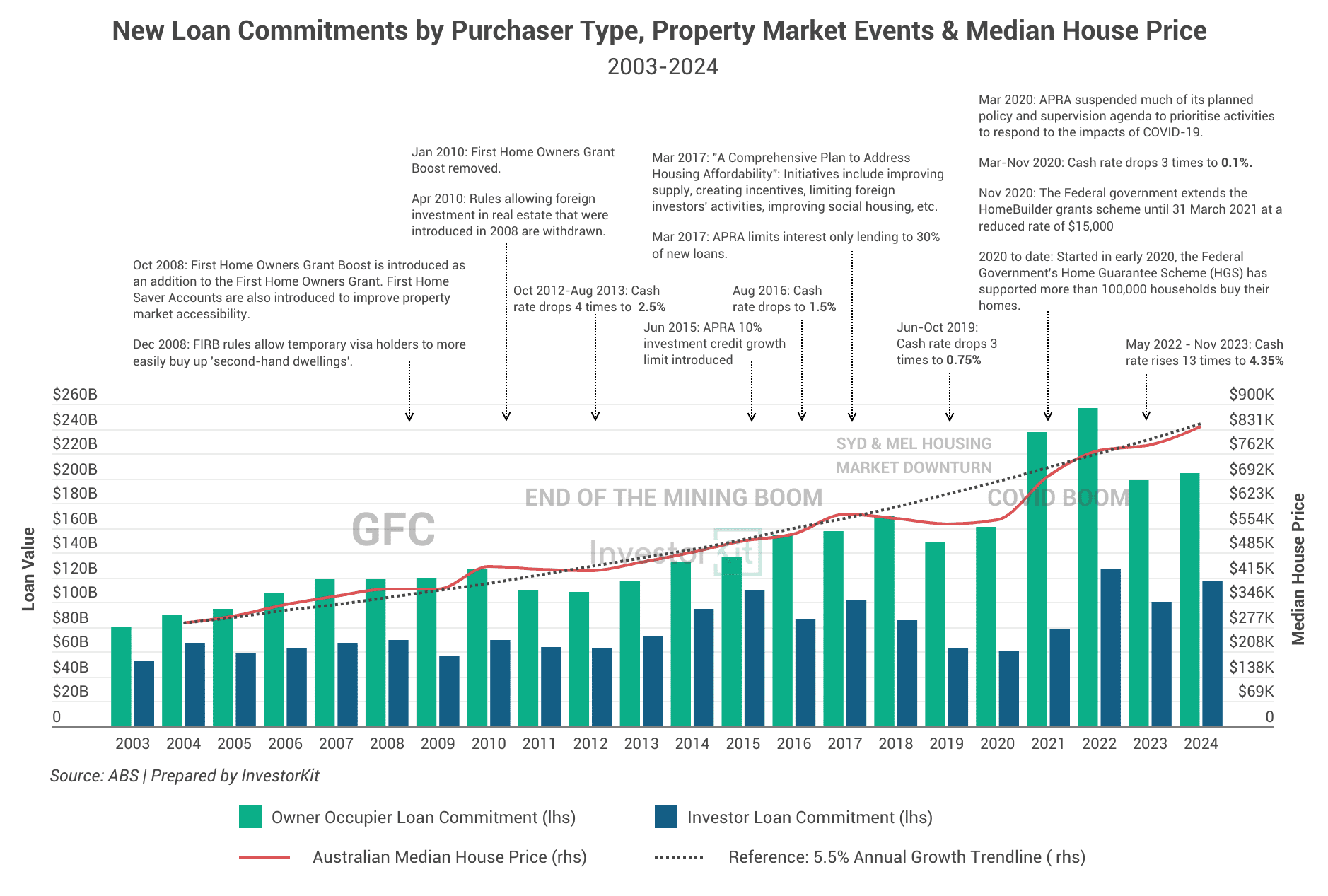

The Current Landscape of Australian Property Investment

Australia’s property market is increasingly shaped by proptech innovations. Platforms leveraging AI and big data now predict suburb growth with uncanny accuracy, helping investors identify undervalued areas. For example, tools like RP Data spotlight regional hubs benefiting from infrastructure upgrades. Embracing these technologies offers a competitive edge in spotting tomorrow’s hotspots today.

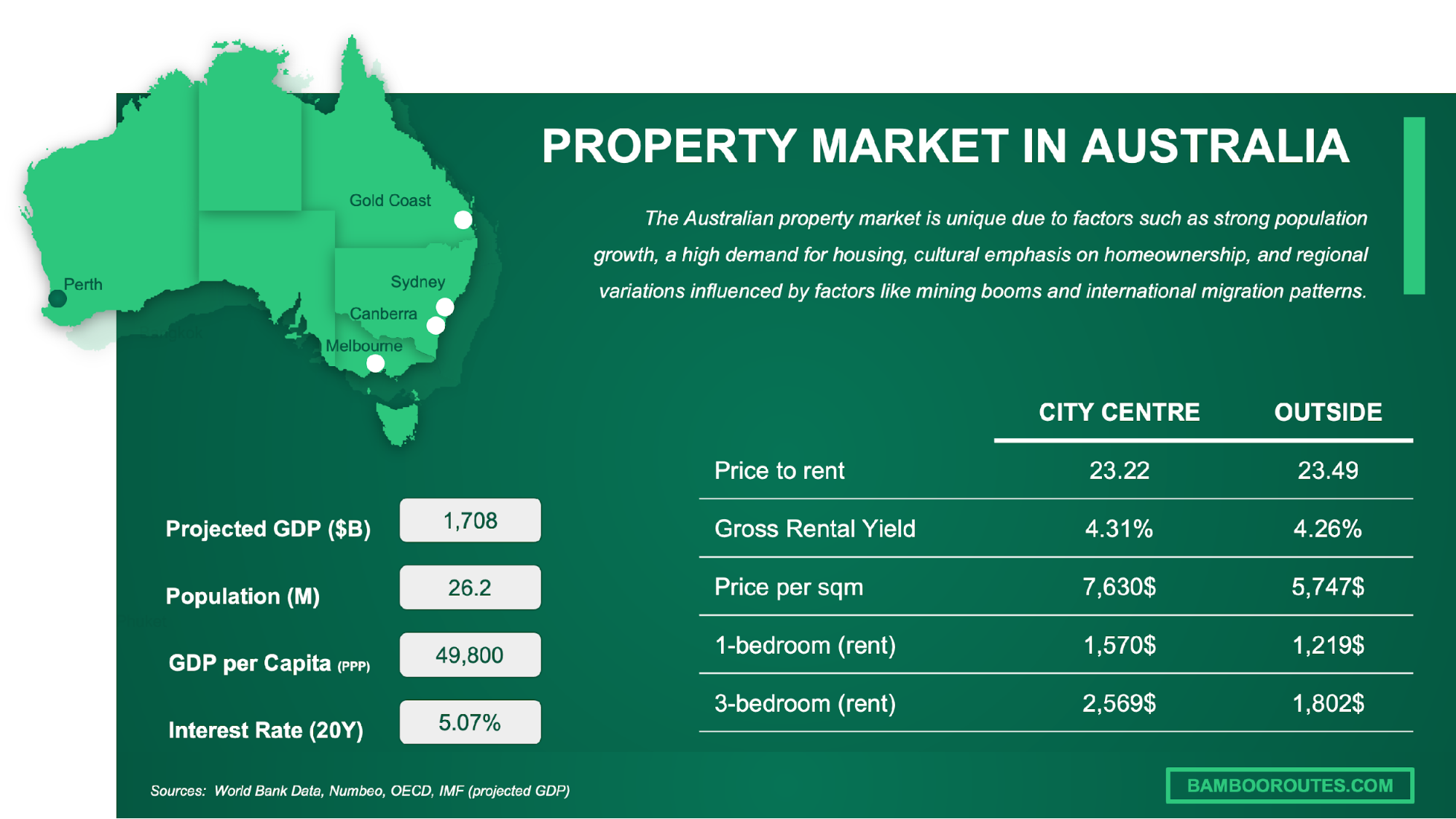

Why Australia? Global and Local Investment Appeal

Australia’s stable currency and transparent legal framework make it a magnet for global investors. Lesser-known? Its $120 billion infrastructure pipeline is transforming regional areas into high-growth zones. This blend of economic resilience and strategic development offers a rare dual advantage: security for cautious investors and high ROI potential for risk-takers.

Understanding the Foundations of Property Investment

Property investment thrives on three pillars: location, timing, and strategy. For instance, Ballarat’s infrastructure boom has spiked rental yields by 15% in five years. Misconception? It’s not just about buying low—aligning with demographic trends and government policies is key. Think of it as planting seeds in fertile, well-irrigated soil.

Image source: bambooroutes.com

Core Principles of Real Estate Investment

Focus on cash flow positivity. Properties yielding rental income above costs outperform speculative buys. For example, regional hubs like Toowoomba offer 6%+ yields due to infrastructure growth. Overlooked? Emotional detachment—treat properties as assets, not trophies. Future-proofing investments by aligning with economic trends ensures long-term stability and scalability in dynamic markets.

Economic Factors Influencing Property Markets

Population growth drives demand, especially in urban hubs. For instance, Melbourne’s 2% annual growth has tightened housing supply, pushing prices upward. Lesser-known? Exchange rates—a weaker Australian dollar attracts foreign investors, amplifying competition. Smart investors monitor these trends, pairing them with infrastructure projects to identify high-growth opportunities early.

Legal and Regulatory Framework in Australia

Trust structures simplify collective property investments, offering tax efficiency and legal protection. For example, property trusts pool investor funds, distributing income proportionally. Overlooked? Zoning laws—they dictate land use, impacting development potential. Investors should consult experts to navigate these complexities, ensuring compliance while maximizing returns in high-demand areas.

Methodologies for Identifying Investment Hotspots

Leverage big data tools like RP Data to analyze suburb growth trends. For instance, Ballarat’s rental yields surged post-infrastructure upgrades. Combine this with on-ground insights—local council plans often reveal hidden gems. Avoid the myth that only capital cities thrive; regional hubs like Toowoomba now outperform due to strategic developments.

Image source: realestate.com.au

Analyzing Economic Indicators

Focus on employment trends—rising job opportunities often signal housing demand. For example, Toowoomba’s economy thrived with infrastructure projects, boosting property values. Look beyond population growth; instead, track median income shifts and industry diversification. These factors reveal long-term stability, helping investors avoid short-lived booms and target sustainable growth areas.

Demographic Trends and Urbanization

Target migration hotspots—areas like Western Sydney thrive as skilled migrants settle near job hubs. Urbanization isn’t just about population density; lifestyle preferences like walkability and green spaces drive demand. Challenge the myth that only young professionals shape trends; retirees downsizing to urban apartments are reshaping property dynamics.

Infrastructure Projects and Development Plans

Focus on transport corridors—projects like Melbourne’s Suburban Rail Loop boost connectivity, driving property demand. Lesser-known factors, such as school upgrades or healthcare expansions, also elevate area appeal. Avoid over-reliance on announced projects; instead, track funding allocations to ensure execution. Proactively align investments with these developments for long-term growth.

Technological Disruptions and Smart Cities

AI-driven tools like PropTrack predict suburb growth by analyzing micro-trends—from traffic patterns to energy efficiency. Smart city initiatives, such as Brisbane’s IoT-enabled infrastructure, enhance livability and attract buyers. Overlooked? Data privacy concerns. Investors should prioritize tech-friendly regions while ensuring compliance with evolving regulations for sustainable, future-proof opportunities.

Unveiling Australia’s Emerging Investment Hotspots

Regional gems like Geelong and Tamworth are thriving due to affordability and connectivity. For instance, Tamworth’s median property prices remain significantly lower than Sydney’s, yet infrastructure upgrades fuel growth. Misconception? Only cities grow. Reality? Lifestyle-driven migration to coastal towns like Sunshine Coast proves regional areas can outperform urban hubs in ROI.

Image source: propertyupdate.com.au

Metropolitan Areas with Untapped Potential

Outer suburbs like Melbourne’s Werribee are hidden gems. Why? Proximity to CBDs, combined with affordable housing and infrastructure projects like the Regional Rail Link, drive demand. Conventional wisdom says inner-city dominates, but commuter-friendly suburbs often outperform. Actionable tip: Target areas with planned transport upgrades for long-term capital growth.

Regional Centers Poised for Growth

Ballarat’s rise highlights infrastructure-driven growth. The Melbourne-Ballarat rail upgrade slashes commute times, attracting professionals seeking affordability. Lesser-known factor? Local job creation in healthcare and education boosts demand. Forget the “regional equals slow growth” myth—target regions with economic diversification and transport links for sustainable returns.

Case Studies: Success Stories of Rising Areas

Geelong’s transformation shows how lifestyle migration and tech-sector growth fuel property demand. Proximity to Melbourne, coupled with waterfront developments, attracts professionals and families. Lesser-known driver? Government incentives for regional relocation. Actionable insight: Focus on areas blending affordability, job creation, and lifestyle appeal to capture long-term growth opportunities.

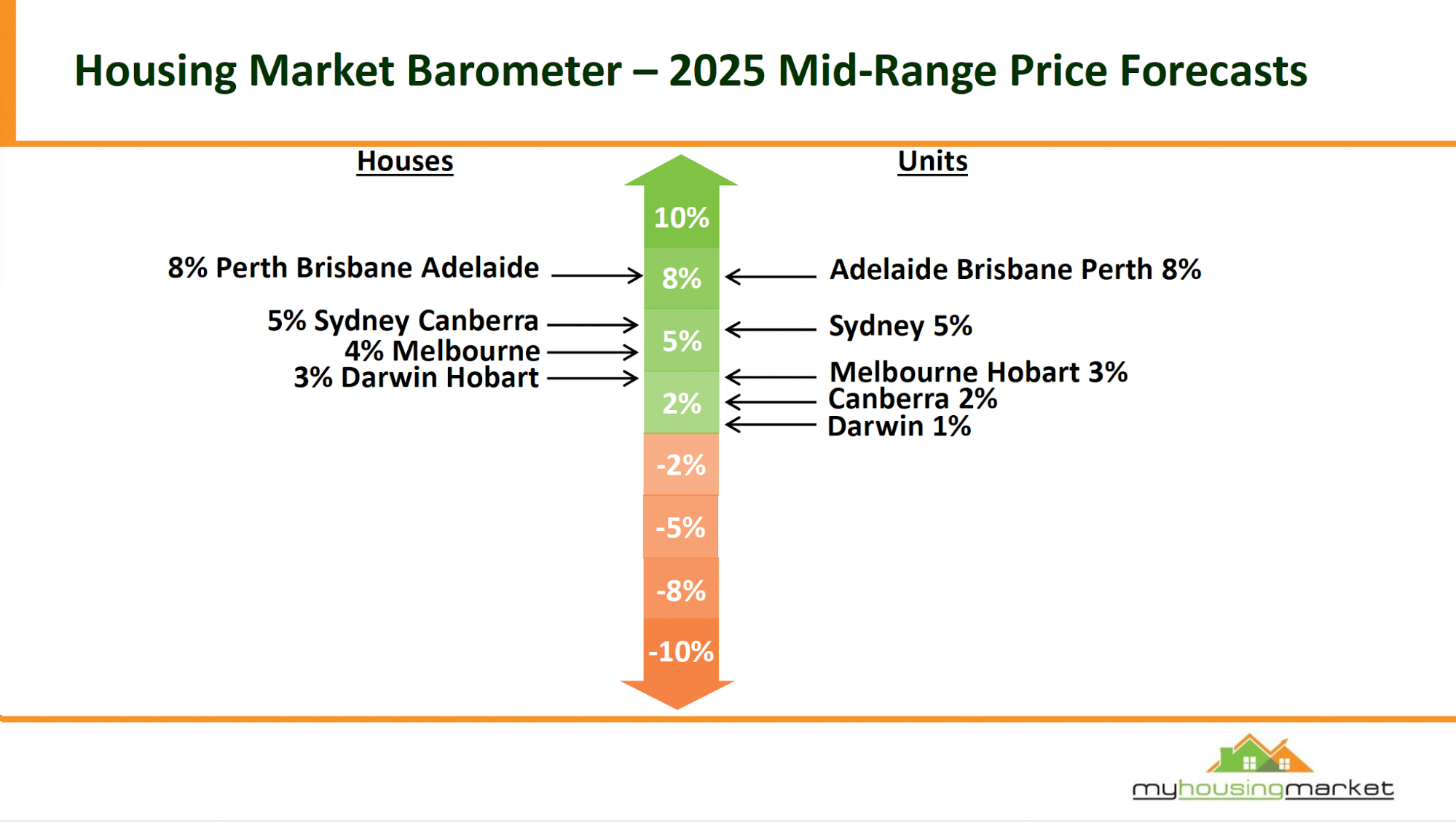

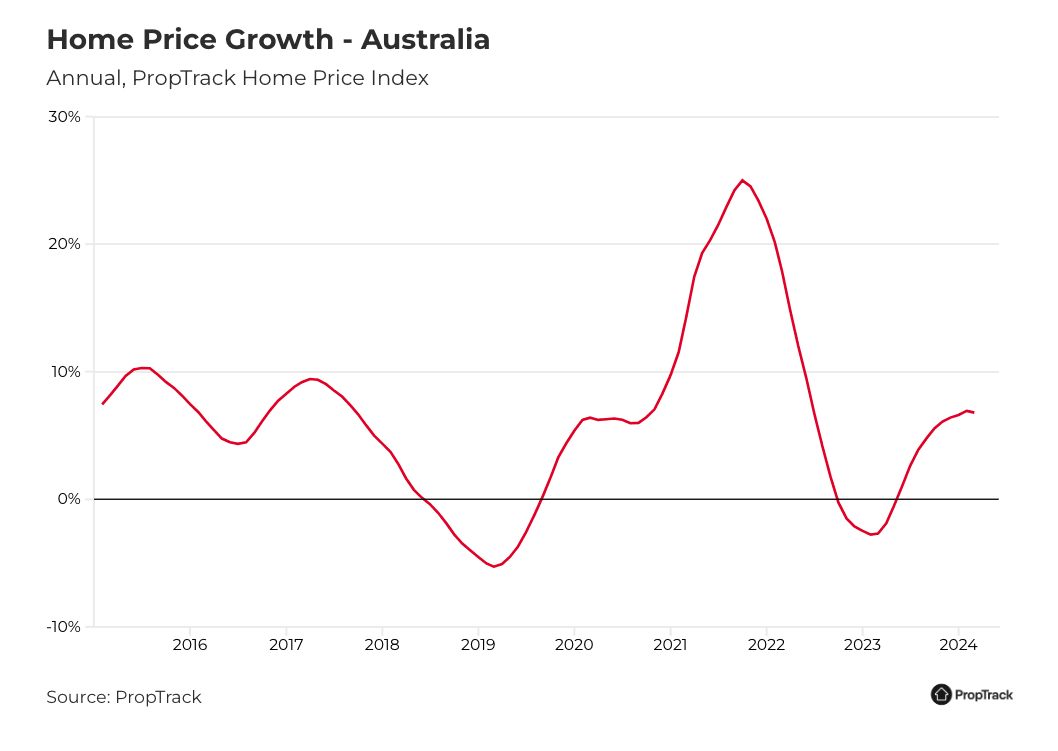

Expert Predictions and Market Forecasts

Dr. Andrew Wilson predicts a 5% national property value increase in 2025, driven by high immigration and constrained housing supply. Lesser-known factor? Delayed rate cuts by the RBA could spark late-year market activity. Actionable tip: Monitor local demand-supply imbalances to identify suburbs primed for above-average growth.

Investing Strategically in Australia’s Property Market

Strategic investing is like solving a puzzle—location, timing, and data are your key pieces. For instance, Ballarat’s 15% rental yield surge over five years highlights the power of infrastructure-driven growth. Misconception? Cities always outperform. Truth: Regional hubs like Toowoomba, with 6% yields, often outshine urban areas.

Image source: amberstudent.com

Formulating Effective Investment Strategies

Focus on cash flow positivity. Properties near planned transport hubs, like Melbourne’s Suburban Rail Loop, often yield higher rents. Lesser-known factor? Zoning changes. A rezoned suburb can skyrocket in value. Actionable tip: Use tools like CoreLogic to track rezoning proposals and demographic shifts for smarter, future-proof investments.

Risk Assessment and Management

Leverage sensitivity analysis to predict impacts of interest rate hikes on cash flow. Lesser-known tip? Monitor tenant reliability metrics—areas with stable employment reduce vacancy risks. Real-world example: Sydney’s tech hubs attract long-term tenants. Actionable insight: Use scenario planning tools to prepare for market dips, ensuring portfolio resilience and growth.

Financing and Leverage Options

Explore offset accounts—they reduce interest while maintaining liquidity. Why it works? Funds offset loan balances, cutting costs without locking cash. Real-world example: Brisbane investors use this to manage cash flow during market dips. Actionable tip: Pair with flexible loan structures for adaptability in fluctuating property cycles.

Taxation and Investment Incentives

Leverage depreciation schedules to claim deductions on property wear and tear—boosting cash flow. Why it works? It reduces taxable income without impacting rental yields. Example: Investors in Melbourne’s new builds save thousands annually. Pro tip: Combine with negative gearing for maximum tax efficiency in high-growth markets.

Future Trends Impacting Property Investment

Sustainability is reshaping investments—green properties now attract premium buyers. Example: Energy-efficient homes in Brisbane saw a 15% value surge in 2024. Misconception? Green upgrades are costly; in reality, they lower long-term expenses. Expert tip: Pair eco-friendly features with smart tech to future-proof assets and boost market appeal.

Image source: investorkit.com.au

Climate Change and Sustainable Development

Rising sea levels are reshaping coastal investments. Example: Byron Bay faces erosion risks, pushing demand inland. Lesser-known factor? Green mortgages incentivize eco-friendly builds, reducing upfront costs. Actionable insight: Target regions blending sustainability with infrastructure upgrades—like Newcastle—where green policies and transport links drive both resilience and long-term growth potential.

Shifts in Work Culture and Remote Living

Hybrid work models are driving demand for flexible homes. Example: Properties near Brisbane with dual-purpose spaces saw a 20% rental premium in 2024. Lesser-known factor? Digital infrastructure—high-speed internet access is now a dealbreaker. Insight: Invest in suburbs upgrading connectivity, like Ipswich, to capture this growing remote-work-driven market.

Government Policies and Economic Stimuli

The Housing Future Fund allocates $10 billion to boost affordable housing, targeting regional hubs like Ballarat. Why it works? It attracts skilled workers, driving demand. Lesser-known factor? Tax incentives for green builds amplify investor returns. Actionable tip: Focus on areas benefiting from dual policies—affordability and sustainability—for long-term growth.

Global Economic Factors and Their Influence

Currency fluctuations play a pivotal role—e.g., a weaker Australian dollar attracts foreign investors, boosting demand. Why it works? It lowers entry costs for overseas buyers. Lesser-known factor? Trade agreements can stabilize export-driven regions. Actionable insight: Monitor trade policies and currency trends to identify undervalued markets with high growth potential.

FAQ

What factors should investors consider when identifying emerging property hotspots in Australia?

Investors should evaluate key factors such as infrastructure developments, population growth, and employment opportunities. Additionally, analyzing zoning changes, rental yields, and demographic trends provides deeper insights. Leveraging tools like big data analytics and consulting local councils can uncover hidden opportunities. Prioritizing areas with strategic government investments ensures long-term growth potential.

How do infrastructure developments influence property market growth in regional areas?

Infrastructure developments enhance accessibility and convenience, driving demand in regional areas. Projects like new transport links or upgraded facilities attract businesses and residents, boosting property values. For example, the Sydney to Newcastle fast rail improves commuting, increasing desirability. Monitoring such developments helps investors capitalize on rising rental yields and capital growth.

What role does demographic data play in predicting high-growth investment locations?

Demographic data reveals population trends, age distributions, and migration patterns, highlighting areas with growing demand. For instance, regions attracting young professionals or retirees often see increased housing needs. Understanding lifestyle preferences, such as walkability or green spaces, helps predict market shifts. This data enables investors to align strategies with future growth opportunities.

How can technology and big data tools assist in uncovering the next big investment hotspots?

Technology and big data tools analyze vast datasets to identify emerging trends and growth patterns. Platforms like RP Data provide insights into suburb performance, infrastructure impacts, and rental yields. AI-driven models predict future hotspots by evaluating factors like population growth and economic activity. These tools empower investors with precise, data-backed decisions.

What are the risks and challenges associated with investing in lesser-known property markets?

Investing in lesser-known property markets carries risks such as limited market data, potential oversupply, and slower liquidity. These areas may also face economic instability or lack of infrastructure development. Thorough due diligence, diversification, and consulting local experts can help mitigate these challenges and ensure informed investment decisions.

Conclusion

Australia’s property market is a dynamic puzzle, where hotspots like Geelong and Perth emerge as hidden gems, driven by lifestyle shifts and infrastructure upgrades. Think of it as surfing—catching the right wave (market trends) at the right time ensures a smooth ride. Stay informed, act early, and ride the property wave smartly!

Image source: realestate.com.au

Synthesizing Key Insights

Focusing on infrastructure-led growth, areas like Western Sydney thrive due to transport upgrades, creating ripple effects on property demand. Think of infrastructure as the backbone—without it, growth falters. Pairing this with demographic data, such as migration trends, offers a powerful framework for spotting untapped opportunities before they peak.

Looking Ahead: The Future of Australian Property Investment

Sustainability will redefine property value—green-certified homes already command higher resale prices. As climate risks intensify, inland regions with resilient infrastructure will outshine coastal hotspots. Pairing eco-conscious design with tech-driven insights, like AI-powered risk assessments, equips investors to future-proof portfolios while aligning with evolving buyer preferences and regulatory shifts.