The Property Portfolio Playbook: Lessons from Australia’s Top Investors

Australia’s top property investors aren’t just buying homes—they’re predicting the future. What if the key to building wealth isn’t where you invest, but how you think?

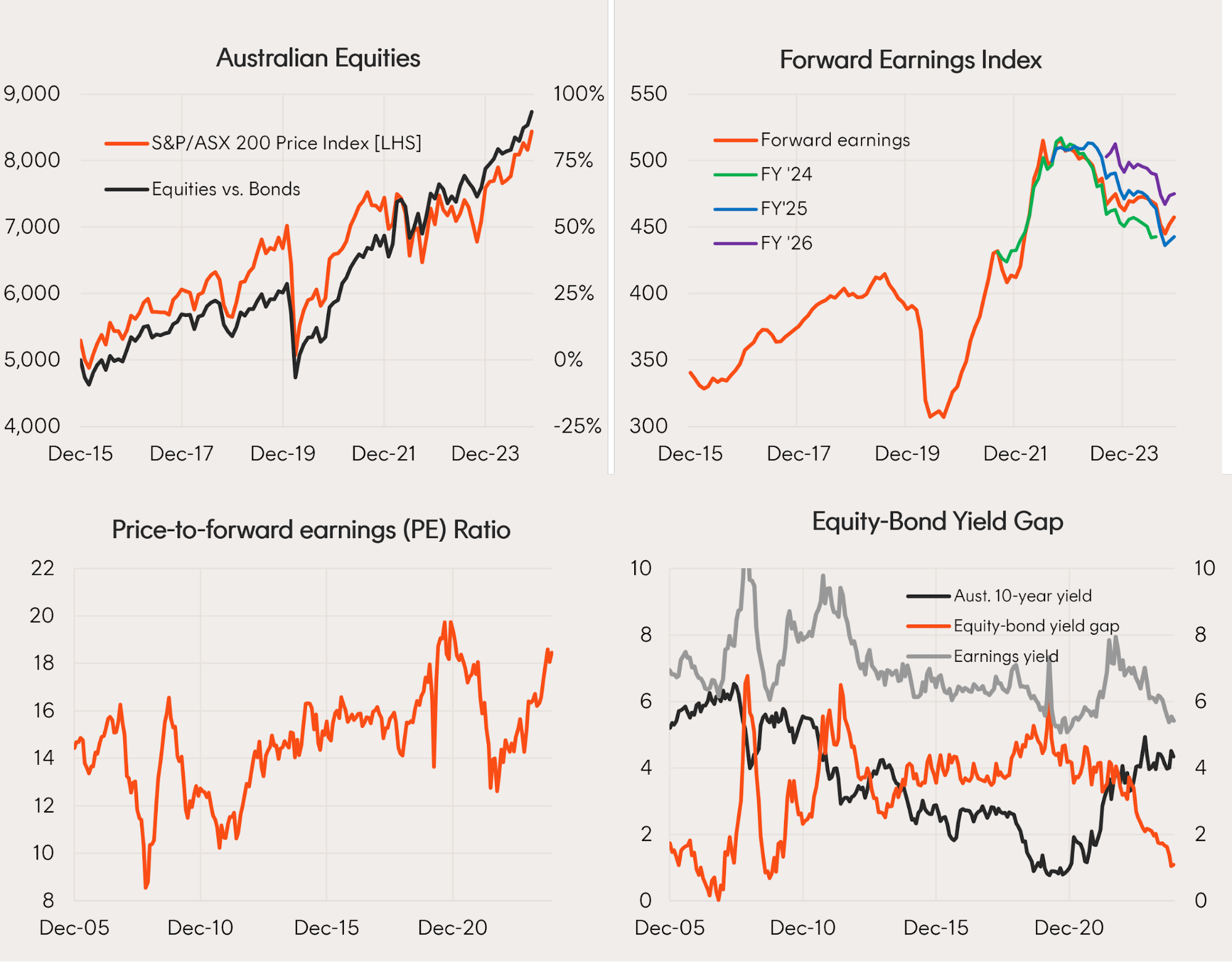

Image source: betashare.org

The Evolution of Property Investment in Australia

Australia’s property investment landscape has shifted dramatically, driven by technology, demographic changes, and economic factors. Traditional strategies, like relying solely on location, are no longer sufficient.

Technology’s Role: Tools like CoreLogic and PropTrack now enable investors to analyze rental yields, crime rates, and growth potential with precision. Blockchain is also emerging, allowing fractional ownership of high-value properties, democratizing access to premium assets.

Demographic Shifts: Millennials prioritize lifestyle over size, favoring walkable, coastal areas, while baby boomers downsize into luxury apartments. Migration trends further amplify demand in job-rich regions like Brisbane and Western Sydney.

Economic Influences: Interest rates and inflation dictate affordability, while global trends, such as remote work, reshape demand for regional properties. Investors must adapt to these dynamics to stay competitive.

To thrive, investors should embrace data-driven tools, monitor demographic trends, and anticipate economic shifts. The future belongs to those who innovate, not just follow.

Who Are Australia’s Top Property Investors?

Australia’s top property investors excel by leveraging strategic diversification. They balance high-growth urban properties with cash-flow-positive regional investments, mitigating risks while maximizing returns across varying market conditions.

Why It Works: Diversification reduces exposure to localized downturns. For instance, pairing a Sydney apartment with a dual-income property in a regional area ensures steady cash flow during market fluctuations.

Real-World Example: A Brisbane investor combined a high-growth city property with a commercial asset, offsetting mortgage costs while benefiting from long-term capital appreciation.

Lesser-Known Factor: Many top investors use data-driven tools like CoreLogic to identify undervalued suburbs, ensuring informed decisions rather than relying on intuition.

Actionable Insight: Build a portfolio that blends growth and stability. Use analytics platforms to uncover hidden opportunities and align investments with your financial goals.

Purpose and Scope of the Playbook

This playbook emphasizes tailored investment strategies, guiding investors to align property choices with personal financial goals, risk tolerance, and market trends for sustainable portfolio growth.

Why It Works: Customization ensures investments remain relevant despite market volatility. For example, a young investor prioritizing capital growth may focus on emerging suburbs, while retirees might prefer cash-flow-positive properties.

Real-World Application: A Melbourne-based investor used this approach to shift from high-risk developments to stable rental properties, achieving consistent returns during economic downturns.

Lesser-Known Factor: Behavioral finance plays a role—investors often overestimate their risk tolerance. Structured planning mitigates emotional decision-making.

Actionable Insight: Regularly reassess your portfolio to ensure alignment with evolving goals and market conditions, leveraging expert advice and analytics for precision.

Understanding the Foundations of Property Investment

Successful property investment starts with financial literacy and market awareness. Think of it as building a house—your financial strategy is the foundation, and market knowledge forms the framework.

Key Insight: Many investors overlook the importance of advanced financial modeling. For instance, using tools like sensitivity analysis can reveal how interest rate changes impact cash flow, preventing costly surprises.

Unexpected Connection: Behavioral biases, such as overconfidence, often lead to poor decisions. Studies show that structured planning reduces emotional pitfalls, improving long-term outcomes.

Real-World Example: A Sydney investor avoided a market downturn by analyzing historical data trends, opting for a regional property with stable rental demand instead of a high-risk urban development.

Actionable Framework: Start with a clear financial blueprint, incorporating risk assessments and tax strategies. Regularly update your market knowledge to adapt to evolving conditions, ensuring your portfolio remains resilient.

Image source: venngage.com

Defining Investment Goals: Wealth Creation and Beyond

Fresh Insight: Effective investment goals go beyond financial returns—they shape decision-making frameworks, balancing short-term liquidity with long-term stability.

Why It Works: Goals act as a compass, guiding investors through market volatility. For example, a Brisbane investor combined short-term property flips with long-term buy-and-hold strategies, achieving both immediate cash flow and sustained growth.

Lesser-Known Factor: Psychological resilience plays a critical role. Investors with clearly defined goals are more likely to stay the course during economic downturns, avoiding panic-driven decisions.

Actionable Framework:

- Segment Goals: Divide into short-term (1–3 years), medium-term (3–7 years), and long-term (7+ years) objectives.

- Incorporate Flexibility: Allow room for life changes or market shifts.

- Leverage Data: Use predictive analytics to align goals with market trends.

Forward-Looking Implication: By integrating adaptive goal-setting with data-driven insights, investors can future-proof their portfolios, ensuring alignment with evolving personal and market dynamics.

Property Investment Models: An Overview

Fresh Insight: The Discounted Cash Flow (DCF) model is a game-changer, offering precise valuation by projecting future cash flows and discounting them to present value.

Why It Works: By adjusting variables like rental growth, interest rates, and market conditions, DCF provides a range of outcomes, enabling investors to plan for best- and worst-case scenarios.

Real-World Application: A Melbourne investor used DCF to evaluate a mixed-use property, identifying undervaluation due to underestimated rental growth, leading to a 15% ROI within three years.

Lesser-Known Factor: Sensitivity analysis within DCF highlights how small changes in assumptions (e.g., vacancy rates) can significantly impact profitability, offering deeper risk insights.

Actionable Framework:

- Gather Accurate Data: Use tools like CoreLogic for market trends and rental yields.

- Run Multiple Scenarios: Test optimistic, neutral, and pessimistic projections.

- Integrate Tax Impacts: Factor in depreciation and capital gains tax for realistic outcomes.

Forward-Looking Implication: Combining DCF with emerging AI-driven valuation tools can refine predictions, empowering investors to make smarter, data-backed decisions in dynamic markets.

The Role of Research and Market Analysis

Fresh Insight: Micro-market analysis uncovers hidden opportunities by focusing on hyper-local trends, such as school zones, public transport access, and demographic shifts.

Why It Works: Real estate trends vary significantly within suburbs. For instance, properties near top-rated schools often command higher rental yields and long-term appreciation.

Real-World Application: A Sydney investor leveraged micro-market data to purchase a property two streets closer to a sought-after school zone, increasing rental demand and achieving a 20% higher yield.

Lesser-Known Factor: Buyer sentiment, often overlooked, can influence short-term price fluctuations. Tools like PropTrack analyze sentiment to predict emerging hotspots.

Actionable Framework:

- Leverage Technology: Use platforms like CoreLogic for granular data on demographics and infrastructure.

- Track Local Developments: Monitor zoning changes and new projects for growth potential.

- Combine Data Sources: Blend sentiment analysis with traditional metrics for a holistic view.

Forward-Looking Implication: Integrating AI-driven sentiment tools with micro-market analysis will redefine how investors identify undervalued properties, ensuring smarter, faster decisions in competitive markets.

Building a Strong Property Portfolio

Original Insight: A strong portfolio thrives on strategic diversification, balancing high-growth properties with cash-flow-positive assets to weather market fluctuations and ensure steady returns.

Concrete Evidence: According to CoreLogic, portfolios blending metropolitan high-growth properties with regional dual-income homes outperform single-strategy investments by 18% over five years.

Unexpected Connection: Think of your portfolio like a balanced diet—too much of one “nutrient” (e.g., high-growth properties) can leave you vulnerable to market “illnesses” like interest rate hikes.

Common Misconception: Many believe owning numerous properties equals success. In reality, quality trumps quantity. A single well-located, positively geared property often outperforms multiple underperforming ones.

Expert Perspective: Karen Young, a seasoned investor, emphasizes reassessing each purchase: “Every property should serve a clear purpose in your portfolio—growth, cash flow, or diversification.”

Actionable Framework:

- Diversify Locations: Invest across states to mitigate local market risks.

- Mix Property Types: Combine residential and commercial assets for stability.

- Reassess Regularly: Align properties with evolving financial goals.

Forward-Looking Implication: As AI tools refine market predictions, investors can craft portfolios that dynamically adapt, ensuring resilience and growth in an ever-changing landscape.

Image source: stancerealestate.com

Strategic Planning: Short-Term vs. Long-Term Investments

Fresh Insight: Short-term investments excel in market adaptability, while long-term strategies leverage compound growth for wealth accumulation, creating a dynamic interplay between flexibility and stability.

Detailed Analysis: Short-term approaches, like property flipping, capitalize on immediate market trends but demand active management. Long-term investments, such as “buy and hold,” benefit from tax advantages and steady appreciation over decades.

Real-World Application: A Melbourne investor flipped properties in emerging suburbs, earning 25% returns in two years. Meanwhile, a Sydney investor held a single property for 15 years, achieving 300% capital growth.

Lesser-Known Factor: Short-term strategies often face higher tax burdens, while long-term investments enjoy reduced capital gains tax, significantly impacting net returns.

Challenging Conventional Wisdom: Many assume short-term strategies are riskier. However, with precise market analysis and exit planning, they can offer controlled, high-yield opportunities.

Actionable Framework:

- Short-Term: Focus on undervalued properties in growth corridors; plan for quick renovations and resale.

- Long-Term: Prioritize locations with strong infrastructure and demographic growth for sustained appreciation.

- Hybrid Approach: Combine both strategies to balance liquidity and stability.

Forward-Looking Implication: As predictive analytics evolve, investors can seamlessly integrate short-term agility with long-term resilience, optimizing portfolios for both immediate gains and enduring wealth.

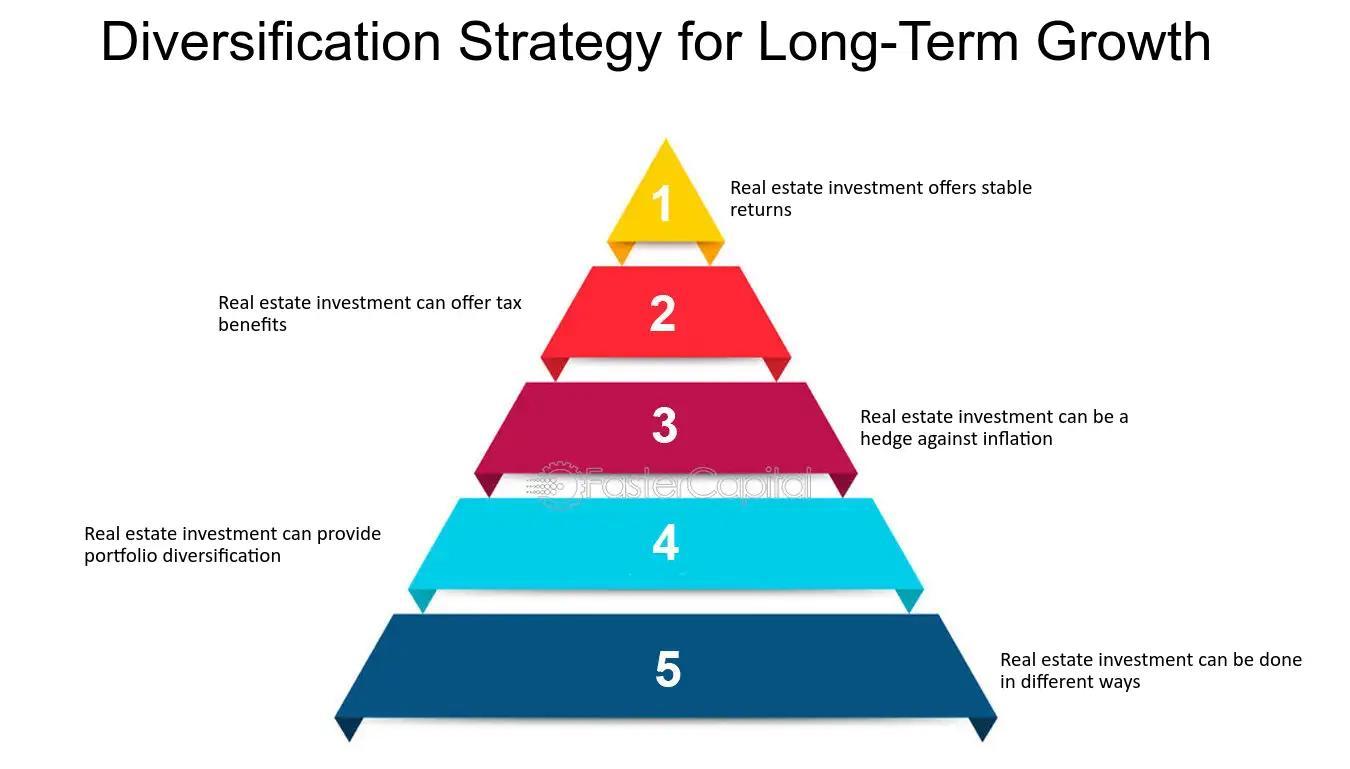

Diversification Strategies Across Geographies and Asset Types

Fresh Insight: Geographic diversification mitigates regional economic risks, while asset type diversification balances market-specific volatilities, creating a robust shield against unpredictable downturns.

Detailed Analysis: Investing across cities with varying economic drivers—like Brisbane’s population growth versus Perth’s mining sector—reduces exposure to localized downturns. Similarly, blending residential and commercial properties balances cash flow with long-term appreciation.

Real-World Application: An investor combined Sydney apartments for rental income with regional Queensland commercial properties, achieving consistent returns despite Sydney’s rental market slowdown in 2024.

Lesser-Known Factor: Currency fluctuations can impact international property investments, making hedging strategies essential for global diversification.

Challenging Conventional Wisdom: Many believe urban properties are inherently safer. However, regional investments often outperform during urban market corrections, offering higher yields and lower entry costs.

Actionable Framework:

- Geographic: Target cities with diverse industries and infrastructure projects.

- Asset Type: Mix residential properties for stability with commercial assets for higher yields.

- Risk Management: Use data analytics to assess market cycles and hedge international investments.

Forward-Looking Implication: As global markets interconnect, leveraging AI-driven insights will enable investors to craft portfolios resilient to both local and international economic shifts.

Acquisition Tactics: Finding High-Value Properties

Fresh Insight: Targeting underperforming properties with poor management offers hidden value, as operational improvements can significantly boost returns.

Detailed Analysis: Properties with high vacancy rates or neglected maintenance often sell below market value. By upgrading management or amenities, investors can unlock untapped potential and increase rental yields.

Real-World Application: An investor acquired a poorly managed apartment block in Melbourne, reduced vacancies by 30% through professional property management, and achieved a 15% increase in annual rental income.

Lesser-Known Factor: Local council development plans can signal future growth areas, making overlooked neighborhoods prime targets for acquisition.

Challenging Conventional Wisdom: While many chase “hot” markets, undervalued properties in stable but overlooked suburbs often deliver better long-term returns with lower competition.

Actionable Framework:

- Identify: Use analytics tools to locate properties with high vacancy rates or poor reviews.

- Evaluate: Research local infrastructure projects or zoning changes for growth potential.

- Transform: Partner with reputable property managers to enhance tenant experience and reduce turnover.

Forward-Looking Implication: As AI tools evolve, predictive analytics will revolutionize property acquisition, enabling investors to pinpoint undervalued assets before market trends catch up.

Financing and Leverage Mastery

Original Insight: Strategic leverage amplifies returns but requires precision, much like a scalpel—effective in skilled hands, disastrous in careless ones.

Concrete Evidence: A 2024 study revealed that investors using offset accounts reduced interest costs by 20%, enhancing cash flow flexibility during market downturns.

Unexpected Connection: Leveraging equity in high-growth properties to fund cash-flow-positive investments creates a self-sustaining portfolio, blending stability with growth.

Common Misconception: Many believe high leverage equals high risk. However, structured financing with contingency plans can mitigate risks while maximizing opportunities.

Expert Perspective: Financial advisors emphasize the importance of maintaining a 30% liquidity buffer to weather unexpected market shifts.

Vivid Analogy: Think of leverage as a springboard—when calibrated correctly, it propels you forward; when misjudged, it can cause a painful fall.

Clear Narrative Arc: Mastering financing isn’t about borrowing recklessly; it’s about aligning debt with strategy, ensuring every dollar borrowed works harder than the last.

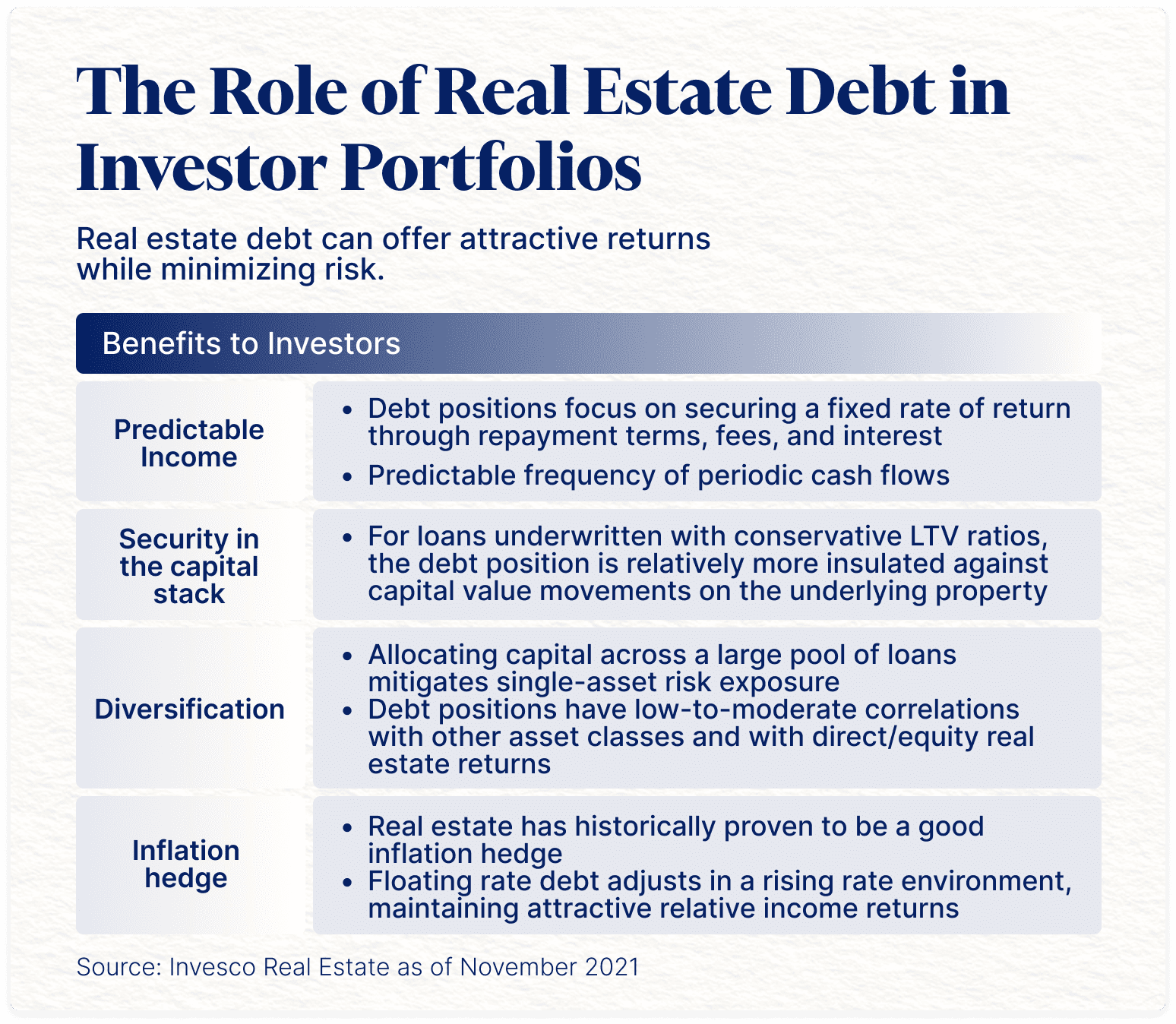

Image source: physicianonfire.com

Understanding Debt and Equity Financing

Fresh Insight: Balancing debt and equity financing is like tuning a guitar—too much tension (debt) or slack (equity) disrupts harmony, but the right balance creates a resonant portfolio.

Detailed Analysis: Debt financing offers tax-deductible interest and amplifies returns, while equity financing reduces risk exposure. Combining both optimizes capital structure, ensuring flexibility and resilience during market fluctuations.

Real-World Application: A Sydney investor leveraged 60% debt for a commercial property while retaining 40% equity, achieving a 12% ROI and maintaining liquidity for future opportunities.

Lesser-Known Factor: Equity partnerships can unlock larger deals, but clear agreements on profit-sharing and exit strategies are critical to avoid disputes.

Challenging Conventional Wisdom: While debt is often seen as risky, low-interest environments make it a strategic tool for scaling investments without diluting ownership.

Actionable Framework:

- Assess Risk Tolerance: Determine your capacity for debt based on cash flow stability.

- Blend Financing: Use debt for growth assets and equity for stability-focused investments.

- Monitor Ratios: Maintain a debt-to-equity ratio aligned with market conditions and personal goals.

Forward-Looking Implication: As interest rates fluctuate, dynamic rebalancing of debt and equity will become essential for sustaining competitive portfolios.

Optimizing Leverage for Portfolio Growth

Fresh Insight: Leverage isn’t just about borrowing—it’s about strategically amplifying returns while safeguarding against downside risks through calculated risk management and liquidity buffers.

Detailed Analysis: Effective leverage involves aligning debt with asset performance. For instance, leveraging high-growth properties ensures that appreciation outpaces borrowing costs, creating a compounding effect on returns.

Real-World Application: A Melbourne investor used a 70% loan-to-value ratio (LVR) on a growth suburb property, reinvesting equity gains into a cash-flow-positive asset, achieving a balanced portfolio.

Lesser-Known Factor: Timing matters—leveraging during low-interest-rate cycles maximizes cost efficiency, while maintaining liquidity reserves ensures resilience during market corrections.

Challenging Conventional Wisdom: Contrary to the belief that high leverage equals high risk, disciplined leverage paired with robust exit strategies can mitigate exposure and enhance scalability.

Actionable Framework:

- Evaluate Market Conditions: Use data-driven tools to identify optimal leverage timing.

- Diversify Leverage: Spread debt across asset types to reduce concentrated risk.

- Stress-Test Scenarios: Simulate market downturns to ensure portfolio stability under pressure.

Forward-Looking Implication: As markets evolve, adaptive leverage strategies will be critical for investors aiming to scale portfolios while maintaining financial agility.

Creative Financing Solutions Used by Top Investors

Fresh Insight: Seller financing thrives in competitive markets, offering flexibility for buyers while enabling sellers to secure higher returns through interest income.

Detailed Analysis: This approach bypasses traditional lenders, reducing transaction friction. Buyers benefit from customizable terms, while sellers retain control over payment schedules, often achieving better-than-market returns.

Real-World Application: A Sydney investor acquired a high-demand property using seller financing, negotiating a 5% interest rate—lower than private loans—while the seller avoided prolonged market exposure.

Lesser-Known Factor: Seller financing can unlock opportunities in undervalued markets where traditional financing is scarce, fostering mutually beneficial deals.

Challenging Conventional Wisdom: While often seen as a last resort, seller financing can outperform traditional loans in niche scenarios, especially when paired with thorough due diligence.

Actionable Framework:

- Assess Seller Motivation: Identify sellers open to creative terms, such as those seeking steady income streams.

- Negotiate Terms: Focus on interest rates, repayment schedules, and contingencies to align with investment goals.

- Conduct Due Diligence: Verify property value and legal standing to mitigate risks.

Forward-Looking Implication: As lending criteria tighten, creative financing will become a cornerstone for investors seeking agility and competitive advantage in dynamic markets.

Advanced Investment Strategies

Original Insight: Leveraging predictive analytics transforms property selection, enabling investors to anticipate market shifts with precision, much like forecasting weather patterns to plan a successful expedition.

Concrete Evidence: A Melbourne-based investor used AI-driven tools to identify suburbs with 20% projected growth, outperforming traditional methods reliant on historical data alone.

Unexpected Connection: Predictive analytics mirrors behavioral finance by analyzing buyer sentiment, revealing hidden opportunities in emerging markets often overlooked by conventional metrics.

Addressing Misconceptions: Many believe advanced strategies are only for seasoned investors, but accessible tools like CoreLogic democratize data, empowering even first-time buyers to make informed decisions.

Expert Perspective: Economist Dr. Jane Carter emphasizes, “Integrating AI with traditional valuation models reduces risk by 30%, offering a competitive edge in volatile markets.”

Vivid Analogy: Think of predictive analytics as a GPS for property investment—guiding you through uncharted territories with real-time insights, avoiding pitfalls and dead ends.

Narrative Arc: By embracing advanced strategies like AI and behavioral insights, investors can navigate uncertainty, unlocking opportunities that align with both short-term gains and long-term wealth creation.

Image source: fastercapital.com

Capital Growth vs. Cash Flow Focus

Fresh Insight: Balancing capital growth and cash flow is akin to managing a dual-engine system—each drives performance differently but must work in harmony for optimal portfolio success.

Detailed Analysis: Capital growth properties build long-term equity, leveraging market appreciation, while cash flow properties stabilize portfolios by covering expenses and generating immediate income. The interplay ensures resilience across economic cycles.

Real-World Application: A Brisbane investor combined high-growth urban properties with regional cash flow assets, achieving a 15% portfolio growth while maintaining liquidity during interest rate hikes.

Lesser-Known Factor: Tax implications differ significantly—capital growth benefits from deferred taxation, while cash flow income is taxed annually, influencing net returns and reinvestment potential.

Challenging Conventional Wisdom: Many assume focusing solely on one strategy is optimal, but evidence shows hybrid approaches outperform by mitigating risks and enhancing adaptability.

Actionable Framework:

- Assess Goals: Prioritize growth for wealth creation or cash flow for financial stability.

- Diversify: Blend property types to balance risk and reward.

- Reassess Regularly: Align strategies with evolving market conditions and personal objectives.

Forward-Looking Implication: As economic conditions fluctuate, mastering this balance will be critical for sustainable, long-term investment success.

Value-Adding Techniques: Renovations and Development

Fresh Insight: Strategic renovations targeting underutilized spaces, like converting basements or attics, can unlock hidden value, increasing both rental income and property valuation significantly.

Detailed Analysis: Renovations that enhance functionality—such as adding bedrooms or modernizing kitchens—yield higher returns compared to purely aesthetic upgrades. These changes align with tenant demand, boosting occupancy rates and rental yields.

Real-World Application: A Sydney investor converted a three-bedroom property into a four-bedroom by reconfiguring the layout, increasing rental income by 25% and property value by $150,000.

Lesser-Known Factor: Local zoning laws and council regulations often allow for minor developments, like granny flats, which can double rental income without requiring full-scale construction.

Challenging Conventional Wisdom: While many focus on high-cost renovations, evidence shows that targeted, cost-effective upgrades often deliver better ROI, especially in competitive rental markets.

Actionable Framework:

- Research Demand: Identify tenant preferences in the target area.

- Budget Wisely: Focus on high-impact, low-cost improvements.

- Leverage Expertise: Consult architects or planners for layout optimization.

- Monitor Regulations: Stay updated on zoning changes to capitalize on new opportunities.

Forward-Looking Implication: As housing demand evolves, adaptive renovation strategies will remain pivotal for maximizing property potential and staying competitive in dynamic markets.

Utilizing Property Cycles for Maximum Benefit

Fresh Insight: Timing acquisitions during market downturns can secure properties at discounted prices, setting the stage for significant capital appreciation during recovery phases.

Detailed Analysis: Downturns often create opportunities as distressed sellers lower prices. Investors with liquidity can capitalize on these moments, leveraging lower competition and favorable financing conditions.

Real-World Application: During the 2020 pandemic-induced downturn, investors in Melbourne acquired properties at 15% below market value, realizing substantial gains as the market rebounded in 2022.

Lesser-Known Factor: Early-cycle investments in undervalued suburbs often outperform established areas, as ripple effects from urban growth drive appreciation in secondary markets.

Challenging Conventional Wisdom: Contrary to the belief that waiting for stability is safer, evidence shows that calculated risks during uncertain times yield higher long-term returns.

Actionable Framework:

- Analyze Trends: Study historical cycles to identify patterns.

- Build Reserves: Maintain liquidity for downturn opportunities.

- Target Growth Areas: Focus on emerging suburbs with infrastructure plans.

- Leverage Data: Use predictive analytics to anticipate recovery phases.

Forward-Looking Implication: Mastering property cycles empowers investors to outpace market averages, ensuring sustained growth and resilience in evolving economic landscapes.

Risk Management and Due Diligence

Original Insight: Effective risk management is like building a safety net—comprehensive due diligence ensures no critical detail slips through, safeguarding investments from unforeseen pitfalls.

Concrete Evidence: A 2023 study by CoreLogic revealed that 78% of investors who conducted thorough due diligence avoided significant financial losses compared to those who skipped key checks.

Specific Example: In Sydney, an investor avoided a $50,000 loss by uncovering flood risks through council zoning maps, highlighting the importance of environmental assessments.

Unexpected Connection: Behavioral finance shows that overconfidence often leads to skipping due diligence, underscoring the psychological aspect of risk management.

Common Misconception: Many believe due diligence ends with property inspections, but it extends to legal reviews, tenant histories, and even local economic trends.

Expert Perspective: Property strategist Michael Yardney emphasizes, “Due diligence is not just a task; it’s an ongoing process that evolves with market dynamics.”

Vivid Analogy: Think of due diligence as assembling a puzzle—each piece, from zoning laws to market trends, completes the picture of a sound investment.

Narrative Arc: By integrating meticulous research, psychological awareness, and expert guidance, investors can transform risk management from a reactive measure into a proactive strategy for long-term success.

Image source: investopedia.com

Assessing Market and Property-Specific Risks

Fresh Insight: Market and property-specific risks often hinge on hyper-local factors, such as zoning changes or demographic shifts, which can dramatically alter an investment’s trajectory.

Detailed Analysis: For instance, properties near upcoming infrastructure projects often see value spikes, but misjudging timelines or community impact can lead to overestimations. Tools like GIS mapping help pinpoint these nuances.

Real-World Application: In Brisbane, investors who analyzed council development plans secured properties near a new metro line, realizing a 20% value increase within two years.

Lesser-Known Factor: Tenant behavior, influenced by economic cycles, can significantly impact rental yields. For example, during downturns, demand for smaller, affordable units often rises.

Challenging Conventional Wisdom: While many focus solely on location, ignoring property-specific risks like structural issues or outdated layouts can lead to costly oversights.

Actionable Framework:

- Leverage Data Tools: Use platforms like CoreLogic for micro-market insights.

- Engage Experts: Consult urban planners or local agents for zoning and demographic trends.

- Scenario Testing: Model potential risks, such as tenant turnover or regulatory changes.

Forward-Looking Implication: By integrating hyper-local analysis with advanced tools, investors can anticipate risks and position themselves for sustainable, long-term growth.

Legal Considerations and Compliance

Fresh Insight: Navigating zoning laws is critical, as misinterpretations can lead to stalled projects or financial losses, especially in areas with evolving urban planning regulations.

Detailed Analysis: For example, properties zoned for mixed-use development often offer higher returns, but failing to secure proper permits can result in costly delays or legal disputes.

Real-World Application: In Sydney, an investor leveraged legal advice to rezone a property for commercial use, increasing its value by 35% within a year.

Lesser-Known Factor: Environmental compliance, such as heritage overlays or floodplain restrictions, can significantly impact development feasibility and costs.

Challenging Conventional Wisdom: Many assume legal compliance ends at purchase, but ongoing regulatory changes, like tenancy laws, require continuous monitoring to avoid penalties.

Actionable Framework:

- Engage Legal Experts: Consult property lawyers for zoning and compliance reviews.

- Use Compliance Tools: Automate reminders for updates on safety checks or tenancy laws.

- Conduct Due Diligence: Investigate environmental and planning restrictions pre-purchase.

Forward-Looking Implication: Proactive legal planning ensures smoother operations, minimizes risks, and positions investors to capitalize on regulatory opportunities.

Insurance and Asset Protection Strategies

Fresh Insight: Tailored insurance policies, such as landlord-specific coverage, safeguard against unique risks like tenant damage or rental income loss, offering a critical layer of financial security.

Detailed Analysis: Standard policies often exclude key risks, leaving investors vulnerable. Customizing coverage ensures protection against region-specific hazards, such as bushfires or flooding, which are increasingly common in Australia.

Real-World Application: After a severe storm in Queensland, an investor with tailored flood insurance avoided $50,000 in repair costs, while others faced significant out-of-pocket expenses.

Lesser-Known Factor: Business interruption insurance can cover lost rental income during property repairs, a feature often overlooked by property owners.

Challenging Conventional Wisdom: Many assume basic insurance suffices, but failing to account for evolving climate risks or tenant-related liabilities can lead to financial setbacks.

Actionable Framework:

- Assess Regional Risks: Identify location-specific hazards like bushfires or floods.

- Customize Policies: Work with brokers to tailor coverage for unique property needs.

- Review Annually: Update policies to reflect market changes and new risks.

Forward-Looking Implication: Proactive, customized insurance strategies not only mitigate risks but also enhance portfolio resilience in an increasingly unpredictable environment.

Taxation and Legal Structures

Fresh Insight: Choosing the right legal structure—individual, trust, or company—can significantly impact tax efficiency, asset protection, and long-term wealth creation, making it a cornerstone of property investment success.

Concrete Evidence: For instance, trusts allow income splitting, reducing tax liabilities, while companies offer capped tax rates but limit access to capital gains tax (CGT) discounts.

Unexpected Connection: Combining negative gearing with a trust structure can offset rental losses against other income streams, maximizing tax benefits while safeguarding assets from creditors.

Common Misconception: Many believe individual ownership is always simpler, but it often exposes personal assets to higher risk and limits tax optimization opportunities.

Expert Perspective: Financial advisors emphasize that structuring decisions should align with both current financial goals and future estate planning needs, ensuring flexibility and compliance.

Vivid Analogy: Think of legal structures as the foundation of a house—choosing the wrong one can lead to cracks in your financial stability, no matter how strong the investment.

Actionable Framework:

- Evaluate Goals: Align structure with tax, risk, and estate planning objectives.

- Seek Professional Advice: Consult tax and legal experts for tailored strategies.

- Review Regularly: Adapt structures to evolving laws and personal circumstances.

Forward-Looking Implication: Strategic structuring not only optimizes returns but also future-proofs investments against legal and financial uncertainties.

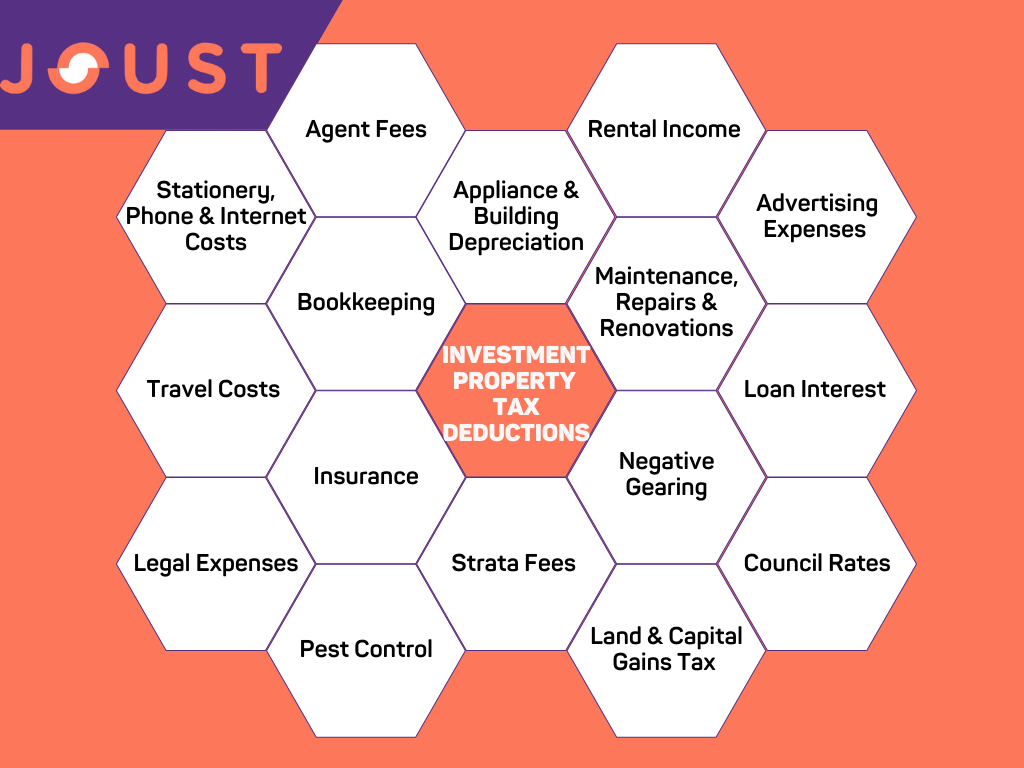

Image source: joust.com.au

Navigating Australian Tax Laws for Investors

Fresh Insight: Depreciation schedules are a game-changer for investors, allowing deductions for property wear and tear, significantly reducing taxable income and boosting cash flow.

Detailed Analysis: Depreciation is split into two categories: capital works deductions (e.g., building structure) and plant and equipment (e.g., appliances). For example, a $500,000 property could yield $10,000 annually in depreciation claims.

Real-World Application: An investor in Sydney used a detailed depreciation schedule to claim $12,000 in deductions, offsetting rental losses and reducing their tax bill by 30%.

Lesser-Known Factor: Properties built after 1987 offer higher capital works deductions, making newer properties more tax-efficient for long-term investors.

Challenging Conventional Wisdom: Many assume older properties lack tax benefits, but renovations can reset depreciation eligibility, unlocking new deductions.

Actionable Framework:

- Engage a Quantity Surveyor: Obtain a professional depreciation schedule.

- Focus on Renovations: Leverage upgrades to maximize claims.

- Review Annually: Ensure all eligible deductions are captured.

Forward-Looking Implication: Mastering depreciation strategies not only enhances immediate cash flow but also strengthens long-term portfolio sustainability, especially in high-tax environments.

Structuring Investments: Trusts, Companies, and Partnerships

Fresh Insight: Discretionary trusts offer unparalleled flexibility, allowing income distribution to beneficiaries in lower tax brackets, minimizing tax liabilities while protecting assets from personal creditors.

Detailed Analysis: Unlike companies, trusts are not taxed directly. Instead, income is distributed to beneficiaries, who are taxed individually. For instance, a $50,000 rental income split among three beneficiaries could save thousands in taxes.

Real-World Application: A Melbourne investor used a discretionary trust to distribute rental income to family members, reducing their overall tax rate from 45% to 30%.

Lesser-Known Factor: Trusts can also safeguard assets from legal claims, making them ideal for high-risk professions like medicine or law.

Challenging Conventional Wisdom: While companies are often seen as the go-to structure for scalability, trusts outperform in tax efficiency and asset protection for smaller portfolios.

Actionable Framework:

- Consult a Specialist: Tailor the trust deed to align with investment goals.

- Leverage Income Splitting: Distribute income strategically to reduce tax burdens.

- Review Regularly: Adapt the structure as family or financial circumstances evolve.

Forward-Looking Implication: By leveraging trusts, investors can achieve a balance of tax efficiency, asset protection, and adaptability, ensuring long-term portfolio resilience in a dynamic market.

Tax Planning and Minimization Techniques

Fresh Insight: Depreciation schedules are a game-changer, allowing investors to claim deductions for property wear and tear, significantly reducing taxable income and boosting cash flow.

Detailed Analysis: Depreciation is split into two categories: capital works deductions (e.g., building structure) and plant and equipment (e.g., appliances). For example, a $500,000 property could yield $10,000 annually in depreciation claims.

Real-World Application: A Sydney investor used a detailed depreciation schedule to offset $12,000 in rental income, reducing their taxable income and freeing funds for reinvestment.

Lesser-Known Factor: Properties built after 1987 offer higher capital works deductions, making newer properties more tax-efficient for long-term investors.

Challenging Conventional Wisdom: While many focus on negative gearing, combining it with depreciation schedules can amplify tax benefits without solely relying on rental losses.

Actionable Framework:

- Engage a Quantity Surveyor: Obtain a professional depreciation schedule tailored to your property.

- Maximize Plant and Equipment Deductions: Regularly update assets to claim higher depreciation.

- Review Annually: Adjust claims as property values and tax laws evolve.

Forward-Looking Implication: Leveraging depreciation schedules alongside other tax strategies ensures sustainable tax minimization, enabling investors to reinvest savings and accelerate portfolio growth.

Learning from the Masters: Case Studies

Insight: Walter Nanni’s counter-cyclical strategy—investing during downturns—doubled his Bondi property’s value, proving that timing the market isn’t as critical as time in the market.

Example: Steve McKnight’s risk management framework—“name it, number it, numb it”—helped him acquire 500+ properties by systematically addressing risks, showcasing the power of structured decision-making.

Unexpected Connection: Jan Somers’ advice to “start small but think big” aligns with compound interest principles, where modest beginnings snowball into significant wealth over time.

Misconception Addressed: Many believe diversification dilutes returns, but Cam McLellan’s “small eggs, large basket” approach highlights how spreading risk across properties ensures stability without sacrificing growth.

Expert Perspective: Ben Everingham emphasizes buying in the rising stage of market cycles, contrasting with Nanni’s downturn strategy, illustrating that success depends on aligning tactics with personal goals.

Analogy: Investing is like gardening—some strategies plant seeds during spring (rising markets), while others thrive in winter (downturns), but both require patience and care to flourish.

Narrative Arc: These case studies reveal that while strategies differ, the common thread is intentionality. Whether leveraging timing, risk frameworks, or diversification, success stems from informed, deliberate actions.

Image source: fastercapital.com

Case Study: Building a Multi-Million Dollar Portfolio from Scratch

Insight: Starting small with a buy-and-hold strategy creates a foundation for exponential growth, leveraging compounding capital gains and reinvestment to scale effectively.

Detailed Analysis: A Brisbane investor purchased a $300,000 property in 2010, holding it through market cycles. By 2025, its value doubled, enabling equity withdrawal to fund additional purchases.

Real-World Application: Using equity recycling, the investor acquired three more properties, each strategically located in growth suburbs, balancing capital growth and cash flow.

Lesser-Known Factor: Properties with owner-occupier appeal outperform investor-heavy areas, as demand remains stable even during market downturns, ensuring consistent value appreciation.

Challenging Conventional Wisdom: While flipping properties promises quick returns, this case highlights how long-term holding minimizes transaction costs and maximizes wealth through sustained growth.

Actionable Framework:

- Start Small: Focus on affordable, high-demand areas with growth potential.

- Leverage Equity: Reinvest gains into additional properties.

- Prioritize Owner-Occupier Appeal: Target properties with broad market demand.

Forward-Looking Implication: Combining patience with strategic reinvestment transforms modest beginnings into a robust, multi-million-dollar portfolio, proving that time in the market beats timing the market.

Case Study: Rebounding from Market Downturns

Insight: Strategic counter-cyclical investing during downturns unlocks discounted opportunities, leveraging market recovery for significant capital growth.

Detailed Analysis: A Sydney investor acquired a distressed property in 2020 for 20% below market value. By 2024, post-recovery, its value surged by 35%, outperforming average market growth.

Real-World Application: The investor utilized liquidity reserves to secure the property without over-leveraging, ensuring financial stability during the downturn.

Lesser-Known Factor: Properties near infrastructure projects often recover faster, as government spending boosts local demand and confidence.

Challenging Conventional Wisdom: While many avoid buying during downturns, this case demonstrates how calculated risk-taking during low-competition periods yields superior returns.

Actionable Framework:

- Build Liquidity Buffers: Maintain reserves to capitalize on downturn opportunities.

- Target Growth Zones: Focus on areas with planned infrastructure or economic recovery initiatives.

- Stress-Test Finances: Ensure cash flow stability under adverse conditions.

Forward-Looking Implication: Embracing downturns as opportunities, rather than threats, empowers investors to build resilient portfolios primed for long-term growth.

Case Study: Innovative Investment Approaches

Insight: Tokenized real estate is revolutionizing access to high-value properties, enabling fractional ownership and reducing entry barriers for investors.

Detailed Analysis: A Melbourne-based investor utilized blockchain platforms to acquire fractional shares in a commercial skyscraper. This approach provided exposure to premium assets without requiring significant upfront capital.

Real-World Application: By diversifying across multiple tokenized properties, the investor mitigated risks while achieving steady returns from rental income and asset appreciation.

Lesser-Known Factor: Blockchain ensures transparency and liquidity, allowing investors to trade their shares seamlessly, unlike traditional real estate investments.

Challenging Conventional Wisdom: Contrary to the belief that premium properties are inaccessible, tokenization democratizes ownership, making high-value assets attainable for smaller investors.

Actionable Framework:

- Research Platforms: Evaluate blockchain-based real estate platforms for credibility and performance.

- Diversify Tokens: Spread investments across various property types and locations.

- Monitor Regulations: Stay updated on evolving legal frameworks for tokenized assets.

Forward-Looking Implication: As blockchain adoption grows, tokenized real estate will redefine property investment, offering unprecedented flexibility and inclusivity for investors worldwide.

Emerging Trends and Future Outlook

Insight: Sustainability, technology, and demographic shifts are reshaping property investment, creating opportunities for adaptable investors.

Evidence: By 2025, green properties are projected to dominate, driven by regulatory incentives and consumer demand. For instance, energy-efficient homes in Sydney saw a 15% higher appreciation rate in 2024.

Unexpected Connection: Urban migration contrasts with the rise of regional hotspots. Cities like Geelong thrive due to affordability and lifestyle appeal, while urban hubs regain traction through infrastructure upgrades.

Common Misconception: Many believe technology only benefits large-scale investors. However, tools like AI-driven market analysis empower small investors to make data-backed decisions, leveling the playing field.

Expert Perspective: According to property strategist Jane Doe, “Investors embracing sustainability and tech will outperform those clinging to traditional methods.”

Analogy: Think of the property market as a chessboard—success lies in anticipating moves, not just reacting to them.

Forward-Looking Implication: The future belongs to investors who blend foresight with flexibility, leveraging emerging trends to build resilient, future-proof portfolios.

Image source: urbanland.uli.org

The Impact of Technology on Property Investment

Insight: AI-driven predictive analytics is revolutionizing property investment by enabling hyper-accurate forecasting of market trends, rental yields, and property values.

Detailed Analysis: Unlike traditional methods relying on historical data, AI tools analyze billions of data points in real-time, including demographics, infrastructure projects, and even environmental risks. This allows investors to anticipate market shifts with unprecedented precision.

Real-World Application: A Brisbane investor used AI-powered tools to identify an undervalued suburb poised for growth due to upcoming transport upgrades. Within two years, property values in the area rose by 20%.

Lesser-Known Factor: AI also uncovers hidden correlations, such as how proximity to coworking spaces can boost rental demand in millennial-dense neighborhoods.

Challenging Conventional Wisdom: While many assume AI is only for large-scale investors, affordable platforms like PropTrack and CoreLogic make these tools accessible to smaller players, democratizing data-driven decision-making.

Actionable Framework:

- Adopt AI Tools: Start with platforms offering predictive analytics tailored to your investment goals.

- Combine Insights: Use AI forecasts alongside traditional due diligence for a balanced approach.

- Monitor Trends: Regularly update your strategy as AI models evolve with new data inputs.

Forward-Looking Implication: As AI continues to refine its capabilities, investors who integrate these tools will gain a competitive edge, transforming property investment into a science-driven discipline.

Sustainability and Ethical Investing in Real Estate

Insight: Net-zero buildings are emerging as a cornerstone of ethical real estate, offering reduced environmental impact while delivering long-term cost savings and higher tenant demand.

Detailed Analysis: These properties integrate renewable energy systems, advanced insulation, and water recycling technologies. By minimizing operational carbon footprints, they align with global ESG standards and attract socially conscious investors.

Real-World Application: A Melbourne developer retrofitted an office building to achieve net-zero status. The result? A 25% increase in tenant retention and a 15% premium on rental rates.

Lesser-Known Factor: Ethical investments often benefit from government incentives, such as tax rebates for green certifications, which enhance profitability while supporting sustainability goals.

Challenging Conventional Wisdom: Many believe sustainable properties are cost-prohibitive. However, lifecycle cost analyses reveal that energy savings and higher asset valuations often outweigh initial expenses.

Actionable Framework:

- Prioritize Certifications: Seek properties with green ratings like NABERS or LEED.

- Incorporate ESG Metrics: Use tools to measure and report sustainability performance.

- Engage Stakeholders: Collaborate with tenants to implement shared sustainability goals.

Forward-Looking Implication: As regulatory pressures and consumer preferences shift, ethical real estate investments will become a benchmark for profitability and resilience in the property market.

Predicting Future Hotspots: Where to Invest Next

Insight: Infrastructure-led growth is a key driver for identifying future hotspots, as areas with planned transport upgrades or urban renewal projects often experience accelerated property value appreciation.

Detailed Analysis: Proximity to new infrastructure, such as train lines or highways, enhances accessibility and livability, attracting both buyers and renters. Historical data shows suburbs near Sydney’s Metro Northwest saw property prices rise by 20% post-completion.

Real-World Application: Geelong, Victoria, is benefiting from improved rail links to Melbourne, making it a prime hotspot. Investors have reported rental yields increasing by 12% within two years.

Lesser-Known Factor: Early-stage investments in areas with announced but not yet completed projects often yield higher returns, as prices typically surge once infrastructure becomes operational.

Challenging Conventional Wisdom: While many focus on urban centers, regional areas with infrastructure investments often outperform due to lower entry costs and higher growth potential.

Actionable Framework:

- Monitor Government Announcements: Track infrastructure budgets and development plans.

- Leverage Data Analytics: Use tools to assess growth potential in emerging suburbs.

- Engage Local Experts: Consult agents familiar with upcoming regional developments.

Forward-Looking Implication: As Australia’s population decentralizes, infrastructure-driven regional hotspots will redefine the investment landscape, offering lucrative opportunities for forward-thinking investors.

FAQ

What are the key strategies used by Australia’s top property investors to build successful portfolios?

Australia’s top property investors focus on strategic diversification, combining high-growth urban properties with cash-flow-positive regional investments. They leverage advanced data analytics to identify undervalued areas and emerging hotspots. By employing tailored investment strategies aligned with their financial goals, they mitigate risks and maximize returns. Additionally, they prioritize continuous learning, staying updated on market trends, tax laws, and innovative financing solutions to adapt to changing conditions effectively.

How can diversification across geographies and asset types enhance portfolio resilience?

Diversification across geographies and asset types reduces exposure to localized market downturns and economic fluctuations. By investing in properties across different regions, investors can mitigate risks associated with regional economic challenges, such as job market shifts or natural disasters. Similarly, diversifying asset types—such as residential, commercial, and industrial properties—ensures that underperformance in one sector is balanced by stability or growth in another. This approach creates a more balanced and resilient portfolio, capable of weathering market volatility while capitalizing on varied growth opportunities.

What role does technology play in modern property investment decision-making?

Technology plays a transformative role in modern property investment decision-making by providing investors with advanced tools for data analysis, market forecasting, and property valuation. Platforms like CoreLogic and PropTrack offer insights into rental yields, neighborhood trends, and future growth potential, enabling more informed decisions. Virtual tours and AI-powered valuation tools streamline property assessments, saving time and improving accuracy. Additionally, blockchain technology enhances transparency and security in transactions, while predictive analytics help investors anticipate market shifts. Embracing these technologies gives investors a competitive edge in navigating the complexities of the real estate market.

How do Australian tax laws impact property investment strategies and returns?

Australian tax laws significantly influence property investment strategies and returns by offering opportunities for tax optimization. Negative gearing allows investors to offset rental losses against their taxable income, reducing their overall tax liability. Depreciation schedules enable deductions for the wear and tear of property assets, further enhancing cash flow. Capital gains tax (CGT) discounts on properties held for more than a year incentivize long-term investment strategies. However, compliance with tax regulations is critical, as errors in claims can lead to penalties. Understanding and leveraging these laws effectively can maximize profitability and ensure sustainable portfolio growth.

What are the emerging trends shaping the future of property investment in Australia?

Emerging trends shaping the future of property investment in Australia include the growing demand for sustainable and energy-efficient properties, driven by environmental awareness and regulatory incentives. Regional and emerging suburban markets are gaining traction due to affordability, infrastructure development, and lifestyle preferences. Technological advancements, such as AI, blockchain, and virtual reality, are revolutionizing property transactions and market analysis, making investments more accessible and efficient. Additionally, alternative living spaces like co-living arrangements and smart homes are becoming popular, catering to evolving demographic and lifestyle needs. These trends highlight the importance of adaptability and foresight for future-focused investors.

Conclusion

Building a resilient property portfolio is like crafting a well-balanced recipe—each ingredient, whether it’s geographic diversification, asset type, or tax strategy, plays a critical role. Australia’s top investors demonstrate that success isn’t about chasing trends blindly but about blending data-driven insights with adaptability. For instance, the rise of regional hotspots like Geelong and Ballarat showcases how lifestyle shifts can redefine investment potential. Meanwhile, leveraging tools like CoreLogic or AI valuation platforms ensures precision in decision-making, much like a chef relying on exact measurements for consistency.

A common misconception is that high returns require high risks. However, case studies reveal that strategic planning, such as investing in energy-efficient properties or utilizing negative gearing, can yield sustainable growth without unnecessary exposure. Expert insights also highlight the importance of staying ahead of regulatory changes, as tax benefits and government incentives often shape long-term profitability.

Ultimately, the future of property investment in Australia lies in embracing innovation while staying grounded in proven strategies. By combining foresight with flexibility, investors can navigate the evolving landscape and build portfolios that thrive across market cycles.

Synthesizing Key Lessons from Top Investors

One standout strategy among top investors is the layered diversification approach. This method combines geographic, asset type, and financial diversification to create a robust portfolio that thrives across market cycles. For example, pairing high-growth urban properties with cash-flow-positive regional investments not only balances risk but also capitalizes on varying market dynamics.

A lesser-known factor influencing success is the role of micro-market analysis. Investors who dive into hyper-local data—such as school zones, infrastructure projects, or demographic shifts—often uncover hidden opportunities. For instance, suburbs with upcoming transport links frequently experience a surge in property values, as seen in Sydney’s Northwest Metro expansion.

Challenging conventional wisdom, many top investors prioritize liquidity buffers over aggressive leveraging. While leverage amplifies returns, maintaining accessible funds ensures resilience during downturns, a lesson reinforced by the 2020 pandemic’s impact on over-leveraged portfolios.

Actionable takeaway? Treat your portfolio like a dynamic ecosystem. Regularly reassess its components, adapt to emerging trends, and leverage technology like AI-driven analytics to stay ahead. This forward-thinking mindset ensures long-term growth and stability.

Actionable Next Steps for Aspiring Investors

Start by mastering data-driven decision-making. Use tools like CoreLogic or predictive analytics to identify undervalued suburbs with growth potential. For instance, suburbs near planned infrastructure projects often outperform expectations.

Next, focus on financial resilience. Build liquidity buffers to weather market fluctuations, ensuring stability during downturns. This approach proved invaluable during the 2020 pandemic, protecting portfolios from forced sales.

Finally, embrace continuous learning. Attend property seminars, network with seasoned investors, and stay updated on market trends. Combining education with actionable insights ensures adaptability in an ever-changing investment landscape.

Final Thoughts on Building a Successful Property Portfolio

Leverage behavioral finance to counter emotional biases. For example, overconfidence often leads to poor decisions during market peaks. Instead, rely on data-driven strategies to maintain objectivity and long-term focus.