How to Pay Off Your Australian Mortgage 10 Years Early Without Feeling Broke

In 2019, a Melbourne couple in their mid-thirties made a decision that defied conventional wisdom about homeownership. Instead of stretching their mortgage over the standard 30 years, they set out to pay it off in just 20—without sacrificing their annual holidays or their children’s private school education. By leveraging a combination of fortnightly payments, a disciplined use of their offset account, and strategic lump-sum contributions from tax refunds, they shaved a decade off their loan term and saved over $150,000 in interest.

Their story is not an anomaly. Across Australia, homeowners are quietly rewriting the rules of mortgage repayment, proving that financial freedom doesn’t have to come at the cost of a comfortable lifestyle. The strategies they employ are as much about mindset as they are about mathematics, offering a blueprint for anyone seeking to escape the weight of long-term debt.

Image source: wealthhubaustralia.com.au

Understanding Core Mortgage Principles

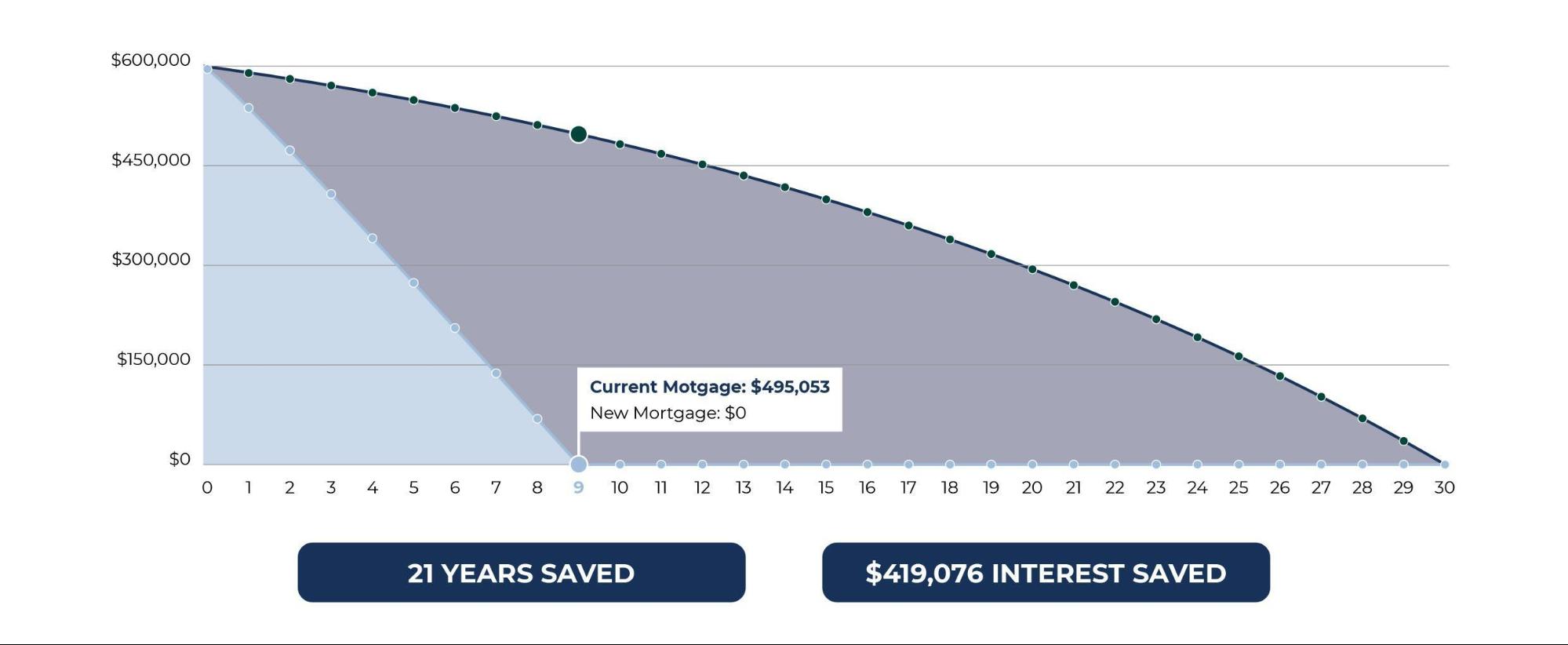

One critical yet underappreciated principle in mortgage management is the timing of extra repayments. Early in a loan’s lifecycle, the majority of repayments go toward interest rather than the principal. This is due to the way interest is calculated on the remaining loan balance. By directing additional funds—whether from bonuses, tax refunds, or even small weekly contributions—toward the principal in the early years, borrowers can significantly reduce the compounding effect of interest over time. For instance, applying a $10,000 lump sum in the first five years of a $500,000 loan at 5% interest could save over $30,000 in interest and cut the loan term by nearly two years.

This approach aligns with the concept of opportunity cost in financial planning. While some may argue that these funds could be invested elsewhere, the guaranteed return of reducing interest payments often outweighs the uncertain gains of market investments, particularly in volatile conditions.

To maximize impact, homeowners should pair this strategy with tools like offset accounts, which further reduce interest by lowering the effective loan balance daily.

Long-Term Financial Benefits of Early Repayment

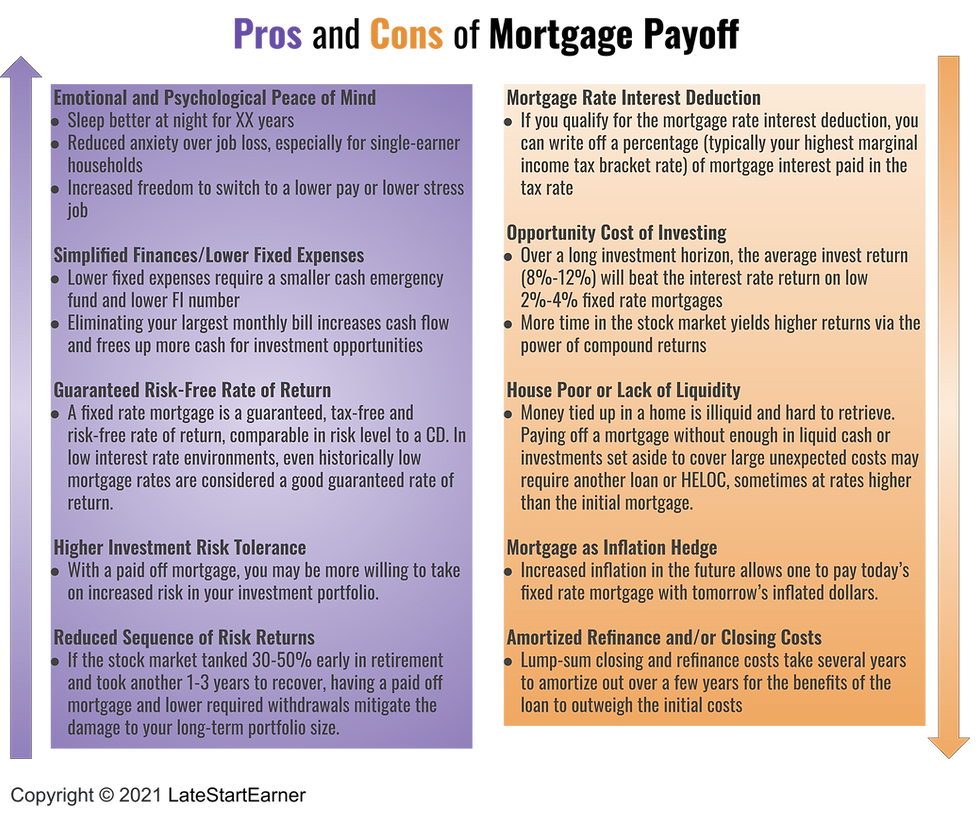

A lesser-explored advantage of early mortgage repayment is the psychological compounding effect of financial freedom. Beyond the tangible savings on interest, eliminating a mortgage early can unlock a cascade of opportunities for wealth-building. For instance, homeowners who achieve debt-free status often redirect their former mortgage payments into diversified investments, such as index funds or property portfolios, accelerating their net worth growth.

Moreover, early repayment enhances financial resilience. Without the burden of a monthly mortgage, households are better equipped to weather economic downturns or unexpected expenses, such as medical emergencies or job loss. This stability can also improve creditworthiness, enabling access to lower interest rates for future borrowing.

Interestingly, early repayment can challenge the conventional wisdom of maintaining liquidity. While critics argue that tying up funds in a mortgage reduces flexibility, the equity gained can serve as a powerful financial tool. For example, leveraging a paid-off property through a line of credit allows homeowners to access funds for high-return investments or entrepreneurial ventures.

Ultimately, early repayment is not just about reducing debt—it’s about creating a foundation for long-term financial agility and opportunity.

Core Strategies for Early Mortgage Repayment

One transformative strategy is leveraging fortnightly repayments. By splitting monthly payments into two equal halves paid every two weeks, homeowners effectively make 26 payments annually instead of 12, equating to an extra month’s repayment each year. For a $600,000 loan at 5% interest, this simple adjustment can save over $100,000 in interest and reduce the loan term by nearly five years.

Another powerful approach involves redirecting windfalls. Tax refunds, bonuses, or even small inheritances can be applied directly to the principal. For instance, a $10,000 lump sum in the first five years of a 30-year loan can save tens of thousands in interest and cut years off the term.

Additionally, offset accounts offer a dynamic way to reduce interest. By parking savings in an offset account, borrowers lower the effective loan balance daily. This strategy not only minimizes interest but also preserves liquidity, addressing concerns about tying up funds in the mortgage.

These methods, when combined, create a compounding effect that accelerates financial freedom.

Image source: themortgagereports.com

Optimizing Payment Frequency and Extra Contributions

Adjusting payment frequency and strategically applying extra contributions can create a multiplier effect on mortgage reduction. A key insight lies in the timing of payments: interest is calculated daily on the outstanding balance, so more frequent payments reduce the principal faster, minimizing compounding interest. For example, switching from monthly to fortnightly payments on a $500,000 loan at 5% interest can save over $80,000 and cut the term by nearly four years.

Beyond frequency, the psychological impact of rounding up payments is often underestimated. Rounding a $2,350 monthly repayment to $2,400 may seem negligible, but over 10 years, this adds $6,000 directly to the principal, amplifying interest savings.

Lesser-known factors, such as aligning extra contributions with income cycles, can further optimize outcomes. For instance, allocating annual bonuses or biannual tax refunds as lump sums early in the loan term maximizes interest reduction due to the higher principal balance.

This approach challenges the misconception that significant financial sacrifices are required. Instead, it demonstrates how incremental adjustments, when compounded over time, can yield substantial results—offering a framework for homeowners to balance financial discipline with lifestyle flexibility.

Leveraging Offset Accounts for Interest Reduction

A critical yet underutilized strategy in maximizing offset account benefits is the strategic timing of deposits. By directing all income streams—such as salaries, rental income, or dividends—into the offset account immediately upon receipt, homeowners can maximize the daily balance used to offset interest. For instance, depositing a $5,000 salary on the first day of the month rather than incrementally throughout can amplify interest savings, as the balance reduces the loan principal for a longer duration.

Another advanced approach involves synchronizing offset account usage with credit card cycles. By deferring daily expenses to a credit card and paying it off in full at the end of the billing cycle, homeowners can maintain a higher offset balance throughout the month. This tactic not only reduces interest but also preserves liquidity for emergencies.

Lesser-known factors, such as choosing an offset account that applies 100% of the balance toward interest reduction, can significantly enhance outcomes. Some accounts only offset a percentage, diluting their effectiveness.

These strategies challenge the notion that offset accounts are passive tools. Instead, they highlight how proactive management can transform them into dynamic instruments for accelerating mortgage repayment and achieving financial agility.

Refinancing for Lower Rates and Better Terms

One often-overlooked aspect of refinancing is the timing of rate locks during volatile interest rate periods. Locking in a favorable rate at the right moment can secure long-term savings, but it requires careful monitoring of market trends. For example, during periods of anticipated rate hikes by central banks, locking a rate early can prevent borrowers from being exposed to sudden increases. Conversely, in a declining rate environment, delaying a lock might yield better terms. Tools like rate trackers or working with brokers who provide real-time updates can be invaluable in this process.

Another critical factor is evaluating the cost-benefit ratio of refinancing. While lower rates are appealing, associated costs—such as discharge fees, application fees, and valuation charges—can erode potential savings. For instance, refinancing a $400,000 loan to save 0.5% annually might save $2,000 in interest but could incur $3,000 in upfront costs. Borrowers should calculate the “break-even point” to determine how long it will take for savings to offset these expenses.

Additionally, refinancing offers an opportunity to restructure loan terms. Switching from an interest-only loan to a principal-and-interest structure can accelerate debt reduction, while extending the loan term may reduce monthly repayments, enhancing cash flow flexibility.

By aligning refinancing decisions with broader financial goals, homeowners can unlock both immediate and long-term benefits, fostering greater financial resilience.

Advanced Techniques and Real-World Insights

A transformative yet underutilized technique is debt recycling, which converts non-deductible mortgage debt into tax-deductible investment debt. For instance, a homeowner could use equity from their property to invest in income-generating assets like shares. The returns, combined with tax benefits, can be redirected toward the mortgage, accelerating repayment. However, this strategy requires meticulous planning and a tolerance for market risk, making professional advice essential.

Another advanced approach involves micro-budgeting for surplus cash flow. By analyzing spending patterns, homeowners can identify overlooked savings opportunities. For example, reallocating $200 monthly from discretionary expenses like dining out into extra repayments on a $500,000 loan at 5% interest could save over $35,000 in interest and cut the term by nearly three years.

A common misconception is that early repayment demands significant sacrifices. In reality, incremental adjustments—such as rounding up repayments or leveraging windfalls—can yield substantial results. For example, applying a $5,000 tax refund as a lump sum in the first five years of a loan can save tens of thousands in interest.

These techniques demonstrate that financial agility, not austerity, is the key to achieving mortgage freedom. By combining strategic foresight with disciplined execution, homeowners can unlock opportunities that challenge conventional repayment paradigms.

Image source: latestartearner.com

Combining Strategies for Maximum Impact

The synergy between fortnightly repayments and offset account optimization offers a powerful framework for accelerating mortgage repayment. While each strategy independently reduces interest, their combined effect amplifies savings by targeting both the frequency of principal reduction and the daily interest calculation.

Consider a $600,000 loan at 5% interest. Switching to fortnightly repayments effectively adds an extra month’s worth of payments annually, reducing the loan term by nearly five years. Simultaneously, maintaining a $20,000 balance in an offset account could save over $50,000 in interest across the loan’s lifespan. Together, these strategies create a compounding effect: the reduced principal from fortnightly payments further enhances the impact of the offset account, as interest is calculated on a progressively smaller balance.

A lesser-known factor is the timing of income deposits. Directing salaries and other inflows into the offset account immediately upon receipt maximizes the daily balance, even if funds are withdrawn later for expenses. Pairing this with credit card cycles—deferring expenses to the card and paying it off in full—extends the offset’s effectiveness without sacrificing liquidity.

This integrated approach challenges the misconception that aggressive repayment requires drastic lifestyle changes. Instead, it demonstrates how aligning financial tools with disciplined execution can unlock exponential benefits, paving the way for sustainable mortgage freedom.

Real-Life Case Studies and Investment Perspectives

A compelling case study involves a Sydney-based family who combined debt recycling with strategic property investment to pay off their mortgage in under 15 years. By leveraging equity in their home, they invested in dividend-yielding shares, redirecting returns and tax benefits toward their mortgage. This approach not only accelerated repayment but also diversified their financial portfolio, mitigating risks associated with a single asset class.

The success of this strategy hinges on timing and market conditions. For instance, investing during a market downturn allowed the family to acquire undervalued assets, amplifying long-term returns. However, this method requires a robust risk tolerance and professional financial advice to navigate potential market volatility.

A lesser-known factor influencing outcomes is the psychological impact of financial diversification. By maintaining investments alongside mortgage repayment, the family avoided the emotional strain of tying all surplus funds into a single goal. This balance enhanced their financial resilience, enabling them to adapt to unexpected expenses without derailing their repayment plan.

Challenging conventional wisdom, this case demonstrates that prioritizing investments over aggressive mortgage repayment can yield superior outcomes when executed strategically. For homeowners, integrating investment perspectives with disciplined repayment offers a pathway to financial freedom while fostering long-term wealth creation.

FAQ

What are the most effective strategies to pay off an Australian mortgage early without sacrificing financial stability?

The most effective strategies include leveraging fortnightly repayments to add an extra month’s worth of payments annually, significantly reducing interest. Utilizing offset accounts to lower the effective loan balance daily preserves liquidity while minimizing interest costs. Redirecting windfalls, such as tax refunds or bonuses, directly to the principal accelerates repayment without impacting regular cash flow. Combining these with debt recycling allows homeowners to convert non-deductible mortgage debt into tax-deductible investment debt, fostering wealth creation. These approaches, when executed strategically, balance financial discipline with flexibility, ensuring early mortgage repayment without compromising financial stability or lifestyle quality.

How do offset accounts and fortnightly repayments work together to reduce mortgage interest and loan terms?

Offset accounts and fortnightly repayments create a synergistic effect in reducing mortgage interest and loan terms. By maintaining savings in an offset account, homeowners lower the effective loan balance daily, minimizing interest charges. Simultaneously, fortnightly repayments add an extra month’s worth of payments annually, accelerating principal reduction. This combination amplifies savings as the reduced principal further enhances the offset account’s impact. Aligning income deposits with offset accounts and leveraging credit card cycles maximizes liquidity while optimizing interest reduction. Together, these strategies ensure faster mortgage repayment, significant interest savings, and financial flexibility without requiring drastic lifestyle changes.

Can debt recycling help accelerate mortgage repayment while building long-term wealth in Australia?

Debt recycling accelerates mortgage repayment while fostering long-term wealth by converting non-deductible home loan debt into tax-deductible investment debt. Homeowners use equity from their property to invest in income-generating assets, such as shares or property, with returns and tax savings redirected toward reducing the mortgage principal. This dual approach reduces debt faster while building a diversified financial portfolio. By leveraging interest-only loans and carefully selecting growth-oriented assets, debt recycling maximizes tax benefits and cash flow. When executed with professional advice and risk management, this strategy balances debt reduction with wealth creation, aligning with long-term financial goals in Australia.

What role do lump-sum payments and windfalls play in cutting years off your mortgage repayment schedule?

Lump-sum payments and windfalls, such as tax refunds, bonuses, or inheritances, directly reduce the mortgage principal, significantly lowering the interest accrued over the loan’s term. Applying these funds early in the repayment schedule maximizes their impact, as interest savings compound over time. For instance, a $10,000 lump sum on a $500,000 loan at 5% interest can save tens of thousands in interest and cut years off the term. This approach preserves financial stability by utilizing unexpected income rather than regular cash flow, enabling homeowners to fast-track mortgage repayment without compromising their budget or lifestyle.

How can homeowners balance early mortgage repayment with maintaining liquidity and investment opportunities?

Homeowners can balance early mortgage repayment with liquidity and investment opportunities by leveraging offset accounts and strategic financial planning. Offset accounts reduce interest while preserving access to funds for emergencies or investments. Pairing this with debt recycling allows homeowners to convert mortgage debt into tax-deductible investment debt, fostering wealth creation alongside repayment. Additionally, aligning lump-sum contributions with windfalls ensures principal reduction without straining cash flow. By maintaining a diversified portfolio and prioritizing high-return investments over low-interest debt, homeowners achieve financial flexibility, enabling them to accelerate mortgage repayment while capitalizing on growth opportunities and safeguarding liquidity.