How Aussies Can Overcome Challenges to Buy Their First Home

In 2024, nearly 35% of Australians who once dreamed of owning their first home considered abandoning the idea altogether. For many, the challenge wasn’t just the soaring property prices in cities like Sydney and Melbourne—where median house prices remain among the least affordable globally—but the relentless grind of saving for a deposit while managing the rising cost of living. A study revealed that 45% of first-home buyers resorted to cutting back on essentials like heating and medical care, underscoring the severity of the financial strain.

Yet, even in this daunting landscape, some have found ways to navigate the barriers. Programs like the First Home Loan Deposit Scheme, which allows buyers to secure a property with just a 5% deposit, have offered a lifeline to thousands. Others have turned to creative strategies, such as “rentvesting” or co-ownership, to sidestep traditional pathways. These stories reveal not just the challenges but the resilience of Australians determined to achieve homeownership.

Image source: linkedin.com

Current Challenges in Homeownership

One critical challenge in Australian homeownership is the widening gap between wage growth and property prices. Over the past two decades, house prices have surged by nearly 150%, while wages have only increased by 82% (CoreLogic). This disparity has pushed first-time buyers to delay purchases, often into their late 30s, as they struggle to save for deposits amidst rising living costs.

A lesser-known factor exacerbating this issue is the reliance on the “bank of mum and dad.” While 45% of first-home buyers turn to parental financial support, this approach is not universally accessible, deepening inequality in homeownership opportunities (Helia Insurance).

Interestingly, unconventional strategies like “rentvesting”—buying in affordable regions while renting in desired locations—are gaining traction. This approach allows buyers to enter the market without compromising lifestyle preferences. Additionally, government schemes like the First Home Loan Deposit Scheme, which reduces deposit requirements to 5%, have proven effective but remain limited in scope.

Looking ahead, addressing systemic wage stagnation and expanding access to innovative financing models could redefine pathways to homeownership, fostering a more inclusive property market.

Historical Context and Market Dynamics

The Australian housing market has undergone significant transformations over the past two decades, shaped by cyclical booms and corrections. A pivotal factor influencing these dynamics is the interplay between population growth and housing supply. For instance, strong overseas migration has consistently driven demand, particularly in states like New South Wales and Victoria, where net migration rates remain the highest (S&P Global Ratings). However, supply constraints—exacerbated by declining dwelling completions, which fell 13.5% year-on-year in Q1 2024—have intensified affordability challenges (ABS).

A lesser-discussed yet critical factor is the role of economic policy uncertainty. Research highlights that such uncertainty disproportionately impacts housing markets, amplifying price volatility and deterring first-home buyers from entering the market during periods of instability (Griffith University).

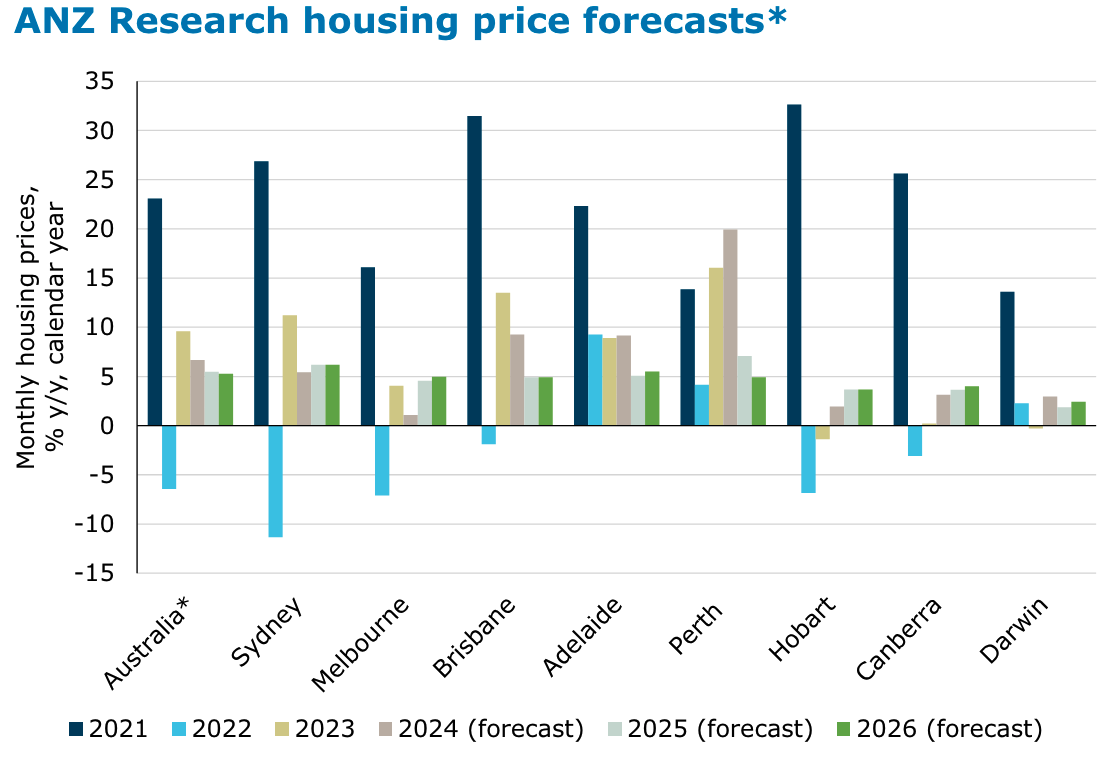

To navigate these dynamics, prospective buyers can leverage data-driven tools to identify emerging growth areas, such as Perth and Adelaide, which have shown consistent annual price increases. Policymakers, on the other hand, must prioritize long-term strategies, including incentivizing “build-to-rent” developments to alleviate supply shortages.

Looking forward, aligning housing policies with demographic trends and fostering economic stability will be essential to creating a more resilient and equitable housing market.

Financial Preparation for First-Time Buyers

Effective financial preparation is the cornerstone of successful homeownership, yet many first-time buyers underestimate its complexity. A common misconception is that saving for a deposit is the sole focus. In reality, buyers must also account for additional costs like stamp duty, legal fees, and building inspections, which can collectively add tens of thousands to the upfront expense (Aspire2Wealth).

One innovative approach is leveraging the First Home Super Saver Scheme (FHSSS), which allows buyers to use their superannuation to accelerate savings while benefiting from tax advantages. For example, a couple earning $80,000 each could save up to $50,000 combined under this scheme, significantly reducing the time needed to reach their deposit goal.

Additionally, financial planners emphasize the importance of building an emergency fund—a safety net covering three to six months of living expenses. This buffer not only mitigates financial stress but also ensures buyers can weather unexpected costs, such as urgent repairs.

By combining disciplined budgeting, strategic use of government incentives, and professional advice, first-time buyers can navigate the financial hurdles with greater confidence, setting a strong foundation for long-term stability.

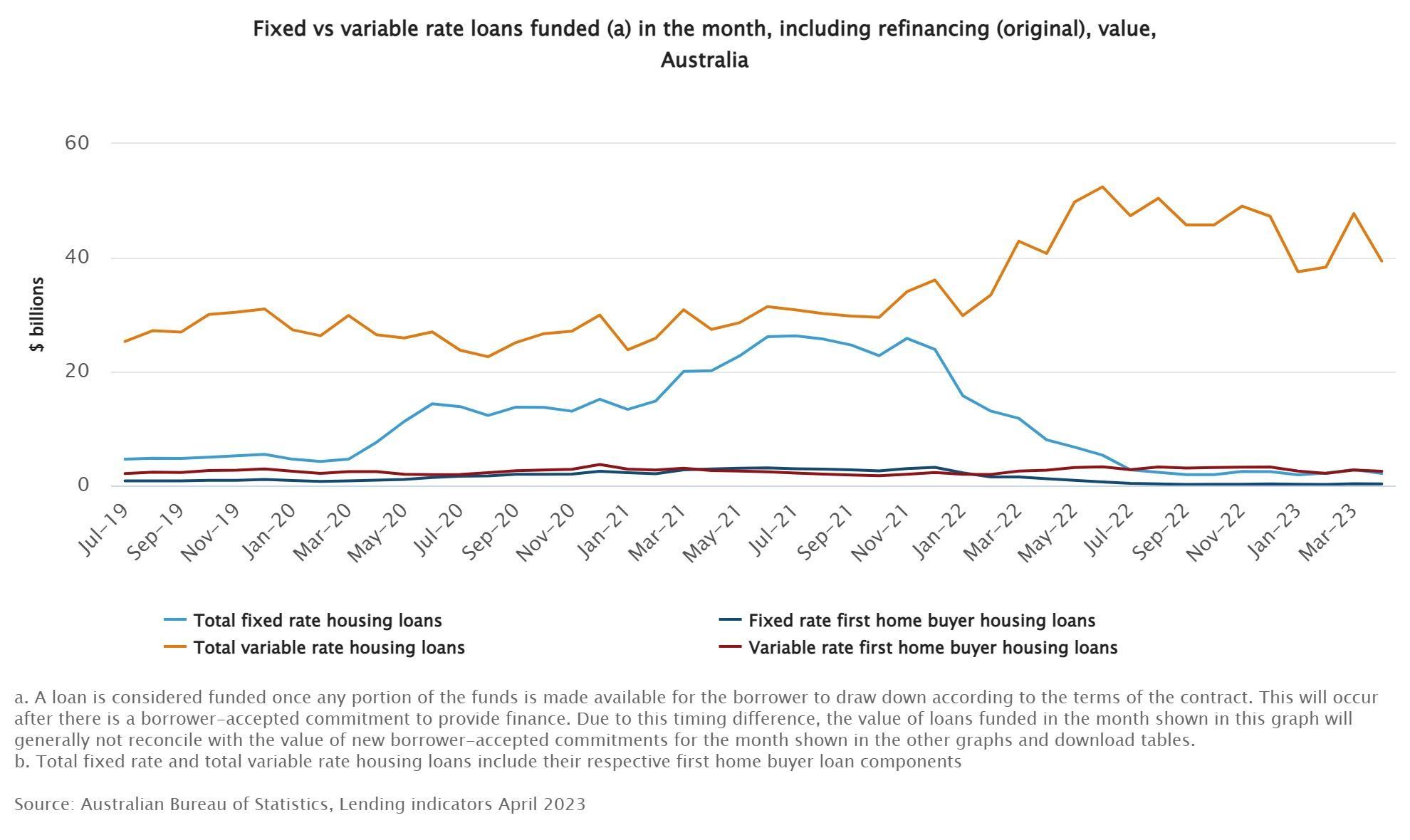

Image source: homeloanexperts.com.au

Effective Budgeting and Saving Strategies

A highly effective yet underutilized strategy for first-time buyers is automating savings contributions. By setting up automatic transfers to a dedicated high-interest savings account, buyers can ensure consistent progress toward their deposit goal without relying on willpower. Behavioral finance studies reveal that automation reduces the cognitive load of decision-making, making it easier to prioritize long-term goals over short-term spending temptations. For instance, a buyer saving $500 monthly in an account with a 3% annual interest rate could accumulate over $6,100 in just one year, thanks to the power of compounding.

Another impactful approach is adopting a cash-only spending plan. This method involves withdrawing a fixed weekly allowance for discretionary expenses, which encourages mindful spending. A Melbourne-based couple reported saving an additional $3,000 annually by switching to cash-only budgeting, as it helped them curb impulsive purchases.

Lesser-known factors, such as the psychological benefits of visualizing progress, also play a role. Tools like budgeting apps that display savings milestones can boost motivation. Additionally, reallocating funds from non-essential expenses—like unused subscriptions or dining out—can yield significant results over time.

By combining automation, disciplined spending, and psychological reinforcement, buyers can create a robust savings framework. These strategies not only accelerate deposit accumulation but also instill financial habits that support long-term stability in homeownership.

Improving Credit Scores and Borrowing Capacity

A critical yet often overlooked strategy for improving credit scores is managing credit utilization ratios. This refers to the percentage of available credit being used across all accounts. Lenders typically view a utilization rate below 30% as favorable, as it signals responsible credit management. For example, if a borrower has a total credit limit of $10,000, keeping balances below $3,000 can positively impact their score. This approach works because it demonstrates financial discipline and reduces perceived risk for lenders.

Another effective tactic is optimizing the age of credit accounts. Closing older, unused credit cards may seem logical, but it can inadvertently lower the average age of credit history, a key factor in credit scoring models. Instead, maintaining these accounts while keeping balances at zero can enhance creditworthiness over time.

Lesser-known factors, such as correcting errors on credit reports, can also yield significant improvements. A study by Equifax found that 20% of Australians had inaccuracies in their credit files, which could unfairly lower scores. Regularly reviewing reports and disputing discrepancies ensures accuracy and maximizes borrowing potential.

By integrating these strategies with debt reduction and timely repayments, buyers can not only improve their credit scores but also unlock better loan terms. As financial technology evolves, tools like credit monitoring apps will further empower buyers to proactively manage their credit health, paving the way for greater borrowing capacity.

Navigating Government Assistance Programs

Government assistance programs can be a game-changer for first-time buyers, but their complexity often deters participation. For instance, the First Home Guarantee (FHG) allows eligible buyers to secure a property with just a 5% deposit, bypassing the need for costly lenders mortgage insurance (LMI). In 2024, one in three first-home buyers leveraged this scheme, demonstrating its impact (Australian Broker News).

However, misconceptions persist. Many assume these programs are universally accessible, yet eligibility often hinges on income thresholds, property value caps, or regional restrictions. For example, the First Home Owner Grant (FHOG) offers $10,000 for new builds but excludes established homes in most states, limiting its appeal in high-demand urban areas.

An unexpected connection lies in how these programs influence market dynamics. Short-term incentives, like the 2009 FHOG boost, spurred demand but inadvertently drove up prices, disadvantaging future buyers (Pawson et al., 2020).

To maximize benefits, buyers should combine programs strategically. For instance, pairing the FHG with state-level stamp duty concessions can significantly reduce upfront costs. By demystifying these options and seeking expert advice, buyers can transform perceived barriers into stepping stones toward homeownership.

Image source: brokernews.com.au

Understanding the First Home Owner Grant

The First Home Owner Grant (FHOG), while widely recognized, often operates under misunderstood parameters that limit its potential impact. A critical yet underexplored aspect is its focus on new homes or substantially renovated properties, which excludes established homes in most states. This restriction, while aimed at stimulating construction, inadvertently narrows options for buyers in urban areas where new builds are scarce or prohibitively expensive (WA Government).

Interestingly, the FHOG’s design aligns with broader economic goals, such as boosting employment in construction and addressing housing supply shortages. However, this focus can create regional disparities. For instance, buyers in outer suburbs or regional areas often benefit more due to the availability of affordable new builds, while urban buyers face limited applicability.

A lesser-known factor influencing outcomes is the timing of applications. Grants are typically paid at settlement or upon construction milestones, meaning buyers must have sufficient liquidity to cover interim costs. This highlights the importance of pairing the FHOG with other incentives, like stamp duty concessions, to ease cash flow constraints.

By understanding these nuances and leveraging the FHOG strategically, buyers can align their choices with both personal goals and market conditions, unlocking opportunities that might otherwise seem out of reach.

Exploring the First Home Loan Deposit Scheme

A pivotal yet underappreciated feature of the First Home Loan Deposit Scheme (FHLDS) is its ability to reduce upfront costs by eliminating the need for Lenders Mortgage Insurance (LMI). This benefit, often overlooked, can save buyers tens of thousands of dollars over the life of their loan. For instance, a buyer purchasing a $500,000 property with a 5% deposit could avoid an LMI cost of approximately $15,000, significantly easing financial pressure (NHFIC).

The scheme’s design also promotes competition among lenders, with 27 participating institutions ranging from major banks to regional lenders. This diversity ensures broader geographic reach and tailored loan products, particularly benefiting buyers in remote or regional areas. However, lesser-known factors, such as property price caps and limited annual places, can restrict access, requiring buyers to act swiftly and strategically.

Interestingly, the FHLDS aligns with behavioral finance principles by lowering psychological barriers to entry. By reducing perceived risks, such as high upfront costs, it encourages participation from buyers who might otherwise delay homeownership.

Looking ahead, expanding the scheme’s scope or integrating it with other incentives, like the First Home Super Saver Scheme, could amplify its impact, fostering a more inclusive housing market.

Utilizing the HomeBuilder Grant

The HomeBuilder Grant offers a unique opportunity for first-time buyers to offset construction costs, yet its potential is often underutilized due to misconceptions about eligibility and timing. A critical aspect deserving attention is its focus on stimulating new builds or substantial renovations, which aligns with broader economic goals like job creation in the construction sector. For instance, a $25,000 grant for a $300,000 construction project effectively reduces the financial burden by over 8%, making homeownership more attainable.

One lesser-known factor influencing outcomes is the strict timeline for contract execution and project commencement. Buyers must navigate these deadlines carefully, often requiring pre-approval for financing and coordination with builders to meet eligibility criteria. This highlights the importance of early planning and collaboration with financial advisors and contractors.

Interestingly, the grant’s design also intersects with urban planning principles. By incentivizing new builds in growth corridors, it indirectly supports infrastructure development in underutilized areas. However, this approach challenges conventional wisdom by prioritizing regional expansion over urban densification, which may not align with all buyers’ preferences.

To maximize its benefits, buyers should pair the HomeBuilder Grant with other schemes, such as the First Home Owner Grant, and explore fixed-price contracts to mitigate cost overruns, ensuring a smoother path to homeownership.

Exploring Alternative Pathways to Homeownership

In a market where traditional homeownership feels increasingly out of reach, alternative pathways are reshaping the landscape. One such approach, rentvesting, allows buyers to purchase properties in affordable regions while continuing to rent in their preferred locations. For instance, a Sydney-based professional might invest in a property in regional NSW, leveraging lower entry costs while maintaining proximity to urban job opportunities. This strategy not only builds equity but also sidesteps the lifestyle compromises often associated with first-home purchases.

Another innovative model is co-ownership, where buyers pool resources with family or friends to share property ownership. A 2024 study by Helia Insurance revealed that 15% of first-home buyers utilized family assistance, with many opting for joint ownership agreements. While this approach requires clear legal frameworks, it democratizes access to the market by reducing individual financial burdens.

Interestingly, these pathways challenge the conventional notion of homeownership as a singular, permanent residence. By embracing flexibility and collaboration, buyers can navigate affordability constraints while aligning with their long-term goals. As these models gain traction, they underscore the importance of rethinking traditional paradigms to foster inclusivity in the housing market.

Image source: azurafinancial.com.au

The Concept of Rentvesting

Rentvesting thrives on the principle of decoupling lifestyle from investment, enabling individuals to live where they desire while building wealth in more affordable markets. A key driver of its appeal is the ability to enter the property market earlier, leveraging rental income and tax benefits like depreciation and negative gearing. For example, a Brisbane-based rentvester might purchase a property in Toowoomba, benefiting from lower entry costs and strong rental yields, while continuing to rent in a vibrant urban area.

A lesser-known yet critical factor is the role of capital growth potential. Strategic location selection is paramount; areas with infrastructure projects or population growth often yield higher long-term returns. This aligns with behavioral finance principles, as rentvesting reduces the psychological barrier of saving for a high-cost deposit in expensive metro areas.

Interestingly, rentvesting also intersects with urban planning. By encouraging investment in regional areas, it indirectly supports economic decentralization, alleviating pressure on overburdened city housing markets. However, rising interest rates and rental market volatility pose challenges, requiring robust financial planning.

To maximize outcomes, aspiring rentvesters should adopt a data-driven approach, analyzing market trends and consulting experts. Tools like property investment calculators can aid decision-making. Ultimately, rentvesting not only redefines homeownership but also empowers individuals to align financial goals with lifestyle aspirations, fostering a more adaptable housing paradigm.

Co-Ownership Arrangements

Co-ownership arrangements offer a transformative approach to overcoming affordability barriers by pooling financial resources among multiple parties. A critical yet underexplored aspect is the importance of legal frameworks in ensuring equitable ownership and mitigating potential disputes. For instance, co-owners can establish a legally binding agreement outlining key terms such as ownership percentages, exit strategies, and financial responsibilities. This clarity fosters trust and reduces the risk of conflicts, making co-ownership a viable long-term solution.

A real-world application of this model is evident in multi-generational housing, where families combine resources to purchase larger properties that accommodate shared living spaces. This approach not only reduces individual financial burdens but also aligns with cultural preferences in communities where extended family living is common. Additionally, co-ownership is gaining traction among friends and colleagues, particularly in urban areas where property prices are prohibitive.

Lesser-known factors influencing success include credit compatibility among co-owners and the impact of shared liabilities on individual borrowing capacities. Financial institutions often assess the collective creditworthiness of all parties, which can either enhance or limit access to favorable loan terms.

Challenging the conventional notion of sole ownership, co-ownership emphasizes collaboration and shared equity. Moving forward, integrating co-ownership models with government incentives, such as stamp duty concessions, could further democratize access to the housing market, fostering inclusivity and innovation in property ownership.

Buying in More Affordable Areas

A focused strategy for first-time buyers is targeting emerging growth corridors in regional or outer suburban areas. These locations often offer lower entry prices while still providing access to essential amenities and infrastructure. A key driver of this approach is the spillover effect from urban centers, where rising property prices push demand into surrounding regions. For instance, areas like Geelong in Victoria or Ipswich in Queensland have seen consistent growth due to their proximity to major cities and ongoing infrastructure investments.

One critical factor influencing success is transport connectivity. Buyers prioritizing areas with planned or existing transport upgrades, such as new rail lines or highway expansions, can benefit from future capital appreciation. This aligns with urban planning principles, as improved connectivity often drives population growth and economic activity in these regions.

Interestingly, lifestyle migration trends are also reshaping demand. Coastal and rural areas with affordable housing are increasingly attractive to remote workers seeking a balance between affordability and quality of life. However, buyers must weigh potential trade-offs, such as limited job opportunities or longer commutes.

To maximize outcomes, buyers should adopt a data-driven approach, leveraging tools like property market analytics to identify undervalued areas with strong growth potential. By aligning purchases with regional development trends, this strategy not only enhances affordability but also positions buyers for long-term financial gains.

Understanding Lending Options and Mortgage Types

Navigating the maze of mortgage options can feel overwhelming, but understanding the nuances can unlock significant advantages. For instance, fixed-rate loans offer repayment stability, ideal for buyers prioritizing predictability in volatile markets. In contrast, variable-rate loans provide flexibility, allowing borrowers to benefit from potential interest rate drops, though they carry the risk of increases. A hybrid option, split loans, combines both, offering a balance of security and adaptability.

A common misconception is that lower interest rates always equate to better deals. However, hidden costs like offset account fees or early repayment penalties can erode savings. For example, a buyer in Sydney saved $5,000 over five years by choosing a slightly higher rate loan with no ongoing fees.

Interestingly, loan features like redraw facilities or offset accounts can act as financial tools, reducing interest while maintaining liquidity. Consulting a mortgage broker ensures tailored advice, helping buyers align loan structures with their financial goals.

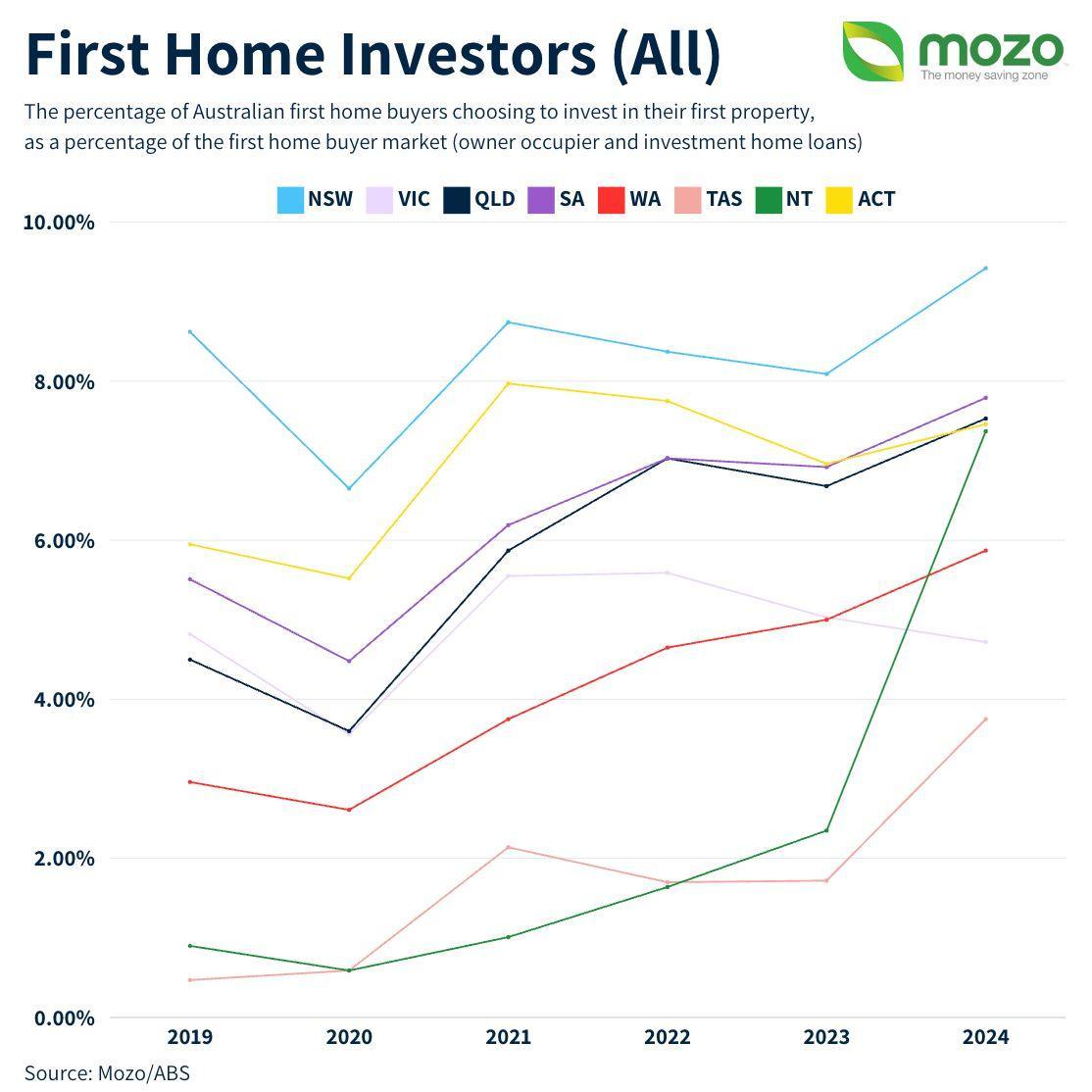

Image source: abc.net.au

Comparing Fixed and Variable Rate Mortgages

A critical yet underexplored aspect of choosing between fixed and variable rate mortgages is the impact of market timing and borrower behavior. Fixed-rate loans provide stability, shielding borrowers from rate hikes, but they often come with break fees if the loan is refinanced or paid off early. This rigidity can be a disadvantage in a declining interest rate environment, where variable-rate loans allow borrowers to capitalize on falling rates.

Interestingly, behavioral finance principles reveal that borrowers often overestimate their ability to predict market trends. For example, during the Reserve Bank of Australia’s rate cuts in 2020, many fixed-rate borrowers missed out on significant savings available to variable-rate holders. This highlights the importance of aligning loan choice with personal financial goals rather than market speculation.

Lesser-known factors, such as the availability of loan features, also play a role. Variable loans often include offset accounts and redraw facilities, offering liquidity and interest savings. Conversely, fixed loans may limit additional repayments, restricting flexibility.

To navigate these complexities, borrowers can adopt a split-loan strategy, combining the predictability of fixed rates with the adaptability of variable rates. This approach not only mitigates risk but also aligns with diverse financial scenarios, fostering long-term stability.

Navigating Lending Criteria and Approval Processes

A pivotal yet often overlooked factor in navigating lending criteria is the debt-to-income (DTI) ratio, which measures a borrower’s total debt against their gross income. Lenders typically favor a DTI below 6, as higher ratios signal increased financial risk. For instance, a Melbourne-based buyer earning $100,000 annually with $500,000 in total debt would meet this threshold, but exceeding it could result in loan rejection or stricter terms. This underscores the importance of managing existing debts, such as credit cards or personal loans, before applying for a mortgage.

Another critical yet underappreciated element is genuine savings requirements. Many lenders require proof of consistent savings over three to six months, demonstrating financial discipline. Buyers relying solely on gifts or windfalls may face challenges meeting this criterion. Automating savings contributions into a dedicated account can help establish this track record while building a deposit.

Interestingly, credit file accuracy plays a significant role in approval outcomes. Errors in credit reports, such as outdated defaults, can unfairly lower scores. Regularly reviewing and disputing inaccuracies ensures borrowers present their strongest financial profile.

Looking ahead, leveraging financial technology tools to simulate borrowing scenarios and consulting mortgage brokers for tailored advice can empower buyers to meet lending criteria with confidence and efficiency.

Leveraging Expert Insights and Market Trends

Understanding market trends and expert insights can transform the daunting process of homeownership into a strategic opportunity. For instance, Nicola Powell, Domain’s Chief of Research, highlights that regional markets like Redbank Plains in Queensland are outperforming metropolitan areas in growth potential, driven by affordability and infrastructure investments. This underscores the importance of looking beyond traditional urban hubs.

A common misconception is that rising interest rates uniformly deter buyers. However, experts argue that such periods often temper competition, creating opportunities for well-prepared buyers to negotiate better deals. For example, during the 2024 rate hikes, savvy buyers in Adelaide capitalized on reduced demand to secure properties below market value.

Unexpectedly, sustainability trends are reshaping buyer preferences. Properties with eco-friendly features, such as solar panels, not only reduce long-term costs but also attract higher resale values. By aligning purchases with these trends, buyers can future-proof their investments while contributing to environmental goals.

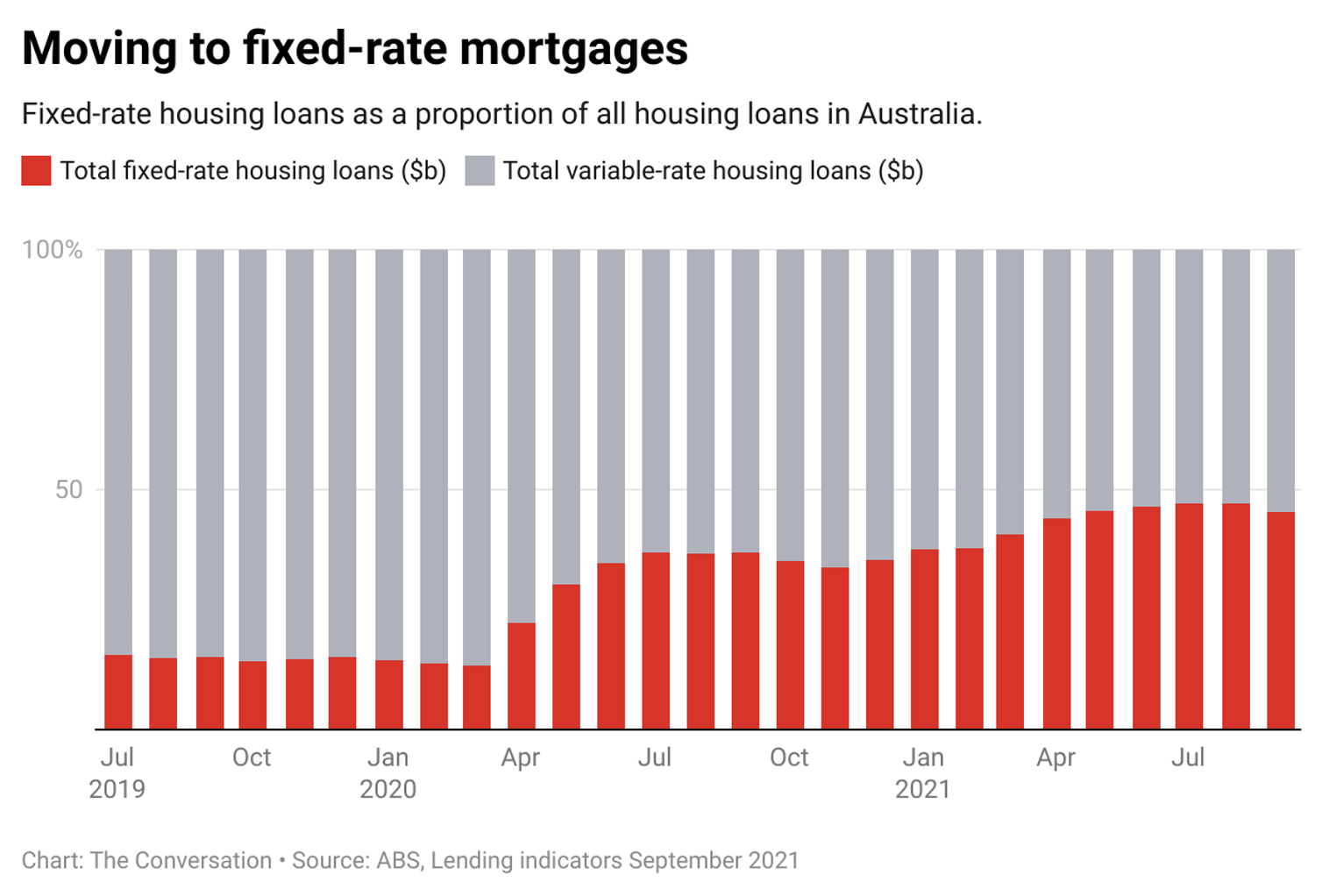

Image source: anz.com.au

Expert Opinions on Market Conditions

One critical yet underexplored aspect of current market conditions is the impact of regional migration on property demand. Dr. Nicola Powell, Domain’s Chief of Research, notes that areas like Toowoomba and Ballarat are experiencing a surge in demand due to affordability and lifestyle migration trends. This shift is driven by remote work flexibility, allowing buyers to prioritize quality of life over proximity to urban centers. Such regions often offer lower entry prices and higher growth potential, making them attractive for first-time buyers.

Interestingly, consumer confidence cycles play a pivotal role in shaping market behavior. During periods of economic uncertainty, buyers tend to delay decisions, creating temporary dips in competition. Savvy buyers can leverage these windows to negotiate favorable terms, as seen during the 2024 interest rate hikes when Adelaide properties saw reduced demand.

A lesser-known factor influencing market dynamics is the role of infrastructure investments. Projects like new rail lines or highway expansions often catalyze property value appreciation in surrounding areas. Buyers who align their purchases with these developments can benefit from long-term capital growth.

By combining data-driven research with expert insights, first-time buyers can navigate market complexities strategically, positioning themselves to capitalize on emerging opportunities while mitigating risks.

Emerging Trends in the Housing Market

A significant emerging trend reshaping the housing market is the increasing demand for sustainable and energy-efficient homes. As environmental awareness grows, buyers are prioritizing properties with eco-friendly features such as solar panels, energy-efficient appliances, and advanced insulation. This shift is not merely a lifestyle choice but a strategic financial decision. Properties with these features often command higher resale values and lower long-term operational costs, making them attractive investments. For instance, a study by the Green Building Council of Australia found that homes with sustainability certifications sold 10% faster and at a premium compared to non-certified properties.

A lesser-known factor driving this trend is the integration of smart home technologies. Features like automated energy management systems and water-saving devices are becoming key differentiators in competitive markets. These technologies not only enhance convenience but also align with broader urban planning goals, such as reducing carbon footprints in high-density areas.

Challenging conventional wisdom, this trend suggests that affordability and sustainability are not mutually exclusive. By leveraging government incentives for green retrofitting and focusing on emerging growth corridors with eco-friendly developments, buyers can align their financial goals with environmental priorities. Looking ahead, this convergence of sustainability and technology will likely redefine housing market dynamics, creating new opportunities for forward-thinking buyers.

FAQ

What are the most effective government schemes available for first-time home buyers in Australia?

The Australian Government offers several impactful schemes to support first-time home buyers. The First Home Guarantee (FHBG) allows eligible buyers to purchase with a 5% deposit, bypassing Lenders Mortgage Insurance (LMI). For regional buyers, the Regional First Home Buyer Guarantee (RFHBG) provides similar benefits, fostering affordability in non-urban areas. Single parents can access the Family Home Guarantee (FHG) with just a 2% deposit. These programs, administered by Housing Australia, include property price caps and eligibility criteria. Combining these schemes with state-level grants, such as the First Home Owner Grant (FHOG), can significantly reduce upfront costs and accelerate homeownership.

How can first-time buyers improve their borrowing capacity and secure better mortgage terms?

First-time buyers can enhance borrowing capacity by improving their credit score through timely bill payments and reducing outstanding debts. Increasing savings for a larger deposit lowers the loan-to-value ratio, making borrowers more attractive to lenders. Engaging a mortgage broker ensures access to tailored loan products and favorable terms. Reducing discretionary expenses and consolidating debts also boosts financial stability. For self-employed buyers, maintaining consistent cash flow and consulting an accountant strengthens financial documentation. Exploring joint borrowing options or extending loan terms can further improve affordability. These strategies collectively optimize borrowing power and secure competitive mortgage terms in Australia’s housing market.

What strategies can Australians use to save for a home deposit faster despite rising living costs?

Australians can accelerate home deposit savings by automating contributions to a high-interest savings account, ensuring consistent progress. Leveraging the First Home Super Saver Scheme (FHSSS) allows tax-efficient savings through superannuation. Budgeting apps help track expenses, redirecting funds from non-essentials like subscriptions or dining out. Increasing income through side hustles or freelance work provides additional savings potential. Minimizing debt and avoiding impulsive purchases enhances financial discipline. Exploring government programs like the First Home Loan Deposit Scheme (FHLDS) reduces deposit requirements, easing the savings burden. Combining these strategies ensures faster deposit accumulation, even amidst rising living costs in Australia.

How does rentvesting work, and is it a viable option for first-time buyers in Australia?

Rentvesting enables first-time buyers to purchase an investment property in an affordable area while renting in their preferred location. This strategy builds equity through capital growth and generates rental income, which can offset mortgage costs. Tax benefits, such as negative gearing, further enhance financial viability. Rentvesting suits buyers prioritizing lifestyle flexibility or those priced out of high-demand suburbs. However, it requires careful planning, including selecting properties with strong growth potential and managing additional costs like property maintenance. Consulting a financial advisor ensures alignment with long-term goals, making rentvesting a practical pathway to homeownership in Australia’s competitive property market.

What are the key factors to consider when choosing between urban and regional property markets?

When comparing urban and regional property markets, affordability is a primary factor, with regional areas often offering lower entry prices. Urban markets provide stronger job opportunities, infrastructure, and amenities, while regional areas appeal to those seeking lifestyle benefits and lower living costs. Consider capital growth potential, as cities like Sydney and Melbourne historically outperform, though regional hotspots like Ballarat show rising demand. Evaluate transport connectivity and planned infrastructure projects, which influence long-term value. Additionally, assess proximity to schools, healthcare, and employment hubs. Balancing these factors ensures alignment with financial goals and lifestyle preferences in Australia’s diverse property landscape.