10 Mortgage Myths Every Australian Needs to Stop Believing

Many Australians believe owning a home is out of reach, but what if the biggest barriers are myths? Misconceptions about mortgages could be costing you opportunities—are you falling for these common traps?

Understanding Mortgage Myths in Australia

Many Australians assume a 20% deposit is mandatory, but low-deposit loans, like the First Home Guarantee, allow entry with just 5%. This flexibility challenges outdated norms, opening doors for first-time buyers.

The Impact of Misinformation on Financial Decisions

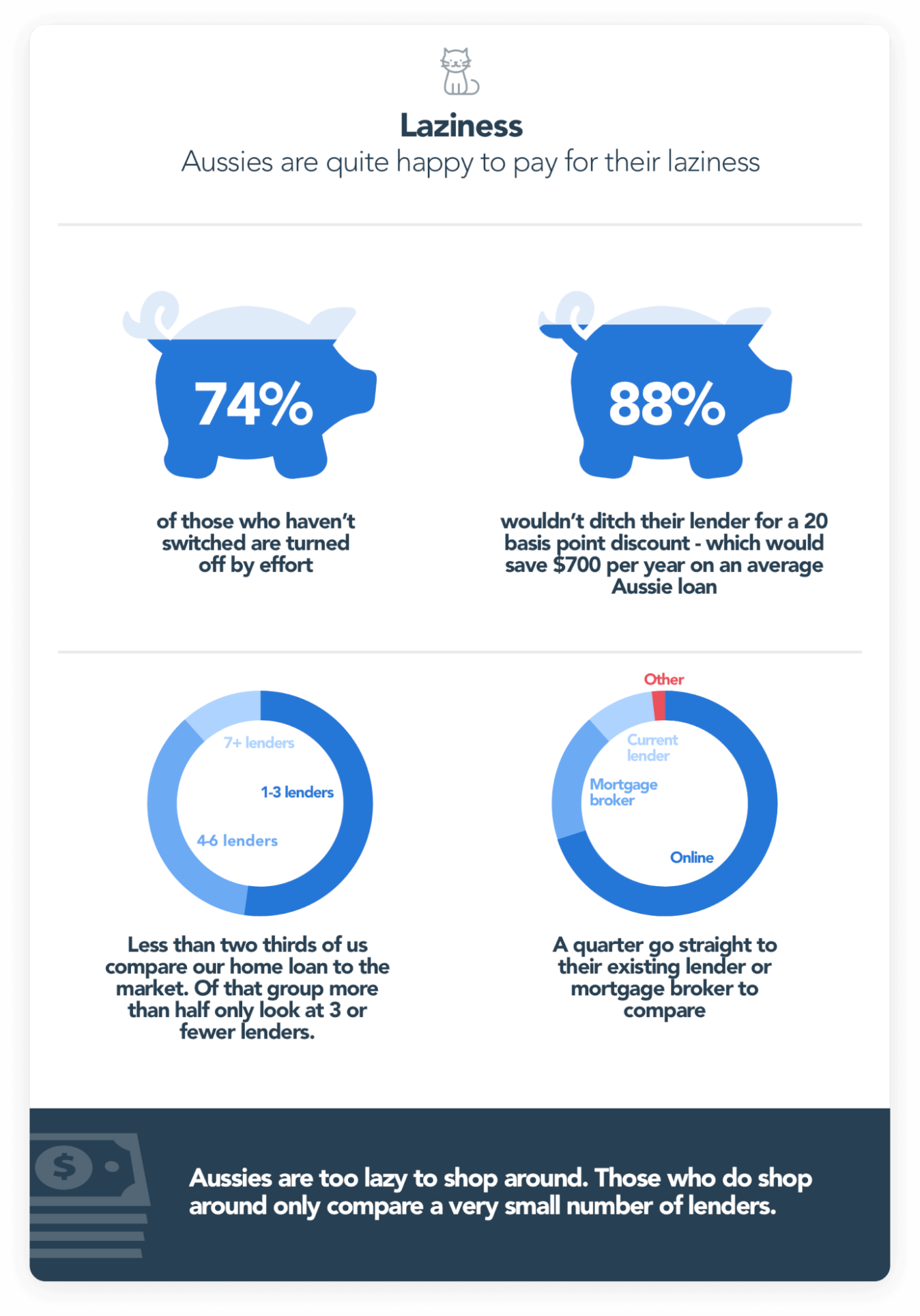

Misinformation fosters status quo bias, discouraging borrowers from switching lenders despite better options. Cognitive overload from complex loan comparisons amplifies this, highlighting the need for transparent pricing and simplified decision-making tools to empower consumers.

Myth 1: You Must Have a 20% Deposit to Buy a Home

Programs like the First Home Guarantee allow buyers to enter the market with just 5% deposit. This shatters traditional beliefs, enabling faster homeownership while balancing risks like Lender’s Mortgage Insurance (LMI).

Image source: linkedin.com

Modern Deposit Requirements Explained

Low-deposit schemes like the Family Home Guarantee (2% deposit) redefine affordability, especially for single parents. These programs reduce barriers, leveraging government guarantees to bypass LMI, fostering inclusivity in homeownership while mitigating financial strain.

Exploring Low Deposit Options and Government Assistance

Programs like the Regional First Home Buyer Guarantee (5% deposit) target rural buyers, addressing urban-rural disparities. Coupled with grants like NSW’s $10,000 or Tasmania’s $30,000, these initiatives empower diverse demographics to achieve homeownership.

Myth 2: You Should Always Buy Instead of Rent

Renting offers flexibility for career shifts or lifestyle changes, unlike homeownership’s long-term commitment. For instance, rising interest rates or stagnant property values can make renting a smarter financial choice in volatile markets.

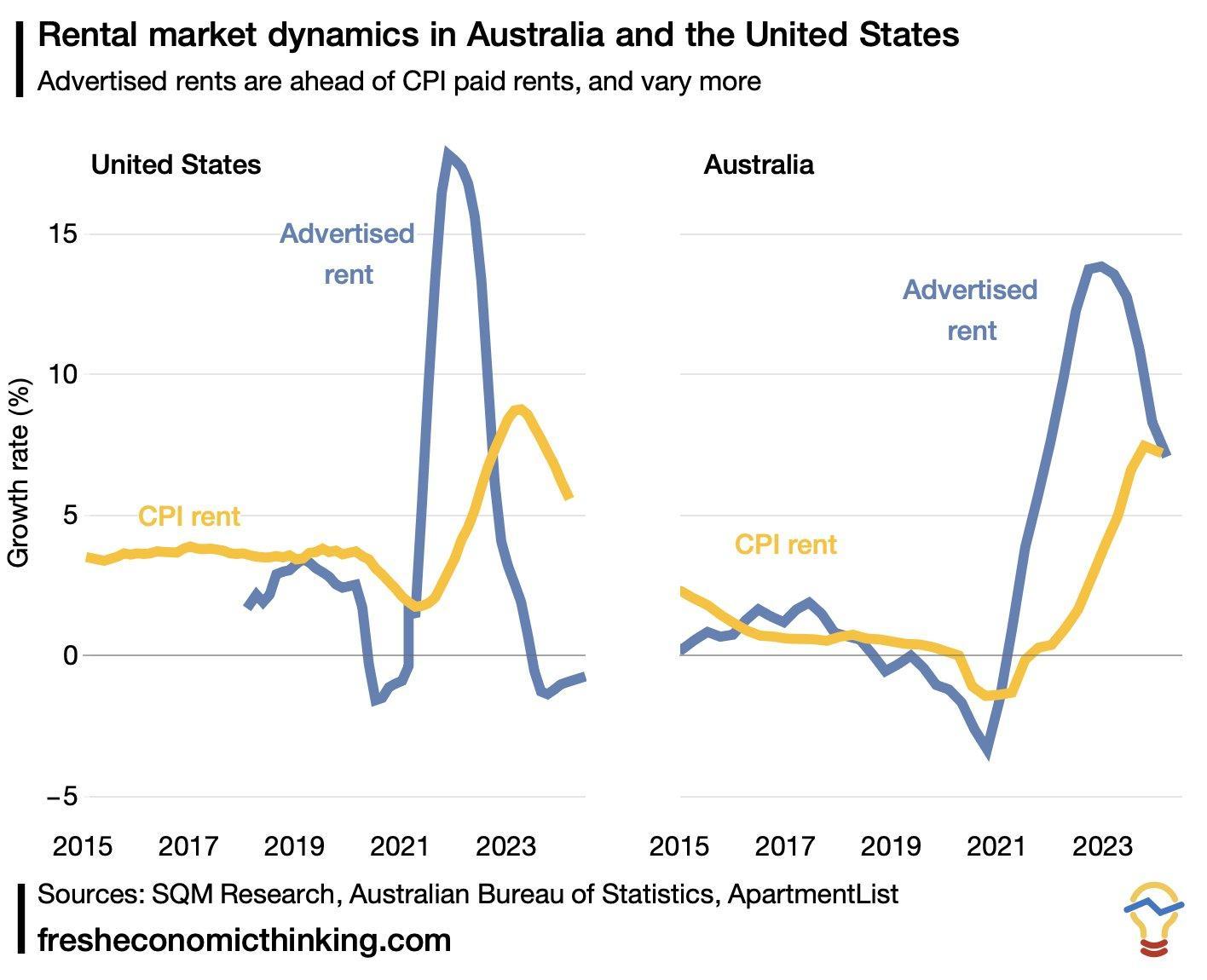

Image source: x.com

Evaluating Rent vs. Buy in the Australian Market

High vacancy rates in cities like Brisbane empower renters with negotiation leverage, while low rates in Sydney drive rents higher. Strategic renting in affordable areas can accelerate savings for future homeownership.

Financial and Lifestyle Considerations

Renting minimizes upfront costs, freeing funds for investments like stocks or superannuation. Meanwhile, homeownership offers stability but demands ongoing expenses. Balancing these trade-offs depends on individual goals, market conditions, and long-term financial strategies.

Myth 3: Once You Have a Mortgage, You’re Stuck with It

Refinancing unlocks flexibility, enabling borrowers to secure lower rates, consolidate debts, or access equity. For example, switching lenders saved Australians an average of $1,200 annually in 2024, proving mortgages are adaptable financial tools.

Image source: unohomeloans.com.au

Understanding Mortgage Refinancing

Refinancing isn’t just about lower rates—it’s a strategic reset. For instance, consolidating high-interest debts into a home loan reduces costs. Expert advice ensures benefits outweigh risks, fostering smarter financial decisions and long-term savings.

Strategies for Switching Lenders and Negotiating Terms

Leverage retention teams for better rates—banks often offer exclusive deals to retain customers. Compare offers using broker insights, and negotiate loan terms like shorter durations to minimize interest, maximizing long-term financial benefits.

Myth 4: All Mortgage Lenders Are the Same

Lenders differ in loan flexibility, fees, and customer service. For example, non-bank lenders often offer niche products, while major banks provide stability. Choosing the right lender depends on your financial goals and unique circumstances.

Image source: ausloans.com.au

Differences Between Banks, Credit Unions, and Brokers

Credit unions prioritize member benefits, often offering lower fees. Brokers simplify comparisons across lenders, saving time. Banks, while stable, may lack flexibility. Align lender choice with your financial priorities for optimal outcomes.

How Lender Choice Affects Your Mortgage Options

Lender selection shapes access to features like offset accounts, redraw facilities, or flexible repayment terms. For instance, non-bank lenders may offer tailored solutions, while banks often impose stricter terms. Match lenders to your financial strategy.

Myth 5: The Lowest Interest Rate Is Always the Best Option

A low rate can mask hidden fees, restrictive terms, or limited features. For example, offset accounts or flexible repayments may save more long-term. Evaluate total costs, not just the headline rate.

Image source: homeloanexperts.com.au

Assessing Loan Features Beyond Interest Rates

Features like offset accounts can reduce interest costs by leveraging savings, while redraw facilities offer liquidity. For instance, pairing these with flexible repayment terms ensures adaptability to changing financial needs.

Calculating the True Cost of a Mortgage

Beyond interest rates, fees like application, ongoing, and exit charges significantly impact costs. For example, a slightly higher rate with lower fees may save thousands over time. Always evaluate comparison rates for clarity.

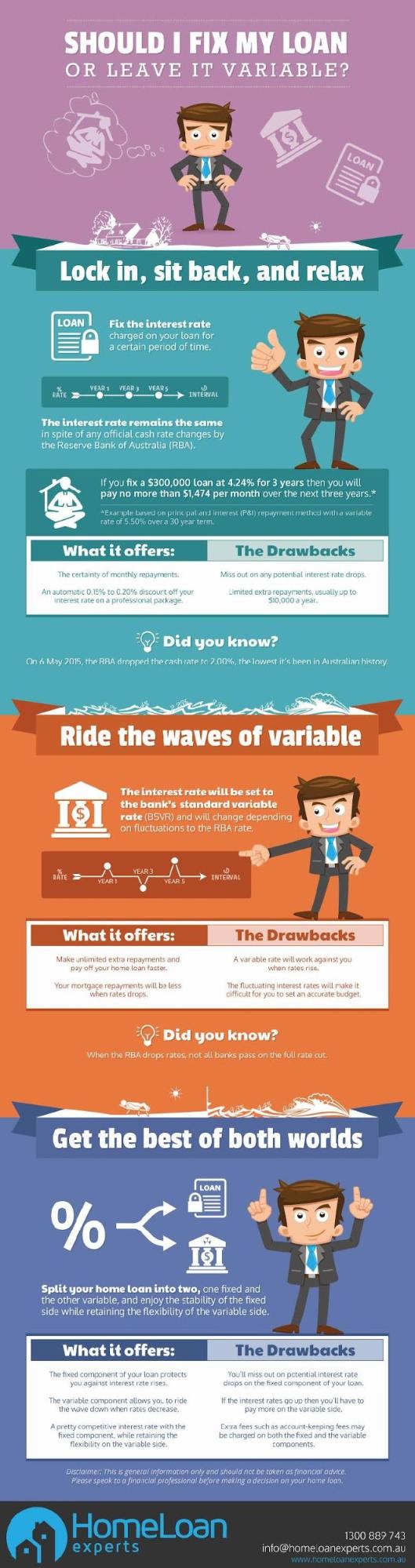

Myth 6: You Should Always Choose a Fixed Interest Rate

Fixed rates offer stability but lack flexibility. For instance, variable rates may save money during rate cuts. A split loan combines both, balancing predictability with adaptability to market changes.

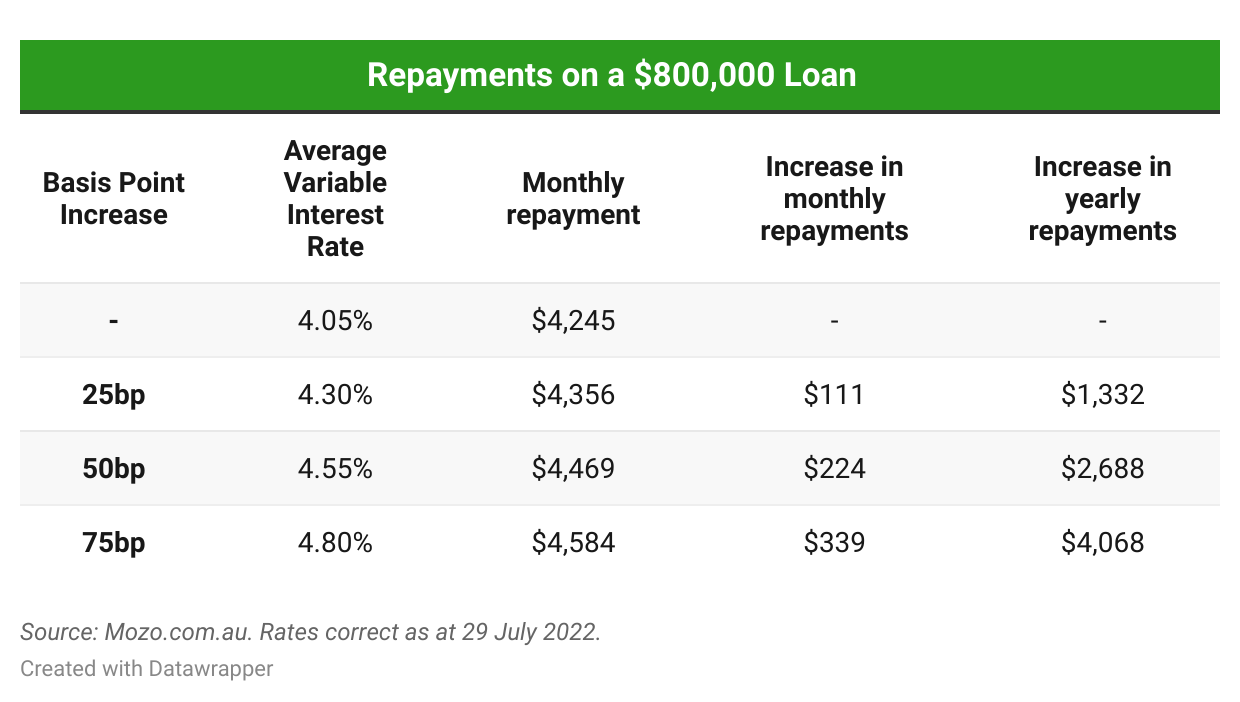

Image source: mozo.com.au

Fixed vs. Variable Interest Rates

Economic cycles heavily influence rate choices. For example, fixed rates protect during inflation spikes, while variable rates excel in declining markets. A split loan mitigates risks, offering tailored solutions for diverse financial goals.

Market Trends and Choosing the Right Option

Rising cash rates often favor fixed loans, while falling rates benefit variable options. Monitoring Reserve Bank policies and inflation trends helps borrowers align loan structures with economic shifts, ensuring smarter, future-proof financial decisions.

Myth 7: Interest-Only Loans Are Always Bad

Interest-only loans suit investors aiming for short-term gains or cash flow flexibility. While risks exist, strategic use—like reinvesting savings—can yield benefits. Expert advice ensures alignment with financial goals and market conditions.

Image source: afmsgroup.com.au

Analyzing the Pros and Cons of Interest-Only Loans

Interest-only loans excel in high-growth markets, enabling investors to maximize leverage. However, stagnant property values or rising rates amplify risks. Balancing cash flow benefits with potential equity loss demands careful market analysis and financial planning.

When Interest-Only Loans Might Be Beneficial

For seasoned investors, interest-only loans free up capital for diversified investments or renovations, boosting returns. In volatile markets, they offer flexibility, but success hinges on timing, market trends, and disciplined financial strategies.

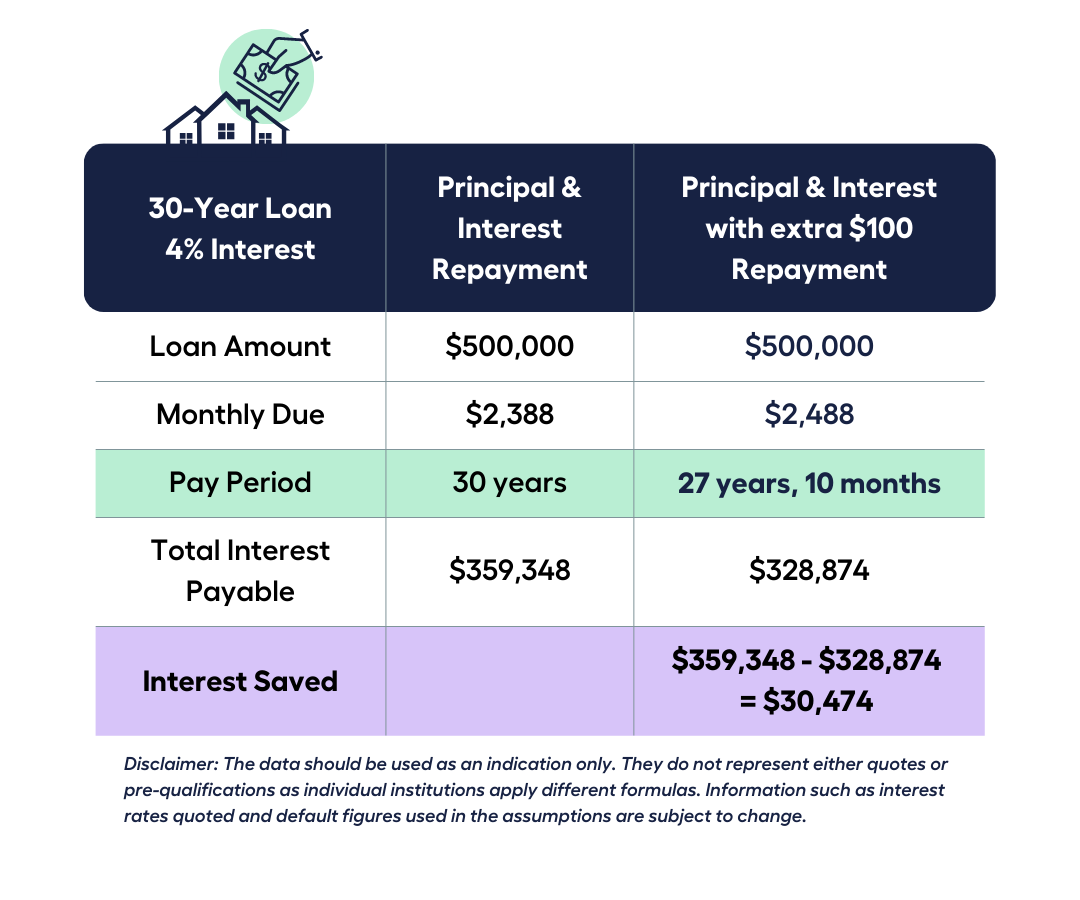

Myth 8: Making Extra Repayments Is Not Worth It

Small extra repayments can slash years off loan terms and save thousands in interest. For instance, adding $100 monthly to a $400,000 loan at 5% could save over $30,000—compounding benefits over time.

Image source: mymoneysorted.com.au

Benefits of Extra Mortgage Repayments

Extra repayments act like a financial snowball, reducing principal faster and compounding interest savings. For example, offset accounts amplify this effect, offering liquidity while slashing interest—blending flexibility with long-term financial gains.

Strategies for Paying Off Your Mortgage Early

Automating fortnightly repayments instead of monthly can reduce interest accrual, leveraging extra annual payments. Pair this with offset accounts or lump-sum contributions to accelerate progress while maintaining financial flexibility for unexpected needs.

Myth 9: You Can’t Get a Mortgage If You’re Self-Employed

Self-employed borrowers can secure mortgages by leveraging low-doc loans, showcasing consistent business growth, or using specialist brokers. Flexible lenders, like Liberty Financial, tailor solutions, proving self-employment isn’t a barrier but an opportunity.

Image source: tnslawyers.com.au

Mortgage Options for Self-Employed Australians

Low-doc loans simplify access by accepting BAS statements or accountant declarations instead of tax returns. Specialist lenders, like Liberty, assess unique income streams, enabling tailored solutions for fluctuating earnings, fostering inclusivity in homeownership opportunities.

Preparing Documentation and Meeting Requirements

Combining BAS statements with bank records demonstrates income stability, even for fluctuating earnings. Engaging an accountant ensures accurate financials, while maintaining separate business accounts simplifies lender assessments, boosting approval odds for self-employed borrowers.

Myth 10: Pre-Approval Guarantees Loan Approval

Pre-approval is like a weather forecast—it offers guidance but no guarantees. Changes in interest rates, lender policies, or your financial situation can derail final approval. Always verify conditions with your lender.

Image source: linkedin.com

Understanding Pre-Approval vs. Formal Approval

Pre-approval assesses your borrowing capacity, but property valuation and updated financial checks during formal approval can shift outcomes. Treat pre-approval as a guide, not a guarantee, and monitor financial changes closely.

Factors That Can Affect Final Loan Approval

Property valuation discrepancies often derail approvals. For example, lenders may reject loans if the property’s market value falls short. Mitigate risks by researching comparable sales and securing a buffer in your deposit.

FAQ

What are the most common misconceptions about mortgage deposits in Australia?

Many Australians mistakenly believe that a 20% deposit is mandatory to secure a home loan. However, programs like the First Home Guarantee allow buyers to enter the market with as little as a 5% deposit. Additionally, options such as guarantor loans, gifted deposits, and low-deposit home loans with Lender’s Mortgage Insurance (LMI) provide alternative pathways. Another misconception is that larger deposits are always better; while they reduce borrowing costs, smaller deposits can still lead to homeownership with proper financial planning and government assistance.

How does renting compare to buying in volatile property markets?

Renting offers flexibility, especially in volatile property markets where rising interest rates or stagnant property values can make homeownership less appealing. High vacancy rates in some cities empower renters to negotiate better terms, while renting in affordable areas can help save for future homeownership. Conversely, buying provides stability and the potential for long-term equity growth, but it requires careful consideration of market conditions and financial readiness. Balancing these factors is crucial to making an informed decision.

Can refinancing really save money, and how does it work?

Refinancing can indeed save money by securing a lower interest rate, reducing monthly repayments, or shortening the loan term. The process involves replacing your current mortgage with a new one, often with a different lender, to take advantage of better terms. Homeowners can also use refinancing to consolidate debts or access equity for renovations or investments. However, it’s essential to weigh the potential savings against costs like break fees, application fees, and property valuation charges to ensure the financial benefits outweigh the expenses.

What factors should Australians consider when choosing a mortgage lender?

Australians should evaluate several factors when selecting a mortgage lender, including interest rates, fees, and loan features such as offset accounts or flexible repayment terms. The lender’s reputation, customer service quality, and responsiveness are also critical considerations. Additionally, borrowers should assess whether a lender’s policies align with their financial goals, such as accommodating low-doc loans for self-employed individuals or offering competitive refinancing options. Comparing multiple lenders through brokers or online tools can help identify the best fit for individual needs.

Why is pre-approval not a guarantee for final loan approval?

Pre-approval is a preliminary assessment of borrowing capacity and does not account for all factors required for final loan approval. Changes in personal financial circumstances, such as job loss or increased debt, can impact the outcome. Additionally, property valuation discrepancies or shifts in lender policies may lead to rejection during the formal approval stage. Borrowers should view pre-approval as a helpful guide rather than a definitive guarantee and ensure they meet all conditions outlined by the lender to improve their chances of success.

Conclusion

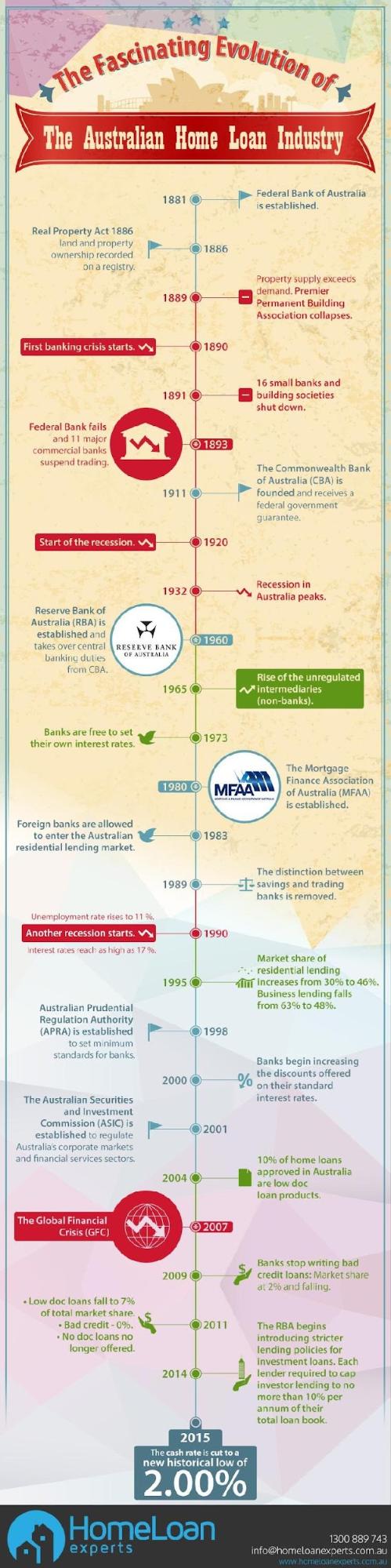

Understanding mortgage myths is like clearing fog from a windshield—it reveals the road ahead. For instance, the belief that a 20% deposit is mandatory often deters potential buyers unnecessarily. Programs like the First Home Guarantee, allowing deposits as low as 5%, prove otherwise. Similarly, renters in high-vacancy cities can leverage flexibility to save for future ownership, challenging the “always buy” mindset.

Refinancing myths also deserve debunking. A case study from 2024 showed a Sydney homeowner saving $12,000 over three years by switching lenders, despite initial fees. This highlights the importance of evaluating total costs, not just interest rates.

Expert advice is invaluable. Mortgage brokers, for example, simplify lender comparisons, ensuring borrowers align loans with their unique goals. Think of them as navigators in a sea of options, steering you toward financial clarity.

Ultimately, busting these myths empowers Australians to make informed, confident decisions. By questioning assumptions and exploring tailored solutions, homeownership becomes less daunting and more achievable.

Image source: homeloanexperts.com.au

Recap of Key Mortgage Insights

One overlooked insight is the power of small extra repayments. For example, adding just $50 weekly to a $400,000 mortgage can shave years off the loan term and save thousands in interest. This approach works because extra payments directly reduce the principal, compounding savings over time.

Additionally, leveraging offset accounts amplifies these benefits. By parking savings in an offset account, borrowers effectively reduce the interest-bearing loan balance. This strategy is particularly effective in high-interest environments, offering flexibility without locking funds away.

These tactics highlight the importance of proactive financial management. Borrowers who embrace such strategies not only save money but also gain greater control over their financial future, challenging the misconception that mortgages are rigid, unchangeable commitments.

Navigating the Future of Homeownership in Australia

Emerging green home loans incentivize energy-efficient upgrades, reducing long-term costs while aligning with sustainability goals. For instance, installing solar panels can lower utility bills and increase property value, creating dual financial and environmental benefits.

Additionally, flexible mortgage structures like split loans allow borrowers to hedge against interest rate volatility. This adaptability is crucial as economic conditions shift, offering stability without sacrificing potential savings.

By integrating these innovative approaches, Australians can future-proof their homeownership journey, balancing financial resilience with evolving market demands.