The Ultimate Mortgage Hacks: Save Thousands on Your Aussie Home Loan

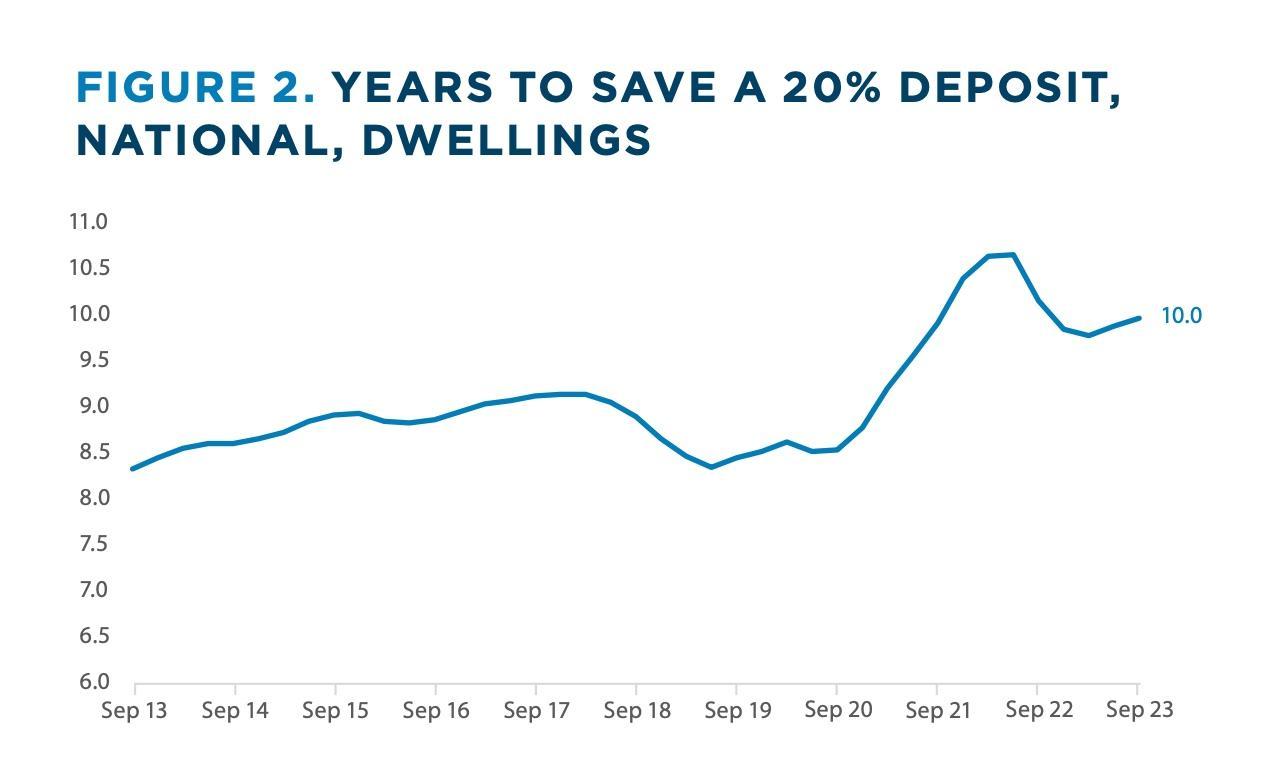

Did you know that the average Aussie homeowner could save tens of thousands on their mortgage simply by tweaking a few overlooked details? With interest rates fluctuating and housing affordability tighter than ever, understanding these hacks isn’t just smart—it’s essential. What if the key to financial freedom lies in strategies most lenders won’t tell you? Let’s uncover the secrets that could transform your home loan journey and your future.

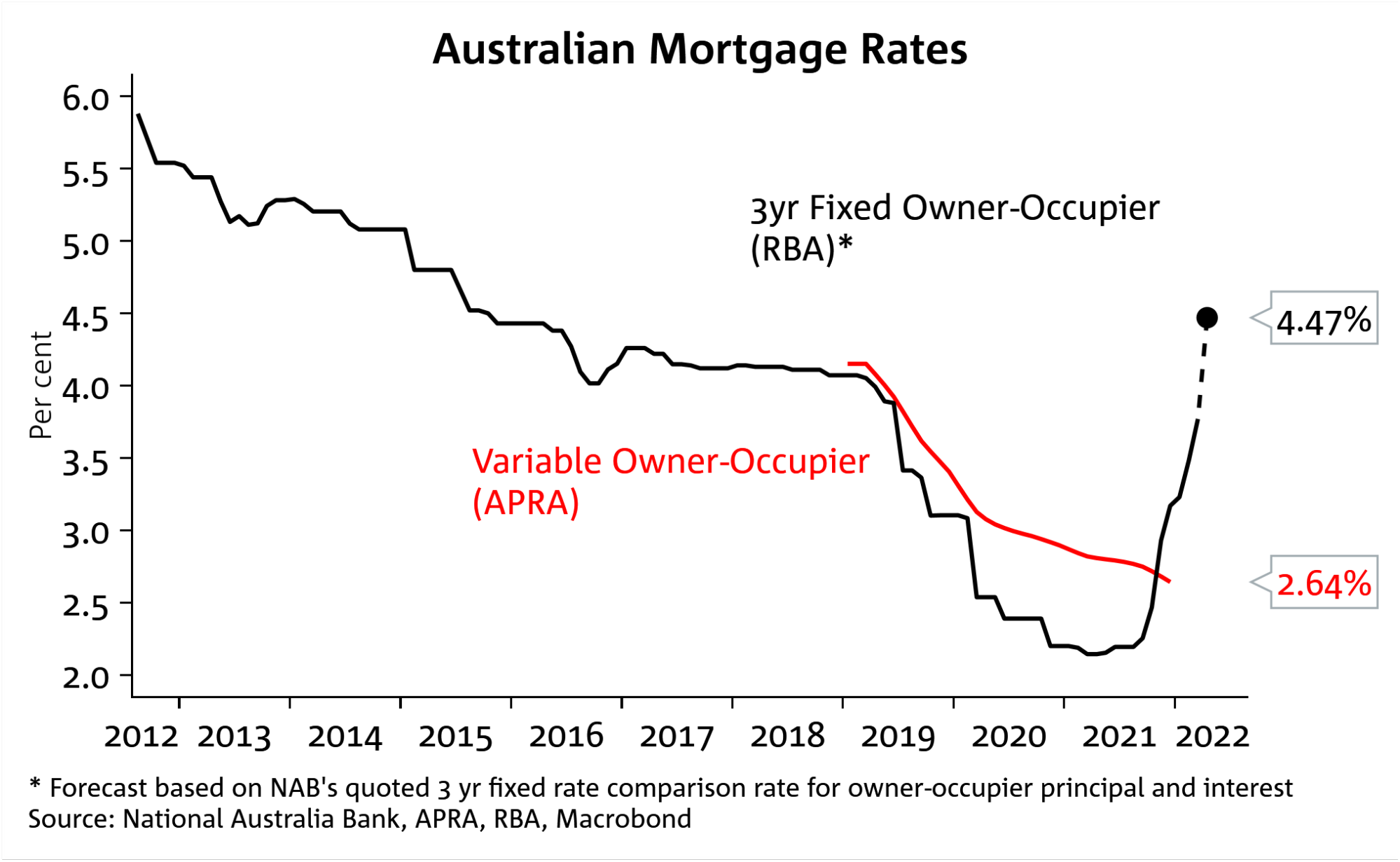

Image source: business.nab.com.au

Understanding the Australian Mortgage Landscape

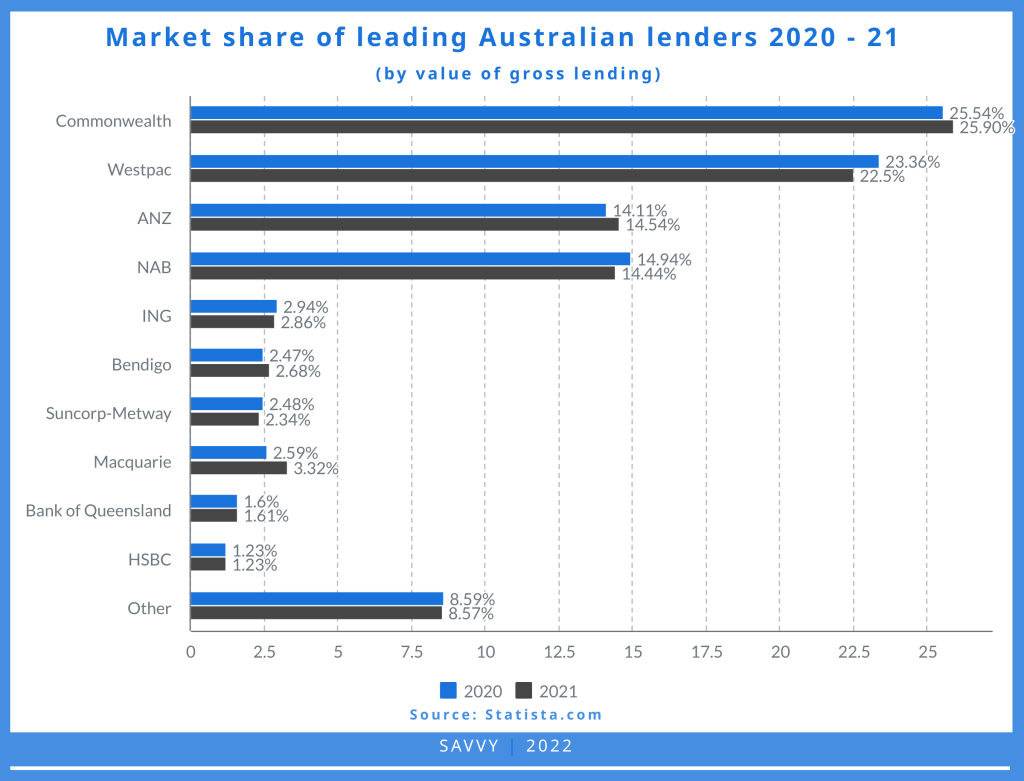

Australia’s mortgage market is shaped by unique factors like strict lending regulations, low securitisation rates, and concentrated banking power, which directly influence borrower options and strategies. For instance, the Responsible Lending Conduct Obligations ensure lenders rigorously assess borrower capacity, creating a more conservative lending environment compared to global counterparts. While this protects consumers, it also limits flexibility for those with unconventional financial profiles.

A lesser-known factor is the role of non-bank lenders, which have grown significantly, offering competitive rates and faster approvals. These lenders often cater to borrowers overlooked by traditional banks, such as those with minor credit impairments or self-employed individuals. However, their higher risk tolerance can lead to increased costs over time, making it crucial to weigh short-term benefits against long-term implications.

Additionally, regional housing cycles play a pivotal role. For example, while Sydney and Melbourne experience price recoveries, cities like Perth and Darwin face stagnation due to slower population growth and employment shifts. Understanding these dynamics can help borrowers time their property purchases or refinancing decisions more effectively.

To navigate this complex landscape, borrowers should focus on customising their approach—whether by leveraging non-bank lenders, negotiating terms with traditional banks, or aligning their strategies with regional market trends. By doing so, they can unlock opportunities that align with their financial goals while mitigating risks.

The Importance of Optimising Your Home Loan

Refinancing to a lower interest rate can save thousands, but pairing it with an offset account amplifies savings. Offset accounts reduce interest by linking your loan to your savings balance, effectively lowering the principal on which interest is calculated. For example, a $20,000 offset balance on a $400,000 loan could save over $1,000 annually in interest.

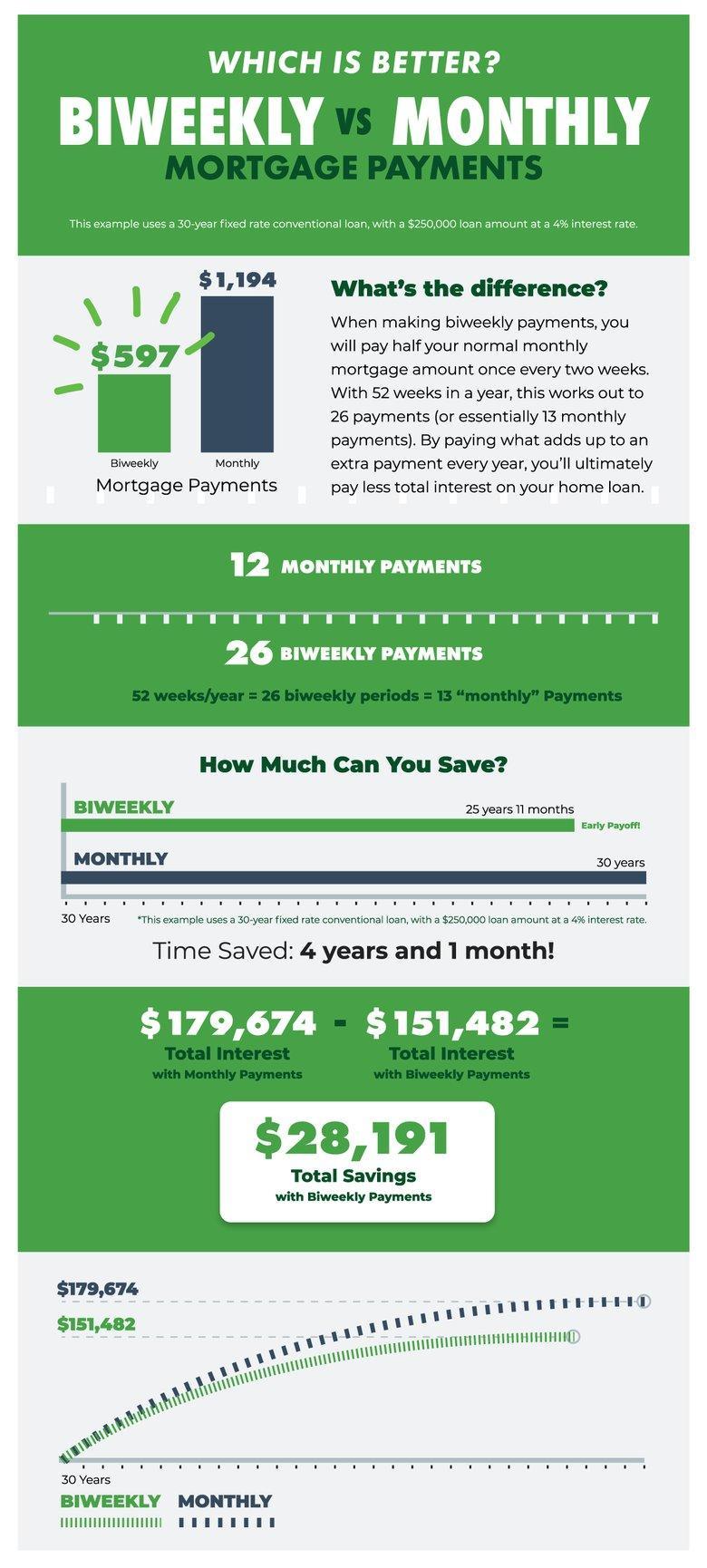

Beyond interest savings, flexible repayment structures like fortnightly payments can further optimise outcomes. By making 26 payments annually instead of 12, borrowers effectively make an extra monthly repayment each year, reducing the loan term significantly.

Lesser-known strategies include negotiating fee waivers or leveraging cashback offers during refinancing. These can offset upfront costs, making optimisation more accessible. Borrowers should also consider loan portability to avoid fees when moving homes, ensuring long-term flexibility.

By combining these tactics, homeowners can create a tailored framework to maximise savings and reduce financial stress, paving the way for greater financial freedom.

Mastering Mortgage Basics

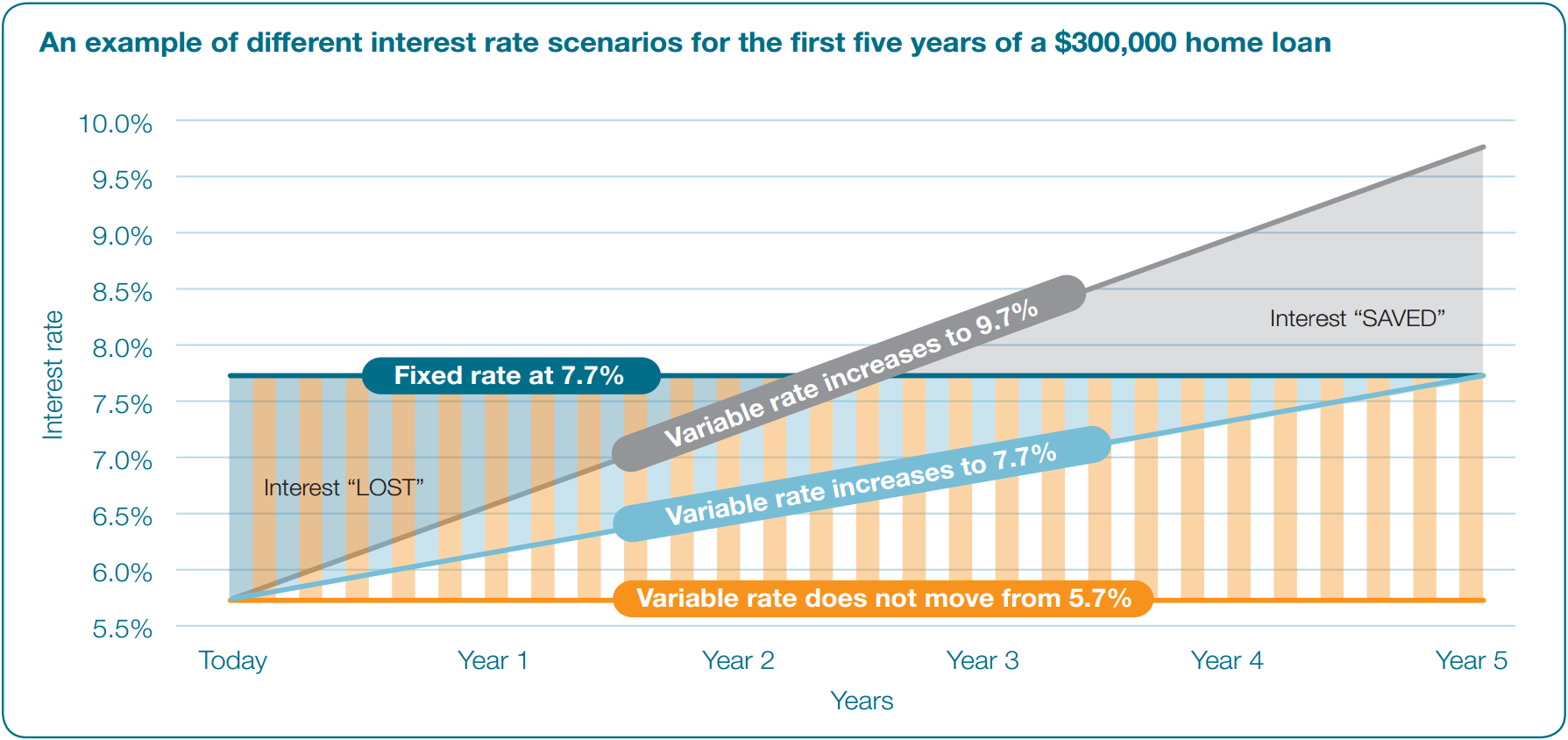

Think of your mortgage as a financial ecosystem. Understanding interest types—fixed, variable, or split—can save thousands. For instance, fixed rates offer stability, while variable rates allow flexibility during rate drops.

A common misconception is that minimum repayments suffice. In reality, paying even a small extra amount monthly can significantly reduce your loan term. For example, adding $100 monthly to a $400,000 loan at 5% interest could save over $30,000 in interest and cut years off repayment.

Loan-to-Value Ratio (LVR) is another critical factor. Borrowers with an LVR below 80% often avoid costly lenders mortgage insurance (LMI), saving thousands upfront. Additionally, a lower LVR can unlock better interest rates, reducing long-term costs.

Finally, offset accounts and redraw facilities are underutilized tools. An offset account reduces interest by linking savings to your loan, while redraw facilities allow access to extra repayments if needed. These features provide flexibility and financial control.

By mastering these basics, you can transform your mortgage from a burden into a strategic financial tool, setting the stage for long-term savings and stability.

Image source: eliteagent.com

Types of Home Loans Available in Australia

When choosing a home loan, variable-rate loans dominate, offering flexibility as rates fluctuate. For example, borrowers benefit during rate cuts but face risks if rates rise unexpectedly.

Fixed-rate loans, on the other hand, provide stability, locking in repayments for a set period. This is ideal for budgeting but limits flexibility if rates drop. A split loan combines both, balancing predictability and adaptability.

For those with irregular income, interest-only loans can reduce initial repayments, though they risk higher long-term costs. Investors often use these to maximize cash flow, but owner-occupiers should tread carefully.

Emerging options like green home loans incentivize eco-friendly upgrades with lower rates and rebates. For instance, installing solar panels could qualify you for discounted rates, saving on both energy and interest costs.

Understanding these loan types and aligning them with your financial goals ensures smarter borrowing decisions, whether you’re a first-time buyer or seasoned investor.

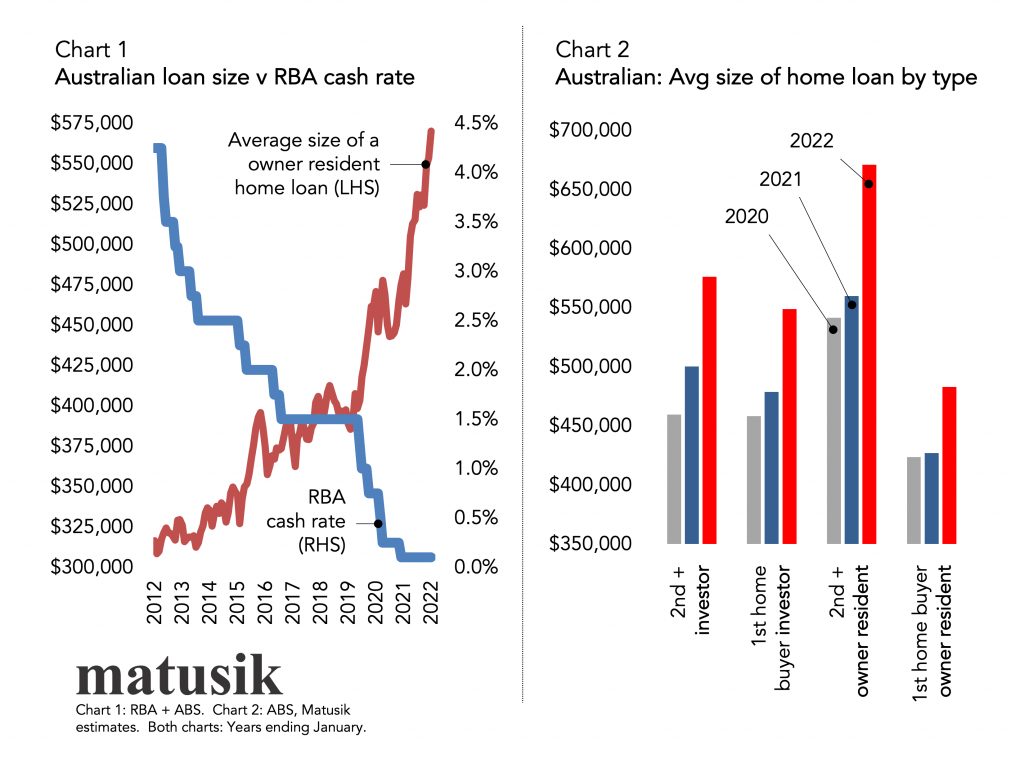

How Interest Rates Affect Your Mortgage

Rate fluctuations impact more than repayments—they shape borrowing power. A 1% rate rise can reduce loan eligibility by up to 10%, limiting property options and affordability.

To counteract, rate-lock features secure current rates during application processing, shielding borrowers from sudden hikes. This is especially useful in volatile markets.

Additionally, compound interest effects magnify over time. For instance, a $500,000 loan at 5% versus 6% over 25 years could cost $90,000 more in interest.

Lesser-known strategies like laddering fixed-rate terms—splitting loans into staggered fixed periods—balance stability and flexibility, mitigating risks of rate spikes.

By proactively managing rate impacts, borrowers can safeguard financial stability and optimize long-term savings.

Common Fees and Charges to Watch Out For

Break fees on fixed-rate loans can be exorbitant, especially if rates drop significantly. For example, switching early could cost thousands, eroding potential refinancing savings.

Discharge fees, often overlooked, apply when closing a loan. While typically small, they can add up if refinancing frequently.

Lesser-known valuation fees may vary by lender, impacting upfront costs. Comparing these across providers ensures better financial planning.

To minimize costs, negotiate fee waivers or explore loans with no ongoing charges. This approach maximizes savings and reduces hidden expenses over time.

Essential Mortgage Hacks to Save Money

Leverage offset accounts to reduce interest costs. For instance, a $50,000 balance in an offset against a $500,000 loan at 5% saves $2,500 annually—like earning tax-free income.

Switch to fortnightly repayments instead of monthly. This simple tweak adds an extra month’s repayment annually, cutting years off your loan term and saving thousands in interest.

Explore split loans to balance stability and flexibility. Fixing part of your loan shields against rate hikes, while a variable portion allows extra repayments without penalties.

Avoid Lenders Mortgage Insurance (LMI) by keeping your Loan-to-Value Ratio (LVR) below 80%. For example, a $600,000 loan with 90% LVR could incur $15,000 in LMI—avoidable with a larger deposit.

Finally, refinance strategically. Case studies show borrowers saving $8,000+ annually by switching to lower-rate loans. Regular reviews ensure your mortgage aligns with market trends and personal goals.

Image source: themortgagereports.com

Making Extra Repayments to Cut Down Interest

Small, consistent extra repayments can dramatically reduce loan costs. For example, adding $100 monthly to a $400,000 loan at 5% could save $34,000+ in interest and cut 3+ years off the term.

The amortisation effect explains this: early repayments target the principal, reducing the base for future interest calculations. This snowball effect amplifies savings over time, especially in the loan’s early years.

Timing matters. Prioritise extra payments during the initial loan phase when interest forms a larger portion of repayments. Later contributions, while still helpful, yield diminishing returns.

Lump sums from bonuses or tax refunds can supercharge this strategy. For instance, a $10,000 one-off payment on the same loan could save $20,000+ in interest over its life.

Before acting, check for early repayment penalties in your loan terms. Some fixed-rate loans impose hefty fees, potentially offsetting savings. Always consult your lender or financial advisor for tailored advice.

By combining regular extra payments with strategic lump sums, borrowers can achieve financial freedom faster while saving tens of thousands in interest.

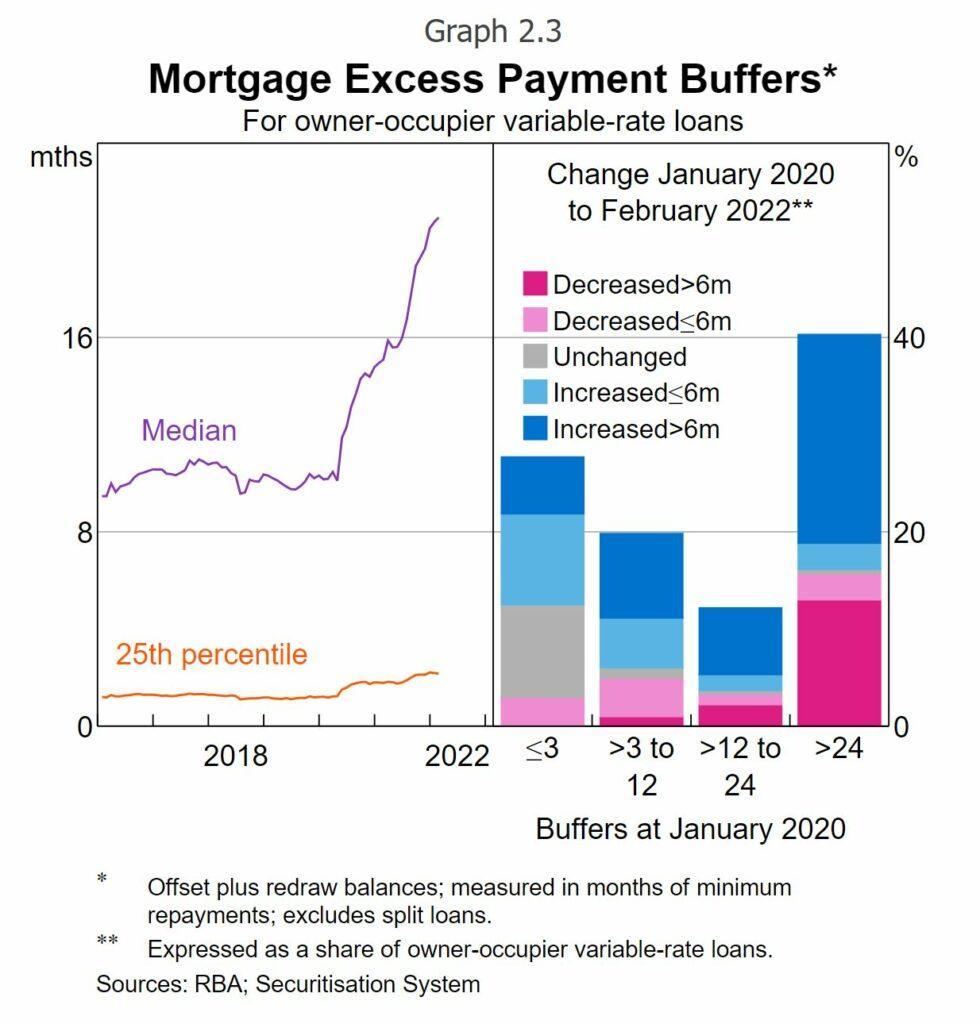

Utilising Offset Accounts Effectively

Maximise offset benefits by syncing deposits with income cycles. For example, directing salaries into the account immediately reduces daily interest calculations, compounding savings over time.

Strategic fund allocation is key. Keep emergency savings in the offset instead of a standard account. This ensures liquidity while reducing mortgage interest, effectively earning a higher “return” than most savings accounts.

Combine with budgeting tools. Apps that track spending and automate transfers can help maintain a high offset balance. This approach ensures consistent savings without manual effort.

Challenge the myth that offsets are always better. If your offset balance consistently exceeds your loan, consider alternative investments for higher returns, as offsets provide diminishing benefits beyond loan parity.

By integrating disciplined financial habits and leveraging technology, borrowers can unlock the full potential of offset accounts, accelerating mortgage repayment and achieving financial goals faster.

Refinancing: When and How to Do It Right

Refinance strategically by timing market dips. For instance, locking in lower rates during economic slowdowns can save thousands, especially when paired with rate-lock features to avoid fluctuations.

Evaluate total costs. Beyond interest rates, factor in discharge fees, valuation costs, and break fees. Use calculators to ensure savings outweigh refinancing expenses over the loan term.

Leverage equity growth. Rising property values can unlock equity for renovations or investments. However, avoid over-leveraging, as this increases financial risk during market downturns.

Challenge the assumption that refinancing always saves money. Frequent refinancing can harm credit scores, reducing future borrowing power. Balance short-term gains with long-term financial health.

By aligning refinancing decisions with market trends and personal goals, borrowers can optimise savings while maintaining financial flexibility.

Negotiating a Better Deal with Your Lender

Highlight competitor rates during negotiations. Lenders often match or beat offers to retain customers, especially when armed with evidence of better deals from non-bank lenders.

Strengthen your position. A strong credit score and consistent repayment history increase leverage. Request fee waivers or reduced rates, citing loyalty and financial reliability.

Timing matters. Approach lenders at the end of the financial year when they’re keen to meet targets. This can lead to more favorable terms or incentives.

Challenge the belief that loyalty guarantees better deals. Regularly reassess your loan to ensure it remains competitive, as lenders prioritize new customers over existing ones.

By proactively negotiating and leveraging market insights, borrowers can secure significant savings while maintaining control over their financial future.

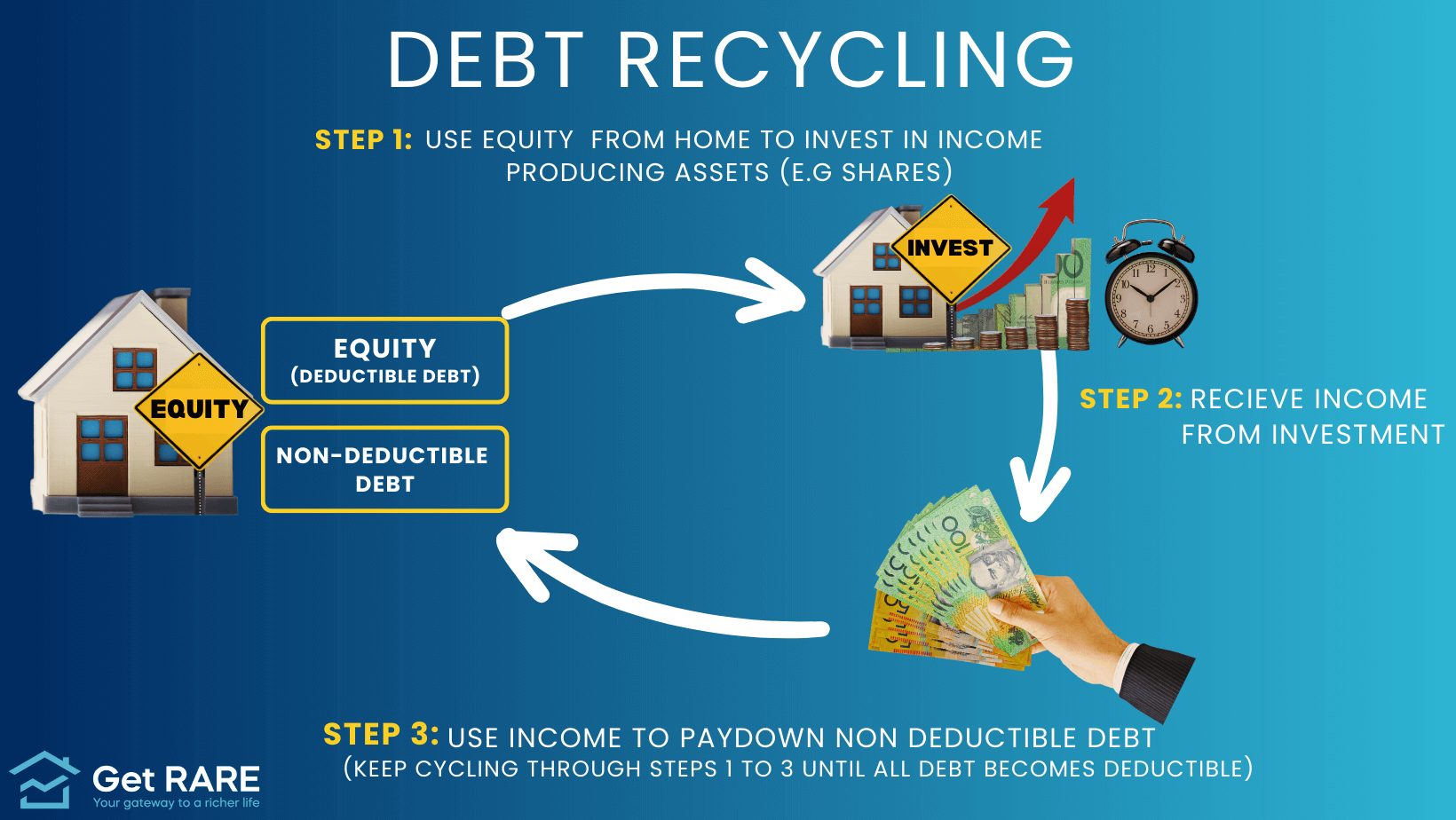

Advanced Strategies for Mortgage Reduction

Maximize savings by combining debt recycling with offset accounts. For instance, redirecting surplus funds into investments can generate returns while reducing mortgage interest, creating a compounding financial advantage.

Case in point: A Melbourne investor used debt recycling to pay off $50,000 faster while building a $20,000 investment portfolio. This dual approach accelerates wealth creation and debt reduction.

Challenge the misconception that extra repayments alone suffice. Instead, integrate smart financial tools like redraw facilities to maintain liquidity while reducing interest costs.

By blending innovative strategies with disciplined financial planning, borrowers can achieve faster mortgage reduction without sacrificing long-term financial growth.

Image source: getrare.com.au

Debt Recycling for Wealth Creation

Leverage home equity to invest in income-producing assets like shares or property. This transforms non-deductible mortgage debt into tax-deductible investment debt, amplifying returns while reducing taxable income.

Example: A Sydney homeowner with $200,000 equity borrowed $100,000 to invest in shares. Dividends and tax savings reduced their mortgage by $15,000 in three years, while growing a $120,000 portfolio.

Key Insight: Align investments with long-term goals and risk tolerance. Diversify to mitigate market volatility, and reinvest returns to accelerate both wealth creation and mortgage reduction.

Pro Tip: Consult financial advisors to tailor strategies, ensuring compliance with tax laws and optimizing outcomes.

Splitting Your Loan: Fixed vs Variable Rates

Optimize flexibility by allocating fixed rates for stability and variable rates for potential savings. This approach balances predictable repayments with opportunities to benefit from market rate drops.

Example: A Brisbane borrower split their $500,000 loan—60% fixed, 40% variable. Fixed repayments ensured budgeting stability, while variable savings reduced interest by $8,000 over three years.

Key Insight: Regularly review the split ratio to adapt to economic shifts. Use variable portions for extra repayments or offset accounts to maximize interest savings.

Pro Tip: Monitor Reserve Bank trends and consult experts to refine your split strategy, ensuring it aligns with evolving financial goals.

Image source: churchillmortgage.com

Leveraging Government Grants and Incentives

Maximize savings by combining First Home Owner Grants (FHOGs) with stamp duty concessions. These reduce upfront costs, enabling faster equity growth and lower long-term interest payments.

Example: A Melbourne buyer accessed a $10,000 FHOG and $15,000 stamp duty concession, reducing their initial loan by $25,000, saving $7,500 in interest over five years.

Key Insight: Eligibility criteria vary by state—research thoroughly to avoid missing opportunities. Pair grants with low-deposit loans to overcome entry barriers.

Pro Tip: Use savings from grants to fund offset accounts or extra repayments, compounding financial benefits over time.

Using Redraw Facilities Wisely

Strategically time redraws for investment opportunities or emergency needs to avoid unnecessary withdrawals. This preserves interest savings while maintaining financial flexibility.

Example: A Sydney homeowner redrew $20,000 for renovations, increasing property value by $50,000, while minimizing interest impact.

Key Insight: Avoid frequent redraws to maintain tax-deductibility on investment loans. Consult financial advisors to align redraws with long-term goals.

Pro Tip: Use redraws for high-return purposes, not daily expenses, ensuring your mortgage remains a wealth-building tool.

Avoiding Common Mortgage Pitfalls

Overlooking hidden fees like break costs can erode refinancing benefits. For instance, a Brisbane borrower faced $5,000 in penalties, negating savings from a lower rate.

Key Insight: Always calculate total costs, not just interest rates. Misjudging affordability risks default; aim for a buffer fund covering six months’ repayments.

Pro Tip: Regularly review loan terms with a broker to adapt to market changes and avoid costly surprises.

Image source: mortgagechoice.com.au

Identifying and Avoiding Hidden Costs

Break fees on fixed loans can surprise borrowers. For example, a Melbourne homeowner paid $8,000 to exit early, erasing refinancing benefits.

Actionable Tip: Request a fee breakdown upfront. Hidden charges like valuation fees or discharge costs often lurk in fine print. Use online calculators to estimate total expenses.

Unexpected Insight: Some lenders waive fees for loyal customers—leverage this during negotiations. Always compare all-inclusive costs, not just interest rates, to avoid financial traps.

Understanding Loan Terms and Conditions

Key Insight: Complex formulas in contracts often obscure true costs. For instance, compounding interest calculations can inflate repayments unexpectedly.

Actionable Tip: Consult a financial advisor to decode terms. Ensure clarity on rate-lock clauses, repayment flexibility, and penalty structures to avoid costly surprises.

Pro Tip: Use loan comparison tools to identify transparent lenders. Prioritize agreements with clear, concise terms to safeguard financial decisions.

The Risks of Interest-Only Loans

Key Insight: Negative equity risk intensifies during market downturns. For example, a $750,000 loan on a $700,000 property creates financial strain, limiting refinancing or selling options.

Actionable Tip: Regularly monitor property valuations and maintain a buffer fund. Diversify investments to mitigate risks tied to property market fluctuations.

Preventing Overcapitalisation on Your Property

Key Insight: Overcapitalisation often stems from renovations exceeding local market value. For instance, adding luxury features in mid-tier suburbs rarely recoups costs during resale.

Actionable Tip: Conduct comparative market analysis before upgrades. Focus on value-adding renovations like kitchens or bathrooms, ensuring alignment with neighborhood standards to maximize return on investment.

Emerging Trends in the Australian Mortgage Market

Key Insight: Digital lenders are reshaping the market with AI-driven approvals, offering faster processing and personalized rates. For example, fintech platforms now approve loans in under 24 hours.

Actionable Tip: Explore non-traditional lenders for competitive rates, but assess long-term costs carefully. Balancing speed with transparency ensures smarter borrowing decisions.

Image source: savvy.com.au

Impact of Digital Lending Platforms

Key Insight: Digital platforms leverage machine learning to assess creditworthiness, reducing bias and approval times. For instance, borrowers with unconventional incomes now access loans previously denied by traditional banks.

Actionable Tip: Use platforms offering real-time credit insights to refine borrowing strategies. Prioritize lenders with transparent algorithms to ensure fair assessments and avoid hidden costs.

Eco-Friendly Mortgages and Sustainability Incentives

Key Insight: Green mortgages reward energy-efficient upgrades with lower rates and rebates. For example, installing solar panels can reduce utility costs while increasing property value by up to 10%.

Actionable Tip: Combine government grants with lender incentives to offset upfront costs. Prioritize upgrades like insulation or solar systems that deliver both environmental and financial returns over time.

The Role of Open Banking in Mortgage Management

Key Insight: Open banking enables real-time financial data sharing, improving loan approvals. For instance, automated income verification reduces processing times by 30%, enhancing borrower experience and lender efficiency.

Actionable Tip: Leverage open banking tools to compare tailored mortgage options instantly. Focus on platforms offering secure APIs to ensure data privacy while optimizing loan terms and conditions.

Real-Life Case Studies

Case Study 1: A Sydney couple refinanced their mortgage during a market dip, reducing their interest rate by 1.2%. This saved them $15,000 over five years, enabling faster debt reduction.

Case Study 2: A Brisbane homeowner used an offset account to park savings, cutting annual interest by $3,000. This strategy also provided liquidity for unexpected expenses without disrupting repayments.

Key Insight: Combining timely refinancing with tools like offset accounts can yield significant savings. Expert advice ensures strategies align with individual financial goals, maximizing both short-term and long-term benefits.

Image source: money.com.au

How One Family Paid Off Their Mortgage in 10 Years

By adopting fortnightly repayments, a Melbourne family effectively made an extra monthly payment each year. Coupled with consistent lump-sum contributions from tax refunds, they slashed interest costs by $80,000.

Key Takeaway: Aligning repayment schedules with income cycles and reinvesting windfalls accelerates debt reduction. This approach, often overlooked, transforms small financial habits into substantial long-term savings.

Strategies Used by Successful Property Investors

Successful investors leverage debt recycling to convert non-deductible debt into tax-deductible investment loans. By reinvesting rental income into offset accounts, they enhance cash flow while reducing interest liabilities.

Key Takeaway: Combining debt recycling with disciplined reinvestment creates a sustainable framework for wealth growth, challenging the misconception that property investment solely relies on capital gains.

FAQ

What are the most effective mortgage hacks to save money on home loans in Australia?

The most effective mortgage hacks include:

- Using offset accounts: Aligning income deposits to reduce interest on the principal.

- Fortnightly repayments: Making an extra payment annually to cut loan terms.

- Strategic refinancing: Securing lower rates while maintaining previous repayment levels.

- Making lump-sum contributions: Utilizing bonuses or tax refunds to reduce the principal.

- Negotiating with lenders: Requesting fee waivers or better rates to minimize costs.

How can offset accounts be utilized to reduce mortgage interest payments?

Offset accounts reduce mortgage interest payments by:

- Depositing income directly: Minimizing the loan balance on which interest is calculated.

- Maintaining high balances: Keeping savings and surplus funds in the account to maximize interest savings.

- Utilizing windfalls: Depositing bonuses or unexpected funds to lower the principal effectively.

- Automating contributions: Ensuring consistent deposits to build a substantial offset balance over time.

- Avoiding unnecessary withdrawals: Preserving the account balance to sustain long-term interest reductions.

What strategies can homeowners use to pay off their mortgage faster?

Homeowners can pay off their mortgage faster by:

- Increasing repayment frequency: Switching to fortnightly payments to make an extra annual repayment.

- Making additional repayments: Allocating surplus funds or windfalls directly to the principal.

- Refinancing to lower rates: Maintaining higher repayment amounts despite reduced interest costs.

- Utilizing lump-sum contributions: Applying bonuses, tax refunds, or savings to reduce the loan balance.

- Adopting a disciplined budget: Redirecting discretionary spending towards mortgage repayments.

Are there specific refinancing tips that can help save thousands on a home loan?

Specific refinancing tips include:

- Comparing lenders: Researching multiple lenders to find the most competitive rates and terms.

- Timing the refinance: Refinancing during low-interest rate periods to maximize savings.

- Negotiating with your current lender: Requesting better rates or fee waivers before switching.

- Calculating total costs: Factoring in discharge, valuation, and setup fees to ensure net savings.

- Maintaining a strong credit score: Improving approval chances and accessing better refinancing deals.

How do government grants and incentives contribute to mortgage savings?

Government grants and incentives contribute to mortgage savings by:

- Reducing upfront costs: Programs like the First Home Owner Grant (FHOG) lower initial expenses for eligible buyers.

- Providing tax benefits: Schemes such as the First Home Super Saver (FHSS) offer concessional tax treatment for savings used towards a home purchase.

- Supporting energy-efficient upgrades: Incentives like the Solar Homes Program subsidize eco-friendly improvements, reducing long-term utility costs.

- Offering stamp duty concessions: Certain state-based initiatives reduce or waive stamp duty for first-time buyers.

- Facilitating shared equity schemes: These programs lower borrowing requirements by sharing property ownership with government entities.

Conclusion

Saving thousands on your Aussie home loan isn’t just about cutting costs—it’s about smart financial engineering. Think of your mortgage as a marathon, not a sprint. By leveraging tools like offset accounts, refinancing strategically, and tapping into government grants, you can shave years off your loan and keep more money in your pocket.

For instance, a Sydney couple refinanced during a market dip, locking in a lower rate and saving $15,000 over five years. Similarly, a Melbourne family used fortnightly payments and lump-sum contributions to pay off their mortgage a decade early, saving $80,000 in interest. These examples highlight how small, consistent actions can lead to massive financial wins.

A common misconception is that refinancing is always expensive. However, with proper timing and negotiation, the benefits often outweigh the costs. Expert advice also reveals that maintaining a high offset balance can outperform many investment returns, especially in volatile markets.

Think of your mortgage as a seesaw—every dollar you save on interest tips the balance in your favor. By combining these hacks with discipline and regular reviews, you’re not just saving money; you’re building a future of financial freedom.

Image source: matusik.com.au

Key Takeaways for Mortgage Savings

One powerful yet underutilized strategy is timing your refinancing during interest rate troughs. For example, a Brisbane homeowner refinanced when rates dropped by 0.5%, saving $12,000 over three years. This approach works because even small rate reductions compound significantly over time, especially on large loan balances.

Another overlooked factor is the psychological impact of structured repayments. Switching to fortnightly payments not only reduces interest but also creates a disciplined financial rhythm, helping borrowers stay ahead of their repayment schedule.

Additionally, integrating offset accounts with automated savings can amplify results. By consistently depositing surplus income, borrowers effectively reduce their loan principal daily, minimizing interest costs without altering their lifestyle.

These strategies challenge the myth that mortgage savings require drastic sacrifices. Instead, they highlight how leveraging timing, behavior, and financial tools can transform your mortgage into a manageable, even advantageous, financial asset.

Next Steps to Implement Your Mortgage Hacks

Start by conducting a comprehensive loan review with a trusted mortgage broker. This ensures your loan structure aligns with your financial goals and leverages the latest market opportunities.

Next, automate offset account contributions by syncing deposits with your income cycle. This simple step maximizes interest savings without requiring constant manual effort.

Finally, schedule biannual financial check-ins to reassess your mortgage strategy. Economic conditions shift, and staying proactive ensures you capitalize on new savings opportunities while avoiding costly oversights.

Looking Towards Future Financial Freedom

Focus on debt recycling to convert non-deductible mortgage debt into tax-deductible investment debt. This strategy builds wealth while reducing liabilities, offering a dual benefit for long-term financial growth.