Millionaire Investors Are Targeting These Australian Suburbs – Should You?

In 2024, a quiet shift began reshaping the Australian property market. Millionaire investors, long associated with blue-chip suburbs in Sydney and Melbourne, started redirecting their attention to unexpected corners of the country. Suburbs like Rutherford in New South Wales and Fraser Rise in Victoria—once overlooked for their distance from city centers—emerged as prime targets. The appeal? Affordable entry points paired with strong capital growth potential and rental yields that outpaced traditional hotspots.

This trend is not confined to regional areas. On the fringes of Brisbane and Melbourne, suburbs with improved transport links and planned infrastructure projects are drawing significant interest. According to CoreLogic, investor loans in Queensland surged by 23% in September 2024, reflecting a broader pivot toward affordability and long-term growth.

For everyday investors, the question looms: should they follow the lead of these high-net-worth individuals, or does this strategy carry risks that outweigh its promise?

Current Trends in Australian Real Estate

A notable trend reshaping the Australian property market is the strategic focus on suburbs benefiting from infrastructure-led growth. Areas like Logan in Queensland and Tarneit in Victoria are prime examples, where planned transport upgrades and urban development projects are driving investor interest. These suburbs, often overlooked in the past, now offer a compelling mix of affordability and long-term growth potential.

The success of this approach lies in its alignment with macroeconomic factors. Improved connectivity reduces commuting times, enhancing the appeal for renters and owner-occupiers alike. For instance, the extension of rail networks in Brisbane’s outer suburbs has directly correlated with a 15% increase in property values over the past two years, as reported by CoreLogic.

However, this strategy is not without risks. Over-reliance on projected infrastructure can lead to overcapitalization if projects are delayed or canceled. Investors must conduct thorough due diligence, analyzing council plans and state budgets to validate growth assumptions.

Looking ahead, the interplay between infrastructure investment and housing demand will likely intensify. Investors who integrate data-driven forecasting into their strategies—leveraging tools like heat maps of planned developments—can position themselves to capitalize on emerging opportunities while mitigating risks.

The Rise of Regional Investment Hotspots

Regional investment hotspots are gaining traction as investors recognize the untapped potential of areas driven by population growth and economic diversification. Locations such as Gosford in New South Wales and Rockhampton in Queensland exemplify this trend, where demographic shifts and local industry expansion are creating robust property markets. These regions offer a unique combination of affordability and strong rental yields, making them attractive alternatives to capital cities.

One critical driver is the rise of remote work, which has decoupled employment from urban centers. This shift has allowed professionals to prioritize lifestyle and affordability, fueling demand in regional areas. For instance, Ballarat and Geelong in Victoria have seen significant housing investments to accommodate growing populations, supported by improved transport links to Melbourne.

A lesser-known factor influencing these markets is the role of educational institutions. Towns like Armidale, home to the University of New England, benefit from a steady influx of students and staff, bolstering rental demand and economic activity.

Investors should adopt a data-driven approach, analyzing metrics such as population growth rates, infrastructure plans, and local economic indicators. By identifying regions with sustainable growth drivers, they can mitigate risks and capitalize on the evolving dynamics of Australia’s property market.

Understanding Millionaire Investors’ Preferences

Millionaire investors are increasingly drawn to suburbs that combine affordability with high growth potential, diverging from traditional blue-chip areas. This shift is exemplified by suburbs like Rutherford in New South Wales and Fraser Rise in Victoria, where entry prices remain accessible, yet rental yields and capital growth outperform established markets. CoreLogic data highlights that investor loans in Queensland surged by 23% in September 2024, underscoring this pivot toward emerging locations.

A key factor driving these preferences is the strategic focus on infrastructure-led growth. For instance, Logan in Queensland has seen heightened interest due to planned transport upgrades, which enhance connectivity and attract renters. Similarly, Tarneit in Victoria benefits from urban development projects that promise long-term value appreciation.

Contrary to the perception that millionaire investors prioritize luxury, their decisions are increasingly data-driven. Heat maps of planned developments and population growth forecasts are now integral tools. This approach challenges the misconception that wealth equates to risk aversion; instead, these investors actively seek undervalued opportunities.

By targeting areas with sustainable growth drivers, millionaire investors not only maximize returns but also reshape market dynamics, intensifying competition for everyday buyers. This trend underscores the importance of aligning investment strategies with evolving market realities.

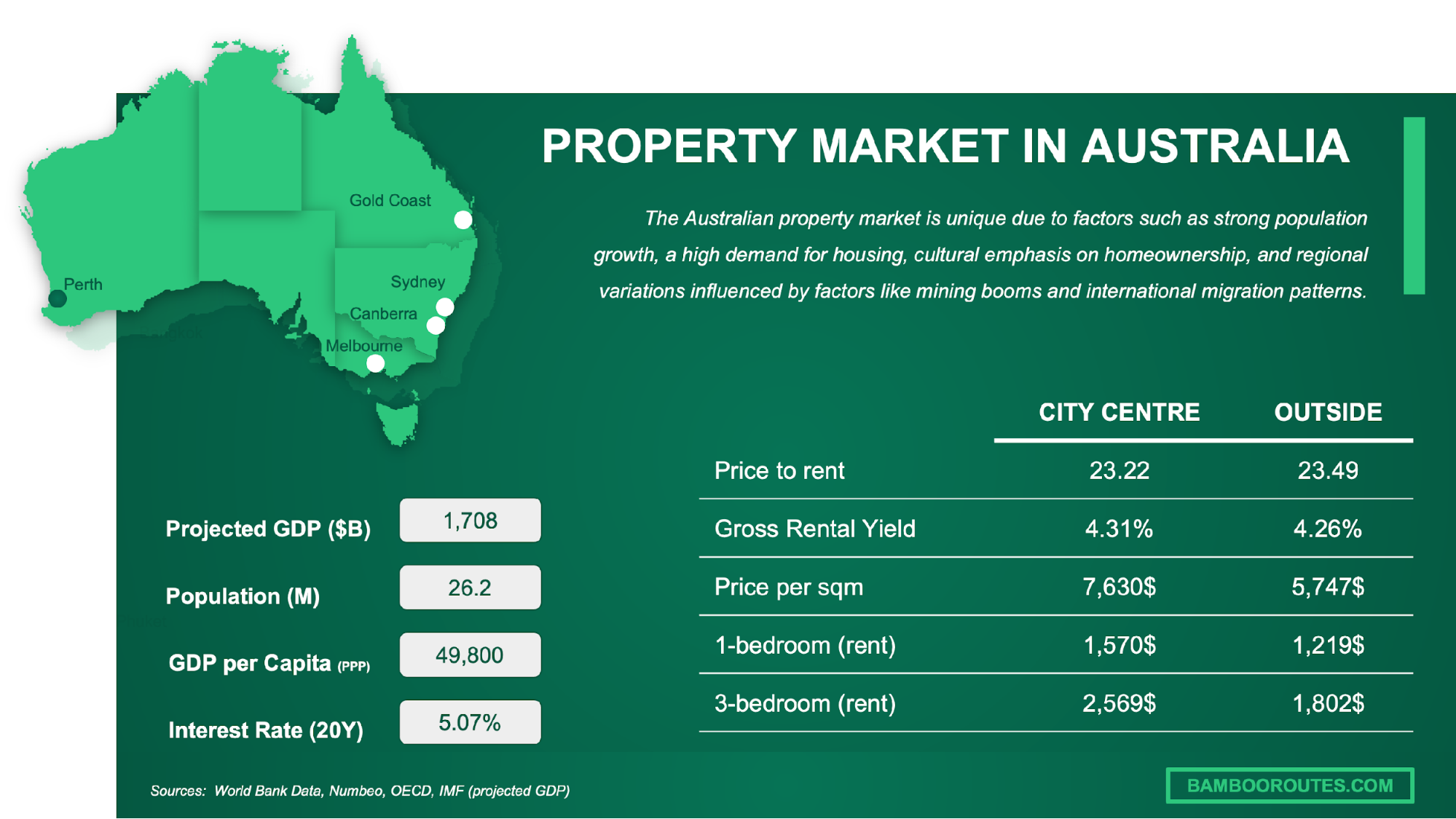

Image source: bambooroutes.com

Factors Influencing Suburb Selection

One critical yet underexplored factor influencing suburb selection is the ripple effect, where price growth in high-demand suburbs spills over into neighboring areas. This phenomenon is particularly evident in Melbourne, where suburbs like Sunshine West and Reservoir have gained traction as more affordable alternatives to their pricier counterparts. Investors leveraging this effect can capitalize on future growth before these areas reach their peak.

Another decisive factor is employment hubs. Proximity to thriving job markets significantly impacts rental demand and property values. For instance, suburbs near Brisbane’s emerging technology precincts have seen a surge in interest, driven by an influx of professionals seeking shorter commutes and lifestyle amenities. This aligns with data from CoreLogic, which shows a direct correlation between employment growth and property value appreciation.

Additionally, gentrification dynamics play a pivotal role. Suburbs undergoing revitalization, such as Dandenong in Victoria, attract working professionals and young families, creating a cycle of increased demand and rising property values. Investors who identify early signs of gentrification—like new cafes, art spaces, or boutique stores—can position themselves for substantial returns.

By integrating these nuanced factors into their strategies, investors can move beyond conventional metrics like median prices and rental yields, adopting a forward-looking approach that anticipates long-term market shifts and maximizes opportunities.

Characteristics of High-Potential Suburbs

A defining characteristic of high-potential suburbs is their alignment with multi-industry economic resilience. Unlike areas reliant on a single economic driver, suburbs with diverse employment opportunities—spanning sectors like healthcare, education, and technology—demonstrate greater stability and growth potential. For example, Geelong in Victoria has successfully transitioned from a manufacturing hub to a center for healthcare and education, attracting both investors and residents seeking long-term security.

Another critical yet often overlooked factor is demographic adaptability. Suburbs that cater to a wide range of demographics, such as young professionals, families, and retirees, tend to experience sustained demand. This adaptability is evident in suburbs like Ballarat, where a mix of affordable housing, lifestyle amenities, and proximity to Melbourne supports diverse population growth.

Additionally, infrastructure readiness plays a pivotal role. Suburbs with planned but not yet saturated infrastructure projects—such as new transport links or schools—offer a unique window of opportunity. For instance, the ongoing rail extension in Brisbane’s outer suburbs has already spurred a 15% increase in property values, as reported by CoreLogic, while leaving room for further appreciation.

Investors should adopt a layered analysis framework, combining economic diversity, demographic trends, and infrastructure timelines to identify suburbs with untapped potential. This approach not only mitigates risks but also positions investors to capitalize on emerging market dynamics.

Comparing Regional and Capital City Investments

The decision between regional and capital city investments hinges on balancing affordability, growth potential, and stability. Regional markets, such as Ballarat in Victoria or Rockhampton in Queensland, offer lower entry costs and higher rental yields, making them attractive to investors seeking immediate cash flow. For instance, the rise of remote work has driven a 12% increase in property demand in regional areas over the past year, according to CoreLogic.

In contrast, capital cities like Sydney and Melbourne provide long-term capital growth underpinned by robust infrastructure and diverse job markets. However, high entry prices—often exceeding $1 million for median properties—can deter smaller investors. Zaki Ameer, founder of DDP Property, notes that “capital cities offer stability but require significant upfront investment, which may limit accessibility.”

A common misconception is that regional markets lack resilience. Yet, regions with diversified economies, such as Geelong, have demonstrated growth comparable to urban centers. Investors should adopt a dual-market strategy, leveraging regional affordability while maintaining exposure to capital city stability, ensuring a balanced portfolio that adapts to evolving market dynamics.

Image source: linkedin.com

Advantages of Investing in Regional Areas

One of the most compelling advantages of regional investments lies in their affordability-driven diversification potential. With entry prices significantly lower than in capital cities, investors can acquire multiple properties across different regions, spreading risk while maximizing rental income. For instance, in 2024, the median house price in Ballarat was approximately $550,000—less than half of Sydney’s median—allowing investors to build a portfolio with the same capital required for a single property in a metropolitan area.

Regional areas also benefit from localized economic catalysts. Towns like Rockhampton in Queensland are experiencing growth due to infrastructure projects such as the $1 billion Ring Road development, which enhances connectivity and stimulates local industries. These projects not only attract new residents but also create sustained demand for rental properties, driving higher yields.

A lesser-known factor is the lifestyle migration effect. The rise of remote work has enabled professionals to prioritize quality of life, fueling demand in regions offering natural beauty and community-focused living. This trend has narrowed the price gap between regional and urban markets, with some areas seeing annual growth rates exceeding 10%.

Investors should leverage data-driven tools to identify regions with sustainable growth drivers, ensuring their strategies align with evolving demographic and economic trends.

Opportunities in Capital Cities

A critical yet underutilized opportunity in capital cities lies in urban renewal projects. These initiatives transform underperforming or neglected areas into vibrant, high-demand neighborhoods, offering investors a chance to capitalize on early-stage growth. For example, Sydney’s Green Square redevelopment has turned an industrial zone into a thriving residential and commercial hub, with property values increasing by over 20% since 2020, according to CoreLogic.

Another promising avenue is micro-market targeting. Within capital cities, not all suburbs perform equally. Investors leveraging granular data—such as demographic shifts, employment trends, and infrastructure upgrades—can identify pockets of high growth potential. Suburbs like Kingsford in Sydney and Reservoir in Melbourne exemplify this, where proximity to universities and transport hubs has driven consistent demand from students and professionals.

A lesser-known factor influencing capital city opportunities is the impact of international migration. Cities like Melbourne and Brisbane, which attract a significant share of skilled migrants, benefit from sustained housing demand. This demographic influx supports both rental yields and long-term capital growth, creating a stable investment environment.

To maximize returns, investors should adopt a layered analysis framework, combining urban renewal insights, micro-market data, and migration trends to identify undervalued opportunities poised for growth.

Risk Assessment and Investment Strategies

Effective risk assessment in property investment hinges on understanding both macro-level trends and micro-level variables. For instance, while infrastructure-led growth often signals opportunity, over-reliance on projected developments can lead to overcapitalization if projects are delayed or canceled. A case in point is Melbourne’s East West Link, where project cancellation left investors in limbo, underscoring the importance of diversifying risk.

A common misconception is that high rental yields equate to low risk. However, suburbs with elevated yields, such as Logan in Queensland, may also face volatility due to socio-economic factors. Investors should balance yield potential with long-term growth indicators, such as employment hubs or demographic adaptability.

Expert insights suggest adopting a data-driven approach. Tools like heat maps of planned developments or population growth forecasts can illuminate hidden opportunities. By integrating these insights into a layered strategy—spanning affordability, infrastructure readiness, and economic resilience—investors can mitigate risks while positioning for sustainable returns.

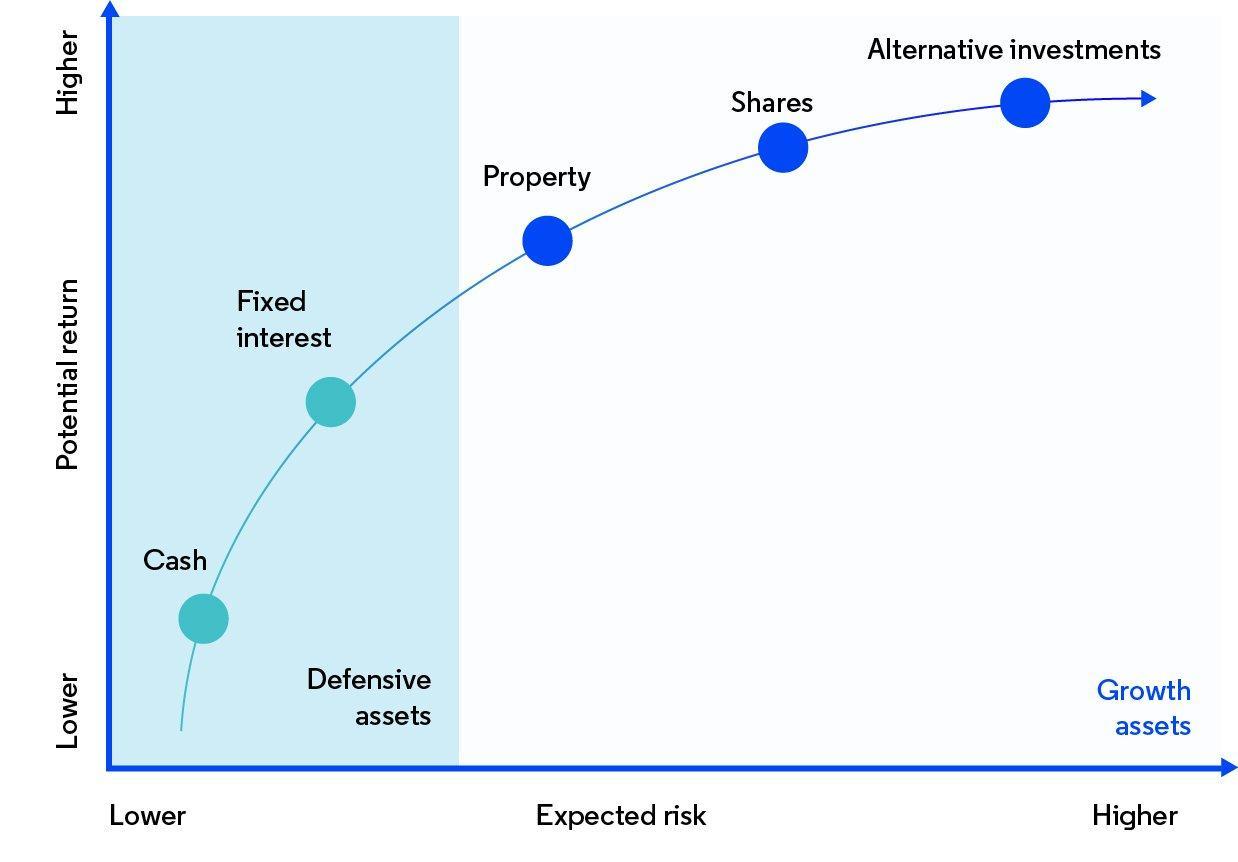

Image source: moneysmart.gov.au

Conducting Due Diligence

A critical yet often overlooked aspect of due diligence is assessing local economic resilience. Suburbs with multi-industry employment bases—such as Geelong in Victoria, which has transitioned from manufacturing to healthcare and education—demonstrate greater stability during economic downturns. Investors should analyze employment diversity metrics and cross-reference them with population growth data to identify areas with sustainable demand.

Another essential approach involves evaluating infrastructure timelines. While planned projects can boost property values, delays or cancellations pose significant risks. For example, Brisbane’s Cross River Rail project has spurred interest in surrounding suburbs, but investors must monitor state budgets and construction progress to avoid overcapitalization. Tools like Monopoly Wealth’s suburb report, which scores market potential based on infrastructure readiness, can provide actionable insights.

Additionally, natural disaster risk is a growing concern. Suburbs prone to bushfires or floods, such as parts of the Sunshine Coast, require thorough environmental assessments. Investors should consult flood maps and fire risk reports to ensure long-term viability.

By integrating these factors into a layered analysis framework—combining economic, infrastructural, and environmental data—investors can mitigate risks and align their strategies with evolving market dynamics, ensuring both resilience and profitability.

Tailoring Strategies for Different Investor Profiles

A nuanced approach to tailoring investment strategies involves aligning them with the risk tolerance and financial goals of distinct investor profiles. For instance, high-net-worth individuals often prioritize long-term capital growth and can afford to invest in emerging suburbs with delayed returns, such as Tarneit in Victoria, where infrastructure projects promise future value appreciation. These investors benefit from leveraging data-driven tools like heat maps to identify undervalued areas poised for growth.

Conversely, smaller investors with limited capital may focus on cash flow-positive properties in regional hotspots like Rockhampton, Queensland. Here, lower entry costs and higher rental yields provide immediate returns, reducing financial strain. This strategy aligns with the growing trend of affordability-driven diversification, as highlighted by CoreLogic’s 2024 data on regional market performance.

A lesser-known yet impactful factor is the role of lifestyle migration. Investors targeting professionals relocating for remote work opportunities can capitalize on suburbs offering lifestyle amenities, such as Ballarat in Victoria. This approach challenges the conventional focus on urban centers, demonstrating that demographic adaptability can drive sustained demand.

By integrating personalized frameworks—balancing affordability, growth potential, and demographic trends—investors can optimize their portfolios while adapting to evolving market dynamics.

FAQ

What factors are driving millionaire investors to target specific Australian suburbs in 2025?

Millionaire investors in 2025 are drawn to Australian suburbs due to a combination of infrastructure-led growth, affordability, and demographic adaptability. Suburbs benefiting from planned transport upgrades, such as Logan in Queensland, offer enhanced connectivity and long-term capital growth. Additionally, areas like Fraser Rise in Victoria provide affordable entry points with strong rental yields. The rise of remote work and lifestyle migration further amplifies demand in regional hotspots like Ballarat. Data-driven tools, including heat maps and population growth forecasts, enable investors to identify undervalued suburbs with sustainable growth drivers, aligning their strategies with evolving market dynamics and maximizing returns.

How do infrastructure-led growth and demographic trends influence property investment decisions?

Infrastructure-led growth enhances property investment appeal by improving connectivity and accessibility, as seen in suburbs like Tarneit in Victoria, where planned transport upgrades drive demand. These projects reduce commuting times and attract renters, boosting property values. Demographic trends, such as population growth and lifestyle migration, further shape investment decisions. For instance, regional areas like Geelong benefit from economic diversification and an influx of remote workers seeking affordability and lifestyle amenities. By analyzing infrastructure timelines and demographic adaptability, investors can identify high-growth suburbs, leveraging data-driven insights to align with market dynamics and secure sustainable returns.

What are the risks and rewards of following millionaire investors into emerging Australian suburbs?

Investing in emerging Australian suburbs offers rewards like affordability, high rental yields, and strong capital growth potential, as seen in areas like Rutherford in New South Wales. These suburbs often benefit from planned infrastructure projects and demographic shifts, creating opportunities for long-term value appreciation. However, risks include overcapitalization if infrastructure projects are delayed or canceled, as well as market volatility in less established areas. Thorough due diligence, including analyzing council plans and economic indicators, is essential. By leveraging data-driven tools and aligning with sustainable growth drivers, investors can mitigate risks while capitalizing on the evolving dynamics of these markets.

How can everyday investors identify high-potential suburbs using data-driven tools and analysis?

Everyday investors can identify high-potential suburbs by leveraging data-driven tools like heat maps, population growth forecasts, and property sales data. Platforms such as CoreLogic and Property Registry provide insights into metrics like rental yields, vacancy rates, and infrastructure readiness. Analyzing demographic trends, employment hubs, and planned developments helps pinpoint areas with sustainable growth drivers. Visiting shortlisted suburbs to assess street-level factors, such as proximity to amenities and transport links, refines the selection process. By combining quantitative analysis with qualitative insights, investors can align their strategies with market dynamics, ensuring informed decisions and maximizing returns in emerging Australian suburbs.

What role do regional hotspots and lifestyle migration play in shaping Australia’s property market trends?

Regional hotspots and lifestyle migration significantly influence Australia’s property market trends by driving demand in areas like Ballarat and Rockhampton. The rise of remote work has decoupled employment from urban centers, enabling professionals to prioritize affordability and lifestyle amenities. This shift boosts property values and rental yields in regional markets, supported by infrastructure upgrades and economic diversification. Locations with strong population growth and proximity to natural attractions, such as Geelong, exemplify this trend. By analyzing migration patterns and regional economic indicators, investors can capitalize on these evolving dynamics, aligning their strategies with the growing appeal of lifestyle-driven property markets.