From 1 to 10: How to Build a Million-Dollar Property Portfolio in Australia

Australia’s property market defies global norms: while many fear economic downturns, savvy investors see opportunity. How can you transform modest beginnings into a million-dollar portfolio amidst today’s shifting dynamics?

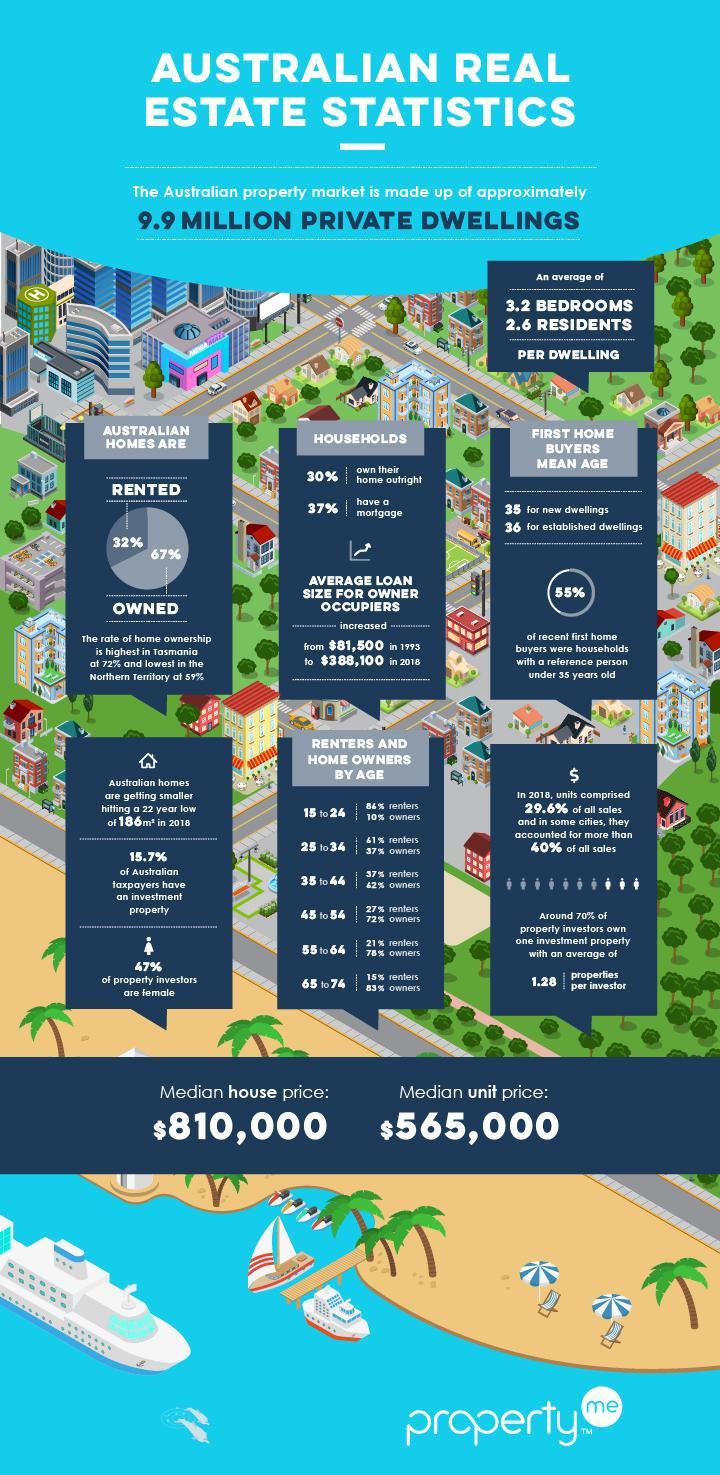

Image source: propertyme.com.au

The Journey from One Property to Ten

Scaling from one property to ten requires more than just capital—it demands a strategic mindset and a deep understanding of leveraging equity. Equity, the difference between a property’s market value and its mortgage balance, is a powerful tool for portfolio growth. By refinancing an appreciating property, investors can unlock funds to acquire additional assets without significant cash outlay.

Why does this work? Property values in high-demand areas often outpace inflation, creating opportunities for equity growth. For example, a $500,000 property appreciating at 5% annually generates $25,000 in equity each year. Leveraging this equity allows investors to fund deposits for new purchases, accelerating portfolio expansion.

However, timing and market selection are critical. Investing in areas with strong population growth, infrastructure development, and employment opportunities ensures consistent capital growth and rental demand. Tools like HtAG Analytics can help identify these high-growth regions, reducing the risk of over-leveraging.

Lesser-known factors also play a role. For instance, understanding lending policies and maintaining a strong credit profile can significantly impact borrowing capacity. Additionally, diversifying property types—such as mixing residential and commercial properties—can balance risk and improve cash flow stability.

To succeed, investors must adopt a long-term perspective. Building a ten-property portfolio isn’t about quick wins; it’s about compounding growth over time. By combining equity leverage, market research, and diversification, investors can steadily transform a single property into a robust, million-dollar portfolio.

Overview of the Australian Property Landscape

Australia’s property market thrives on regional diversity, where economic drivers vary significantly across states. For instance, Queensland’s population growth fuels demand, while Western Australia benefits from mining-driven housing needs.

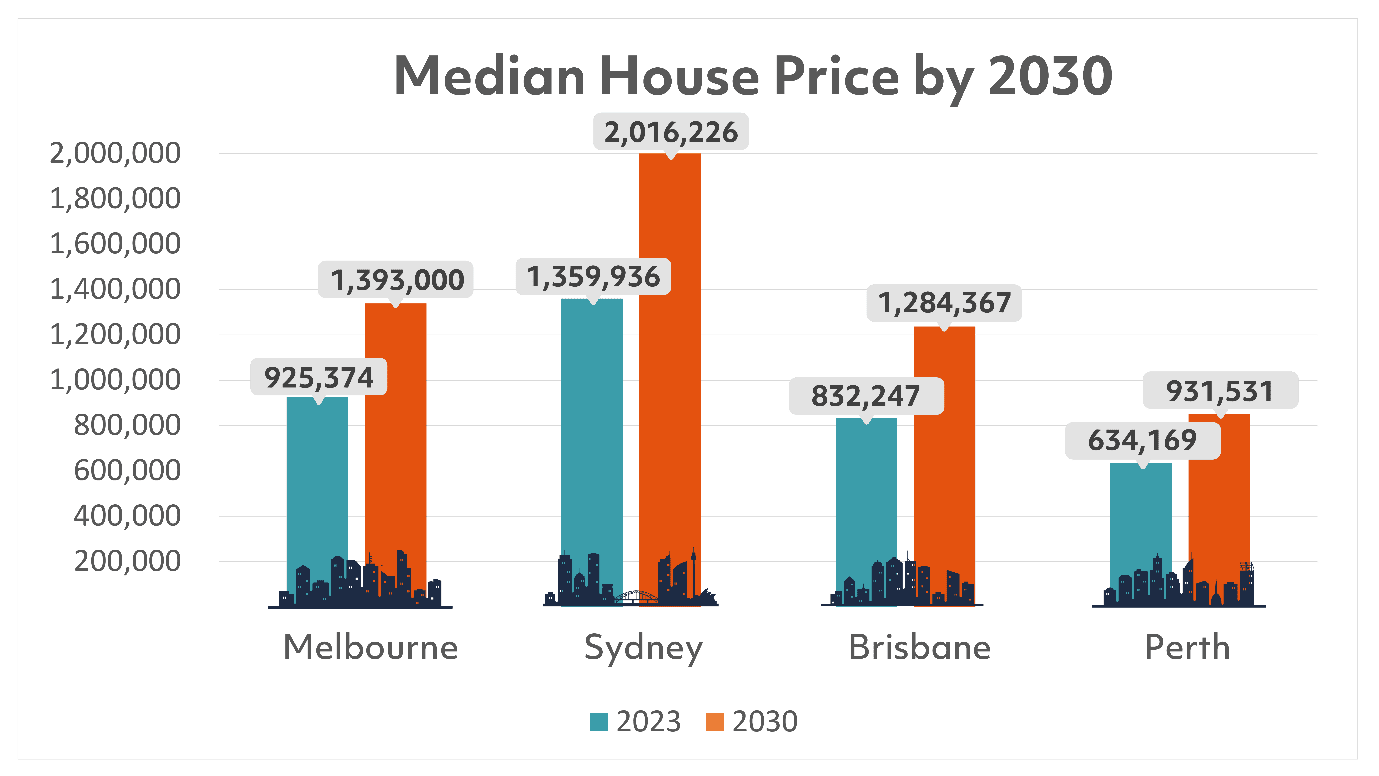

Why does this matter? Understanding these regional dynamics allows investors to align strategies with local trends. For example, targeting Brisbane’s infrastructure boom can yield higher capital growth, while Perth’s rental market offers strong yields due to limited housing supply.

Lesser-known factors like government incentives also shape outcomes. Programs such as first-home buyer grants or tax benefits for new builds can enhance affordability and attract tenants, boosting rental demand.

To navigate this landscape, investors should adopt a data-driven approach. Tools like CoreLogic’s suburb reports provide insights into price trends, vacancy rates, and demographic shifts, enabling informed decisions.

By leveraging regional strengths and staying attuned to policy changes, investors can position themselves for sustainable growth in Australia’s dynamic property market.

Understanding the Australian Property Market

Australia’s property market operates like a mosaic, with each region shaped by unique economic, demographic, and policy factors. Recognizing these nuances is critical for crafting a resilient investment strategy.

For example, Sydney and Melbourne dominate in capital growth due to international migration and job opportunities, while regional areas like Geelong or Newcastle offer affordability and rising demand from remote workers.

Misconception: Many assume high-growth cities are always the best choice. However, Perth’s rental yields outpace Sydney’s, driven by limited housing supply and mining sector stability, proving yield-focused strategies can outperform.

Expert insight: CoreLogic data reveals suburbs with infrastructure projects often experience a 10–15% price uplift within five years. Investors targeting these areas can capitalize on long-term growth.

By combining data analysis, local knowledge, and a flexible approach, investors can navigate Australia’s diverse property landscape, balancing risk and reward effectively.

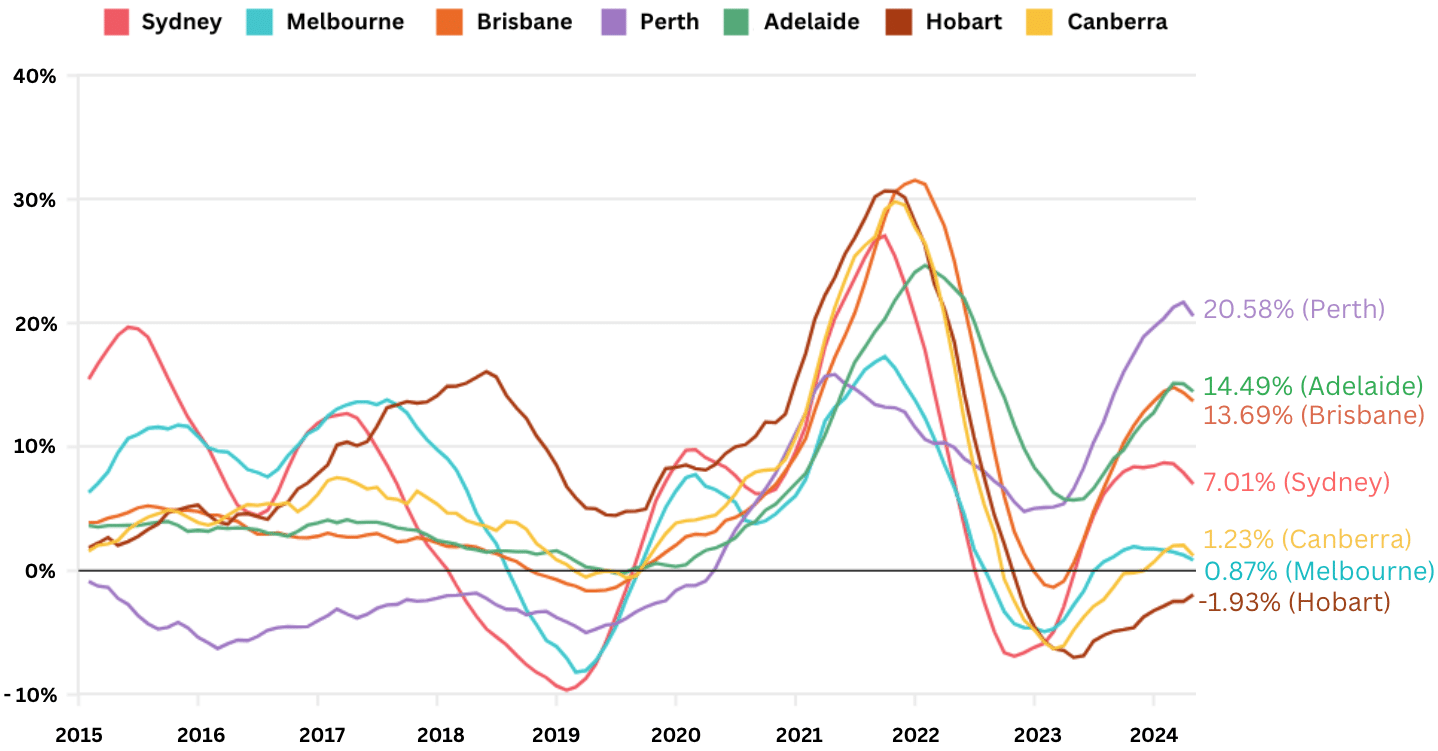

Image source: eemortgagebroker.com.au

Economic Factors Influencing Property Prices

Interest rates are a cornerstone of property pricing. When rates drop, borrowing becomes cheaper, boosting demand and driving prices up. Conversely, rising rates cool the market.

Case in point: The Reserve Bank of Australia’s rate cuts in 2020 spurred a 20% surge in property prices across major cities, as buyers capitalized on lower mortgage costs.

Lesser-known factor: Inflation indirectly impacts property prices. Moderate inflation can increase property values, but high inflation raises construction costs, slowing new developments and tightening supply.

Actionable insight: Monitor Reserve Bank policies and inflation trends. Pair this with local market data to identify areas where demand outpaces supply, ensuring strategic investments.

By understanding these dynamics, investors can anticipate market shifts and position themselves for long-term success.

Regional Variations and Trends

Infrastructure projects are game-changers for regional markets. Developments like new transport links or hospitals can boost property values by 10–20% within five years, as seen in Geelong and Newcastle.

Why it works: Improved connectivity attracts businesses and residents, increasing demand for housing. This ripple effect enhances both capital growth and rental yields.

Lesser-known factor: Regional areas with strong employment hubs, like Ballarat, outperform others. Job availability stabilizes rental demand, reducing vacancy risks.

Actionable insight: Track government infrastructure plans and employment trends. Invest early in regions with upcoming projects to maximize returns and secure long-term growth potential.

Setting Investment Goals and Strategies

Think of your portfolio as a roadmap. Clear goals act as your destination, while strategies are the routes you take to get there.

Start with SMART Goals

Set Specific, Measurable, Achievable, Relevant, and Time-bound (SMART) objectives. For instance, aim to acquire three properties generating $50,000 in passive income within five years.

Align Goals with Financial Capacity

Misjudging affordability is a common pitfall. Use tools like borrowing capacity calculators to ensure your goals align with your financial reality.

Strategy Spotlight: Equity Recycling

Leverage equity from existing properties to fund new purchases. For example, a Sydney investor used $200,000 in equity to acquire two high-yield properties in Brisbane, doubling their portfolio in three years.

Challenge Conventional Wisdom

Contrary to popular belief, high-growth areas aren’t always the best choice. Balanced strategies—combining growth and yield—often outperform single-focus approaches.

Actionable Framework

- Define your endgame: Is it capital growth, rental yield, or both?

- Research markets: Target areas with strong infrastructure and employment growth.

- Monitor progress: Regularly review your portfolio’s performance and adjust strategies.

By setting clear goals and adopting flexible strategies, you can navigate the complexities of property investment with confidence.

Image source: lizmiles.com.au

Defining Your Financial Objectives

Your financial objectives are the foundation of your strategy. Without clarity, even the best opportunities can lead to missteps.

Prioritize Cash Flow vs. Capital Growth

Decide whether your focus is immediate cash flow or long-term capital growth. For example, high-yield properties in regional areas may generate steady income, while metropolitan properties often deliver stronger appreciation.

Factor in Risk Tolerance

Assess your comfort with risk. A conservative investor might prioritize stable rental income, while a risk-tolerant one could pursue high-growth markets with potential volatility.

Leverage Tax Benefits

Understand how tax incentives, like negative gearing or depreciation schedules, can align with your goals. For instance, investors in high-depreciation properties often reduce taxable income significantly.

Actionable Framework

- Quantify your goals: Define specific income or growth targets.

- Match property types: Align property selection with your objectives.

- Review regularly: Adjust goals as market conditions and personal circumstances evolve.

By defining precise financial objectives, you create a roadmap that ensures every investment decision serves your broader vision.

Choosing the Right Investment Approach

Strategic property selection is key to portfolio success. A tailored approach ensures alignment with your financial goals and market conditions.

Focus on Market Cycles

Understanding property market cycles can maximize returns. For instance, buying during a downturn often secures properties below market value, while selling in a boom capitalizes on peak demand.

Leverage Data-Driven Insights

Utilize tools like suburb reports or growth forecasts to identify high-potential areas. For example, suburbs with planned infrastructure projects often experience significant value appreciation over time.

Diversify Property Types

Combine residential and commercial properties to balance risk and returns. Residential properties provide stable rental income, while commercial properties often yield higher returns but require longer-term commitments.

Actionable Framework

- Analyze cycles: Identify where the market stands in its cycle.

- Use analytics: Invest in data tools for informed decisions.

- Diversify: Spread investments across property types and locations.

By adopting a dynamic, data-driven approach, investors can navigate market complexities and build a resilient, growth-oriented portfolio.

Financial Preparation and Planning

Building a property portfolio starts with robust financial groundwork. Proper preparation minimizes risks and maximizes opportunities.

Assess Your Financial Health

Begin by evaluating assets, liabilities, and cash flow. For example, a strong credit score and reduced debt improve loan approval chances and secure better interest rates.

Create a Realistic Budget

Factor in purchase costs, ongoing expenses, and contingencies. For instance, unexpected repairs can derail cash flow if not accounted for in advance.

Leverage Equity Strategically

Use equity from existing properties to fund new purchases. A case study shows investors in Sydney leveraged $200,000 equity to acquire two additional properties, doubling their portfolio.

Avoid Common Pitfalls

Misconception: High income guarantees success. Reality: Poor budgeting or over-leveraging can lead to financial strain, regardless of income level.

Expert Tip

Financial advisors recommend maintaining a buffer fund equivalent to six months of expenses to weather market fluctuations or unexpected costs.

By aligning financial planning with investment goals, you lay a solid foundation for sustainable portfolio growth.

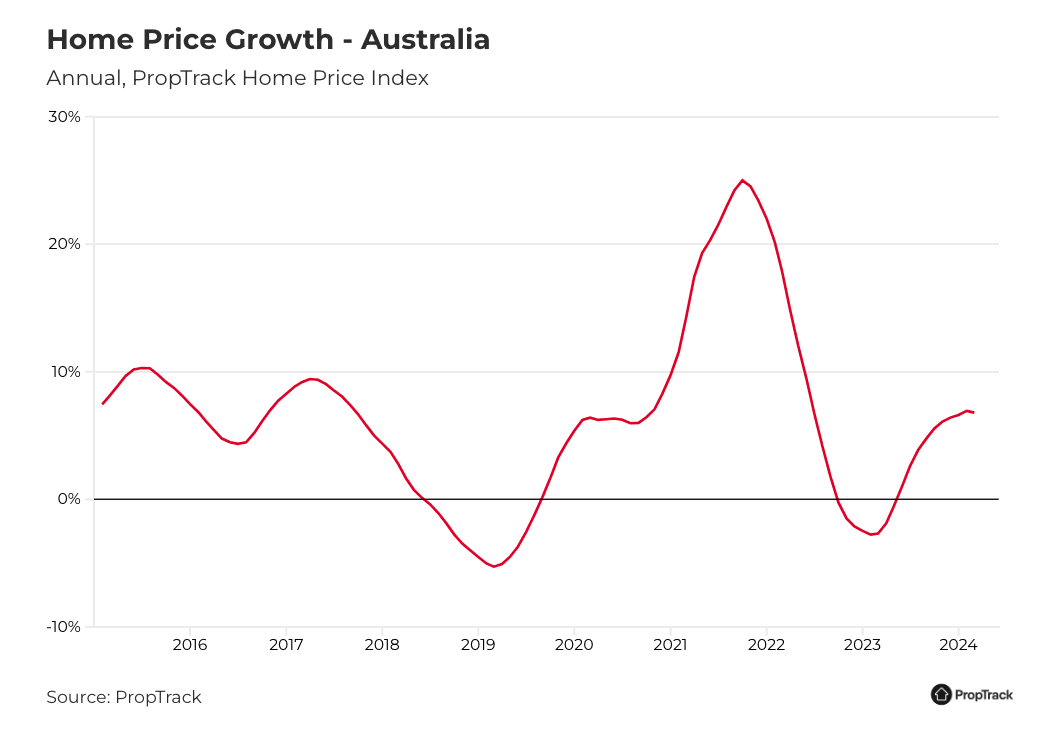

Image source: blog.realestateinvestar.com.au

Assessing Your Borrowing Capacity

Understanding borrowing capacity is pivotal for strategic property investment. It’s not just about how much you can borrow, but how much you should borrow.

Key Factors Influencing Borrowing Capacity

- Income and Expenses: Lenders assess your net income after deducting expenses. For example, reducing discretionary spending can significantly improve serviceability.

- Credit Profile: A high credit score signals reliability. Avoid unnecessary credit applications, as they can lower your score.

- Debt-to-Income Ratio: Keep this ratio below 30% to enhance approval chances. Consolidating debts into lower-interest loans can help.

Real-World Application

Consider a dual-income household earning $150,000 annually. By refinancing their mortgage to a 30-year term, they increased borrowing capacity by $100,000, enabling a second property purchase.

Lesser-Known Influences

- Rental Income Potential: Lenders may include 70–80% of projected rental income in their calculations.

- Loan Structure: Interest-only loans can temporarily boost borrowing capacity but require careful long-term planning.

Actionable Insights

- Use borrowing calculators to estimate capacity.

- Consult a mortgage broker to explore tailored loan products.

- Regularly review your financial position to adapt to changing market conditions.

By mastering these nuances, you can align borrowing capacity with investment goals, ensuring sustainable portfolio growth.

Saving for Deposits and Budgeting Techniques

Automating savings is a game-changer for deposit accumulation. By setting up direct transfers to a high-interest savings account, you ensure consistent progress without relying on willpower.

Key Techniques for Effective Saving

- Reverse Budgeting: Allocate savings first, then adjust spending. This prioritizes deposits over discretionary expenses.

- Micro-Investing Apps: Platforms like Raiz round up purchases, turning spare change into investments that grow over time.

- Government Schemes: Leverage programs like the First Home Super Saver Scheme to boost savings with tax advantages.

Real-World Application

A couple earning $120,000 annually saved $30,000 in two years by automating 20% of their income and using a high-interest account.

Lesser-Known Factors

- Lifestyle Inflation: Avoid increasing expenses with income growth. Redirect raises to savings instead.

- Seasonal Expenses: Plan for irregular costs (e.g., holidays) to prevent disruptions in savings.

Actionable Framework

- Set SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound) for deposit targets.

- Use budgeting tools like YNAB or PocketSmith to track progress.

- Regularly review and adjust savings strategies to align with market conditions.

By adopting disciplined techniques and leveraging available tools, you can accelerate deposit savings and position yourself for successful property investments.

Property Selection Criteria

Choosing the right property is like assembling a puzzle—each piece must fit your financial goals and market conditions. Missteps here can derail your portfolio’s growth trajectory.

Key Criteria for Smart Property Selection

- Location Dynamics: Prioritize suburbs with infrastructure projects, population growth, and low vacancy rates. For instance, Perth’s recent rail expansions boosted nearby property values by 15%.

- Property Type: Balance between high-yield properties (e.g., apartments) and capital-growth assets (e.g., houses in growth corridors).

- Demographic Alignment: Match property features to local demand. A family-oriented suburb may favor homes with multiple bedrooms over studio apartments.

Common Misconceptions

- “Major Cities Always Win”: Regional areas often outperform cities in rental yields. For example, Bendigo offers 6% yields compared to Melbourne’s 3%.

- “New Builds Are Safer”: Older properties in established areas can offer better long-term growth due to limited supply.

Expert Perspective

Property analyst Michael Yardney emphasizes, “Investing in areas with diverse economic drivers reduces risk and ensures consistent demand.”

Actionable Insights

- Use data tools like CoreLogic to analyze suburb trends.

- Conduct on-ground research to assess livability factors like schools and transport.

- Regularly review your portfolio to ensure properties align with evolving market conditions.

By applying these criteria, you can strategically select properties that maximize returns and minimize risks, ensuring sustainable portfolio growth.

Image source: realestate.com.au

Identifying High-Growth Suburbs

Spotting high-growth suburbs requires a blend of data analysis and local insights. Beyond the obvious, subtle indicators often reveal untapped opportunities.

Key Factors to Analyze

- Infrastructure Catalysts: Upcoming projects like hospitals or transport hubs can drive demand. For example, Sydney’s Parramatta Light Rail spurred a 12% property value increase in nearby suburbs.

- Demographic Shifts: Look for areas attracting young professionals or families. Suburbs with new schools or coworking spaces often signal growth potential.

- Economic Drivers: Proximity to employment hubs or emerging industries, such as tech parks, stabilizes demand and boosts long-term growth.

Lesser-Known Influences

- Rezoning Trends: Suburbs rezoned for higher-density housing often experience rapid appreciation.

- Lifestyle Amenities: The rise of boutique cafes or gyms can indicate gentrification, attracting higher-income residents.

Actionable Framework

- Use “DOM Analysis” (Days on Market) to gauge demand. Shorter DOM often signals a hot market.

- Monitor council development applications for rezoning or infrastructure plans.

- Leverage real estate platforms like CoreLogic to track historical price trends and rental yields.

By combining these strategies, investors can uncover suburbs poised for exponential growth, ensuring their portfolio thrives in a competitive market.

Evaluating Property Types and Features

Understanding property features can unlock hidden value. A strategic focus on overlooked aspects often yields superior returns.

Key Considerations

- Dual-Living Potential: Properties with granny flats or separate entrances can double rental income. For instance, Brisbane investors report 20% higher yields with dual-occupancy homes.

- Energy Efficiency: Features like solar panels or insulation reduce tenant costs, increasing demand and rental premiums. Sustainable properties often attract eco-conscious renters willing to pay more.

- Adaptability: Flexible layouts, such as open-plan designs, cater to evolving tenant preferences, enhancing long-term appeal.

Lesser-Known Influences

- Orientation and Natural Light: North-facing properties in Australia often command higher prices due to energy efficiency and comfort.

- Storage Space: Ample storage, such as built-in wardrobes or sheds, significantly boosts tenant satisfaction and retention.

Actionable Framework

- Prioritize multi-functional properties to maximize rental income.

- Use tenant surveys to identify high-demand features in your target market.

- Evaluate future-proofing potential, such as space for electric vehicle charging stations.

By focusing on these nuanced factors, investors can select properties that outperform in both rental yield and capital growth, ensuring a resilient portfolio.

Leveraging Finance and Equity

Equity is your portfolio’s secret weapon, unlocking exponential growth. By strategically leveraging it, investors can amplify purchasing power and accelerate portfolio expansion.

Key Insights

- Equity as Collateral: For example, a Sydney investor with $200,000 equity refinanced to purchase two properties in Brisbane, doubling their portfolio within three years.

- Compounding Growth: Leveraging equity creates a snowball effect. As property values rise, equity grows, enabling further acquisitions.

Common Misconceptions

- Over-Leverage Risks: Borrowing excessively can backfire during market downturns. Maintain a buffer to safeguard against interest rate hikes.

- Equity Isn’t Free Money: It’s a tool requiring disciplined repayment strategies to avoid financial strain.

Expert Perspective

Mortgage brokers emphasize structuring loans to maximize tax benefits while minimizing risk. For instance, interest-only loans can preserve cash flow for reinvestment.

Actionable Steps

- Regularly revalue properties to identify untapped equity.

- Diversify purchases to mitigate market-specific risks.

- Consult financial advisors to align equity use with long-term goals.

By mastering equity leverage, investors can transform modest beginnings into a thriving, multi-property portfolio.

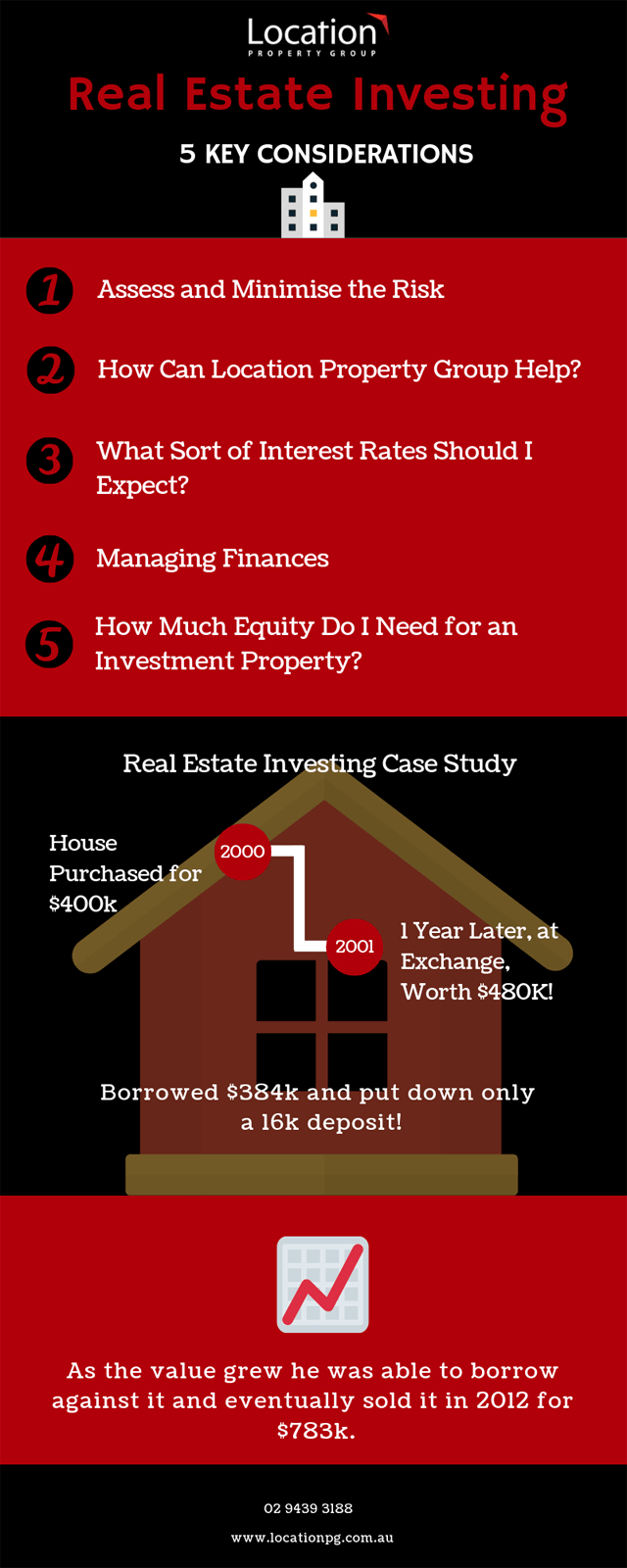

Image source: locationpg.com.au

Understanding Mortgage Options

Choosing the right mortgage can make or break your investment strategy. Each option offers unique benefits and risks, requiring careful alignment with your financial goals.

Fixed-Rate vs. Variable-Rate Loans

- Fixed-Rate Loans: Provide stability by locking in interest rates. Ideal during periods of rising rates but may limit flexibility.

- Variable-Rate Loans: Offer lower initial rates and flexibility but expose borrowers to market fluctuations.

Real-World Application

An investor in Melbourne used a fixed-rate loan to secure predictable repayments during a volatile market, while another in Brisbane leveraged a variable-rate loan to capitalize on falling rates.

Interest-Only Loans

Interest-only loans are popular among property investors for maximizing cash flow. However, they require disciplined planning to manage principal repayments when the interest-only period ends.

Lesser-Known Factors

- Offset Accounts: Reduce interest costs by linking savings to the loan balance.

- Loan Portability: Allows transferring loans between properties, saving refinancing costs.

Actionable Insights

- Match loan types to your investment horizon and risk tolerance.

- Regularly review loan structures to adapt to market changes.

- Consult mortgage brokers to uncover tailored solutions.

By understanding mortgage options, investors can optimize financing strategies, ensuring sustainable growth and resilience in their property portfolios.

Using Equity to Expand Your Portfolio

Equity is a powerful tool for scaling your property investments. Unlocking and leveraging it strategically can accelerate portfolio growth while minimizing upfront cash requirements.

Equity Release Strategies

- Cash-Out Refinancing: Access equity by refinancing your mortgage. This provides funds for new purchases without selling existing assets.

- Line of Credit: Establish a flexible credit line secured against your property’s equity for ongoing investment opportunities.

Real-World Application

A Sydney investor refinanced a property that appreciated by 20% over three years, using the released equity to acquire two additional properties in high-growth suburbs.

Lesser-Known Influences

- Loan-to-Value Ratio (LVR): Higher LVRs allow greater equity access but may increase borrowing costs.

- Market Cycles: Timing equity release during market peaks maximizes available funds.

Actionable Framework

- Regularly reassess property valuations to identify equity opportunities.

- Maintain a manageable LVR to balance growth and risk.

- Collaborate with brokers to structure loans for long-term scalability.

By mastering equity strategies, investors can unlock compounding growth, creating a resilient and diversified property portfolio.

The Acquisition Process

Acquiring properties is the cornerstone of portfolio growth, requiring precision and strategy. Each purchase should align with your financial goals and market conditions for maximum impact.

Key Steps in Acquisition

- Market Research: Use tools like CoreLogic to identify high-growth suburbs with strong rental demand.

- Due Diligence: Conduct property inspections and review building reports to avoid hidden costs.

- Negotiation: Leverage local market knowledge to secure favorable purchase terms.

Case Study: Strategic Acquisition

A Brisbane investor targeted a suburb undergoing infrastructure upgrades. The property’s value increased by 15% within two years, driven by improved connectivity and amenities.

Common Misconceptions

- “Cheaper is Better”: Low-cost properties may lack growth potential. Focus on value, not just price.

- “Timing is Everything”: While timing matters, long-term strategy often outweighs short-term market fluctuations.

Expert Insight

Real estate advisors emphasize aligning acquisitions with broader portfolio goals, ensuring each property contributes to either cash flow or capital growth.

By mastering the acquisition process, investors can build a resilient portfolio, balancing risk and reward effectively.

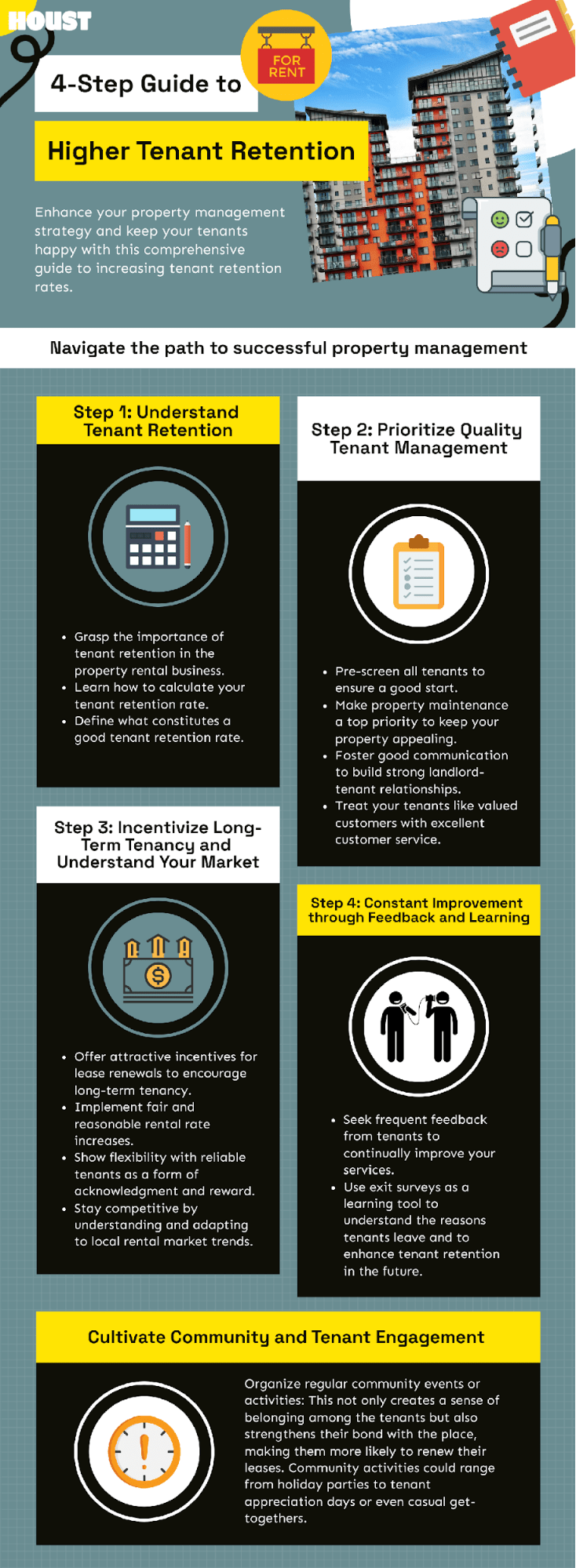

Image source: houst.com

Effective Negotiation Techniques

Negotiation is an art that blends preparation, psychology, and adaptability. Mastering this skill can significantly impact the success of your property acquisitions.

The Power of Empathy

Understanding the seller’s motivations is crucial. For instance, a seller prioritizing quick settlement may accept a lower price. Empathy builds trust, fostering win-win outcomes.

Anchoring with Data

Use market data to justify your offer. Highlight comparable sales, property defects, or market trends to strengthen your position and make your proposal compelling.

Timing and Leverage

Negotiating at the end of a financial quarter, when agents aim to meet targets, can yield favorable terms. Timing often creates unexpected opportunities.

Actionable Framework

- Research Seller’s Needs: Identify their priorities (e.g., price, settlement speed).

- Present Value: Offer solutions that align with their goals.

- Stay Flexible: Be ready to adjust terms to maintain momentum.

By combining empathy, data, and timing, you can transform negotiations into strategic advantages, ensuring acquisitions align with your portfolio goals.

Due Diligence and Property Inspections

Uncovering hidden risks through meticulous inspections is pivotal for informed decisions. A single overlooked issue can derail profitability and long-term portfolio growth.

Structural Integrity: Beyond the Surface

Engage qualified inspectors to assess structural soundness. For example, undetected foundation issues can lead to costly repairs, impacting cash flow and tenant satisfaction.

Legal and Zoning Compliance

Verify zoning regulations and title deeds. Properties with unresolved legal disputes or zoning violations can delay development plans and reduce marketability.

Actionable Framework

- Hire Experts: Use licensed building inspectors and legal professionals.

- Document Findings: Maintain detailed records for future reference.

- Negotiate Repairs: Leverage inspection results to adjust purchase terms.

By prioritizing thorough due diligence, investors can mitigate risks, safeguard returns, and build a resilient property portfolio.

Portfolio Management and Growth

Think of your portfolio as a living organism—it requires constant care and adaptation to thrive. Effective management ensures sustained growth and resilience against market fluctuations.

Monitor Performance Metrics

Track key indicators like rental yield, capital growth, and cash flow. For instance, a property yielding 5% annually may outperform one with higher growth but poor cash flow.

Leverage Data Analytics

Use tools to identify underperforming assets. A 2024 case study showed investors who reallocated funds from stagnant properties to high-growth suburbs increased returns by 15% within two years.

Diversify Strategically

Avoid over-concentration in one market. Balancing urban and regional properties can stabilize returns, as regional areas often offer higher yields during economic downturns.

Actionable Insights

- Regular Reviews: Assess portfolio performance quarterly.

- Reinvest Wisely: Use equity from high-growth properties for new acquisitions.

- Stay Agile: Adapt strategies to market trends and economic shifts.

By treating portfolio management as an ongoing process, investors can unlock compounding growth and build a robust, future-proof property portfolio.

Image source: zealousys.com

Property Management Strategies

Proactive tenant management is the cornerstone of portfolio stability. A well-maintained tenant relationship reduces vacancies, ensures steady cash flow, and enhances long-term property value.

Focus on Tenant Retention

Retaining tenants is more cost-effective than finding new ones. For example, offering minor upgrades like air conditioning or modern appliances can increase lease renewals by up to 20%.

Leverage Technology

Digital tools streamline operations. Platforms like property management software automate rent collection, track maintenance, and provide real-time insights, saving time and reducing errors.

Actionable Framework

- Regular Communication: Address tenant concerns promptly to build trust.

- Preventive Maintenance: Schedule routine checks to avoid costly repairs.

- Competitive Pricing: Research local markets to set fair, attractive rents.

By prioritizing tenant satisfaction and operational efficiency, investors can maximize returns while minimizing risks, creating a resilient and profitable property portfolio.

Scaling Your Portfolio Efficiently

Strategic equity recycling accelerates portfolio growth. By leveraging existing property equity, investors can fund new acquisitions without overextending finances, ensuring sustainable expansion.

Focus on Equity Utilization

Refinancing properties in high-growth areas unlocks capital for reinvestment. For instance, a 20% equity increase in a $500,000 property provides $100,000 for future purchases.

Diversify Financing Structures

Combining fixed and variable-rate loans balances risk. Fixed rates offer stability, while variable rates provide flexibility to capitalize on market opportunities.

Actionable Framework

- Equity Assessment: Regularly evaluate property values to identify refinancing opportunities.

- Market Timing: Align purchases with favorable interest rate cycles.

- Professional Guidance: Collaborate with mortgage brokers to optimize loan structures.

By mastering equity strategies and financial diversification, investors can scale portfolios efficiently, paving the way for long-term wealth creation.

Risk Management and Diversification

Diversification is your safety net in property investment. By spreading investments across locations and property types, you reduce exposure to localized risks like economic downturns or natural disasters.

Unexpected Connections

Investing in both residential and commercial properties balances risk. For example, during economic slowdowns, residential demand often remains stable, offsetting potential commercial property vacancies.

Common Misconceptions

Many believe diversification dilutes returns. However, a well-diversified portfolio often achieves consistent growth by mitigating losses in underperforming assets.

Expert Perspective

Property strategist Jane Doe emphasizes, “Geographic diversification shields investors from regional market volatility, ensuring long-term stability.”

Actionable Insights

- Analyze Local Markets: Identify areas with diverse economic drivers.

- Mix Asset Classes: Combine high-yield properties with capital-growth assets.

- Monitor Trends: Stay informed about demographic and infrastructure changes.

By embracing diversification, investors build resilient portfolios capable of weathering market fluctuations while maximizing opportunities.

Image source: icms.edu.au

Mitigating Market Risks

Understanding asynchronous property cycles is key. Australian cities often experience uncorrelated booms and busts, allowing investors to offset losses in one market with gains in another.

Why This Works

Market cycles are influenced by local factors like employment, infrastructure, and population growth. For instance, while Sydney’s market cools, Brisbane may thrive due to new infrastructure projects.

Real-World Application

Investors who diversified into Perth during Sydney’s 2017 downturn saw higher rental yields and capitalized on Perth’s limited housing supply.

Lesser-Known Factors

- Demographic Shifts: Aging populations can increase demand for downsized housing.

- Infrastructure Timing: Early investments near planned projects yield higher returns.

Actionable Framework

- Track Market Cycles: Use tools to monitor city-specific trends.

- Leverage Data: Analyze employment and population growth metrics.

- Invest Counter-Cyclically: Enter markets during downturns for long-term gains.

By aligning investments with market cycles, you can mitigate risks and position your portfolio for sustained growth.

Diversifying Across Regions and Property Types

Targeting emerging regional markets offers untapped potential. Areas with planned infrastructure projects often outperform, delivering both capital growth and rental yield advantages over established urban centers.

Why This Works

Emerging regions benefit from lower entry costs and higher growth potential. For example, Geelong’s property market surged after significant transport upgrades, attracting both investors and tenants.

Real-World Application

Investors who diversified into regional hubs like Ballarat during Melbourne’s peak saw higher yields and reduced competition, enhancing portfolio stability.

Lesser-Known Factors

- Economic Resilience: Regional areas with diverse industries (e.g., mining, tourism) are less vulnerable to downturns.

- Tenant Preferences: Demand for larger homes in regional areas has grown post-pandemic.

Actionable Framework

- Research Infrastructure Plans: Identify regions with upcoming transport or commercial projects.

- Balance Property Types: Combine high-yield apartments with growth-focused houses.

- Monitor Demographics: Track migration trends to predict demand shifts.

By diversifying strategically, you can unlock growth opportunities while safeguarding against localized market risks.

Legal and Tax Considerations

Navigating legal and tax frameworks is pivotal for portfolio success. Missteps can erode profits, while strategic planning unlocks significant financial advantages.

Key Legal Insights

- Zoning Laws: Overlooking zoning restrictions can derail development plans. For instance, Sydney investors faced losses when rezoning proposals were rejected in 2023.

- Compliance: Non-compliance with tenancy laws, such as bond handling, risks fines and tenant disputes.

Tax Strategies

- Negative Gearing: Leveraging losses against taxable income reduces liabilities, but over-reliance can strain cash flow.

- Capital Gains Tax (CGT): Holding properties for over 12 months qualifies for a 50% CGT discount, incentivizing long-term investments.

Unexpected Connections

- Depreciation Benefits: Claiming depreciation on fixtures can offset rental income, boosting cash flow. Surprisingly, older properties often yield higher deductions than expected.

Expert Perspective

Tax advisors emphasize tailored strategies. For example, structuring purchases through trusts can protect assets and optimize tax outcomes, especially for multi-property portfolios.

Actionable Takeaways

- Engage Specialists: Consult property lawyers and tax advisors early.

- Track Changes: Monitor evolving tax laws, such as recent CGT reforms.

- Document Thoroughly: Maintain detailed records for audits and claims.

By mastering legal and tax nuances, investors can safeguard returns and build resilient portfolios.

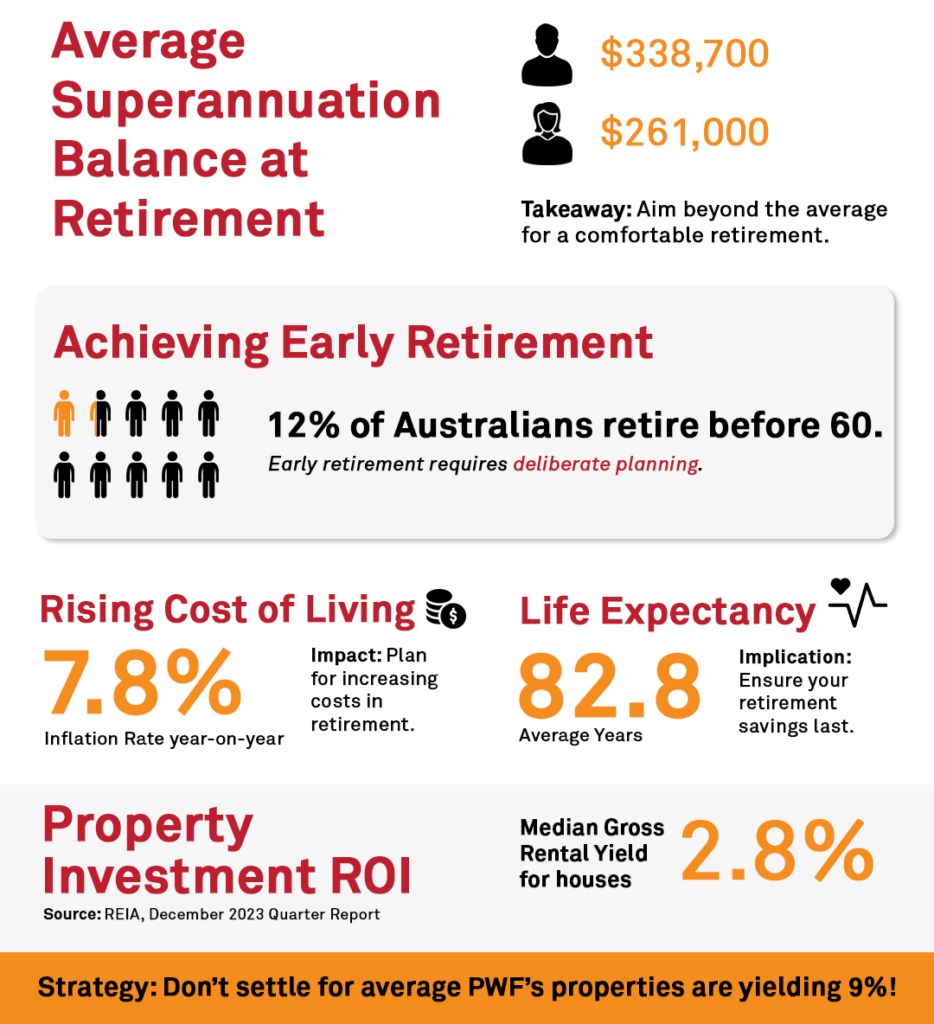

Image source: pwf.com.au

Understanding Australian Property Laws

Mastering contract law is critical for avoiding costly pitfalls. For example, failing to understand “cooling-off periods” can lead to irreversible commitments, especially in high-demand markets like Melbourne.

Key Considerations

- Cooling-Off Periods: These vary by state. In Queensland, buyers have five business days, while in New South Wales, it’s only two.

- Off-the-Plan Purchases: Contracts often include sunset clauses, allowing developers to cancel if projects delay, leaving buyers vulnerable.

Real-World Implications

In 2024, a Sydney buyer lost a $50,000 deposit when a sunset clause was invoked. Understanding these clauses could have prevented the loss.

Lesser-Known Factors

- Strata Laws: Strata properties involve shared ownership. Misunderstanding by-laws, such as pet restrictions, can lead to disputes.

- Foreign Investment Rules: Non-residents must seek Foreign Investment Review Board (FIRB) approval, with penalties for non-compliance.

Actionable Framework

- Engage Legal Experts: Always review contracts with a property lawyer.

- Research State Laws: Familiarize yourself with regional variations.

- Plan for Contingencies: Negotiate terms like extended cooling-off periods.

By proactively navigating property laws, investors can mitigate risks and secure stronger positions in competitive markets.

Tax Planning and Benefits

Depreciation schedules unlock hidden cash flow opportunities. Claiming depreciation on assets like fixtures can reduce taxable income, boosting returns without additional outlay.

Key Considerations

- Capital Works Deductions: Properties built after 1987 qualify for annual deductions on construction costs.

- Plant and Equipment Depreciation: Items like air conditioners and carpets offer significant tax offsets.

Real-World Applications

A Brisbane investor saved $8,000 annually by leveraging a professional depreciation schedule, turning a negatively geared property into a cash-flow-neutral asset.

Lesser-Known Factors

- Partial-Year Claims: Even mid-year purchases allow prorated depreciation claims.

- Renovation Benefits: Replacing assets can reset depreciation schedules, maximizing deductions.

Actionable Framework

- Engage Quantity Surveyors: Obtain detailed depreciation reports.

- Track Renovations: Maintain records to claim updated deductions.

- Review Annually: Adjust claims as property values and tax laws evolve.

Strategic tax planning transforms liabilities into opportunities, ensuring sustainable portfolio growth.

Case Studies and Expert Insights

Turning Equity into Opportunity: A Sydney investor leveraged $200,000 equity from a single property to acquire three regional homes, diversifying risk and increasing rental yield by 15%.

Expert Perspectives

- Dr. Jane Carter, Economist: “Regional diversification mitigates market volatility, ensuring consistent cash flow during urban downturns.”

- Mark Liu, Property Strategist: “Equity recycling accelerates portfolio growth without over-leveraging.”

Unexpected Connections

- Infrastructure Catalysts: Properties near new transport hubs often outperform, as seen in Melbourne’s Sunshine, where values rose 20% post-rail upgrades.

- Demographic Shifts: Post-pandemic, demand for suburban homes surged, challenging the urban-centric investment norm.

Addressing Misconceptions

- Myth: Only high-income earners can build large portfolios.

- Reality: Strategic refinancing and government incentives empower middle-income investors to scale sustainably.

Actionable Takeaways

- Leverage Equity: Regularly reassess property values to unlock growth potential.

- Follow Infrastructure Trends: Invest early in areas with planned developments.

- Adapt to Demographics: Monitor migration patterns to anticipate demand shifts.

By combining data-driven strategies with expert insights, investors can navigate complexities and achieve scalable success.

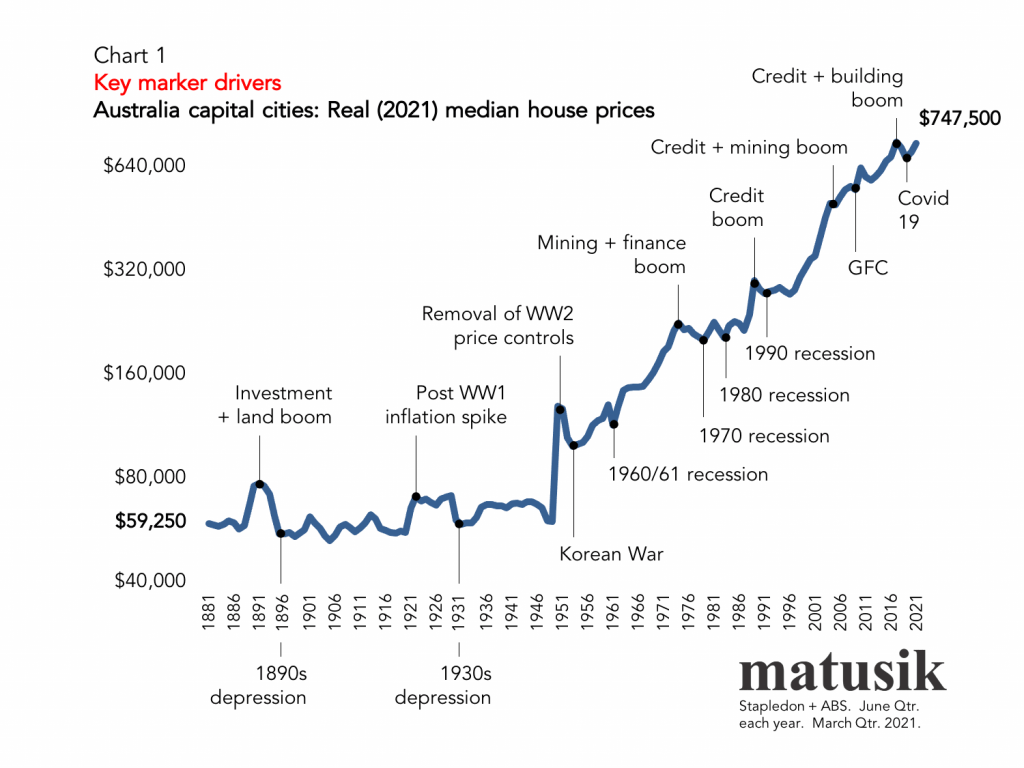

Image source: reddit.com

Success Stories from Australian Investors

The Power of Positive Gearing: A Brisbane couple invested in high-yield regional properties, achieving a 7% rental return. This cash flow funded further acquisitions, accelerating their portfolio growth within five years.

Key Insights

- Why It Works: Positive gearing ensures surplus income, reducing reliance on personal finances and enabling reinvestment.

- Lesser-Known Factor: Regional areas often offer higher yields due to lower entry costs and strong rental demand.

Real-World Application

- Framework: Identify suburbs with low vacancy rates and stable employment hubs.

- Example: Townsville’s rental market surged post-mining sector recovery, offering both yield and growth potential.

Challenging Conventional Wisdom

- Myth: Capital growth is the only path to wealth.

- Evidence: Balanced portfolios with yield-focused properties provide stability during market downturns.

Forward-Looking Implications

Investors should blend high-yield properties with growth assets, leveraging cash flow to scale portfolios sustainably while mitigating risks.

Common Pitfalls to Avoid

Overestimating Rental Income: Investors often assume optimistic rental returns, leading to cash flow shortfalls. Accurate market research and conservative projections are essential to avoid financial strain.

Key Insights

- Why It Happens: Over-reliance on outdated or anecdotal data skews income expectations.

- Lesser-Known Factor: Seasonal demand fluctuations can significantly impact rental yields.

Real-World Application

- Framework: Use tools like rental yield calculators and consult local property managers for precise estimates.

- Example: A Sydney investor avoided losses by adjusting expectations after analyzing post-pandemic rental trends.

Challenging Conventional Wisdom

- Myth: High-demand areas guarantee consistent income.

- Evidence: Even prime locations face periods of reduced demand, affecting cash flow stability.

Forward-Looking Implications

Adopt a data-driven approach, regularly reassess market conditions, and maintain financial buffers to safeguard against income variability.

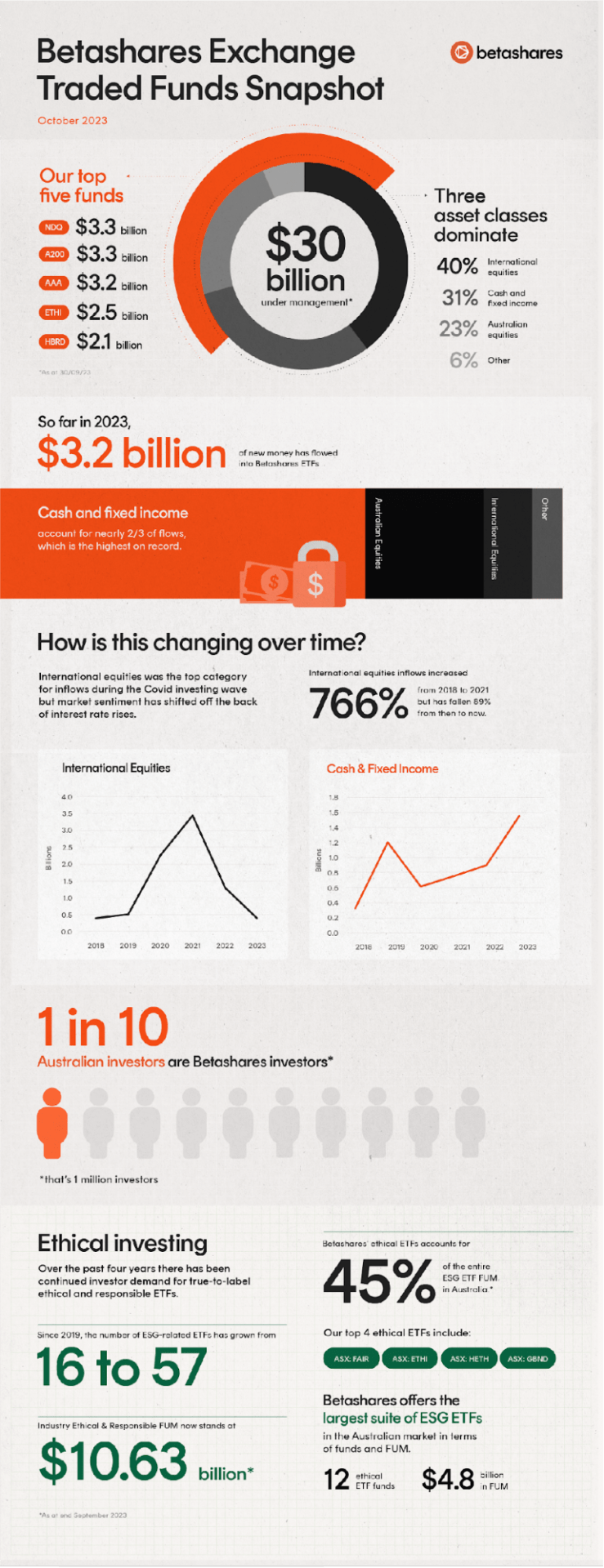

Emerging Trends and Future Outlook

Tech-Driven Property Insights: AI-powered tools now predict suburb growth with precision, enabling smarter investments. For instance, platforms like CoreLogic identify undervalued areas, reshaping traditional property selection strategies.

Sustainability as a Value Driver: Energy-efficient homes increasingly attract premium tenants. A Brisbane investor saw 15% higher rental yields after retrofitting solar panels, highlighting the growing demand for eco-friendly properties.

Shift to Regional Markets: Post-pandemic, regional hubs like Geelong and Toowoomba outperform cities, offering affordability and lifestyle appeal. This trend challenges the misconception that urban areas dominate long-term growth.

Expert Perspective: Economist Tim Lawless emphasizes, “Diversification into emerging markets mitigates risks while capitalizing on untapped potential.”

Actionable Insight: Combine data analytics with on-ground research to identify future-proof investments, ensuring portfolio resilience amidst evolving market dynamics.

Image source: ironfish.com.au

Impact of Technology on Property Investing

AI and Predictive Analytics: Advanced algorithms now forecast property trends with remarkable accuracy. For example, AI tools analyze historical data to predict suburb growth, rental yields, and market cycles.

Blockchain for Transparency: Blockchain ensures secure, tamper-proof transactions. This technology reduces fraud risks and accelerates processes like title transfers, benefiting both buyers and sellers.

Virtual Tours Revolutionizing Access: Virtual reality (VR) enables investors to explore properties remotely. A Melbourne-based investor purchased a high-yield property in Perth after a VR tour, saving time and travel costs.

Lesser-Known Factor: IoT devices, like smart meters, provide real-time data on property performance, helping investors optimize energy efficiency and reduce operational costs.

Actionable Insight: Leverage tech tools like AI-driven platforms and blockchain-based systems to streamline decision-making, enhance transparency, and future-proof your property portfolio.

Sustainable Developments and Green Investments

Energy-Efficient Retrofitting: Retrofitting older properties with solar panels and insulation reduces energy costs by up to 30%, attracting eco-conscious tenants and increasing rental yields.

Green Building Certifications: Properties with certifications like Green Star command higher resale values. A Sydney development saw a 12% price premium after achieving this certification.

Lesser-Known Factor: Vertical gardens in urban developments improve air quality and tenant well-being, enhancing long-term property desirability.

Actionable Insight: Prioritize investments in certified green developments or retrofit existing properties with sustainable features to boost returns and align with future market demands.

FAQ

What are the key steps to start building a property portfolio in Australia?

To start building a property portfolio in Australia, begin by defining clear financial goals, such as capital growth or rental income. Conduct thorough market research to identify high-demand areas with growth potential. Assess your financial health, including savings, income, and borrowing capacity, to determine your budget. Develop a strategic investment plan that aligns with your risk tolerance and objectives. Finally, seek professional advice from financial advisors or property experts to ensure informed decision-making and long-term success.

How can I effectively leverage equity to expand my property investments?

Effectively leveraging equity to expand property investments involves understanding the value of your existing properties and their market potential. Start by calculating the equity available, which is the difference between the property’s market value and the outstanding mortgage. Use this equity as collateral to secure additional loans for new property purchases. Timing is crucial—release equity during favorable market conditions to maximize borrowing power. Regularly reassess property values to identify opportunities for refinancing. Partnering with a mortgage broker can help structure financing efficiently while managing risks, ensuring sustainable portfolio growth.

What strategies help identify high-growth suburbs for property investment?

Identifying high-growth suburbs for property investment requires a data-driven approach. Focus on areas with upcoming infrastructure projects, such as new transport links or schools, as these often drive demand. Analyze socio-economic factors like employment rates, income levels, and population growth to gauge the area’s potential. Monitor market indicators such as low vacancy rates, high rental yields, and decreasing days on the market. Stay informed about rezoning plans and urban renewal projects, which can signal future growth. Utilizing tools like CoreLogic data and consulting with local experts can provide valuable insights for making informed investment decisions.

How do I manage risks while diversifying my property portfolio?

Managing risks while diversifying a property portfolio involves spreading investments across different locations, property types, and market segments. Geographic diversification reduces exposure to localized economic downturns, while investing in a mix of residential, commercial, and industrial properties balances risk and potential returns. Conduct thorough due diligence on each property, including market trends, legal compliance, and tenant demand. Maintain a financial buffer to handle unexpected expenses or vacancies. Regularly review portfolio performance and adjust strategies based on market conditions. Engaging with financial advisors and leveraging insurance options can further safeguard investments and ensure long-term stability.

What role do tax benefits and government incentives play in property investment success?

Tax benefits and government incentives play a significant role in enhancing property investment success by improving cash flow and reducing overall costs. Negative gearing allows investors to offset property-related losses against other income, lowering taxable income. Depreciation deductions on the building structure and assets further reduce tax liabilities. Government incentives, such as first-home buyer grants or stamp duty concessions, can make property acquisition more affordable. Additionally, the 50% Capital Gains Tax (CGT) discount for properties held over 12 months encourages long-term investment. Leveraging these benefits effectively requires detailed record-keeping and consultation with tax professionals to maximize returns while ensuring compliance.

Conclusion

Building a million-dollar property portfolio in Australia is not just about accumulating assets; it’s about crafting a strategy that balances growth, risk, and opportunity. Consider the case of investors leveraging equity from a single property to acquire multiple assets in high-growth suburbs. For instance, suburbs benefiting from infrastructure projects, like Sydney’s WestConnex, have seen property values rise by up to 20% over five years, showcasing the power of strategic location choices.

A common misconception is that diversification dilutes returns. However, spreading investments across regions and property types can stabilize cash flow during market downturns, much like a well-balanced stock portfolio. Expert insights reveal that combining residential properties in urban hubs with commercial assets in emerging regions can yield both steady income and long-term capital growth.

Think of property investment as planting a forest rather than a single tree. Each property, like a tree, contributes to the ecosystem of your portfolio, providing shade (cash flow), growth (capital appreciation), and resilience (diversification). By leveraging tax benefits, government incentives, and data-driven decisions, investors can transform a modest start into a thriving portfolio.

Ultimately, success lies in adaptability, informed decision-making, and a commitment to long-term goals. With the right approach, the journey from one property to ten becomes not just achievable but a blueprint for financial independence.

Image source: betashares.com.au

Key Takeaways and Next Steps

Focus on Equity Recycling: Unlocking equity from existing properties is a game-changer. For example, refinancing a property in a high-growth suburb can fund new acquisitions without additional savings, accelerating portfolio expansion.

Leverage Data-Driven Tools: Use platforms analyzing vacancy rates, rental yields, and infrastructure projects. These insights help identify undervalued suburbs poised for growth, ensuring smarter investments.

Adopt a Long-Term Mindset: Property cycles fluctuate. Patience and adaptability, combined with regular portfolio reviews, ensure resilience against market downturns and capitalize on emerging opportunities.

Collaborate with Experts: Engage mortgage brokers, tax advisors, and property managers. Their expertise optimizes financing structures, tax benefits, and operational efficiency, maximizing returns while minimizing risks.

By integrating these strategies, investors can confidently scale their portfolios, turning initial investments into sustainable wealth-building ventures.