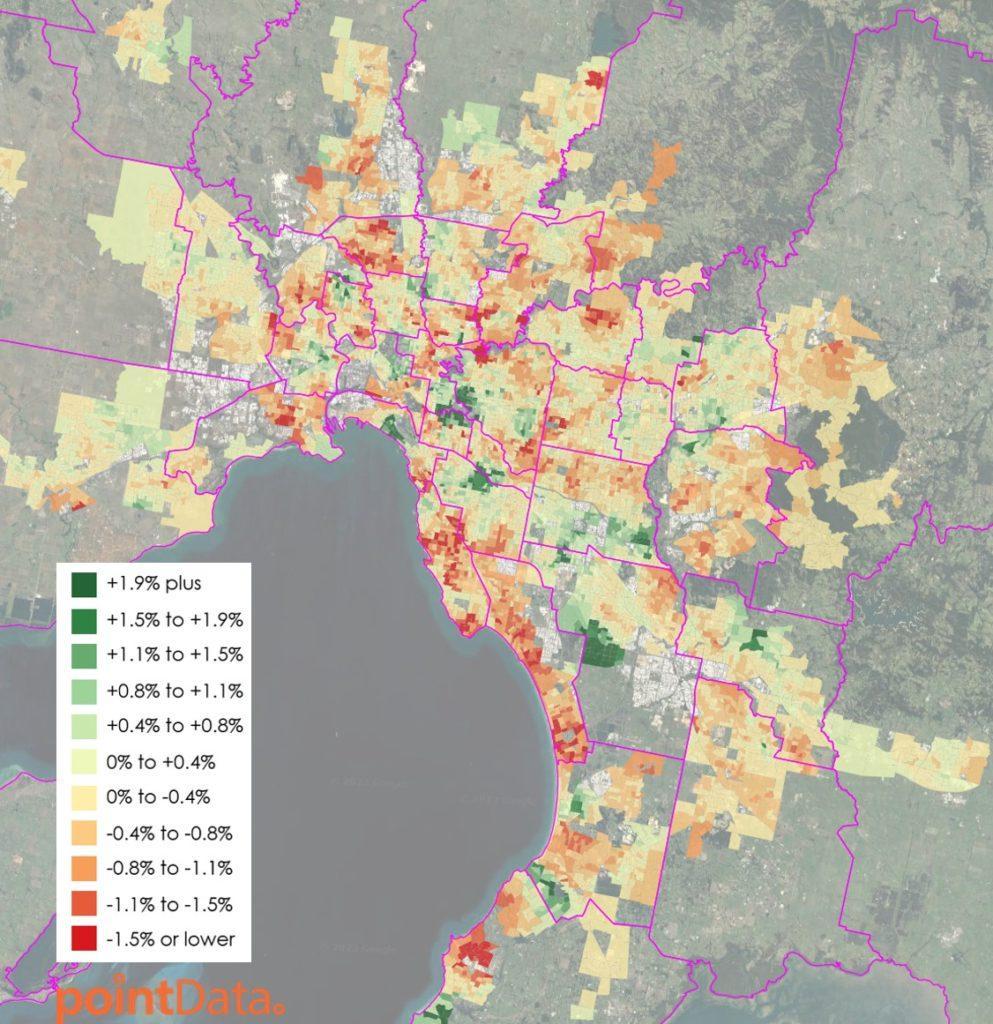

Melbourne’s Hidden Gems: The Suburbs Set to Skyrocket in 2025

In 2025, Melbourne’s outer suburb of Melton is projected to see property values rise by as much as 5% annually, driven by a combination of affordability and strategic infrastructure investments, according to data from the Australian Bureau of Statistics. This growth trajectory is not an isolated phenomenon but part of a broader trend reshaping the city’s real estate landscape. Suburbs once dismissed as peripheral are now emerging as focal points for both investors and families seeking value without compromising on connectivity or amenities.

Dr. Andrew Wilson, Chief Economist at My Housing Market, notes that “the alignment of infrastructure projects like the West Gate Tunnel with demographic shifts has created unprecedented opportunities in areas previously overlooked.” For instance, Wyndham’s population surged by 4.2% in 2024 alone, fueled by new housing developments and improved transport links.

This recalibration of Melbourne’s property market underscores a critical shift: growth is no longer confined to traditional hotspots but is increasingly defined by strategic planning and community-driven development.

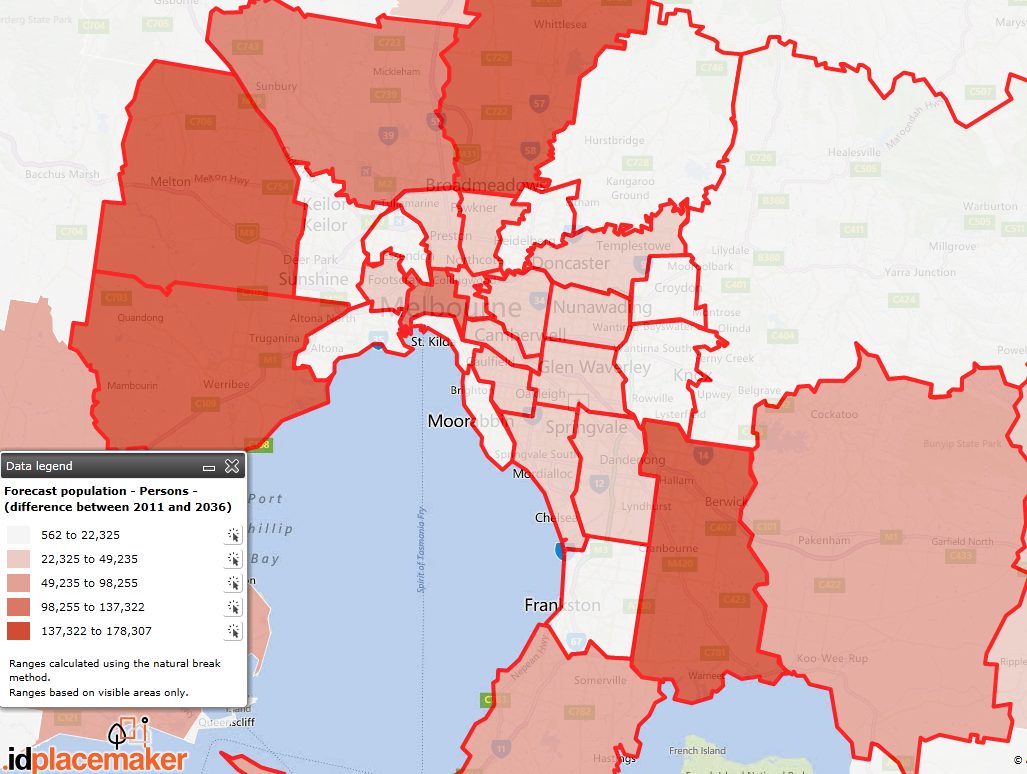

Image source: blog.id.com.au

Understanding the Current Property Market

A critical yet often overlooked driver of Melbourne’s property market in 2025 is the nuanced relationship between infrastructure upgrades and localized demographic shifts. While large-scale projects like the Metro Tunnel dominate headlines, it is the micro-level enhancements—such as the addition of new bus routes or the expansion of suburban train stations—that frequently catalyze transformative market dynamics. These smaller interventions improve accessibility incrementally, reshaping buyer perceptions and unlocking hidden value in previously undervalued suburbs.

For example, the suburb of Tarneit has seen a measurable uptick in demand following the extension of its train line, reducing commute times to the CBD by 15%. This improvement has not only attracted first-time buyers but also spurred interest from investors seeking long-term capital growth. Such localized changes often outperform broader market trends, as they directly address the practical needs of residents.

“Localized infrastructure improvements are the unsung heroes of property market growth, creating tangible benefits that resonate with everyday buyers.”

— Dr. Andrew Wilson, Chief Economist, My Housing Market

This interplay between infrastructure and demographics highlights the importance of granular analysis. Investors who prioritize these subtleties can identify opportunities that traditional metrics, such as median price growth, fail to capture.

Identifying Hidden Gems: Criteria and Indicators

The emergence of hidden gems in Melbourne’s property market often hinges on subtle, localized shifts that traditional metrics fail to capture. One critical indicator is the alignment of infrastructure upgrades with demographic trends. For instance, the introduction of a new rail link or the expansion of a local school can act as a catalyst for gentrification, attracting both families and investors seeking long-term growth.

A detailed analysis reveals that suburbs with a high “Infrastructure Accessibility Index” (IAI) score—measuring proximity to transport, schools, and amenities—tend to outperform in value appreciation. However, the effectiveness of these upgrades is context-dependent. For example, while a new train station may boost demand in a middle-ring suburb, the same intervention in an already saturated area might yield diminishing returns.

“Localized infrastructure investments often create a ripple effect, enhancing livability and driving sustained demand,”

— Marc Lucas, Managing Director, 151 Property

Investors can refine their approach by monitoring planning applications and community engagement initiatives. A case study of Stockland’s master-planned community in Melton, which achieved a 92% occupancy rate within two years, underscores the importance of integrating residential and recreational spaces. This hands-on strategy ensures that emerging suburbs are identified before broader market recognition, maximizing capital growth potential.

Economic and Demographic Drivers of Growth

Melbourne’s outer suburbs are experiencing a unique convergence of economic resilience and demographic evolution, creating fertile ground for property market expansion. According to the Australian Bureau of Statistics, Melbourne’s population is projected to grow by 1.8% annually through 2030, driven by interstate migration and international arrivals. This influx is not uniform; younger professionals and families are gravitating toward suburbs offering affordability and lifestyle amenities, reshaping demand patterns in areas like Rockbank and Cobblebank.

Economically, government-backed infrastructure investments totaling $1.2 billion in 2023-2024 have catalyzed local job creation and improved connectivity. These projects, such as the West Gate Tunnel, reduce commute times and enhance access to employment hubs, directly influencing property desirability. A study by the Property Council of Australia highlights that suburbs with significant infrastructure upgrades see property value increases of up to 7% annually, outpacing citywide averages.

This interplay between economic opportunity and demographic shifts underscores a critical insight: growth is not merely about population size but the alignment of infrastructure and community needs. Such synergy transforms overlooked suburbs into high-potential investment zones.

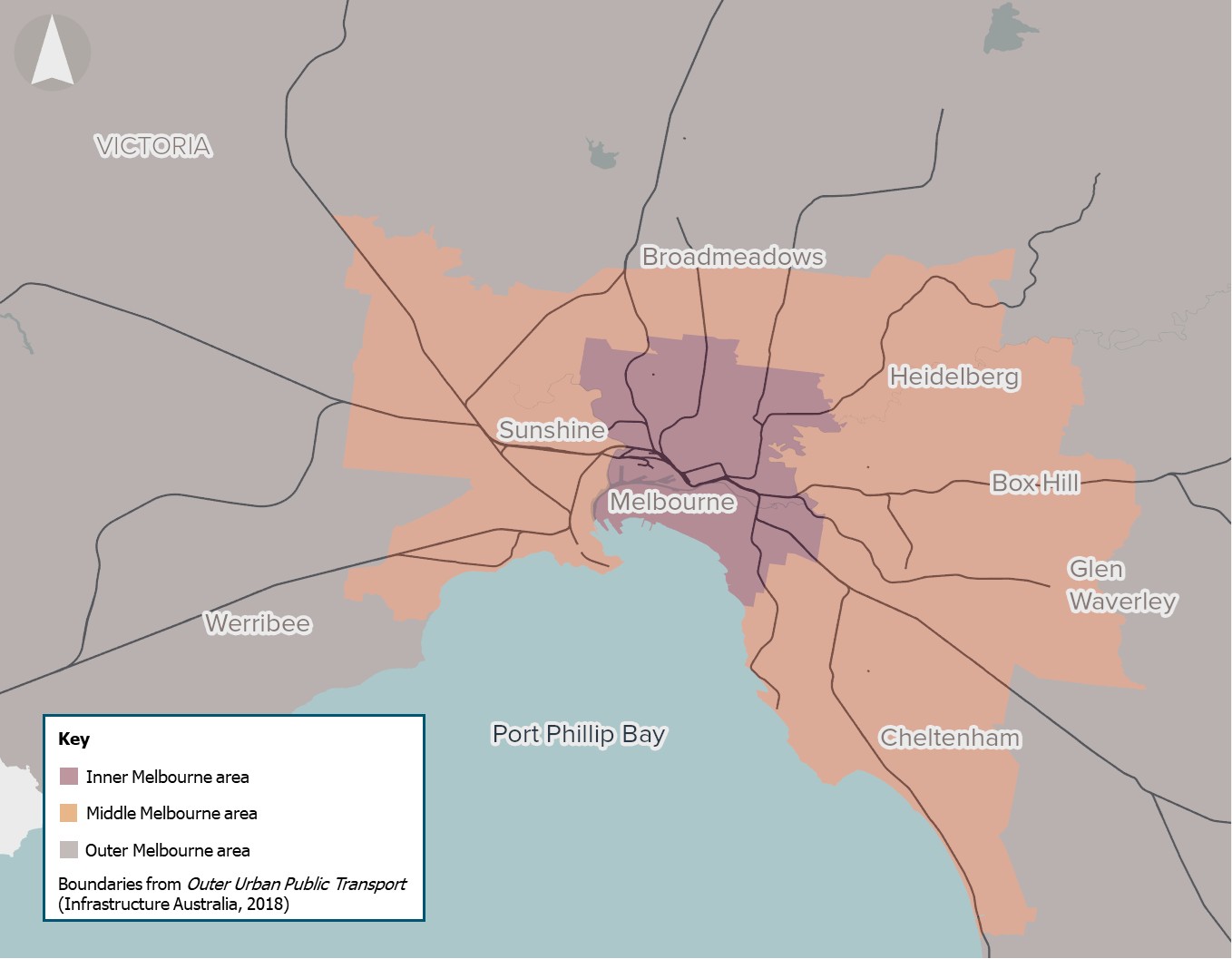

Image source: infrastructureaustralia.gov.au

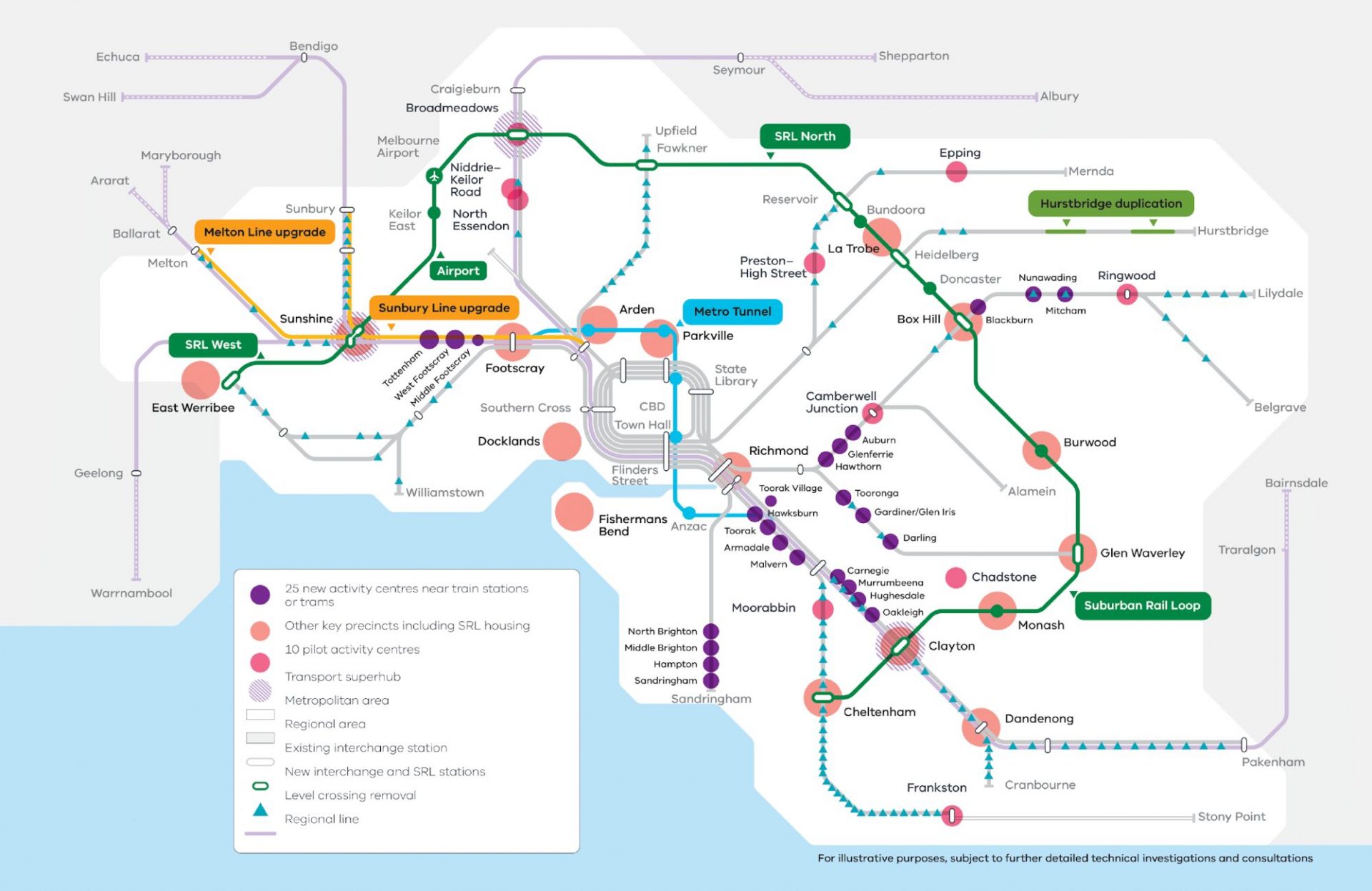

Impact of Infrastructure Developments

The introduction of high-density zoning around Melbourne’s new suburban rail loop stations exemplifies how targeted infrastructure can reshape property markets. By enabling mixed-use developments within a 1.6-kilometer radius, these zones integrate residential, commercial, and recreational spaces, fostering vibrant, self-sustaining communities. This approach not only enhances livability but also creates a multiplier effect on property values, as proximity to amenities becomes a key driver of demand.

A critical mechanism behind this transformation is the Victorian government’s strategic use of development contribution plans (DCPs). These frameworks ensure that infrastructure funding aligns with projected population growth, mitigating risks of overdevelopment or underutilization. However, the success of such plans depends heavily on precise forecasting and community engagement, as misaligned priorities can lead to inefficiencies or public resistance.

“Infrastructure investments must balance immediate utility with long-term adaptability, ensuring they remain relevant as demographics evolve.”

— Marc Lucas, Managing Director, 151 Property

A case study of the Deer Park Bypass highlights the ripple effects of such projects. Following its completion, suburbs like Caroline Springs experienced property value growth exceeding regional averages, driven by improved connectivity and reduced commute times. Yet, challenges remain: areas with insufficient public transport integration often see diminished returns, underscoring the importance of holistic planning. This nuanced interplay between infrastructure and market dynamics reveals opportunities for investors to capitalize on emerging growth corridors.

Demographic Shifts and Their Influence

The rise of multi-generational households in Melbourne’s outer suburbs is reshaping property demand in ways that traditional metrics often overlook. This demographic shift, driven by cultural preferences and economic necessity, has led to increased demand for larger homes with flexible layouts. Suburbs like Cranbourne and Melton are seeing a surge in developments that cater to this trend, offering properties with additional living spaces or dual-occupancy options.

What sets this trend apart is its impact on community dynamics. Multi-generational living fosters localized economic activity, as families prioritize proximity to schools, healthcare, and retail hubs. This creates a self-reinforcing cycle: as demand for amenities grows, developers respond with targeted investments, further enhancing the area’s appeal. However, the success of such developments hinges on nuanced urban planning that balances density with livability.

“Understanding the interplay between cultural shifts and housing preferences is key to unlocking sustainable growth in emerging suburbs.”

— Dr. Sarah Lin, Urban Sociologist, University of Melbourne

A case study in Rockbank highlights this dynamic. The introduction of family-oriented housing projects, combined with community-driven initiatives like local markets, has resulted in a 15% increase in property values over three years. This underscores the importance of aligning housing strategies with evolving demographic profiles, rather than relying solely on infrastructure upgrades.

Spotlight on Promising Suburbs

Coburg and Reservoir are redefining Melbourne’s middle-ring potential, leveraging a unique blend of affordability, infrastructure connectivity, and lifestyle appeal. According to the Australian Bureau of Statistics, Coburg’s median house price rose by 4.8% in the past year, driven by its proximity to the Upfield train line and the Merri Creek Trail, which enhance both commuter convenience and recreational opportunities. Reservoir, meanwhile, has seen a 5.2% increase in rental yields, attributed to its gentrification and the extension of the Plenty Road tram line, which has significantly improved access to the CBD.

A critical yet underappreciated factor in these suburbs’ growth is their alignment with Melbourne’s “20-minute neighborhood” planning framework. This concept prioritizes access to essential services within a 20-minute walk or cycle, fostering self-sufficient communities. For instance, Coburg’s Pentridge redevelopment integrates residential, retail, and cultural spaces, creating a micro-economy that attracts diverse demographics.

These examples challenge the misconception that inner-city proximity is the sole driver of value, highlighting how strategic urban planning can unlock untapped potential in middle-ring suburbs.

Image source: abc.net.au

Case Study: Werribee’s Growth Trajectory

Werribee’s transformation exemplifies how targeted, community-centric infrastructure investments can redefine suburban growth. Unlike rapid, large-scale developments, Werribee’s trajectory is shaped by incremental yet strategic enhancements, such as the integration of shared-use paths and pedestrian-friendly urban planning. These initiatives not only improve accessibility but also foster a sense of place, encouraging both residential and commercial activity.

A key driver of this growth is the alignment of infrastructure upgrades with local needs. For instance, the Werribee River Shared Trail Strategy, supported by Melton and Wyndham City Councils, has prioritized the creation of open space corridors and pedestrian connections. This approach enhances recreational opportunities while preserving environmental assets, directly contributing to property value appreciation. Evidence from the Growth Areas Infrastructure Contribution Scheme (GAIC) highlights how such projects attract long-term investment by balancing urban expansion with ecological sustainability.

“Infrastructure investments must balance immediate utility with long-term adaptability, ensuring they remain relevant as demographics evolve.”

— Marc Lucas, Managing Director, 151 Property

What sets Werribee apart is its focus on integrating natural and built environments. By leveraging tools like Public Acquisition Overlays to secure land for public use, the suburb ensures that growth remains inclusive and sustainable. This model challenges the assumption that high-density urbanization is the sole path to value creation, offering a replicable framework for other emerging suburbs.

Carrum Downs: A Rising Star

Carrum Downs exemplifies how incremental, community-focused enhancements can drive sustainable property market growth. Unlike suburbs reliant on high-profile infrastructure projects, its evolution is rooted in the steady improvement of local amenities and services. Recent upgrades to public transport routes and the expansion of educational facilities have significantly enhanced livability, attracting young families and long-term renters. This gradual transformation underscores the importance of cumulative, localized changes in shaping property value trajectories.

A critical factor in Carrum Downs’ appeal is its ability to balance affordability with accessibility. Comparative analysis reveals that while neighboring suburbs often experience price volatility due to speculative investments, Carrum Downs maintains a stable growth pattern. This stability is bolstered by its relatively low median property price of $621,500, which positions it as an attractive entry point for first-time buyers and investors alike.

“The interplay between affordability and incremental community upgrades creates a unique value proposition for Carrum Downs, making it a standout in Melbourne’s outer suburbs.”

— Kate Ashmor, Victorian Conveyancing Lawyer

However, challenges such as zoning restrictions and limited high-density housing options could constrain future growth. Addressing these limitations through strategic urban planning will be essential to sustaining its upward trajectory. This nuanced dynamic highlights Carrum Downs as a model for balanced, long-term suburban development.

Investment Strategies for Emerging Markets

Identifying opportunities in Melbourne’s emerging property markets requires a nuanced approach that integrates data-driven insights with on-the-ground observations. A key strategy involves targeting suburbs where infrastructure investments align with demographic shifts, creating a multiplier effect on property values. For instance, areas benefiting from the $50 billion Suburban Rail Loop project have seen land values increase by up to 12% within a 1.5-kilometer radius, according to the Victorian Department of Transport.

Another critical tactic is leveraging the concept of land-to-asset ratio, which measures the proportion of land value relative to the total property price. Properties in growth corridors like Pakenham often exhibit higher ratios, signaling untapped potential for capital appreciation as urban sprawl continues. This metric, often overlooked by novice investors, provides a predictive edge in identifying undervalued assets.

Contrary to popular belief, emerging markets are not solely defined by affordability. As Dr. Sarah Lin, Urban Sociologist at the University of Melbourne, explains, “Cultural and lifestyle factors, such as proximity to community hubs, often outweigh price considerations in driving long-term demand.” This insight underscores the importance of evaluating non-financial indicators, such as planned recreational spaces or school expansions, which can catalyze gentrification.

By combining technical metrics with qualitative assessments, investors can uncover opportunities that remain invisible to those relying solely on traditional market indicators. This dual approach not only mitigates risk but also positions stakeholders to capitalize on Melbourne’s evolving suburban landscape.

Image source: thepropertytribune.com.au

Maximizing Returns in Undervalued Areas

Identifying undervalued areas with high growth potential requires a focus on micro-market dynamics rather than broad market trends. One critical yet often overlooked factor is the role of incremental infrastructure upgrades, such as the addition of local bus routes or minor road expansions. These changes, while less publicized than large-scale projects, can significantly enhance accessibility and livability, creating a ripple effect on property demand.

A detailed analysis of Melbourne’s outer suburbs reveals that areas with targeted, small-scale improvements often experience faster value appreciation compared to regions relying solely on major infrastructure investments. For example, a study by the Victorian Department of Transport found that suburbs with new feeder bus services saw property values increase by 8% within two years, outperforming citywide averages. This demonstrates the importance of identifying localized enhancements that directly address residents’ daily needs.

“Localized infrastructure upgrades often act as catalysts for growth, unlocking hidden value in ways that broader metrics fail to capture.”

— Dr. Sarah Lin, Urban Sociologist, University of Melbourne

However, the effectiveness of these upgrades depends on contextual factors such as existing population density and connectivity gaps. Investors must also consider potential limitations, such as delayed community adoption or insufficient integration with larger transport networks. By combining granular data analysis with on-the-ground observations, investors can uncover opportunities that align with both immediate demand and long-term growth trajectories.

Navigating Market Dynamics and Risks

A critical yet underexplored aspect of navigating Melbourne’s emerging property markets is the role of risk-adjusted investment timing. This concept emphasizes aligning entry points with infrastructure rollouts and demographic shifts, rather than relying solely on historical growth patterns. By focusing on the interplay between these factors, investors can mitigate exposure to volatility while maximizing returns.

One effective methodology involves analyzing Infrastructure Accessibility Index (IAI) scores in conjunction with projected population density changes. For instance, suburbs with moderate IAI scores but high forecasted population growth often present opportunities for early-stage investment. However, timing is crucial; entering too early risks prolonged holding periods, while late entry may erode profit margins due to inflated prices.

A case study of Melbourne’s northern growth corridor highlights this dynamic. In 2023, investors who acted on early-stage planning approvals for feeder bus networks in Craigieburn achieved a 9% annualized return by 2025, outperforming citywide averages. This underscores the importance of monitoring planning applications and community engagement initiatives to anticipate market shifts.

“Risk management in emerging markets hinges on understanding the nuanced relationship between infrastructure and demographic evolution.”

— Dr. Sarah Lin, Urban Sociologist, University of Melbourne

Ultimately, this approach demands a balance of technical analysis and local expertise, ensuring investments align with both market potential and practical realities.

FAQ

What are the key factors driving property value growth in Melbourne’s hidden gem suburbs for 2025?

The property value growth in Melbourne’s hidden gem suburbs for 2025 is driven by a synergy of infrastructure upgrades, demographic shifts, and affordability. Strategic projects like the Suburban Rail Loop enhance connectivity, making these areas more accessible. Population growth, particularly among young families and professionals, increases demand for housing in well-connected yet affordable suburbs. Additionally, proximity to employment hubs, schools, and lifestyle amenities amplifies desirability. Government incentives and urban planning initiatives further catalyze development, ensuring sustainable growth. These factors collectively position emerging suburbs as high-potential investment zones, aligning with Melbourne’s broader urban expansion and economic resilience strategies.

How do infrastructure projects influence the potential of emerging suburbs in Melbourne?

Infrastructure projects significantly enhance the potential of emerging suburbs in Melbourne by improving accessibility, reducing commute times, and fostering economic activity. Developments like the Suburban Rail Loop and Metro Tunnel create direct connections between suburbs, boosting their appeal to both residents and investors. These projects also attract businesses, increasing local employment opportunities and driving demand for housing. Additionally, upgrades to schools, healthcare, and recreational facilities elevate livability, making these areas more desirable. By aligning with demographic trends and urban planning goals, infrastructure investments act as catalysts for sustained property value growth in Melbourne’s hidden gem suburbs.

Which demographic trends are shaping the demand for properties in Melbourne’s up-and-coming suburbs?

Demographic trends shaping demand in Melbourne’s up-and-coming suburbs include the influx of young families seeking affordable housing with access to quality schools and amenities. Millennials, prioritizing walkability and proximity to public transport, are driving interest in well-connected areas. Additionally, the rise of multi-generational households is increasing demand for larger homes with flexible layouts. Population growth fueled by interstate migration and international arrivals further amplifies housing needs. Retirees downsizing to age-friendly, low-maintenance properties near healthcare and lifestyle facilities also contribute to this demand. These evolving preferences align with Melbourne’s urban planning strategies, solidifying the growth potential of emerging suburbs.

What are the top indicators to identify undervalued suburbs with high growth potential in Melbourne?

Top indicators for identifying undervalued suburbs with high growth potential in Melbourne include planned infrastructure upgrades, such as new transport links or road developments, which enhance connectivity and accessibility. Low property supply combined with rising demand signals untapped opportunities, while increasing rental yields indicate strong tenant interest. Proximity to growing suburbs often predicts spillover growth, especially when paired with emerging amenities like schools, shopping centers, and healthcare facilities. Gentrification markers, such as new cafes and retail spaces, also highlight evolving desirability. Monitoring council planning applications and demographic shifts ensures a data-driven approach to uncovering Melbourne’s next high-growth investment hotspots.

How do Melbourne’s hidden gem suburbs compare to established areas in terms of investment opportunities?

Melbourne’s hidden gem suburbs often outperform established areas in investment opportunities due to their affordability, higher land-to-asset ratios, and untapped growth potential. While established areas offer stability and consistent demand, hidden gems benefit from infrastructure projects, gentrification, and demographic shifts, driving rapid value appreciation. These emerging suburbs typically provide stronger rental yields and lower entry costs, appealing to first-time investors and young families. Additionally, government incentives and urban planning initiatives often prioritize these areas, enhancing their long-term prospects. By identifying undervalued locations with strategic growth drivers, investors can achieve higher returns compared to Melbourne’s more saturated, established markets.