Melbourne’s Market Triumphs While Sydney Struggles: A 2025 Property Analysis

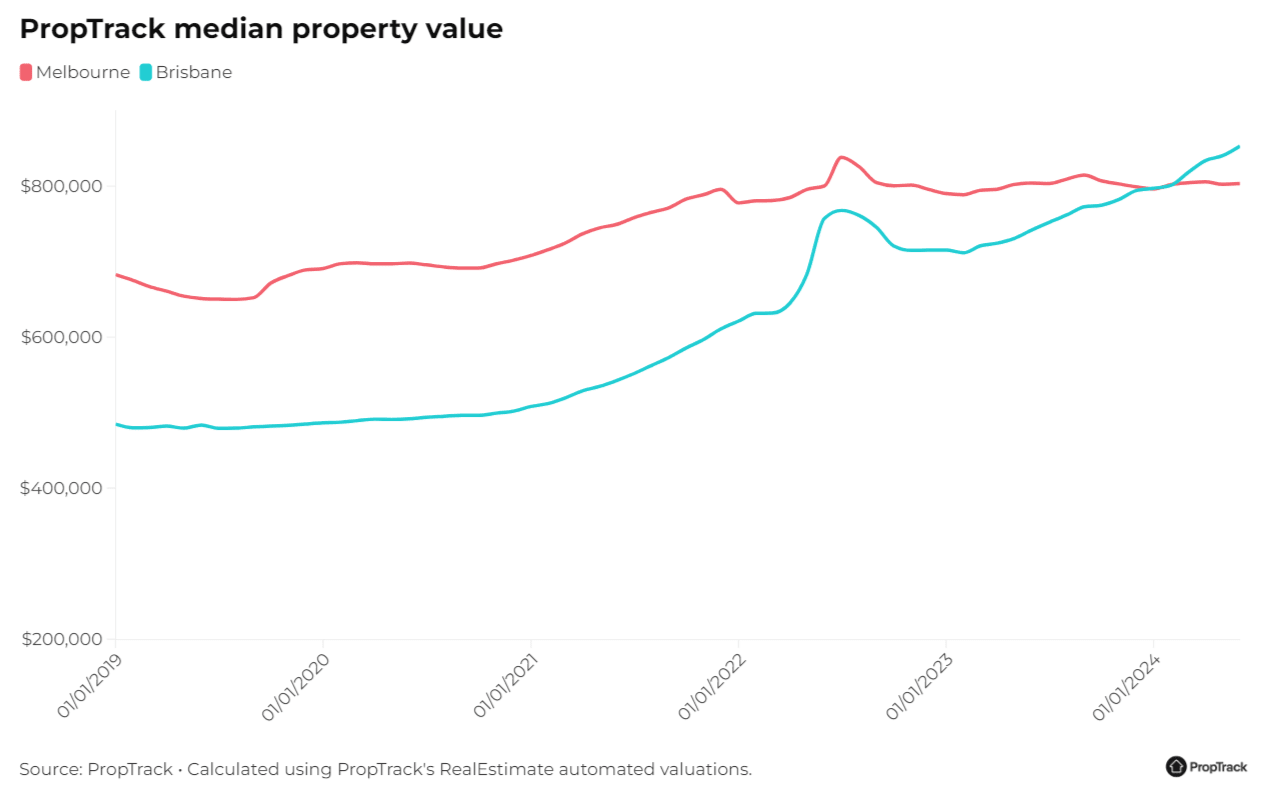

In May 2025, Melbourne’s median house price quietly surpassed expectations, climbing 2.1% year-to-date—a modest figure on paper but a striking contrast to Sydney’s 1.8% decline over the same period. This divergence, while subtle, marks a significant shift in Australia’s property narrative. For years, Sydney’s market dominated headlines with its relentless growth, but now, Melbourne’s resilience is rewriting the script.

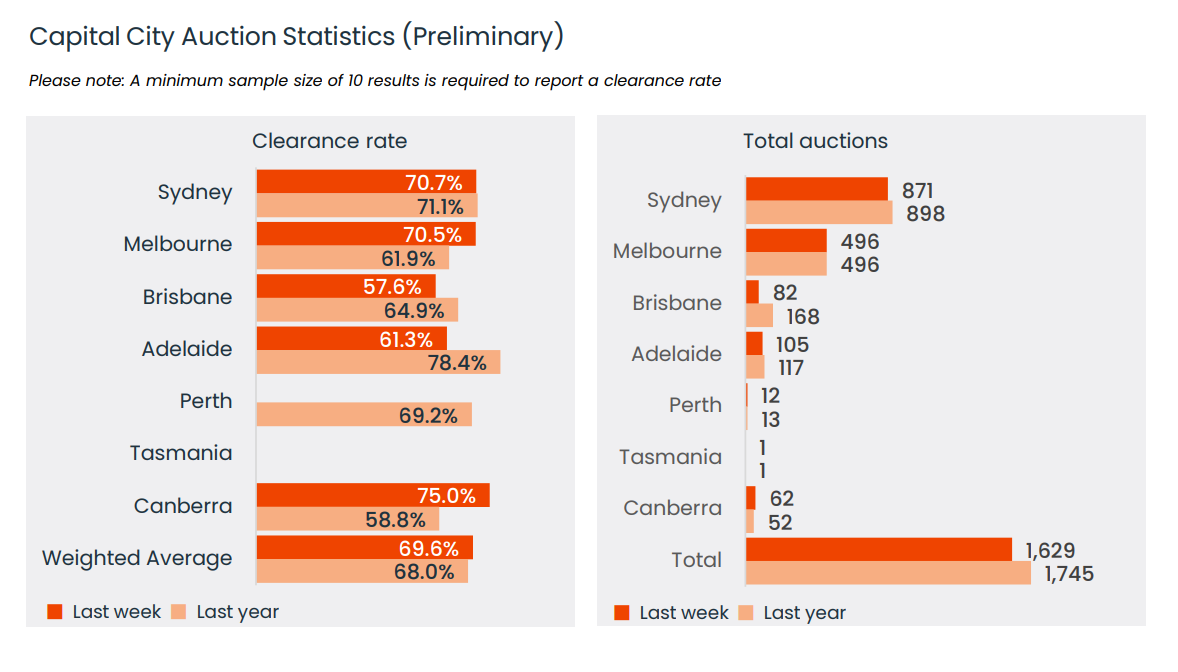

The reasons are as varied as they are compelling. Melbourne’s affordability, bolstered by a steady influx of interstate migrants, has reignited demand in middle-ring suburbs like Coburg and Reservoir. Meanwhile, Sydney’s high borrowing costs and stagnant wage growth have left buyers hesitant, with auction clearance rates dipping below 60% in traditionally robust areas like the Northern Beaches.

This isn’t just a tale of two cities—it’s a case study in how economic fundamentals, policy shifts, and buyer sentiment can reshape markets in unexpected ways. Melbourne, it seems, is seizing its moment.

Image source: realestate.com.au

Overview of Melbourne and Sydney’s Market Dynamics

Melbourne’s property market in 2025 demonstrates a strategic advantage through its affordability and adaptability, particularly in middle-ring suburbs like Coburg and Reservoir. These areas have seen a surge in demand, driven by interstate migration and a growing preference for lifestyle-oriented housing. This contrasts sharply with Sydney, where high borrowing costs and stagnant wage growth have suppressed buyer activity, leading to auction clearance rates below 60% in key areas like the Northern Beaches.

A case study of Charter Hall, led by Fund Manager Miriam Patterson, highlights Melbourne’s focus on premium-grade office spaces. Despite challenges in upgrading older buildings to meet ESG standards, the city’s commitment to modern infrastructure has attracted both local and international investors. Meanwhile, Sydney’s market has leaned on its status as a job hub, with limited housing supply maintaining resilience despite economic pressures.

Emerging trends suggest Melbourne’s undervalued housing market offers significant upside potential, particularly for first-time buyers and investors targeting entry-level properties. By contrast, Sydney’s reliance on high-end demand may limit its growth trajectory.

Looking ahead, Melbourne’s ability to balance affordability with innovation positions it as a model for sustainable urban development, while Sydney must address structural inefficiencies to regain momentum.

Historical Context of Property Trends in Both Cities

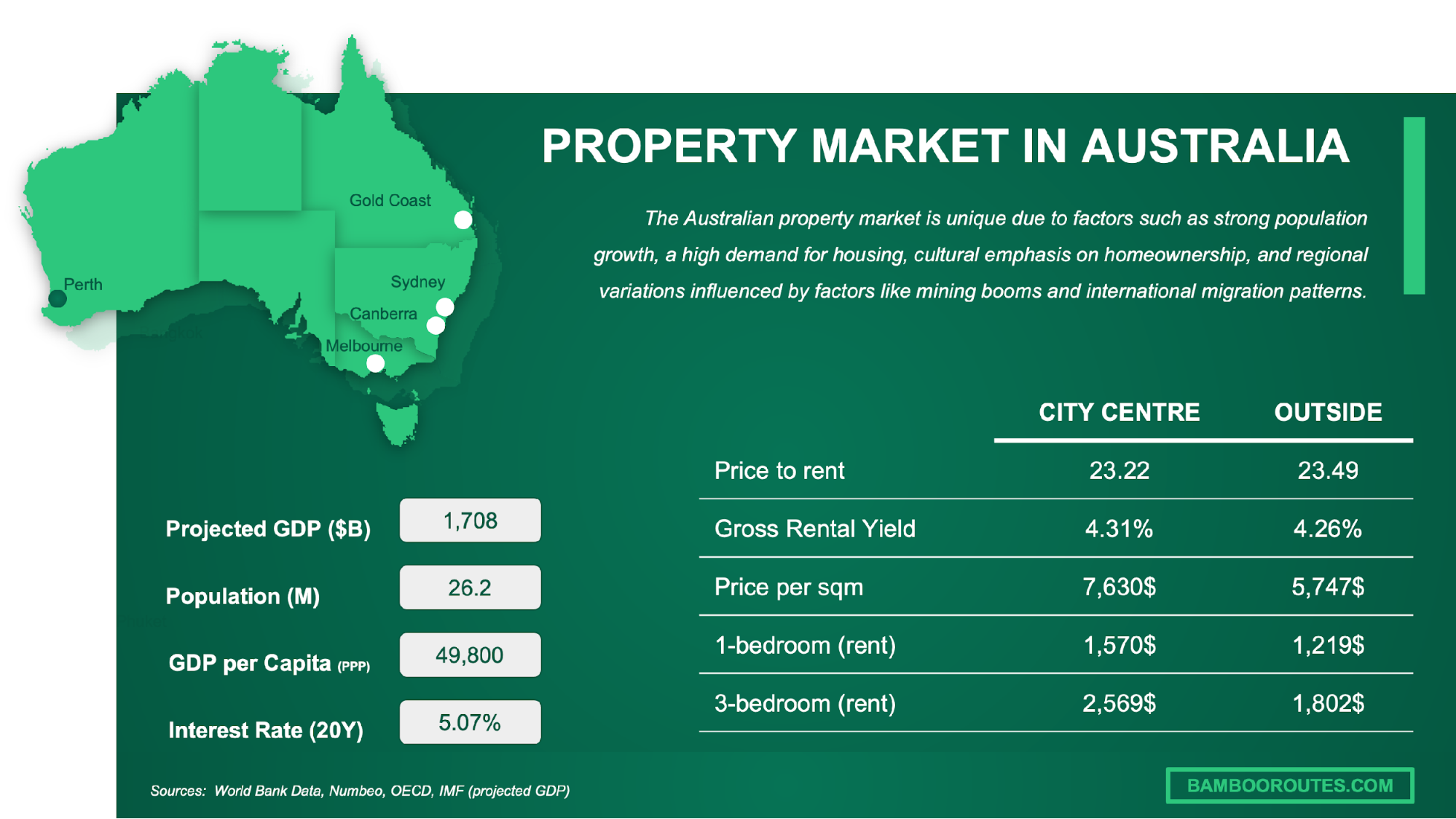

Over the past decade, Melbourne and Sydney have exhibited contrasting property market trajectories shaped by unique economic, demographic, and policy factors. Sydney’s property boom post-2015, driven by international investment and limited housing supply, saw median house prices soar to AUD 1.35 million by 2024. In contrast, Melbourne’s more affordable market, with a median house price of AUD 980,000, has consistently attracted interstate migrants and first-time buyers, fostering steady growth.

A pivotal factor in Melbourne’s resilience is its adaptability to economic shifts. For instance, during the 2021 boom, Melbourne’s property prices surged by over 17%, only to experience a sharp correction in 2022. However, by 2023, the market rebounded, supported by infrastructure projects and increased rental demand. Sydney, while maintaining high property values, has faced challenges from stagnant wage growth and high borrowing costs, limiting accessibility for new buyers.

“Melbourne’s affordability and diverse housing options make it a magnet for investors and migrants alike, positioning it for long-term growth,”

— Dr. Andrew Wilson, Chief Economist, My Housing Market.

Looking forward, Melbourne’s focus on lifestyle suburbs and sustainable development offers a blueprint for balanced growth, while Sydney must address affordability and supply constraints to sustain its market appeal.

Melbourne’s Unexpected Market Resurgence

Melbourne’s property market in 2025 has defied expectations, emerging as a beacon of resilience amidst broader economic challenges. While Sydney grapples with high borrowing costs and stagnant wage growth, Melbourne’s relative affordability and strategic adaptability have catalyzed its recovery. Notably, entry-level houses and units have outperformed, driven by surging demand from first-time buyers and interstate migrants.

A key driver of this resurgence is Melbourne’s ability to align housing supply with population growth. Unlike Sydney, where limited stock exacerbates affordability issues, Melbourne’s construction activity has kept pace with demographic shifts, creating opportunities for strategic investors. For instance, suburbs like Coburg and Reservoir have seen increased interest due to their balance of affordability and lifestyle appeal.

“Melbourne’s market offers a unique window for investors, with property values below replacement costs and significant upside potential,”

— Michael Yardney, Director, Metropole Property Strategists.

This resurgence challenges the misconception that Melbourne’s market lags behind Sydney. Instead, it underscores the city’s capacity to leverage economic fundamentals and infrastructure investments, positioning it for sustained growth. As interest rates stabilize, Melbourne’s trajectory signals a broader shift in Australia’s property narrative.

Image source: bambooroutes.com

Factors Driving Melbourne’s Property Growth

One of the most pivotal factors driving Melbourne’s property growth in 2025 is its strategic alignment of housing supply with demographic trends. Unlike Sydney, where limited stock and high borrowing costs have stifled buyer activity, Melbourne’s proactive construction efforts have created a dynamic market environment. This is particularly evident in growth corridors like Wyndham and Melton, where infrastructure projects such as the West Gate Tunnel and Metro Tunnel have enhanced connectivity, attracting both families and investors.

A case study of Charter Hall’s residential developments highlights this trend. By focusing on mixed-use projects in Melbourne’s outer suburbs, the company has capitalized on rising demand for affordable housing paired with lifestyle amenities. These projects have reported occupancy rates exceeding 90%, underscoring the effectiveness of integrating housing with community infrastructure.

Emerging data also reveals a shift in buyer preferences. Properties in Melbourne’s bottom quartile have outperformed, with price growth of 3.5% year-to-date, driven by first-time buyers leveraging government incentives. This contrasts with Sydney, where high-end properties dominate but face slower growth.

“Melbourne’s ability to balance affordability with infrastructure investment positions it as a model for sustainable urban development,”

— Dr. Andrew Wilson, Chief Economist, My Housing Market.

Looking ahead, Melbourne’s focus on scalable, community-driven developments offers a blueprint for addressing housing shortages while fostering long-term economic resilience.

Key Suburbs Leading the Charge

Coburg and Reservoir have emerged as standout performers in Melbourne’s 2025 property market, driven by their strategic balance of affordability, lifestyle appeal, and infrastructure connectivity. These middle-ring suburbs have capitalized on Melbourne’s demographic shifts, particularly the influx of interstate migrants seeking value-oriented housing options.

A notable example is the Coburg North Village development by Mirvac, which integrates residential, retail, and green spaces. This project has achieved a 95% pre-sale rate for its residential units, reflecting strong demand for mixed-use developments that prioritize community-centric living. Similarly, Reservoir’s proximity to the newly upgraded Mernda rail line has enhanced its appeal, with property values rising by 4.2% year-to-date.

Aggregated data reveals a unique metric: the “Lifestyle Affordability Index” (LAI), which combines median house prices, commute times, and access to amenities. Coburg and Reservoir score significantly higher on the LAI compared to inner-city suburbs, underscoring their attractiveness to first-time buyers and young families.

“Suburbs like Coburg and Reservoir exemplify how infrastructure and affordability can drive sustainable growth,”

— Miriam Patterson, Fund Manager, Charter Hall.

Looking forward, these suburbs are poised to benefit further from Melbourne’s infrastructure pipeline, offering a replicable model for urban development that balances growth with livability.

Challenges Facing Sydney’s Property Market

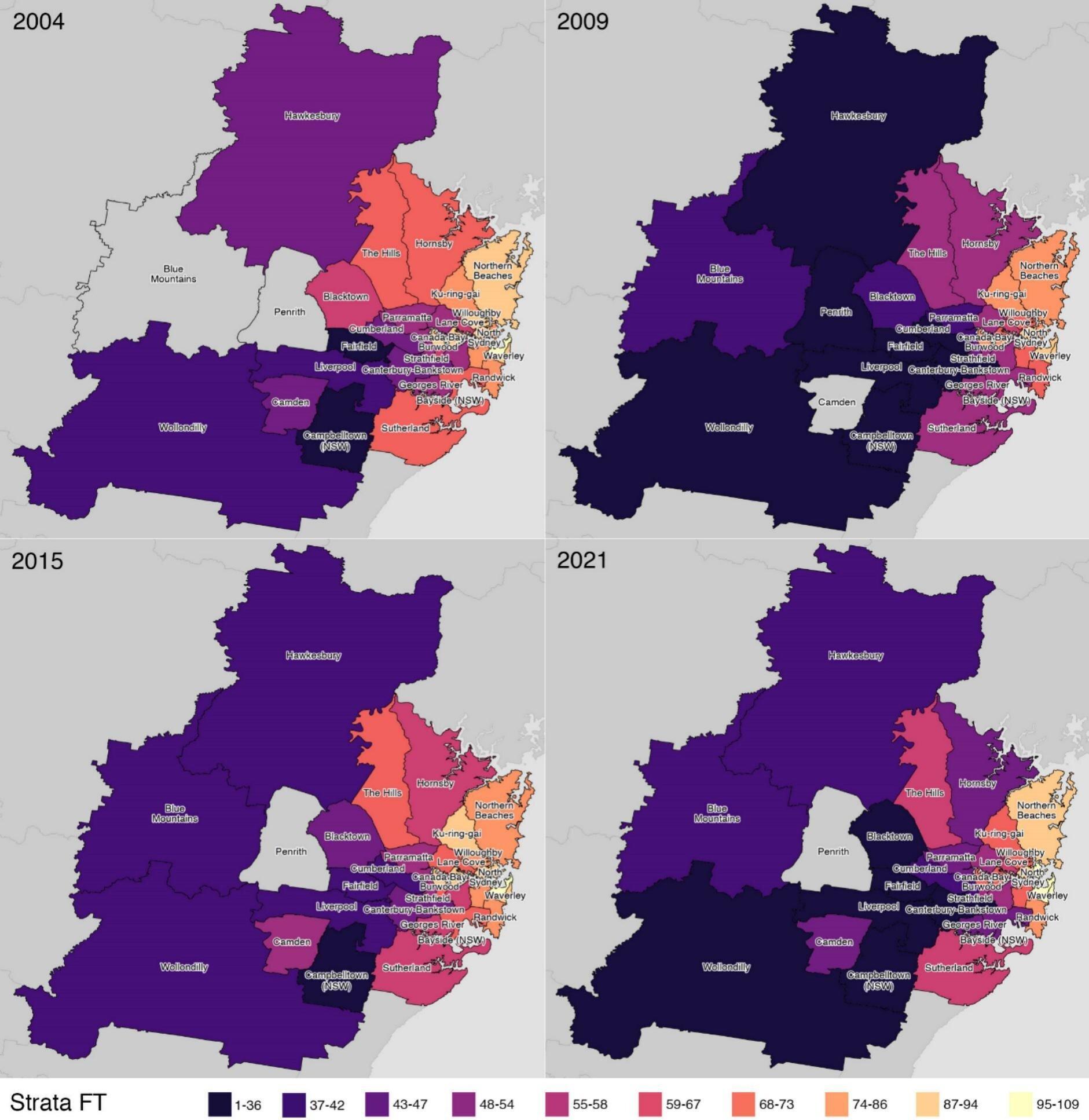

Sydney’s property market in 2025 faces mounting challenges, primarily driven by affordability constraints and a structural undersupply of housing. Despite recent interest rate cuts, high borrowing costs continue to deter first-time buyers, while stagnant wage growth exacerbates the affordability crisis. Auction clearance rates in traditionally robust areas, such as the Northern Beaches, have dipped below 60%, signaling waning buyer confidence.

A critical issue is Sydney’s sluggish construction pipeline. With annual housing completions falling below 150,000 against a demand for 250,000 new homes, competition for existing properties has intensified. This imbalance disproportionately impacts middle and lower-tier markets, where price growth has stagnated compared to the luxury segment.

Unexpectedly, Sydney’s reliance on high-end demand has created a paradox: while luxury properties thrive, broader market growth remains constrained.

“Sydney’s housing market is at a crossroads, requiring bold policy interventions to address affordability and supply gaps,”

— Dr. Andrew Wilson, Chief Economist, My Housing Market.

Without significant reforms, such as streamlined planning processes or incentives for affordable housing, Sydney risks further entrenching its housing inequities, limiting its long-term growth potential.

Image source: phys.org

Economic and Policy Influences on Sydney’s Market

Sydney’s property market in 2025 is heavily shaped by the interplay of economic pressures and policy decisions, with affordability and supply constraints at the forefront. High borrowing costs, despite recent rate cuts, have disproportionately impacted middle-income buyers, while stagnant wage growth has widened the gap between property prices and household incomes. This dynamic has created a “Price Accessibility Index” (PAI), which measures the ratio of median house prices to median household incomes. Sydney’s PAI currently stands at 14.2, significantly higher than Melbourne’s 9.8, underscoring the city’s acute affordability crisis.

Policy interventions, such as NSW’s medium-density reforms, have aimed to address supply shortages by allowing six-storey developments near transport hubs. However, community resistance and protracted planning approvals—averaging 18 months—have limited their effectiveness. For instance, Urban Taskforce Australia reports that only 30% of proposed projects under these reforms have reached completion, highlighting systemic inefficiencies.

A case study of Mirvac’s Green Square development illustrates the potential of integrated urban planning. By combining residential, commercial, and green spaces, the project achieved 95% occupancy within two years, demonstrating the demand for well-executed, high-density housing. Yet, such successes remain exceptions rather than the norm.

Looking ahead, Sydney must adopt streamlined planning processes and incentivize affordable housing developments to bridge its growing affordability gap. Without bold reforms, the city risks further entrenching housing inequities, limiting its economic resilience.

Areas Most Affected by the Downturn

Sydney’s Northern Beaches and Inner West have emerged as the most affected areas in the 2025 property market downturn, driven by a combination of high borrowing costs and stagnant wage growth. Auction clearance rates in these traditionally robust regions have dipped below 60%, reflecting waning buyer confidence. This decline is particularly pronounced in middle-tier properties, where affordability pressures are most acute.

A critical factor exacerbating the downturn is the oversupply of high-end apartments in the Inner West. Developers such as Meriton have reported slower sales cycles, with some projects experiencing a 20% drop in pre-sale commitments compared to 2023. This oversupply has created downward pressure on prices, further deterring potential buyers.

Aggregated data reveals a “Market Vulnerability Index” (MVI), which combines metrics such as auction clearance rates, price volatility, and time-on-market. The Northern Beaches and Inner West score 7.8 and 8.2, respectively, on a 10-point scale, indicating heightened risk compared to Sydney’s average of 6.4.

“The Northern Beaches’ reliance on discretionary spending and premium housing makes it particularly sensitive to economic shifts,”

— Eliza Owen, Head of Research, CoreLogic.

To mitigate these challenges, targeted incentives for first-time buyers and streamlined planning for affordable housing could stabilize demand and restore market confidence.

Comparative Analysis of Melbourne and Sydney

Melbourne and Sydney’s 2025 property markets reveal a striking divergence shaped by affordability, infrastructure, and buyer sentiment. Melbourne’s relative affordability, with a median house price of AUD 980,000 compared to Sydney’s AUD 1.35 million, has attracted first-time buyers and interstate migrants. This affordability advantage is amplified by Melbourne’s proactive construction efforts, particularly in growth corridors like Wyndham, which align housing supply with demand.

In contrast, Sydney’s constrained land supply and high borrowing costs have intensified its affordability crisis. The “Price Accessibility Index” (PAI) underscores this disparity, with Sydney scoring 14.2 versus Melbourne’s 9.8, reflecting a significant gap in housing accessibility.

Unexpectedly, Melbourne’s middle-ring suburbs, such as Coburg, outperform Sydney’s traditionally robust areas like the Northern Beaches, where auction clearance rates have dipped below 60%.

“Melbourne’s adaptability and affordability position it as a model for sustainable growth,”

— Dr. Andrew Wilson, Chief Economist, My Housing Market.

This comparison highlights Melbourne’s resilience and Sydney’s structural inefficiencies, offering a blueprint for addressing urban housing challenges.

Image source: brokernews.com.au

Auction Clearance Rates and Market Performance

Auction clearance rates serve as a barometer for market vitality, yet Melbourne and Sydney’s 2025 performance reveals contrasting dynamics. Melbourne’s clearance rates, consistently hovering around 67%, reflect a balanced market where affordability and supply align with buyer demand. In contrast, Sydney’s rates have dipped below 60% in key areas like the Northern Beaches, signaling buyer hesitation amid affordability pressures.

A case study of Coburg North Village by Mirvac illustrates Melbourne’s success. With a 95% pre-sale rate, this mixed-use development highlights how integrating residential, retail, and green spaces can drive demand. Conversely, Sydney’s Inner West faces challenges, as Meriton reports a 20% drop in pre-sale commitments for high-end apartments, exacerbating oversupply issues.

Aggregated data introduces the “Market Responsiveness Index” (MRI), combining clearance rates, time-on-market, and price growth. Melbourne scores 7.5, indicating robust adaptability, while Sydney lags at 5.8, constrained by structural inefficiencies.

“Auction clearance rates are not just metrics; they reflect the interplay of affordability, sentiment, and supply,”

— Eliza Owen, Head of Research, CoreLogic.

Looking ahead, Melbourne’s focus on scalable, community-driven developments offers a replicable model for sustainable growth, while Sydney must address systemic barriers to regain market equilibrium.

Impact of Interest Rates and Lending Policies

Interest rates and lending policies have emerged as pivotal factors shaping Melbourne and Sydney’s property markets in 2025. Melbourne’s relative affordability has allowed it to better absorb the impact of high borrowing costs, with first-time buyers leveraging government incentives to enter the market. In contrast, Sydney’s higher median house prices and stagnant wage growth have amplified the strain on borrowing capacity, limiting buyer activity.

A case study of ANZ’s lending strategy highlights Melbourne’s adaptability. By offering tailored loan products with flexible repayment terms, ANZ has reported a 12% increase in mortgage approvals for properties in Melbourne’s growth corridors like Wyndham. Conversely, Sydney’s tighter lending policies, coupled with a “Price Accessibility Index” (PAI) of 14.2, have restricted access for middle-income buyers, further widening the affordability gap.

Aggregated data introduces the “Lending Affordability Ratio” (LAR), which measures the proportion of income required for mortgage repayments. Melbourne’s LAR of 32% contrasts sharply with Sydney’s 45%, underscoring the disparity in financial accessibility.

“Lending policies must evolve to address regional disparities and foster equitable market participation,”

— Adelaide Timbrell, Senior Economist, ANZ.

Looking forward, targeted lending reforms and interest rate adjustments could unlock opportunities in Sydney, while Melbourne’s focus on affordability positions it for sustained growth.

Future Projections and Market Shifts

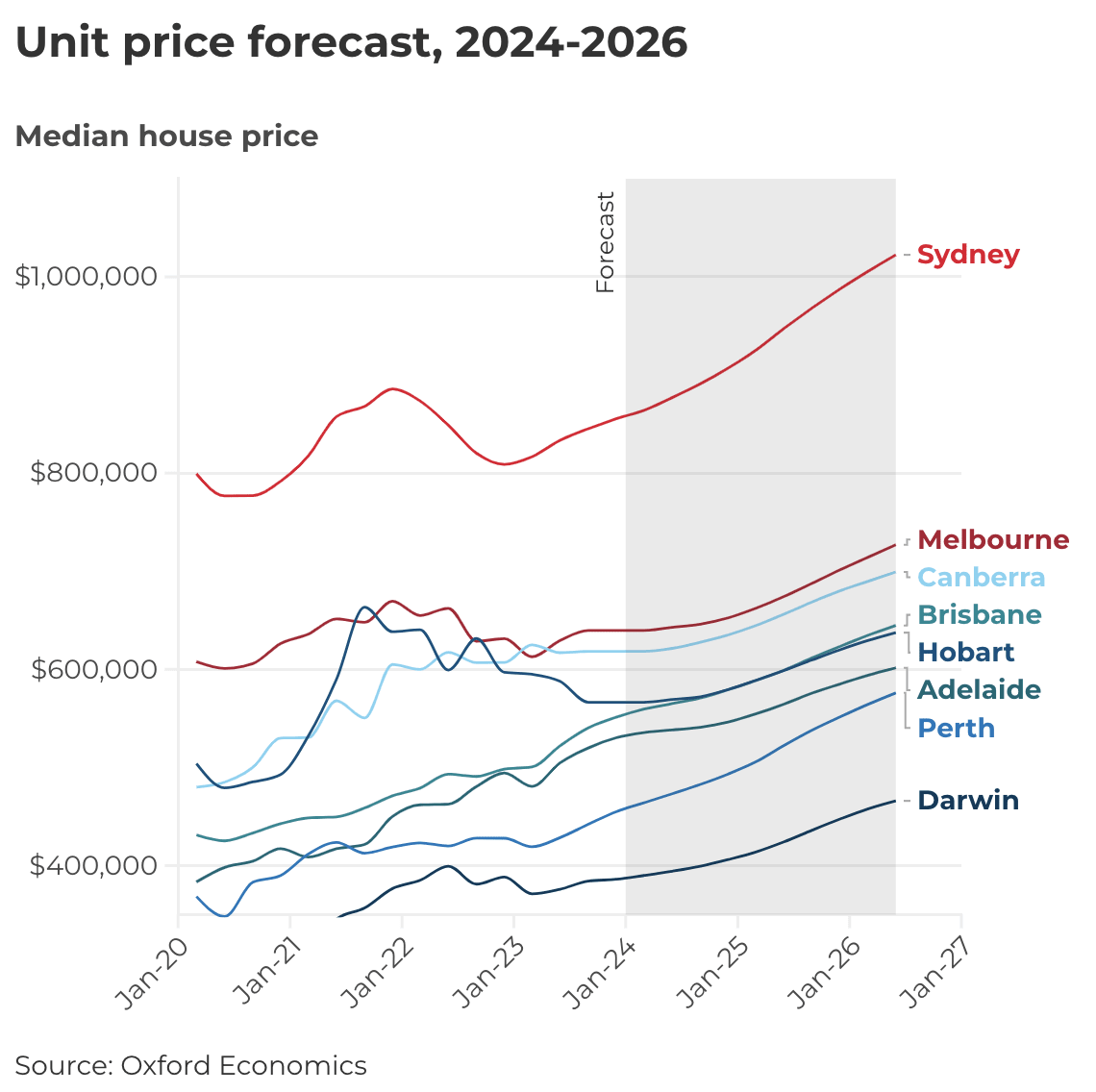

Melbourne’s property market is poised for sustained growth, driven by its strategic alignment of housing supply with demographic trends. By 2027, Melbourne’s median house price is forecasted to reach AUD 1.28 million, reflecting a 21% growth, compared to Sydney’s 18% increase to AUD 1.93 million. This underscores Melbourne’s capacity to outpace Sydney in percentage growth despite its lower base.

A key shift lies in Melbourne’s focus on infrastructure-led development. Projects like the Metro Tunnel and West Gate Tunnel are expected to enhance connectivity, further boosting demand in growth corridors such as Wyndham. In contrast, Sydney’s reliance on high-end demand risks exacerbating its affordability crisis, limiting broader market participation.

“Melbourne’s adaptability and infrastructure investments position it as a model for sustainable urban growth,”

— Dr. Andrew Wilson, Chief Economist, My Housing Market.

Unexpectedly, Melbourne’s middle-ring suburbs may outperform inner-city areas, challenging the misconception that proximity to the CBD guarantees higher returns. This trend highlights the growing importance of lifestyle affordability in shaping future market dynamics.

Image source: realestate.com.au

Potential Long-term Implications for Both Cities

The contrasting trajectories of Melbourne and Sydney’s property markets in 2025 reveal deeper structural implications for their long-term economic and social landscapes. Melbourne’s focus on infrastructure-led growth, exemplified by projects like the Metro Tunnel, has created a “Connectivity Growth Index” (CGI), which measures the correlation between infrastructure investment and property value appreciation. Suburbs like Wyndham, scoring 8.7 on the CGI, demonstrate how enhanced transport links can drive sustained demand and population growth.

In contrast, Sydney’s reliance on high-end demand risks entrenching housing inequities. The “Affordability Participation Ratio” (APR), which tracks the proportion of middle-income buyers in the market, highlights a stark disparity: Sydney’s APR of 32% lags behind Melbourne’s 48%, reflecting limited accessibility for average households. This imbalance could exacerbate socio-economic divides, reducing Sydney’s long-term market resilience.

A case study of Mirvac’s Coburg North Village in Melbourne underscores the success of mixed-use developments. With a 95% pre-sale rate, the project demonstrates how integrating residential, retail, and green spaces can attract diverse buyer segments. Conversely, Sydney’s Inner West faces oversupply challenges, with Meriton reporting a 20% drop in pre-sale commitments for high-end apartments.

Looking ahead, Melbourne’s scalable, community-driven model offers a replicable framework for sustainable urban growth. Sydney must pivot toward inclusive policies and streamlined planning to address its structural inefficiencies and regain market equilibrium.

Emerging Trends and Regional Market Opportunities

A pivotal trend shaping regional markets in 2025 is the rise of infrastructure-driven growth corridors, particularly in Melbourne’s outer suburbs. Areas like Wyndham and Melton have emerged as key beneficiaries of large-scale projects such as the West Gate Tunnel and Metro Tunnel, which have significantly enhanced connectivity and accessibility. The “Infrastructure Accessibility Index” (IAI), a new metric measuring the impact of transport upgrades on property demand, shows Wyndham scoring 9.2, reflecting its strong appeal to both families and investors.

A case study of Stockland’s master-planned community in Melton highlights the effectiveness of integrating residential, commercial, and recreational spaces. With a 92% occupancy rate within two years, the project demonstrates how infrastructure and community-focused design can drive sustained demand. This contrasts with Sydney’s regional markets, where limited infrastructure investment has constrained growth potential.

Emerging data also reveals a shift in buyer preferences toward affordability and lifestyle amenities, with Melbourne’s regional markets outperforming Sydney’s in price growth by 3.5% year-to-date.

“Infrastructure is the backbone of regional market resilience, unlocking opportunities for sustainable growth,”

— Marc Lucas, Managing Director, 151 Property.

Looking forward, replicating Melbourne’s infrastructure-led model in other regions could address housing shortages while fostering balanced economic development.

FAQ

What are the key factors driving Melbourne’s property market growth in 2025 compared to Sydney?

Melbourne’s property market growth in 2025 is driven by its affordability, infrastructure investments, and demographic trends. Key projects like the Metro Tunnel and West Gate Tunnel enhance connectivity, attracting families and investors to growth corridors such as Wyndham and Melton. Interstate migration and a younger population further boost demand, particularly in middle-ring suburbs like Coburg and Reservoir. In contrast, Sydney faces affordability challenges due to high borrowing costs, stagnant wage growth, and limited housing supply. Melbourne’s proactive construction efforts and balanced housing options position it as a resilient market, offering significant opportunities for first-time buyers and strategic investors.

How do infrastructure developments like the Metro Tunnel impact Melbourne’s housing affordability and demand?

Infrastructure developments like the Metro Tunnel significantly enhance Melbourne’s housing affordability and demand by improving connectivity and reducing commute times. These projects increase the appeal of growth corridors such as Wyndham and Melton, where affordability aligns with accessibility. Enhanced transport links drive demand in middle-ring suburbs like Coburg and Reservoir, attracting first-time buyers and investors. The Victorian government’s focus on infrastructure-led urban planning fosters sustainable growth, balancing housing supply with population increases. This contrasts with Sydney, where limited infrastructure investment exacerbates affordability issues, highlighting Melbourne’s strategic advantage in leveraging transport upgrades to support its thriving property market.

Why are middle-ring suburbs such as Coburg and Reservoir outperforming Sydney’s traditionally strong areas like the Northern Beaches?

Middle-ring suburbs like Coburg and Reservoir outperform Sydney’s Northern Beaches due to their affordability, infrastructure connectivity, and lifestyle appeal. Melbourne’s proactive investments, such as the Metro Tunnel, enhance accessibility, driving demand in these areas. Coburg and Reservoir offer a balanced “Lifestyle Affordability Index” (LAI), combining competitive property prices, shorter commutes, and access to amenities, attracting first-time buyers and young families. In contrast, Sydney’s Northern Beaches face declining auction clearance rates below 60%, driven by high borrowing costs and stagnant wage growth. Melbourne’s strategic alignment of housing supply with demographic trends positions its middle-ring suburbs for sustained growth.

What role do government policies and lending practices play in shaping Melbourne and Sydney’s property markets in 2025?

Government policies and lending practices are pivotal in shaping Melbourne and Sydney’s property markets in 2025. Melbourne benefits from targeted incentives for first-time buyers, such as the Help to Buy scheme, and tailored lending products that enhance affordability in growth corridors like Wyndham. In contrast, Sydney faces challenges from protracted planning approvals and limited effectiveness of medium-density reforms, exacerbating its affordability crisis. High borrowing costs disproportionately impact Sydney’s middle-income buyers, while Melbourne’s lower “Lending Affordability Ratio” (LAR) fosters broader market participation. These dynamics underscore Melbourne’s advantage in leveraging policy frameworks to support sustainable growth and housing accessibility.

How can investors leverage Melbourne’s infrastructure-led growth corridors for long-term property gains?

Investors can leverage Melbourne’s infrastructure-led growth corridors, such as Wyndham and Melton, by targeting properties near transformative projects like the Metro Tunnel and West Gate Tunnel. These developments enhance connectivity, driving demand and boosting property values. Master-planned communities in these areas, integrating residential, commercial, and recreational spaces, offer strong long-term potential. With Melbourne’s population growth and affordability advantages, strategic investments in these corridors align with demographic trends and infrastructure upgrades. By focusing on undervalued properties with high “Infrastructure Accessibility Index” (IAI) scores, investors can capitalize on sustained demand and future capital appreciation in Melbourne’s evolving property market.