Melbourne’s Housing Market: Where ‘Affordable’ Now Means Selling a Kidney

In 2023, Melbourne’s median house price reached an astonishing $915,000, according to CoreLogic—more than 12 times the city’s median annual household income. This staggering figure places Melbourne among the least affordable housing markets globally, alongside cities like Hong Kong and Vancouver. Yet, the crisis is not confined to homebuyers. A 2022 report by the Australian Housing and Urban Research Institute revealed that 17% of Melbourne’s key workers—teachers, nurses, and paramedics—were experiencing housing stress, with many forced into overcrowded or substandard accommodations.

The roots of this crisis are deeply entrenched. Decades of restrictive zoning laws, coupled with population growth that surged by over 800,000 between 2011 and 2021, have created a supply-demand imbalance that policy interventions have barely dented. Meanwhile, the 2021 Demographia International Housing Affordability Survey highlighted a grim reality: saving for a 20% deposit on a median-priced home now requires 14 years for an average-income household.

As housing costs spiral, the social fabric of Melbourne is fraying.

Image source: financiallysorted.com.au

Historical Context and Current Trends

The evolution of Melbourne’s housing affordability crisis is deeply tied to the interplay between restrictive zoning policies and shifting demographic patterns. A critical yet underexplored factor is the role of zoning laws that have historically favored low-density residential development, effectively limiting the construction of medium-density housing in areas with high demand. This policy framework, established decades ago, has created a structural bottleneck in housing supply, exacerbating affordability challenges as the city’s population surged.

Comparative analysis reveals that cities like Brisbane, which implemented significant zoning reforms in 2014, experienced a measurable increase in housing stock, particularly in fringe and brownfield areas. In contrast, Melbourne’s reforms have been piecemeal, with limited impact on medium-density housing availability. This disparity underscores the importance of comprehensive zoning adjustments in addressing long-term affordability.

“Restrictive zoning has locked up vast swathes of Melbourne’s suburbs, preventing the market from responding to demand effectively,” notes Bob Birrell, a researcher at the Australian Population Research Institute.

However, even with zoning reforms, challenges persist. The high cost of land acquisition and infrastructure development in inner-city areas limits the feasibility of large-scale affordable housing projects. This highlights the need for integrated strategies that combine zoning changes with financial incentives for developers and public-private partnerships.

Key Metrics: Prices, Incomes, and Ratios

The crux of Melbourne’s housing affordability crisis lies in the widening disparity between property prices and household incomes, encapsulated by the Median Multiple. This metric, which compares median house prices to median annual incomes, has surged to levels exceeding 9 in Melbourne—far above the threshold of 3, which defines affordability. Such ratios highlight a systemic misalignment between wage growth and property market inflation.

A deeper examination reveals that this imbalance is not uniform across the city. In outer suburbs, where housing is ostensibly more affordable, commuting costs and time often negate financial savings. Conversely, inner-city areas exhibit ratios nearing 12, driven by high demand and limited supply. These figures underscore the inadequacy of traditional affordability measures, which fail to account for spatial and socio-economic nuances.

“The affordability crisis is fundamentally a wage-price mismatch, exacerbated by policy inertia and speculative investment,” explains Dr. Virginia Rapson, a housing economist at The Australian Population Research Institute.

This dynamic forces many households into precarious financial positions, with over 40% of income often allocated to housing costs. Addressing this issue requires recalibrating affordability metrics to reflect real-world conditions, enabling policymakers to craft targeted, equitable interventions.

Factors Driving Housing Unaffordability

Melbourne’s housing unaffordability is driven by a confluence of structural and financial dynamics, each amplifying the other’s effects. A critical factor is the city’s sustained population growth, which, according to the Australian Bureau of Statistics, increased by 26% between 2011 and 2021. This surge, fueled by both international immigration and domestic migration, has outpaced housing supply, particularly in high-demand areas with established infrastructure and amenities. The result is a market where demand consistently outstrips supply, inflating property values and rental costs.

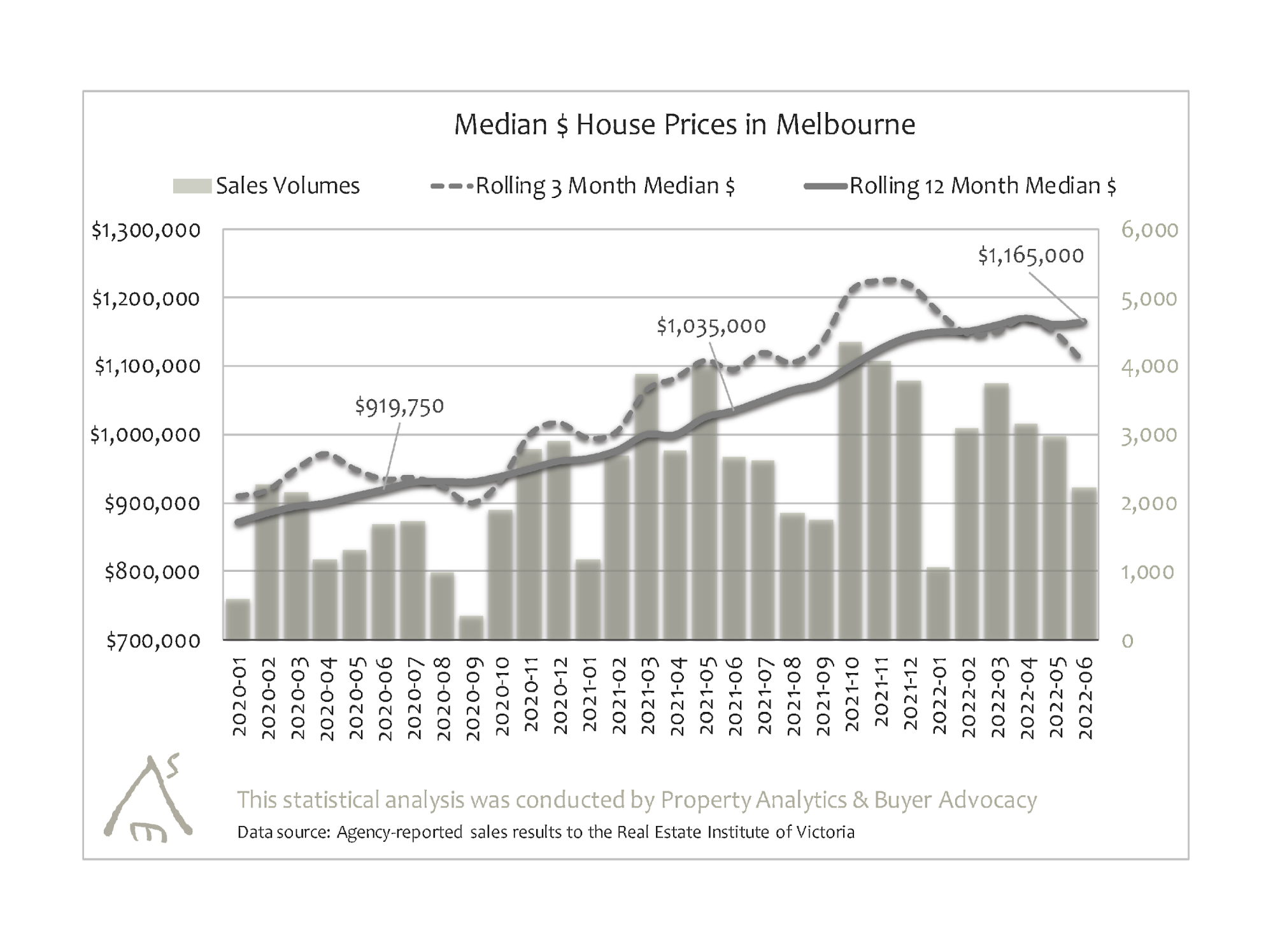

Compounding this is the role of interest rates and lending policies. Research from the Melbourne Institute highlights a “critical lending rate threshold,” below which house prices escalate sharply. For instance, during periods of historically low interest rates, borrowing capacity expanded, enabling speculative investment and driving prices higher. This phenomenon underscores the disproportionate impact of financial policy on affordability, as even minor rate adjustments can significantly alter market dynamics.

These intertwined forces—demographic pressures and financial mechanisms—create a feedback loop, perpetuating Melbourne’s housing crisis and necessitating systemic reform.

Image source: anz.com.au

Economic and Demographic Pressures

Melbourne’s rapid population growth has created a cascading effect on housing affordability, with infrastructure development lagging behind demographic expansion. A critical yet underexplored dimension is the strain on middle-ring suburbs, where demand for medium-density housing has surged. These areas, often seen as a compromise between affordability and accessibility, are now facing unprecedented pressures due to their proximity to employment hubs and established amenities.

The interplay between population growth and infrastructure inadequacy is particularly evident in public transport systems. For example, the Victorian government’s Suburban Rail Loop project aims to alleviate congestion, but its completion timeline lags far behind the immediate housing needs of a growing population. This delay exacerbates the spatial mismatch between affordable housing and employment opportunities, forcing many households into longer commutes and higher transportation costs.

“Population growth without synchronized infrastructure investment creates a compounding affordability crisis,” notes Dr. Sarah Jones, an urban economist at Monash University.

A comparative analysis reveals that cities like Sydney have partially mitigated such issues through targeted medium-density developments in middle suburbs. However, Melbourne’s fragmented planning approach has left significant gaps, particularly in integrating housing supply with transport and community services. Addressing these challenges requires not only accelerating infrastructure projects but also adopting a holistic urban planning framework that aligns demographic trends with housing and service delivery.

Impact of Interest Rates and Lending Policies

The interplay between interest rates and lending policies in Melbourne’s housing market reveals a counterintuitive dynamic: lower rates, while ostensibly improving affordability, often exacerbate price inflation. This occurs because reduced borrowing costs incentivize speculative investment, diverting housing stock away from owner-occupiers. The Melbourne Institute’s research highlights a critical threshold rate of approximately 6.1%, below which investor activity surges, creating price-feedback loops that inflate housing costs disproportionately.

A detailed examination of lending practices during low-rate periods uncovers a relaxation of credit standards, enabling higher loan-to-value ratios and increased borrowing capacity. This amplifies demand, particularly among investors, who leverage these conditions to outbid first-home buyers. For instance, during the 2019 rate cuts, Melbourne experienced a 20% rise in investment loans, correlating with a sharp uptick in median house prices.

“Lower rates have driven a surge in investment loans, which pushes prices higher even as borrowing becomes cheaper,” explains Dr. Vanessa Matthews, a housing economist at the Melbourne Institute.

This dynamic underscores the need for regulatory interventions, such as stricter loan serviceability tests, to mitigate speculative pressures. Without such measures, the benefits of low rates remain inaccessible to average households, perpetuating affordability challenges and market inequities.

Challenges for First-Home Buyers and Renters

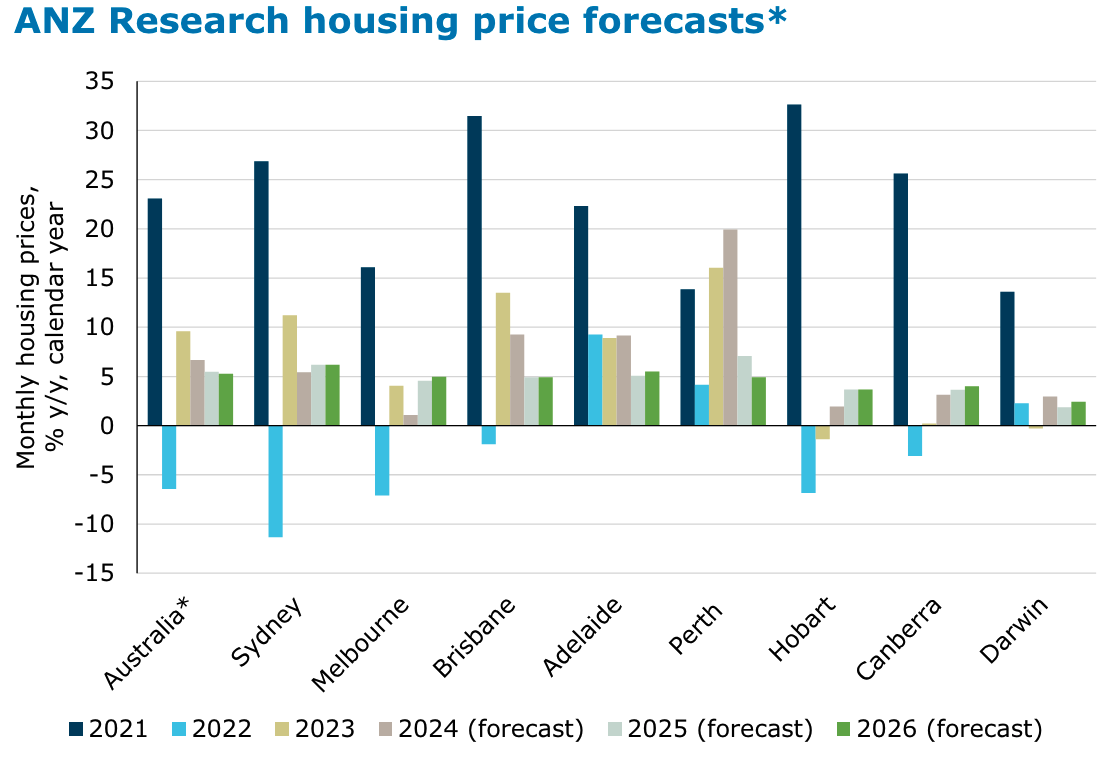

Melbourne’s housing market presents a dual crisis: first-home buyers face prohibitive entry barriers, while renters grapple with escalating costs and limited security. According to the Helia Home Buyer Sentiment Report 2024, 40% of first-home buyers are considering interstate purchases due to Melbourne’s high property prices, yet the narrowing price gap between Melbourne and mid-sized cities like Brisbane complicates this strategy. This underscores a critical misconception: relocating does not always equate to affordability, as associated costs like relocation expenses and job market disparities often offset perceived savings.

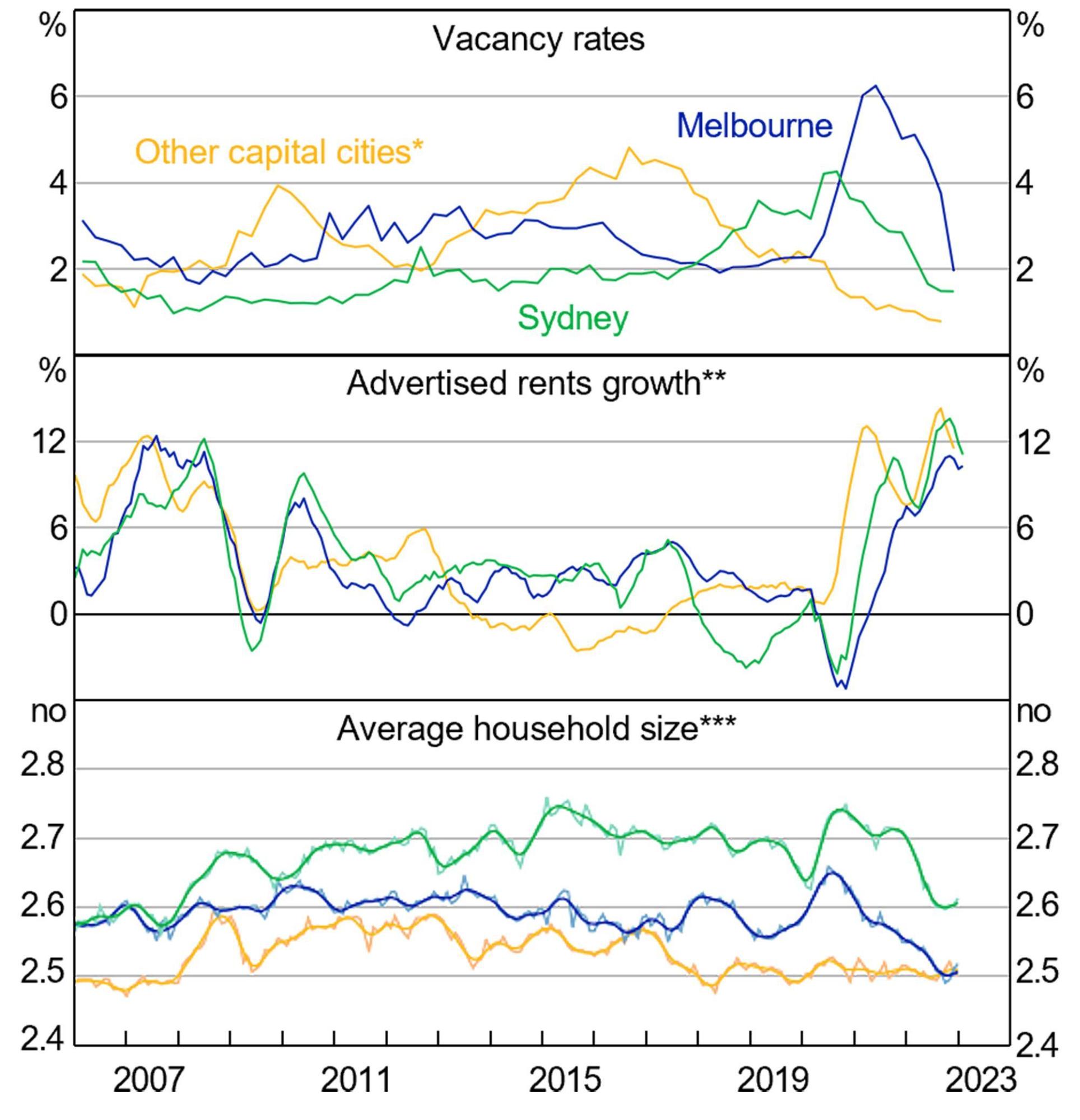

For renters, the situation is equally dire. Melbourne’s rental vacancy rate has plummeted to near-record lows, exacerbating competition and driving rents to unprecedented levels. Data from Motion Property highlights that construction slowdowns and population growth have intensified this imbalance, leaving renters with fewer options and higher costs. Compounding this, Australia’s relatively unregulated rental market offers minimal tenant protections, as noted in the 2016 Census analysis.

These intertwined challenges demand systemic reforms, including targeted housing supply initiatives and enhanced tenant protections, to stabilize Melbourne’s volatile housing ecosystem.

Image source: fticonsulting.com

Barriers to Home Ownership

One of the most significant yet underexplored barriers to home ownership in Melbourne is the interplay between restrictive lending criteria and the volatility of entry-level property supply. While deposit requirements are often cited as the primary hurdle, the reality is far more complex. Lending institutions frequently impose stringent serviceability tests, which disproportionately affect first-home buyers with fluctuating incomes or limited financial histories. This rigidity often excludes otherwise capable buyers from accessing the market.

The scarcity of affordable entry-level properties compounds this issue. Research from the Australian Housing and Urban Research Institute (AHURI) highlights that supply-side constraints, particularly in inner and middle suburbs, are exacerbated by restrictive zoning laws and protracted approval processes. These factors create a bottleneck, inflating prices and reducing the availability of homes within reach of first-time buyers.

“Current policy settings tend to disadvantage aspiring first-home buyers and benefit existing homeowners,” notes Professor Stephen Whelan of the University of Sydney.

A novel approach to addressing these barriers involves integrating shared equity schemes with targeted zoning reforms. By allowing buyers to co-invest with government entities while simultaneously unlocking medium-density developments, this dual strategy could mitigate both financial and supply-side constraints. However, its success hinges on precise implementation and robust oversight to prevent speculative misuse.

Rental Market Pressures and Implications

The intensifying rental market pressures in Melbourne reveal a complex interplay between low vacancy rates, speculative investment, and tenant vulnerabilities. A critical yet underexamined factor is the role of lease structures in perpetuating housing insecurity. Short-term leases, often favored by landlords to capitalize on rising rents, leave tenants with limited stability and bargaining power. This dynamic disproportionately affects low-income renters, who are more likely to face frequent relocations and associated financial burdens.

A comparative analysis of international rental markets highlights Melbourne’s unique challenges. For instance, Germany’s tenant-friendly regulations, such as indefinite leases and rent caps, contrast sharply with Australia’s relatively unregulated system. While these measures provide stability, they also reduce landlord incentives to invest in rental properties, illustrating the trade-offs inherent in policy design.

“The lack of long-term lease options exacerbates housing stress, forcing tenants into a cycle of instability,” explains Dr. Sarah Jones, an urban economist at Monash University.

Addressing these pressures requires innovative solutions, such as incentivizing landlords to offer longer leases through tax benefits or subsidies. Additionally, integrating tenant protections with broader housing supply strategies could mitigate the adverse effects of speculative practices. These measures must be carefully calibrated to balance tenant security with market viability, ensuring equitable outcomes for all stakeholders.

Government Interventions and Potential Solutions

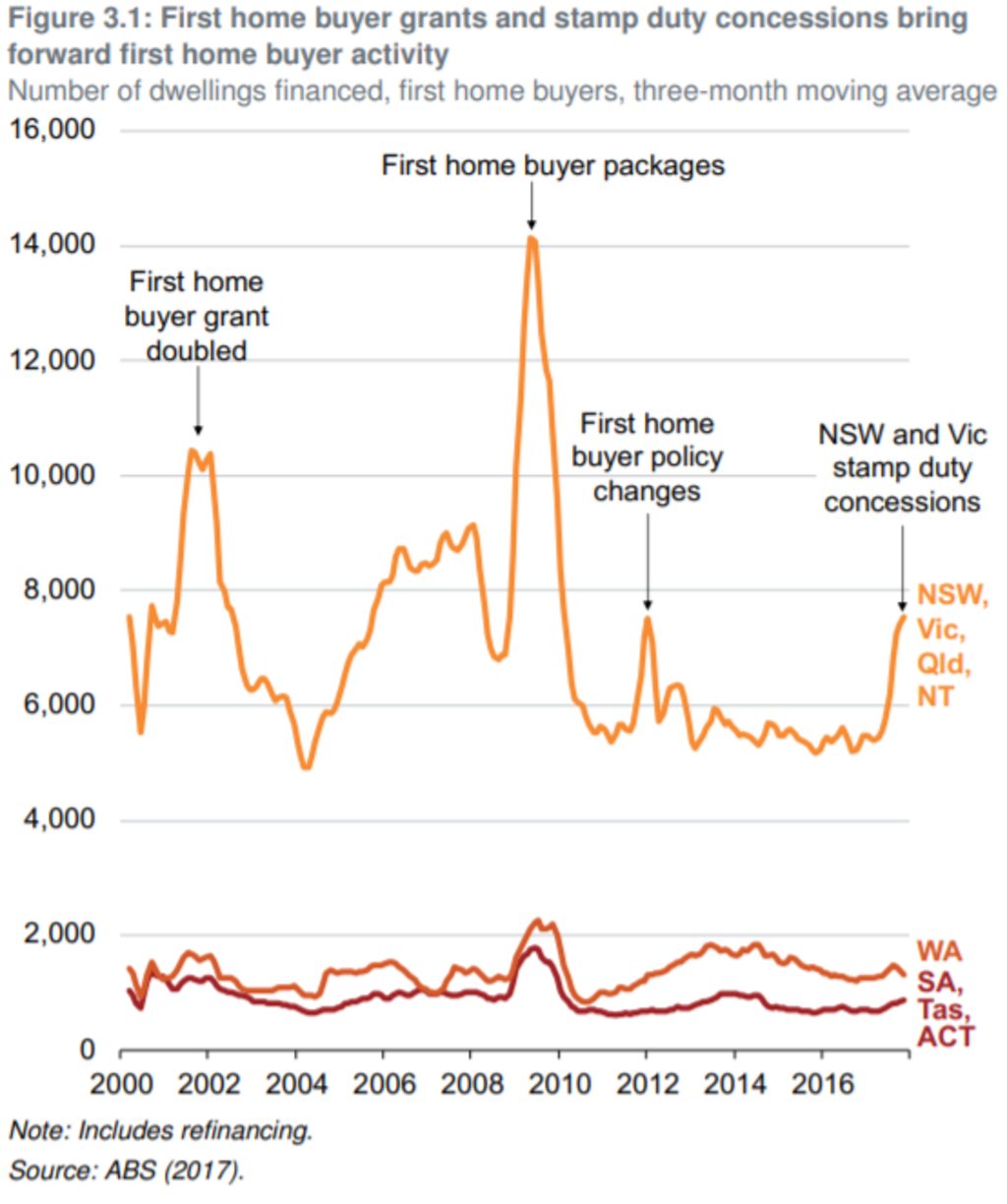

Melbourne’s housing crisis demands interventions that address systemic inefficiencies rather than perpetuating short-term fixes. A 2023 report by the Grattan Institute revealed that first-home buyer grants often inflate property prices by up to 8%, disproportionately benefiting sellers rather than buyers. This underscores the need to pivot toward supply-side solutions, such as unlocking underutilized government land for affordable housing projects. For example, the Victorian Government’s 2020 initiative to repurpose surplus land added 1,000 affordable units, yet this represents only a fraction of the 23,000 units needed by 2036.

Innovative models like shared equity schemes, where buyers co-invest with government entities, have shown promise. The Western Australian Keystart program, which reduced deposit requirements to 2%, enabled over 100,000 households to enter the market since its inception. However, experts like Professor Nicole Gurran from the University of Sydney caution that such programs must be paired with zoning reforms to prevent speculative distortions.

Without bold, integrated strategies, Melbourne risks deepening socio-economic divides.

Image source: domain.com.au

Evaluating Current Policies and Their Effectiveness

The effectiveness of Melbourne’s housing policies is often undermined by their failure to address systemic supply constraints. A critical example is the reliance on first-home buyer grants, which, while politically popular, frequently exacerbate affordability issues by inflating demand without increasing supply. This dynamic is particularly evident in markets constrained by restrictive zoning laws, where the additional purchasing power granted to buyers merely drives up prices.

Shared equity schemes, another widely discussed policy, illustrate the complexities of implementation. While these programs can lower entry barriers for first-time buyers, their success is contingent on concurrent zoning reforms and infrastructure investments. Without these, the increased demand they generate risks further straining an already limited housing stock. Research from the Grattan Institute highlights that such schemes often lead to localized price surges, particularly in high-demand suburbs.

“Financial incentives alone cannot resolve affordability challenges; they must be paired with structural reforms to unlock supply,” notes Professor Nicole Gurran, an expert in urban planning.

A nuanced evaluation reveals that policies focusing solely on financial assistance often neglect the broader market dynamics. Effective interventions must integrate fiscal measures with regulatory and planning reforms to ensure sustainable, long-term improvements in housing affordability.

Innovative Approaches to Improve Affordability

One transformative approach to addressing Melbourne’s housing affordability crisis is the implementation of mandatory inclusionary zoning (IZ), a policy requiring developers to allocate a percentage of new housing projects to affordable units. This mechanism embeds affordability into the development process, ensuring a steady supply of below-market-rate housing without direct government expenditure.

The effectiveness of IZ lies in its ability to leverage rising land values created by rezoning or infrastructure investments. For instance, when the Victorian Government rezoned land for urban renewal, the potential for value capture through IZ was significant. However, Melbourne’s current voluntary IZ framework has limited impact due to inconsistent application and lack of enforceability. By contrast, Sydney’s Green Square project demonstrated the success of mandatory IZ, delivering hundreds of affordable units by integrating affordability requirements into statutory planning instruments.

“Mandatory inclusionary zoning ensures affordability is not an afterthought but a core component of urban development,” explains Dr. Nicole Gurran, an urban planning expert.

Despite its promise, IZ faces challenges, including resistance from developers concerned about profit margins. Addressing these concerns requires phased implementation, financial offsets, and clear guidelines. When paired with streamlined planning processes, IZ can balance market viability with social equity, offering a scalable solution to Melbourne’s housing crisis.

FAQ

What factors have contributed to Melbourne’s housing market becoming one of the least affordable globally?

Melbourne’s housing market has been shaped by a combination of restrictive zoning laws, rapid population growth, and speculative investment. Decades of low-density zoning have limited medium-density developments, creating a supply bottleneck. Population surges, driven by immigration and urbanization, have outpaced housing availability, intensifying demand. Financial policies, such as low interest rates and tax incentives like negative gearing, have fueled speculative buying, further inflating prices. Additionally, infrastructure development has lagged behind urban expansion, exacerbating spatial mismatches between affordable housing and employment hubs. These interconnected factors have collectively positioned Melbourne among the least affordable housing markets globally.

How do zoning laws and urban planning policies impact housing affordability in Melbourne?

Zoning laws and urban planning policies in Melbourne have significantly constrained housing affordability by prioritizing low-density residential zones, particularly in middle-ring suburbs. These restrictions limit medium-density developments, reducing the housing supply in high-demand areas. Lengthy approval processes and fragmented planning frameworks further delay projects, increasing costs for developers and buyers. Additionally, local councils often resist rezoning efforts to preserve neighborhood character, exacerbating supply shortages. While some reforms have aimed to streamline planning, their impact remains limited compared to cities like Brisbane. Addressing these systemic barriers requires comprehensive zoning adjustments and integrated urban planning to align housing supply with demand.

What are the financial and social implications of Melbourne’s skyrocketing property prices for first-home buyers and renters?

Melbourne’s soaring property prices have created severe financial strain for first-home buyers, who face prohibitive deposit requirements and stringent lending criteria, often excluding them from the market. Many resort to strategies like rent-vesting, sacrificing homeownership benefits for long-term equity growth. Renters, meanwhile, endure record-low vacancy rates and escalating rents, with over 40% of income frequently allocated to housing costs. This dynamic exacerbates wealth inequality, as property ownership becomes concentrated among higher-income groups. Socially, these pressures displace lower-income households, eroding community diversity and increasing commuting burdens as people relocate to more affordable but less accessible outer suburbs.

Are there any government initiatives or policy reforms aimed at addressing Melbourne’s housing affordability crisis?

Government initiatives addressing Melbourne’s housing affordability crisis include the Victorian Government’s $5.3 billion Big Housing Build, which aims to deliver over 12,000 social and affordable homes. Legislative amendments, such as updates to the Planning and Environment Act 1987, now prioritize affordable housing supply. Additionally, programs like shared equity schemes and first-home buyer grants provide financial assistance, though their effectiveness is debated. Local councils, including the City of Melbourne, are leveraging public land for affordable housing projects. However, systemic issues like restrictive zoning and speculative investment remain unaddressed, limiting the overall impact of these reforms on long-term affordability.

How does Melbourne’s housing market compare to other major cities in terms of affordability and accessibility?

Melbourne’s housing market ranks among the least affordable globally, comparable to cities like Hong Kong, Vancouver, and San Jose. The Demographia International Housing Affordability Survey highlights Melbourne’s Median Multiple exceeding 9, far above the affordability benchmark of 3. Unlike cities such as Brisbane, which have implemented effective zoning reforms, Melbourne’s restrictive policies exacerbate supply shortages. Accessibility is further hindered by lagging infrastructure, forcing many to relocate to outer suburbs with limited amenities. While cities like Berlin offer tenant-friendly regulations, Melbourne’s unregulated rental market intensifies housing stress, underscoring its unique challenges in balancing affordability and accessibility.