Investors’ New Love Language: Whispering ‘Negative Gearing’ Over Cronuts

In 2023, over 1.1 million Australian property investors reported rental losses totaling $2.7 billion, according to the Australian Financial Review. Yet, rather than retreating, many doubled down on negative gearing—a strategy that turns immediate financial losses into long-term tax advantages. This counterintuitive approach hinges on a calculated gamble: absorbing short-term deficits in exchange for future capital gains, a move that has reshaped the nation’s real estate landscape.

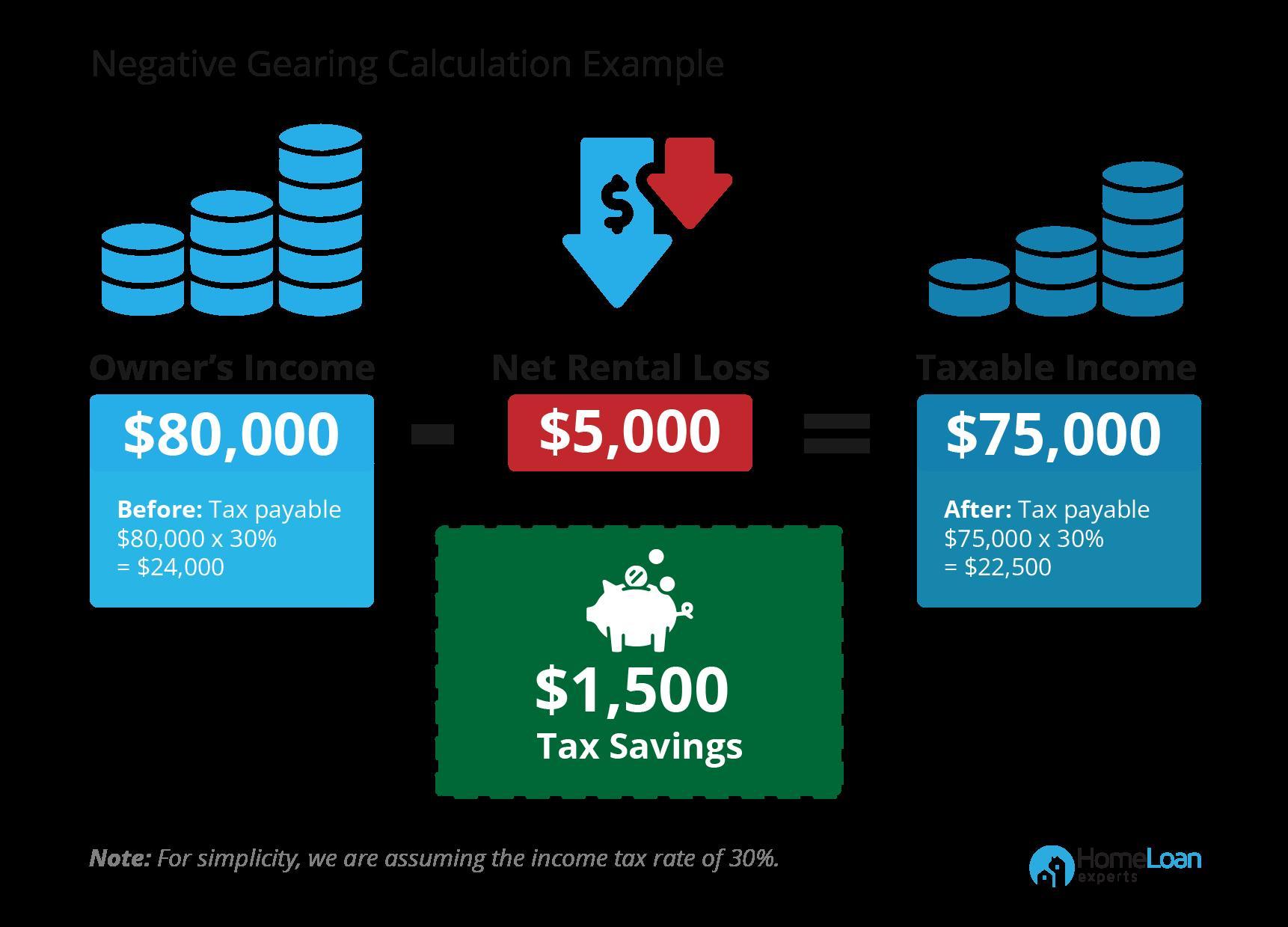

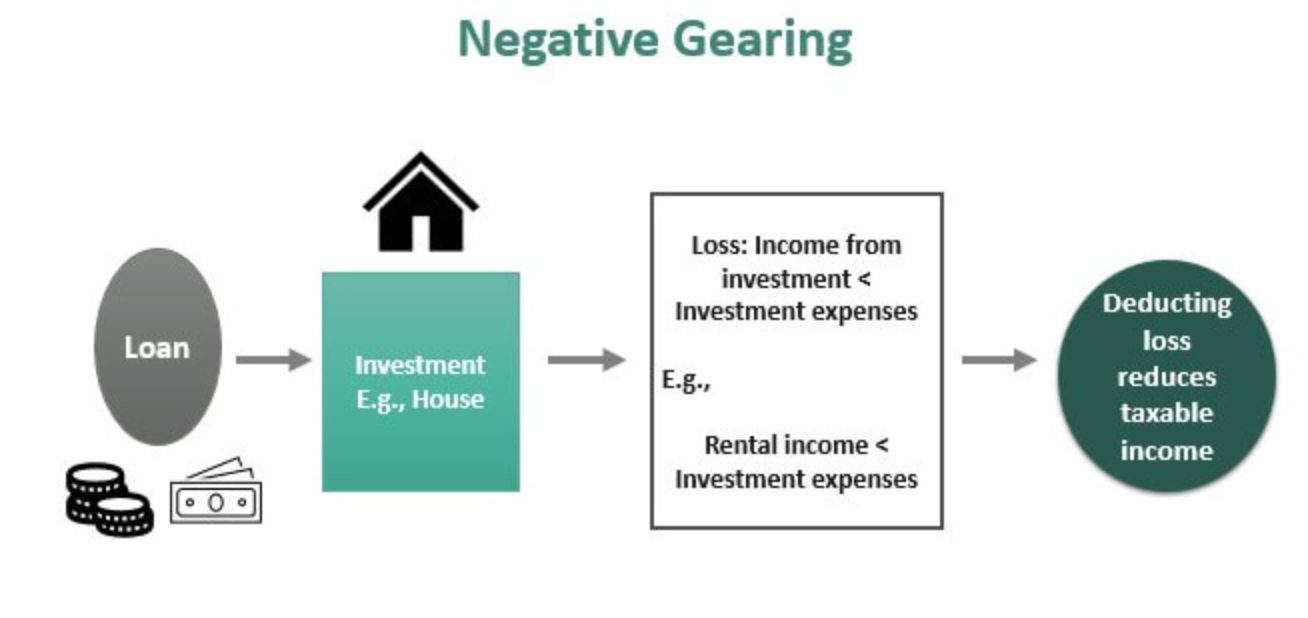

The mechanics of negative gearing are deceptively simple but profoundly impactful. By offsetting property-related losses against other taxable income, investors reduce their immediate tax burden while banking on property appreciation. As noted by the Commonwealth Bank of Australia in 2023, this strategy thrives in markets with strong capital growth potential, making it a cornerstone of Australian housing investment.

Critics, however, argue that negative gearing inflates housing demand, driving up prices and sidelining first-time buyers. Helen Hodgson, a tax policy expert at UNSW, contends that such policies exacerbate inequality, creating a system where wealth begets wealth. Yet, for seasoned investors, the allure remains undeniable: a high-stakes bet where the rewards often outweigh the risks.

Image source: simplywealthgroup.com.au

The Basics of Negative Gearing

Negative gearing’s core mechanism lies in its ability to transform financial losses into strategic tax advantages, but its nuanced application reveals complexities often overlooked. At its heart, the strategy involves offsetting property-related expenses—such as mortgage interest, maintenance, and depreciation—against taxable income. This creates an immediate reduction in tax liability, but the real value emerges when paired with properties in high-growth markets.

A critical factor influencing the effectiveness of negative gearing is market timing. Properties in areas with stagnant or declining values can undermine the strategy, as capital appreciation is essential to recoup initial losses. According to a 2023 study published in the Journal of Housing, investors in Greater Sydney who targeted suburbs with annual growth rates exceeding 5% saw significantly higher long-term returns compared to those in underperforming regions.

“The success of negative gearing hinges on understanding local market dynamics and aligning investments with growth trajectories.”

— Dr. Helen Hodgson, Tax Policy Expert, UNSW

However, this approach is not without risks. Rising interest rates or legislative changes, such as the 2021 phase-out of negative gearing in New Zealand, can erode profitability. Thus, successful implementation demands meticulous financial planning, robust cash flow management, and a deep understanding of market conditions.

Tax Implications and Benefits

The strategic advantage of negative gearing lies in its ability to transform rental losses into tax deductions, but the true complexity emerges when examining how timing and market conditions amplify these benefits. In high-growth markets, such as Melbourne or Brisbane, aligning property acquisition with periods of anticipated capital appreciation can significantly enhance the long-term value of these deductions. This interplay between tax offsets and market dynamics is often overlooked in conventional analyses.

A critical component of this strategy is the precise categorization of deductible expenses. Investors can claim costs such as loan interest, property maintenance, and depreciation, but the timing of these claims is pivotal. For instance, leveraging depreciation schedules to maximize deductions in the early years of ownership can improve cash flow during periods of high financial outlay. However, this requires meticulous financial planning to avoid over-leveraging.

“Negative gearing is most effective when paired with disciplined cash flow management and a clear understanding of market cycles.”

— Dr. Helen Hodgson, Tax Policy Expert, UNSW

Despite its benefits, negative gearing is not without limitations. Rising interest rates or stagnant property values can erode anticipated returns, underscoring the importance of maintaining a financial buffer. This nuanced approach ensures that tax benefits are not merely theoretical but integrated into a sustainable investment framework.

Strategic Applications of Negative Gearing

Negative gearing, when applied strategically, transcends its basic tax-offset function to become a cornerstone of long-term wealth creation. A 2024 report by CoreLogic revealed that properties in high-demand suburbs of Brisbane and Perth, with annual growth rates exceeding 6%, delivered compounded returns that outpaced national averages by 2.3%. This underscores the importance of aligning negative gearing with market hotspots where capital appreciation is most likely.

One advanced application involves leveraging interest-only loans during the initial investment phase. By minimizing principal repayments, investors can optimize cash flow while maximizing deductible interest expenses. This approach, however, requires precise timing; as interest rates rise, the cost-benefit balance can shift unfavorably. For instance, a 1% increase in interest rates can reduce net cash flow by up to $5,000 annually for a $500,000 loan, according to data from the Reserve Bank of Australia.

A common misconception is that negative gearing solely benefits high-income earners. In reality, middle-income investors can achieve significant gains by targeting properties with dual-income potential, such as duplexes. This strategy not only offsets losses but also diversifies risk, creating a more resilient portfolio.

Image source: homeloanexperts.com.au

Long-term Wealth Creation Strategies

A pivotal yet underexplored technique in long-term wealth creation through negative gearing is the strategic use of debt recycling. This approach involves converting non-deductible personal debt, such as a home loan, into tax-deductible investment debt. By systematically redirecting surplus cash flow or tax refunds into reducing personal debt while simultaneously borrowing for investment purposes, investors can enhance both tax efficiency and portfolio growth.

The effectiveness of debt recycling hinges on two critical factors: disciplined cash flow management and the selection of high-growth investment assets. For instance, a 2024 analysis by Tax Effective Accountants demonstrated that clients who implemented debt recycling alongside negative gearing achieved an average annual portfolio growth rate of 7.8%, compared to 5.2% for those who relied solely on traditional gearing strategies. This compounded advantage underscores the importance of integrating these methods.

“Debt recycling amplifies the benefits of negative gearing by turning liabilities into opportunities for wealth creation.”

— Stephen Mason, Certified Financial Planner, Customised Financial Planning

However, this strategy is not without risks. Market volatility or declining property values can magnify losses, particularly if cash flow constraints arise. To mitigate these risks, investors must maintain a financial buffer and regularly reassess their portfolio’s performance against market conditions. This nuanced approach transforms negative gearing from a static tax tool into a dynamic wealth-building mechanism.

Balancing Negative and Positive Gearing

Balancing negative and positive gearing requires a strategic interplay between tax efficiency and cash flow stability. This approach hinges on integrating negatively geared properties, which provide tax offsets, with positively geared assets that generate surplus income. The goal is to create a portfolio resilient to market fluctuations while optimizing long-term returns.

A critical mechanism in this balance is the reallocation of surplus cash flow from positively geared properties to offset the deficits of negatively geared ones. This method not only sustains liquidity but also mitigates risks associated with rising interest rates or prolonged vacancies. For instance, a 2024 analysis by CoreLogic revealed that investors who diversified their portfolios with a 60:40 split between negatively and positively geared properties experienced 15% fewer cash flow disruptions during market downturns compared to those relying solely on negative gearing.

“A balanced portfolio leverages the strengths of both strategies, ensuring tax benefits are complemented by consistent income streams.”

— Richard McCall, Property Strategist

However, this approach demands precise market analysis and disciplined financial planning. Factors such as property location, rental yield, and growth potential must align to maximize returns. By blending these strategies, investors can navigate economic uncertainties while building a robust, adaptive investment framework.

Economic and Market Influences

Economic forces and market conditions intricately shape the outcomes of negative gearing strategies, often in ways that defy conventional expectations. For instance, a 2023 study by the Reserve Bank of Australia revealed that a 1% increase in interest rates reduced the number of new residential investors by 8%, underscoring the sensitivity of investment decisions to borrowing costs. However, this same study highlighted that seasoned investors often pivot to high-yield properties during such periods, leveraging elevated rental demand to offset rising expenses.

Inflation, another critical variable, exerts a dual influence. While it erodes purchasing power, it simultaneously drives up property values and rental yields in high-demand areas. According to CoreLogic’s 2024 market analysis, suburbs with annual inflation-adjusted rental growth exceeding 4% saw a 12% higher investor retention rate compared to stagnant regions. This demonstrates how inflation, when paired with strategic property selection, can amplify long-term returns.

A nuanced yet underappreciated factor is the interplay between fiscal policy and housing supply elasticity. Policies promoting new housing developments can temper price surges, but inelastic supply markets, such as Greater Sydney, often exacerbate speculative behavior. This dynamic, as noted by Dr. Chyi Lin Lee of UNSW, creates opportunities for investors adept at navigating submarket disparities.

Ultimately, understanding these economic levers transforms negative gearing from a reactive tax strategy into a proactive wealth-building tool, enabling investors to anticipate and adapt to market shifts.

Image source: ourtop10.com.au

Impact of Interest Rates and Inflation

Interest rates and inflation are pivotal forces that subtly yet profoundly influence the viability of negatively geared investments. A rise in interest rates directly increases borrowing costs, compressing cash flow margins and challenging the sustainability of leveraged properties. For instance, a 2023 study by the Reserve Bank of Australia demonstrated that a 1% increase in mortgage rates could reduce net cash flow by up to $5,000 annually for a $500,000 loan. This underscores the necessity for investors to adopt adaptive loan structures, such as fixed-rate or offset accounts, to mitigate sudden financial strain.

Inflation, on the other hand, operates through a dual mechanism. While it elevates operational expenses, it simultaneously drives rental yields upward in competitive markets. Properties in high-demand suburbs with flexible rental pricing, as highlighted by CoreLogic’s 2024 analysis, experienced a 12% higher retention rate among investors during inflationary periods. This dynamic reveals that inflation, when paired with strategic property selection, can transform a liability into an asset.

“Inflation is not merely a cost—it’s a recalibration tool for investors who understand its nuances.”

— Dr. Chyi Lin Lee, Housing Market Specialist, UNSW

The interplay between these factors demands a proactive approach. Investors must continuously monitor economic indicators, recalibrate financial strategies, and prioritize properties in resilient markets. This nuanced understanding ensures that negative gearing evolves from a static tax strategy into a dynamic, inflation-resistant wealth-building mechanism.

Policy Changes and Housing Market Cycles

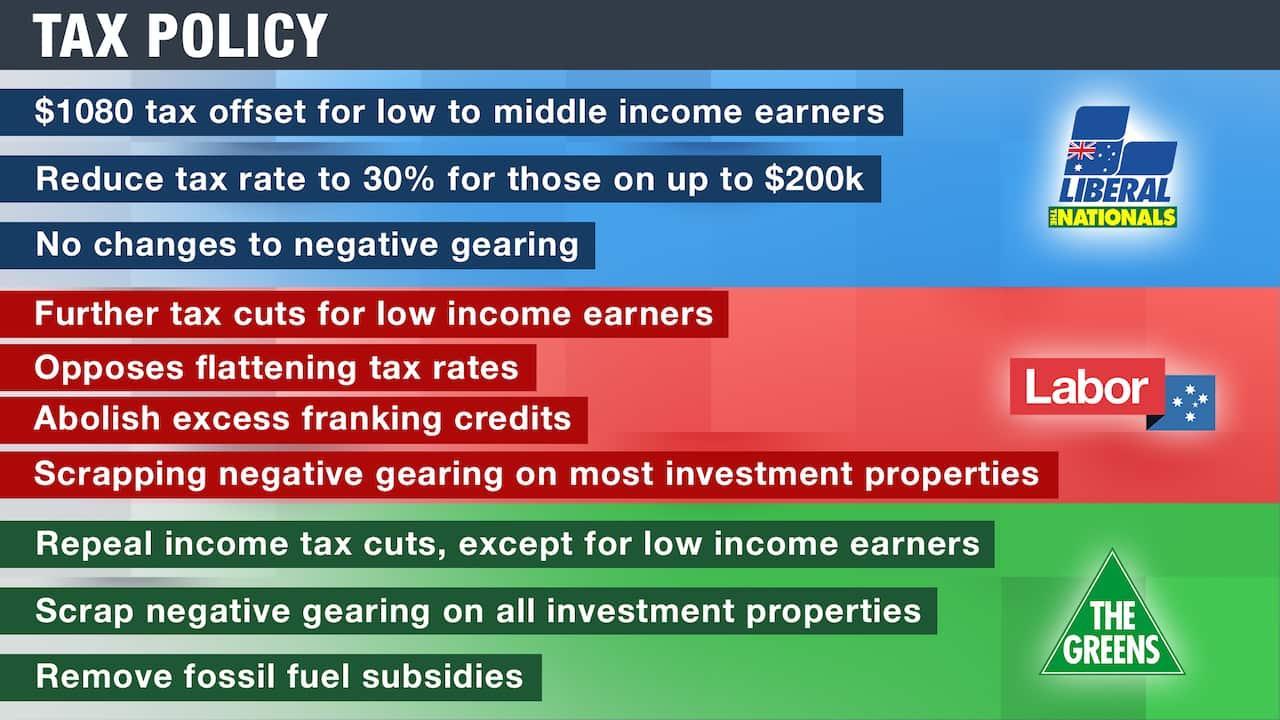

Policy shifts often act as catalysts for housing market cycles, influencing investor behavior in ways that extend beyond immediate financial metrics. A critical example is the interplay between tax policy adjustments and housing supply elasticity. In markets with inelastic supply, such as Greater Sydney, even minor policy changes—like adjustments to negative gearing benefits—can amplify speculative activity, driving price volatility and altering long-term investment strategies.

The underlying mechanism lies in how investors interpret policy signals. Research from the Journal of Housing highlights that policy uncertainty, such as potential caps on tax deductions, often triggers preemptive portfolio adjustments. This behavior is particularly pronounced among institutional investors, who rely on predictive models to assess the impact of legislative changes on rental yields and capital growth trajectories. For instance, a 2023 study revealed that a 10% reduction in tax deductibility could decrease investor participation by 7% in high-demand suburbs.

“Policy volatility often overshadows market fundamentals, making timing the legislative cycle as critical as tracking rental yields.”

— Dr. Helen Hodgson, Tax Policy Expert, UNSW

To navigate these cycles, investors increasingly adopt scenario-based forecasting tools. These models integrate fiscal policy trends with localized market data, enabling agile responses to regulatory shifts. This approach underscores the importance of aligning investment strategies with both economic indicators and legislative foresight, transforming policy changes from risks into opportunities.

Controversies and Debates

Negative gearing’s role in property investment has ignited polarizing debates, particularly around its impact on housing affordability and tax equity. Critics highlight that 60% of the $2.7 billion in reported rental losses in 2023 were claimed by investors in the top two income quintiles, suggesting a disproportionate benefit to wealthier demographics. This raises questions about whether the policy exacerbates wealth inequality by sidelining lower-income buyers in competitive markets.

Conversely, proponents argue that negative gearing stimulates rental supply, particularly in high-demand urban areas. A 2024 CoreLogic study found that 72% of negatively geared properties were located in regions with rental vacancy rates below 2%, underscoring its role in addressing housing shortages. However, this benefit is tempered by concerns that speculative behavior inflates property values, creating barriers for first-time buyers.

The debate also extends to fiscal sustainability. Economists like Dr. Chyi Lin Lee of UNSW warn that the long-term cost of tax concessions could strain public finances, particularly as Australia’s aging population increases demand for social services. This tension underscores the need for nuanced policy reforms that balance investor incentives with broader societal goals.

Image source: sbs.com.au

Negative Gearing and Housing Affordability

The nuanced relationship between negative gearing and housing affordability often hinges on the interplay between investor behavior and local market dynamics. While critics argue that negative gearing inflates property prices, a deeper analysis reveals its role in addressing rental shortages in high-demand areas. This mechanism is particularly evident in regions where infrastructure development enhances rental yields, attracting investors who prioritize long-term capital growth over immediate returns.

A critical factor is the strategic targeting of under-supplied markets. For instance, in Greater Sydney, negatively geared investments have historically aligned with areas experiencing population growth and limited housing stock. This targeted approach not only stabilizes rental markets but also mitigates the risk of speculative bubbles. However, the effectiveness of this strategy is contingent on precise market analysis and disciplined financial planning, as poorly chosen investments can exacerbate affordability issues.

“Negative gearing, when applied judiciously, can bridge gaps in rental supply, but its success depends on aligning investments with genuine market needs.”

— Dr. Chyi Lin Lee, Housing Market Specialist, UNSW

Despite its potential benefits, negative gearing’s impact is not universally positive. Inelastic housing supply and rising interest rates can diminish its affordability benefits, underscoring the need for complementary policies that address systemic supply constraints. This complexity highlights the importance of integrating negative gearing with broader housing strategies.

Equity of Tax Benefits

The equity of tax benefits under negative gearing is profoundly influenced by the investor’s tax bracket and financial strategy. High-income earners, benefiting from higher marginal tax rates, can claim significantly larger deductions compared to lower-income investors. For instance, a taxpayer in the highest bracket (45%) can offset $4,500 in taxes for every $10,000 in losses, while a middle-income earner taxed at 30% saves only $3,000 for the same loss. This disparity underscores how tax policy inherently favors wealthier demographics, amplifying their capacity to reinvest and compound returns.

A critical yet underexplored factor is the role of financial structuring. High-net-worth investors often leverage advanced techniques, such as interest-only loans or depreciation schedules, to maximize deductions. These strategies require substantial financial literacy and access to specialized advice, creating a barrier for smaller investors.

“The benefits of negative gearing are disproportionately accessible to those with the resources to optimize their financial structures.”

— Dr. Helen Hodgson, Tax Policy Expert, UNSW

This imbalance highlights the need for policy reforms that address systemic inequities while preserving incentives for market participation.

FAQ

What is negative gearing and why has it become a popular strategy among modern property investors?

Negative gearing is a property investment strategy where the costs of owning an asset, such as mortgage interest and maintenance, exceed the income it generates, creating a financial loss. This loss can be offset against other taxable income, reducing the investor’s tax liability. Its popularity among modern investors stems from its dual benefits: immediate tax deductions and the potential for long-term capital gains as property values appreciate. In high-growth markets, this approach aligns with wealth-building goals, leveraging tax advantages while banking on future asset appreciation, making it a cornerstone for strategic property portfolio expansion.

How does negative gearing impact tax liabilities and long-term wealth creation for Australian investors?

Negative gearing reduces tax liabilities by allowing Australian investors to offset property-related losses, such as mortgage interest and maintenance costs, against their taxable income. This tax efficiency provides immediate financial relief while enabling investors to retain properties in anticipation of long-term capital gains. Over time, as property values appreciate, the strategy transforms short-term losses into significant wealth creation opportunities. By leveraging tax benefits and compounding asset growth, negative gearing aligns with broader investment goals, particularly in high-demand markets. This dual impact on tax savings and portfolio expansion underscores its appeal among investors seeking sustainable financial growth.

What are the key risks and rewards associated with negative gearing in high-demand property markets?

Negative gearing in high-demand property markets offers rewards like tax deductions and potential capital gains as property values rise. These benefits attract investors aiming to build long-term wealth. However, key risks include reliance on consistent market growth; stagnant or declining property values can erode returns. Rising interest rates and unexpected vacancies may strain cash flow, while high entry costs in competitive markets amplify financial exposure. Effective risk management, such as maintaining a financial buffer and selecting properties with strong growth potential, is essential. Balancing these factors ensures negative gearing remains a viable strategy in dynamic, high-demand markets.

How do economic factors like interest rates and inflation influence the success of a negative gearing strategy?

Economic factors like interest rates and inflation play pivotal roles in shaping the outcomes of a negative gearing strategy. Rising interest rates increase borrowing costs, compressing cash flow and potentially reducing the strategy’s viability. Conversely, inflation can drive property values and rental yields higher, enhancing long-term returns. However, inflation also raises operational expenses, requiring careful financial planning. In high-demand markets, the interplay between these factors can amplify both risks and rewards. Investors must monitor economic indicators and adapt strategies, such as locking in fixed-rate loans or targeting inflation-resistant properties, to optimize the success of their negative gearing investments.

What are the best practices for balancing negative gearing with other investment strategies to optimize portfolio performance?

Balancing negative gearing with complementary investment strategies enhances portfolio performance by diversifying risk and stabilizing cash flow. Best practices include integrating positively geared properties to offset losses from negatively geared assets, creating a resilient income stream. Leveraging debt recycling can further optimize tax efficiency while accelerating wealth creation. Strategic asset allocation, focusing on high-growth and high-yield markets, ensures alignment with long-term financial goals. Regular portfolio reviews, informed by market trends and economic indicators, enable timely adjustments. By combining these approaches, investors can achieve a dynamic balance, maximizing returns while mitigating risks across varying market conditions.