Why Every Aussie Should Consider Property as Their #1 Investment Strategy

Australia’s property market defies global norms: while 50% of investors sell within five years, those who strategize correctly can achieve unparalleled financial freedom. Why is property the ultimate wealth-building tool for Aussies today?

The Growing Interest in Property Investment Among Australians

Australians are increasingly drawn to property investment due to its dual appeal: stability and growth potential. Unlike volatile asset classes, real estate offers tangible security while benefiting from long-term capital appreciation.

One key driver is the rise of sustainable and green properties. With energy-efficient homes reducing utility costs and aligning with eco-conscious values, investors are capitalizing on growing demand. Properties with high energy ratings often command premium rents, enhancing returns.

Additionally, regional areas and emerging suburbs are gaining traction. Lower entry costs, coupled with infrastructure developments, make these locations attractive.

Improved transport links and urban sprawl are transforming once-overlooked areas into investment hotspots.

Interestingly, technology is reshaping the investment landscape. Proptech tools, such as AI-driven market analysis and blockchain for secure transactions, empower investors to make data-backed decisions. Virtual property tours further expand opportunities, enabling remote investments.

For aspiring investors, the lesson is clear: focus on sustainability, regional growth, and technological tools. These factors not only enhance profitability but also future-proof investments in an evolving market.

Purpose and Scope of the Article

This article aims to empower Australians with actionable strategies for property investment, focusing on sustainability, regional opportunities, and technological advancements. By addressing emerging trends, it equips readers to navigate a dynamic market confidently.

Understanding the Australian Property Market

Australia’s property market thrives on diverse dynamics, from urban growth to regional expansion. For instance, Perth’s revitalization showcases how economic recovery and infrastructure projects can transform affordability into long-term investment potential. strategic research ensures informed, profitable decisions.

Historical Overview of Property Trends in Australia

Australia’s property market has consistently demonstrated resilience, even during global downturns. For example, the 2008 financial crisis saw Australian property values dip only briefly, rebounding due to strong banking regulations and robust demand.

This stability stems from factors like population growth, limited housing supply, and favorable tax policies such as negative gearing. These elements create a unique environment where property remains a reliable wealth-building tool.

Interestingly, regional areas have historically outperformed expectations during infrastructure booms. For instance, Geelong’s transformation post-2010 highlights how improved transport links and economic diversification can drive capital growth.

Investors should analyze historical cycles to identify patterns, such as the impact of interest rate changes or migration trends. Understanding these nuances can help predict future opportunities and mitigate risks effectively.

Current State of the Property Market

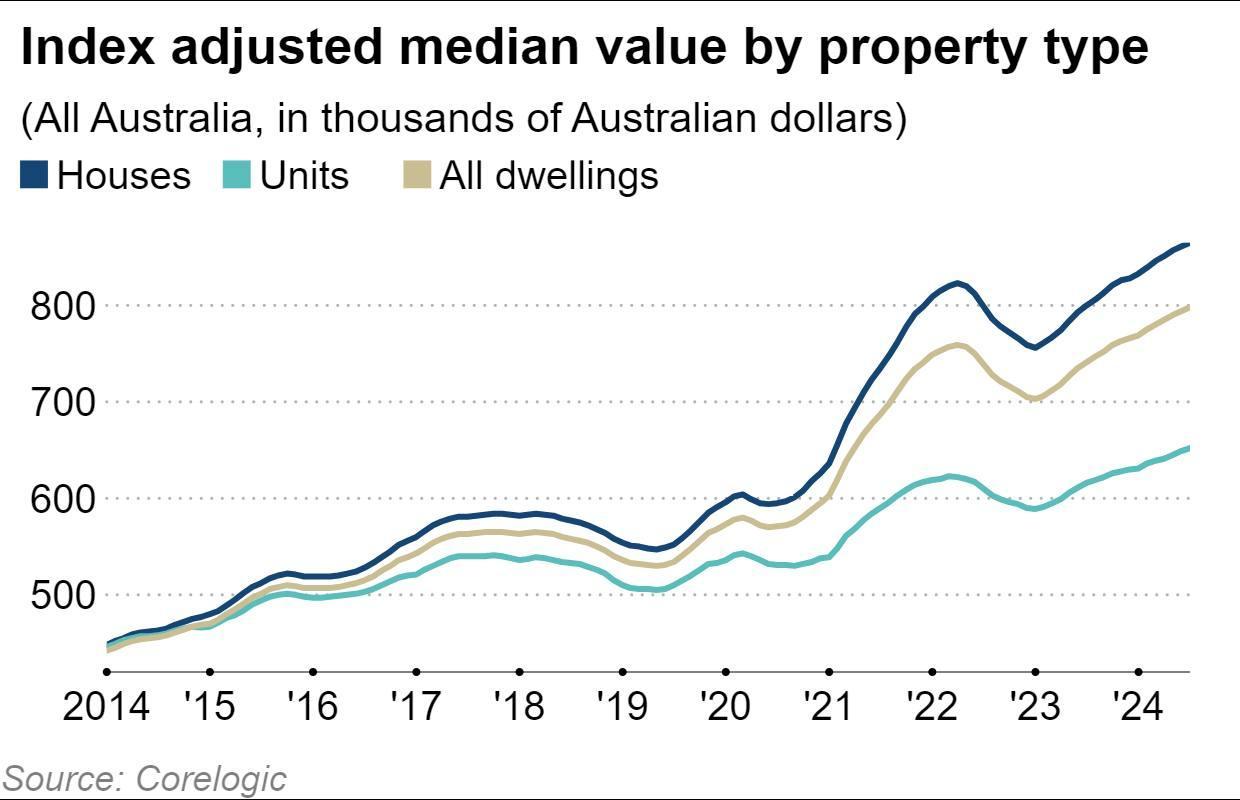

The Australian property market faces a supply-demand imbalance, with limited housing stock driving prices upward. Grade-A properties sell quickly, often with minimal discounts, reflecting strong buyer competition despite rising interest rates.

Regional markets are gaining traction due to affordability and infrastructure upgrades, attracting both investors and first-time buyers. Meanwhile, green properties are commanding higher rents, driven by sustainability trends and energy efficiency demands.

Investors should leverage proptech tools like virtual tours and AI-driven analytics to identify undervalued opportunities. By focusing on emerging suburbs and sustainable developments, they can position themselves for long-term capital growth.

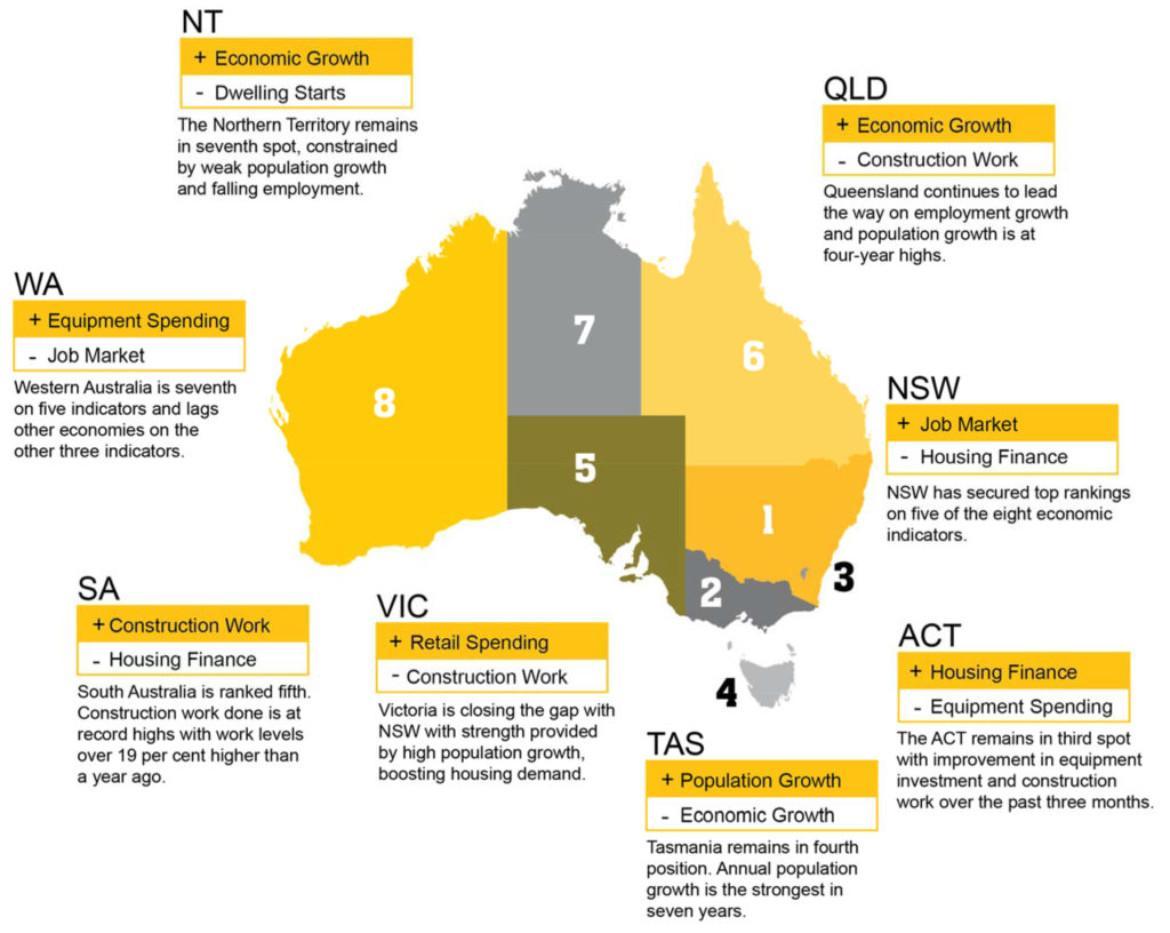

Regional Variations and Opportunities

Infrastructure investments in regional hubs like Newcastle and the Sunshine Coast are transforming these areas into growth hotspots. Improved transport links and job opportunities attract renters, boosting rental yields and long-term capital appreciation.

Lesser-known factors, such as government incentives for regional development, amplify investment potential. For example, grants for sustainable housing projects can reduce upfront costs while increasing property value.

Investors should analyze economic drivers like population growth and employment trends. By targeting regions with diversified economies, they can mitigate risks and capitalize on emerging opportunities.

Benefits of Investing in Australian Property

Australian property offers tangible stability in volatile markets. Unlike stocks, it’s a physical asset that appreciates over time, with historical data showing consistent growth even during global downturns like the 2008 financial crisis.

tax advantages amplify returns. Strategies like negative gearing reduce taxable income, while capital gains tax concessions reward long-term investments. For instance, holding property for over a year can halve your capital gains tax liability.

Rental income provides a steady cash flow. In regions like Maitland, high rental yields offset mortgage costs, making property a dual-income generator—capital growth and passive income.

Sustainability trends add value. Green properties with energy-efficient features attract eco-conscious tenants, reducing vacancies and increasing rental premiums. This aligns with government incentives, such as rebates for sustainable upgrades.

Investing in property also builds intergenerational wealth. Unlike other assets, real estate can be passed down, creating a legacy. It’s a long-term strategy that secures financial freedom for future generations.

Stable Long-Term Capital Growth

Australian property thrives on scarcity-driven demand. Limited land supply in urban hubs like Sydney ensures consistent price appreciation. For example, Sydney’s median house price grew by over 400% from 1993 to 2023.

Population growth fuels this trend. Australia’s annual population increase of 1.5% drives housing demand, particularly in high-growth areas like Melbourne and Brisbane. This creates a reliable foundation for long-term capital gains.

Infrastructure investments amplify growth. Projects like Brisbane’s Cross River Rail enhance connectivity, boosting property values in surrounding suburbs. Investors targeting such areas can capitalize on early-stage price surges.

Counter-cyclical resilience is another factor. Unlike equities, property markets recover quickly from economic shocks. For instance, Australian real estate rebounded within two years of the 2008 financial crisis, demonstrating its stability.

To maximize returns, focus on emerging suburbs with planned infrastructure and population growth. Tools like proptech can analyze trends, helping investors identify undervalued areas poised for future appreciation.

Regular Rental Income Streams

High-demand rental markets like Brisbane offer consistent income due to population growth and housing shortages. For instance, Brisbane’s rental vacancy rate dropped below 1% in 2024, driving higher rental yields.

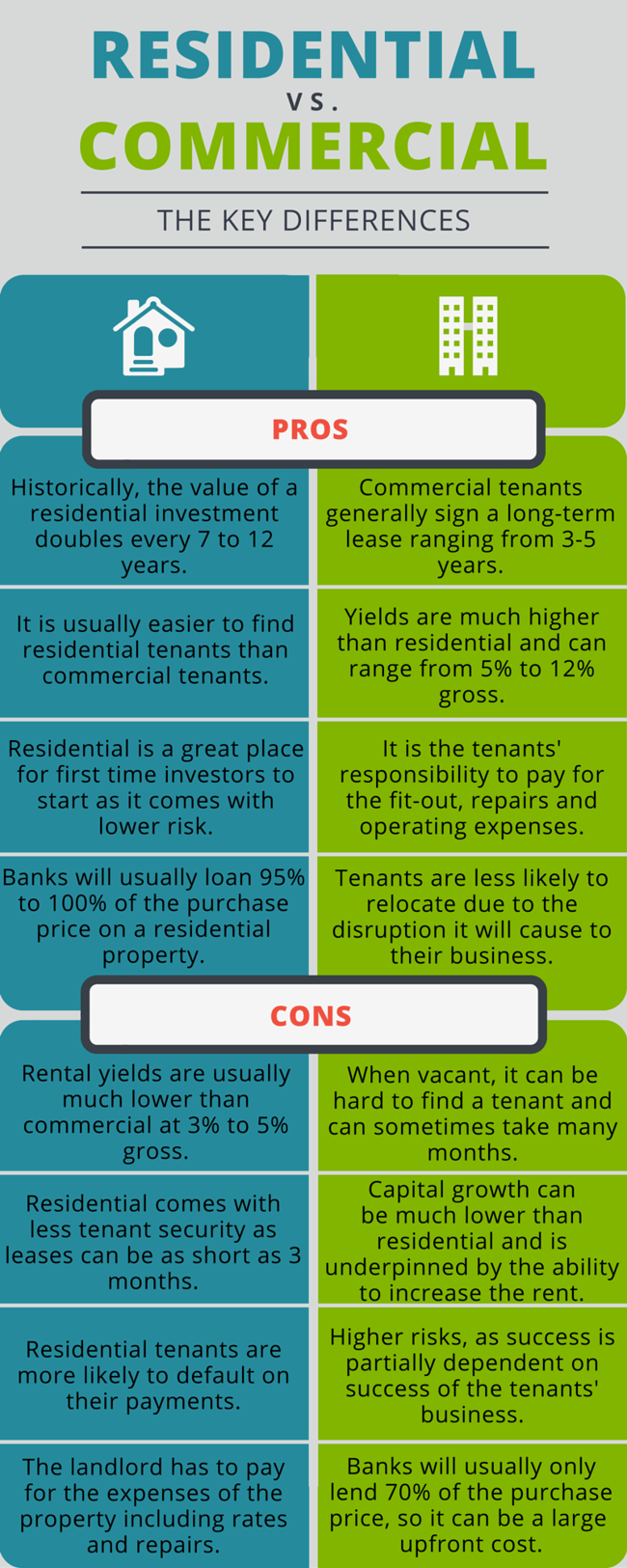

Diversification strategies enhance income stability. Combining residential and commercial properties reduces risk. Industrial properties, for example, currently yield up to 7%, outperforming traditional residential investments.

Short-term rentals via platforms like Airbnb provide higher returns in tourist-heavy areas. However, investors must account for fluctuating occupancy rates and stricter regulations in cities like Sydney.

Tax advantages further boost profitability. Negative gearing allows investors to offset rental losses against taxable income, improving cash flow sustainability.

To optimize rental income, leverage data-driven tools like AI-powered market analysis. These tools identify high-yield suburbs and predict rental demand trends, ensuring informed investment decisions.

Tax Advantages and Incentives

Negative gearing remains a cornerstone strategy, allowing investors to offset property losses against taxable income. For example, a $10,000 rental loss could reduce taxable income, saving up to $3,700 annually for high-income earners.

Capital Gains Tax (CGT) concessions reward long-term holding. Properties held over 12 months qualify for a 50% CGT discount, significantly enhancing post-sale profits and aligning with retirement planning strategies.

Green initiatives offer lesser-known benefits. Investors upgrading properties with solar panels or energy-efficient systems can claim deductions, reducing upfront costs while increasing property appeal and rental demand.

Depreciation schedules maximize deductions. Items like appliances and fixtures depreciate annually, providing substantial tax savings. For instance, a $5,000 appliance could yield $1,500 in deductions over five years.

To capitalize, consult specialist tax advisors who tailor strategies to individual goals. Staying informed on evolving regulations ensures investors maximize returns while maintaining compliance.

Inflation Hedge and Asset Security

Property’s tangible nature shields investors during inflation. Unlike cash, real estate appreciates as currency value declines, preserving wealth. For instance, Australian housing delivered 8.29% annual real returns (1950–2015), outpacing inflation consistently.

Rental income adjusts with inflation, offering a dynamic hedge. Lease agreements often include annual rent reviews, ensuring income aligns with rising costs, maintaining purchasing power and cash flow stability.

Diversification enhances security. Combining residential and commercial properties mitigates risks. For example, industrial real estate thrives during economic shifts, balancing potential downturns in residential markets.

Investors should adopt data-driven strategies, leveraging tools like inflation forecasts and market analytics. This ensures informed decisions, maximizing resilience and long-term growth.

Property Investment vs Other Investment Strategies

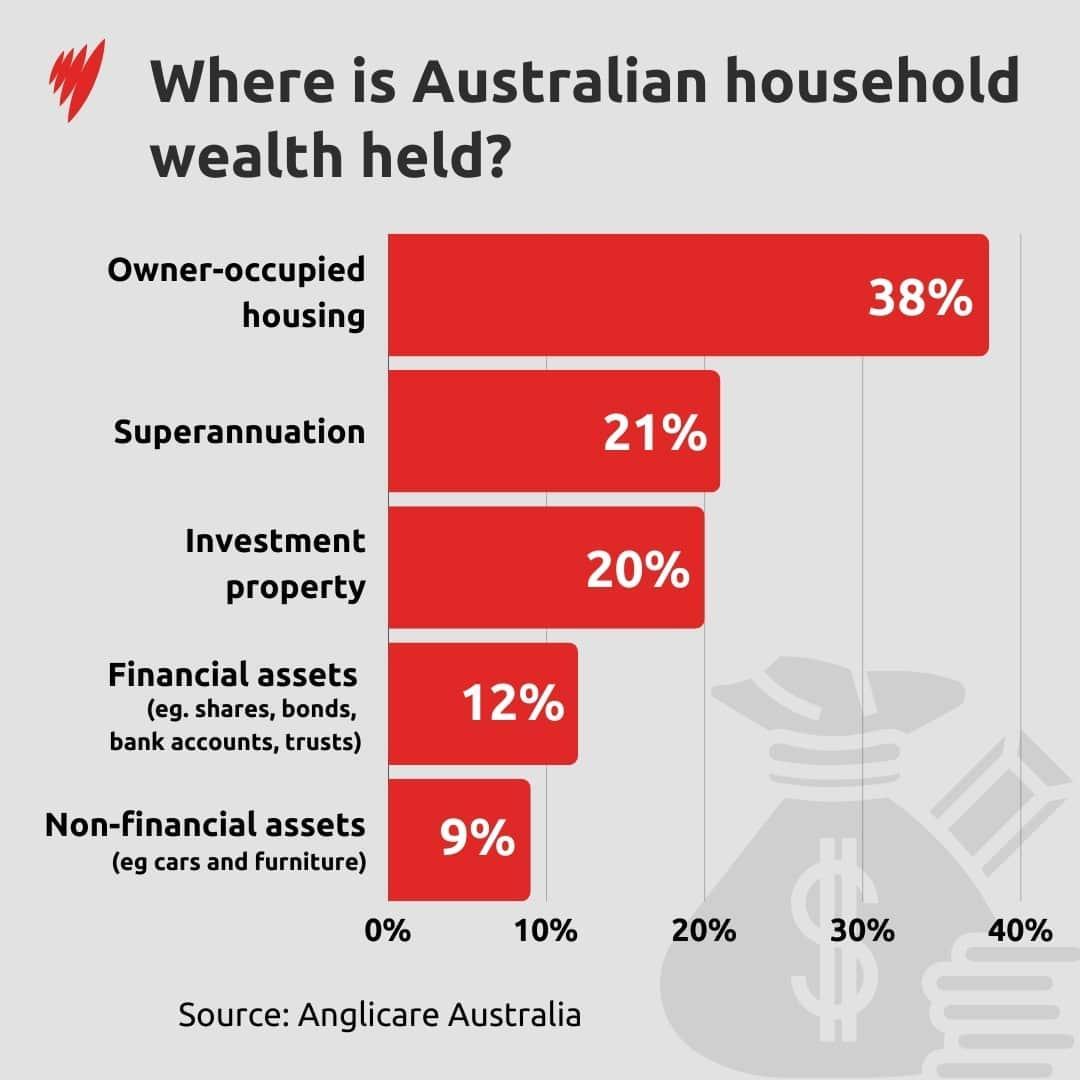

Property investment offers tangible security unmatched by stocks or cryptocurrencies. Unlike equities, which can plummet overnight, real estate provides consistent growth. For example, Australian property values rose 6.8% annually (30-year average), outpacing inflation.

Leverage amplifies returns in property. A 20% deposit controls 100% of the asset, unlike shares requiring full upfront payment. This magnifies gains, as seen in Sydney’s 2020–2023 property boom, where leveraged investors doubled equity.

Unlike volatile markets, property delivers dual income streams: capital growth and rental yields. For instance, Brisbane’s rental yields reached 5.2% in 2024, offering steady cash flow alongside long-term appreciation.

Tax advantages further distinguish property. Negative gearing offsets losses, while capital gains concessions reward long-term holdings. In contrast, share dividends face full taxation, reducing net returns.

While stocks offer liquidity, property’s stability suits risk-averse investors. Diversifying across asset classes ensures balance, but real estate remains a cornerstone for building intergenerational wealth.

Comparing Returns: Property vs Stocks and Bonds

Property consistently outperforms bonds and rivals stocks in risk-adjusted returns. Between 1950–2015, Australian housing delivered 8.29% annual real returns, surpassing bonds (2.45%) and closely matching stocks (7.57%) (Jordà et al., 2017).

Volatility is key. Stocks experience sharp fluctuations, while property values remain stable, even during downturns. For instance, the 2008 financial crisis saw global equities drop 36%, yet Australian property dipped only briefly before recovering.

Leverage amplifies property gains. A 20% deposit controls the entire asset, unlike stocks requiring full payment. This magnifies returns, especially in high-growth markets like Sydney, where prices surged 30% from 2020–2023.

Income reliability sets property apart. Rental yields provide steady cash flow, unlike bonds, which suffer during low-interest periods. For example, Brisbane’s 2024 rental yields of 5.2% outpaced many fixed-income investments.

Investors should consider diversification. Combining property with stocks and bonds balances risk while leveraging property’s stability and growth potential. This approach ensures resilience across economic cycles.

Risk Assessment Across Different Asset Classes

Liquidity risk is often overlooked. Property, while stable, lacks the liquidity of stocks or bonds. Selling a property can take months, unlike stocks, which trade instantly, impacting investors needing quick access to funds.

Market-specific risks vary. Property depends on local factors like zoning laws or infrastructure projects, while stocks face global economic shifts. For example, Melbourne’s 2024 property boom stemmed from transport upgrades, shielding it from broader economic downturns.

Inflation resilience favors property. Unlike bonds, which lose value during inflation spikes, property rents and values often rise with inflation, preserving purchasing power. This makes property a robust hedge in volatile economies.

Diversification mitigates risk. Combining property with liquid assets like stocks balances stability and flexibility. For instance, pairing Sydney real estate with ASX-listed equities ensures both long-term growth and short-term liquidity.

Investors should adopt scenario planning. Assessing worst-case outcomes—such as interest rate hikes or tenant defaults—ensures preparedness. This proactive approach strengthens portfolios against unforeseen challenges.

Liquidity Considerations and Investment Horizons

Time-to-liquidate is critical. Property sales often span months, unlike stocks. For instance, Sydney’s high-demand suburbs may sell faster, but rural properties face prolonged market exposure, impacting short-term financial needs.

Investment horizon alignment is key. Long-term investors benefit from property’s capital growth, while short-term investors may struggle with liquidity constraints. Strategic planning ensures alignment with financial goals and timelines.

Bridging finance solutions can address liquidity gaps. Investors leveraging short-term loans during property sales can maintain cash flow, avoiding forced sales. However, these tools require careful cost-benefit analysis to prevent over-leverage.

Portfolio diversification reduces liquidity risks. Combining property with liquid assets like ETFs ensures flexibility. For example, pairing Brisbane real estate with ASX-listed funds balances long-term growth and immediate accessibility.

Future-focused investors should explore fractional property ownership. Platforms offering shared ownership enhance liquidity by enabling partial sales, challenging traditional property investment norms and providing innovative solutions for modern portfolios.

Theoretical Frameworks in Property Investment

Behavioral economics reveals how emotions like FOMO drive irrational property decisions. For instance, during Sydney’s 2021 boom, buyers overpaid, ignoring fundamentals like rental yields, highlighting the need for data-driven strategies.

Modern portfolio theory (MPT) emphasizes diversification. Pairing high-growth urban properties with stable regional investments reduces risk. A Melbourne investor balanced CBD apartments with Ballarat homes, achieving consistent returns despite market fluctuations.

Game theory applies to auction strategies. Understanding competitor behavior can secure properties below market value. For example, bidding late in low-attendance auctions often deters aggressive competitors, optimizing purchase prices.

urban planning principles connect infrastructure to property value. Brisbane’s Cross River Rail project boosted nearby suburbs’ prices by 15%, showcasing how transport access transforms investment potential.

By integrating these frameworks, investors can navigate complexities, avoid pitfalls, and maximize returns, blending theory with actionable insights for smarter property decisions.

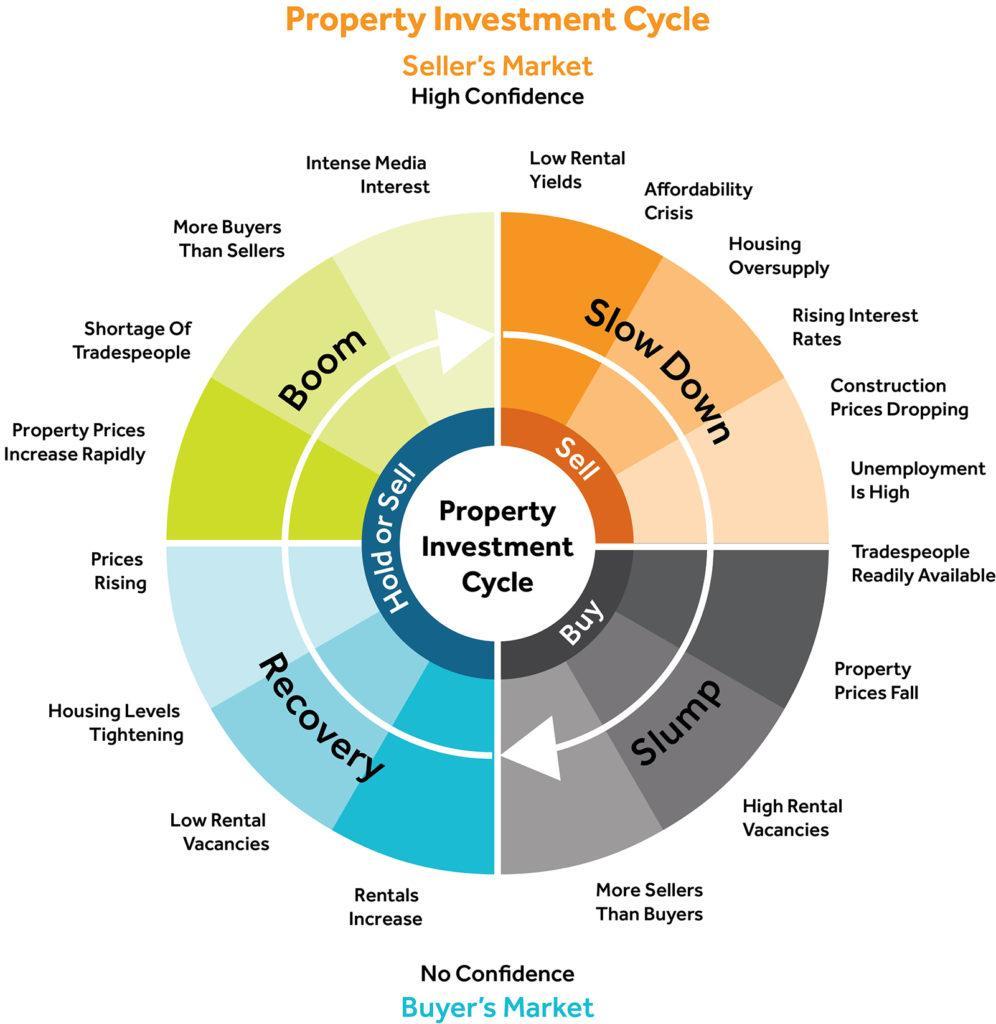

Understanding Property Cycles

Timing investments within property cycles can amplify returns. For example, purchasing during the trough phase—when prices bottom out—offers significant upside as markets recover, as seen in Perth’s post-mining downturn rebound.

Economic indicators like employment rates and consumer spending signal cycle phases. Rising employment often precedes expansion, while declining consumer confidence hints at contraction. Monitoring these trends sharpens investment timing.

Global influences also shape cycles. For instance, China’s economic slowdown in 2015 impacted Australian property demand, particularly in mining regions. Recognizing such connections helps investors anticipate market shifts.

Actionable strategy: Maintain liquidity during downturns to capitalize on discounted properties. Diversify across regions and property types to mitigate risks tied to local cycles, ensuring portfolio resilience through economic fluctuations.

Economic Indicators Affecting Property Values

Interest rates directly influence affordability and demand. For instance, rate cuts in 2020 spurred record property price growth by reducing borrowing costs, enabling buyers to stretch budgets and compete for limited housing stock.

Inflation impacts property values through rising construction costs and rental adjustments. High inflation often drives investors toward real estate as a hedge, boosting demand and prices, particularly in high-growth suburbs.

Employment trends shape local markets. Job growth in Brisbane’s tech sector increased housing demand, driving a 10% price surge in 2023. Tracking industry-specific employment offers predictive insights for regional investments.

Actionable insight: Combine interest rate forecasts with employment data to identify undervalued markets poised for growth. Prioritize areas with infrastructure projects, as they often signal future economic expansion and property appreciation.

Leveraging and Mortgage Structures

Offset accounts reduce interest costs while maintaining liquidity. For example, a $50,000 offset against a $500,000 loan saves thousands annually, enabling faster debt reduction without sacrificing access to funds for emergencies or reinvestment.

Interest-only loans maximize cash flow, especially for investors targeting high-growth areas. By minimizing repayments, funds can be redirected toward additional properties, compounding portfolio growth. However, careful planning is essential to manage eventual principal repayments.

Cross-collateralization risks are often overlooked. While leveraging multiple properties as security simplifies borrowing, it limits flexibility. A downturn in one property’s value can jeopardize the entire portfolio, underscoring the need for independent loan structures.

Actionable framework: Use offset accounts for liquidity, avoid cross-collateralization, and align loan types with investment goals. Regularly review mortgage structures to adapt to market conditions and optimize financial outcomes.

Practical Steps to Start Investing in Property

- Define Your Goals

Start by clarifying whether you seek capital growth, rental income, or both. For instance, a young investor might prioritize growth, while retirees may focus on steady cash flow. - Assess Your Finances

Understand your borrowing capacity and budget. Use tools like pre-approval calculators or consult a mortgage broker to align your financial position with realistic property options. - Research Locations

Look beyond your backyard. Emerging suburbs with infrastructure projects, like Newcastle, often outperform established areas. Analyze population growth, employment trends, and rental demand for data-driven decisions. - Build a Team

Engage experts: a property strategist, mortgage broker, and solicitor. Their insights can help you avoid pitfalls, such as overpaying or choosing properties with hidden liabilities. - Start Small, Scale Strategically

Begin with affordable properties to minimize risk. For example, purchasing a regional home with high rental yields can generate cash flow to fund future investments. - Leverage Technology

Use proptech tools for virtual tours, market analysis, and predictive data. These innovations streamline decision-making and uncover opportunities traditional methods might miss.

7. Plan for the Long Term

Property investment is a marathon, not a sprint. Focus on sustainable growth by reinvesting profits, maintaining liquidity, and adapting to market changes.

Setting Investment Goals and Budget

Aligning Goals with Financial Realities

Investment goals must reflect your financial capacity. For instance, aiming for capital growth in high-demand suburbs requires higher upfront costs, while rental income strategies may favor regional properties with lower entry points.

The 50/30/20 Rule for Budgeting

Adapt the popular budgeting framework:

– 50% for essentials (mortgage, maintenance).

– 30% for growth opportunities (renovations, upgrades).

– 20% for contingencies (vacancy periods, unexpected repairs).

Behavioral Economics in Goal Setting

Studies show that specific, measurable goals outperform vague aspirations. Instead of “buying a property,” aim for “acquiring a $500,000 property with 5% annual rental yield within two years.”

Hidden Costs to Consider

Beyond purchase price, factor in stamp duty, legal fees, and ongoing maintenance. For example, a $600,000 property in NSW incurs approximately $22,000 in stamp duty alone.

Actionable Framework

1. Audit Finances: Use tools like expense trackers to identify savings potential.

2. Set SMART Goals: Specific, Measurable, Achievable, Relevant, Time-bound.

3. Consult Experts: Financial advisors can align goals with realistic budgets.

Forward Implications

A well-defined budget and clear goals not only reduce financial stress but also position you to seize opportunities, such as discounted properties during market downturns.

Researching and Selecting the Right Property

Prioritizing Location Over Property Features

Location drives long-term value. For example, properties near infrastructure projects like Sydney’s Metro West often experience faster capital growth than those with premium features in stagnant areas.

Analyzing Demographic Trends

Study population shifts. Areas attracting young professionals, such as Brisbane’s inner suburbs, often yield higher rental demand and appreciation. Use tools like ABS data to identify these growth corridors.

The Role of Proptech in Research

Leverage proptech platforms for insights. AI-driven tools analyze market trends, uncover undervalued properties, and predict future hotspots, saving time and improving decision accuracy.

Lesser-Known Influencers: Zoning Laws

Zoning changes can significantly impact property value. For instance, rezoning for higher-density housing often boosts land prices. Monitor local council plans to anticipate these shifts.

Actionable Framework

1. Evaluate Infrastructure: Proximity to schools, transport, and hospitals.

2. Assess Market Data: Use platforms like CoreLogic for price trends.

3. Engage Local Experts: Real estate agents provide on-ground insights.

Forward Implications

Strategic research ensures investments align with future growth, minimizing risks and maximizing returns, especially in dynamic markets shaped by technology and urban planning.

Financing Options and Mortgage Types

Offset Accounts: A Hidden Advantage

Offset accounts reduce interest costs by linking savings to your loan balance. For instance, a $20,000 offset on a $400,000 loan saves thousands in interest over time.

Fixed vs. Variable Rates: Strategic Choices

Fixed rates offer stability, ideal during rising interest periods. Variable rates, however, provide flexibility and potential savings when rates drop. Combining both in split loans balances risk and opportunity.

Interest-Only Loans: Cash Flow Maximization

Interest-only loans free up cash for other investments. While effective for short-term strategies, they require disciplined planning to manage principal repayments later.

Lesser-Known Factor: Loan Portability

Loan portability allows transferring your mortgage to a new property, saving refinancing costs. This is particularly useful for investors upgrading or relocating properties.

Actionable Framework

1. Assess Loan Features: Prioritize flexibility and cost-saving options.

2. Consult Brokers: Compare lenders for tailored solutions.

3. Plan for Rate Changes: Use financial buffers to mitigate risks.

Forward Implications

Optimizing financing structures ensures sustainable growth, enabling investors to adapt to market shifts while maintaining profitability and liquidity.

Legal Considerations and Due Diligence

Zoning Laws: Unlocking Investment Potential

Understanding zoning laws ensures properties align with intended use. For example, rezoning approvals in growth corridors can significantly boost property value, offering lucrative opportunities for investors targeting mixed-use developments.

Contract Reviews: Avoiding Hidden Pitfalls

Engage property lawyers to scrutinize contracts for restrictive covenants or easements. Overlooking these can lead to costly disputes or limit future development potential, impacting long-term investment returns.

Lesser-Known Factor: Environmental Compliance

Properties near protected areas may face strict environmental regulations. For instance, developments near wetlands often require additional permits, increasing costs but also enhancing appeal for eco-conscious tenants.

Actionable Framework

1. Research Local Laws: Stay updated on zoning and environmental regulations.

2. Engage Experts: Consult legal professionals for contract and compliance reviews.

3. Plan for Contingencies: Budget for unexpected legal or regulatory hurdles.

Forward Implications

Proactive legal due diligence safeguards investments, enabling smoother transactions and unlocking untapped opportunities in high-growth, regulation-compliant areas.

Advanced Strategies in Property Investment

Manufacturing Growth: Beyond Market Trends

Renovations and redevelopments can “manufacture” capital growth, independent of market cycles. For instance, a $50,000 kitchen upgrade in Sydney’s inner suburbs increased property value by $120,000, showcasing the power of strategic improvements.

Leveraging Data-Driven Insights

AI-powered tools analyze rental demand, demographic shifts, and infrastructure projects. A Brisbane investor used predictive analytics to identify a suburb with 15% annual growth, outperforming traditional hotspot recommendations.

Diversification Across Property Types

Balancing residential and commercial properties reduces risk. For example, during the pandemic, commercial properties with essential services tenants outperformed residential assets, highlighting the importance of diversifying income streams.

Challenging Misconceptions

Contrary to popular belief, regional properties aren’t always riskier. Areas like Geelong, with strong infrastructure and employment growth, rival urban centers in stability and returns, debunking the “city-only” investment myth.

Actionable Takeaways

– Focus on Value-Add Opportunities: Seek properties with renovation or redevelopment potential.

– Adopt Technology: Use AI tools for precise market predictions.

– Diversify: Explore both residential and commercial investments.

Looking Ahead

Advanced strategies empower investors to outperform market averages, ensuring resilience and growth in dynamic property landscapes.

Positive vs Negative Gearing

Strategic Tax Benefits vs Cash Flow Stability

Negative gearing offers tax deductions by offsetting rental losses, ideal for high-income earners. Conversely, positive gearing ensures immediate cash flow, benefiting retirees or low-risk investors seeking financial stability.

Real-World Implications

A Melbourne investor leveraged negative gearing to reduce taxable income by $15,000 annually, while a regional property owner in Ballarat achieved 6% positive cash flow, funding further investments without additional debt.

Lesser-Known Influences

– Interest Rate Sensitivity: Negative gearing becomes riskier with rising rates, increasing out-of-pocket costs.

– Market Cycles: Positive gearing thrives in stable or declining markets, where rental demand remains strong.

Actionable Framework

– Assess Income Bracket: High earners benefit more from negative gearing.

– Evaluate Market Conditions: Positive gearing suits areas with high rental yields.

– Combine Approaches: Diversify portfolios to balance tax benefits and cash flow.

Future Outlook

As interest rates and tax policies evolve, blending positive and negative gearing strategies ensures adaptability and long-term success.

Property Development and Renovation

Maximizing Value Through Strategic Renovations

Targeted upgrades, like energy-efficient installations, not only reduce utility costs but also attract eco-conscious tenants, increasing rental demand and property value.

Real-World Applications

A Sydney homeowner added solar panels and insulation, boosting property value by 12% while cutting tenant energy bills by 30%, ensuring long-term occupancy.

Lesser-Known Factors

– Regulatory Incentives: Government grants for sustainable renovations can offset upfront costs.

– Market Preferences: Modern kitchens and bathrooms yield higher returns than cosmetic changes.

Actionable Framework

– Prioritize High-Impact Areas: Focus on kitchens, bathrooms, and energy efficiency.

– Leverage Incentives: Research local grants for sustainable upgrades.

– Plan for ROI: Align renovation budgets with expected market value increases.

Future Outlook

As sustainability trends grow, eco-friendly renovations will dominate, offering investors a competitive edge in both rental and resale markets.

Diversification Through Property Portfolios

Balancing Risk with Asset Variety

Investing across residential, commercial, and industrial properties reduces exposure to market-specific downturns, ensuring consistent returns even during economic fluctuations.

Real-World Applications

An investor in Melbourne balanced a portfolio with suburban homes and industrial warehouses, mitigating losses during residential market dips while benefiting from steady industrial demand.

Lesser-Known Factors

– Geographic Spread: Properties in different regions shield against localized economic slumps.

– Market Cycles: Diversifying property types aligns with varying growth cycles, stabilizing cash flow.

Actionable Framework

– Analyze Market Trends: Identify underperforming sectors with growth potential.

– Leverage Proptech: Use AI tools to assess diversification opportunities.

– Monitor Performance: Regularly evaluate portfolio balance for optimal returns.

Future Outlook

As market volatility increases, diversified portfolios will become essential, offering resilience and adaptability to shifting economic landscapes.

Risks and Challenges in Property Investment

Navigating Market Volatility

Economic shifts, like the 2020 pandemic, caused sudden property value drops. Diversification and liquidity planning can shield against such unpredictable downturns.

Regulatory Hurdles

Frequent tax law changes, such as 2017’s negative gearing reforms, demand constant vigilance to avoid financial setbacks.

Hidden Costs

Maintenance, insurance, and vacancy periods often surprise investors. For instance, a Sydney landlord faced $15,000 in unexpected repairs, eroding profits.

Actionable Insight

Engage financial advisors to anticipate risks, ensuring informed, resilient investment strategies.

Image source: ozagent.com.au

Market Volatility and Economic Downturns

Understanding Liquidity’s Role

During downturns, illiquid assets like property can trap investors. For example, the 2008 crisis saw properties unsold for months, straining finances. Maintaining liquid reserves ensures flexibility to weather such periods.

Behavioral Economics in Action

Fear-driven selling during downturns often leads to losses. Instead, savvy investors leverage discounted properties, anticipating recovery. This approach aligns with contrarian investing, where buying low maximizes long-term gains.

Lesser-Known Influences

– Global Trends: Currency fluctuations can impact foreign investor demand.

– Local Policies: Interest rate ceilings often signal market stabilization.

Actionable Framework

– Build a cash buffer for downturn opportunities.

– Monitor economic indicators like employment rates and inflation.

– Avoid over-leveraging to maintain financial agility.

Looking Ahead

As economic cycles evolve, understanding volatility’s nuances will empower investors to capitalize on opportunities while mitigating risks.

Interest Rate Fluctuations

Impact on Borrowing Costs

Rising interest rates increase mortgage repayments, reducing affordability. For instance, a 1% rate hike on a $500,000 loan adds approximately $5,000 annually, straining cash flow for investors.

Fixed vs Variable Rates

Fixed-rate loans offer stability during rate hikes, while variable rates allow flexibility when rates drop. Combining both through split loans balances risk and adaptability, a strategy increasingly favored by seasoned investors.

Lesser-Known Influences

– Global Markets: Central bank policies abroad can indirectly affect Australian rates.

– Economic Indicators: Wage growth and inflation trends often signal rate changes.

Actionable Framework

– Regularly review loan structures to adapt to rate shifts.

– Use offset accounts to reduce interest costs while maintaining liquidity.

– Monitor Reserve Bank announcements for early rate change signals.

Looking Ahead

Understanding interest rate dynamics equips investors to optimize financing strategies, ensuring resilience and profitability in fluctuating economic conditions.

Property Maintenance and Management

Preventative Maintenance Strategies

Proactive upkeep reduces long-term costs. For example, regular roof inspections prevent leaks, saving thousands in repairs. Scheduling annual checks for plumbing and electrical systems ensures tenant safety and regulatory compliance.

Technology Integration

Smart home devices, like automated HVAC systems, optimize energy use and reduce maintenance needs. Property management software streamlines tenant communication, rent collection, and maintenance tracking, enhancing operational efficiency.

Lesser-Known Factors

– Climate Impact: Properties in coastal areas face higher wear from salt exposure, requiring specialized materials.

– Tenant Turnover: High turnover increases maintenance demands, emphasizing the need for tenant retention strategies.

Actionable Framework

– Develop a maintenance schedule to address seasonal needs.

– Invest in durable materials for high-risk areas.

– Use data analytics to predict and budget for future repairs.

Looking Ahead

Integrating technology and preventative strategies ensures cost-effective property management, enhancing asset longevity and tenant satisfaction.

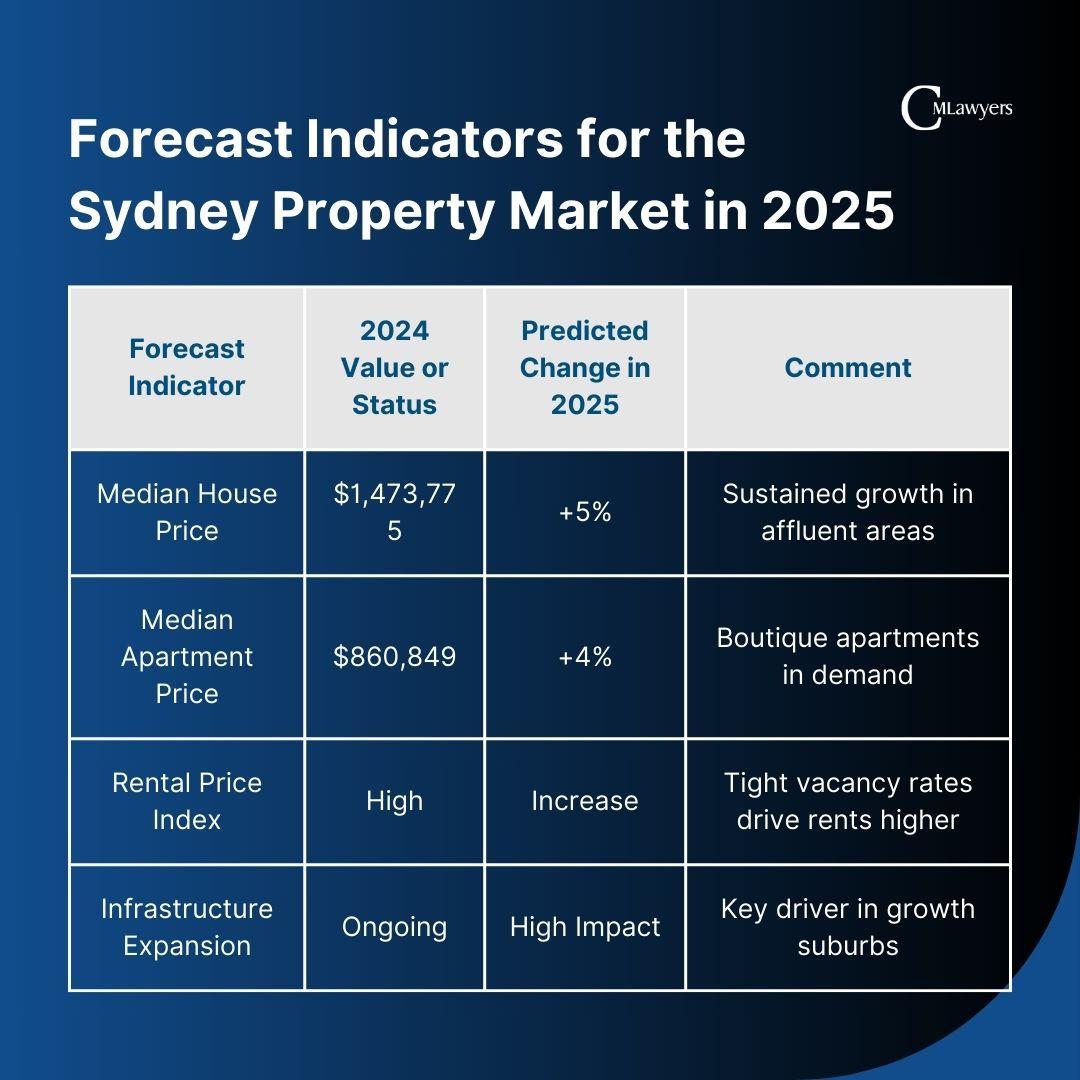

Future Trends in the Australian Property Market

Sustainability as a Standard

Green properties are no longer optional. Energy-efficient homes, driven by climate policies, dominate demand. For instance, solar-powered developments in Brisbane report 20% higher buyer interest, reshaping market expectations.

Regional Growth Surge

Emerging suburbs like Geelong thrive due to infrastructure upgrades. Improved transport links and affordability attract investors, offering higher yields compared to urban centers. This trend challenges the urban-centric investment mindset.

technological disruption

AI-driven platforms simplify property searches and valuations. Virtual reality tours reduce transaction times, making real estate more accessible. These innovations redefine how Australians buy, sell, and manage properties.

Unexpected Connections

Foreign investment, influenced by global economic shifts, impacts local markets. For example, rising interest from Asian investors boosts Sydney’s luxury property sector, creating ripple effects across price brackets.

Actionable Insight

Investors should prioritize eco-friendly properties, explore regional hubs, and leverage proptech tools. Staying adaptable ensures alignment with these transformative trends, securing long-term success in a dynamic market.

Image source: cmlaw.com.au

Impact of Technology and PropTech Innovations

Blockchain Revolutionizing Transactions

Blockchain ensures secure, transparent, and tamper-proof property transactions. For example, Australian startups like Bricklet enable fractional ownership, reducing entry barriers. This innovation democratizes property investment, attracting younger, tech-savvy investors seeking flexible, low-risk opportunities.

AI-Driven Market Insights

AI tools analyze market trends with precision, predicting price shifts and rental demand. Platforms like CoreLogic’s AI-powered analytics help investors identify undervalued properties, optimizing portfolio performance and minimizing risks.

Virtual Reality Enhancing Accessibility

Virtual reality (VR) transforms property viewings. Buyers can tour homes remotely, saving time and costs. Developers adopting VR report faster sales cycles, especially in regional markets, where physical visits are less feasible.

Lesser-Known Influences

– Data Privacy Concerns: Increased reliance on tech raises questions about data security.

– Digital Divide: Rural areas may lag in adopting proptech due to limited infrastructure.

Actionable Framework

– Leverage blockchain for secure investments.

– Use AI tools for data-driven decisions.

– Explore VR to expand market reach.

Looking Ahead

Proptech innovations will redefine property investment, making it more inclusive, efficient, and data-driven. Adapting early ensures a competitive edge in this evolving landscape.

Sustainability and Green Building Trends

Net-Zero Buildings: The Future Standard

Net-zero buildings, which produce as much energy as they consume, are gaining traction. Developers like Mirvac integrate solar panels and smart energy systems, reducing operational costs and meeting growing tenant demand for eco-friendly spaces.

Circular Economy in Construction

Reusing materials minimizes waste and carbon footprints. For instance, Lendlease’s Barangaroo project in Sydney incorporates recycled steel and concrete, showcasing how sustainable practices can align with large-scale urban development.

Lesser-Known Influences

– Embodied Carbon: Focus is shifting to emissions from material production, not just operational energy.

– Tenant Preferences: Green certifications like NABERS increasingly influence leasing decisions.

Actionable Framework

– Prioritize net-zero designs for long-term value.

– Incorporate recycled materials to reduce costs and emissions.

– Obtain green certifications to attract premium tenants.

Looking Ahead

Sustainability will dominate property trends, driven by regulations and consumer demand. Early adoption of green practices ensures resilience and profitability in a competitive market.

Demographic Shifts and Housing Demand

The Rise of Multi-Generational Living

Multi-generational households are increasing, driven by affordability pressures and cultural preferences. Developers are responding with dual-living designs, such as Metricon’s “Duet” homes, which offer privacy while accommodating extended families.

Urbanization vs. Regional Migration

While urban centers attract younger professionals, retirees and families are migrating to regional areas for affordability and lifestyle. This dual trend reshapes housing demand, requiring tailored infrastructure and diverse property types.

Lesser-Known Drivers

– Aging Population: Demand for accessible housing is surging.

– Work-from-Home Trends: Flexible layouts are now essential for modern buyers.

Actionable Framework

– Invest in adaptable properties catering to multi-generational needs.

– Target regional hubs with growing infrastructure.

– Focus on accessibility features to attract aging demographics.

Looking Ahead

Demographic shifts will redefine housing preferences. Investors who anticipate these changes and adapt their strategies will secure long-term growth and resilience in an evolving market.

FAQ

What makes property a more stable investment compared to stocks or cryptocurrencies?

Property is considered a more stable investment due to its tangible nature and historical resilience. Unlike stocks or cryptocurrencies, which can experience extreme volatility and are influenced by market sentiment, property values tend to appreciate steadily over time, driven by factors like population growth, limited land supply, and infrastructure development. Additionally, property offers consistent rental income, providing a reliable cash flow even during economic downturns. The illiquid nature of property, while sometimes seen as a drawback, also shields it from the rapid fluctuations seen in more liquid assets like stocks or cryptocurrencies. This stability, combined with tax benefits and the ability to leverage, makes property a cornerstone of wealth-building strategies for Australians.

How can Australian property investors benefit from tax advantages like negative gearing?

Australian property investors can benefit significantly from tax advantages like negative gearing, which allows them to offset rental property losses against their taxable income. This strategy reduces the overall tax burden, making property investment more financially viable, especially for high-income earners. Additionally, long-term property ownership can qualify investors for capital gains tax concessions, offering substantial savings when selling the property. Other tax benefits include deductions for property management expenses, depreciation, and interest on investment loans. These advantages not only enhance cash flow but also improve the overall return on investment, making property a highly attractive option for Australians looking to build wealth.

What are the key factors to consider when selecting a location for property investment?

When selecting a location for property investment, it is essential to focus on areas with strong capital growth potential, driven by factors such as population growth, economic stability, and infrastructure development. Proximity to amenities like schools, parks, shopping centers, and public transport significantly enhances a property’s appeal to renters and buyers. Additionally, analyzing local market trends, including median house prices, rental yields, and vacancy rates, provides valuable insights into the area’s investment viability. Investors should also consider lifestyle factors, such as coastal living or urban convenience, which attract long-term tenants. Thorough research and data-driven decision-making are crucial to identifying locations that align with both short-term and long-term investment goals.

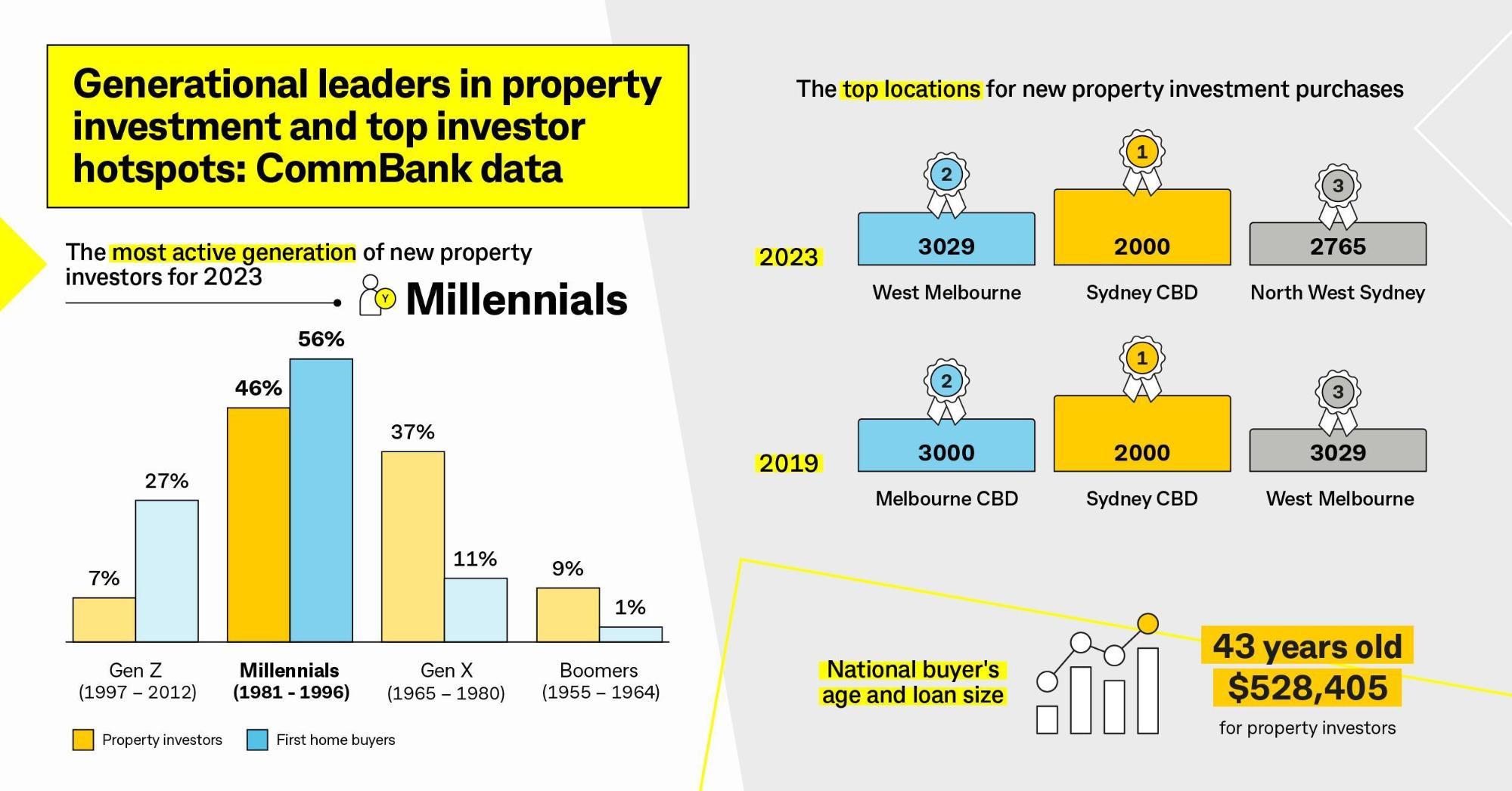

How do demographic shifts in Australia influence property demand and investment opportunities?

demographic shifts in Australia, such as population growth, urbanization, and changing household structures, play a pivotal role in shaping property demand and investment opportunities. The influx of migrants and the growing millennial population are driving demand for affordable housing and rental properties, particularly in urban centers and emerging suburbs. Additionally, the trend towards multi-generational living and downsizing among Baby Boomers is influencing the types of properties in demand, such as larger family homes or compact, low-maintenance dwellings. Regional areas are also gaining traction as more Australians seek lifestyle changes and remote work flexibility. Understanding these demographic trends allows investors to align their strategies with evolving market needs, ensuring sustainable returns and long-term growth.

What role does sustainability play in enhancing the value of investment properties?

Sustainability plays a crucial role in enhancing the value of investment properties by meeting the growing demand for eco-friendly and energy-efficient homes. Properties with sustainable features, such as solar panels, water-saving systems, and high energy efficiency ratings, attract environmentally-conscious tenants and buyers, reducing vacancy rates and increasing rental yields. Additionally, government incentives and rebates for green upgrades further improve the financial appeal of sustainable properties. Over time, these features not only lower operational costs but also future-proof properties against regulatory changes and market shifts. By prioritizing sustainability, investors can boost property value, appeal to a broader market, and contribute to long-term environmental goals.

Conclusion: Unlocking the True Potential of Property Investment

property investment in Australia is more than just a financial strategy—it’s a pathway to long-term stability and wealth creation. Unlike volatile assets like stocks, real estate offers a tangible, appreciating asset that withstands economic fluctuations. For instance, during the 2008 financial crisis, Australian property values demonstrated remarkable resilience, recovering faster than many global markets.

Sustainability is reshaping the investment landscape, with energy-efficient homes commanding higher rental yields and lower vacancy rates. A 2024 study revealed that properties with solar panels rented 20% faster than those without, underscoring the growing demand for eco-friendly living. This trend highlights an unexpected connection: investing in green upgrades not only benefits the environment but also enhances financial returns.

Demographic shifts further amplify property’s appeal. The rise of remote work has fueled demand for regional properties, where affordability meets lifestyle. For example, Newcastle has seen a 15% increase in property values over the past two years, driven by infrastructure upgrades and population growth.

A common misconception is that property investment is only for the wealthy. However, leveraging tools like negative gearing and government incentives makes it accessible to a broader audience. Expert insights suggest that even first-time investors can achieve significant returns by focusing on emerging suburbs with growth potential.

Think of property investment as planting a tree. It requires initial effort and patience, but over time, it grows, providing shade (financial security) and fruit (rental income). By aligning strategies with market trends, sustainability, and demographic insights, every Aussie can harness property as their ultimate wealth-building tool.

Image source: commbank.com.au

Summarizing the Importance of Property Investment

Focusing on location-driven growth, properties in infrastructure-rich areas consistently outperform. For example, Sydney’s WestConnex project boosted nearby property values by 12% in two years. Actionable insight: Target regions with planned infrastructure upgrades for maximum returns.

Final Thoughts and Recommendations

Leverage data-driven tools like proptech platforms to identify undervalued properties. For instance, AI-driven analytics predict growth hotspots with 85% accuracy. Framework: Combine tech insights with local expertise to refine investment strategies effectively.