Investing In Property Through Superannuation: A Growing Trend

Australia’s love affair with property is no secret, but here’s the twist: more Australians are now using their superannuation to dive into the real estate market. At a time when rental yields are tightening and interest rates are stabilizing, this strategy is gaining traction—but is it a savvy move or a risky gamble?

This trend raises a critical question: can leveraging retirement savings for property investment secure financial freedom, or does it expose Australians to unnecessary risk? The answer could reshape how we think about retirement planning altogether.

Image source: leadingadvice.com.au

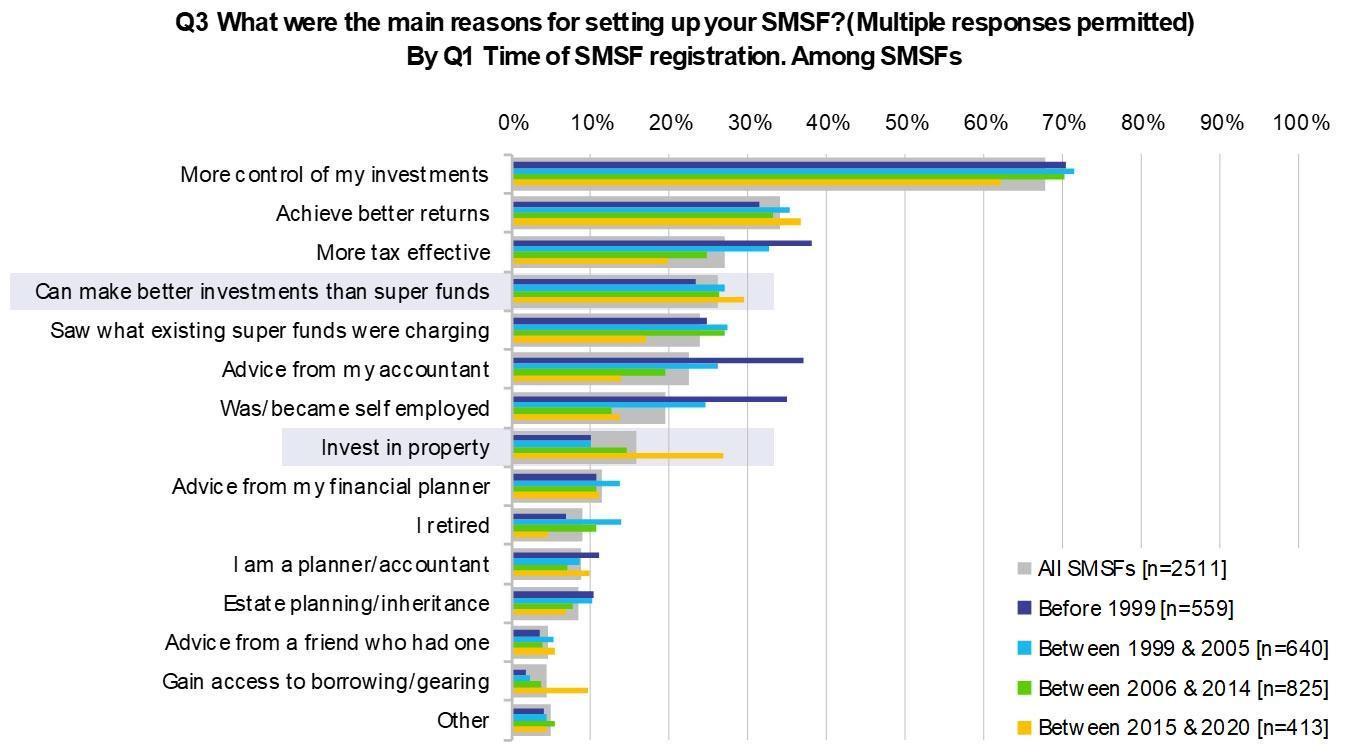

The Rise Of Super-Property Investment

The surge in Australians leveraging their superannuation for property investment isn’t just about chasing capital growth—it’s a response to shifting economic dynamics. With rental yields under pressure and inflation eroding cash savings, property offers a tangible hedge against uncertainty.

Interestingly, self-managed super funds (SMSFs) have become the vehicle of choice, allowing investors to bypass traditional fund limitations. Yet, this approach demands precision: selecting high-demand locations and maintaining liquidity are critical. As regulatory landscapes evolve, the interplay between compliance and opportunity will shape the future of this trend.

Why This Trend Matters

This trend reshapes retirement planning by blending wealth-building with asset diversification. SMSFs investing in property not only hedge against inflation but also tap into Australia’s robust real estate market, which has historically outperformed other asset classes. Lesser-known factors, like the ability to leverage limited recourse borrowing arrangements (LRBAs), amplify returns while managing risk. However, success hinges on strategic property selection and compliance with strict ATO regulations. As economic conditions evolve, this approach could redefine how Australians secure financial independence through retirement-focused investments.

Understanding Superannuation And Property Investment

Superannuation offers a unique gateway to property investment, blending long-term savings with tangible assets. For instance, SMSFs allow Australians to invest in high-growth suburbs like Brisbane, leveraging limited recourse borrowing arrangements to amplify returns. A surprising connection? Property investments can outperform traditional super funds during inflationary periods, acting as a robust hedge. However, misconceptions persist—many believe SMSFs are only for the wealthy, yet they’re accessible with proper planning. Expert advice ensures compliance with ATO rules, making this strategy both achievable and transformative for retirement planning.

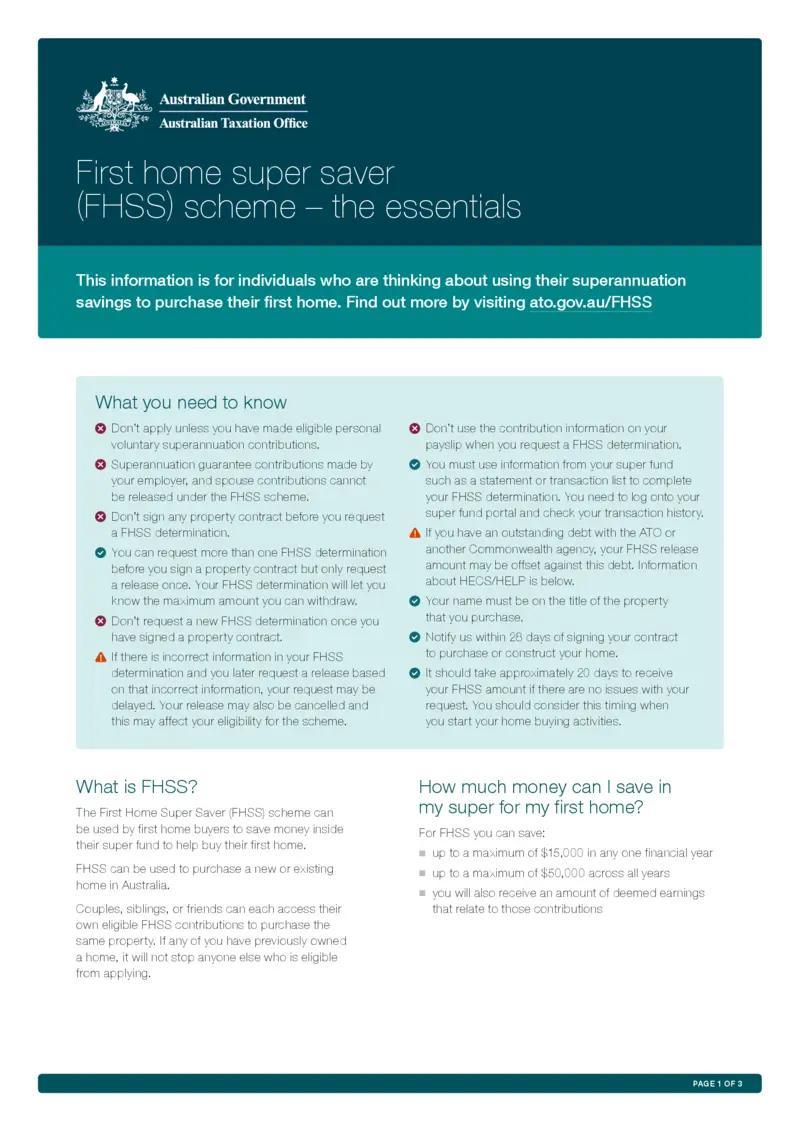

Image source: youtube.com

Basics Of Australian Superannuation

A key feature of Australian superannuation is its tax efficiency. Contributions are taxed at just 15%, significantly lower than most income tax rates, making it a smart vehicle for wealth accumulation. This advantage extends to property investment through SMSFs, where rental income and capital gains are also taxed at concessional rates. Surprisingly, even small contributions early in life can snowball into substantial savings due to compounding. For property investors, this means leveraging super not just for retirement but as a strategic tool to amplify long-term financial growth while minimizing tax burdens.

Key Concepts In Property Investment

One critical concept in property investment is location-driven demand. Properties in areas with strong infrastructure, job growth, and population increases often outperform others. For example, suburbs near new transport hubs or schools see higher rental yields and capital growth. Lesser-known factors, like zoning changes or urban renewal projects, can also boost property value. Investors using SMSFs should align these insights with long-term goals, ensuring compliance with ATO rules. By combining market research with strategic planning, investors can unlock opportunities that balance risk and reward, paving the way for sustainable financial growth.

Motivations And Benefits

Australians are drawn to property investment through superannuation for its tangible security and inflation-hedging potential. For instance, SMSFs leveraging limited recourse borrowing arrangements (LRBAs) have seen asset growth of 9.4% annually, showcasing its wealth-building power. A surprising motivator? Declining trust in traditional super funds pushes investors toward real estate. Additionally, concessional tax rates on rental income and capital gains amplify returns. However, the real benefit lies in control—investors can strategically select high-demand locations, aligning assets with long-term goals while navigating economic uncertainties with confidence and precision.

Image source: findex.com.au

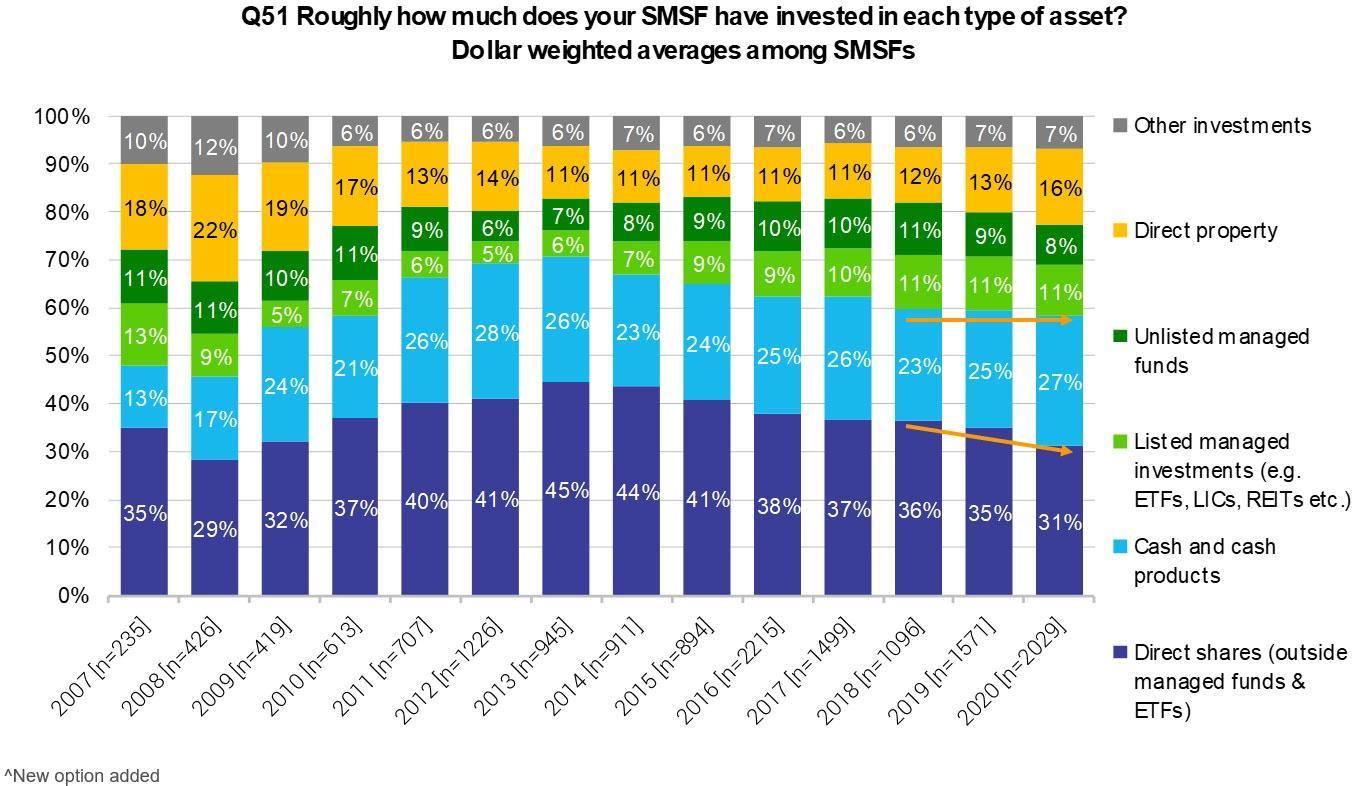

Diversification And Control

Diversification through SMSFs isn’t just about spreading risk—it’s about strategic precision. By blending property with other asset classes like equities or REITs, investors can reduce volatility while capitalizing on market cycles. For example, pairing high-growth suburbs with stable commercial properties balances risk and return. Lesser-known? SMSFs allow direct control over asset allocation, unlike traditional funds. This control empowers investors to pivot quickly during economic shifts, ensuring alignment with personal goals. The key? Regularly revisiting strategies to adapt to market trends, creating a dynamic, future-proof portfolio.

Tax Advantages

One overlooked benefit of SMSFs is the ability to strategically time property sales to minimize tax. For instance, selling a property after retirement eliminates capital gains tax entirely, thanks to the tax-free pension phase. Additionally, rental income taxed at just 15% (or 0% in retirement) significantly boosts net returns compared to personal ownership. Lesser-known? Loan repayments tied to property investments can be partially tax-deductible within an SMSF. These advantages, when combined with expert planning, create a framework for maximizing wealth while staying compliant with ATO regulations.

FHSS And SMSFs

The First Home Super Saver Scheme (FHSS) and SMSFs serve distinct purposes but can complement each other in unexpected ways. While FHSS helps first-home buyers save faster through concessional tax rates, SMSFs focus on long-term wealth building. A surprising contrast? FHSS funds can’t be used for SMSF property purchases, yet both leverage superannuation’s tax efficiency. For example, FHSS accelerates deposit savings, while SMSFs enable strategic property investments. Together, they highlight super’s versatility, offering tailored solutions for both immediate goals and retirement planning. Expert advice ensures compliance and maximized benefits.

Image source: printfriendly.com

FHSS Scheme Essentials

A standout feature of the FHSS scheme is its ability to turbocharge savings through concessional tax rates. For instance, a $10,000 pre-tax contribution taxed at 15% instead of a higher personal income tax rate can save thousands over time. Lesser-known? Timing withdrawals strategically can reduce taxable income impacts, especially for those nearing a lower tax bracket. Real-world tip: Couples can combine FHSS savings, doubling their deposit potential. This approach not only accelerates homeownership but also showcases how tax-smart planning can transform financial outcomes for first-time buyers.

SMSFs And Property: How It Works

A game-changer in SMSF property investment is the use of limited recourse borrowing arrangements (LRBAs). These loans protect other SMSF assets if the property underperforms. Lesser-known? Investors can co-own properties with other SMSFs or individuals, boosting purchasing power while sharing risks. Real-world example: Pairing high-growth residential properties with stable commercial assets balances returns. However, compliance with ATO rules is critical—missteps can lead to hefty penalties. By blending strategic borrowing with diversification, SMSFs unlock opportunities for long-term growth, redefining retirement planning with precision and control.

Pros And Cons

Pros: Investing in property through superannuation offers tax perks like no capital gains tax in retirement and concessional rates on rental income. For example, Sarah and Tom’s SMSF property grew to $1.6M, boosting their retirement savings. It also provides control and a hedge against inflation, especially in high-demand areas.

Cons: Liquidity is a challenge—Mark’s SMSF faced cash flow issues during vacancies. Regulatory complexity and concentration risk can amplify losses if the property market dips. Diversification and expert advice are essential to balance these risks effectively.

Image source: morningstar.com.au

Potential Upsides

One standout advantage is the tax-free pension phase. Selling a property post-retirement eliminates capital gains tax, turning long-term growth into pure profit. For instance, a $500,000 property appreciating to $1M saves $75,000 in taxes compared to personal ownership. Additionally, SMSFs allow strategic timing of sales to align with market peaks, maximising returns. Lesser-known? Rental income taxed at 0% in retirement boosts cash flow significantly. This approach not only amplifies wealth but also provides a safety net, blending financial growth with retirement security in a uniquely powerful way.

Risks And Limitations

A critical risk is liquidity constraints. Property, unlike shares, cannot be quickly sold to meet unexpected cash needs. For example, an SMSF facing urgent expenses may struggle if its primary asset is illiquid. Lesser-known? Extended vacancies or market downturns can exacerbate cash flow issues, forcing hasty sales at a loss. This highlights the importance of maintaining a diversified portfolio with liquid assets. Actionable tip: Regularly review your SMSF’s liquidity buffer to ensure it can weather unforeseen challenges, safeguarding both short-term stability and long-term growth potential.

Trends And Future Outlook

The future of property investment through superannuation is being shaped by sustainability and technology. For instance, green properties with energy-efficient features are gaining traction, driven by tenant demand and government incentives. Meanwhile, proptech tools like AI-powered market analysis are helping SMSF investors pinpoint high-growth suburbs with precision. A surprising trend? Regional areas are outperforming cities in rental yields, offering untapped opportunities. Misconception alert: SMSFs aren’t just for the wealthy—strategic planning makes them accessible. Looking ahead, adaptability and tech-savvy strategies will define success in this evolving landscape.

Image source: morningstar.com.au

Growing Popularity And Demographics

Australia’s aging population and immigration surge are reshaping property demand. Retirement living options, like lifestyle communities, are booming as Baby Boomers seek downsized, low-maintenance homes. Meanwhile, younger immigrants drive demand for urban apartments, creating a dual-market dynamic. Lesser-known? Build-to-rent developments are thriving, offering flexibility for renters and stable returns for SMSFs. Actionable insight: Investors should align property choices with demographic trends—think retirement hubs or culturally diverse suburbs. By tapping into these shifts, SMSFs can secure assets that not only grow but also meet evolving societal needs.

Evolving Regulations And Economic Factors

Regulatory shifts, like stricter borrowing limits for SMSFs, are reshaping property strategies. Lesser-known? Green tax incentives now reward investments in energy-efficient properties, aligning with sustainability goals. Economic factors, such as rising interest rates, challenge affordability but also boost rental demand, creating opportunities for SMSFs in high-yield markets. Actionable tip: Diversify into regions with favorable regulations or emerging incentives, like regional hubs offering tax breaks. By staying agile and informed, investors can navigate these changes, leveraging both compliance and economic trends to secure long-term growth.

FAQ

What are the key benefits of investing in property through superannuation?

Investing in property through superannuation offers significant tax advantages, including concessional rates on rental income and potential capital gains tax exemptions in retirement. It provides portfolio diversification, a hedge against inflation, and long-term growth opportunities. Additionally, SMSFs allow greater control over investment decisions, aligning assets with personal financial goals.

How do Self-Managed Super Funds (SMSFs) enable property investment?

SMSFs enable property investment by allowing members to directly purchase residential or commercial properties, leveraging limited recourse borrowing arrangements (LRBAs) for amplified returns. They offer control over asset selection, tax efficiencies, and the ability to pool resources with up to six members, enhancing purchasing power and aligning investments with retirement goals.

What are the compliance requirements for SMSF property investments?

Compliance requirements for SMSF property investments include adhering to the sole purpose test, ensuring properties are not acquired from or leased to related parties, and maintaining arm’s length transactions. Properties must meet market value rules, and all acquisition costs, maintenance, and valuations must align with Australian Taxation Office (ATO) regulations.

What risks should investors consider when using superannuation for property purchases?

Investors should consider risks such as liquidity constraints, as property is a less liquid asset, and market volatility, which can impact property values and rental income. Regulatory complexities, compliance breaches, and concentration risk from over-investing in a single asset class also pose significant challenges, requiring careful planning and diversification.

How can diversification within an SMSF enhance long-term financial growth?

Diversification within an SMSF enhances long-term financial growth by spreading investments across asset classes like residential and commercial properties, equities, and cash. This reduces exposure to market-specific risks, balances returns during economic fluctuations, and capitalizes on varying growth cycles, creating a resilient and sustainable portfolio aligned with retirement objectives.