Interest Rates Hike February 2026

Here is the updated full blog post with that crucial point about landlords and tenants integrated. I have added it to the “Impact on the Victoria Property Market“ section, as that is where the tight supply makes it easiest for landlords to pass these costs on.

The RBA’s February Shock: What the Return to 3.85% Means for You

Date: February 5, 2026

Category: Market Update, Property News

Just as many Australians were beginning to breathe a sigh of relief, the Reserve Bank of Australia (RBA) has delivered a sharp wake-up call. In a move that caught many off-guard, the RBA Board decided at its February meeting to lift the official cash rate by 25 basis points, taking it back up to 3.85%.

After a period of stability where rates hovered at 3.60%—and with many predicting the next move would be down—this “U-turn” has sent shockwaves through the market. But what exactly triggered this reversal, and more importantly, what does it mean for your mortgage and the Victorian property market?

Let’s break it down.

1. What Does This Mean? (The Mechanics)

In simple terms, the cost of money just got more expensive.

When the RBA raises the cash rate, they are effectively increasing the cost for banks to do business. While banks are quick to pass this cost on to borrowers, the reverse isn’t always true for savers.

-

For Borrowers: You can expect your lender to pass on the full 0.25% increase to your variable home loan rate within the next few weeks.

-

For Savers: Savings rates should increase, offering slightly better returns on cash deposits, though banks often lag in passing these benefits on.

This move signals that the RBA is no longer confident that inflation is “done and dusted.” By raising rates, they are trying to suck excess cash out of the economy to stop prices from rising further.

2. The Hit to Mortgages and Repayments

For homeowners, this hike is a double-edged sword: it increases your monthly costs and decreases how much you can borrow.

The Repayment Reality

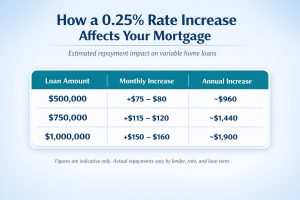

If you are on a variable rate, your repayments will rise. Here is the estimated impact of a 0.25% rise on typical mortgage sizes:

| Loan Amount | Monthly Increase (approx.) | Annual Increase |

| $500,000 | +$75 – $80 | ~$960 |

| $750,000 | +$115 – $120 | ~$1,440 |

| $1,000,000 | +$150 – $160 | ~$1,900 |

The “Borrowing Capacity” Shrink

This is the hidden impact that affects buyers the most. Banks assess your ability to repay a loan at an interest rate roughly 3% higher than the actual rate (the “serviceability buffer”). When the base rate goes up, that stress-test bar gets raised, instantly reducing the maximum loan amount a buyer can get approved for.

3. Why Now? The Economic Ripple Effect

Why did the RBA pull the trigger on a hike when the economy already feels slow? The answer is sticky inflation.

Recent data showed inflation ticking back up to 3.8% (above the RBA’s 2-3% target). The RBA is using this hike as a “preventative measure.” However, this risks a “hard landing.” By squeezing disposable income further, the RBA is forcing households to cut back spending even more aggressively.

4. Impact on the Victoria Property Market

Victoria is currently in a unique position. Usually, when interest rates rise, property prices fall because people can borrow less. However, Victoria is defying gravity.

Despite the rate rise, we are seeing a “floor” under prices in Melbourne. Why? Because the fundamental law of Supply vs. Demand is overpowering the interest rate headwinds.

-

Supply Crisis: Victoria’s new housing build approvals have hit historic lows. Builders have struggled with costs, meaning very few new homes are being completed.

-

The Tenant “Pass-Through” Effect: Landlords are not immune to these rate hikes. As their mortgage repayments jump, their holding costs increase significantly. In a normal market, they might absorb this. But in Victoria’s current “landlord’s market”—where vacancy rates are record-low—investors are highly likely to pass these increased costs directly to tenants. This means we can expect rents to rise further as landlords try to cover the gap in their mortgage repayments.

5. The Driving Force: Why Prices Are Still Growing

Even with a 3.85% cash rate, two massive engines are driving the Victorian market:

-

Population Surge: Victoria continues to attract a high share of overseas migration. Every new arrival needs a roof over their head, creating immediate demand that supply cannot match.

-

The “Value” Proposition: Compared to the explosive growth seen recently in Perth and Brisbane, Melbourne property looks comparatively undervalued. This “lower base” is attracting investors who see room for catch-up growth.

The Bottom Line

The era of volatility isn’t over yet. This rate hike is a reminder that your financial buffer matters.

-

If you are buying: Check your pre-approval immediately. It may need to be refreshed at the new stress-test rate.

-

If you are renting: Be prepared for potential rent adjustments as your landlord reacts to their own increased costs.

-

If you are holding: Review your budget. That extra $100–$200 a month needs to come from somewhere.

Are you worried about how this rate rise impacts your borrowing power?

Reply to this email or book a 15-minute strategy call with us. We can run the new numbers and help you navigate the 3.85% landscape.