Melbourne’s Comeback Story: How the City Led February’s Housing Recovery

Melbourne’s housing market, long overshadowed by a year of stagnation and decline, delivered an unexpected turn in February. Property prices in the city rose by 0.4%, a modest yet significant shift that marked the end of a prolonged downturn. This recovery, mirrored in Hobart, was driven by a combination of factors: a recent interest rate cut, renewed buyer confidence, and a recalibration of market expectations.

The change was not merely statistical. It was felt in auction rooms, where clearance rates edged higher, and in suburban neighborhoods, where listings began to attract competitive offers once again. Tim Lawless, research director at CoreLogic, attributed the rebound to improved sentiment, a critical ingredient in a market that had been grappling with uncertainty.

While the gains remain fragile, Melbourne’s February performance underscores the city’s resilience and hints at a broader recovery taking shape across Australia’s housing sector.

Image source: realestate.com.au

Overview of Melbourne’s Housing Market History

Melbourne’s housing market has long been a barometer of Australia’s economic and social evolution, with its trajectory shaped by distinct cycles of growth, stagnation, and recovery. A pivotal moment occurred in 1966, when the median house price was just $9,400. Over the decades, values doubled more than six times, breaking the $100,000 barrier by 1988 and continuing to climb steadily, driven by population growth, urbanization, and infrastructure development.

The city’s resilience is evident in its ability to rebound from downturns. For instance, during the 2008 global financial crisis, Melbourne’s property market outperformed other Australian capitals, buoyed by strong migration and government stimulus measures. Similarly, the post-COVID recovery highlighted the market’s adaptability, as demand surged in suburban areas due to shifting lifestyle preferences.

A key driver of Melbourne’s historical growth has been its diverse economy, which supports a wide range of industries, from finance to education. This economic diversity has consistently attracted international migrants, further fueling housing demand.

“Melbourne’s long-term fundamentals—population growth, infrastructure investment, and economic diversity—make it one of the most resilient property markets globally,”

— Michael Yardney, Director of Metropole Property Strategists.

Understanding these historical patterns provides a framework for navigating future market dynamics, particularly as Melbourne enters a new phase of recovery.

Key Indicators of Recovery in February 2025

February 2025 marked a turning point for Melbourne’s housing market, with a 0.4% rise in property prices signaling the end of a prolonged downturn. A critical driver of this recovery was the improvement in auction clearance rates, which consistently exceeded 60%, reflecting renewed buyer confidence. This metric, often seen as a barometer of market health, highlighted the growing competition for properties, particularly in suburban areas.

Another significant factor was the recalibration of market expectations following a recent interest rate cut. This policy shift not only reduced borrowing costs but also spurred investor activity, particularly in undervalued segments such as high-quality apartments. For example, CoreLogic data revealed that finished homes in premium suburbs experienced heightened demand, with competitive offers driving price growth.

Additionally, Melbourne’s rental market played a pivotal role. Vacancy rates remained tight at 1.5%, while rental prices surged by over 9% for both houses and units, underscoring the city’s supply constraints. This dynamic created a favorable environment for landlords and investors alike.

“Improved sentiment and strategic policy adjustments have laid the groundwork for Melbourne’s recovery,”

— Tim Lawless, Research Director, CoreLogic.

Looking ahead, sustained population growth and infrastructure investment are expected to solidify this upward trajectory, presenting strategic opportunities for investors.

Factors Driving Melbourne’s Housing Market Recovery

Melbourne’s housing market recovery in February 2025 was underpinned by a confluence of economic, demographic, and policy-driven factors. A pivotal element was the Reserve Bank of Australia’s recent interest rate cut, which reduced borrowing costs and reignited investor activity. This was particularly evident in Melbourne’s premium suburbs, where CoreLogic reported a surge in competitive offers for high-quality properties, driving localized price growth.

Demographic shifts also played a critical role. The return of international students and skilled migrants, following years of pandemic-induced stagnation, bolstered demand for rental properties. Vacancy rates dropped to 1.5%, while rental prices increased by over 9%, creating a favorable environment for landlords and signaling renewed market confidence.

Unexpectedly, suburban markets outperformed inner-city areas, driven by changing buyer preferences for larger homes with outdoor spaces. This trend, accelerated by remote work, highlights a shift in lifestyle priorities.

“Melbourne’s recovery reflects a recalibration of market expectations and the enduring appeal of its long-term fundamentals,”

— Michael Yardney, Director, Metropole Property Strategists.

Looking forward, sustained infrastructure investment and easing lending conditions are poised to amplify this recovery, offering strategic opportunities for investors.

Image source: placeprojects.com.au

Economic and Policy Influences

The Reserve Bank of Australia’s recent interest rate cut has emerged as a cornerstone of Melbourne’s housing market recovery, directly reducing borrowing costs and stimulating investor activity. This policy shift has had a pronounced impact on premium suburbs, where CoreLogic data shows a surge in competitive offers for high-quality properties, driving localized price growth. For instance, in Toorak, auction clearance rates exceeded 70% in February 2025, reflecting heightened buyer confidence.

Complementing monetary policy, the Victorian government introduced targeted measures to address supply constraints. A 12-month stamp duty reduction on off-the-plan units and streamlined planning processes for multi-storey developments in 50 new activity centers have incentivized both developers and buyers. These initiatives are expected to add over 10,000 new dwellings by mid-2026, alleviating pressure on Melbourne’s tight rental market.

Historically, Melbourne’s economic diversity has provided resilience during downturns. The city’s robust finance, education, and healthcare sectors continue to attract skilled migrants, bolstering housing demand. However, a lesser-known factor is the role of cultural vibrancy in sustaining long-term appeal. Melbourne’s arts and sports scenes, coupled with its liveability, create a unique value proposition for residents and investors alike.

Looking ahead, aligning fiscal policies with infrastructure investment could amplify recovery momentum. Strategic opportunities lie in leveraging these synergies to address affordability while sustaining growth in high-demand segments.

Role of Buyer Sentiment and Investor Activity

Buyer sentiment has proven to be a pivotal driver in Melbourne’s housing market recovery, with the House Price Expectations Index for Victoria surging 31.5% in late 2024, reaching a positive reading of 101.3. This shift reflects growing confidence among buyers, who increasingly perceive current conditions as favorable for property acquisition. Notably, this sentiment often acts as a leading indicator, signaling market shifts before they materialize in pricing trends.

Investor activity has also intensified, particularly in undervalued segments such as high-quality apartments in premium suburbs. CoreLogic data highlights a 9% rise in rental prices and a vacancy rate of just 1.5%, creating attractive yields for investors. For example, in South Yarra, competitive bidding for investment-grade properties has driven localized price growth, underscoring the interplay between sentiment and market dynamics.

A lesser-known factor influencing sentiment is the psychological impact of rate cut expectations. As Tim Lawless of CoreLogic notes, “Expectations of lower interest rates… are flowing through to improved buyer sentiment.” This optimism, coupled with strategic policy adjustments, has catalyzed renewed activity.

Looking forward, fostering sustained confidence through transparent lending policies and targeted incentives could solidify recovery momentum, particularly in high-demand suburban markets. This approach offers a roadmap for balancing affordability with growth.

Comparative Analysis with Other Australian Cities

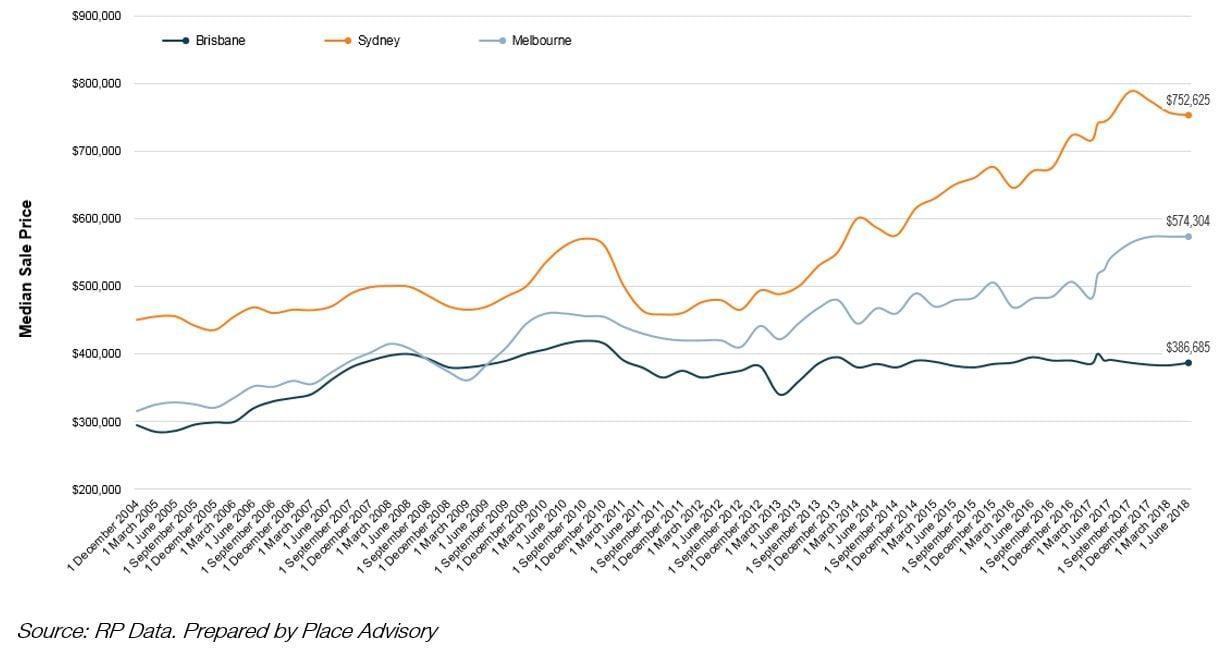

Melbourne’s February recovery, marked by a 0.4% rise in property prices, contrasts sharply with the slowing momentum in Brisbane, Perth, and Adelaide, where growth ranged from 0.2% to 0.3% (CoreLogic). While these cities previously led the market, Melbourne’s rebound highlights its resilience and unique dynamics. For instance, Melbourne’s affordability—tracking at 65% of Sydney’s median dwelling price—has positioned it as a more accessible option for buyers and investors alike.

Unlike Sydney, where upper-quartile properties dominate growth, Melbourne’s recovery is more evenly distributed, driven by suburban demand and rental market constraints. Vacancy rates in Melbourne remain tight at 1.5%, compared to Brisbane’s 2.1%, underscoring stronger rental demand.

Terry Ryder, Founder of Hotspotting, emphasizes Melbourne’s long-term fundamentals: “The strongest population growth and economic diversity make Melbourne a standout recovery market.” This divergence from other capitals suggests Melbourne’s recovery is not only cyclical but also structurally robust, offering strategic opportunities for investors.

Image source: realestate.com.au

Melbourne vs. Sydney: A Tale of Two Recoveries

Melbourne and Sydney’s housing recoveries reveal contrasting dynamics shaped by affordability, buyer behavior, and market segmentation. Melbourne’s affordability advantage—its median dwelling price at 65% of Sydney’s—has attracted a broader pool of buyers, particularly first-home purchasers and investors seeking value. In contrast, Sydney’s recovery has been concentrated in its upper-quartile properties, where high-end buyers dominate.

A case study of 92 Hewlett Street, Bronte, underscores Sydney’s luxury market sensitivity to interest rate cuts. The property attracted last-minute interstate interest, with a Melbourne-based buyer placing the winning bid on auction day. This highlights Sydney’s reliance on affluent, mobile buyers, a trend less pronounced in Melbourne’s more evenly distributed recovery.

Melbourne’s rental market, with a vacancy rate of 1.5%, has further bolstered its recovery by creating strong investor yields. In comparison, Sydney’s higher vacancy rates and constrained land supply have limited rental market growth.

“Melbourne’s recovery reflects its economic diversity and population growth, while Sydney’s high-end market remains more volatile,”

— Michael Yardney, Director, Metropole Property Strategists.

Looking ahead, Melbourne’s focus on infrastructure investment and suburban demand positions it for sustained growth, while Sydney’s reliance on luxury segments may expose it to greater volatility in future downturns.

Insights from Brisbane and Adelaide’s Market Trends

Brisbane and Adelaide’s housing markets have demonstrated resilience, driven by affordability and strategic infrastructure investments. Brisbane’s lower-quartile housing segment has attracted first-home buyers, leveraging affordability and high rental yields. For instance, suburbs like Logan and Ipswich have seen rental yields exceeding 5%, supported by strong demand and limited supply. This trend highlights the effectiveness of targeting high-yield areas for sustained growth.

Adelaide, on the other hand, has capitalized on its compact urban design and lifestyle appeal. The city’s focus on regional connectivity, such as the electrification of the Gawler rail line, has enhanced suburban accessibility, driving demand in areas like Salisbury. CoreLogic data shows Adelaide’s annual growth at 13.1%, outpacing most capitals, underscoring the impact of infrastructure-led development.

“Adelaide and Brisbane’s affordability and infrastructure investments create a blueprint for sustainable growth,”

— Zaki Ameer, Property Investment Advisor.

Looking forward, replicating these strategies in other cities could mitigate affordability challenges. For investors, identifying undervalued suburbs with planned infrastructure projects offers a roadmap for maximizing returns while addressing housing demand.

Impact on Different Property Segments

Melbourne’s housing recovery has revealed divergent trends across property segments, with premium suburbs and rental markets leading the charge. High-quality apartments in areas like South Yarra and Toorak have seen a surge in demand, driven by investor activity and tight vacancy rates of 1.5%. CoreLogic data highlights a 9% rise in rental prices, creating attractive yields for landlords and signaling renewed confidence in these segments.

In contrast, high-rise apartments near universities remain under pressure due to oversupply and shifting buyer preferences. This underscores a broader trend: suburban homes with outdoor spaces are outperforming inner-city units, reflecting lifestyle changes accelerated by remote work.

“The recalibration of buyer priorities has reshaped Melbourne’s property landscape, favoring space and quality over density,”

— Michael Yardney, Director, Metropole Property Strategists.

Unexpectedly, entry-level houses in outer suburbs are lagging, hindered by rising interest rates and limited infrastructure. This highlights the importance of strategic planning in addressing affordability and connectivity. Moving forward, targeted policies and infrastructure investments could bridge these gaps, ensuring balanced growth across all segments.

Image source: investorkit.com.au

House vs. Apartment Price Growth

Melbourne’s housing market recovery has highlighted a nuanced divergence between house and apartment price growth, driven by shifting buyer priorities and structural market dynamics. While houses historically outperformed apartments, recent trends suggest a recalibration. Apartments, particularly in premium suburbs like South Yarra, have seen a 5% annual price increase, fueled by limited supply and rising rental demand. This contrasts with the slower growth of entry-level houses in outer suburbs, where affordability challenges and infrastructure gaps persist.

A key driver of apartment growth is their relative affordability. With Melbourne’s median apartment price at AUD 615,000—significantly lower than houses—first-home buyers and investors are increasingly drawn to this segment. Additionally, the return of international students and skilled migrants has intensified demand for rental apartments, further boosting their appeal.

However, high-rise apartments near universities remain an exception, struggling with oversupply and reduced buyer interest. This bifurcation underscores the importance of location and quality in determining performance.

“The scarcity of well-located apartments is creating a competitive market, particularly in premium areas,”

— Tim Lawless, Research Director, CoreLogic.

Looking ahead, sustained apartment growth will depend on addressing supply constraints and enhancing urban infrastructure. For investors, targeting high-demand suburbs with tight vacancy rates offers a strategic pathway to capitalize on Melbourne’s evolving property landscape.

Suburban vs. Urban Property Dynamics

Melbourne’s property market recovery has revealed a growing divergence between suburban and urban property dynamics, driven by shifting lifestyle preferences and structural market factors. Suburban areas, particularly those offering larger homes with outdoor spaces, have outperformed urban markets. This trend, accelerated by remote work, reflects a recalibration of buyer priorities toward space and quality.

For instance, suburbs like Werribee and Craigieburn have seen a surge in demand, with CoreLogic data showing a 7% annual price increase for family homes. This growth is underpinned by affordability and improved infrastructure, such as the Regional Rail Link, which enhances connectivity to the city. Conversely, inner-city high-rise apartments near universities, such as those in Carlton, continue to struggle due to oversupply and reduced international student demand.

A lesser-known factor influencing suburban growth is the rise of “15-minute neighborhoods,” where essential services are within walking distance. Developers like Stockland have capitalized on this trend, integrating retail, education, and green spaces into new projects, driving both demand and price appreciation.

“Suburban markets are thriving as buyers prioritize lifestyle and connectivity,”

— Michael Yardney, Director, Metropole Property Strategists.

Looking forward, strategic investments in suburban infrastructure and mixed-use developments will be critical to sustaining this momentum, offering investors a roadmap for long-term growth.

Economic Implications and Future Outlook

Melbourne’s housing recovery signals broader economic resilience, with ripple effects extending beyond real estate. The city’s 0.4% price growth in February reflects renewed consumer confidence, a critical driver of economic activity. This recovery aligns with increased infrastructure spending, such as the Victorian government’s $125 billion Big Build initiative, which enhances connectivity and stimulates job creation.

Unexpectedly, the rental market’s tight vacancy rate of 1.5% has amplified economic pressures, driving a 9% surge in rental prices. While beneficial for investors, this trend exacerbates affordability challenges for tenants, potentially limiting discretionary spending in other sectors.

A key misconception is that Melbourne’s recovery is uniform. In reality, suburban markets thrive due to lifestyle shifts, while inner-city high-rises lag.

“Melbourne’s economic diversity underpins its recovery, but targeted policies are essential to balance growth,”

— Tim Lawless, Research Director, CoreLogic.

Looking ahead, sustained population growth and strategic investments in affordable housing will be pivotal. Policymakers must address supply constraints to ensure equitable economic benefits, fostering long-term stability.

Image source: domain.com.au

Long-term Sustainability of the Recovery

The sustainability of Melbourne’s housing recovery hinges on addressing structural imbalances in supply and demand while integrating long-term economic and environmental strategies. A critical factor is the alignment of infrastructure investment with housing development. For instance, the Victorian government’s $125 billion Big Build initiative has already improved suburban connectivity, driving demand in areas like Werribee, where property prices rose by 7% annually. However, without parallel investments in affordable housing, these gains risk being unevenly distributed.

A lesser-known yet pivotal element is the role of sustainable urban planning. Projects like the Green Square redevelopment in Sydney offer a blueprint, combining high-density housing with green spaces and efficient public transport. Melbourne could replicate this model to balance growth with liveability, particularly in outer suburbs where infrastructure gaps persist.

Emerging trends also highlight the importance of adaptive reuse in urban areas. For example, the transformation of Docklands’ commercial spaces into mixed-use developments has mitigated oversupply while revitalizing the area. This approach not only addresses immediate market needs but also reduces the ecological footprint of new construction.

“Sustainability in housing is not just about environmental impact; it’s about creating resilient communities,”

— Michael Yardney, Director, Metropole Property Strategists.

Looking forward, integrating circular economy principles and incentivizing energy-efficient developments could ensure Melbourne’s recovery remains robust, equitable, and future-proof.

Potential Policy Implications for Urban Planning

Melbourne’s housing recovery underscores the need for urban planning policies that balance growth with affordability and sustainability. A key focus should be on integrating housing development with transport infrastructure. For example, the Regional Rail Link has spurred demand in suburbs like Wyndham Vale, where property values increased by 6% annually, demonstrating the economic benefits of connectivity-driven planning.

A lesser-explored approach is the adoption of “15-minute neighborhoods,” where essential services are accessible within walking or cycling distance. Developers like Stockland have successfully implemented this model in projects such as Cloverton, combining residential, retail, and green spaces. This strategy not only enhances liveability but also reduces urban sprawl and transportation emissions.

Emerging data suggests that incentivizing mixed-use developments in underutilized urban areas could address housing shortages while revitalizing local economies. For instance, the Docklands precinct’s transformation into a mixed-use hub has reduced commercial vacancies by 12% while adding 1,500 residential units, showcasing the potential of adaptive reuse.

“Urban planning must evolve to create inclusive, resilient cities that meet both current and future needs,”

— Tim Lawless, Research Director, CoreLogic.

Looking ahead, policies that prioritize affordable housing near transit hubs and promote sustainable urban design will be critical in ensuring equitable growth and long-term resilience.

FAQ

What were the key factors driving Melbourne’s housing market recovery in February 2025?

Melbourne’s February 2025 housing recovery was driven by a confluence of factors, including a recent interest rate cut by the Reserve Bank of Australia, which reduced borrowing costs and spurred investor activity. Tight rental vacancy rates at 1.5% and a 9% surge in rental prices underscored strong demand amidst constrained supply. Suburban markets outperformed, reflecting shifting buyer preferences for larger homes with outdoor spaces. Government initiatives, such as stamp duty reductions and streamlined planning for multi-storey developments, further bolstered market confidence. These elements, combined with Melbourne’s economic diversity and population growth, positioned the city as a leader in Australia’s housing rebound.

How did Melbourne’s affordability compare to other Australian cities during the recovery period?

Melbourne’s affordability emerged as a pivotal advantage during the recovery period, with its median dwelling price at 65% of Sydney’s, making it a more accessible option for buyers and investors. This relative affordability attracted first-home buyers and investors seeking value, particularly in suburban markets. While Sydney’s recovery was concentrated in high-end properties, Melbourne’s growth was more evenly distributed, driven by demand for rental properties and suburban homes. CoreLogic data highlighted Melbourne’s competitive edge, with tight vacancy rates at 1.5% and rising rental yields, reinforcing its position as a cost-effective yet high-potential market in Australia’s housing landscape.

What role did government policies and infrastructure investments play in Melbourne’s housing rebound?

Government policies and infrastructure investments were instrumental in Melbourne’s housing rebound. The Victorian government introduced a 12-month stamp duty reduction for off-the-plan units and streamlined planning for multi-storey developments, incentivizing both buyers and developers. Major infrastructure projects, such as the Metro Tunnel and Suburban Rail Loop, enhanced connectivity and supported suburban growth, aligning with shifting buyer preferences. Additionally, targeted housing initiatives, including the Victorian Homebuyer Fund and Regional Housing Fund, addressed affordability and supply constraints. These measures, combined with Melbourne’s $125 billion Big Build initiative, created a foundation for sustained recovery, reinforcing the city’s appeal to investors and residents alike.

How have buyer sentiment and investor activity influenced Melbourne’s property market dynamics?

Buyer sentiment and investor activity significantly shaped Melbourne’s property market dynamics during the recovery. The House Price Expectations Index for Victoria surged 11% in February 2025, reflecting renewed confidence among buyers. This optimism, driven by interest rate cuts and affordability, acted as a leading indicator of market shifts. Investor activity intensified in undervalued segments, such as high-quality apartments in premium suburbs, where tight vacancy rates of 1.5% and a 9% rise in rental prices created attractive yields. This interplay between sentiment and market conditions catalyzed competitive bidding, particularly in suburban areas, reinforcing Melbourne’s position as a resilient and dynamic housing market.

What are the long-term implications of Melbourne’s February recovery for future housing market trends?

Melbourne’s February recovery signals long-term implications for future housing market trends, emphasizing sustained growth driven by population expansion, infrastructure investment, and economic diversity. The rebound highlights the enduring appeal of suburban markets, where demand for larger homes aligns with lifestyle shifts. Tight rental vacancy rates and rising yields underscore persistent supply constraints, likely to fuel continued price growth. Government policies, such as streamlined planning and stamp duty reductions, set a precedent for addressing affordability and supply challenges. These factors position Melbourne as a resilient market, with strategic opportunities for investors in high-demand segments and infrastructure-linked suburban developments.