From Sydney to Melbourne: The 2025 Property Trends You Can’t Afford to Miss

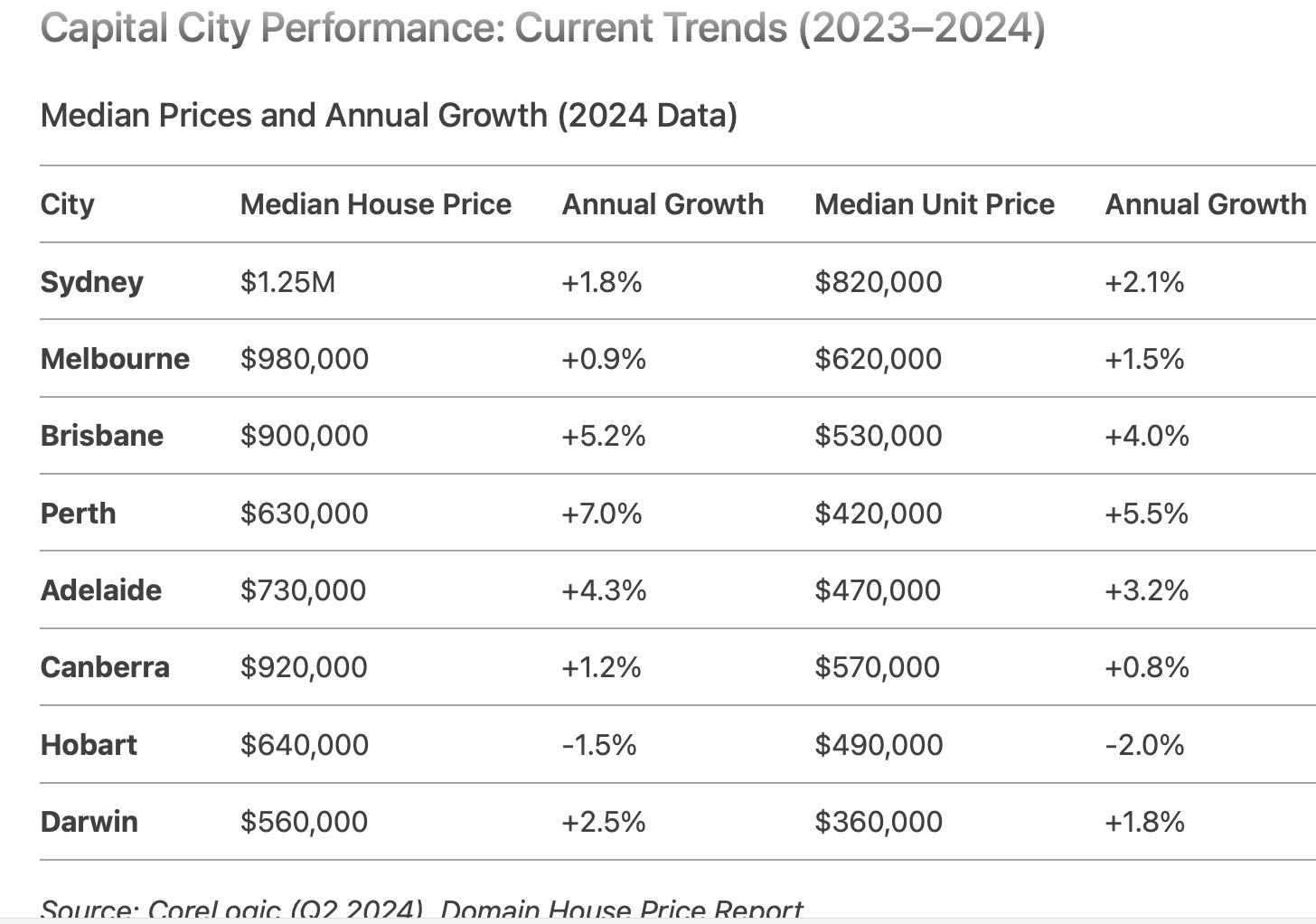

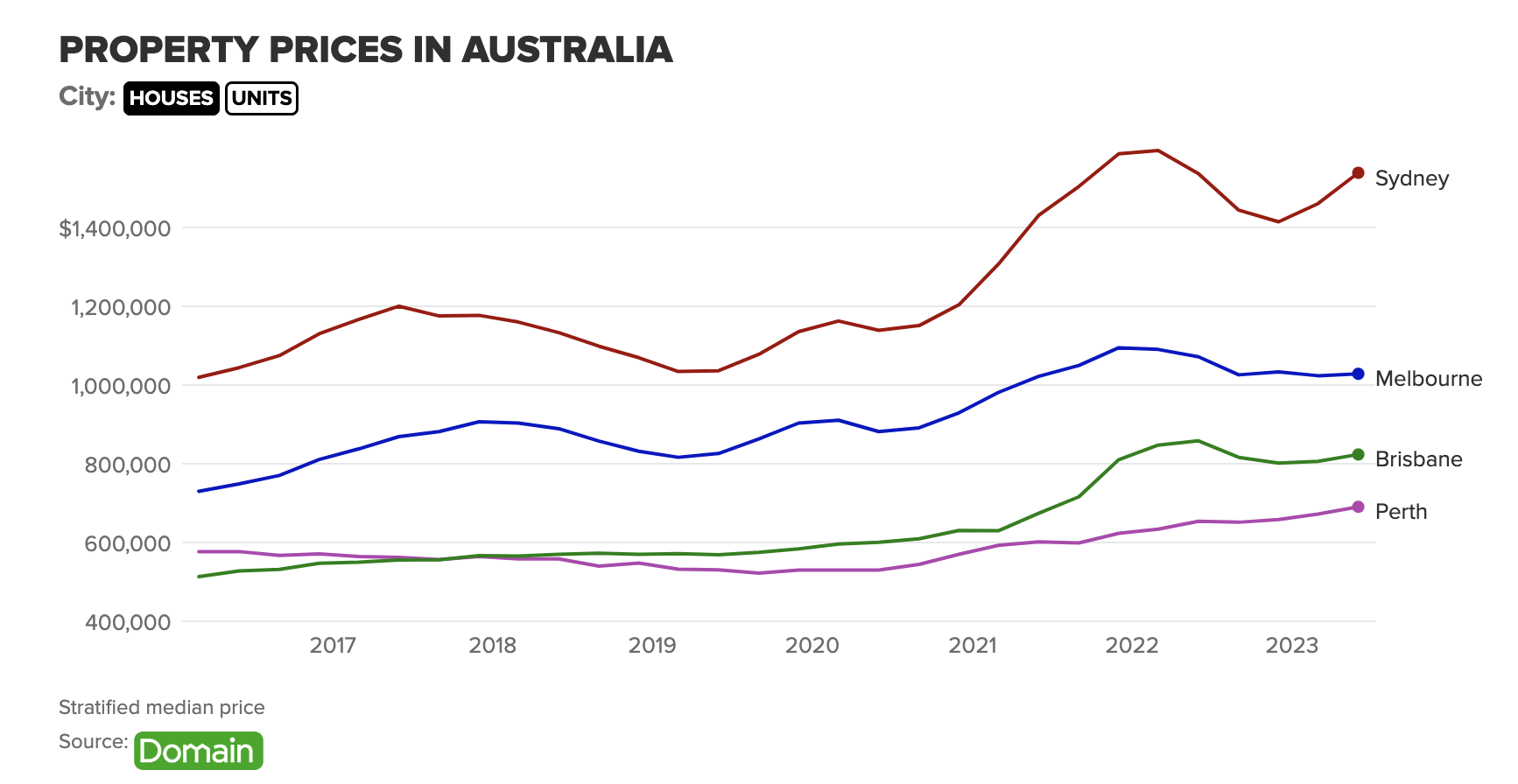

In January 2025, Sydney’s median house price surged by 4.5% year-on-year, reaching record highs despite a national slowdown in property growth, according to CoreLogic data. Meanwhile, Melbourne’s housing market, long overshadowed by Sydney’s meteoric rise, is quietly rebounding—its affordability advantage drawing both interstate and international buyers. This divergence underscores a critical shift: while Sydney grapples with constrained land supply and soaring demand for luxury properties, Melbourne’s expansive urban sprawl and recent tax reforms are reshaping its investment landscape.

Dr. Nicola Powell, Chief of Research at Domain, notes that “Melbourne’s relative affordability, combined with infrastructure upgrades, is creating opportunities that Sydney simply cannot match.” Yet, Sydney’s metro expansion—projected to increase property values in newly connected suburbs by up to 10%—continues to attract high-net-worth individuals and foreign investors.

These contrasting dynamics reveal a broader truth: Australia’s two largest cities are navigating 2025’s property market through fundamentally different trajectories, each shaped by unique economic and policy forces.

Image source: top5ozrealestate.com.au

Overview of Market Dynamics

The 2025 Australian property market is increasingly defined by the nuanced interplay between affordability constraints and infrastructure-driven growth. A critical yet underexplored dynamic is the role of infrastructure upgrades in reshaping suburban property values. For instance, the extension of Sydney’s metro network has catalyzed a 10% surge in property values in newly connected suburbs, as reported by CoreLogic. This phenomenon underscores the importance of accessibility as a driver of localized demand, particularly in high-density urban areas.

However, the impact of such upgrades is not uniform. Comparative analysis reveals that while Sydney’s infrastructure projects primarily benefit high-income buyers, Melbourne’s tax reforms and urban sprawl create opportunities for mid-tier investors. This divergence highlights the contextual factors—such as policy frameworks and demographic shifts—that influence the effectiveness of infrastructure investments.

“Infrastructure upgrades are not just about connectivity; they redefine market hierarchies by shifting demand to previously overlooked areas.”

— Dr. Nicola Powell, Chief of Research, Domain

These insights challenge the traditional focus on macroeconomic indicators, emphasizing the need for granular, location-specific strategies to navigate 2025’s complex market landscape.

Key Economic and Demographic Influences

The interplay between migration trends and economic adjustments is reshaping property markets in Sydney and Melbourne, with profound implications for investment strategies. A critical yet often overlooked factor is the role of income stratification in determining housing demand. As migration patterns shift, particularly with an influx of skilled workers and international students, the demand for mid-tier housing in well-connected suburbs intensifies. This trend is amplified by fiscal policies that favor first-home buyers, such as stamp duty concessions, which redirect purchasing power toward specific market segments.

According to Eliza Owen, Head of Research at CoreLogic, “The alignment of demographic shifts with targeted economic policies creates micro-markets where demand outpaces supply, driving localized price surges.” For instance, suburbs near Melbourne’s upgraded transport corridors have seen a marked increase in rental yields, reflecting the growing preference for accessibility among younger professionals.

However, this dynamic is not without challenges. The uneven distribution of infrastructure investments can exacerbate affordability issues in high-demand areas, limiting access for lower-income groups. To navigate these complexities, investors must integrate granular demographic data with economic indicators, enabling precise identification of growth hotspots. This approach transforms broad market trends into actionable insights, bridging the gap between theory and practice.

Price Forecasts and Affordability Challenges

Sydney’s property market is projected to experience a 3.8% price increase by the end of 2025, according to KPMG, driven by sustained demand in high-income suburbs and limited land availability. In contrast, Melbourne’s growth is expected to stabilize at 2.5%, reflecting its broader affordability and urban expansion. These figures highlight a critical divergence: while Sydney’s market caters increasingly to luxury buyers, Melbourne’s relative accessibility continues to attract mid-tier investors and first-home buyers.

Affordability remains a pressing issue, with the national cost-to-income ratio exceeding 7.5 times the median household income, as reported by CoreLogic. This imbalance forces many potential buyers into long-term renting, particularly in Sydney, where median house prices are among the highest globally. However, Melbourne’s recent tax reforms and infrastructure investments have slightly eased entry barriers, creating pockets of opportunity for younger demographics.

This dynamic can be likened to a bottleneck: while demand flows steadily, supply constraints and income disparities restrict access, intensifying competition. Addressing these challenges requires targeted policy interventions, such as streamlined building approvals and expanded affordable housing initiatives.

Image source: createvic.com.au

Projected Price Growth in Sydney and Melbourne

Sydney’s projected 3.8% price growth in 2025 is underpinned by a unique interplay of constrained land supply and targeted infrastructure investments. The scarcity of developable land, particularly in high-demand inner-ring suburbs, creates a persistent upward pressure on prices. This dynamic is further amplified by metro expansions, which have historically driven localized price increases of up to 10% in newly connected areas. These factors collectively position Sydney as a market where accessibility and exclusivity converge, attracting high-net-worth individuals and institutional investors.

In contrast, Melbourne’s anticipated 2.5% growth reflects a more balanced trajectory, shaped by its expansive urban sprawl and affordability-driven policies. The Victorian government’s recent tax reforms, while initially dampening investor sentiment, have redirected focus toward first-home buyers and mid-tier investors. This shift is evident in the increased activity within Melbourne’s middle-ring suburbs, where improved transport links and lower entry costs are fostering renewed demand.

“Melbourne’s strategic focus on affordability and infrastructure is creating a more inclusive market dynamic,”

— Eliza Owen, Head of Research, CoreLogic

These contrasting growth patterns underscore the importance of localized strategies. Investors must weigh Sydney’s exclusivity against Melbourne’s broader accessibility, tailoring their approaches to align with the nuanced drivers of each market.

Affordability and Housing Demand

The interplay between housing affordability and demand is deeply influenced by the concept of transport poverty, a phenomenon where limited access to efficient public transport restricts affordable housing options. This dynamic is particularly evident in Melbourne, where urban sprawl has created a stark divide between well-connected suburbs and those lacking infrastructure. The result is a bifurcated market: areas with robust transport links experience heightened demand, while poorly connected regions struggle to attract buyers despite lower prices.

A critical factor shaping this trend is the Victorian government’s investment in transport infrastructure, such as the Suburban Rail Loop. By reducing commute times and enhancing accessibility, these projects elevate the desirability of previously overlooked suburbs. However, the benefits are not uniformly distributed. Suburbs with delayed or incomplete infrastructure projects often face stagnating demand, highlighting the importance of timely execution.

“Transport accessibility is a key determinant of housing demand, often outweighing price considerations in buyer decisions.”

— Peter Tulip, Economist, Centre for Independent Studies

Comparatively, Sydney’s constrained land supply exacerbates affordability challenges, but its metro expansions have demonstrated the potential to counteract these pressures by unlocking new growth corridors. This underscores a broader insight: affordability is not solely a function of price but a complex equation involving connectivity, amenities, and future growth potential. Addressing these nuances requires integrating transport planning with housing policy to create sustainable demand patterns.

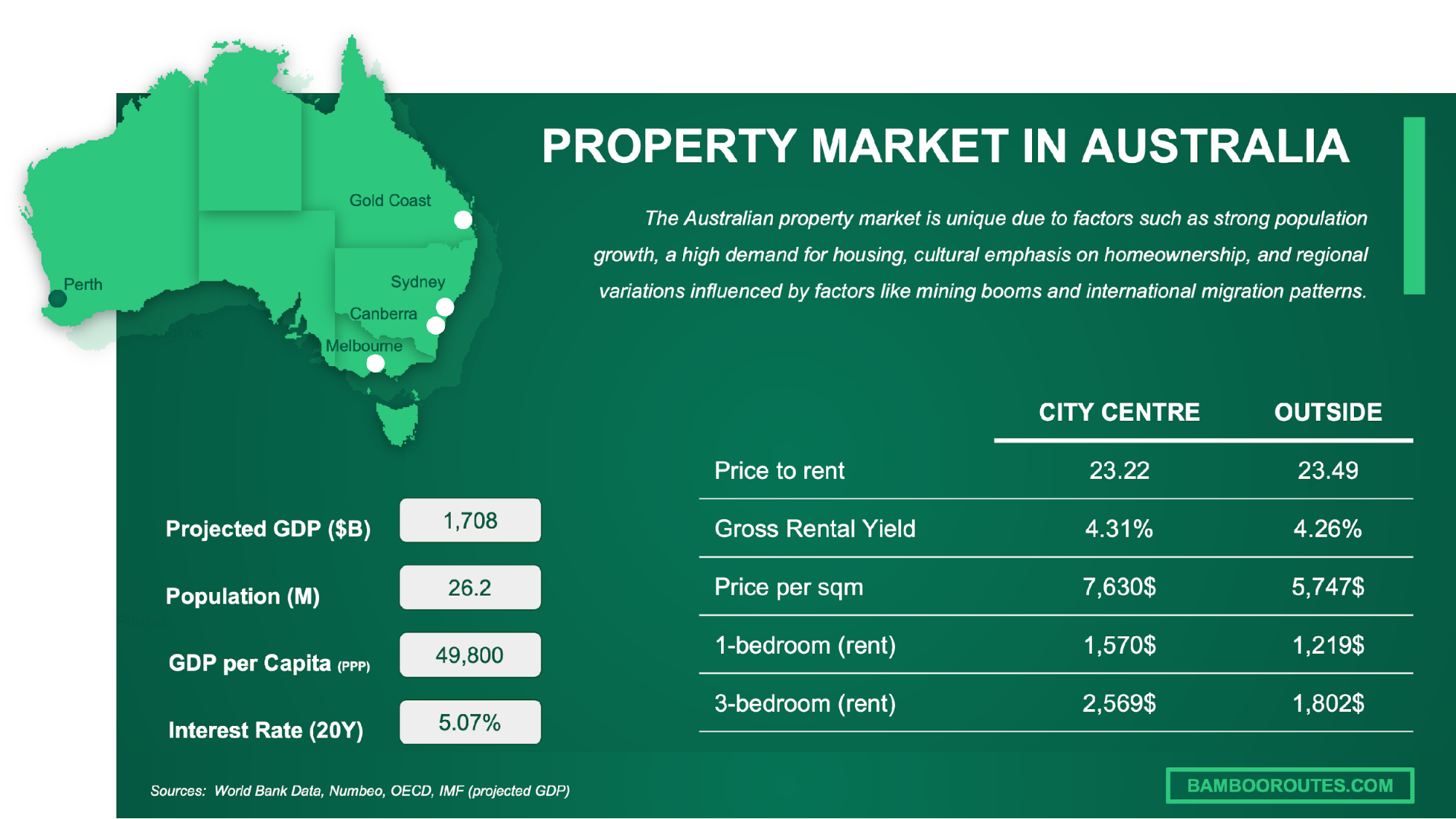

Rental Market Trends and Investment Opportunities

The rental market in 2025 is defined by a paradox: while vacancy rates remain critically low—sub-1% in cities like Melbourne and Sydney—rental growth is decelerating, according to REA Group’s latest report. This deceleration, however, masks a deeper trend: the divergence between high-demand urban centers and underperforming regional markets. For instance, Melbourne’s CBD has seen a 10% surge in unit rental demand, driven by younger professionals prioritizing proximity to work and amenities, while outer suburbs face stagnation due to limited transport connectivity.

A key technical concept shaping this landscape is rental yield optimization. Investors are increasingly targeting SA3 regions with yields between 3.5% and 4.5%, as identified by InvestorKit. These areas, often overlooked, are now outperforming due to improving infrastructure and moderate entry costs. For example, Brisbane’s middle-ring suburbs have seen rental yields rise by 0.8% year-on-year, reflecting strategic investments in transport corridors.

This dynamic underscores a critical insight: successful rental investments hinge on granular, data-driven strategies that align with evolving tenant preferences and infrastructure trajectories. Misjudging these factors risks eroding long-term returns.

Image source: bambooroutes.com

Shifts in Rental Preferences

A significant shift in rental preferences is emerging as tenants prioritize connectivity and lifestyle integration over traditional property metrics like size. In Sydney and Melbourne, younger professionals are increasingly drawn to units near transport hubs and lifestyle amenities, reflecting a broader trend toward urban convenience. This preference is not merely anecdotal; data from CoreLogic highlights a 10% rise in rental demand for properties within proximity to metro expansions, underscoring the premium placed on accessibility.

This trend is driven by evolving work habits, such as hybrid models, which reduce the necessity for larger suburban homes while amplifying the value of shorter commutes and flexible lease terms. Comparative analysis reveals that properties in well-connected urban corridors consistently outperform those in less accessible areas, with rental yields in these hotspots averaging 4.5%, as reported by InvestorKit.

However, this dynamic is not without its challenges. The concentration of demand in specific regions risks exacerbating affordability issues, particularly for lower-income renters. Addressing this requires a nuanced investment strategy that balances high-yield opportunities with long-term sustainability.

“Connectivity is no longer a luxury but a necessity, reshaping tenant priorities and market dynamics.”

— Eliza Owen, Head of Research, CoreLogic

This paradigm shift highlights the importance of aligning investment strategies with these evolving preferences to maximize returns.

Strategic Investment Approaches

A critical yet underutilized strategy in rental market investment is leveraging infrastructure-led demand forecasting. This approach focuses on identifying areas where upcoming infrastructure projects—such as transport hubs or community facilities—are likely to drive sustained tenant interest and rental growth. Unlike traditional methods that rely on static metrics like current yields, this technique integrates predictive analytics with localized development timelines to uncover hidden opportunities.

The effectiveness of this strategy lies in its ability to anticipate shifts in tenant preferences. For instance, a study by InvestorKit revealed that suburbs within a 2-kilometer radius of planned rail extensions in Brisbane experienced a 15% higher rental demand projection compared to those without such connectivity. This demonstrates how infrastructure not only enhances accessibility but also reshapes tenant demographics, favoring younger professionals and families seeking convenience.

However, this method is not without challenges. Accurate forecasting requires granular data on project timelines, demographic shifts, and potential delays. Misjudging these variables can lead to overestimating demand, particularly in areas where infrastructure completion is uncertain. To mitigate this, investors should combine predictive tools with on-ground research, ensuring a balanced risk-reward profile.

“Infrastructure-driven strategies are redefining rental markets, offering investors a roadmap to sustainable returns.”

— Peter Tulip, Economist, Centre for Independent Studies

By aligning investment decisions with infrastructure trajectories, this approach transforms speculative ventures into calculated, data-backed opportunities.

Impact of Government Policies and Economic Factors

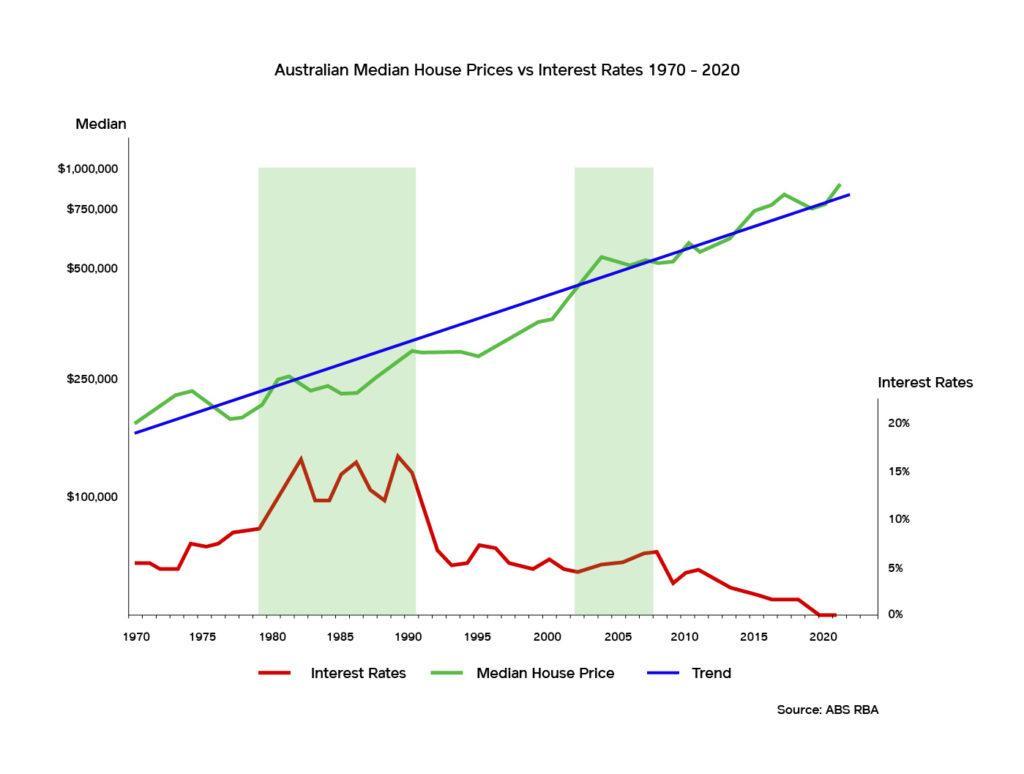

Government interventions in the property market often act as both catalysts and constraints, reshaping investment landscapes in ways that defy surface-level trends. For instance, Victoria’s 2022-23 budget introduced a 10-year COVID debt levy, significantly increasing land taxes. This policy has driven a 15% decline in investor activity in Melbourne, as reported by Property Update, while simultaneously creating opportunities for first-home buyers through reduced competition.

Economic factors, particularly interest rate adjustments, amplify these dynamics. The Reserve Bank of Australia’s anticipated rate cuts in mid-2025 are expected to lower borrowing costs, potentially increasing buyer activity by up to 20% in affordable housing segments, according to Vasttu. However, this benefit is unevenly distributed; Sydney’s high mortgage servicing costs—currently 70% of household income—may limit the impact compared to Melbourne’s more accessible market.

These interconnected forces highlight a critical insight: policies and economic shifts don’t merely influence prices—they redefine market hierarchies, favoring adaptable strategies over static assumptions.

Image source: opencorp.com.au

Role of Government Interventions

Government interventions in property markets often operate as precision tools rather than broad-spectrum solutions, with their effectiveness hinging on nuanced implementation. In Melbourne, the introduction of stamp duty concessions for first-home buyers has recalibrated affordability dynamics, particularly in middle-ring suburbs. This policy not only reduces upfront costs but also redirects demand toward areas with latent growth potential, fostering a more inclusive market environment.

A critical mechanism underpinning these interventions is their ability to signal market priorities. For instance, targeted tax reforms in Victoria have incentivized development in underutilized zones, aligning with infrastructure upgrades to create synergistic growth. However, these measures are not without limitations. The administrative lag in implementing such policies often delays their impact, leaving certain demographics underserved in the short term.

“Effective policy design requires a balance between immediate relief and long-term market stability,”

— Dr. Nicola Powell, Chief of Research, Domain

By integrating fiscal incentives with infrastructure planning, governments can transform abstract policies into actionable frameworks, enabling investors to identify emerging opportunities while mitigating systemic risks. This approach underscores the strategic interplay between policy and market behavior.

Influence of Interest Rates and Immigration

The interaction between interest rates and immigration reveals a layered complexity that reshapes property market dynamics in ways often overlooked. While interest rate cuts are traditionally seen as a catalyst for increased buyer activity, their real impact is contingent on localized affordability thresholds. For instance, in Sydney, where mortgage servicing costs remain among the highest globally, even modest rate reductions fail to significantly alleviate financial barriers for average buyers. This creates a bifurcated market where high-income segments benefit disproportionately, leaving mid-tier buyers constrained.

Immigration, on the other hand, exerts a more targeted influence. In Melbourne, the influx of international students and skilled workers has concentrated demand in specific suburbs with strong transport links and affordable rental options. This localized pressure subtly elevates property values and rental yields without triggering uniform citywide price surges. Such patterns highlight the importance of granular demographic data in forecasting market shifts.

“The nuanced interplay of interest rates and migration flows underscores the need for precision in market analysis, as broad trends often mask critical localized variations.”

— Eliza Owen, Head of Research, CoreLogic

By integrating these insights, investors can refine strategies to align with micro-market dynamics, leveraging both fiscal and demographic trends for sustainable returns.

FAQ

What are the key differences between Sydney and Melbourne’s property markets in 2025?

Sydney’s property market in 2025 is characterized by constrained land supply and high demand for luxury housing, driving prices upward in premium suburbs. In contrast, Melbourne benefits from its expansive urban sprawl, offering more affordable housing options and attracting mid-tier investors and first-home buyers. Infrastructure upgrades in Sydney, such as metro expansions, enhance property values in connected areas, while Melbourne’s tax reforms and transport projects foster growth in middle-ring suburbs. These distinctions highlight Sydney’s exclusivity versus Melbourne’s accessibility, with each city shaped by unique economic policies, demographic shifts, and investment opportunities, creating diverse pathways for property market participants.

How do infrastructure upgrades influence property values in Sydney and Melbourne?

Infrastructure upgrades significantly impact property values in both Sydney and Melbourne by enhancing connectivity and accessibility. In Sydney, metro expansions have historically driven capital growth in newly connected suburbs, with areas like Castle Hill experiencing substantial value increases. Melbourne’s transport projects, such as the Suburban Rail Loop, elevate demand in middle-ring suburbs by reducing commute times and improving livability. These developments not only attract buyers but also reshape investment patterns, with Sydney favoring high-income segments and Melbourne fostering opportunities for mid-tier investors. The strategic alignment of infrastructure with urban planning amplifies long-term growth potential in both cities.

What demographic trends are shaping housing demand in Sydney and Melbourne this year?

In 2025, Sydney’s housing demand is driven by younger professionals seeking urban apartments, fueled by a 10% rise in CBD rental demand, while families gravitate toward suburban areas like the Hills District. Melbourne sees a surge in international students and skilled migrants, concentrating demand in affordable, well-connected suburbs. Baby Boomers in both cities are downsizing, influencing the market for smaller, low-maintenance homes. These demographic shifts, combined with fiscal policies like stamp duty concessions in Melbourne, create micro-markets where demand intensifies, particularly in areas with strong transport links and lifestyle amenities, shaping distinct housing trends in each city.

Which suburbs in Sydney and Melbourne are expected to see the highest growth in 2025?

In Sydney, suburbs like Auburn and Mays Hill are poised for significant growth in 2025, driven by rising rental yields and population increases, supported by infrastructure projects like the Parramatta light rail. Newly connected metro areas also show strong potential for capital appreciation. In Melbourne, middle-ring suburbs such as Werribee and Wyndham stand out due to major transport upgrades and affordability, attracting both families and investors. Additionally, areas like Glen Waverley, known for excellent schools and green spaces, continue to draw steady demand. These hotspots reflect the interplay of accessibility, demographic shifts, and urban planning in shaping growth trajectories.

How do government policies and tax reforms impact property investment opportunities in these cities?

Government policies and tax reforms play a pivotal role in shaping property investment opportunities in Sydney and Melbourne. In Sydney, high property taxes and restrictive development policies limit new supply, pushing investors toward established properties with immediate rental demand. Melbourne’s tax reforms, including stamp duty concessions for first-home buyers, enhance affordability and redirect focus to middle-ring suburbs. However, increased land taxes and stricter tenancy laws in Victoria deter some investors. These measures, combined with infrastructure planning, create a dynamic landscape where policy-driven incentives and constraints redefine market hierarchies, influencing both short-term returns and long-term growth potential in these cities.