Understanding the Fortnightly Tax Table: It’s Not as Simple as It Looks

The Fortnightly Tax Table might look innocent at first glance—a simple chart, a few numbers, and some tax jargon thrown in for good measure. But don’t be fooled by its bland exterior; it’s a silent menace lurking in your payroll, ready to throw your finances into chaos. Think you can skim through it and know what’s up? Spoiler alert: you probably don’t. Understanding this table isn’t just useful—it’s the difference between getting your paycheck expectations right or gasping at deductions that seem to come out of nowhere.

Source: Australian Taxation Office (ATO)

If you’ve ever looked at the Fortnightly Tax Table and felt your brain short-circuit, congratulations, you’re human. It’s a bewildering blend of percentages, calculations, and mysterious figures that feel more like deciphering an ancient code than managing modern finances. And what’s worse? The moment you think you’ve cracked it, something changes—a new rate, an update from the ATO—and you’re back to square one, shaking your head at why taxes have to be so complicated.

But don’t worry, there’s hope for those brave enough to tackle this beast. Understanding the Fortnightly Tax Table isn’t just about numbers; it’s about protecting your hard-earned money from unnecessary surprises. So, why is it essential? Because when the unexpected tax bites, it’s not just your wallet that suffers—it’s your peace of mind. Master this, and you’ll finally be the one in control, smirking as others scratch their heads at the labyrinth you’ve conquered.

Why the Fortnightly Tax Table Might Be More Important Than You Think

If you’re the kind of person who skips over the details of the Fortnightly Tax Table, you’re not alone. Most of us treat it like that odd relative at family gatherings—we know it’s there, but we’d rather not deal with it. But here’s the kicker: ignoring it could mean missing out on the full picture of what’s happening with your paycheck. This table is the unsung hero (or villain) that dictates just how much of your hard-earned cash the tax office scoops up every two weeks. Think of it as the hidden script behind those deductions that leave you wondering, “Wait, where did all my money go?”

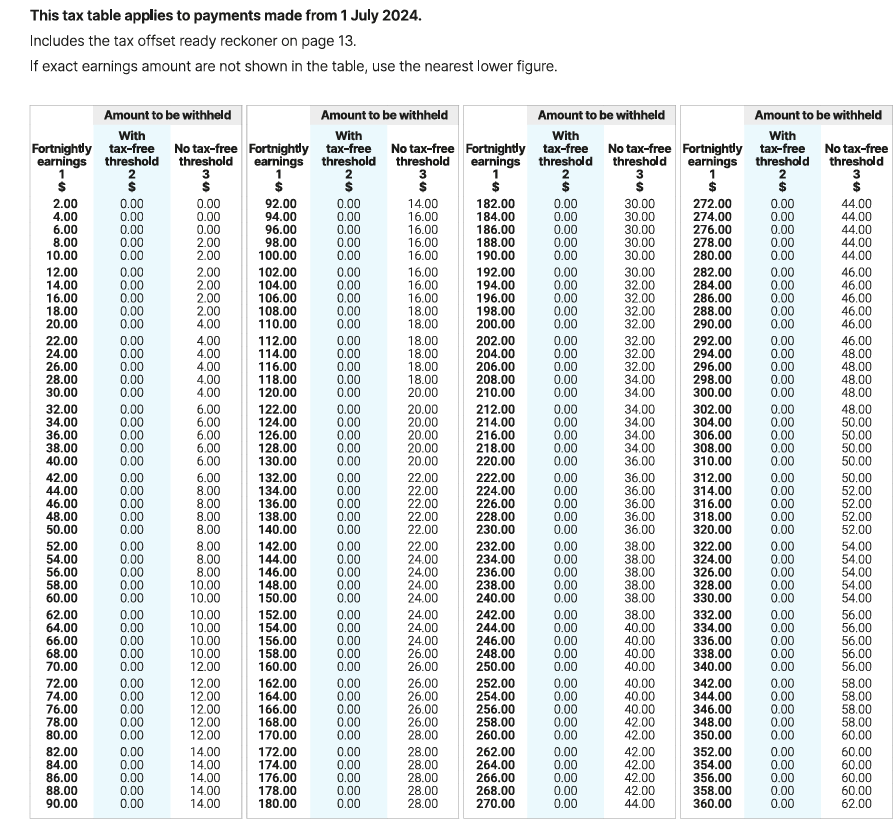

Let’s break down a snippet of what the Fortnightly Tax Table actually looks like. For instance, if you earn between $3,001 and $3,080 in a fortnight, the tax withheld is $420, according to the Australian Taxation Office (ATO) table. Now imagine knowing this instead of being blindsided every payday. Here’s a quick look at how it plays out:

| Fortnightly Earnings ($) | Tax Withheld ($) |

|---|---|

| 1,001 – 1,080 | 42 |

| 2,001 – 2,080 | 250 |

| 3,001 – 3,080 | 420 |

| 4,001 – 4,080 | 620 |

Understanding this data is like finding the cheat code to a game you didn’t even know you were playing. It changes the narrative from “Where did my money go?” to “I see exactly where this is going”—and suddenly, you’re in control.

Still think the Fortnightly Tax Table isn’t worth your attention? Think again. Being aware of how much tax is withheld helps you plan, save, and avoid the heart-stopping shock of an unexpected tax bill. It’s the kind of knowledge that pays off, literally. And while deciphering tax tables might sound as thrilling as watching paint dry, knowing how to navigate them could make you the financial whiz among your friends—or at least the one who doesn’t freak out every payday. In a world where everyone’s trying to keep more of what they earn, can you really afford to ignore it?

Fortnightly Tax Table Explained: Myths vs. Reality

When it comes to the Fortnightly Tax Table, myths and misconceptions are everywhere. One of the most common? The idea that it’s just another piece of bureaucratic nonsense designed to confuse you. But the reality is, this table is more like a behind-the-scenes playbook that holds the answers to how your income and tax deductions align. The problem? Most people don’t bother digging into it until they’re hit with a surprise tax bill. And by then, it’s often too late to make sense of it.

Another myth is that the Fortnightly Tax Table only applies to those with complex financial situations. Nope. This little table touches just about everyone earning a regular paycheck. The truth is, it doesn’t care if you’re a nine-to-fiver or a freelancer—it has its say in how much tax you’re shelling out. Ignoring it won’t make it go away; it’ll just keep working in the background, making decisions for you without your input.

Finally, there’s the belief that understanding the Fortnightly Tax Table is akin to learning an ancient language. While it might not be your next casual read, it’s far from impossible to grasp. Once you crack the code, you start to see how a small adjustment here or a little tweak there can affect your overall tax position. Suddenly, the table isn’t an enigma; it’s a tool. And if wielded right, it can help you stay one step ahead of the taxman. So, are you ready to separate the myths from reality and take control?

How to Navigate the Fortnightly Tax Table Without Losing Your Sanity

Let’s be honest: the Fortnightly Tax Table isn’t exactly a page-turner, and it definitely wasn’t designed with your sanity in mind. But fear not! The trick is knowing what to look for and how to make it work for you, rather than against you. Start by understanding that this table is more than just a spreadsheet of numbers; it’s a map that reveals how your income dances with tax deductions every two weeks. Embrace it, and you’ll see that knowledge is power—and peace of mind.

The first step is to break it down into manageable pieces. Don’t try to gulp down the entire Fortnightly Tax Table in one go; that’s a surefire way to give up halfway. Focus on the earnings bracket you fall into and see how much tax is withheld. Keep an eye on changes and updates from the Australian Taxation Office (ATO) so you’re never caught off guard. Before you know it, you’ll be the person who actually gets what’s going on behind the scenes of their paycheck.

And here’s a tip that will save your nerves: don’t hesitate to ask questions or seek out guides that make the process easier. There’s no medal for suffering through tax calculations alone. Whether it’s a tax professional’s advice or a simple online tool, use every resource available to demystify the Fortnightly Tax Table. Because at the end of the day, staying sane while navigating it isn’t just about understanding your tax—it’s about taking back control of your financial life.

Fortnightly Tax Table: Breaking Down the Confusion Step by Step

If the Fortnightly Tax Table feels like an unsolvable maze, you’re not alone. The idea of breaking down each line of it might sound as fun as deciphering ancient scrolls, but trust me, it’s worth it. Think of it as an instruction manual for your paycheck—it tells you how much you’ll actually take home, what goes to taxes, and what you might need to set aside. Understanding it step by step can mean the difference between financial peace of mind and the frustration of surprise tax debts.

Start with your earnings range and locate where you fall on the table. It’s a straightforward step, but one that so many overlook. This is where you’ll find out just how much tax you’re parting with each fortnight. Once you know this, it’s easier to plan and avoid nasty surprises when tax season rolls around. Each column has a purpose, each number has a story—it’s about time you read yours.

Don’t let the daunting format scare you off. Tackle it piece by piece, and the chaos starts to look a lot more like order. A little understanding can go a long way, and who knows, you might even impress yourself (and your friends) with how on top of your finances you are. The Fortnightly Tax Table doesn’t have to be a mystery; it just needs a willing detective to crack the case.

Unlocking the Fortnightly Tax Table: Tips to Get It Right Every Time

Let’s wrap this up. Mastering the fortnightly tax table is easier than you think—it’s all about paying attention to the details and not letting those cryptic columns freak you out. The truth is, once you understand how it works, you’ll find it much less intimidating, and it’ll be smooth sailing from there. No more second-guessing or crossing your fingers, hoping your tax deductions won’t leave you in shock at the end of the week.

The best part? With just a little bit of knowledge and a few simple checks, you can avoid the dreaded payday surprise. It’s not about being a tax expert—it’s about knowing which numbers matter and applying them correctly. Once you’ve got the hang of it, you’ll be handling your paychecks like a seasoned pro, with no more confusion over how your tax is calculated.

So there you have it, folks! Say goodbye to tax-time stress and hello to a paycheck that actually makes sense. By using the right tips and keeping the tax table in check, you’re in control. Now, every time you see that pay slip, you’ll feel confident that you’ve nailed it—and that’s a pretty great feeling, right? Keep these tips in mind, and make your next payday the smoothest one yet!