Fixed rates drop amidst predictions

Variable and fixed home loan rates saw both increases and cuts this week, with fixed rates outperforming variable, and a potential cash rate cut anticipated by February, Canstar reported.

Home loan rate changes

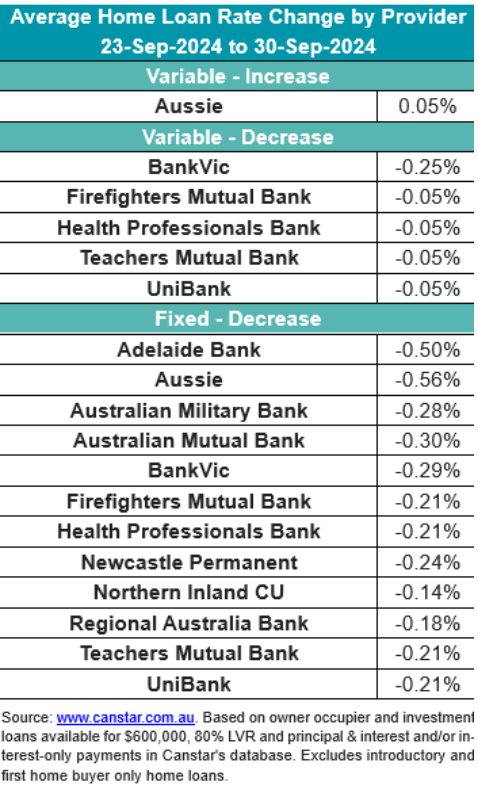

Aussie Home Loans raised interest rates on two variable owner-occupier and investor loans by 0.05%, while five other lenders reduced rates across 50 variable loans for both owner-occupiers and investors.

Meanwhile, twelve lenders slashed fixed rates on 322 loans, with an average decrease of 0.24%.

Fixed rates outperform variable options

Abal Banking continues to offer the lowest variable rate at 5.75%, although a surge in rate cuts means that 112 fixed rates now sit below this, a significant increase from last week’s 64.

“There was yet another downpour of fixed rate cuts this week,” said Sally Tindall (pictured above), Canstar’s data insights director.

Major institutions like Bendigo Bank and Teachers Mutual Group are among those offering reduced rates.

Read Full Article here at: Broker News