Your First Home Purchase Made Easy: A Comprehensive Guide for First-Time Buyers

Imagine this: nearly 40% of first-time homebuyers regret their purchase within the first year. Why? Missteps in preparation and decision-making. In today’s volatile market, how can you avoid becoming part of this statistic and secure lasting satisfaction?

Embarking on Your Homeownership Journey

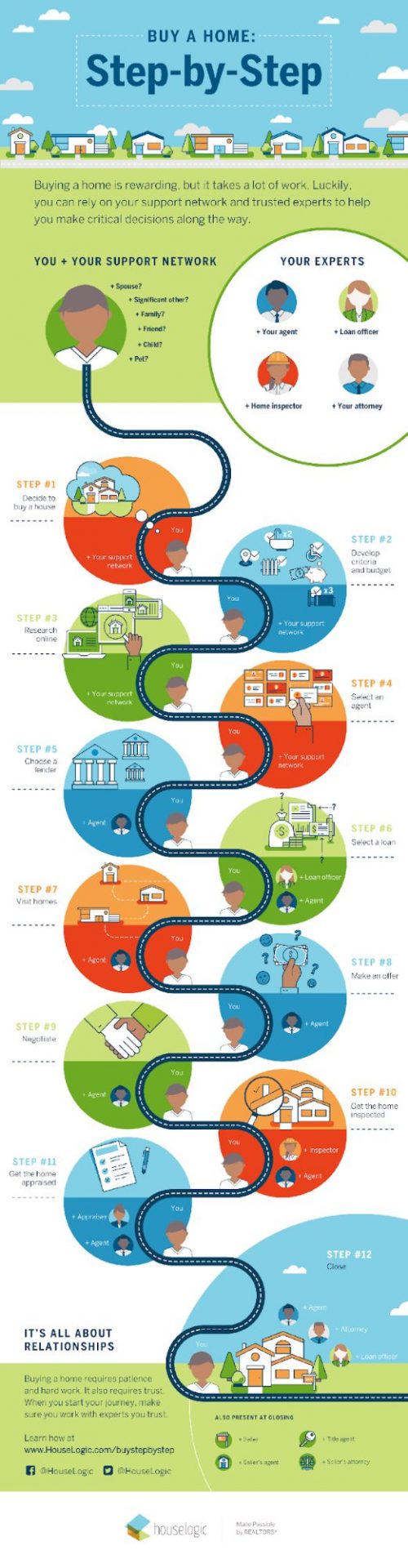

Understanding the psychology of decision-making is critical when purchasing your first home. Studies reveal that analysis paralysis often delays decisions, leading to missed opportunities. To counter this, adopt a structured decision framework:

- prioritize needs over wants: Focus on essentials like location and size before considering aesthetics.

- Set Non-Negotiables: Define deal-breakers early to streamline choices.

- Leverage Data: Use tools like market trend reports to validate your instincts.

Interestingly, behavioral economics suggests that buyers who rely on predefined criteria report higher satisfaction. This approach minimizes emotional bias, ensuring decisions align with long-term goals. By combining rational analysis with emotional readiness, you can confidently navigate the complexities of homeownership.

Purpose and Scope of This Guide

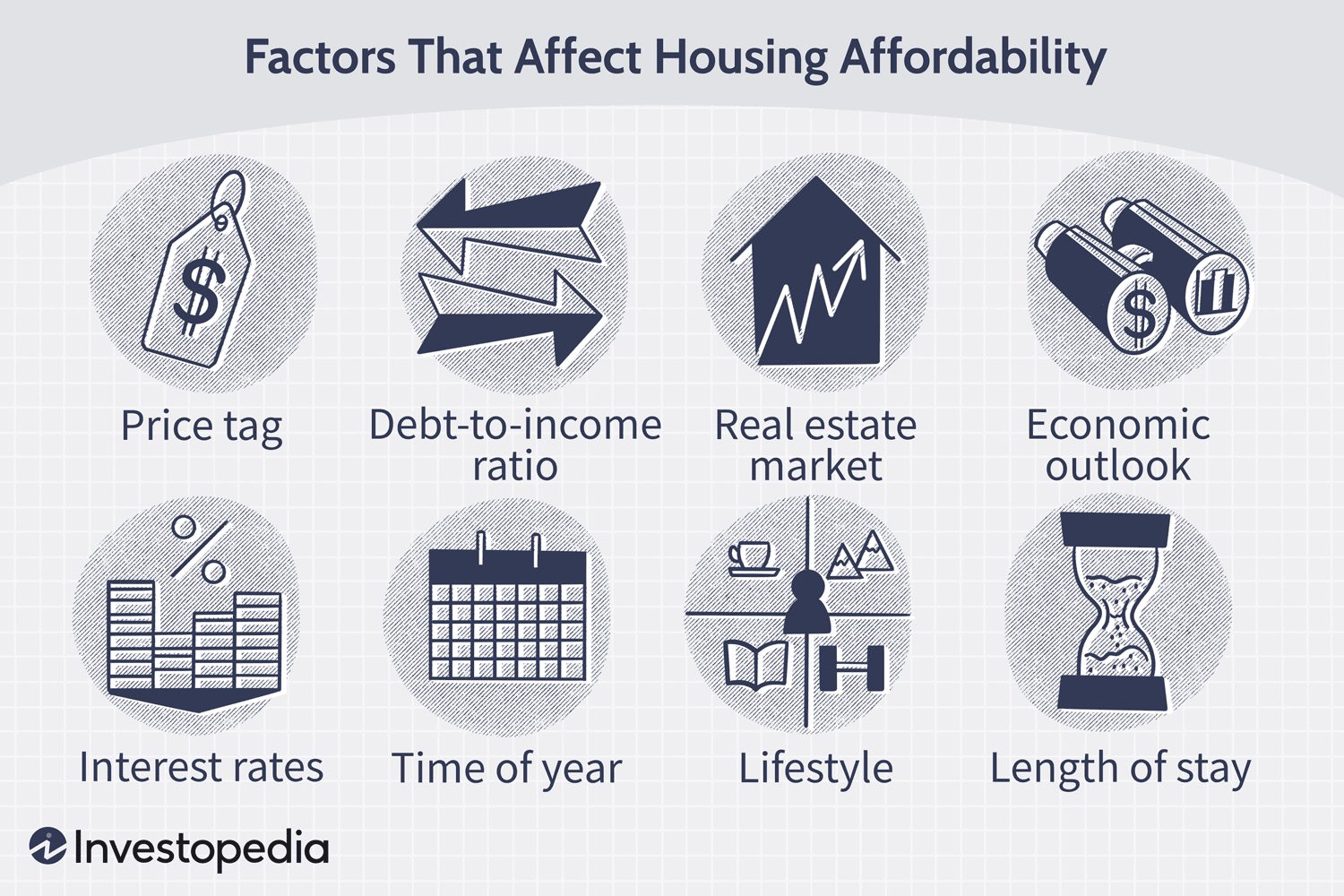

This guide emphasizes financial readiness as a cornerstone of homeownership. Research shows that buyers who assess debt-to-income ratios and credit health early secure better mortgage terms. By integrating budgeting tools and market insights, you’ll make informed, future-proof decisions.

Assessing Your Readiness to Buy

Evaluate readiness by analyzing financial stability, lifestyle goals, and emotional preparedness. For example, a stable income and manageable debt-to-income ratio signal financial health. Misjudging readiness often leads to regret—aligning finances with long-term plans ensures confident, informed decisions.

Evaluating Your Financial Health

Focus on your debt-to-income (DTI) ratio, a critical metric for lenders. Aim for a DTI below 43% by reducing high-interest debts. Use tools like FinLocker to track progress, aligning financial habits with long-term homeownership goals.

The Importance of Credit Scores

A credit score above 670 unlocks better mortgage terms, including lower interest rates. Prioritize timely payments and reduce credit utilization below 30%. Leverage free annual credit reports to identify errors, ensuring financial readiness for homeownership success.

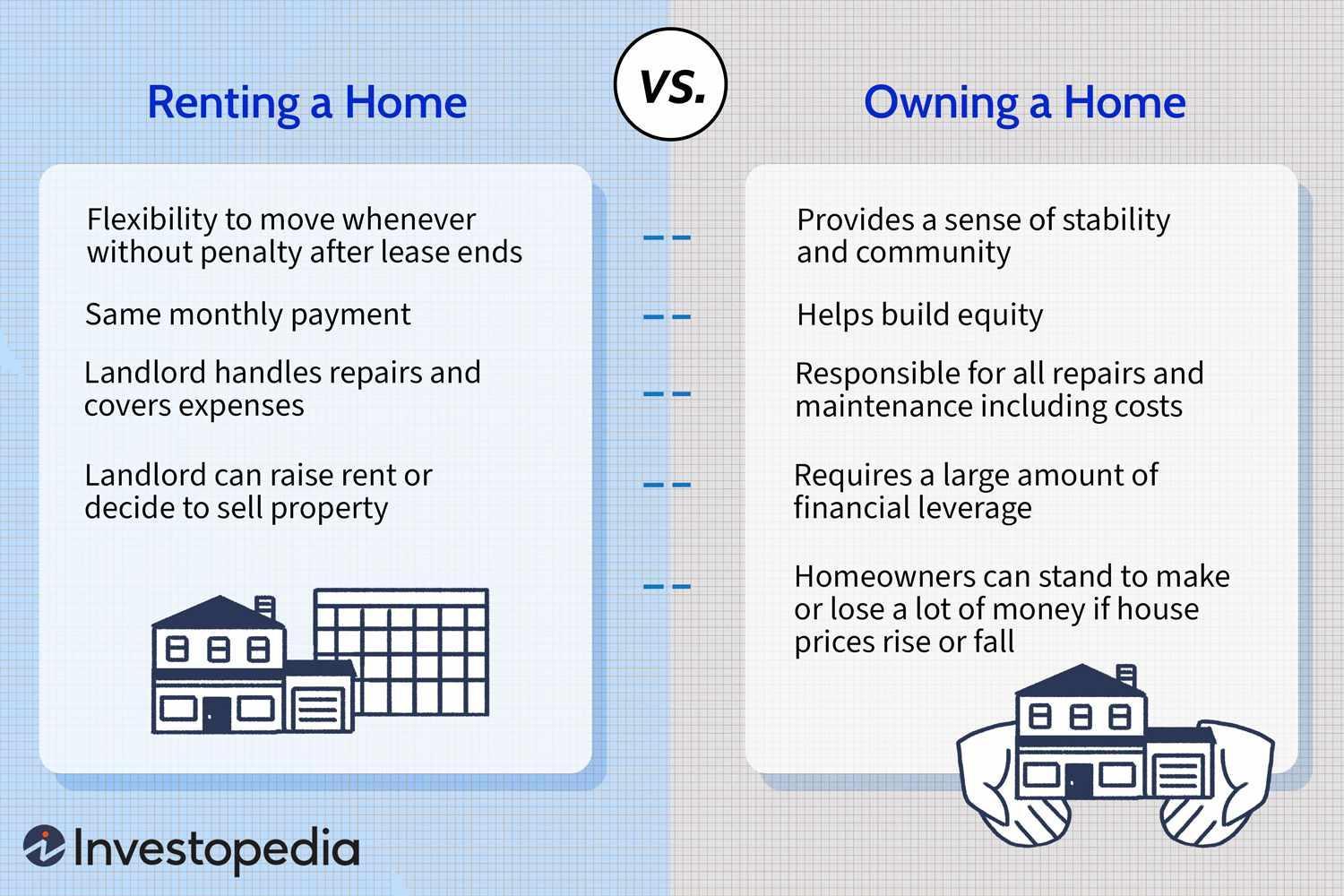

Renting vs. Buying: Timing Considerations

Evaluate market conditions like interest rates and housing inventory. high rates may favor renting, while low inventory inflates prices. Align decisions with career stability and life goals, ensuring financial flexibility for future opportunities or unexpected changes.

Financial Planning and Budgeting

A well-crafted budget is your roadmap to homeownership success. Start by analyzing income, debts, and savings. For example, allocating 28% of income to housing costs ensures sustainability. Use tools like affordability calculators and consult experts to refine your financial strategy.

Determining How Much House You Can Afford

Consider the 50/30/20 rule: allocate 50% of income to needs, 30% to wants, and 20% to savings. Apply this to housing by ensuring mortgage payments, taxes, and insurance fit within the “needs” category. Use lifestyle goals to refine affordability.

Saving for Down Payments and Closing Costs

Automate savings with dedicated accounts to ensure consistent progress. Explore down payment assistance programs or grants, especially for first-time buyers. Factor in closing costs (2–5% of purchase price) early to avoid financial surprises and ensure readiness.

Budgeting for Ongoing Homeownership Expenses

Prioritize maintenance reserves by saving 1–3% of your home’s value annually. Use seasonal cost tracking to anticipate fluctuations in utilities or repairs. Integrate emergency funds for unexpected expenses, ensuring financial stability and reducing long-term stress.

Understanding Mortgages and Financing Options

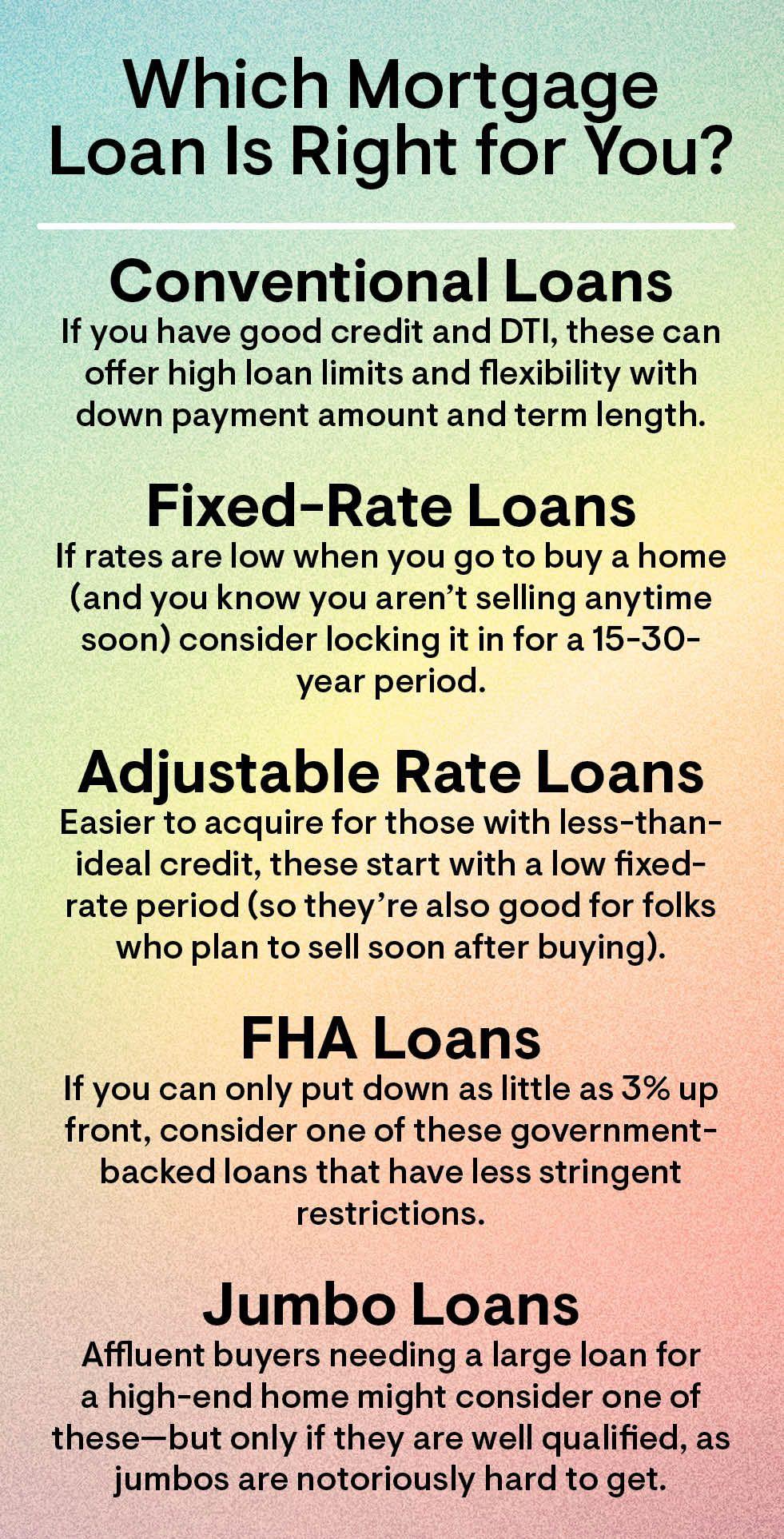

Mortgages are financial tools, not just loans. Fixed-rate mortgages offer stability, while adjustable-rate mortgages suit short-term plans. For example, FHA loans enable low down payments, but higher insurance costs. Compare options carefully to align with your financial goals.

Fixed-Rate vs. Adjustable-Rate Mortgages

Timing matters. fixed-rate mortgages excel in high-interest environments, locking predictable costs. Conversely, ARMs thrive when rates are declining, offering initial savings. Pro tip: Use ARMs strategically if expecting income growth or short-term ownership, but assess adjustment caps carefully.

Government-Backed Loans and Programs

FHA loans empower buyers with low credit scores, requiring just 3.5% down. Lesser-known USDA loans offer zero down payment for rural areas, fostering community growth. Tip: Explore local programs for layered benefits, maximizing affordability and financial flexibility.

Getting Pre-Approved for a Mortgage

pre-approval strengthens your negotiation power. Key insight: Multiple pre-approvals within 14–45 days minimize credit score impact. Actionable tip: Compare lenders’ terms, fees, and hidden costs to secure the most favorable loan for your financial goals.

Identifying Your Ideal Home

Define priorities by balancing needs (e.g., proximity to work) and wants (e.g., modern design). Example: A family prioritizing school districts may compromise on square footage. Use tools like heatmaps to analyze commute times, enhancing decision-making precision.

Setting Priorities: Needs vs. Wants

Focus on adaptability: Prioritize features that cannot be changed, like location or lot size. Example: A home near transit hubs supports long-term value. Tip: Reassess wants—upgrades like flooring or appliances can be added later.

Exploring Different Types of Properties

Evaluate maintenance demands: Single-family homes require higher upkeep, while condos offer shared maintenance. Example: Condos suit busy professionals prioritizing convenience. Insight: Assess homeowners’ association (HOA) fees—unexpected costs can impact affordability and long-term financial planning.

Assessing Location and Neighborhood Factors

Analyze future development plans: Upcoming infrastructure projects can boost property values. Example: A planned transit hub increases accessibility and demand. Framework: Use municipal planning documents to identify growth areas, balancing affordability with long-term investment potential.

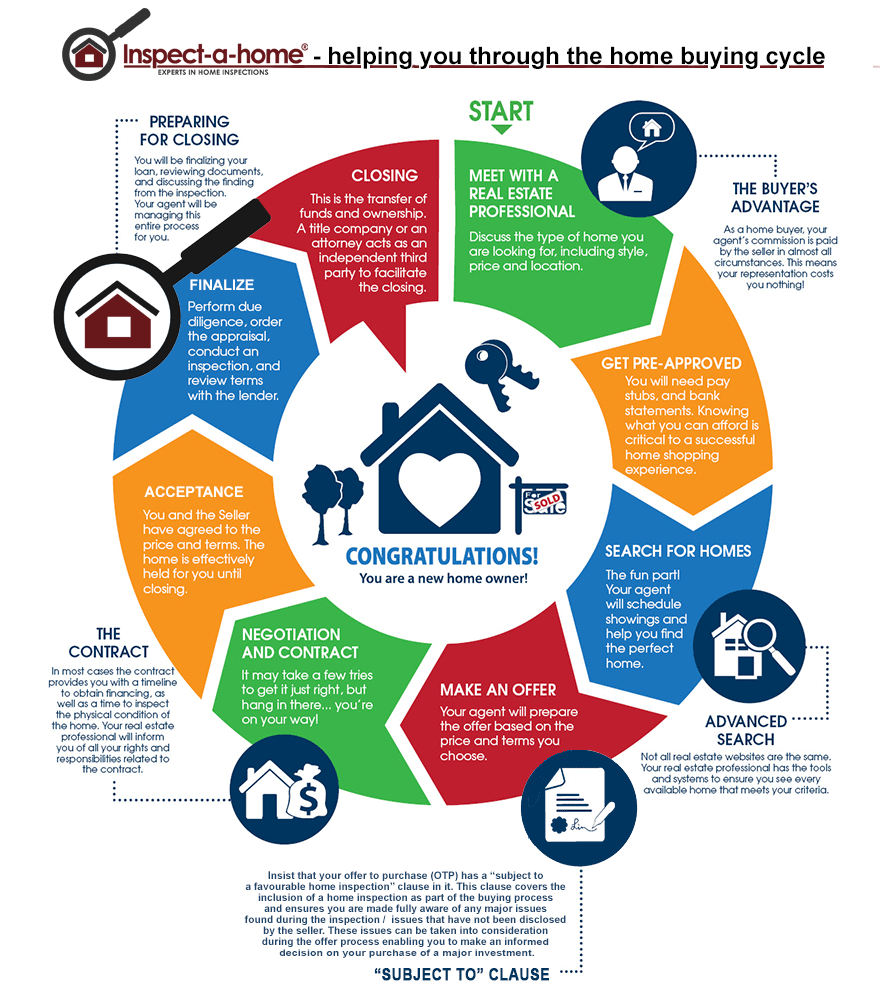

The Home Search Process

Think like an investor: Treat your home search as a strategic venture. Example: Prioritize resale potential by analyzing neighborhood trends. Insight: Homes near schools or transit hubs often appreciate faster, offering both lifestyle benefits and financial security.

Selecting a Real Estate Agent

Prioritize negotiation expertise: Agents skilled in creative deal-making can secure better terms. Example: Negotiating seller concessions, like covering closing costs, reduces upfront expenses. Tip: Evaluate agents’ track records in competitive markets to ensure they deliver measurable financial advantages.

Using Online Tools and Resources

Leverage predictive analytics: Platforms like Redfin’s Hot Homes feature forecast quick-selling properties. Why it works: data-driven insights highlight competitive listings. Actionable Tip: Combine these tools with local market trends to refine your strategy and act decisively.

Effective House Hunting Strategies

Master timing dynamics: Target off-peak seasons like winter for reduced competition and better deals. Why it works: Sellers are more flexible during slower markets. Actionable Tip: Pair this with pre-approval to act swiftly on opportunities.

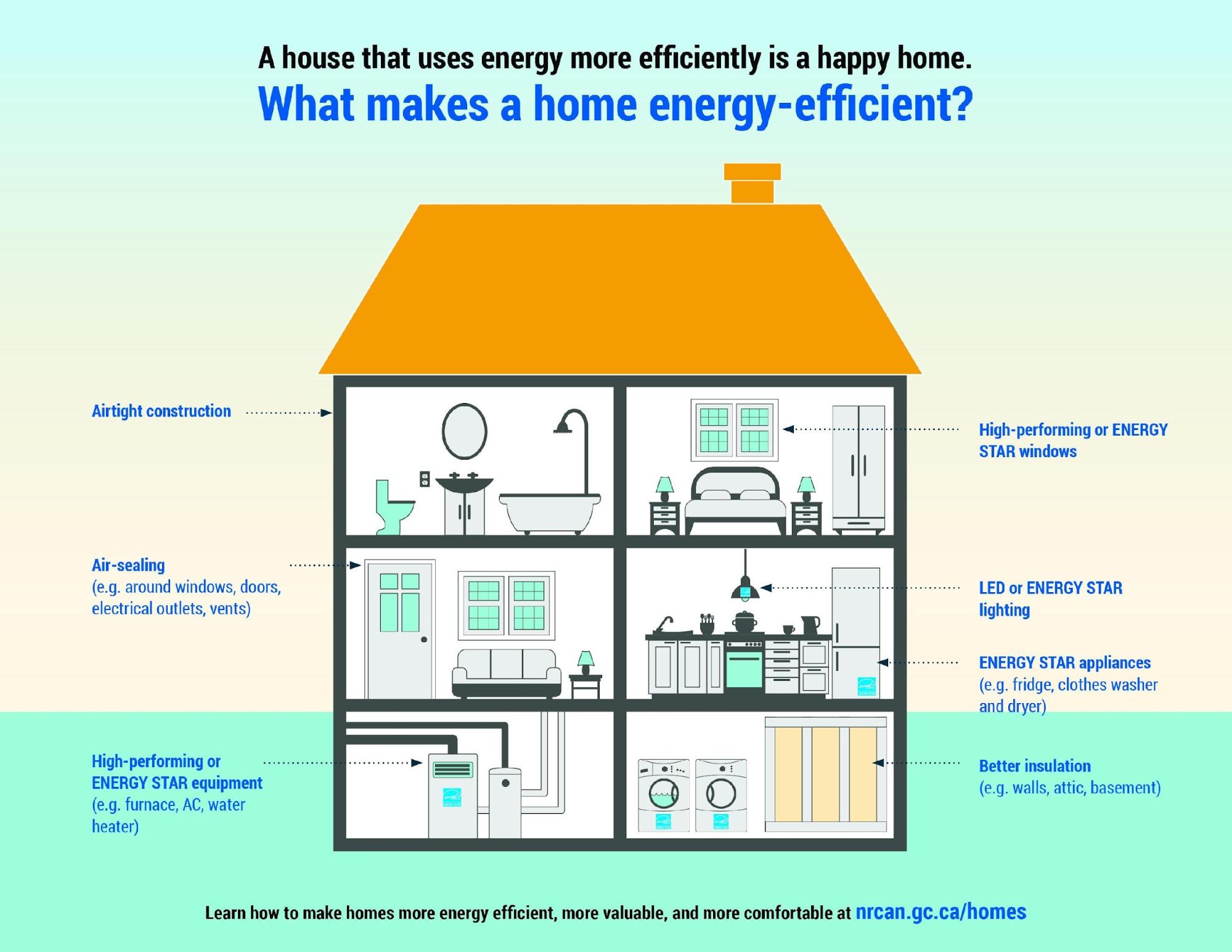

Incorporating Sustainable and Green Features

Invest in energy-efficient upgrades: Features like solar panels and LED lighting reduce utility costs by up to 50%. Unexpected benefit: Homes with eco-friendly certifications sell 5–10% higher. Actionable Tip: Explore government incentives to offset initial costs.

Benefits of Energy-Efficient Homes

Enhanced durability and resilience: Energy-efficient homes use advanced materials like insulated concrete forms, reducing maintenance costs by 30%. Lesser-known advantage: These materials withstand extreme weather, safeguarding investments. Actionable Tip: Prioritize upgrades like high-performance insulation for long-term savings and protection.

Identifying Eco-Friendly Property Features

Smart water management: rainwater harvesting systems reduce water bills by 40% while conserving resources. Lesser-known factor: Permeable landscaping prevents runoff, protecting local ecosystems. Actionable Tip: Evaluate properties for integrated water-saving technologies to enhance sustainability and long-term cost efficiency.

Financial Incentives for Green Buyers

Tax credits for renewable energy: Federal programs offer up to 30% credits for solar installations. Lesser-known insight: State-specific rebates can stack, amplifying savings. Actionable Tip: Use DSIRE (Database of State Incentives for Renewables & Efficiency) to uncover local opportunities.

Making an Offer and Negotiation

strategic timing matters: Offers made midweek often face less competition. Unexpected insight: Personalizing your offer with a letter can sway sellers emotionally. Actionable Tip: Use escalation clauses to outbid competitors without exceeding your budget cap.

Understanding Market Conditions

Leverage seasonal trends: Spring markets often favor sellers, while winter offers buyers more negotiating power. Lesser-known factor: Monitor local zoning changes; they can signal future demand shifts. Actionable Framework: Combine historical sales data with interest rate trends for precise timing.

Crafting a Competitive Offer

Focus on seller priorities: Tailor offers to meet seller needs, like flexible closing dates. Lesser-known insight: A larger earnest money deposit signals financial strength. Actionable Tip: Use escalation clauses strategically to outpace competitors without overcommitting.

Negotiation Techniques for Success

Leverage market data: Use recent comparable sales to justify your offer. Lesser-known tactic: Highlight your flexibility on contingencies to appeal to sellers. Actionable Framework: Combine data-driven insights with emotional intelligence to build rapport and secure favorable terms.

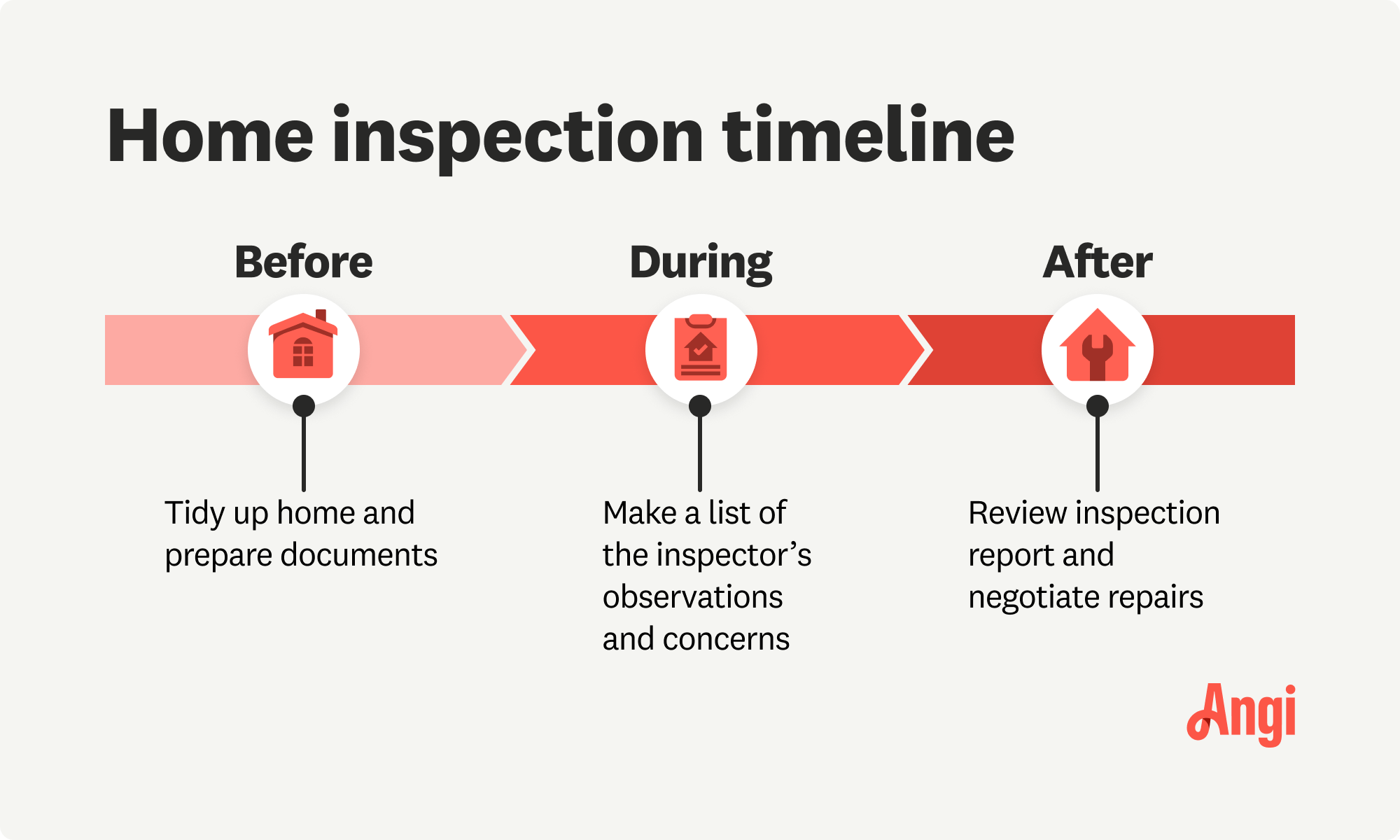

Due Diligence: Inspections and Appraisals

Inspections uncover hidden risks: A professional inspection can reveal structural issues, like foundation cracks, saving thousands. Example: A buyer renegotiated $15,000 off due to plumbing defects. Insight: Appraisals ensure fair pricing, aligning market value with lender requirements, avoiding overpayment pitfalls.

The Role of Home Inspections

Spotting hidden liabilities: Inspections go beyond surface-level issues, identifying risks like mold or outdated wiring. Example: A buyer avoided $20,000 in repairs by uncovering roof damage. Actionable Tip: Attend inspections to ask questions and prioritize future maintenance.

Interpreting Inspection Reports

Prioritize critical findings: Focus on structural issues, safety hazards, and costly repairs. Example: A cracked foundation flagged in a report saved a buyer $30,000. Framework: Categorize findings by urgency—immediate fixes, negotiable repairs, and long-term maintenance.

Navigating the Appraisal Process

Leverage comparable sales: Provide recent, relevant sales data to support your home’s value. Example: A seller used updated comps to challenge a low appraisal, increasing the valuation by 8%. Tip: Collaborate with agents to identify overlooked market trends.

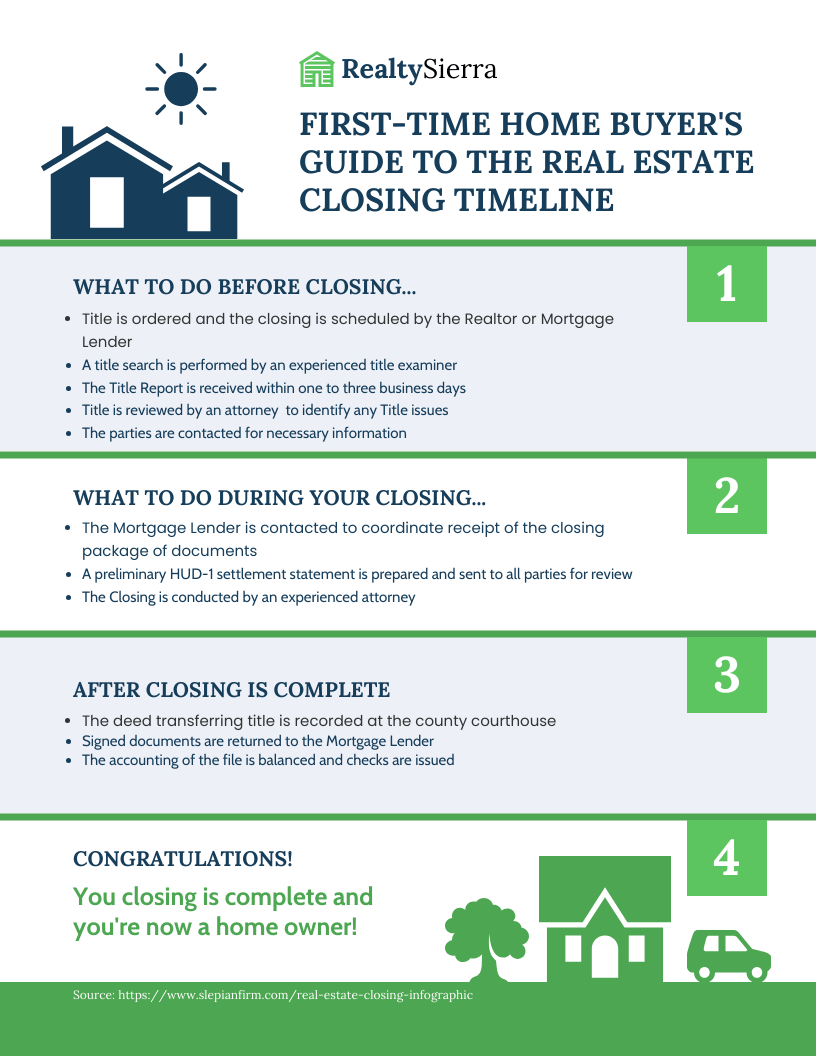

Closing the Deal

Synchronize timelines: Align lender, agent, and seller schedules to avoid delays. Example: A buyer’s proactive coordination reduced closing time by 15%. Insight: Review the Closing Disclosure meticulously; errors can cost thousands. Think of it as your financial blueprint.

Understanding Closing Costs and Procedures

Uncover hidden fees: Beyond standard costs, watch for prorated taxes or HOA dues. Example: A buyer saved $1,200 by negotiating lender fees. Actionable Tip: Request a detailed Closing Disclosure early to identify and dispute discrepancies effectively.

Finalizing Your Mortgage

Optimize rate locks: lock interest rates strategically during market dips. Example: A buyer saved $3,000 over five years by timing their lock. Pro Tip: Monitor economic indicators like inflation trends to predict favorable rate movements.

What to Expect on Closing Day

Verify document accuracy: Cross-check loan terms and fees against the Closing Disclosure. Example: A buyer avoided $500 in errors by spotting discrepancies. Actionable Tip: Bring a checklist to ensure all terms match prior agreements.

Transitioning to Homeownership

Adapt to new financial habits: Treat homeownership like running a small business. Example: Allocate 1–3% of your home’s value annually for maintenance. Insight: Proactive budgeting prevents costly surprises, fostering long-term stability and financial confidence.

Moving into Your New Home

Strategize your unpacking: Prioritize essential spaces like the kitchen and bedroom first. Why it works: These areas create immediate comfort and functionality. Pro Tip: Label boxes by room and urgency to streamline the process and reduce stress.

Establishing Home Maintenance Routines

Focus on seasonal tasks: Schedule HVAC servicing in spring and fall to optimize efficiency. Why it matters: Preventative care reduces costly breakdowns. Actionable Tip: Use digital reminders or apps to track recurring maintenance and inspections seamlessly.

Financial Management Post-Purchase

Prioritize an emergency fund: Allocate 1–3% of your home’s value annually for unexpected repairs. Why it works: This proactive approach prevents financial strain. Framework: Use automated savings tools to ensure consistent contributions and long-term stability.

Leveraging Technology and Innovation

Streamline decisions with AI tools: Platforms like Zillow use predictive analytics to forecast property values. Unexpected insight: Virtual reality tours reduce time spent on-site visits by 30%. Actionable tip: Combine tech insights with local expertise for balanced decisions.

Smart Home Technologies

energy efficiency redefined: Smart thermostats like Nest reduce energy bills by up to 15%. Why it works: AI learns usage patterns, optimizing consumption. Actionable insight: Pair with solar panels for sustainable savings, enhancing both environmental impact and property value.

Online Tools for Home Management

Centralized maintenance tracking: Apps like HomeZada streamline upkeep by scheduling tasks and tracking expenses. Why it works: Consolidated data prevents overlooked repairs. Actionable insight: Integrate with IoT devices for real-time updates, enhancing efficiency and long-term property value.

Future Trends in Homeownership

Rise of modular construction: Prefabricated homes reduce costs by 20% and construction time by 50%. Why it works: Factory precision minimizes waste. Actionable insight: Combine modular designs with renewable energy systems to meet sustainability goals and future-proof investments.

Planning for the Future

Anticipate lifestyle shifts: A growing family or remote work needs can redefine space requirements. Example: A 2023 study found 60% of buyers regret not planning for future needs. Actionable insight: Prioritize flexible layouts to adapt seamlessly over time.

Building Equity Over Time

Leverage biweekly payments: Splitting monthly mortgage payments into biweekly installments reduces principal faster. Why it works: This approach adds an extra payment annually, accelerating equity growth. Actionable tip: Use automated payment systems to stay consistent and maximize results.

Home Improvements and Renovations

Prioritize energy-efficient upgrades: Installing smart thermostats or solar panels reduces utility costs and boosts resale value. Evidence: Energy-efficient homes sell 6% faster. Actionable insight: Research local incentives for green renovations to offset initial investment and maximize returns.

Preparing for Potential Resale

Focus on universal appeal: Neutral color schemes and functional layouts attract broader buyer interest. Why it works: Homes with adaptable designs sell 15% faster. Actionable tip: Avoid over-personalization; instead, invest in timeless upgrades like hardwood flooring or energy-efficient windows.

FAQ

What are the key steps to prepare financially for your first home purchase?

To prepare financially for your first home purchase, start by assessing your financial health, including income, savings, and debt-to-income ratio. Build a strong credit score by paying bills on time and reducing debts. Save for a substantial down payment, ideally 20%, to secure better loan terms and avoid private mortgage insurance (PMI). Create a comprehensive budget that includes not only the purchase price but also closing costs, property taxes, insurance, and maintenance expenses. Finally, get pre-approved for a mortgage to understand your borrowing capacity and demonstrate seriousness to sellers.

How can first-time buyers determine the right mortgage option for their needs?

First-time buyers can determine the right mortgage option by evaluating their financial goals, credit score, and long-term plans. Fixed-rate mortgages are ideal for those seeking stability with consistent monthly payments, while adjustable-rate mortgages (ARMs) may suit buyers planning to sell or refinance before rate adjustments. Government-backed loans, such as FHA, VA, or USDA loans, offer flexible eligibility criteria and lower down payment requirements, making them attractive for buyers with limited savings or lower credit scores. Comparing interest rates, loan terms, and additional costs across multiple lenders is essential to finding the best fit for individual needs.

What factors should be considered when choosing the ideal location for a first home?

When choosing the ideal location for a first home, consider proximity to essential services such as workplaces, schools, healthcare facilities, and grocery stores. Evaluate the neighborhood’s safety, crime rates, and overall atmosphere to ensure it aligns with your lifestyle preferences, whether it’s a quiet suburb or a bustling urban area. Research the quality of local school districts if you have or plan to have children, as this can impact both daily life and property value. Accessibility to public transportation and major highways is crucial for convenient commuting. Additionally, investigate future development plans and market trends in the area to assess the potential for property value appreciation over time.

How do first-time homebuyer programs and assistance work, and who qualifies?

First-time homebuyer programs and assistance provide financial support through grants, low-interest loans, or tax credits to make homeownership more accessible. These programs often include down payment assistance, reduced closing costs, or favorable mortgage terms. Eligibility typically depends on factors such as income limits, credit score requirements, and whether the buyer has owned a home in the past three years. Some programs, like FHA loans, cater to buyers with lower credit scores, while others, such as VA loans, are designed for veterans and active-duty military members. State and local programs may also offer additional benefits tailored to specific regions or professions, such as teachers or first responders.

What are the most common mistakes to avoid during the home buying process?

The most common mistakes to avoid during the home buying process include failing to establish a realistic budget, which can lead to financial strain. Skipping mortgage pre-approval is another error, as it weakens your negotiating position and may result in wasted time on unaffordable properties. Overlooking hidden costs, such as property taxes, insurance, and maintenance, can create unexpected financial burdens. Neglecting thorough property inspections may leave you with costly repairs after purchase. Additionally, letting emotions drive decisions instead of sticking to predefined criteria can lead to regret. Finally, not researching the neighborhood or future development plans can impact long-term satisfaction and property value.

Conclusion

Purchasing your first home is not just a financial milestone but a transformative life event that requires careful planning and informed decision-making. Studies show that nearly 40% of first-time buyers experience regret due to inadequate preparation—highlighting the importance of a structured approach. For instance, leveraging tools like budgeting apps or mortgage calculators can help avoid overspending, while programs such as FHA loans provide accessible pathways for those with limited savings.

A common misconception is that the highest offer always wins; however, personalized offers or flexible terms often sway sellers more effectively. Think of the home-buying process as assembling a puzzle—each piece, from financial readiness to market research, must fit seamlessly to reveal the bigger picture of long-term satisfaction.

Expert insights emphasize the value of balancing emotional desires with practical needs. As real estate advisor Jessica Feuerstein notes, “Preparation and clarity are your greatest allies in navigating the complexities of homeownership.” By aligning your goals with actionable strategies, you can turn what seems like a daunting process into a rewarding journey, ensuring your first home truly feels like home.