A Complete Guide to the First Home Buyers Grant in Victoria: Everything You Need to Know

Imagine owning your first home sooner than you thought possible—sounds like a dream, right? For first-time buyers in Victoria, this dream can become a reality with the right financial support. Understanding the grants and incentives available could be the key to unlocking your path to homeownership.

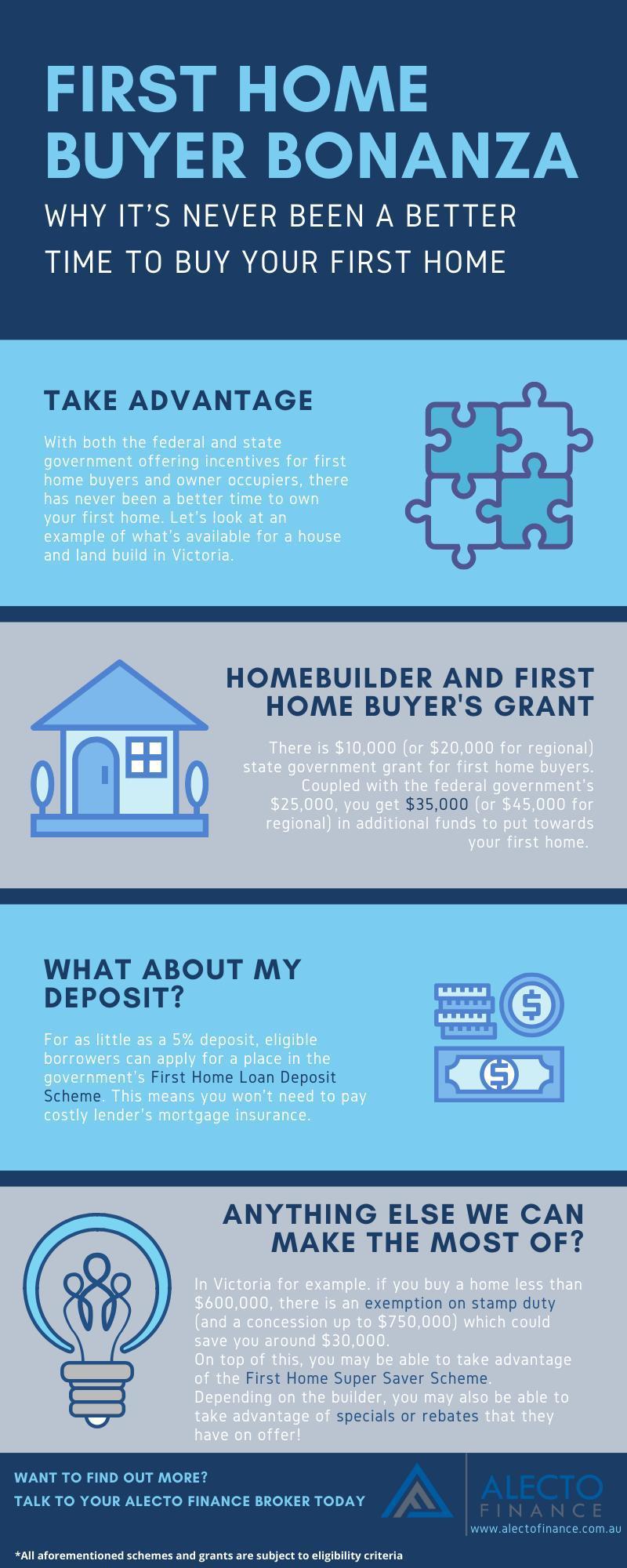

The Importance of the First Home Buyers Grant

For many first-time buyers, saving for a home deposit feels like climbing a mountain. The First Home Buyers Grant acts as a financial lifeline, reducing upfront costs and making homeownership more accessible. It’s not just about affordability—it’s about turning aspirations into achievable milestones for Victorians entering the property market.

Overview of the Housing Market in Victoria

Victoria’s housing market is a dynamic mix of opportunities and challenges. While Melbourne remains one of the least affordable cities, recent trends show subdued price growth, offering first-home buyers a window of opportunity.

In regional Victoria, housing prices have nearly doubled over the past decade, reflecting growing demand outside metropolitan areas. However, government initiatives, such as the First Home Buyers Grant and shared equity schemes, are helping buyers navigate these rising costs.

With increased stock availability and steady prices in some areas, first-home buyers in Victoria are finding more confidence to enter the market.

Understanding the First Home Buyers Grant in Victoria

The First Home Buyers Grant (FHOG) in Victoria is a game-changer for those stepping into the property market for the first time. It’s designed to ease the financial burden of buying or building a new home, making the dream of homeownership more attainable.

Here’s how it works: eligible first-home buyers can receive a $10,000 grant when purchasing or constructing a new property valued up to $750,000. If the property is located in regional Victoria, the grant increases to $20,000, providing even greater support for those looking to settle outside Melbourne.

To qualify, the property must be newly built or never previously occupied. This means established homes or previously owned properties don’t meet the criteria. Additionally, applicants must meet specific residency requirements, such as living in the home as their primary residence for at least 12 continuous months.

The grant isn’t just about financial relief—it’s also a strategic initiative to stimulate the construction industry. By focusing on new builds, the program supports local jobs and encourages the development of modern, energy-efficient housing.

For first-time buyers, this grant can significantly reduce upfront costs, especially when combined with other incentives like stamp duty exemptions or the First Home Guarantee. Together, these programs create a pathway to homeownership that’s more accessible than ever before.

What Is the First Home Buyers Grant?

The First Home Buyers Grant (FHOG) is a government initiative aimed at helping first-time buyers enter the property market. It provides a one-off payment to eligible individuals purchasing or building a new home.

In Victoria, the grant offers $10,000 for properties valued up to $750,000. For those buying in regional areas, the amount increases to $20,000. This financial boost can be used to cover upfront costs, such as deposits or transaction fees, making homeownership more achievable.

The grant is exclusively available for newly built homes, including off-the-plan properties and substantially renovated homes. However, it’s not applicable to established homes or properties that have been previously occupied. This focus on new builds also supports the construction industry, creating jobs and promoting sustainable housing development.

Grant Amount in Victoria

The First Home Buyers Grant in Victoria offers a substantial financial boost to eligible buyers. If you’re purchasing or building a new home valued up to $750,000, you can receive $10,000.

For those opting to settle in regional Victoria, the grant amount doubles to $20,000, encouraging homeownership outside metropolitan areas. This difference makes regional properties an attractive option for first-time buyers looking to maximize their benefits.

Keep in mind, the grant is only available for newly built homes, off-the-plan properties, or substantially renovated homes. established homes are not eligible, ensuring the grant supports new developments and modern housing solutions.

Recent Changes and Updates to the Grant

The First Home Buyers Grant in Victoria has seen several updates to better align with the evolving housing market.

One significant change is the inclusion of non-first home buyers who haven’t owned property in the last 10 years, broadening eligibility. Additionally, joint applications are now allowed, enabling friends, siblings, or family members to apply together.

For regional buyers, the grant remains a priority, with the $20,000 incentive continuing to support homeownership outside metropolitan areas. These updates reflect the government’s commitment to making homeownership more accessible for a wider range of buyers.

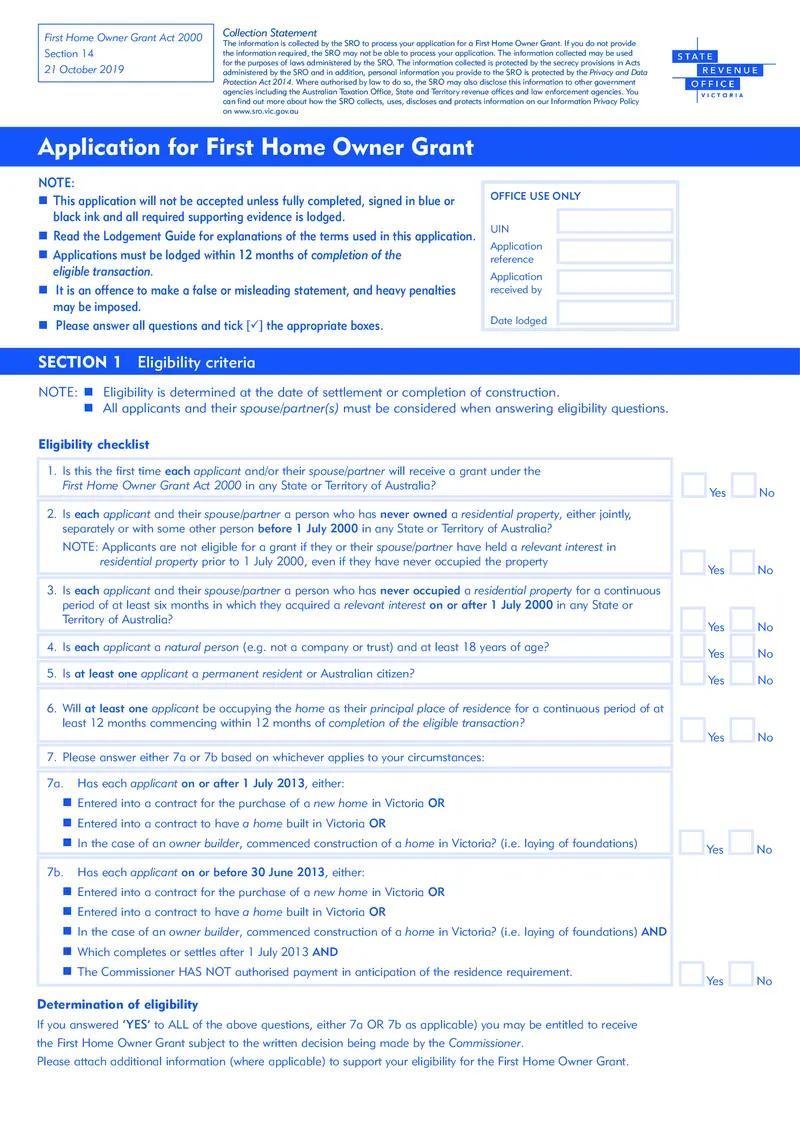

Eligibility Criteria for the First Home Buyers Grant

Wondering if you qualify for the First Home Buyers Grant (FHOG) in Victoria? The eligibility rules are straightforward but come with a few key conditions you need to meet.

Who Can Apply?

To be eligible, you must:

- Be at least 18 years old at the time of application.

- Be an Australian citizen, permanent resident, or a New Zealand citizen holding a permanent visa.

- Be a first-time homebuyer who has never owned or co-owned residential property in Australia.

If you’ve owned property before but didn’t live in it, you may still qualify under specific conditions.

Property Requirements

The grant is only available for new homes, which include:

- Newly constructed houses, townhouses, apartments, or units.

- Off-the-plan properties.

- Substantially renovated homes (where most structural or non-structural elements have been replaced).

The property’s value must not exceed $750,000.

Residency Conditions

You must live in the property as your principal place of residence for at least 12 continuous months. This residency must begin within 12 months of settlement or the completion of construction.

There’s an exemption for Australian Defence Force personnel who are on duty or leave.

Joint Applications and Expanded Eligibility

Recent updates now allow joint applications, meaning you can apply with friends, siblings, or family members. Additionally, if you haven’t owned property in the last 10 years, you may still qualify—even if you’re not a first-time buyer.

What’s Not Eligible?

The grant excludes established homes that have been previously occupied or sold as a residence. It’s designed to encourage new developments and support the construction industry.

By meeting these criteria, you can take a significant step toward owning your dream home in Victoria.

Applicant Eligibility Requirements

To qualify for the First Home Buyers Grant (FHOG) in Victoria, applicants must meet specific personal criteria. These include:

- Age: You must be at least 18 years old at the time of application.

- Residency: Applicants must be an Australian citizen, permanent resident, or a New Zealand citizen with a permanent visa.

- First-Time Buyer Status: Neither you nor your spouse/partner can have previously owned or co-owned residential property in Australia.

If you’ve owned property but didn’t live in it, you may still be eligible under certain conditions. Additionally, joint applications are now allowed, making it easier for friends or family to apply together.

Property Eligibility Requirements

Not all properties qualify for the First Home Buyers Grant (FHOG) in Victoria. To ensure your dream home meets the criteria, here’s what you need to know:

- Newly Built Homes Only: The grant applies exclusively to new properties. This includes houses, townhouses, apartments, or units that have never been sold or occupied as a residence.

- Value Cap: The property must be valued at $750,000 or less to qualify.

- First Sale Requirement: The property must be sold for the first time as a residential home. This means it cannot have been used for short-term accommodation or previously owned as a residence.

If you’re building a home, the grant also covers land and building packages or vacant land where construction will occur. This ensures flexibility for buyers looking to customize their first home.

Regional Considerations

If you’re considering buying in regional Victoria, the First Home Buyers Grant offers even greater incentives.

For eligible buyers, the grant amount doubles to $20,000 when purchasing or building a new home in regional areas. This boost is designed to encourage homeownership outside metropolitan hubs, where housing affordability is often more favorable.

Additionally, regional buyers may benefit from the Regional First Home Buyer Guarantee, which allows you to secure a home with as little as a 5% deposit without paying Lenders Mortgage Insurance (LMI).

This makes regional Victoria an attractive option for first-time buyers looking to maximize their grant benefits while enjoying a more relaxed lifestyle.

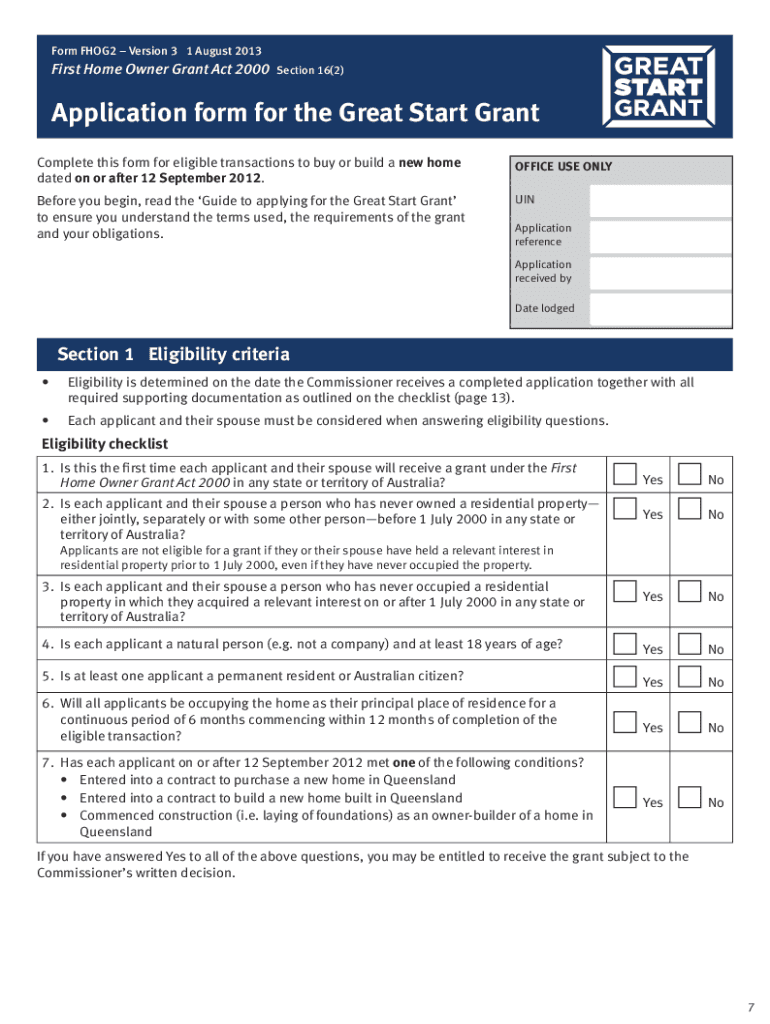

How to Apply for the First Home Buyers Grant

Applying for the First Home Buyers Grant (FHOG) in Victoria is simpler than you might think, but it’s important to get it right. Here’s a step-by-step guide to help you navigate the process:

1. Determine Your Eligibility

Before diving into the application, ensure you meet all the eligibility criteria. This includes being a first-time buyer, purchasing a new home under $750,000, and planning to live in the property for at least 12 months.

2. Choose Your Application Method

You can apply for the FHOG in two ways:

– Through an Approved Agent: Most lenders, such as banks or financial institutions, can handle the application on your behalf.

– Directly with the State Revenue Office (SRO): If you prefer to manage the process yourself, visit sro.vic.gov.au to access the application form and detailed instructions.

3. Prepare Your Documents

Gather all necessary documents to support your application. These typically include:

– Proof of identity (e.g., passport or driver’s license).

– A copy of the contract of sale or building contract.

– Evidence of property value (if required).

4. Submit Your Application

- If applying through an approved agent, they’ll submit the form for you after you sign and have it witnessed.

- For direct applications, complete the form online or mail it to the SRO. Ensure you submit it within 12 months of settlement or construction completion.

5. Track Your Application

Once submitted, you can track the progress of your application. If additional information is needed, respond promptly to avoid delays.

By following these steps, you’ll be well on your way to securing the grant and taking a significant step toward homeownership.

Steps to Apply

Applying for the First Home Buyers Grant doesn’t have to be overwhelming. Follow these simple steps to get started:

- Check Your Eligibility

Confirm that you meet all the requirements, such as being a first-time buyer and purchasing a new home under $750,000. - Choose Your Application Method

Decide whether to apply through an approved agent (like your lender) or directly with the State Revenue Office (SRO). - Gather Required Documents

Collect essential documents, including proof of identity, the contract of sale or building contract, and property value evidence if needed. - Complete and Submit the Application

Fill out the application form accurately. If applying through an agent, they’ll handle submission. For direct applications, submit via the SRO website or by mail. - Follow Up

Keep track of your application status. Respond quickly to any requests for additional information to avoid delays.

By breaking the process into these manageable steps, you’ll be well-prepared to secure your grant and move closer to owning your first home.

Required Documentation

Getting your paperwork in order is a critical step in applying for the First Home Buyers Grant. Here’s what you’ll need:

- Proof of Identity

Provide certified copies of documents like your Australian passport, birth certificate, or permanent residency visa. - Contract of Sale or Building Contract

Include a copy of the signed contract for the property purchase or construction agreement. - Proof of Property Value

If required, submit evidence of the property’s value, such as a valuation report or final build cost statement. - Residency Evidence

Show proof that you’ll live in the property, such as a statutory declaration or utility bill with your name and address. - Additional Supporting Documents

Depending on your situation, you may need marriage certificates, divorce papers, or other legal documents.

Having these documents ready will streamline your application process and help avoid unnecessary delays.

Processing Time and What to Expect

Once you’ve submitted your application, the waiting game begins—but it’s not as long as you might think.

- Standard Processing Time: Applications are typically reviewed within 10 working days after submission.

- Payment Timeline: If approved, the grant is paid directly into your nominated EFT account shortly after processing.

The timing can vary depending on how you apply:

- Through a Lender: Payments are often aligned with settlement or the first progressive payment for construction.

- Direct to the State Revenue Office (SRO): Expect payment within 14 days after settlement or issuance of the Certificate of Occupancy.

To avoid delays, double-check your documentation before submission. Missing or incorrect details can extend the processing time significantly.

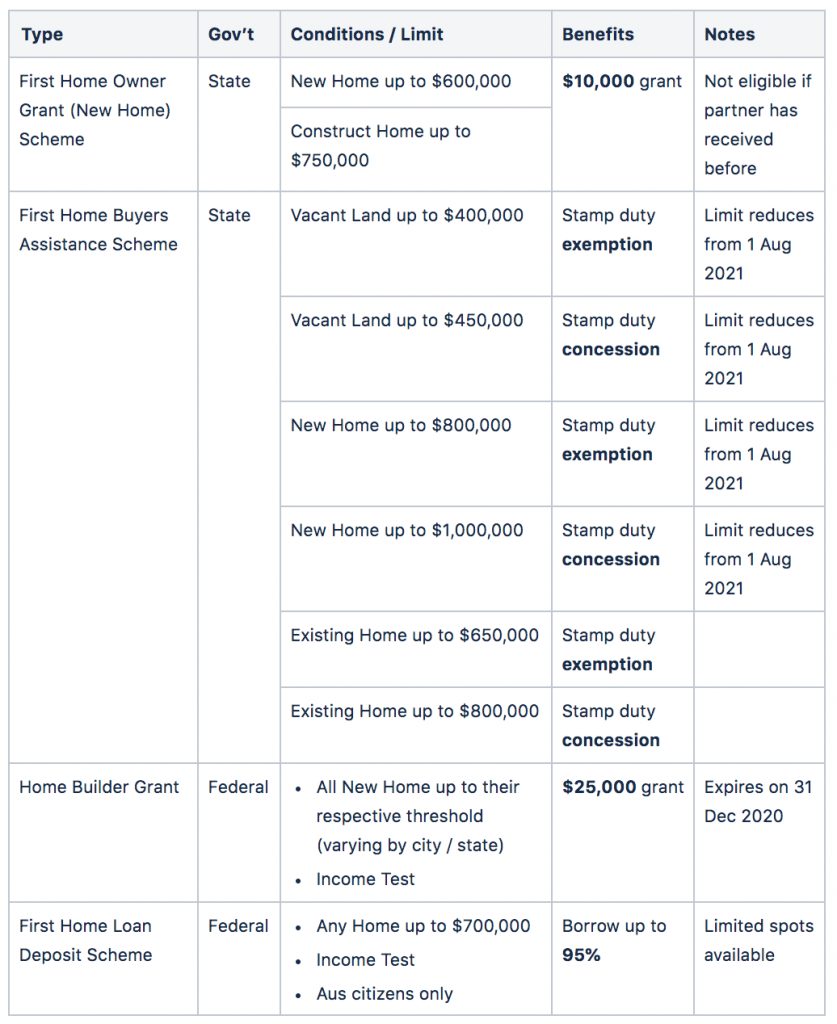

Additional Benefits and Concessions for First Home Buyers in Victoria

Buying your first home in Victoria comes with more than just the First Home Buyers Grant. There are additional benefits and concessions designed to make homeownership more affordable and accessible.

1. stamp duty exemptions and Concessions

Stamp duty can be a significant cost, but first home buyers in Victoria enjoy generous relief:

- Full Exemption: If your property is valued at $600,000 or less, you won’t pay any stamp duty.

- Concessions: For properties valued between $600,001 and $750,000, you’ll receive a sliding-scale discount.

For example, purchasing a $600,000 home could save you up to $31,070 in stamp duty costs.

2. First Home Guarantee

The First Home Guarantee (formerly the First Home Loan Deposit Scheme) helps buyers with limited savings.

- Instead of the usual 20% deposit, eligible buyers can purchase with as little as 5% deposit.

- The government guarantees up to 15% of the deposit, eliminating the need for costly Lenders Mortgage Insurance (LMI).

This program is available through 27 lenders and supports up to 35,000 borrowers annually.

3. Off-the-Plan Concessions

If you’re buying an off-the-plan property, you may qualify for additional savings:

- The dutiable value of the property is reduced by deducting construction costs incurred after the contract date.

- This can significantly lower the stamp duty payable, provided the property’s final value doesn’t exceed $750,000.

4. First Home Super Saver Scheme

Saving for a deposit can be daunting, but the First Home Super Saver Scheme (FHSSS) offers a tax-effective solution:

- You can make extra contributions to your superannuation and withdraw up to $50,000 (or $100,000 for couples) to fund your deposit.

- This strategy leverages the lower tax rates within super funds, helping you save faster.

5. Homebuyer Fund

The Victorian Homebuyer Fund is a shared equity scheme that reduces the financial burden of homeownership:

- The government contributes up to 25% of the property’s purchase price, reducing the size of your loan.

- Buyers need only a 5% deposit, and no LMI is required.

This program is ideal for those struggling to meet traditional lending requirements.

6. Regional Incentives

For those considering regional Victoria, the benefits are even greater:

- The First Home Buyers Grant increases to $20,000 for eligible properties.

- Regional buyers also enjoy access to favorable deposit terms and additional government support.

These incentives make regional areas an attractive option for first-time buyers seeking affordability and lifestyle benefits.

By combining these benefits with the First Home Buyers Grant, you can significantly reduce the upfront costs of purchasing your first home.

Stamp Duty Concessions

Stamp duty is often one of the largest upfront costs when buying a home, but first home buyers in Victoria can breathe a sigh of relief thanks to generous stamp duty concessions.

Here’s how it works:

- Full Exemption: If your property is valued at $600,000 or less, you won’t pay any stamp duty at all.

- partial concession: For properties priced between $600,001 and $750,000, you’ll receive a sliding-scale discount. The closer the property value is to $750,000, the smaller the concession.

For example, purchasing a $600,000 home could save you up to $31,070 in stamp duty costs. This makes a significant difference, especially when combined with other first home buyer incentives.

These concessions apply to both new and established homes, provided you meet the eligibility criteria. This flexibility ensures that buyers can explore a wide range of properties while still enjoying substantial savings.

Other Government Incentives

In addition to the First Home Buyers Grant, Victoria offers several other government-backed incentives to make homeownership more accessible.

- First Home Guarantee: With this scheme, you can buy a home with just a 5% deposit without paying Lenders Mortgage Insurance (LMI). The government guarantees up to 15% of your deposit, saving you thousands.

- Victorian Homebuyer Fund: This shared equity scheme allows the government to contribute up to 25% of the property price. You only need a 5% deposit (or **3.5% for Aboriginal and Torres Strait Islander participants).

- First Home Super Saver Scheme (FHSSS): Save for your deposit faster by making tax-effective contributions to your superannuation. You can withdraw up to $15,000 per year (up to a total of $50,000) to fund your first home purchase.

These programs are designed to reduce financial barriers, whether it’s through lower deposits, shared equity, or tax savings. Together, they provide a powerful toolkit for first home buyers navigating the property market.

Combining Grants and Concessions

Did you know you can combine multiple benefits to maximize your savings as a first home buyer in Victoria?

For example, you can pair the First Home Buyers Grant with a stamp duty exemption or concession. If your property is valued at $600,000 or less, you’ll not only receive the grant but also avoid paying any stamp duty—saving up to $31,070.

Additionally, programs like the First Home Guarantee can work alongside these benefits. This means you could secure your home with just a 5% deposit, avoid LMI, and still enjoy the grant and stamp duty savings.

By stacking these incentives, first home buyers can significantly reduce upfront costs, making homeownership more achievable than ever.

Common Mistakes to Avoid When Applying

Applying for the First Home Buyers Grant can be a game-changer, but small mistakes can cost you big time. Here’s how to avoid the most common pitfalls:

1. Failing to Meet the Residency Requirement

One of the most frequent errors is not living in the property as your principal place of residence. You must move in within 12 months of settlement or construction completion and live there for at least 12 continuous months. Failing to comply could result in repayment of the grant or even legal action.

2. Misrepresenting the Property’s Purpose

The grant is strictly for owner-occupied homes, not investment properties. Leasing out the property or using it for short-term accommodation without disclosure can lead to serious penalties. Always be transparent about your intentions.

3. Overlooking Documentation Requirements

Missing or incomplete documents can delay or even void your application. Ensure you have:

– Proof of identity.

– Property contracts.

– Evidence of residency status.

– Proof of property value.

Double-check everything before submission to avoid unnecessary setbacks.

4. Ignoring the Price Cap

The grant only applies to properties valued under $750,000. Purchasing a home above this limit will automatically disqualify you. Be mindful of this cap when house hunting.

5. Applying Without Checking Eligibility

Some applicants rush into the process without confirming their eligibility. For instance, if you or your partner have previously owned property or received a grant in another state, you may not qualify. Use tools like the State Revenue Office’s decision tool (url: https://www.sro.vic.gov.au/common-errors-first-home-owners) to verify your status.

6. Missing Deadlines

Timing is everything. Applications must be submitted within 12 months of settlement or construction completion. Missing this window could mean forfeiting the grant entirely.

By avoiding these common mistakes, you’ll ensure a smoother application process and maximize your chances of securing the grant.

Missing Documentation

Missing documentation is one of the easiest ways to derail your grant application. Without the right paperwork, your application could face delays or outright rejection.

To avoid this, ensure you have:

– Proof of identity (e.g., passport, driver’s license).

– Property contracts showing purchase details.

– Evidence of property value, such as a builder’s cost statement or valuation.

– Residency proof, confirming you meet the living requirements.

double-check every document before submission. Even a small oversight, like a missing signature, can cause unnecessary headaches.

Misunderstanding Eligibility Criteria

Misinterpreting the eligibility criteria is a common pitfall that can lead to wasted time and disappointment.

To qualify, you must:

– Be at least 18 years old.

– Be an Australian citizen or permanent resident.

– Ensure neither you nor your partner has previously owned property in Australia.

Additionally, the property must be newly built, valued under $750,000, and meet residency requirements. Overlooking these details—like assuming established homes qualify—can jeopardize your application. Always review the criteria carefully to avoid surprises.

Timing Issues

Timing is everything when applying for the First Home Buyers Grant. Missing key deadlines can cost you the grant entirely.

For example, your application must be submitted after settlement or once construction is complete. Additionally, you must move into the property within 12 months and live there continuously for at least a year.

Failing to align your application with these timelines can lead to rejection. To stay on track, create a checklist of deadlines and set reminders to ensure you meet every requirement.

Tips for First Home Buyers in Victoria

Buying your first home is a big step, but with the right strategies, you can make the process smoother and more rewarding. Here are some essential tips to help you navigate the journey:

1. Understand Your Budget

Before diving into the property market, take time to calculate your budget. Factor in not just the deposit but also additional costs like stamp duty, conveyancing fees, and inspection costs. Use tools like a mortgage calculator to estimate your repayments and ensure they fit comfortably within your financial limits.

2. Research Available Grants and Concessions

Victoria offers several incentives for first home buyers, including the First Home Buyers Grant and stamp duty exemptions. Check your eligibility for these programs to maximize your savings. For example, properties under $600,000 may qualify for a full stamp duty exemption, significantly reducing upfront costs.

3. Choose the Right Location

Location matters—not just for lifestyle but also for long-term property value. Consider regional areas where the First Home Buyers Grant doubles to $20,000, offering more financial support. Research local amenities, transport options, and future development plans to ensure the area aligns with your needs.

4. Get Pre-Approval for Your Loan

Securing pre-approval from a lender gives you a clear idea of how much you can borrow. It also shows sellers you’re serious, giving you an edge in negotiations. Ensure your savings history and financial documents are in order to streamline the process.

5. Work with Professionals

Buying a home involves many moving parts. Engage a mortgage broker, conveyancer, and building inspector to guide you through the process. These experts can help you avoid costly mistakes and ensure everything runs smoothly.

6. Plan for the Long Term

Think beyond the purchase. Will this home meet your needs in five or ten years? Consider factors like family growth, commute times, and potential resale value. A well-thought-out decision now can save you from needing to move again soon.

By following these tips, you’ll be better prepared to make informed decisions and take full advantage of the opportunities available to first home buyers in Victoria.

Financial Planning and Budgeting

Smart financial planning is the foundation of a successful home-buying journey. Start by assessing your income, expenses, and savings to determine how much you can realistically afford.

Create a detailed budget that includes not just the deposit but also hidden costs like stamp duty, legal fees, and moving expenses. Aim to save at least 20% of the property price to avoid paying Lender’s Mortgage Insurance (LMI). If that’s challenging, explore options like the First Home Guarantee, which allows a deposit as low as 5%.

Use tools like a savings calculator to set achievable goals and track your progress. Automating your savings can also help you stay consistent. Remember, a well-planned budget isn’t just about buying the home—it’s about ensuring you can comfortably manage repayments long-term.

Choosing the Right Property

Finding the perfect property is about more than just price—it’s about aligning with your lifestyle and long-term goals.

Start by considering the location. Is it close to work, schools, or public transport? A great location can enhance your quality of life and boost future resale value.

Next, evaluate the type of property. Are you looking for a house, apartment, or townhouse? Each comes with unique benefits and challenges, so think about your current and future needs.

Don’t forget to inspect the condition of the property. Look for structural issues, outdated systems, or potential renovation costs. A professional building inspection can save you from costly surprises later.

Finally, ensure the property meets the First Home Buyers Grant eligibility criteria. It must be a new build and fall within the price cap of $750,000.

Seeking Professional Advice

Navigating the home-buying process can feel overwhelming, but professional advice can make all the difference.

Start by consulting a mortgage broker. They’ll help you understand your borrowing capacity, compare loan options, and secure the best deal.

A conveyancer or property lawyer is essential for reviewing contracts and ensuring a smooth settlement process. They’ll catch any legal red flags you might miss.

Consider hiring a buyer’s agent, especially if you’re new to the market. They can negotiate on your behalf and find properties that meet your needs.

Finally, don’t hesitate to seek advice from financial planners. They can help you budget effectively and plan for long-term financial stability.

FAQ

What is the First Home Buyers Grant in Victoria and how does it work?

The First Home Buyers Grant in Victoria is a one-time financial assistance program provided by the Victorian government to help first-time homebuyers purchase or build a new home. It offers eligible applicants a grant of $10,000 for properties valued up to $750,000 in metropolitan areas and $20,000 in regional areas.

The grant is specifically designed to support the purchase of newly built homes, including houses, apartments, and townhouses, or to assist with the construction of a new property. To qualify, the property must not have been previously sold or occupied as a residence.

Applicants must meet specific eligibility criteria, including being at least 18 years old, an Australian citizen or permanent resident, and a first-time homebuyer. Additionally, the property must be used as the applicant’s primary residence for at least 12 months within the first year of settlement or construction completion.

The grant not only reduces the financial burden of purchasing a home but also encourages the development of modern, energy-efficient housing across Victoria.

Who is eligible to apply for the First Home Buyers Grant in Victoria?

Eligibility for the First Home Buyers Grant in Victoria is determined by several key criteria. Applicants must be at least 18 years old and either an Australian citizen, a permanent resident, or a New Zealand citizen holding a permanent visa. The grant is exclusively available to individuals, meaning companies or trusts are not eligible.

Applicants and their spouses or partners must not have previously owned or co-owned residential property in Australia, nor have they received a First Home Buyers Grant in any state or territory. Additionally, the property being purchased or built must be a newly constructed home, and the applicant must intend to use it as their principal place of residence for at least 12 continuous months, starting within 12 months of settlement or construction completion.

There are exemptions for Australian Defence Force personnel who are on duty or leave and enrolled to vote in Victorian state elections. These criteria ensure that the grant is targeted at genuine first-time buyers looking to enter the property market.

What types of properties qualify for the First Home Buyers Grant in Victoria?

The First Home Buyers Grant in Victoria applies exclusively to newly built properties. Eligible properties include houses, townhouses, apartments, and units that have not been previously sold, occupied as a residence, or used for short-term accommodation. This ensures that the grant supports the development of modern and energy-efficient housing.

Additionally, off-the-plan properties and substantially renovated homes may qualify, provided the renovations involve significant structural or non-structural changes that effectively make the property new. For owner-builders, the grant is available if construction has commenced, such as the laying of foundations, on land owned by the applicant.

The property must also meet the valuation requirement, with a maximum value of $750,000. These criteria are designed to encourage the purchase or construction of new homes, contributing to the growth of Victoria’s housing market.

How can I apply for the First Home Buyers Grant in Victoria and what documents are required?

To apply for the First Home Buyers Grant in Victoria, you can choose between two methods: through your lender or directly with the State Revenue Office (SRO). If applying through a lender, they will handle the submission process on your behalf, which is ideal if you need the grant before settlement or during the construction phase. Alternatively, if you are not borrowing through a lender, you can apply directly to the SRO by downloading the application form from their website and submitting it along with the required documents.

The required documents include:

– A copy of the contract of sale or building contract.

– A title search showing the applicant as the owner.

– A vendor statement confirming the property has never been occupied.

– A final build cost statement from the builder (if applicable).

– Evidence of the total property value, such as a valuation report.

– Proof of identity, which may include a passport, birth certificate, or permanent residency documents.

It’s important to complete the property transaction before lodging your application. Once submitted, applications are typically processed within 10 working days, and the grant is paid out promptly upon approval.

Are there additional benefits or concessions available for first home buyers in Victoria?

Yes, there are several additional benefits and concessions available for first home buyers in Victoria, complementing the First Home Buyers Grant. These include:

- Stamp Duty Exemptions and Concessions: First home buyers purchasing properties valued at $600,000 or less are eligible for a full exemption from stamp duty. For properties valued between $600,001 and $750,000, a sliding scale concession applies, significantly reducing the upfront costs.

- First Home Guarantee: This federal initiative allows eligible buyers to purchase a home with as little as a 5% deposit without paying Lenders Mortgage Insurance (LMI). The government guarantees up to 15% of the loan, making it easier to secure financing.

- First Home Super Saver Scheme: Buyers can save for a home deposit within their superannuation fund, benefiting from concessional tax rates. Individuals can withdraw up to $50,000, while couples can combine their savings for a total of $100,000.

- Homebuyer Fund: This shared equity scheme allows the Victorian government to contribute up to 25% of the property purchase price, reducing the amount buyers need to borrow. This is particularly beneficial for those with smaller deposits.

- Off-the-Plan Concessions: Buyers of off-the-plan properties may qualify for reduced stamp duty, as the dutiable value is calculated based on the property’s value at the time of contract signing, excluding construction costs.

These additional benefits and concessions are designed to make homeownership more accessible and affordable for first-time buyers in Victoria.

Conclusion

Navigating the journey to homeownership in Victoria is no small feat, but the First Home Buyers Grant and its accompanying benefits provide a solid foundation. By leveraging these opportunities, first-time buyers can reduce financial barriers and step confidently into the property market. Take the time to explore all available incentives, plan strategically, and make informed decisions to turn your dream of owning a home into reality.

Image source: warralily.com.au.

Recap of Key Points

- The First Home Buyers Grant offers up to $20,000 for eligible buyers in regional Victoria.

- Additional benefits like stamp duty exemptions and the First Home Guarantee can further reduce costs.

- Eligibility hinges on factors like property type, value, and residency requirements—so understanding these is crucial for success.

Encouragement and Next Steps

Taking the leap into homeownership is a big step, but with the First Home Buyers Grant, it’s more achievable than ever. Start by reviewing your eligibility, gathering the required documents, and seeking advice from professionals like mortgage brokers or conveyancers. With the right preparation, your dream home is within reach!

Want Assistance for First Home Buying Process? Contact Us today!