Government Grants and Schemes for First-Home Buyers in Australia

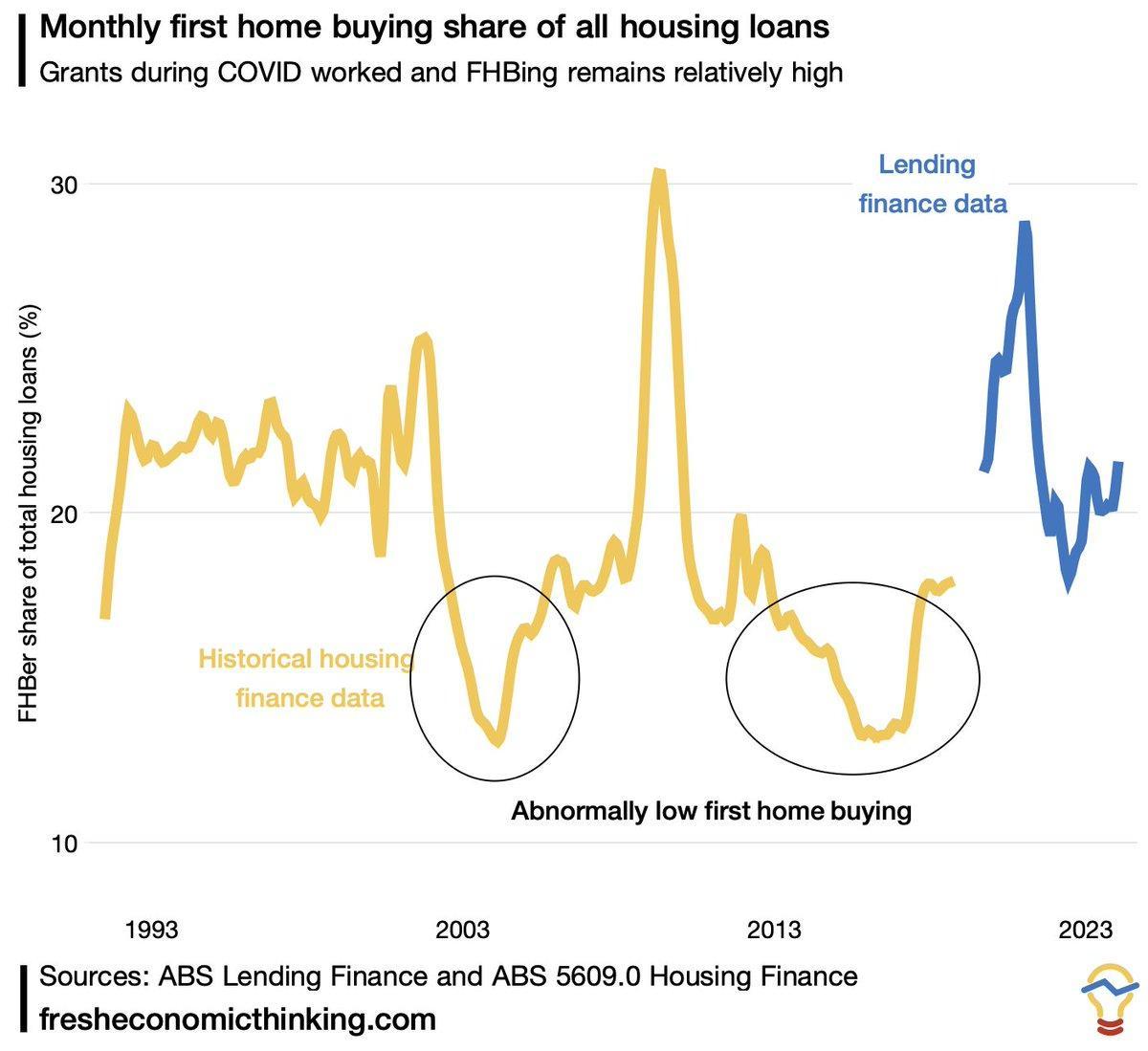

In a nation where homeownership is a cornerstone of financial security, why are first-home buyers increasingly locked out of the market despite billions in government support? As housing affordability reaches critical lows, the effectiveness of grants and schemes demands urgent scrutiny.

Image source: twitter.com.

Understanding the Challenges Facing First-Home Buyers

One critical yet underexplored challenge is the mortgage deposit gap. While government grants aim to bridge this, evidence suggests they inadvertently inflate property prices, negating their intended benefits.

For instance, stamp duty concessions and First Home Owner Grants (FHOG) often increase demand in already competitive markets, driving prices higher. This creates a paradox where assistance programs exacerbate affordability issues rather than alleviating them.

Moreover, rising interest rates and stagnant wage growth further widen the gap, leaving many buyers unable to save the required deposit. These factors disproportionately affect younger buyers, who face limited access to intergenerational wealth transfers compared to previous generations.

A potential solution lies in supply-side interventions, such as mandating affordable housing quotas in new developments. This approach, successfully implemented in countries like Singapore, directly addresses supply shortages without distorting market dynamics.

To navigate these challenges, first-home buyers should focus on comprehensive financial planning. Engaging with accredited mortgage brokers and leveraging tools like borrowing capacity calculators can provide clarity and actionable steps toward homeownership.

Role of Government Assistance in Home Ownership

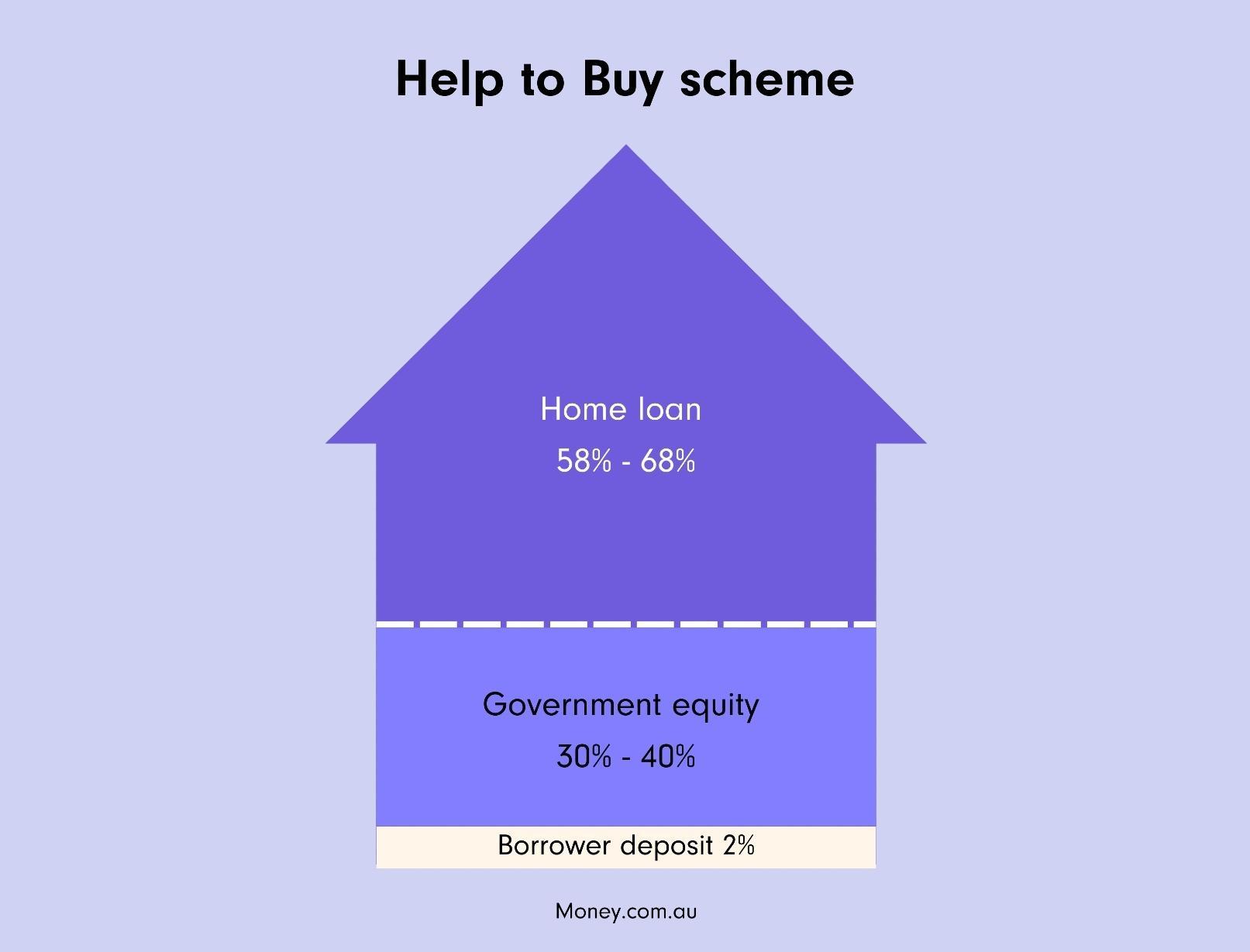

A pivotal yet underexamined aspect is the shift toward shared equity schemes. Unlike traditional grants, these programs reduce upfront costs while allowing governments to recoup investments through shared capital gains, ensuring long-term fiscal sustainability.

For example, Australia’s recent adoption of shared equity models, inspired by international practices, demonstrates their potential to balance affordability with market stability. These schemes are particularly effective in mitigating risks for low-income buyers, offering a structured pathway to ownership without inflating property prices.

However, challenges remain. Shared equity programs require robust administrative frameworks and clear guidelines to prevent misuse or inequitable outcomes. Additionally, they must address regional disparities, as housing markets vary significantly across urban and rural areas.

Integrating shared equity with supply-side measures, such as affordable housing quotas, could amplify their impact. Policymakers should also explore partnerships with private developers to scale these initiatives efficiently, ensuring broader accessibility for first-home buyers.

Image source: joust.com.au.

Overview of the Australian Housing Market

Australia’s housing market is a paradox of high demand and constrained supply. Property prices have surged, with median house prices in Sydney exceeding $1.2 million in 2024, driven by limited land availability and restrictive zoning laws.

A striking contrast emerges between urban and regional markets. While cities face affordability crises, regional areas offer lower prices but lack infrastructure and employment opportunities, creating a geographic imbalance in housing accessibility.

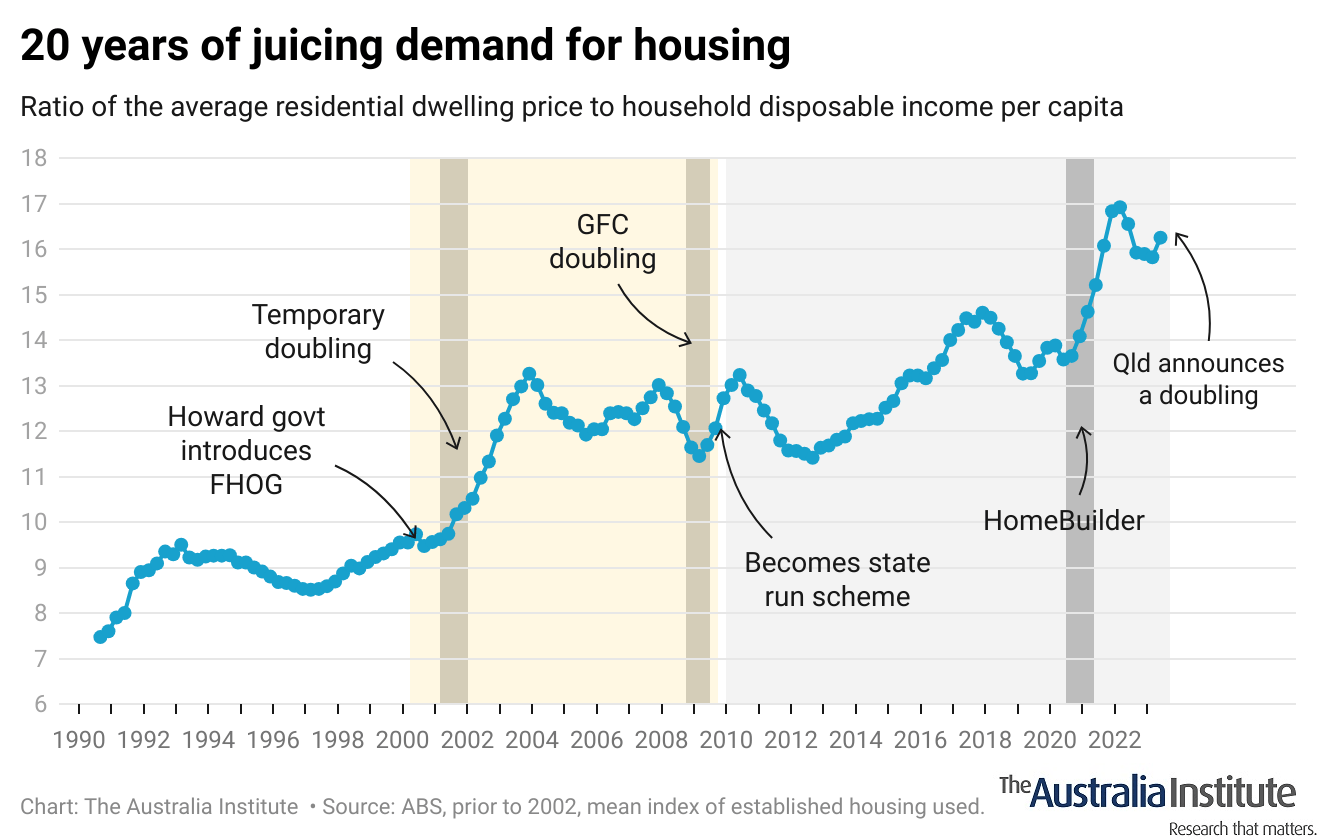

Misconceptions persist that government grants alone can resolve affordability. However, evidence shows these measures often inflate demand, exacerbating price growth. For instance, Queensland’s doubled First Home Owners Grant coincided with record-high property prices.

Experts advocate for supply-side interventions, such as streamlined planning regulations and affordable housing quotas, to address structural issues. Without these, demand-side schemes risk perpetuating the cycle of unaffordability, leaving first-home buyers increasingly reliant on inherited wealth.

Image source: australiainstitute.org.au.

Current Trends and Statistics

The Australian housing market is witnessing a shift toward apartment living, driven by urbanization and affordability concerns. high-rise developments now dominate urban landscapes, catering to young professionals and retirees seeking convenience and cost-effective options.

Sustainability is another emerging trend. Eco-friendly housing, supported by government incentives and green technologies, is gaining traction. For instance, energy-efficient homes are increasingly preferred, reflecting a growing awareness of environmental impacts.

However, rental markets remain critically tight, with vacancy rates hovering at 1.2% in cities. This scarcity, coupled with rising migration, intensifies competition, pushing rents higher and straining affordability for lower-income households.

Interestingly, construction approvals for medium to high-density housing have fallen below the 10-year average since 2018. This under-supply exacerbates housing shortages, despite demand remaining robust, particularly in urban centers.

To address these challenges, experts recommend streamlined planning regulations and incentives for sustainable developments. These measures could balance supply-demand dynamics while fostering long-term affordability and environmental responsibility.

Factors Impacting Housing Affordability

Land use planning restrictions significantly inflate housing costs by limiting supply. Zoning laws often prioritize low-density housing, restricting urban expansion and driving up prices in high-demand areas.

For example, Sydney’s restrictive zoning policies have constrained housing supply, contributing to skyrocketing property prices. This issue is compounded by infrastructure bottlenecks, where inadequate transport links deter development in outer suburbs, further centralizing demand.

Additionally, foreign investment policies influence affordability. While foreign buyers inject capital, they also intensify competition, particularly in premium markets, sidelining local first-home buyers.

To counteract these challenges, adaptive zoning reforms and targeted infrastructure investments are essential. These measures can unlock underutilized land, balance supply-demand dynamics, and improve affordability without compromising urban livability.

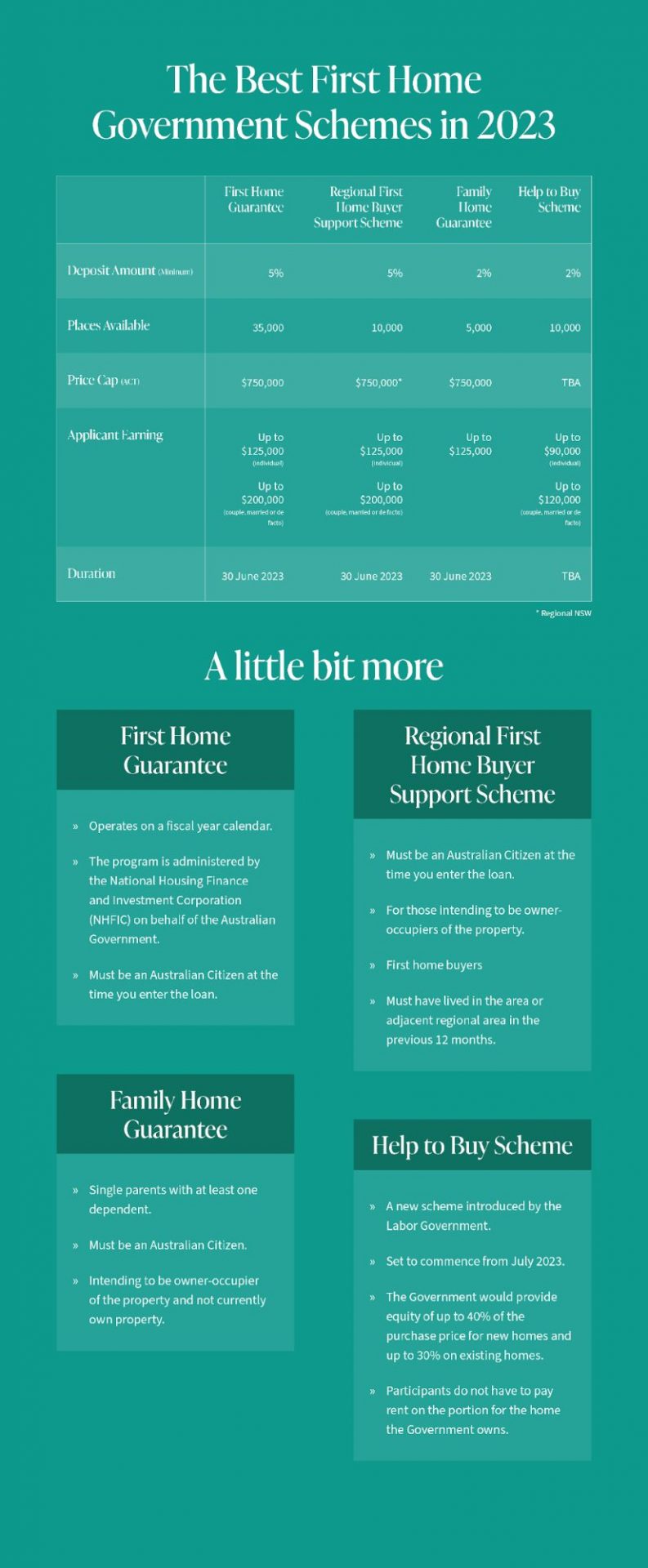

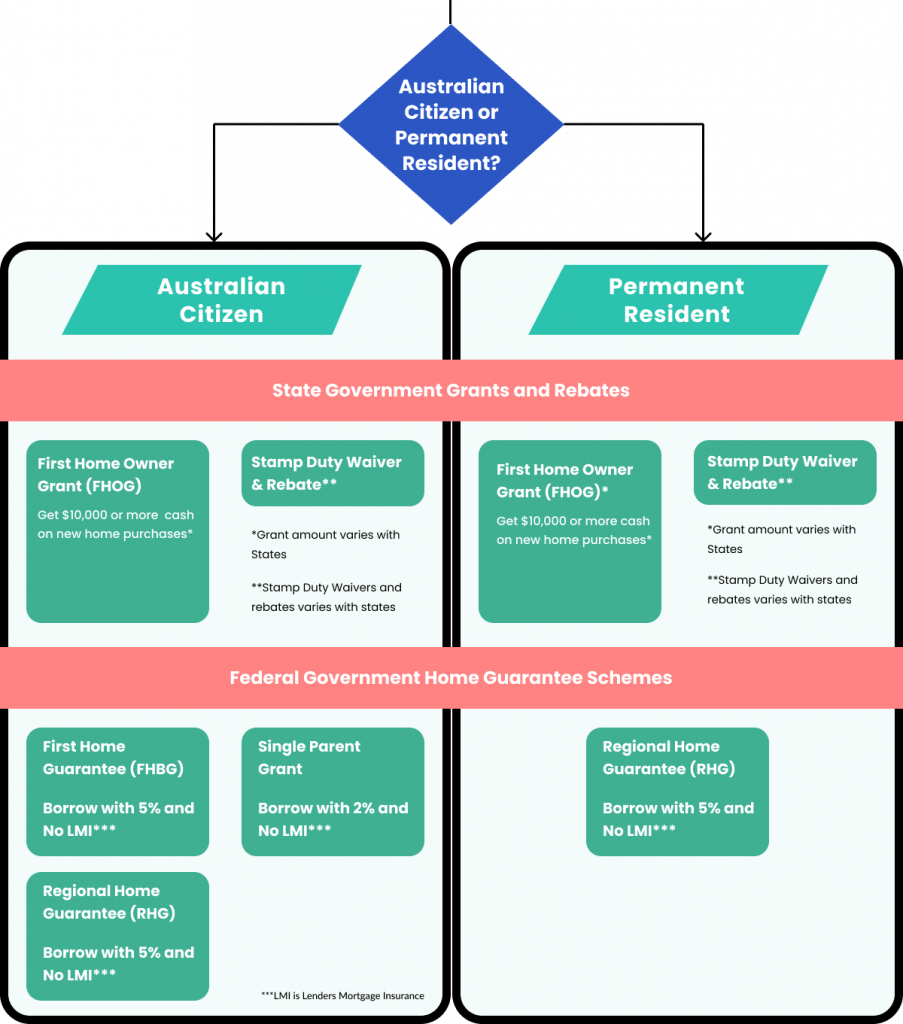

Federal Government Grants and Schemes

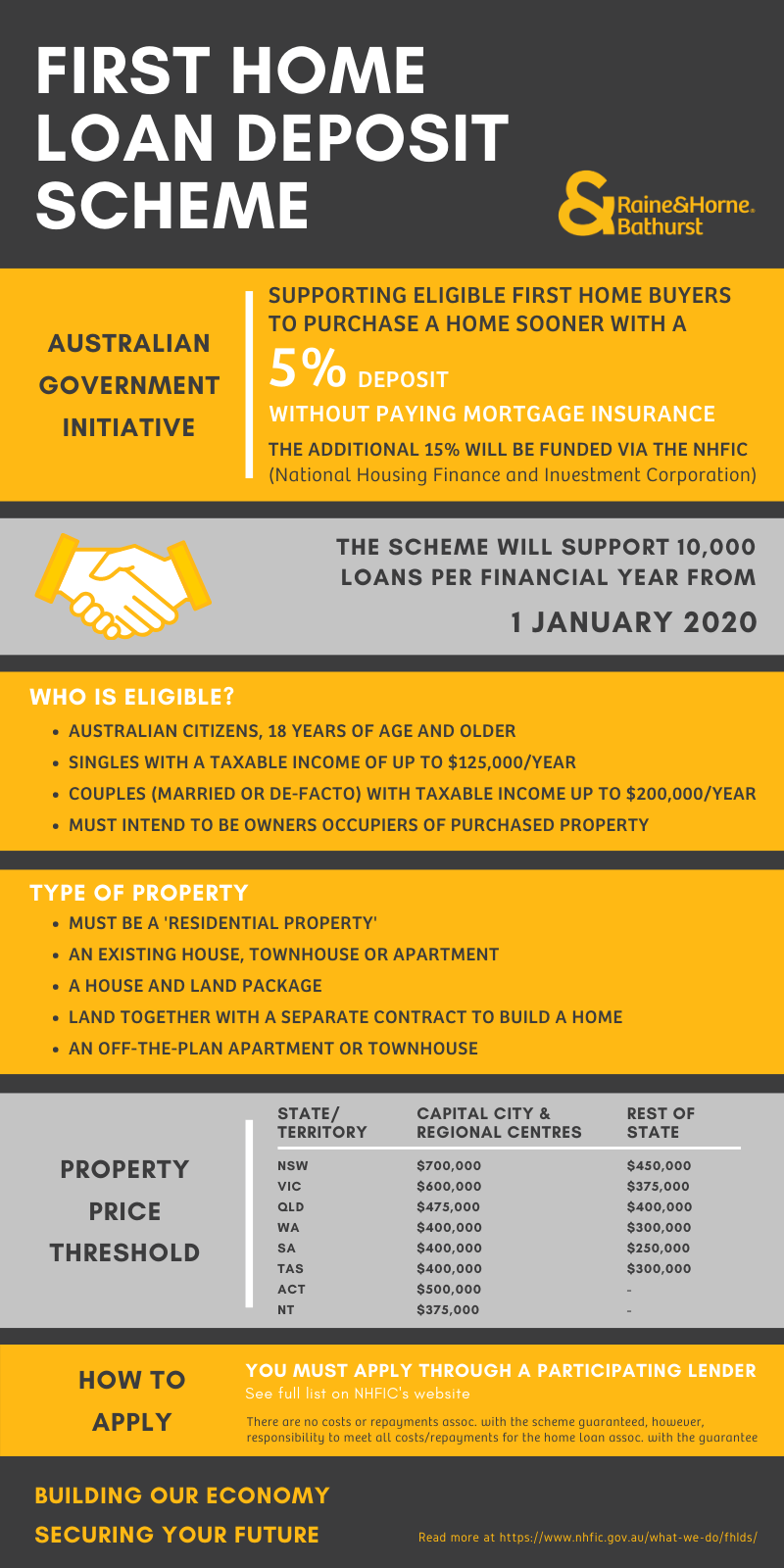

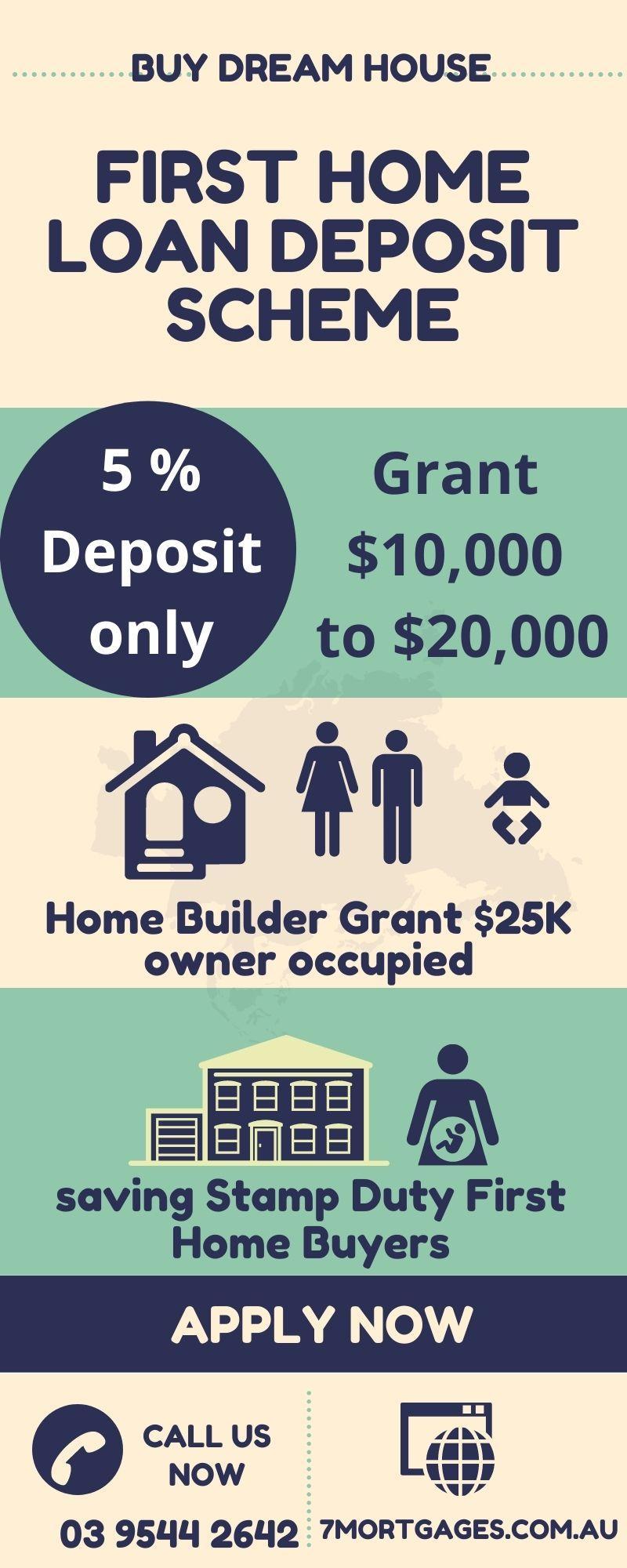

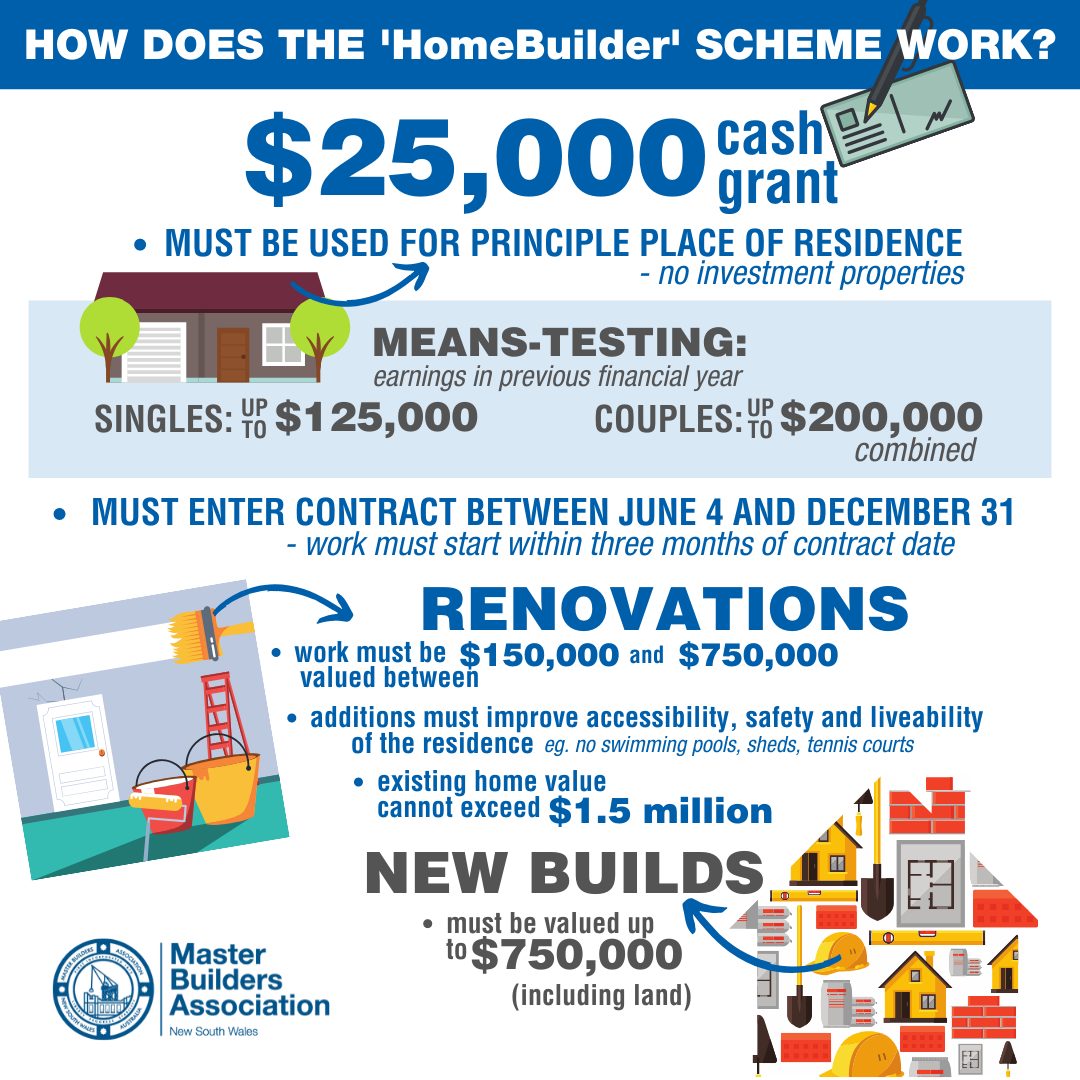

Federal schemes like the First Home Guarantee reduce deposit barriers, enabling buyers to secure homes with just 5% down. For instance, over 196,000 Australians have benefited, avoiding lenders mortgage insurance (LMI) and accelerating ownership.

The Help to Buy Scheme, launching in 2024, introduces shared equity, where the government co-owns up to 40% of new homes. This innovative approach balances affordability with market stability, offering a lifeline to buyers in high-cost regions.

However, misconceptions persist. Critics argue grants inflate demand, yet evidence shows targeted schemes, when paired with supply-side reforms, mitigate price surges. For example, regional guarantees have bolstered rural markets without destabilizing urban areas.

By integrating shared equity models and regional incentives, federal programs can address affordability gaps while fostering sustainable growth.

Image source: greenassociates.com.au.

First Home Guarantee (Formerly First Home Loan Deposit Scheme)

The First Home Guarantee addresses affordability by reducing deposit requirements to 5%, eliminating lenders mortgage insurance (LMI). However, its real impact lies in risk redistribution, where the government acts as guarantor, mitigating lender exposure.

This approach fosters financial inclusivity, enabling buyers with limited savings to access competitive interest rates. For example, a $700,000 property under the scheme saves buyers nearly $30,000 in LMI costs, accelerating market entry.

Yet, challenges persist. A higher loan-to-value ratio (LVR) increases interest costs and vulnerability to rate hikes. Buyers must weigh short-term affordability against long-term financial stability, emphasizing the need for robust financial planning.

By integrating education programs on financial risks and leveraging regional price caps, the scheme can enhance its effectiveness, ensuring sustainable homeownership while minimizing market distortions.

Family Home Guarantee

The Family Home Guarantee uniquely supports single parents and legal guardians with just a 2% deposit, addressing intergenerational housing inequities. By guaranteeing up to 18% of the loan, it reduces barriers for vulnerable households.

This scheme empowers participants to secure stable housing without relying on intergenerational wealth. For instance, grandparents and aunts now qualify, broadening access for non-traditional family structures often excluded from conventional programs.

However, income constraints and regional price caps can limit its reach. Expanding eligibility criteria and aligning caps with local market conditions could enhance its impact, ensuring equitable access for diverse family units.

Regional First Home Buyer Guarantee

The Regional First Home Buyer Guarantee addresses housing disparities by enabling buyers to secure homes with a 5% deposit. It prioritizes regional revitalization, encouraging population growth in areas with declining demographics and underutilized infrastructure.

This scheme’s success hinges on localized property price caps, ensuring affordability while preventing market inflation. For example, over 13,000 regional Australians accessed the program in 2023-24, fostering economic activity in underserved areas.

However, challenges like limited regional infrastructure and employment opportunities persist. Integrating strategic infrastructure investments and job creation initiatives alongside the scheme could amplify its impact, creating sustainable regional communities and reducing urban housing pressures.

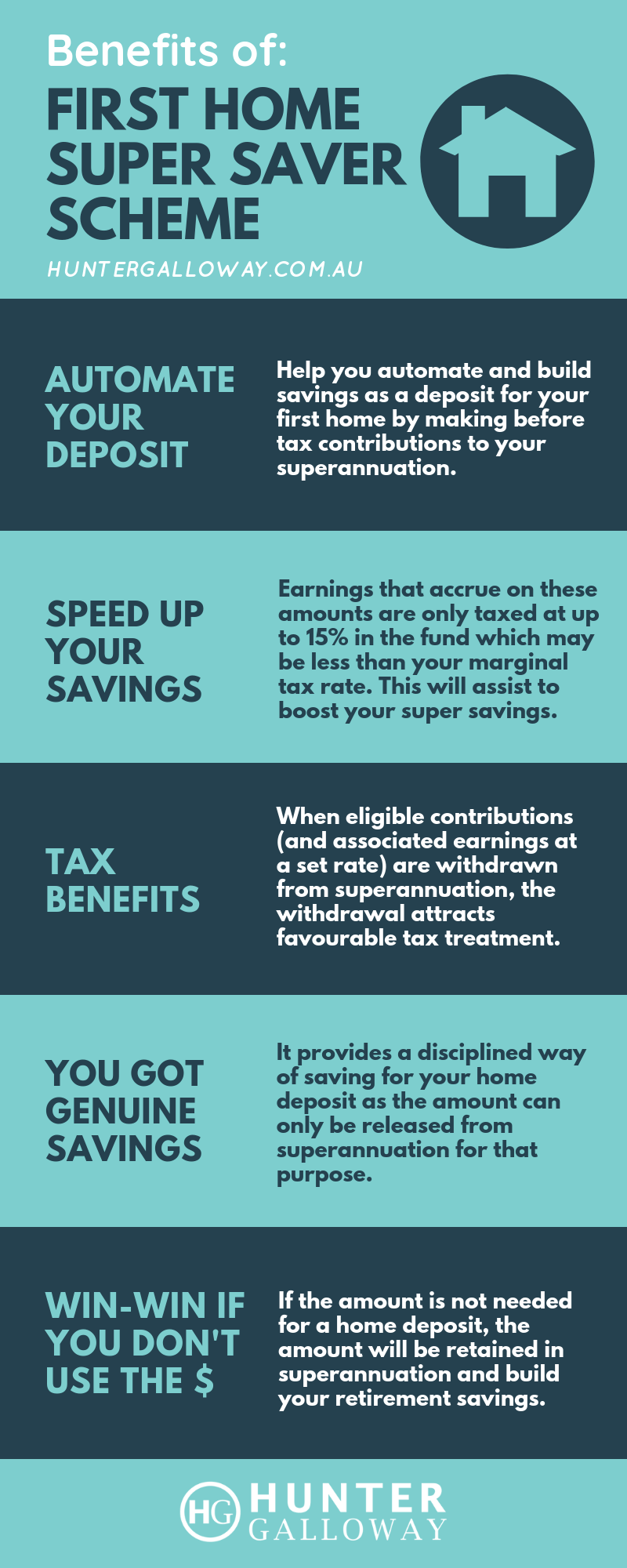

First Home Super Saver Scheme (FHSSS)

The First Home Super Saver Scheme (FHSSS) leverages tax advantages to accelerate deposit savings. By allowing voluntary contributions taxed at 15%, it offers a 30% boost compared to traditional savings accounts, as noted by the ATO.

A critical yet underexplored factor is investment earnings within superannuation accounts, which compound tax-efficiently. For instance, a $15,000 annual contribution could grow significantly faster than in standard savings, depending on fund performance.

However, low participation rates—only 18,000 users by 2021—highlight barriers like limited awareness and fear of locking funds. Addressing these through targeted education campaigns and simplified application processes could unlock the scheme’s full potential.

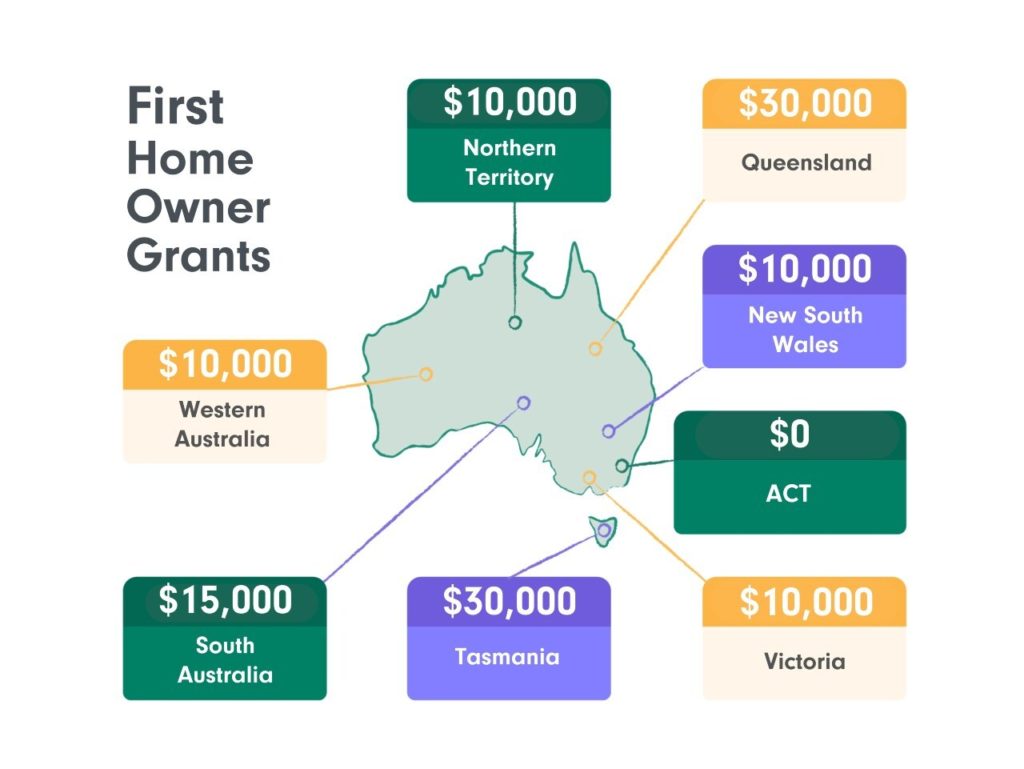

State and Territory Government Grants and Schemes

State and territory grants, like Queensland’s $30,000 First Home Owner Grant for new builds, offer region-specific incentives. These programs address local affordability challenges, but eligibility criteria and funding caps vary widely, creating uneven access across Australia.

For example, Victoria’s stamp duty concessions save buyers up to $31,000, while Tasmania’s grants focus on boosting regional construction. However, critics argue these schemes can inflate prices in high-demand areas, reducing their long-term effectiveness.

To maximize impact, governments could integrate infrastructure investments with grants, ensuring sustainable growth. This approach aligns housing incentives with broader economic development, fostering balanced regional opportunities.

Image source: successavenue.com.au.

New South Wales: Grants and Concessions

The First Home Buyers Assistance Scheme in NSW offers stamp duty exemptions for properties under $800,000, with concessions up to $1,000,000. This approach reduces upfront costs, making homeownership more accessible in high-demand urban areas.

However, property value thresholds often exclude buyers in Sydney’s competitive market, where median prices exceed $1.2 million. This creates a geographic disparity, favoring regional buyers but limiting urban accessibility.

To address this, policymakers could implement dynamic thresholds tied to local market conditions, ensuring equitable access. Additionally, integrating shared equity models with concessions could further reduce financial barriers for first-home buyers.

Victoria: Grants and Concessions

Victoria’s First Home Owner Grant offers $10,000 for new homes, doubling to $20,000 in regional areas. This incentivizes regional development, addressing urban congestion while boosting local economies and construction activity.

However, regional infrastructure gaps often deter buyers despite financial incentives. Without adequate transport, healthcare, and education facilities, these areas struggle to retain long-term residents, limiting the grant’s effectiveness.

A holistic approach combining grants with targeted infrastructure investments could enhance regional appeal. Additionally, integrating sustainability incentives for eco-friendly builds may attract environmentally conscious buyers, aligning with broader climate goals.

Queensland: Grants and Concessions

Queensland’s $30,000 First Home Owner Grant for new homes (valid until June 2025) directly stimulates housing supply. By targeting new builds, it encourages construction activity, addressing supply shortages and supporting economic growth.

However, regional disparities persist. While grants incentivize regional purchases, limited access to employment and essential services often undermines their impact. This highlights the need for integrated regional development strategies, combining grants with infrastructure and job creation initiatives.

Additionally, stamp duty exemptions for properties under $700,000 further reduce barriers for first-home buyers. Expanding these thresholds in high-demand areas could enhance accessibility, particularly for urban buyers facing affordability challenges.

Western Australia: Grants and Concessions

Western Australia’s $10,000 First Home Owner Grant for new builds supports housing affordability while boosting construction. However, regional uptake remains limited due to infrastructure gaps, highlighting the need for coordinated urban planning and transport investments to enhance accessibility.

The Shared Home Ownership Scheme offers equity contributions, enabling buyers to enter the market with minimal deposits. This innovative approach reduces financial strain but requires robust financial literacy programs to ensure long-term sustainability for participants.

Expanding stamp duty concessions for properties under $750,000 could further alleviate affordability pressures, particularly in metropolitan areas. Integrating these measures with sustainability incentives could align housing growth with environmental goals.

Other States and Territories: Overview

Tasmania’s First Home Owner Grant prioritizes new builds, addressing supply shortages. However, limited construction capacity in regional areas slows progress. Integrating skilled migration programs with housing initiatives could accelerate development and balance regional housing demand with workforce availability.

Eligibility Criteria and Application Processes

Eligibility hinges on factors like income thresholds, citizenship, and property type. For example, the First Home Guarantee requires a 5% deposit, aiding low-income buyers. Missteps, like overlooking residency rules, often delay approvals. expert guidance ensures smoother applications and compliance.

Image source: raineandhorne.com.au.

General Eligibility Requirements

A critical yet overlooked factor is property value caps, which vary by region. For instance, urban limits often exceed $800,000, while regional caps remain lower. This disparity influences buyer decisions, emphasizing the need for localized financial planning and strategic property selection.

How to Apply for Federal Schemes

Pre-approval timing is pivotal. Applying for grants alongside home loans streamlines processes and avoids delays. Lenders often assist with applications, ensuring compliance. This integration highlights the importance of early financial planning and lender collaboration for success.

State-Specific Application Procedures

Digital platforms simplify applications, but regional disparities in processing times persist. States like NSW offer online tools for eligibility checks, expediting approvals. Aligning state systems with federal frameworks could reduce delays and enhance applicant experiences nationwide.

Tips for a Successful Application

Document accuracy is critical. Errors in income proof or residency details can delay approvals. Cross-check all forms against eligibility criteria. Leveraging financial advisors ensures compliance, reducing risks and improving outcomes for first-home buyer applications.

Financial and Legal Considerations

Understanding hidden costs like stamp duty, legal fees, and inspections is crucial. For example, a $500,000 home in NSW may incur $18,000 in stamp duty. Consulting legal experts ensures compliance, while financial advisors optimize grant usage, avoiding costly missteps.

Image source: frangipanifinance.com.au.

Impact on Mortgage and Borrowing Capacity

Government schemes like the First Home Guarantee reduce deposit requirements but increase loan-to-value ratios (LVRs). Higher LVRs amplify repayment risks, especially during interest rate hikes. Buyers should use borrowing capacity calculators to align loans with long-term financial stability.

Understanding Legal Obligations

Failing to meet residency requirements—such as living in the property for 12 months—can trigger penalties, including repayment of grants. Cross-referencing data by agencies like Revenue NSW ensures compliance. Buyers should consult legal experts to preempt costly oversights.

Tax Implications of Receiving Grants

Grants like the First Home Owner Grant are not taxable, but misusing funds can lead to audits. Aligning grant usage with taxable supply rules (e.g., GST compliance) ensures legitimacy. Consult tax professionals to avoid inadvertent liabilities.

Maximizing Benefits: Strategies for First-Home Buyers

Leverage shared equity schemes to reduce upfront costs while planning an exit strategy for long-term growth. Use tax-effective savings tools like the First Home Super Saver Scheme. Engage financial advisors to align grants with broader financial goals.

Image source: huntergalloway.com.au.

Combining Multiple Grants and Schemes

Strategically combining grants like the First Home Owner Grant with stamp duty exemptions can significantly reduce upfront costs. For example, pairing these with the First Home Guarantee minimizes deposit requirements, enabling faster market entry. Consult experts to navigate eligibility complexities effectively.

Financial Planning and Budgeting

Integrating pre-approval processes with realistic budgeting ensures buyers focus on affordable properties. For instance, allocating 30% of income to housing costs aligns with financial stability. Use digital tools to track expenses and adjust savings goals dynamically for long-term success.

Consulting with Professionals

Engaging a certified financial planner ensures tailored strategies for leveraging grants effectively. For example, planners optimize loan structures, balancing interest rates and repayment terms. Their expertise bridges gaps in understanding complex schemes, fostering informed decisions and long-term financial resilience.

Case Studies and Practical Examples

In Queensland, a couple utilized the First Home Owner Grant to secure $30,000 for a $500,000 new build. By combining this with stamp duty exemptions, they reduced upfront costs by 10%, demonstrating how layered incentives significantly ease financial burdens.

Image source: blackk.com.au.

Case Study: Utilizing the First Home Guarantee

A single buyer earning $80,000 leveraged the First Home Guarantee to purchase a $400,000 townhouse with a 5% deposit. By avoiding Lenders Mortgage Insurance (LMI), they saved $12,000, redirecting funds toward renovations, enhancing property value and equity.

Case Study: Benefits of the First Home Super Saver Scheme

A couple maximized voluntary super contributions, saving $50,000 taxed at 15%. This approach boosted savings by 30% compared to traditional accounts, enabling faster homeownership. strategic salary sacrifice further reduced taxable income, offering dual financial benefits and long-term stability.

Lessons from Common Application Errors

Failing to align property price caps with grant criteria often leads to rejections. Applicants should cross-check regional thresholds and consult experts. Proactive documentation reviews prevent delays, ensuring compliance and improving approval rates for first-home buyer schemes.

Impact of Government Assistance on the Housing Market

Government schemes often inflate demand, driving up prices in high-demand areas. For instance, stamp duty concessions in Sydney increased competition, benefiting sellers more than buyers. Balancing supply-side reforms with assistance programs is crucial to stabilize affordability.

Image source: 7mortgages.com.au.

Effect on Housing Demand and Prices

Shared equity schemes reduce upfront costs without inflating demand, unlike grants that often spike competition. For example, Singapore’s substantial subsidies improved affordability but distorted markets. Integrating zoning reforms with assistance programs can mitigate price surges and enhance long-term stability.

Market Sustainability and Affordability

Incentivizing high-density housing in urban centers balances affordability and sustainability. For instance, Tokyo’s relaxed zoning laws increased supply, stabilizing prices. Combining infrastructure investments with eco-friendly housing policies ensures long-term affordability while addressing environmental and urbanization challenges effectively.

Evaluating the Effectiveness of Grants

Targeting low-income households enhances grant impact. Research shows middle-income recipients often purchase homes without assistance, inflating prices. Redirecting funds to underserved groups fosters equity, reduces demand-driven inflation, and aligns with broader affordability goals, ensuring sustainable housing market interventions.

Emerging Trends and Future Outlook

Eco-conscious housing incentives are gaining traction, with governments promoting sustainable designs. For example, energy-efficient grants in Victoria reduce costs and environmental impact. Coupling these with adaptive zoning reforms could address affordability while fostering greener urban development, ensuring long-term resilience.

Image source: mbansw.asn.au.

Recent Policy Changes

The Help to Buy Scheme launched in 2024 integrates shared equity with affordability goals. By reducing upfront costs, it empowers low-income buyers. However, regional disparities persist, highlighting the need for localized infrastructure investments to maximize its impact.

Technological Advancements in Home Buying

AI-driven property platforms streamline searches by matching buyers with properties based on preferences and budgets. Integrating blockchain ensures secure transactions, reducing fraud risks. Expanding these tools to regional markets could enhance accessibility and transparency for first-home buyers.

Predictions for Government Assistance Programs

Future programs may integrate dynamic property price caps, adjusting to market trends. This approach ensures equitable access while preventing inflationary pressures. Coupling these with AI-driven eligibility tools could streamline applications, enhancing efficiency and reducing administrative bottlenecks.

Expert Perspectives and Advice

Experts emphasize shared equity schemes as transformative, balancing affordability and market stability. For instance, Australia’s Help to Buy program reduces upfront costs while ensuring government returns. However, experts warn of long-term equity-sharing implications, urging buyers to plan exit strategies carefully.

Image source: money.com.au.

Financial Advisors on Leveraging Grants

Financial advisors recommend layering grants strategically to maximize benefits. For example, combining the First Home Owner Grant with stamp duty concessions can significantly reduce upfront costs. Advisors also stress aligning grants with long-term financial goals to avoid over-leveraging.

Real Estate Insights for First-Home Buyers

Focus on emerging suburbs with planned infrastructure growth. These areas often offer lower entry prices and higher long-term value. Leverage tools like CoreLogic to analyze trends, ensuring investments align with future urban development and lifestyle needs.

Academic Research on Housing Affordability

Research highlights zoning reform as a critical lever for affordability. Studies show reducing land-use restrictions increases housing supply, lowering prices. Integrating this with transport infrastructure planning ensures equitable access, fostering sustainable urban growth and addressing affordability disparities effectively.

FAQ

What are the main government grants and schemes available for first-home buyers in Australia?

The main government grants and schemes for first-home buyers in Australia include:

- First Home Guarantee: Allows buyers to secure a home with a 5% deposit, avoiding Lenders Mortgage Insurance (LMI).

- Help to Buy Scheme: Offers co-ownership with the government contributing up to 40% for new homes.

- First Home Owner Grant (FHOG): Provides up to $30,000 for purchasing or building new homes, varying by state.

- Family Home Guarantee: Supports single parents with a 2% deposit requirement.

- Regional First Home Buyer Guarantee: Assists regional buyers with a 5% deposit, promoting regional growth.

These programs aim to reduce financial barriers and improve accessibility for first-home buyers.

How do eligibility criteria vary across different states and territories?

Eligibility criteria for government grants and schemes for first-home buyers in Australia vary significantly across states and territories. Common requirements include being at least 18 years old, an Australian citizen or permanent resident, and a first-home buyer who has not previously owned property. However, differences arise in the following areas:

- Property Value Caps: Each state sets specific limits on the maximum property value eligible for grants.

- Residency Requirements: Some states mandate living in the property for a minimum period, typically 6 to 12 months.

- Grant Amounts: The First Home Owner Grant (FHOG) varies, with states like Queensland offering up to $30,000 for new builds, while others provide less.

- Income Thresholds: Programs like the Regional First Home Buyer Guarantee impose income caps, such as $125,000 for singles and $200,000 for couples.

- Property Type: Certain grants apply only to new builds or significantly renovated homes, while others include established properties.

Applicants should consult their state or territory revenue office for precise eligibility details.

What is the application process for federal and state-level first-home buyer schemes?

The application process for federal and state-level first-home buyer schemes typically involves the following steps:

- Check Eligibility: Review the specific criteria for the scheme, including income thresholds, property value caps, and residency requirements.

- Choose a Scheme: Identify the federal or state-level program that aligns with your financial situation and property goals.

- Gather Documentation: Prepare necessary documents such as proof of income, identification, and property purchase details.

- Apply Through Approved Channels: Federal schemes like the First Home Guarantee require applications through participating lenders or mortgage brokers. State-level grants often involve submitting applications to the relevant state revenue office.

- Secure Pre-Approval: For schemes tied to home loans, pre-approval from a lender is often required before finalizing the application.

- Submit the Application: Complete the application form accurately and submit it along with the required documents.

- Await Approval: Processing times vary, with some schemes offering digital platforms for faster approvals.

- Receive Benefits: Upon approval, benefits such as grants or deposit guarantees are applied directly to the home purchase process.

Applicants are advised to consult with financial advisors or mortgage brokers to ensure compliance and streamline the process.

How can first-home buyers combine multiple grants to maximize benefits?

First-home buyers in Australia can combine multiple grants and schemes to maximize benefits by strategically layering programs that complement each other. Here’s how:

- Combine Federal and State Schemes: For example, a buyer can use the First Home Guarantee to secure a home with a 5% deposit while also applying for the First Home Owner Grant (FHOG) offered by their state.

- Leverage Stamp Duty Concessions: Many states provide stamp duty exemptions or reductions, which can be used alongside grants like the FHOG to reduce upfront costs further.

- Utilize Shared Equity Programs: Programs like the Help to Buy Scheme can be paired with other grants to lower the financial burden of homeownership.

- Plan for Regional Incentives: Buyers in regional areas can combine the Regional First Home Buyer Guarantee with state-specific grants to benefit from reduced deposit requirements and additional financial support.

- Engage Professional Advice: Consulting with mortgage brokers or financial advisors ensures eligibility for multiple programs and helps navigate application processes effectively.

By carefully aligning these programs, first-home buyers can significantly reduce their financial outlay and improve their chances of successful homeownership.

What are the potential risks or limitations associated with these government schemes?

Government grants and schemes for first-home buyers in Australia come with potential risks and limitations that buyers should carefully consider:

- Market Inflation: Cash grants can increase demand, leading to inflated property prices. Developers may raise prices to match the increased purchasing power of buyers, reducing the overall affordability.

- Loan-to-Value Ratio (LVR) Risks: Programs like the First Home Guarantee allow buyers to purchase with a low deposit, resulting in higher LVRs. This increases financial vulnerability, especially during interest rate hikes.

- Regional Disparities: Property price caps and grant amounts may not align with market conditions in certain areas, limiting accessibility for buyers in high-demand regions.

- Eligibility Constraints: Strict income thresholds, property value caps, and residency requirements can exclude some buyers from accessing these schemes.

- Administrative Challenges: Complex application processes and limited spots for certain programs, such as the First Home Guarantee, can create barriers for potential applicants.

- Long-Term Financial Implications: Shared equity schemes may reduce upfront costs but require buyers to share future capital gains with the government, impacting long-term wealth accumulation.

Understanding these risks and limitations is crucial for first-home buyers to make informed decisions and ensure financial stability.

Conclusion

Government grants and schemes for first-home buyers in Australia offer a double-edged sword: while they provide critical support, they can inadvertently exacerbate affordability challenges. For instance, the doubling of Queensland’s First Home Owner Grant to $30,000 for new builds under $750,000 has sparked debate. While it aids buyers, it also risks inflating property prices, benefiting sellers more than buyers.

A striking contrast emerges when comparing demand-side measures like grants to supply-side interventions such as affordable housing quotas. Countries like Singapore have demonstrated that robust public housing programs can stabilize markets more effectively than cash incentives. This highlights a key misconception: grants alone cannot resolve systemic housing issues.

Experts like Brendan Coates from the Grattan Institute emphasize that shared equity schemes, though promising, require careful implementation to avoid long-term equity erosion for buyers. Analogously, these schemes act like a “double-edged investment,” offering immediate relief but potentially limiting future financial growth.

Ultimately, a balanced approach combining targeted grants with supply-side reforms and infrastructure investments is essential. By addressing both immediate needs and structural barriers, Australia can pave a sustainable path to homeownership for future generations.

Image source: starhl.com.au.

Summary of Key Insights

Shared equity schemes emerge as a transformative tool, blending affordability with market stability. Unlike traditional grants, they mitigate price inflation by reducing upfront costs without spiking demand. For example, Singapore’s hybrid tenure models demonstrate how structured co-ownership fosters long-term affordability.

However, success hinges on precise implementation frameworks. Mismanagement risks eroding buyer equity, as seen in poorly regulated schemes internationally. Policymakers must integrate these programs with supply-side reforms, such as affordable housing quotas, to ensure systemic impact.

Actionable takeaway: Combine shared equity with infrastructure investments to balance immediate relief and sustainable growth, creating a resilient housing ecosystem.

Final Recommendations for First-Home Buyers

Focus on leveraging multiple schemes strategically. For instance, combining the First Home Guarantee with the First Home Super Saver Scheme can optimize savings and reduce upfront costs. Seek professional advice to navigate eligibility and maximize benefits across programs.

Additionally, prioritize long-term financial planning. Rising interest rates and repayment risks demand careful budgeting. Use tools like mortgage calculators to assess affordability under various scenarios, ensuring resilience against economic fluctuations.

Actionable insight: Research regional markets with lower price caps but growing infrastructure investments. These areas often offer better value and future growth potential, aligning affordability with lifestyle aspirations.