Step-by-Step Guide to Financing a House and Land Package in Australia

Navigating the Australian property market can be a complex task. Especially when it comes to financing a house and land package.

This guide aims to simplify that process. It provides a step-by-step approach to securing financing for your dream home.

House and land packages offer a unique opportunity. They allow you to buy a plot of land and build a home to your specifications. But understanding the financing process can be daunting.

This guide will cover everything from understanding the concept of a house and land package to finalizing your loan. It will delve into the role of lenders, the importance of budgeting, and how to determine your borrowing capacity.

We’ll also explore different types of loans, the application process, and the role of a mortgage broker. We’ll discuss government grants, the importance of a good credit score, and much more.

Whether you’re a first-time homebuyer or an investor, this guide is for you. It’s designed to help you navigate the Australian property market with confidence.

So, let’s embark on this journey together. Let’s demystify the process of financing a house and land package in Australia.

Check Out: House and Land Packages in Melbourne

Understanding House and Land Packages

A house and land package is a popular option among Australian homebuyers. This package allows you to buy land and build a house as a single agreement.

These packages simplify the homebuilding process. They combine the purchase of land with a building contract. This means less stress managing separate contracts.

There are often two separate contracts involved. One for the land purchase and another for building the home. But they are managed together to ease the process.

The home designs are usually created by builders for efficiency. Buyers can often customize certain elements to suit their preferences.

In Australia, there are many developers offering these packages. They often offer a range of locations and house designs. This provides plenty of choices based on budget and lifestyle.

Check Out Our Blog On: How to Choose the Right House and Land Package for Your Needs

Benefits of House and Land Packages

Choosing a house and land package has several advantages. These packages are often more cost-effective. They combine land and construction at a competitive price.

These packages also offer a streamlined process. This can reduce stress and construction delays. Moreover, buyers enjoy a new home with modern designs and technologies.

Potential homebuyers may also benefit from tax savings. New builds often have lower maintenance costs. Energy-efficient designs help reduce utility bills.

Also Read: House and Land Package Buying Guide

Types of House and Land Packages

There are different types of house and land packages to consider. Each type offers different levels of involvement and customization.

Turnkey Package: This option delivers a ready-to-live home. Everything is complete, from fixtures to landscaping. Perfect for buyers who want everything done for them.

Build-only Package: Here, buyers choose their land separately. The builder provides the house design and construction. Suitable for those who want control over location.

Each type has its pros and cons. Turnkey packages reduce hassle but may limit design choices. Build-only packages offer flexibility but require more coordination. Understanding these options helps make an informed decision.

Also Read Our Comparison between House and Land Package vs. Buying an Existing Home

Preparing for Financing

Securing financing for a house and land package requires preparation. It’s crucial to understand your financial situation before jumping in. This includes evaluating savings, income, and current debts.

Begin by creating a detailed budget. Outline all your current expenses and income sources. This will help you see what you can afford in monthly mortgage repayments.

Use Our: Mortgage Repayment Calculator

Budgeting helps identify areas where you can save money. Focus on cutting unnecessary costs to boost savings for your deposit.

Consider talking to a financial advisor. They can provide insights into managing finances and saving. Professional advice is invaluable, especially for first-time buyers.

Another essential step is understanding the market. Research current interest rates and lender offers. This knowledge will guide you in selecting a suitable loan product.

Finally, ensure your financial documents are organized. This includes pay slips, tax returns, and bank statements. Lenders will require these during the loan application process.

Assessing Your Financial Readiness

Assessing your financial readiness involves a thorough review of your finances. Start by analyzing your income stability. Ensure your job is secure and income consistent.

Next, take stock of your assets and liabilities. List out savings, investments, and any existing loans or debts. Understanding these will give a clear picture of financial health.

Finally, think about future financial commitments. Consider potential life changes like family expansion. Being prepared for future obligations ensures you choose the right financing option.

Understanding Your Borrowing Capacity

Your borrowing capacity influences how much you can spend. It is determined by your income, expenses, and credit profile.

To understand borrowing limits, calculate your disposable income. This involves subtracting expenses from total income. A higher disposable income increases borrowing potential.

Engage with lenders to get insights into their lending criteria. They consider factors like employment history and income type. Gathering this information helps set realistic budget expectations.

The Importance of a Good Credit Score

A good credit score is vital for loan approval. It reflects financial reliability and impacts interest rates.

Lenders use credit scores to assess the risk of lending to you. A higher score often results in better loan terms. Therefore, it’s crucial to maintain a healthy credit profile.

Saving for Your Deposit

Saving for a deposit is a critical step in buying a house and land package. Most lenders require a minimum of 10-20% of the property’s price.

Set a realistic savings goal based on the property price range you’re considering. Automate savings by setting up regular transfers to a savings account.

Consider first-time buyer incentives or grants available. These can provide financial relief and help reach your deposit goal faster. Committing to a disciplined savings plan pays off in the long run.

Exploring Loan Options

Choosing the right loan can significantly impact your home-buying process. Understanding various loan options is crucial when financing house and land packages. Knowledge empowers you to make informed decisions.

There are many loan types available, each with unique features. Loans vary by interest rates, repayment options, and flexibility. Considering these factors helps in finding the best match for your financial situation.

Interest rates are a primary consideration. Fixed-rate loans offer stability, locking in rates for a certain period. Conversely, variable-rate loans can fluctuate with the market, offering potential savings if rates drop.

Repayment options also matter. Some loans offer interest-only payments during construction phases, reducing initial financial burden. Others might offer redraw or offset facilities, which help manage finances better in the long run.

Before deciding, compare different lenders and loan products. Look for competitive rates, favorable terms, and special features. Using comparison sites can streamline this process, providing quick insights.

Lastly, consider the total cost of the loan, including fees and charges. Hidden costs can add up, impacting the overall affordability. Transparency and thorough research ensure better loan selection.

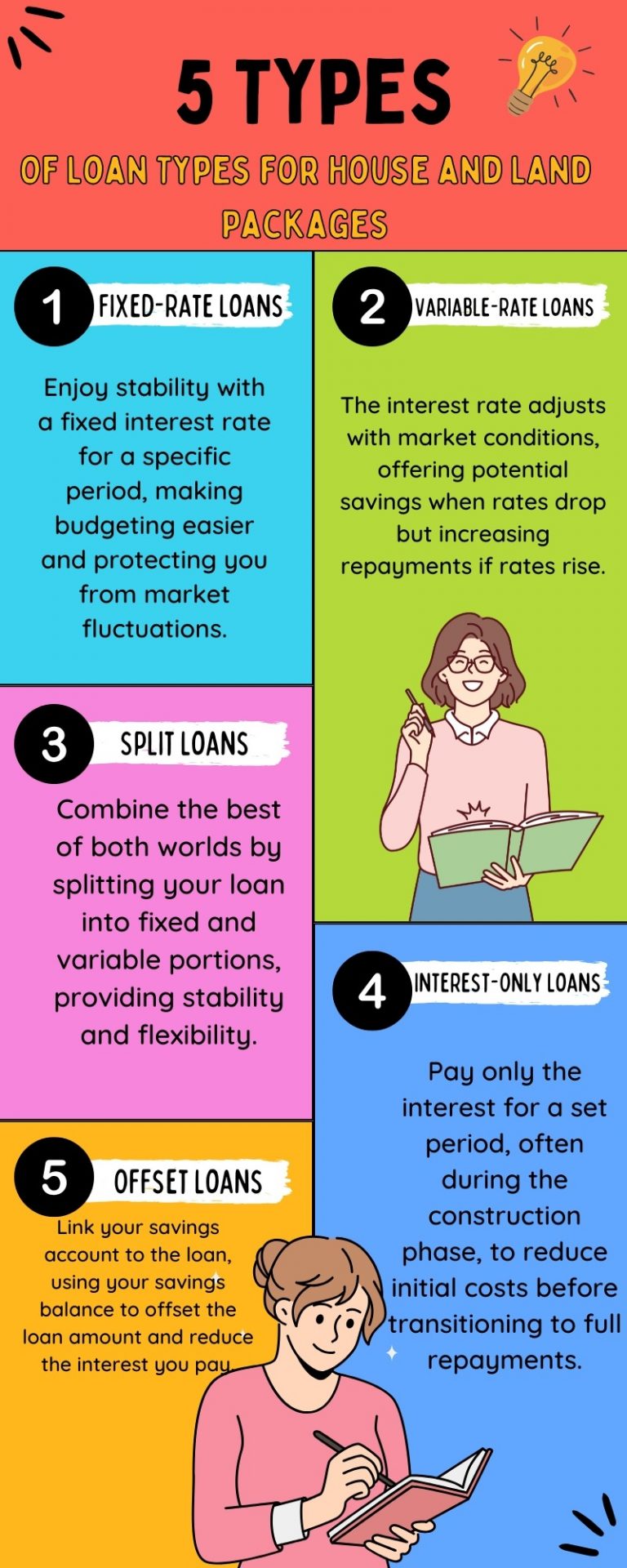

Types of Loans for House and Land Packages

When financing a house and land package, several loan types are available. Each caters to different financial needs and circumstances.

Here’s a list of common loan types for house and land packages:

- Fixed-Rate Loans: Offers a stable interest rate over a set period.

- Variable-Rate Loans: The interest rate can change with market conditions.

- Split Loans: Combines fixed and variable rates for flexibility.

- Interest-Only Loans: Allows payment of interest only for a set term.

- Offset Loans: Links savings account to the loan, reducing interest payments.

Fixed-rate loans provide predictability, ideal for budget-conscious buyers. On the other hand, variable-rate loans offer flexibility and potential cost-saving opportunities.

Split loans offer a balanced approach. Part of the loan is fixed, while the rest is variable. This combines stability and flexibility in one package.

Interest-only loans may lower payments in the short term. They’re often suitable during the construction period.

Offset loans help reduce interest payable by linking savings with the mortgage. This can lead to significant savings over time.

The Construction Loan Process

The construction loan process is structured into stages. Each stage aligns with the construction progress. This helps manage cash flow better during the build.

Initially, the approval process for a construction loan is thorough. Lenders assess detailed building plans and costs. They also require signed contracts from a registered builder.

Once approved, funds are released in stages known as progress draws. Typically, these stages include the base, frame, lockup, fixing, and completion. After each stage, a lender inspection ensures completion before the next draw.

Interest is usually only paid on the amount drawn. As work progresses, your repayment gradually increases. Once construction is complete, the loan typically transitions to a standard mortgage.

The Role of Mortgage Brokers

Mortgage brokers can be valuable in the house and land package journey. They act as intermediaries between borrowers and lenders.

Brokers have access to a wide range of loan products. They can compare various options, saving you time and effort. Their expertise helps you find competitive interest rates and favorable terms.

Additionally, brokers offer personalized advice. They assess financial situations and recommend loans suited to individual needs. This guidance can simplify the complex loan process, ensuring a smoother experience.

Navigating the Application Process

Starting the loan application can seem daunting. However, breaking it down into manageable steps simplifies the journey. Understanding each step is crucial for a successful experience.

Begin with gathering necessary documentation. Lenders typically require proof of income, identity, and assets. Being prepared with these documents can expedite the application process.

Next, complete the lender’s application form. Accuracy is key, as errors can delay approval. Providing comprehensive details fosters a smoother process.

Stay in communication with your lender throughout the process. Promptly address any questions or requests. This helps in maintaining momentum and avoiding potential setbacks.

Upon submission, patiently await the lender’s assessment. They’ll evaluate your application based on provided details. If approved, you’ll receive a formal offer detailing terms and conditions.

Pre-Approval and Its Significance

Pre-approval is a vital step in financing house and land packages. It provides a clear indication of borrowing capacity, aiding in budgetary planning.

A pre-approval is a tentative nod from a lender. It states how much they’re willing to lend based on your financial profile. This clarity helps narrow down property searches to realistic targets.

Having pre-approval enhances credibility with sellers. It shows seriousness and financial readiness, often leading to more favorable negotiations. Additionally, it streamlines the final loan approval process once a property is secured.

Understanding Loan Terms and Conditions

Understanding loan terms and conditions is essential for informed decision-making. It ensures there are no surprises down the line.

Firstly, focus on the interest rate specifics. Know whether it’s fixed or variable, and any associated conditions. This affects monthly payments and overall loan cost.

Next, examine repayment terms. Understand the frequency and flexibility of payments. Consider penalties for early repayments, which some loans may impose.

Finally, identify additional fees and charges. These may include application fees, ongoing fees, or discharge fees. A thorough understanding of all costs upfront prevents unexpected expenses later.

Government Grants and Incentives

Government grants and incentives can significantly ease the financial burden when financing house and land packages. These programs are designed to promote home ownership and support buyers.

In Australia, several incentives are available for eligible buyers. Understanding these opportunities can lead to substantial savings. Researching local and federal programs is crucial to maximize benefits.

Programs may differ by state, so it’s essential to explore what is accessible in your area. Consulting with experts, like mortgage brokers or financial advisors, can provide valuable insights. They can guide you in the application process and help identify applicable programs.

First Home Owner Grant and Stamp Duty Concessions

The First Home Owner Grant (FHOG) is a key incentive for eligible buyers. It’s a one-time grant provided to first-time home buyers. The grant amount and criteria vary by state and territory.

Applying for FHOG requires meeting specific conditions, such as the property being a primary residence. It’s vital to understand the terms to ensure eligibility. The grant can significantly reduce the upfront costs of purchasing a house and land package.

Stamp duty concessions offer additional financial relief. They reduce the tax burden on property transactions for eligible buyers. Like FHOG, these concessions differ across regions. It’s beneficial to check state-specific guidelines and seek professional advice if needed.

Also Read: Understanding First Home Buyers Grants in 2025

The Role of Professionals in Your Purchase

In the journey of securing a house and land package, enlisting professional help is vital. These experts ensure that your transaction proceeds smoothly and legally.

First, consider a conveyancer or solicitor. They handle the complex legal aspects and ensure your interests are protected. Their role includes reviewing contracts and handling the settlement process.

Next, a reputable builder is essential. Their expertise will bring your dream home to life. From construction quality to meeting timelines, a good builder makes a big difference.

Moreover, financial advisors can aid in managing budgets and aligning goals. They offer guidance on loan options and long-term planning. Engaging with such professionals can facilitate a successful and stress-free purchase experience.

Choosing a Conveyancer or Solicitor

A conveyancer or solicitor plays a crucial role in any property purchase. They handle legal documentation and protect your interests throughout the process.

Hiring a qualified professional ensures that contracts meet legal standards. They also manage the settlement, coordinating with lenders and other parties. It’s best to engage a conveyancer or solicitor early in the buying process.

Selecting a Reputable Builder

Finding a reliable builder ensures your house is constructed with quality and care. Check their credentials, experience, and customer reviews before making a decision.

A good builder will offer clear timelines and transparent pricing. They should also provide builder’s insurance to cover potential issues. Open communication with your builder is vital to resolve any concerns during the construction phase.

Consider conducting interviews with multiple builders. This can help you gauge their work ethic and compatibility with your vision. Ultimately, a reputable builder makes the home-building process smooth and rewarding.

Finalizing Your House and Land Package

The final phase of purchasing a house and land package involves several critical steps. It’s a time for ensuring all details align with expectations.

Start by confirming that all documentation is accurate and complete. This step is fundamental before proceeding to the closing stages. Double-check every detail with your conveyancer to avoid surprises.

An essential task during this phase is arranging a final inspection. This step allows you to verify that the construction meets agreed standards. Addressing any discrepancies now is crucial before moving forward.

Close communication with your lender remains important. Ensure that your loan is ready for finalization. This ensures a smooth transition from loan approval to settlement, reducing stress and potential delays.

Property Valuation and Loan Finalization

Property valuation is a key step before finalizing your loan. Lenders require this to assess the property’s worth. It helps them ensure the investment aligns with the loan amount.

Choose a qualified valuer to conduct this assessment. Accurate valuations prevent loan complications. Also, it provides confidence that you’re not overpaying.

Once valuation is complete, finalize your loan arrangements. Ensure all financial conditions are met, and documents are signed. This sets the stage for the final settlement process, making the financing formal and secure.

Settlement and Moving In

Settlement marks the official transfer of property ownership to you. On settlement day, your conveyancer will handle transactions between you and the seller. This includes paying any outstanding balance and fees.

Preparation is crucial for a smooth settlement process. Confirm that all finances are in order and ready for transfer. Any last-minute issues could delay moving in.

After settlement, you receive the keys to your new home. Plan your move-in date to coincide with settlement completion. This ensures a seamless transition into your new house, turning your dream into reality.

Conclusion and Next Steps

Financing a house and land package in Australia is a step-by-step process, and you’ve made it to the end. Each stage brings you closer to owning your ideal home, from understanding packages to finalizing loans. By following this guide, you’ll navigate decisions with confidence and clarity.

As you settle into your new home, continue to educate yourself on property management. Stay informed about market trends and financial opportunities. This knowledge not only helps with immediate tasks but also prepares you for future property investments.

Maintaining Communication with Your Lender

Communication with your lender should remain a priority even after purchase. Regularly check in to stay updated on your loan status and any changes that might arise. Open dialogue helps anticipate challenges and resolve issues swiftly.

Moreover, if financial circumstances change, inform your lender immediately. Proactive communication creates trust and ensures your lender is aware of your financial landscape. This relationship can be invaluable if you choose to refinance or make adjustments later.

Planning for the Future

Looking ahead is key to maximizing your investment’s potential. Consider how future changes, like interest rate shifts or market fluctuations, might affect your property. Being aware of these factors allows for better planning and financial stability.

Additionally, think about future needs, such as renovations or expansions. Long-term visions keep your property aligned with your lifestyle and financial goals. Finally, regularly review and adjust your financial strategies to stay ahead in the Australian property market.