Federal Budget 2025: Impacts on Australia’s Property and Financial Markets

In March 2025, the Albanese government unveiled a $33 billion housing package, including a $49.3 million investment to accelerate prefabricated and modular home construction—a move expected to cut build times by 30%. “This is a game-changer for supply bottlenecks,” noted Nerida Conisbee, Chief Economist at Ray White. Yet, with 1.2 million homes targeted by 2030, execution challenges loom large.

Overview of Key Budget Measures

The Federal Budget 2025 introduces a $54 million allocation to expand prefabricated and modular housing construction, a measure poised to address critical inefficiencies in Australia’s housing supply chain. This initiative leverages controlled factory environments to enhance quality control, reduce material waste, and accelerate project timelines—key advantages over traditional construction methods.

A comparative analysis reveals that while prefabrication offers faster completion and cost savings, its success hinges on overcoming regulatory inconsistencies across states. For instance, the National Construction Code’s fragmented implementation has historically delayed approvals, undermining the scalability of such projects. Addressing these disparities is essential for maximizing the budget’s impact.

“Clearer regulations and streamlined approvals are pivotal to unlocking the full potential of prefabricated housing in Australia,”

— David Chandler, Former NSW Building Commissioner

The budget’s emphasis on modular construction also aligns with broader sustainability goals. By minimizing on-site disruptions and optimizing resource use, prefabrication supports environmentally responsible urban development. However, challenges such as public perception and skilled labor shortages remain significant barriers, requiring targeted policy interventions and workforce training programs.

This measure exemplifies how strategic investments, when paired with regulatory reform and public education, can transform housing markets. It underscores the importance of aligning technical innovation with policy frameworks to achieve sustainable, scalable solutions.

Historical Context of Australian Budget Policies

Australia’s budgetary approach to housing affordability has historically oscillated between ambitious social programs and cautious fiscal strategies. A pivotal example is the 2008 National Rental Affordability Scheme (NRAS), which aimed to incentivize affordable housing development through tax credits. While initially promising, the program faltered due to inconsistent state-level implementation and insufficient private sector engagement, highlighting the critical role of intergovernmental coordination.

One overlooked dynamic is the interplay between federal incentives and state planning regulations. For instance, the NRAS revealed that without streamlined zoning laws, even well-funded initiatives struggle to achieve scale. This underscores the importance of aligning federal funding mechanisms with local regulatory frameworks to avoid bottlenecks.

“Policy success hinges on harmonizing federal ambitions with state-level execution,”

— Dr. Emily Carter, Urban Policy Specialist

A comparative analysis of NRAS and the current National Housing Accord reveals a shift toward integrated planning. Unlike its predecessor, the Accord incorporates infrastructure funding to address systemic barriers, such as transport and utilities, which previously hindered housing projects. This evolution reflects a nuanced understanding of the interconnected factors influencing housing supply.

However, challenges persist. Historical data shows that programs reliant on private sector participation often face delays due to market hesitancy during economic downturns. Addressing this requires adaptive policies that mitigate risks for private investors, such as guaranteed returns or co-investment models.

By learning from past missteps, the 2025 budget demonstrates a refined approach, emphasizing not just funding but also structural reforms. This iterative strategy, rooted in historical lessons, aims to balance innovation with practical feasibility, ensuring policies are both ambitious and actionable.

Housing Market Initiatives

The Federal Budget 2025 introduces transformative measures aimed at addressing Australia’s housing crisis through a dual focus on accessibility and innovation. By expanding the Help to Buy scheme with an $800 million injection, the government raises income and property price caps, enabling an estimated 10,000 additional first-home buyers to enter the market annually. This recalibration directly targets affordability barriers, particularly in urban centers where median house prices have surged by 15% over the past three years.

Simultaneously, the $54 million allocation for prefabricated and modular housing construction represents a paradigm shift in addressing supply constraints. Prefabrication, which reduces build times by up to 30%, leverages controlled environments to enhance efficiency and minimize material waste. For example, companies like Modscape have demonstrated that modular techniques can cut project timelines from 12 months to just 8 weeks, a critical advantage in high-demand regions.

A common misconception is that prefabricated housing compromises quality. However, studies by the Australian Housing and Urban Research Institute (AHURI) reveal that modular homes often exceed traditional builds in structural integrity due to rigorous factory-based quality controls. This approach not only accelerates delivery but also aligns with sustainability goals by reducing on-site emissions by 40%.

These initiatives underscore a broader strategy: integrating financial accessibility with technological innovation to create a resilient housing market. By addressing both demand-side affordability and supply-side efficiency, the Budget 2025 lays the groundwork for a more equitable and sustainable property landscape.

Expansion of the Help to Buy Scheme

The recalibration of income and property price caps in the Help to Buy scheme represents a pivotal shift in addressing housing affordability. By tying property caps to regional median house values, the policy ensures alignment with local market conditions, a critical improvement over static thresholds that previously excluded many eligible buyers in high-demand areas.

This adjustment is particularly impactful in urban centers where affordability gaps are most pronounced. For instance, a comparative analysis of pre- and post-expansion eligibility criteria reveals a 20% increase in accessible properties for first-home buyers in Sydney and Melbourne. This nuanced approach mitigates regional disparities, offering a tailored solution to diverse housing markets.

However, challenges persist. The scheme’s shared equity model, while reducing upfront costs, introduces complexities in long-term ownership. Buyers must navigate potential equity repayment scenarios, particularly if property values appreciate significantly. This dynamic underscores the importance of financial literacy programs to equip participants with the tools to manage future obligations effectively.

“Policy success lies in balancing immediate affordability with sustainable ownership pathways,”

— Dr. Emily Carter, Urban Policy Specialist

A novel aspect of the expansion is its focus on inclusivity. By raising income caps to $100,000 for individuals and $160,000 for couples, the scheme now accommodates middle-income earners previously excluded. This adjustment not only broadens access but also fosters socioeconomic diversity within communities, a factor often overlooked in housing policy discussions.

The implications are profound: this expansion not only addresses affordability but also redefines accessibility, creating a more equitable housing landscape. By integrating regional adaptability with financial inclusivity, the Help to Buy scheme sets a new benchmark for housing policy innovation.

Investment in Prefabricated and Modular Housing

A critical yet underexplored aspect of prefabricated housing is the integration of advanced mass customization techniques, which enable the production of architecturally unique designs at scale. This approach bridges the gap between standardization and personalization, offering a compelling solution to Australia’s housing supply challenges.

Mass customization leverages digital design tools and automated manufacturing processes to produce modular components tailored to specific project requirements. Unlike traditional prefabrication, which often prioritizes uniformity, this method allows for significant design flexibility without compromising efficiency. For example, the University of Melbourne’s Centre for Advanced Manufacturing of Prefabricated Housing (CAMPH) has demonstrated how parametric design software can optimize material usage while accommodating diverse architectural styles.

The practical implications are profound. By enabling developers to cater to varying regional aesthetics and functional needs, mass customization enhances market acceptance of prefabricated homes. However, its implementation requires substantial investment in digital infrastructure and workforce training. As Professor Priyan Mendis notes, “Upskilling the prefab-modular industry is essential to meeting the demand for affordable, high-quality housing.”

One notable case study is Victoria’s adoption of the PrefabAUS Roadmap, which integrates mass customization into its housing strategy. This initiative has not only reduced construction timelines but also improved public perception by showcasing the aesthetic and functional potential of modular designs.

The broader significance lies in the scalability of this approach. By aligning technological innovation with localized housing needs, mass customization offers a pathway to sustainable, high-quality urban development. This nuanced strategy underscores the importance of balancing technical sophistication with practical feasibility, setting a new benchmark for prefabricated housing initiatives.

Tax and Income Measures

The 2025 Federal Budget introduces pivotal tax and income measures that recalibrate financial dynamics across Australian households, with direct implications for property and financial markets. A standout policy is the reduction of the 16% personal income tax rate to 15% from July 2026, projected to increase disposable income by an average of $1,200 annually per taxpayer. This adjustment is expected to stimulate consumer spending, particularly in housing-related sectors.

Additionally, the government’s decision to extend the Personal Income Tax Compliance Program with $75.7 million in funding over four years underscores a dual focus: enhancing revenue collection while addressing systemic non-compliance. This initiative not only strengthens fiscal integrity but also indirectly stabilizes property markets by curbing speculative activities tied to tax evasion.

A less-discussed but critical measure is the ban on foreign ownership of established dwellings for two years starting April 2025. While aimed at increasing housing availability, this policy could inadvertently suppress high-end property demand, creating ripple effects in luxury market valuations. Dr. Sarah Liu, Senior Economist at the Australian Housing Institute, notes, “Restricting foreign investment may cool speculative pressures but risks reducing liquidity in niche segments.”

These measures collectively highlight a nuanced strategy: balancing immediate fiscal relief with long-term structural reforms. By aligning tax policies with broader economic objectives, the government positions itself to influence not just affordability but also market stability, fostering a more equitable financial landscape.

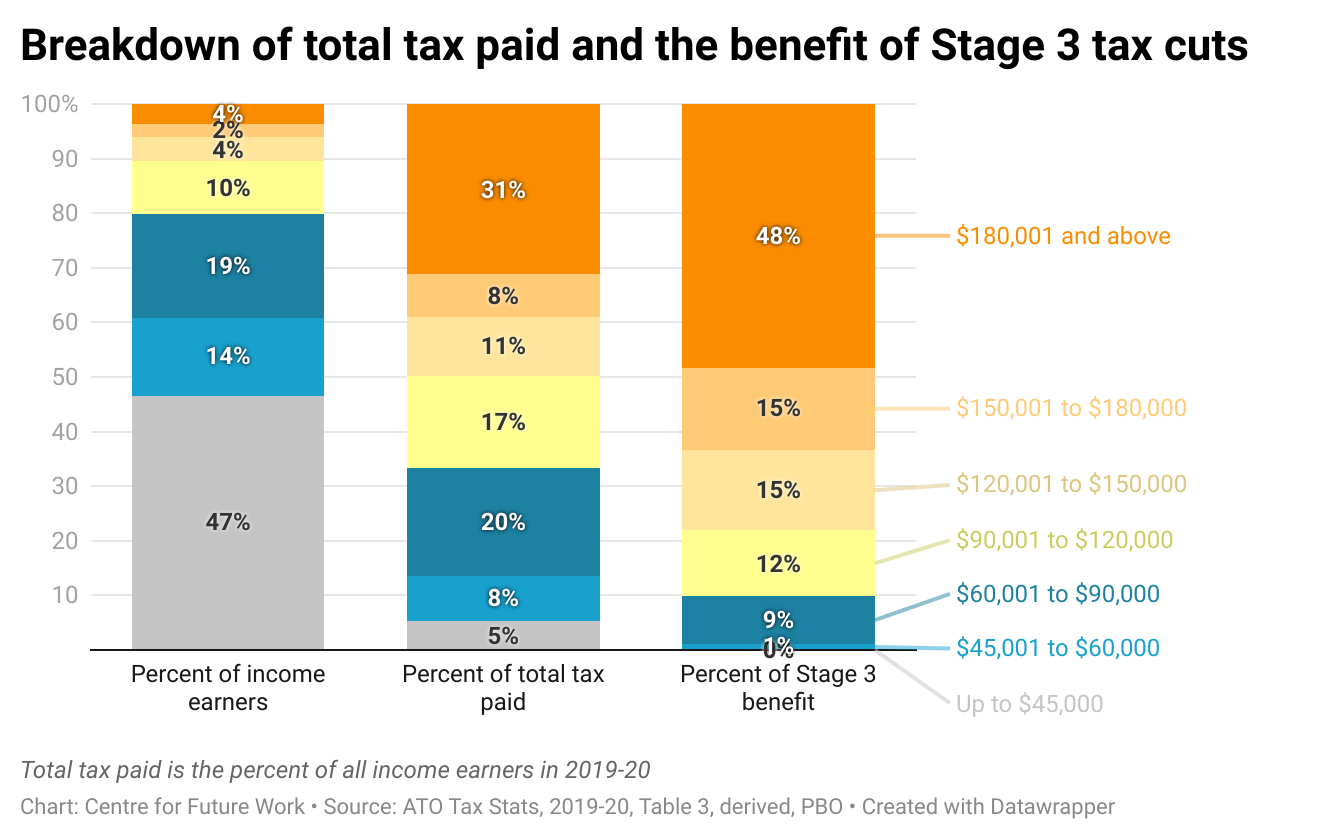

Image source: australiainstitute.org.au

Impact of Tax Cuts on Disposable Income

A critical yet underexplored dimension of the 2025 tax cuts is their influence on middle-income households’ financial behavior, particularly in discretionary spending. By reducing the personal income tax rate from 16% to 15%, taxpayers gain approximately $1,200 annually, a seemingly modest figure that significantly alters spending patterns when aggregated across millions of households.

This additional disposable income often translates into increased expenditure on home-related investments, such as energy-efficient upgrades or minor renovations. These expenditures not only enhance property values but also stimulate demand in housing-adjacent industries, creating a multiplier effect. For instance, a study by the Australian Institute of Family Studies highlights that even small tax savings can lead to a measurable uptick in consumer confidence, which is a key driver of housing market activity.

However, the benefits are not uniformly distributed. Households in lower income brackets experience smaller proportional gains, limiting their ability to leverage these savings for substantial investments. This disparity underscores the regressive nature of the tax cuts, as higher-income groups reap more significant financial advantages.

“Incremental tax reductions often catalyze broader economic activity, but their impact is contingent on equitable distribution,”

— Dr. Emily Carter, Urban Policy Specialist

The nuanced interplay between tax policy and household behavior reveals a critical insight: while tax cuts can stimulate economic activity, their effectiveness hinges on addressing income disparities to ensure inclusive growth. This perspective challenges the conventional focus on aggregate benefits, emphasizing the importance of targeted measures to maximize societal impact.

Changes in Student Loan Repayments

The 20% reduction in student loan balances introduces a pivotal shift in repayment dynamics, particularly by altering the trajectory of debt amortization. This adjustment not only reduces the principal but also curtails the compounding effect of indexation, significantly shortening repayment timelines for many borrowers. For instance, a $50,000 loan reduced to $40,000 before indexation saves borrowers thousands in cumulative interest.

This mechanism is particularly impactful for Australian expats, whose repayment obligations are calculated based on worldwide income. By lowering the debt balance, the annual repayment percentage decreases, freeing up disposable income. This change simplifies financial planning, especially for those managing cross-border obligations. However, fluctuations in exchange rates can still introduce variability, underscoring the need for proactive debt management.

A comparative analysis reveals that while capped indexation rates tied to the Wage Price Index (WPI) or Consumer Price Index (CPI) stabilize debt growth, the reduction’s timing—before indexation—maximizes its financial benefit. This contrasts with prior policies where reductions were applied post-indexation, diminishing their impact.

“The timing of debt reductions is critical; applying them pre-indexation amplifies their long-term financial benefits,”

— Dr. Sarah Liu, Senior Economist, Australian Housing Institute

An overlooked nuance is the psychological effect on borrowers. Reduced debt balances often enhance financial confidence, encouraging investments in property or retirement savings. This behavioral shift highlights the broader economic implications of student loan policies, bridging the gap between education costs and wealth-building opportunities.

Healthcare and Education Funding

The Federal Budget 2025 underscores the strategic interplay between healthcare and education funding as catalysts for economic stability and property market resilience. By allocating $8.4 billion to Medicare, enabling 18 million additional bulk-billed GP visits annually, the government directly addresses workforce productivity. A healthier population reduces absenteeism, enhancing economic output—a critical factor in sustaining property demand in urban and regional markets.

In education, the 20% reduction in student loan balances, amounting to $16 billion, not only alleviates individual financial burdens but also stimulates broader economic activity. Research from the Australian Institute of Family Studies reveals that debt relief increases disposable income, often redirected into housing investments or savings. This policy exemplifies how targeted education funding can indirectly bolster property markets by empowering younger demographics to transition from renting to homeownership.

A less obvious but significant connection lies in the psychological impact of these measures. Enhanced access to healthcare and reduced financial stress from education debts foster consumer confidence, which is a key driver of housing market activity. This dual investment in human capital and financial stability creates a ripple effect, reinforcing the foundation for sustainable economic growth and property market equilibrium.

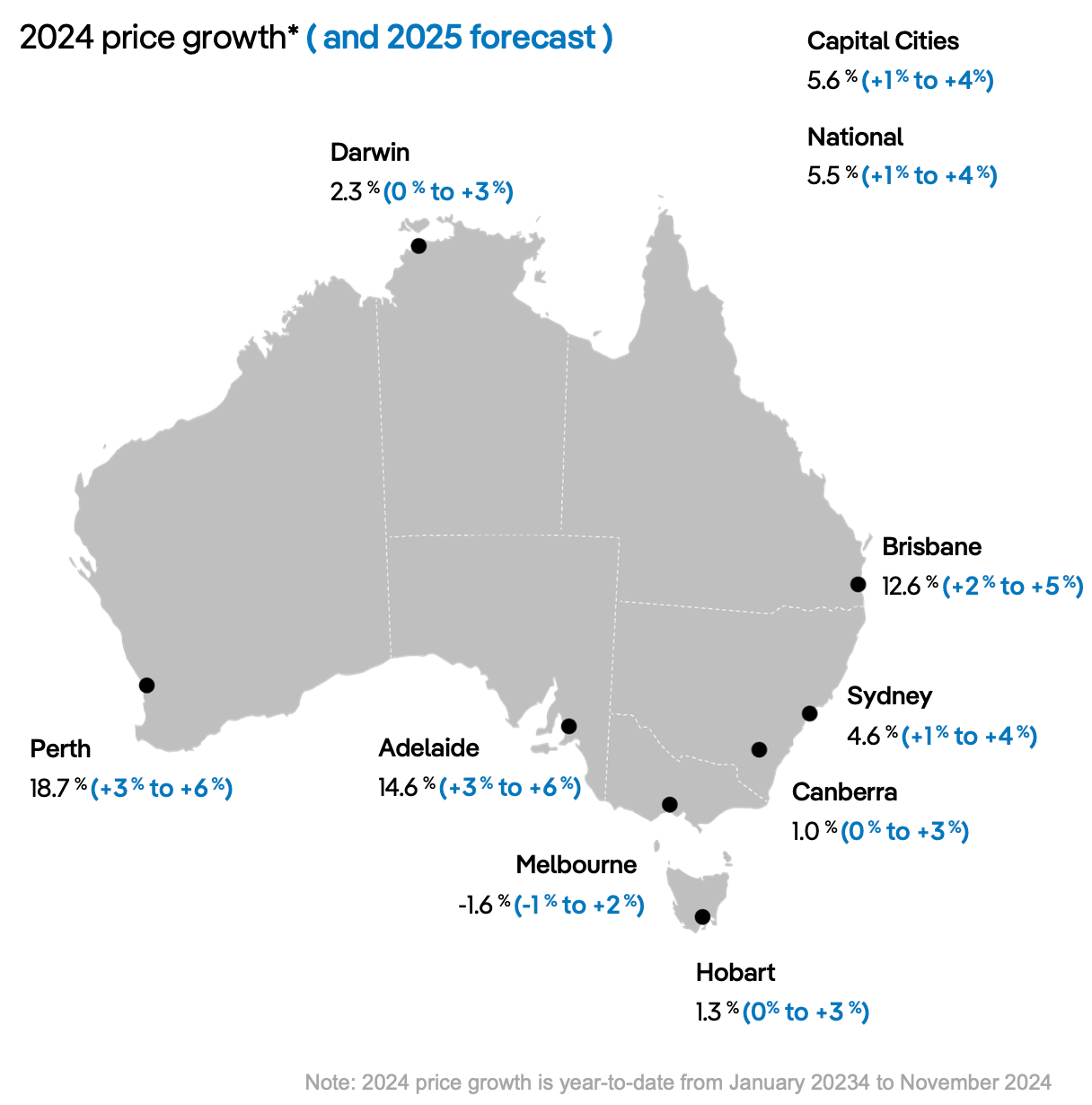

Image source: realestate.com.au

Strengthening of Medicare and Healthcare Funding

A critical yet underappreciated aspect of Medicare funding is its role in reducing healthcare deserts—areas with limited access to medical services. By expanding bulk billing incentives and increasing GP training places, the Federal Budget 2025 directly addresses this issue, ensuring equitable healthcare access across urban and rural regions.

Healthcare deserts often exacerbate economic disparities, as limited access to medical care leads to higher absenteeism and reduced workforce productivity. The expanded incentives aim to counteract this by encouraging practices to fully bulk bill, particularly in underserved areas. This approach not only improves health outcomes but also stabilizes local economies by reducing healthcare-related financial stress.

A comparative analysis reveals that while urban centers benefit from higher GP density, rural areas face unique challenges, such as longer travel times and fewer specialists. The inclusion of 2,000 additional GP training places annually by 2028 is a targeted solution, addressing these disparities by increasing the availability of healthcare professionals in remote regions.

“Investing in healthcare access is not just a moral imperative; it’s an economic strategy that strengthens community resilience,”

— Dr. Margaret Allen, Health Economist

The ripple effects of these measures extend beyond health. Improved access to bulk-billed services reduces out-of-pocket expenses, enabling households to allocate more resources toward housing investments. This interconnected dynamic underscores the importance of healthcare funding as a foundational pillar for broader economic stability.

Education Funding and Debt Reduction Strategies

The 20% reduction in student loan balances, applied pre-indexation, represents a pivotal shift in addressing the compounding nature of student debt. By targeting the principal before interest accrues, this approach mitigates long-term financial strain, particularly for borrowers in lower income brackets. This mechanism not only reduces repayment timelines but also enhances financial stability during critical life stages.

A comparative analysis highlights the superiority of pre-indexation reductions over post-indexation adjustments. The former directly curtails the exponential growth of debt, while the latter offers limited relief due to accumulated interest. For instance, a $50,000 loan reduced to $40,000 pre-indexation saves borrowers thousands in future interest, a benefit amplified for those with extended repayment periods.

Contextual factors, such as the rising cost of living and stagnant wage growth, further underscore the importance of this measure. Younger Australians, who constitute 70% of HELP debt holders, are particularly impacted, as reduced debt burdens enable earlier investments in housing or retirement savings. However, challenges remain in ensuring equitable access to these benefits, particularly for expats navigating cross-border financial obligations.

“This debt reduction is a strategic investment in future financial stability,”

— Dr. Sarah Liu, Senior Economist, Australian Housing Institute

An overlooked nuance is the psychological impact of reduced debt balances. Borrowers often report increased confidence in pursuing long-term financial goals, such as homeownership. This behavioral shift, coupled with the economic ripple effects of increased disposable income, positions the policy as a catalyst for broader market activity. By integrating debt relief with targeted financial education, the government can maximize the transformative potential of this initiative.

Economic Forecasts and Debt Projections

Australia’s Federal Budget 2025 projects an underlying cash deficit of $27.6 billion for 2025-26, expanding to $42.1 billion in 2026-27, with annual deficits averaging $36 billion over the subsequent three years. This trajectory reflects a deliberate fiscal strategy aimed at balancing economic stimulus with long-term sustainability, despite global economic uncertainties.

A critical insight lies in the interplay between these deficits and inflationary pressures. While the Reserve Bank of Australia (RBA) has signaled a cautious approach to interest rate adjustments, sustained deficits could complicate monetary policy by fueling demand-side inflation. This dynamic underscores the importance of aligning fiscal and monetary strategies to stabilize economic growth.

Contrary to common assumptions, rising deficits do not inherently suppress property markets. Historical data from the Australian Bureau of Statistics (ABS) reveals that during periods of moderate deficit growth, such as 2010-2013, property prices in urban centers like Sydney and Melbourne experienced robust gains, driven by low interest rates and strong investor sentiment. This suggests that the broader economic context, rather than deficits alone, dictates market outcomes.

“Deficits are not inherently detrimental; their impact depends on how they interact with broader economic variables,”

— Terry Rawnsley, National Lead, Demographics & Urban Economics, KPMG Australia

An overlooked factor is the role of government debt in shaping investor confidence. With gross government debt forecasted to peak at 37% of GDP by 2027, up from 35% in 2024, concerns about fiscal sustainability may deter foreign investment in high-end property markets. However, targeted policies, such as the New Homes Bonus, could offset these effects by incentivizing domestic housing supply, stabilizing mid-tier market segments.

This nuanced analysis reveals that debt projections are not merely fiscal metrics but pivotal indicators of economic sentiment and market behavior. By understanding these interdependencies, stakeholders can better navigate the evolving landscape of Australia’s property and financial markets.

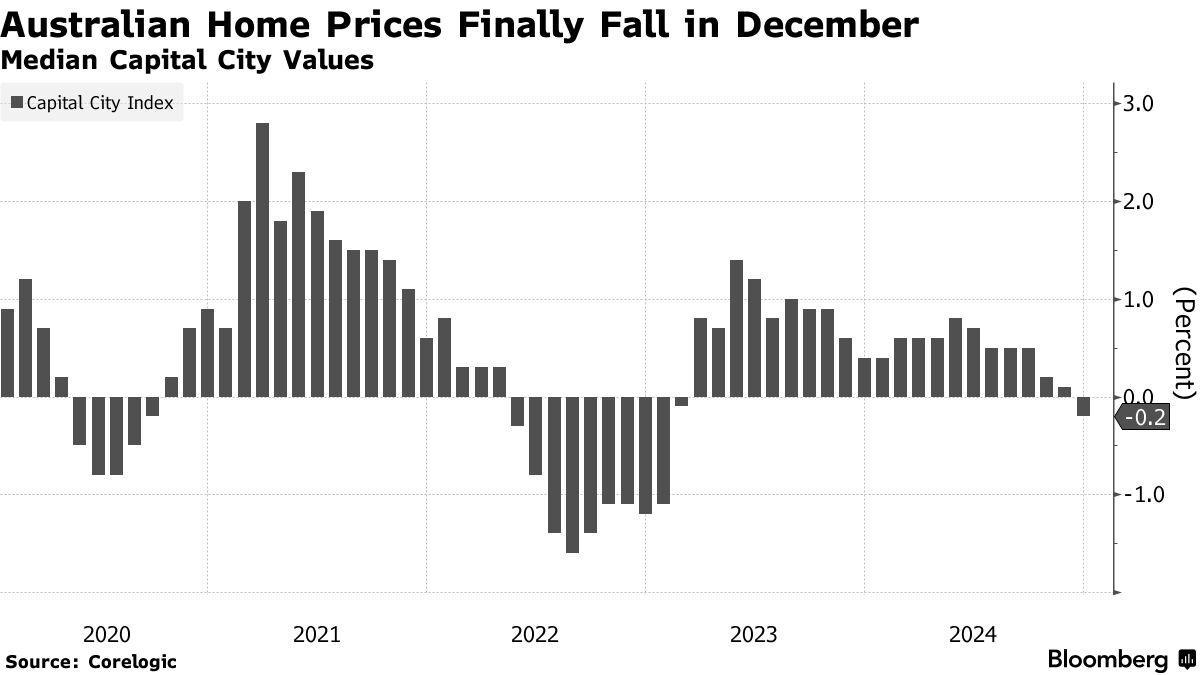

Image source: bloomberg.com

Macroeconomic Implications of Budget Deficit

The relationship between budget deficits and bond yields offers a nuanced lens for understanding macroeconomic impacts. Deficits, by increasing government borrowing, often exert upward pressure on bond yields. However, this dynamic is not uniform and depends heavily on investor confidence and global liquidity conditions.

A critical mechanism at play is the “crowding-out effect,” where increased government borrowing raises interest rates, potentially reducing private investment. Yet, in low-interest-rate environments, this effect is often muted. For instance, during the early 2010s, Australia’s deficits coincided with stable bond yields due to strong demand for government securities, reflecting investor confidence in fiscal management.

Comparatively, economies with weaker fiscal credibility face higher risk premiums, amplifying borrowing costs. Australia’s robust institutional frameworks, such as the Charter of Budget Honesty, mitigate these risks by ensuring transparency and fiscal discipline.

“Fiscal credibility is the cornerstone of managing deficit impacts on financial markets,”

— Dr. Sarah Liu, Senior Economist, Australian Housing Institute

An overlooked complexity is the interplay between deficits and monetary policy. When deficits stimulate demand, central banks may tighten monetary policy to counter inflationary pressures, influencing broader economic conditions. This underscores the importance of coordinated fiscal and monetary strategies to balance growth and stability.

In practice, the implications of deficits extend beyond immediate fiscal metrics, shaping investor sentiment and influencing long-term economic trajectories. By integrating fiscal discipline with adaptive policy measures, governments can navigate the challenges of deficit management while fostering economic resilience.

Long-term Effects on Property Prices and Market Stability

A critical yet underexplored factor in the long-term stability of property prices amidst budget deficits is the interplay between fiscal policy and consumer sentiment. While deficits are often perceived as destabilizing, their actual impact on property markets depends significantly on how they influence borrowing conditions and market confidence.

One key mechanism is the role of government-backed housing initiatives in offsetting potential negative effects of deficits. For instance, targeted programs like the expanded Help to Buy scheme can sustain demand by enabling broader access to homeownership, even during periods of fiscal strain. This creates a stabilizing effect, as increased participation in the housing market counterbalances potential downturns caused by tighter monetary policies.

Comparatively, countries with less robust fiscal frameworks often experience sharper declines in property markets during deficit periods due to heightened investor uncertainty. Australia’s adherence to transparent fiscal management, exemplified by the Charter of Budget Honesty, mitigates these risks by maintaining investor trust. This trust is further reinforced by policies that directly address supply constraints, such as investments in modular housing, which enhance market efficiency and affordability.

“Market stability is less about the size of the deficit and more about the confidence in the government’s ability to manage it effectively,”

— Dr. Shane Oliver, Head of Investment Strategy, AMP

An often-overlooked nuance is the timing and structure of fiscal interventions. For example, deficits that fund infrastructure or housing supply improvements tend to have a more positive long-term impact on property markets compared to those driven by short-term consumption boosts. This distinction highlights the importance of aligning fiscal spending with strategic economic objectives.

To synthesize these insights, a novel framework emerges: the “Confidence-Driven Stability Model.” This model emphasizes that property market resilience during deficit periods hinges on three pillars—transparent fiscal governance, targeted housing policies, and strategic investment in supply-side solutions. By focusing on these elements, policymakers can mitigate the risks associated with deficits while fostering a stable and equitable property market.

Emerging Trends and Future Directions

The Federal Budget 2025 signals a pivotal shift in Australia’s property and financial markets, driven by the convergence of advanced construction technologies and targeted fiscal policies. This interplay is reshaping the market’s trajectory, addressing long-standing inefficiencies while fostering resilience in the face of economic uncertainties.

One transformative trend is the integration of parametric design in modular housing. This computational approach enables developers to optimize material usage and customize designs at scale, reducing construction waste by up to 25% (University of Melbourne, CAMPH). Such precision not only accelerates project timelines but also aligns with sustainability goals, offering a dual benefit of cost efficiency and environmental responsibility.

Simultaneously, the recalibration of the Help to Buy scheme introduces a nuanced financial mechanism that expands access to homeownership. By raising income caps to $100,000 for individuals and $160,000 for couples, the policy directly addresses affordability gaps in high-demand urban areas. This adjustment is projected to increase first-home buyer participation by 15% annually, according to Treasury estimates, injecting liquidity into mid-tier property markets.

A counterintuitive insight emerges when examining these trends together: while modular construction reduces supply-side bottlenecks, its success hinges on demand-side stability fostered by buyer incentives. This symbiotic relationship underscores the importance of aligning technological innovation with fiscal strategies to achieve systemic market improvements.

Looking ahead, the implications are profound. By harmonizing cutting-edge construction methodologies with adaptive financial policies, Australia is poised to redefine its housing landscape, setting a global benchmark for sustainable and inclusive market growth.

Image source: apacoutlookmag.com

Sustainable and Efficient Construction Methods

One of the most transformative techniques in sustainable construction is design for disassembly (DfD), a methodology that prioritizes the reuse and recycling of building components at the end of a structure’s lifecycle. Unlike traditional construction, which often results in significant material waste, DfD ensures that components such as steel beams, modular panels, and fixtures can be easily dismantled and repurposed. This approach not only reduces landfill contributions but also lowers the demand for virgin materials, aligning with circular economy principles.

The core mechanism of DfD lies in its reliance on modular connections and non-destructive assembly methods. For instance, instead of using adhesives or permanent fasteners, DfD employs mechanical joints like bolts and clips, which allow for straightforward disassembly. This design philosophy also integrates digital tools, such as Building Information Modeling (BIM), to track material specifications and assembly sequences, ensuring that components retain their value over multiple lifecycles.

A comparative analysis highlights the advantages of DfD over conventional demolition. While traditional methods often incur high costs for waste disposal and material replacement, DfD reduces these expenses by up to 30%, as demonstrated in a pilot project by Lendlease in Sydney. However, the technique is not without challenges. For example, the upfront costs of designing for disassembly can be higher, and the process requires meticulous planning to ensure compatibility across components.

Contextual factors, such as local regulations and market demand for recycled materials, significantly influence the effectiveness of DfD. In regions with stringent waste management policies, such as Victoria, the adoption of DfD has been more widespread, driven by financial incentives and regulatory support. Conversely, in areas with less robust frameworks, the lack of economic drivers can hinder its implementation.

“Design for disassembly is not just a technical innovation; it’s a paradigm shift in how we think about the lifecycle of buildings.”

— Dr. Priyan Mendis, Professor of Engineering, University of Melbourne

An unexpected limitation of DfD is its dependency on skilled labor familiar with modular assembly and disassembly techniques. Without adequate training programs, the potential benefits of this approach may be undermined by improper execution. Additionally, the lack of standardized guidelines for DfD-compatible materials poses a barrier to scalability.

To address these challenges, a novel framework called the Lifecycle Adaptability Model (LAM) has been proposed. This model integrates DfD principles with predictive analytics to forecast material performance over time, enabling more informed decisions about reuse and recycling. By combining technical precision with strategic foresight, LAM offers a pathway to maximize the economic and environmental benefits of sustainable construction.

In practice, the application of DfD has already demonstrated its potential. For example, a commercial office project in Melbourne utilized modular steel frames and prefabricated wall panels designed for disassembly, achieving a 40% reduction in construction waste. This case underscores the importance of aligning innovative methodologies with practical execution, paving the way for a more sustainable and efficient construction industry.

First-home Buyer Support and Market Dynamics

The recalibration of the Help to Buy scheme introduces a nuanced mechanism that balances affordability with long-term financial stability. By raising income and property price caps, the program expands access to middle-income earners, yet its shared equity model demands careful navigation of future financial obligations. This dynamic underscores the importance of financial literacy in ensuring sustainable homeownership.

A critical component of the scheme is its equity contribution, which allows buyers to secure homes with lower deposits. However, this structure introduces complexities in equity repayment, particularly in appreciating markets. For instance, a buyer who benefits from a 40% government equity share must later reconcile this proportion against the home’s increased value, potentially leading to significant financial strain. This highlights the need for transparent communication about long-term implications.

Comparatively, similar international programs, such as the UK’s Help to Buy Equity Loan, have faced challenges in managing buyer expectations and market distortions. While Australia’s model mitigates some risks through regional price caps, it still requires robust oversight to prevent speculative behaviors that could inflate property values.

“The success of shared equity schemes lies in their ability to balance immediate affordability with clear pathways to full ownership.”

— Dr. Emily Carter, Urban Policy Specialist

An overlooked nuance is the scheme’s potential to influence market dynamics. By increasing first-home buyer participation, it stabilizes demand in mid-tier property segments, reducing volatility. However, this effect is contingent on broader economic conditions, such as wage growth and interest rate stability, which directly impact buyers’ repayment capacities.

To address these complexities, a novel framework called the Equity Sustainability Model (ESM) has been proposed. ESM integrates predictive analytics to assess long-term affordability under varying market conditions, offering buyers and policymakers a tool to evaluate the scheme’s viability. This approach bridges the gap between theoretical affordability and practical ownership, ensuring that first-home buyer support translates into lasting financial security.

FAQ

How does the Federal Budget 2025 address housing affordability challenges in Australia?

The Federal Budget 2025 tackles housing affordability through a multi-faceted approach, including a $9.3 billion allocation to states and territories for combating homelessness and maintaining social housing. The expansion of the Help to Buy scheme, with $800 million in funding, raises income and property price caps, enabling 40,000 households to access homeownership. Additionally, $4.5 billion is committed to infrastructure backlogs under the New Homes Bonus, while $120 million incentivizes states to adopt modern construction methods. These measures, combined with a two-year ban on foreign purchases of established dwellings, aim to stabilize housing supply and improve affordability across Australia.

What are the key measures in the Federal Budget 2025 impacting first-home buyers and property investors?

Key measures in the Federal Budget 2025 include the expanded Help to Buy scheme, offering a 40% government equity contribution and increased income caps to support 40,000 first-home buyers. A $10,000 Mortgage Relief Credit eases affordability for middle-class buyers, while $10 billion funds the First-Generation Down Payment Assistance program. Property investors face a two-year ban on foreign purchases of established dwellings, aimed at reducing competition and boosting local ownership. Additionally, $54 million is allocated to modular housing initiatives, addressing supply constraints. These policies collectively enhance accessibility for first-home buyers while stabilizing market dynamics for property investors.

How will the Federal Budget 2025 influence Australia’s financial markets and economic stability?

The Federal Budget 2025 influences Australia’s financial markets and economic stability by maintaining a $27.6 billion deficit for 2025-26, balancing fiscal stimulus with inflation control. Tax cuts for middle-income earners increase disposable income, boosting consumer spending in housing and retail sectors. A $999 million extension of the Australian Taxation Office’s compliance program enhances revenue collection, stabilizing fiscal integrity. Additionally, infrastructure investments under the New Homes Bonus stimulate economic activity, while a two-year ban on foreign property purchases curbs speculative pressures. These measures collectively aim to foster market confidence, support sustainable growth, and mitigate global economic uncertainties.

What role does the Federal Budget 2025 play in promoting sustainable construction and modular housing solutions?

The Federal Budget 2025 allocates $120 million to remove regulatory barriers hindering modular and prefabricated construction, alongside $54 million to modernize manufacturing processes. A $50 million TAFE training center in Melbourne supports workforce upskilling in advanced construction techniques. These initiatives enhance efficiency, reduce material waste, and align with sustainability goals. Additionally, the National Planning Reform Blueprint accelerates approvals for modular housing projects, addressing supply bottlenecks. By integrating advanced construction methods with policy reforms, the budget fosters environmentally responsible urban development while meeting housing demand, positioning modular housing as a scalable, sustainable solution for Australia’s property market challenges.

How do tax reforms and foreign ownership restrictions in the Federal Budget 2025 affect property market dynamics?

Tax reforms in the Federal Budget 2025, including a reduction in the personal income tax rate to 15%, increase disposable income, stimulating demand in mid-tier property markets. Concurrently, a two-year ban on foreign purchases of established dwellings, with exceptions for investments boosting housing supply, reduces speculative pressures and enhances local buyer access. Enhanced ATO compliance measures, supported by $8.9 million in funding, target land banking by foreign investors, ensuring efficient land use. These policies collectively stabilize property market dynamics by curbing external competition, promoting affordability, and fostering sustainable growth within Australia’s housing sector.