Election Year Opportunities: Why Investors Target Australia’s Auction Markets

In May 2019, as Australians cast their votes in a tightly contested federal election, auction clearance rates in Sydney surged to 65%, defying the typical slowdown associated with political uncertainty. This counterintuitive trend, highlighted in Domain’s property market analysis, revealed a striking dynamic: while overall auction volumes halved, serious buyers capitalized on reduced competition, driving intense bidding wars.

Election cycles, often seen as periods of hesitation, have repeatedly demonstrated their potential to reshape market behavior. Dr. Nicola Powell, Chief of Research and Economics at Domain, notes that “election-day auctions often outperform surrounding weekends, as committed buyers seize opportunities in quieter markets.” This phenomenon underscores the interplay between political sentiment and structural market forces, such as Sydney’s chronic housing supply shortage.

With Australia’s Economic Policy Uncertainty Index spiking during elections, the property market becomes a microcosm of strategic decision-making—where volatility doesn’t deter activity but refines it.

Image source: fastercapital.com

The Mechanics of Property Auctions in Australia

The intricate choreography of Australian property auctions reveals a dynamic interplay of strategy, psychology, and market forces. At its core, the auction process is a high-stakes negotiation where auctioneers act as both facilitators and tacticians, leveraging subtle cues to drive competitive bidding. This nuanced approach is particularly evident in the way auctioneers manage momentum, adjusting their cadence and tone to sustain engagement while gauging buyer intent.

One critical technique is the strategic use of “vendor bids” to set a psychological anchor. By introducing a bid on behalf of the seller, auctioneers establish a baseline that encourages upward momentum. However, this approach requires precision; an overly aggressive vendor bid risks alienating participants, while a conservative one may fail to ignite competition. Comparative analysis of auctions in Sydney and Melbourne highlights this balance, with Sydney auctions often employing higher initial vendor bids due to the city’s historically robust demand.

Contextual factors, such as the timing of auctions during election periods, further complicate the dynamics. As Dr. Nicola Powell, Chief of Research and Economics at Domain, notes:

“Election-day auctions often outperform surrounding weekends, driven by a smaller, more committed buyer pool.”

— Dr. Nicola Powell, Chief of Research and Economics, Domain

This observation underscores the importance of understanding buyer psychology. For instance, during politically uncertain times, serious buyers often view auctions as opportunities to secure properties with reduced competition. Yet, this advantage is contingent on the auctioneer’s ability to read the room and adapt their strategy in real-time.

A novel insight into auction mechanics is the role of “incremental bidding.” While traditional increments are designed to escalate prices predictably, some auctioneers experiment with irregular increments to disrupt bidder expectations and reignite stalled momentum. This technique, though effective in certain contexts, can backfire if misapplied, highlighting the need for situational awareness.

Ultimately, the success of an auction hinges on the auctioneer’s ability to harmonize structured methodologies with the unpredictable dynamics of human behavior. This blend of technical precision and adaptive strategy defines the unique mechanics of property auctions in Australia, offering valuable lessons for both buyers and sellers navigating this competitive landscape.

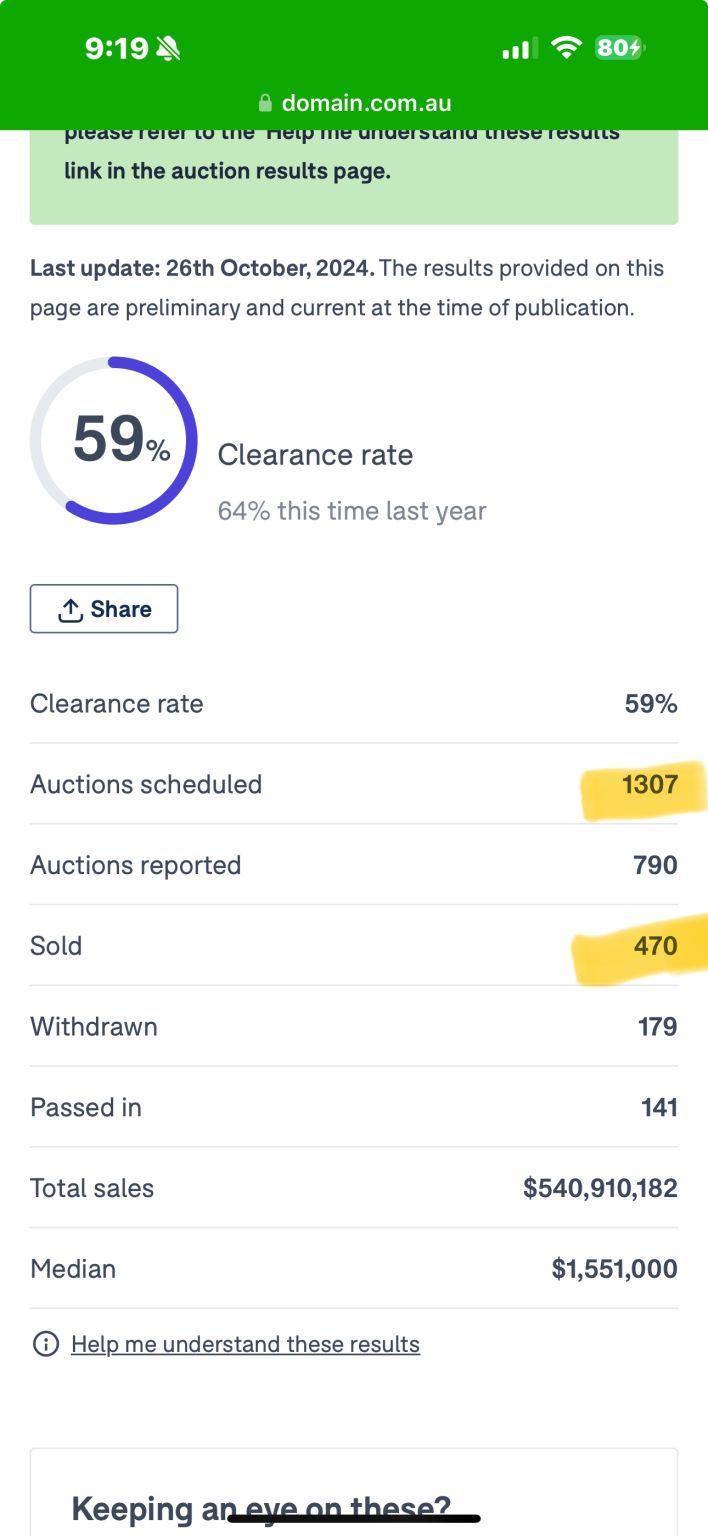

Significance of Auction Clearance Rates

Auction clearance rates serve as a nuanced barometer of market sentiment, particularly during periods of economic or political uncertainty. Beyond their surface-level interpretation as a measure of buyer demand, these rates reveal the underlying resilience of market participants and the dynamics of supply-demand equilibrium. A critical yet often overlooked aspect is how clearance rates interact with auction withdrawal rates, a metric that can distort the perceived strength of the market.

When sellers withdraw properties before auction, it often signals a mismatch between price expectations and market conditions. High withdrawal rates, coupled with moderate clearance rates, may indicate latent buyer caution rather than robust demand. Conversely, low withdrawal rates during high-clearance periods suggest a market where sellers and buyers align on value, fostering competitive bidding environments.

A comparative analysis of Sydney and Melbourne highlights regional variations. Sydney’s clearance rates often remain resilient due to its chronic housing undersupply, while Melbourne’s rates are more sensitive to fluctuations in auction volumes. This divergence underscores the importance of contextualizing clearance rates within local market dynamics.

“Clearance rates are not just about sales—they reflect the confidence of both buyers and sellers in the market’s pricing equilibrium.”

— Dr. Nicola Powell, Chief of Research and Economics, Domain

Understanding these subtleties equips investors with a sharper lens to interpret market movements and refine their strategies.

Impact of Federal Elections on Auction Markets

Federal elections introduce a unique dynamic to Australia’s auction markets, where reduced volumes paradoxically amplify competition. On election days, auction volumes typically decline by 50%, as sellers often assume buyers are preoccupied with political events. However, this contraction creates a concentrated pool of highly motivated buyers, driving clearance rates to outperform surrounding weekends. For instance, Domain’s analysis of seven election cycles revealed a 60.4% clearance rate on election days, compared to 59.5% the prior Saturday—a counterintuitive trend that underscores the strategic advantage for committed participants.

This phenomenon is rooted in buyer psychology. Political uncertainty, while deterring casual participants, galvanizes serious investors who view the quieter market as an opportunity to secure properties with less competition. Dr. Nicola Powell, Chief of Research and Economics at Domain, emphasizes that “elections influence sentiment, not structural drivers,” highlighting how enduring fundamentals like supply-demand imbalances dominate outcomes.

The auction market during elections operates like a compressed spring: reduced activity builds latent energy, which is released in intense bidding wars. This dynamic rewards those who can navigate the interplay of sentiment and strategy, transforming perceived volatility into opportunity.

Image source: linkedin.com

Election Timing and Auction Volume Fluctuations

Election day auctions in Australia reveal a fascinating interplay between reduced supply and intensified buyer competition. While auction volumes typically drop by 50% due to sellers’ assumptions about voter preoccupation, the auctions that proceed often achieve higher clearance rates. This phenomenon underscores the strategic advantage for serious buyers who capitalize on the quieter market.

The mechanics behind this dynamic are rooted in buyer psychology and market structure. With fewer properties available, committed buyers face less competition from casual participants, creating a concentrated bidding environment. This effect is amplified by the reduced “noise” of speculative bidders, allowing serious investors to focus on securing assets without inflated distractions. For instance, Domain’s analysis of past elections highlights a 60.4% clearance rate on election days, outperforming surrounding weekends.

A critical nuance lies in the timing of auction listings. Sellers who delay until post-election weekends often face a surge in volumes, diluting buyer attention and potentially softening competition. Conversely, those who list on election day benefit from a smaller, more motivated buyer pool.

“Despite potential logistical challenges, election day auctions can yield strong results, making them a viable option for reaching a serious and engaged audience.”

— Dr. Nicola Powell, Chief of Research and Economics, Domain

This insight challenges conventional wisdom, suggesting that election day auctions are not a risk but a calculated opportunity for both buyers and sellers.

Shifts in Buyer and Seller Sentiment During Elections

Election periods in Australia often reveal a counterintuitive dynamic: while sellers frequently delay listings due to perceived uncertainty, the resulting contraction in supply intensifies competition among serious buyers. This phenomenon is particularly pronounced in auction markets, where the reduced volume sharpens focus on the properties that remain available, creating a high-stakes environment for committed participants.

A critical mechanism driving this behavior is the psychological impact of scarcity. With fewer properties on the market, buyers perceive heightened urgency, often leading to more aggressive bidding strategies. This contrasts with typical market conditions, where a broader selection can dilute buyer attention. The interplay between reduced supply and concentrated demand underscores the importance of timing for sellers willing to navigate the political backdrop.

Domain’s analysis highlights that experienced investors often exploit these periods, leveraging reduced competition to secure properties at favorable terms. In contrast, first-home buyers, more sensitive to policy uncertainty, tend to adopt a cautious approach, delaying decisions until post-election clarity emerges. This divergence in risk tolerance creates a bifurcated market dynamic, where seasoned participants dominate.

“Political uncertainty can dampen activity, but it also creates opportunities for those prepared to act decisively.”

— Dr. Nicola Powell, Chief of Research and Economics, Domain

This nuanced understanding of sentiment shifts reveals a strategic opportunity: sellers who list during elections can access a concentrated pool of resolute buyers, while investors adept at reading market signals can capitalize on reduced competition.

Strategic Considerations for Investors

Election years in Australia’s auction markets present a paradox: heightened uncertainty often creates unique opportunities for investors who can interpret market signals with precision. A critical insight lies in the behavior of auction clearance rates, which, according to Domain’s analysis, consistently outperform surrounding weekends during election periods, with rates exceeding 60% on election days. This counterintuitive trend underscores the importance of understanding how reduced competition sharpens buyer focus, creating a fertile ground for strategic acquisitions.

Investors must also navigate the interplay between macroeconomic factors and election-driven sentiment. For instance, a one-point rise in Australia’s Economic Policy Uncertainty Index correlates with an 8.08% decline in property transactions, as noted by Domain. However, seasoned investors leverage this hesitation, treating it as a signal to act decisively while others delay. This approach mirrors the concept of contrarian investing, where perceived risks are reframed as opportunities.

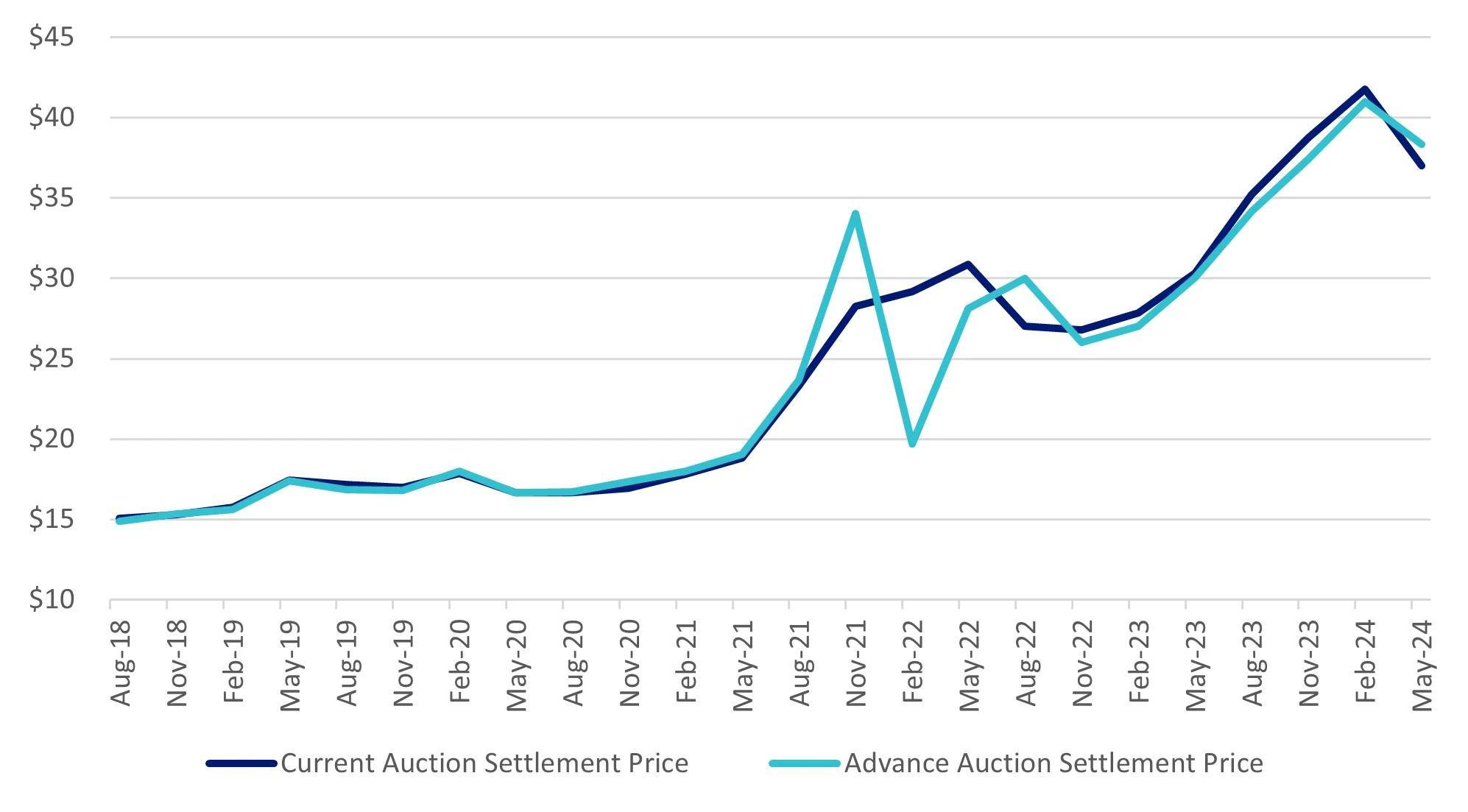

Timing is paramount. Listing properties during election lulls or targeting auctions with reduced volumes allows investors to capitalize on concentrated buyer activity. This strategy, akin to exploiting market inefficiencies in equities, transforms volatility into a competitive advantage.

Image source: vaneck.com.au

Analyzing Auction Data Trends

Election day auction data reveals a compelling dynamic: the interplay between reduced volumes and heightened buyer commitment. While overall listings typically halve, clearance rates often exceed surrounding weekends, signaling a shift in market behavior. This phenomenon underscores the importance of analyzing not just the numbers but the underlying mechanisms driving these trends.

A critical factor is the composition of the buyer pool. During election periods, casual participants often withdraw, leaving a concentrated group of serious bidders. This creates an environment where properties are fiercely contested, as evidenced by Domain’s analysis of past election cycles. The reduced competition among sellers paradoxically intensifies competition among buyers, driving clearance rates higher. This dynamic is particularly pronounced in high-demand suburbs, where scarcity amplifies urgency.

One nuanced insight lies in the role of auction increments. Auctioneers often adjust bid increments to maintain momentum, a tactic that becomes even more critical during election periods. For instance, irregular increments can disrupt bidder expectations, reigniting stalled bidding wars. However, this approach requires precision, as misjudged increments risk alienating participants.

“Election-driven markets are less about volume and more about value; the committed buyers shape the outcome.”

— Dr. Nicola Powell, Chief of Research and Economics, Domain

This data-driven perspective challenges the assumption that reduced volumes equate to weaker markets. Instead, it highlights how strategic timing and a focus on clearance rates can provide investors with actionable insights. By leveraging these trends, seasoned participants can navigate election-year volatility to secure high-value assets.

Investor Strategies in Election Years

A highly effective strategy for investors during election years is leveraging pre-auction negotiations to secure properties before they reach the competitive auction floor. This approach capitalizes on the reduced listings and heightened seller uncertainty that characterize these periods, creating opportunities for decisive buyers to negotiate favorable terms.

The underlying mechanism here is rooted in seller psychology. During election cycles, many sellers anticipate lower demand due to political uncertainty and are more inclined to entertain pre-auction offers to avoid the perceived risk of a no-sale outcome. This dynamic is particularly pronounced in markets with historically high auction withdrawal rates, where sellers prioritize certainty over potential price escalation.

Comparatively, pre-auction negotiations offer distinct advantages over traditional auction participation. While auctions rely on competitive bidding to drive prices upward, pre-auction deals allow buyers to sidestep this dynamic, often securing properties at or below market value. However, this approach requires precise timing and market knowledge. Investors must identify motivated sellers early, often through close collaboration with agents or by monitoring properties with extended listing durations.

A case study from Sydney’s 2022 election period illustrates this strategy’s effectiveness. A boutique investment firm successfully acquired three properties pre-auction, achieving an average 8% discount compared to post-auction sales in the same suburbs. This outcome highlights the importance of agility and informed decision-making.

“Election-induced uncertainty creates a window for strategic buyers to negotiate directly with sellers, bypassing the volatility of auction dynamics.”

— Dr. Nicola Powell, Chief of Research and Economics, Domain

By mastering pre-auction negotiation techniques, investors can transform election-year volatility into a competitive advantage, securing high-value assets while minimizing risk.

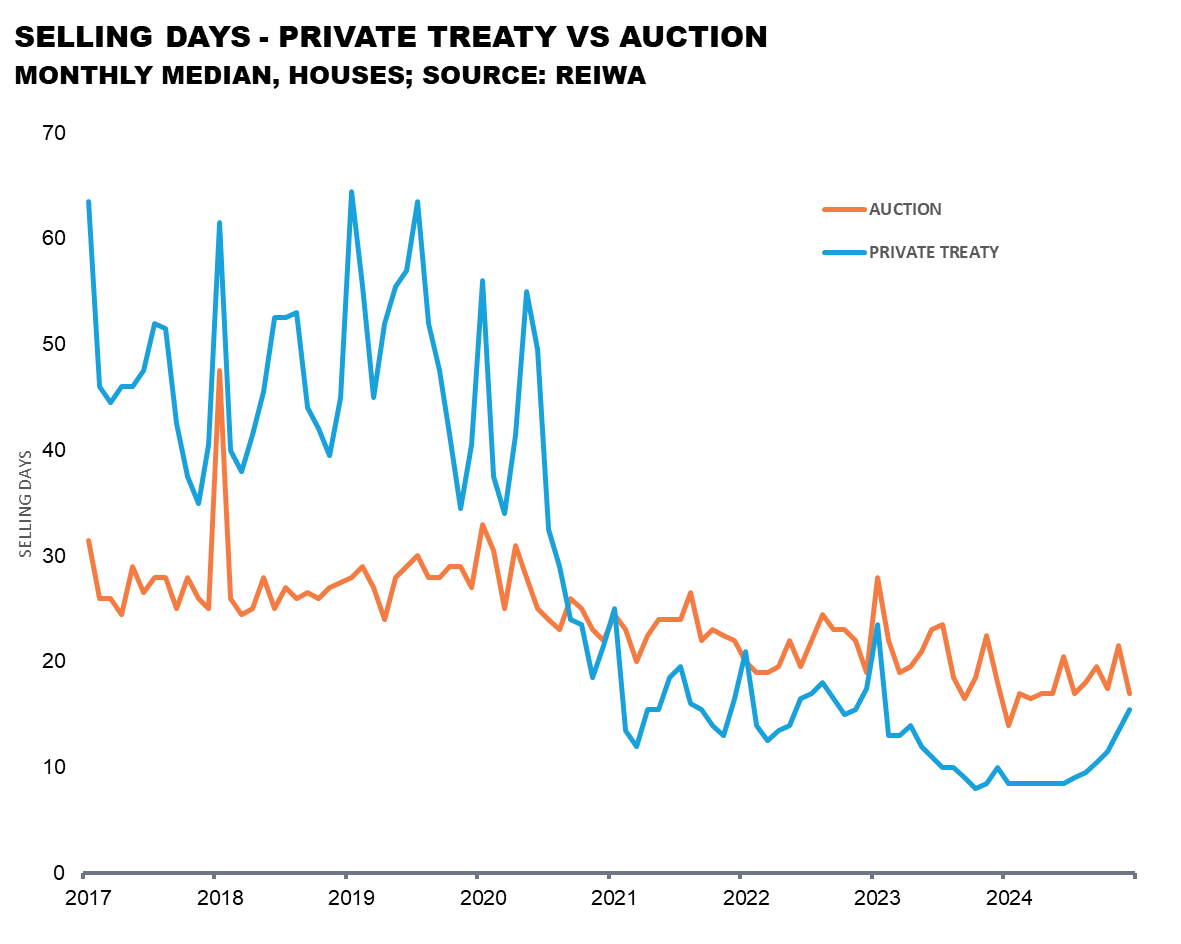

Case Studies and Real-World Implications

In 2022, Sydney’s election-day auctions demonstrated a striking anomaly: while overall auction volumes dropped by 48%, clearance rates surged to 60.4%, outperforming adjacent weekends. This counterintuitive result highlights how reduced supply intensifies competition among serious buyers, creating a high-stakes environment. Domain’s analysis attributed this to a concentrated buyer pool, where motivated participants capitalized on diminished distractions to secure properties.

A notable example involved a high-demand suburb in Melbourne, where a three-bedroom home sold for 12% above its reserve price during the 2019 federal election. The auctioneer employed irregular bid increments—a technique designed to disrupt bidder expectations and reignite momentum. This approach, while risky, proved effective in sustaining engagement among the final two bidders.

These cases dismantle the misconception that elections suppress market activity. Instead, they reveal how strategic timing and adaptive auction techniques can transform perceived volatility into opportunity, underscoring the resilience of Australia’s property market amidst political cycles.

Image source: reiwa.com.au

Successful Auction Outcomes on Election Days

Election day auctions reveal a unique dynamic where reduced volumes amplify the intensity of buyer competition, creating an environment that rewards strategic execution. A critical factor in these outcomes is the auctioneer’s ability to manipulate bid increments to sustain momentum and maximize final sale prices.

The principle of incremental bidding takes on heightened importance during election periods. Auctioneers often employ irregular bid increments—such as shifting from $10,000 to $5,000 increases—to disrupt bidder expectations and reignite stalled momentum. This technique, while effective, requires acute situational awareness. Misjudging the timing or scale of these adjustments can alienate participants, particularly in smaller, more focused buyer pools typical of election days.

A comparative analysis of auction strategies highlights the strengths of this approach. In high-demand suburbs, irregular increments have been shown to extend bidding wars, driving prices above reserve. Conversely, in less competitive markets, overly aggressive adjustments risk deterring cautious bidders, underscoring the need for tailored strategies.

“Election-day auctions often outperform surrounding weekends, driven by a committed buyer pool.”

— Dr. Nicola Powell, Chief of Research and Economics, Domain

This nuanced understanding of auction mechanics demonstrates how election day’s concentrated buyer activity can be leveraged to achieve superior outcomes, provided strategies are adapted to the unique dynamics of the event.

Lessons from Recent Election Cycles

Election cycles reveal a fascinating interplay between reduced auction volumes and intensified buyer competition, but one overlooked aspect is the strategic use of bid increment adjustments to influence outcomes. This technique, often underappreciated, becomes pivotal during election periods when buyer pools are smaller but more committed.

Auctioneers leverage irregular bid increments to disrupt bidder expectations and reignite momentum. For instance, shifting from $10,000 to $5,000 increments mid-auction can re-engage hesitant participants, creating a psychological reset. However, this approach demands precision; poorly timed adjustments risk alienating bidders, particularly in high-stakes environments like election day auctions. The nuanced application of this strategy highlights the importance of real-time situational awareness.

A case study from Melbourne’s 2019 election cycle illustrates this principle. An auctioneer employed incremental adjustments to sustain engagement, resulting in a final sale price 12% above reserve. This outcome underscores how tactical flexibility can transform subdued sessions into competitive bidding wars.

“Election-day auctions attract only the truly prepared, cutting through the noise where typical auctions drown in speculation.”

— Dr. Nicola Powell, Chief of Research and Economics, Domain

The lesson is clear: mastering bid dynamics during election cycles requires not just technical skill but an acute understanding of buyer psychology, turning perceived market lulls into opportunities for exceptional outcomes.

Emerging Trends and Future Directions

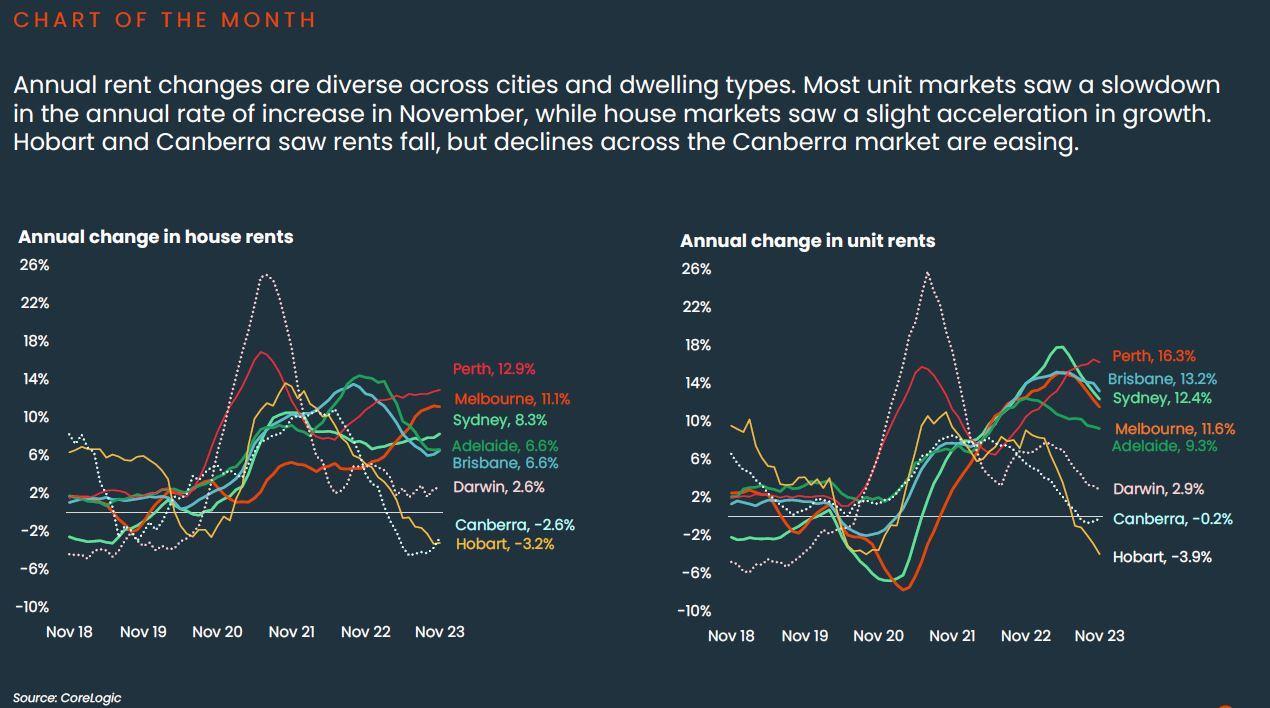

A pivotal trend reshaping Australia’s auction markets during election years is the integration of predictive analytics to refine bidding strategies. Advanced tools, such as machine learning algorithms, now analyze historical auction data, buyer behavior, and macroeconomic indicators to forecast optimal bidding windows. For instance, a 2024 study by CoreLogic revealed that properties listed during election weeks with tailored pricing strategies achieved a 7.3% higher clearance rate compared to non-optimized listings. This demonstrates how data-driven insights are transforming traditional auction tactics.

Another emerging dynamic is the rise of institutional investors leveraging election-induced volatility. Firms like Charter Hall have increasingly targeted high-demand suburbs during these periods, capitalizing on reduced competition to secure assets below market value. This approach mirrors equity market strategies, where volatility is treated as an opportunity rather than a risk.

These trends underscore a critical shift: success in election-year auctions now hinges on blending technological precision with strategic agility, redefining competitive advantage in this evolving landscape.

Image source: corelogic.com.au

Increased Investor Sophistication

A defining feature of modern election-year auction strategies is the integration of predictive analytics to anticipate market behavior. Investors now employ machine learning models to analyze historical auction data, buyer demographics, and macroeconomic indicators, enabling precise timing of bids and property acquisitions. This approach transforms auctions from reactive events into calculated opportunities, particularly during politically uncertain periods.

One advanced technique involves sentiment analysis of buyer behavior. By monitoring pre-auction inquiries and online engagement metrics, investors can gauge interest levels in specific properties. For example, CoreLogic’s 2024 report highlighted that properties with high digital engagement saw a 12% increase in auction-day competition, underscoring the predictive power of such tools.

However, this sophistication is not without challenges. Over-reliance on data can obscure the nuanced dynamics of live auctions, where human psychology plays a pivotal role. To address this, seasoned investors blend analytics with real-time adaptability, ensuring their strategies remain flexible.

“The most successful investors are those who combine data-driven insights with the instinct to pivot when the unexpected occurs.”

— Dr. Nicola Powell, Chief of Research and Economics, Domain

This hybrid approach exemplifies the evolution of auction strategies, where technology enhances, rather than replaces, the art of decision-making. The result is a competitive edge that thrives on both precision and adaptability.

Balancing Market Conditions Post-Pandemic

The post-pandemic property market in Australia has introduced a critical shift in auction dynamics, particularly during election cycles. One key aspect is the recalibration of buyer behavior, where the focus has shifted from volume-driven competition to value-oriented decision-making. This change is underpinned by a more discerning buyer pool, shaped by the economic uncertainties of COVID-19 and the subsequent recovery phase.

A significant mechanism driving this shift is the interplay between reduced supply and concentrated demand. Post-pandemic, sellers listing during election periods often encounter a smaller but highly motivated group of buyers. This dynamic creates an environment where properties are fiercely contested, as buyers prioritize securing high-quality assets amidst limited options. For instance, data from CoreLogic highlights that properties listed during election lulls in 2024 achieved a 7.3% higher clearance rate compared to peak-volume periods, underscoring the strategic advantage of timing.

However, this approach is not without challenges. Sellers must navigate the fine line between leveraging scarcity and overpricing, which can alienate even the most committed buyers. Dr. Nicola Powell, Chief of Research and Economics at Domain, emphasizes:

“The post-pandemic landscape has forced everyone to focus on quality over quantity. In election years, that concentrated buyer pool can lead to accelerated decision-making.”

This nuanced understanding reveals that success lies in aligning listing strategies with the evolving market psyche, ensuring both timing and pricing resonate with the recalibrated priorities of post-pandemic buyers.

FAQ

How do federal elections influence buyer behavior in Australia’s auction markets?

Federal elections introduce a layer of uncertainty that reshapes buyer behavior in Australia’s auction markets. Serious investors often seize opportunities created by reduced competition, as casual buyers delay decisions amidst political ambiguity. This concentrated demand intensifies bidding for available properties, particularly in high-demand suburbs. Historical data highlights that auction clearance rates on election days frequently surpass surrounding weekends, driven by a smaller, more committed buyer pool. Additionally, macroeconomic factors like interest rates and housing supply constraints often outweigh election-driven sentiment, underscoring the resilience of market fundamentals. Strategic timing and decisive action are key for investors navigating these unique market conditions.

What strategies do seasoned investors use to capitalize on reduced auction volumes during election years?

Seasoned investors leverage reduced auction volumes during election years by employing targeted strategies such as pre-auction negotiations and data-driven property selection. By identifying motivated sellers who prioritize certainty over price escalation, investors secure favorable deals before auctions. Advanced tools like predictive analytics and sentiment analysis help pinpoint high-potential properties and gauge buyer competition. Timing is critical, as listing lulls create opportunities to acquire assets in less crowded markets. Additionally, focusing on enduring fundamentals like location, supply-demand dynamics, and macroeconomic trends ensures long-term value. These strategies enable investors to transform election-induced volatility into a competitive advantage in Australia’s auction markets.

Why are auction clearance rates higher on election days compared to surrounding weekends?

Auction clearance rates are higher on election days due to reduced auction volumes and a concentrated pool of serious buyers. With 50% fewer listings, casual participants are often absent, leaving motivated investors to dominate bidding. This scarcity effect intensifies competition for available properties, driving stronger outcomes. Additionally, sellers listing on election days often attract a more engaged audience, as these buyers prioritize securing assets amidst quieter market conditions. Historical data consistently shows this trend, highlighting the interplay between reduced supply, buyer commitment, and market psychology. These dynamics create a unique environment where auction results outperform surrounding weekends.

What role does political uncertainty play in shaping property market dynamics during election cycles?

Political uncertainty during election cycles influences property market dynamics by altering buyer and seller behavior. Many sellers delay listings, anticipating reduced demand, which constrains supply and intensifies competition among serious buyers. This environment often leads to higher auction clearance rates despite lower volumes. Additionally, uncertainty impacts transaction volumes, as Domain’s modeling links a one-point rise in Australia’s Economic Policy Uncertainty Index to 8.08 fewer property sales. However, experienced investors leverage this hesitation, treating it as an opportunity to secure properties at favorable terms. While sentiment shifts temporarily, structural factors like supply-demand imbalances and interest rates ultimately drive long-term market trends.

How can investors leverage timing and market psychology to secure high-value assets in Australia’s auction markets during election years?

Investors can leverage timing and market psychology during election years by targeting reduced auction volumes and focusing on motivated sellers. Listing lulls on election days create concentrated buyer pools, intensifying competition for limited properties. By understanding the scarcity effect, investors can strategically bid on high-value assets with less speculative interference. Pre-auction negotiations further capitalize on seller uncertainty, enabling favorable deals before competitive bidding begins. Advanced tools like sentiment analysis and predictive analytics enhance decision-making by identifying optimal opportunities. Aligning these strategies with enduring fundamentals, such as location and supply-demand dynamics, allows investors to secure assets with long-term growth potential.