Election 2025: Australia’s Property Market at a Crossroads Amid Political Battle

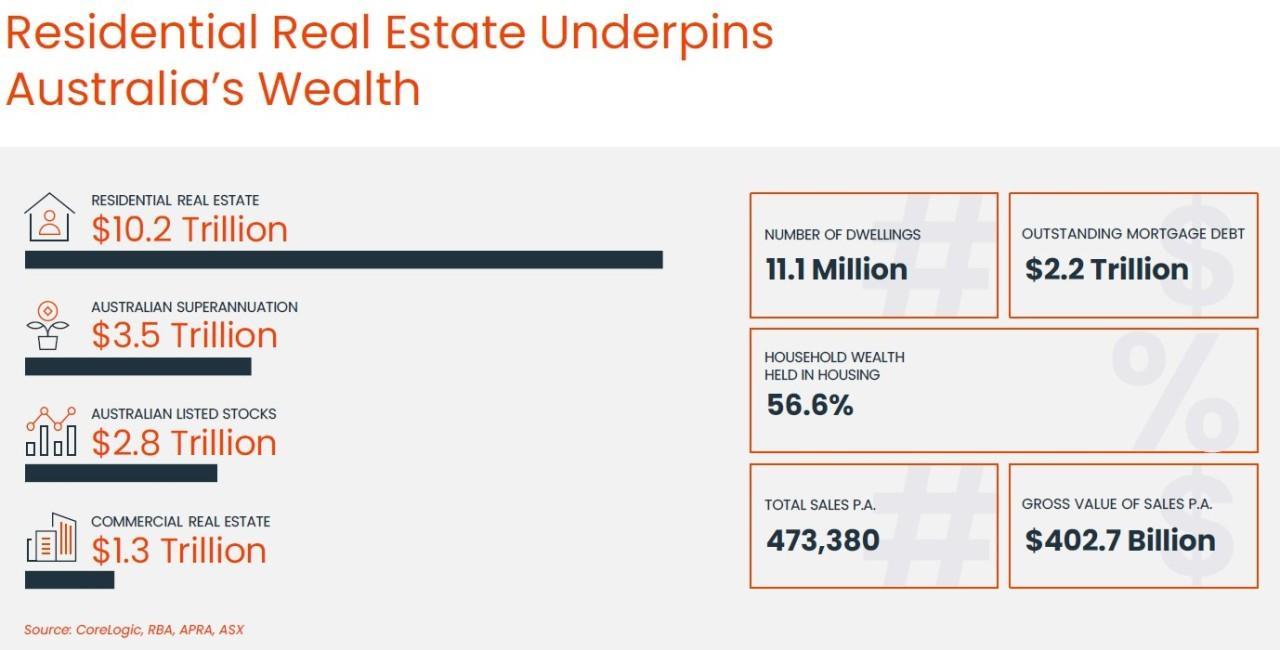

In the lead-up to Australia’s 2025 federal election, a striking figure looms over the property market: $11.1 trillion. This staggering valuation of the nation’s residential real estate—nearly three times the size of the superannuation sector—underscores the political stakes tied to housing policy. According to CoreLogic, this sector represents the bedrock of household wealth, making it a focal point for both major parties as they vie for voter trust.

Yet, the market’s trajectory is far from straightforward. A Reuters survey conducted in February 2025 revealed that home prices are projected to rise by 3.7% this year, despite persistent affordability challenges. Johnathan McMenamin of Barrenjoey notes that “homeownership remains a luxury,” with stretched price-to-income ratios sidelining many first-time buyers.

As political leaders debate reforms to negative gearing and foreign investment rules, the interplay between policy promises and entrenched market dynamics raises critical questions about the future of Australian housing.

Image source: linkedin.com

The Structure of Australia’s Property Market

Australia’s property market operates as a multi-layered ecosystem, shaped by its geographic diversity and socio-economic segmentation. Unlike markets with centralized dynamics, Australia’s structure is defined by a duality: urban hubs like Sydney and Melbourne dominate in value and activity, while regional areas exhibit distinct demand patterns driven by local industries and demographics. This bifurcation creates a complex interplay between national policies and localized market responses.

One critical factor is the disparity in housing supply elasticity. Urban centers, constrained by zoning laws and infrastructure bottlenecks, face chronic undersupply, leading to sustained price pressures. In contrast, regional markets often experience sharper fluctuations due to their reliance on specific economic drivers, such as mining or agriculture. For instance, the mining boom of the early 2010s saw towns like Port Hedland experience rapid price surges, only to face steep declines as commodity cycles shifted.

“The Australian property market is not a single entity but a mosaic of micro-markets, each with unique sensitivities to policy and economic changes,”

— Dr. Andrew Wilson, Chief Economist at My Housing Market

This fragmented structure underscores the challenge of implementing one-size-fits-all policies. Tailored approaches that consider regional nuances and urban constraints are essential for fostering balanced growth and mitigating unintended consequences.

The Role of Federal Elections in Shaping Housing Policy

Federal elections serve as pivotal junctures for housing policy, often amplifying public discourse on affordability and supply. However, the electoral cycle introduces a paradox: while campaigns spotlight housing issues, the structural complexities of the market frequently undermine the feasibility of proposed solutions. This tension underscores the gap between political promises and actionable reform.

One critical dynamic is the interplay between federal initiatives and state-level implementation. Policies like the National Housing Accord hinge on cooperation with state governments, which control zoning and planning approvals. Joey Moloney, Deputy Program Director at the Grattan Institute, highlights this challenge: “The federal government has limited levers on supply. Real progress requires alignment with state and local authorities, particularly in established suburbs where infrastructure exists.”

Comparatively, demand-side measures, such as first-home buyer grants, often exacerbate price inflation without addressing supply bottlenecks. Historical data from the 2019 election illustrates this: investor anxiety over proposed tax changes temporarily slowed the market, but supply constraints persisted, driving prices higher post-election.

To bridge this disconnect, a nuanced approach is essential—one that integrates federal funding with localized planning reforms. This synthesis could transform electoral rhetoric into meaningful, long-term housing solutions.

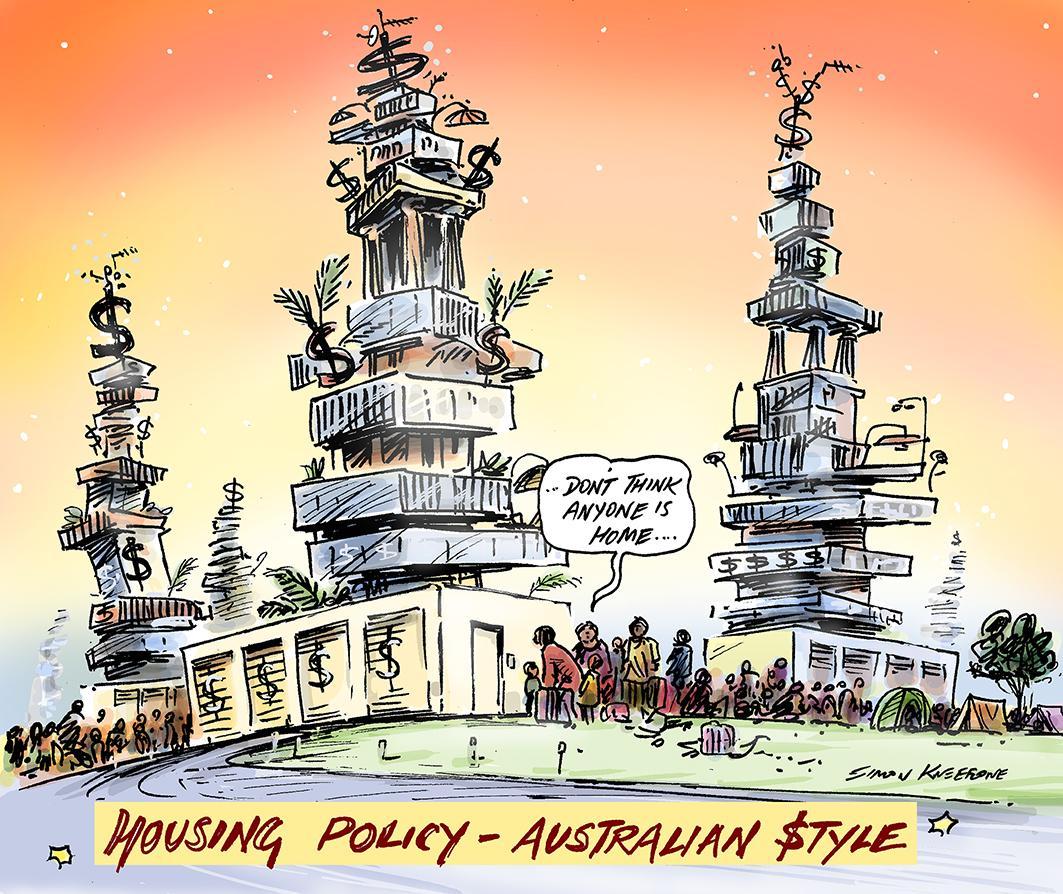

Major Party Housing Policies and Their Implications

Labor’s Help to Buy scheme, which allocates $33 billion to expand housing support, aims to lower barriers for first-home buyers by raising income caps and excluding HECS debt from mortgage calculations. While this initiative could enable broader access, historical data suggests such demand-side measures often exacerbate price inflation. For instance, a 2019 Grattan Institute report found that similar policies increased median home prices by up to 5% in high-demand areas, disproportionately benefiting sellers over buyers.

In contrast, the Coalition’s proposal to allow early superannuation withdrawals for housing deposits introduces a different dynamic. By unlocking an estimated $20 billion in superannuation funds, this policy could inject liquidity into the market. However, experts like Dr. Brendan Coates of the Grattan Institute warn that this approach risks inflating demand without addressing supply constraints, potentially driving prices higher in already overheated markets.

Both policies underscore a critical tension: while politically appealing, they fail to tackle structural barriers like zoning restrictions and construction bottlenecks. Without addressing these root causes, affordability gains may remain elusive, perpetuating systemic inequities.

Image source: simonkneebone.com

Labor’s Help to Buy Scheme: Prospects and Criticisms

Labor’s Help to Buy scheme introduces a shared equity model aimed at reducing financial barriers for first-home buyers. By allowing participants to secure properties with as little as a 2% deposit and government equity stakes of up to 40%, the policy seeks to address affordability challenges. However, its real-world implications reveal a complex interplay of benefits and risks.

One critical issue lies in the scheme’s demand-side focus. While it lowers entry costs, it inadvertently intensifies competition in high-demand markets, particularly in urban centers where supply is already constrained. According to Dr. Brendan Coates, Economics Program Director at the Grattan Institute, “Policies like this often lead to marginal price increases, as they fail to address the underlying supply bottlenecks.” This dynamic disproportionately benefits sellers, as increased buyer activity drives up property values.

Moreover, the scheme’s eligibility caps—such as the $950,000 limit in Sydney—highlight regional disparities. In cities with median prices exceeding these thresholds, the policy risks excluding many potential buyers or pushing them toward less desirable options. This limitation underscores the importance of aligning demand-side incentives with robust supply-side reforms, such as expedited zoning approvals and infrastructure investments.

A nuanced evaluation reveals that while the scheme may provide short-term relief for select buyers, its long-term efficacy hinges on addressing systemic supply constraints. Without such measures, the policy risks perpetuating affordability challenges rather than resolving them.

Coalition’s Superannuation Access Policy: Impact on Affordability

The Coalition’s superannuation access policy, which allows first-home buyers to withdraw up to $50,000 from their superannuation, fundamentally alters the affordability equation by injecting liquidity into the market. However, this approach reveals critical limitations when examined through the lens of supply-constrained housing markets.

Unlocking an estimated $20 billion in superannuation funds may initially appear to empower buyers, but the policy’s demand-side focus exacerbates competition in already overheated markets. Historical data from similar initiatives demonstrates that increased purchasing power often translates into higher property prices rather than improved accessibility. For instance, analysis by Rebecca Thistleton of The McKell Institute highlights that such schemes could add $69,000 to the average house price in Sydney, with even steeper increases in other cities.

“Injecting extra cash without addressing structural supply issues only fuels price growth.”

— Dr. Brendan Coates, Economics Program Director, Grattan Institute

A deeper issue lies in the policy’s uneven impact across demographics. Renters with low superannuation balances, often the most vulnerable, are unlikely to benefit, while wealthier individuals gain disproportionate advantages. Furthermore, the policy risks undermining retirement savings, creating long-term financial vulnerabilities.

To achieve meaningful affordability improvements, this policy must be paired with robust supply-side reforms, such as incentivizing higher-density developments and streamlining zoning processes. Without these measures, the policy risks perpetuating systemic inequities rather than resolving them.

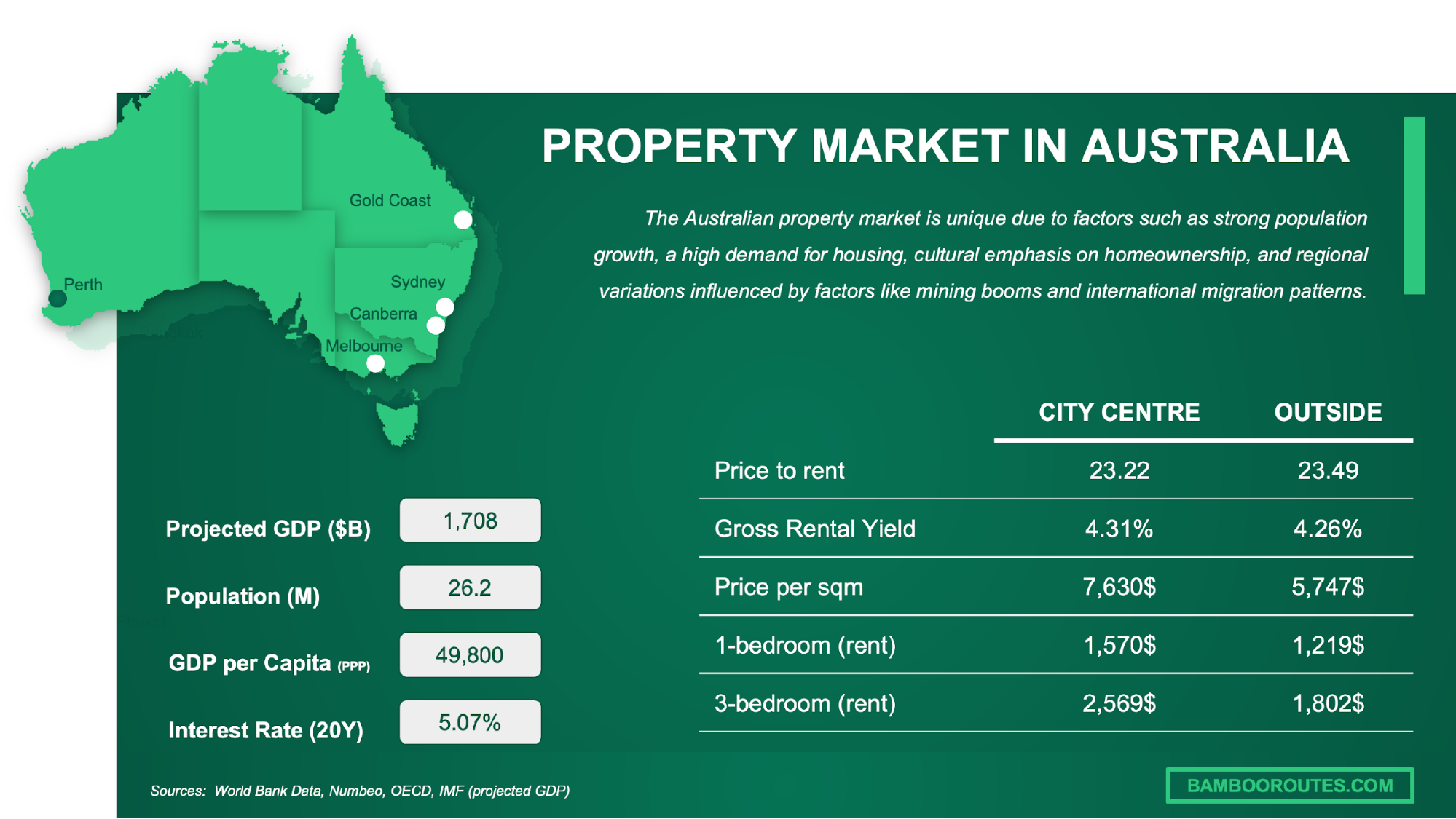

Market Performance Forecasts and Economic Influences

Australia’s property market in 2025 is poised at a critical juncture, shaped by the interplay of economic forces and political decisions. A key driver is the anticipated population growth, projected to exceed 1.5% this year, largely fueled by immigration. This surge intensifies housing demand, particularly in urban and suburban regions, where supply remains constrained. According to CoreLogic, rental prices in these areas have already risen by 9.7% year-on-year, reflecting acute shortages.

Interest rate movements further complicate the landscape. With financial markets pricing a 90% likelihood of rate cuts by August, borrowing costs could decline, potentially reigniting buyer activity. However, this optimism is tempered by construction cost inflation, which has increased by 6.2% over the past year, limiting new housing supply. This dynamic creates a paradox: while lower rates may boost demand, supply-side bottlenecks could exacerbate affordability challenges.

The market’s fragmentation adds another layer of complexity. Regional areas, often overlooked, may outperform due to lifestyle-driven migration and remote work trends. This divergence underscores the need for nuanced, region-specific policy interventions to address systemic inequities.

Image source: bambooroutes.com

Predicted Trends in House and Unit Prices

The shift toward units as a preferred housing option in 2025 reflects a deeper structural evolution in Australia’s property market. Units, often positioned as more accessible alternatives to detached houses, are increasingly favored in urban centers and emerging regional hubs. This trend is driven by affordability constraints, particularly in capital cities, where the median house price remains unattainable for many buyers. Units, with their lower price points and smaller footprints, cater to first-home buyers, downsizers, and investors seeking higher rental yields.

A critical factor influencing this divergence is the elasticity of supply. While detached housing faces significant bottlenecks due to zoning restrictions and high land costs, unit developments can often bypass these constraints through higher-density approvals. This dynamic has led to unit price growth outpacing that of houses in cities like Brisbane and Perth, where demand for compact, affordable living is surging.

“The relative strength of unit markets highlights their resilience in addressing affordability challenges,”

— Dr. Brendan Rynne, Chief Economist, KPMG

However, this trend is not uniform. In regions like Melbourne, where unit oversupply persists, price growth remains subdued. This underscores the importance of localized strategies that align supply with demographic and economic realities, ensuring balanced market performance.

Macroeconomic Factors: Interest Rates, Migration, and Construction Costs

The interplay between interest rates, migration, and construction costs forms a critical triad influencing Australia’s property market in 2025. While anticipated rate cuts—forecasted with a 90% probability by mid-year—are expected to lower borrowing costs, their impact is tempered by persistent construction cost inflation, which has risen approximately 6% year-on-year. This duality creates a paradox: cheaper financing may stimulate demand, but escalating build costs constrain supply, limiting affordability gains.

Migration adds another layer of complexity. With annual population growth projected to exceed 1.5%, the demand for housing intensifies, particularly in urban and suburban areas. However, the profile of incoming migrants—often younger, workforce-ready individuals—shifts demand toward affordable rental and entry-level housing, sectors already strained by limited inventory. This dynamic underscores the inadequacy of rate cuts alone in addressing structural supply challenges.

“Lower rates may invite more buyers, but without resolving construction delays and rising costs, affordability improvements remain illusory.”

— Dr. Brendan Coates, Economics Program Director, Grattan Institute

Localized market responses further illustrate these dynamics. In Sydney, rate cuts might temporarily boost buyer activity, yet in regional hubs, migration-driven demand and high construction costs sustain price pressures. This nuanced interaction highlights the necessity of integrated policy approaches that address both demand stimulation and supply-side bottlenecks, ensuring sustainable market performance.

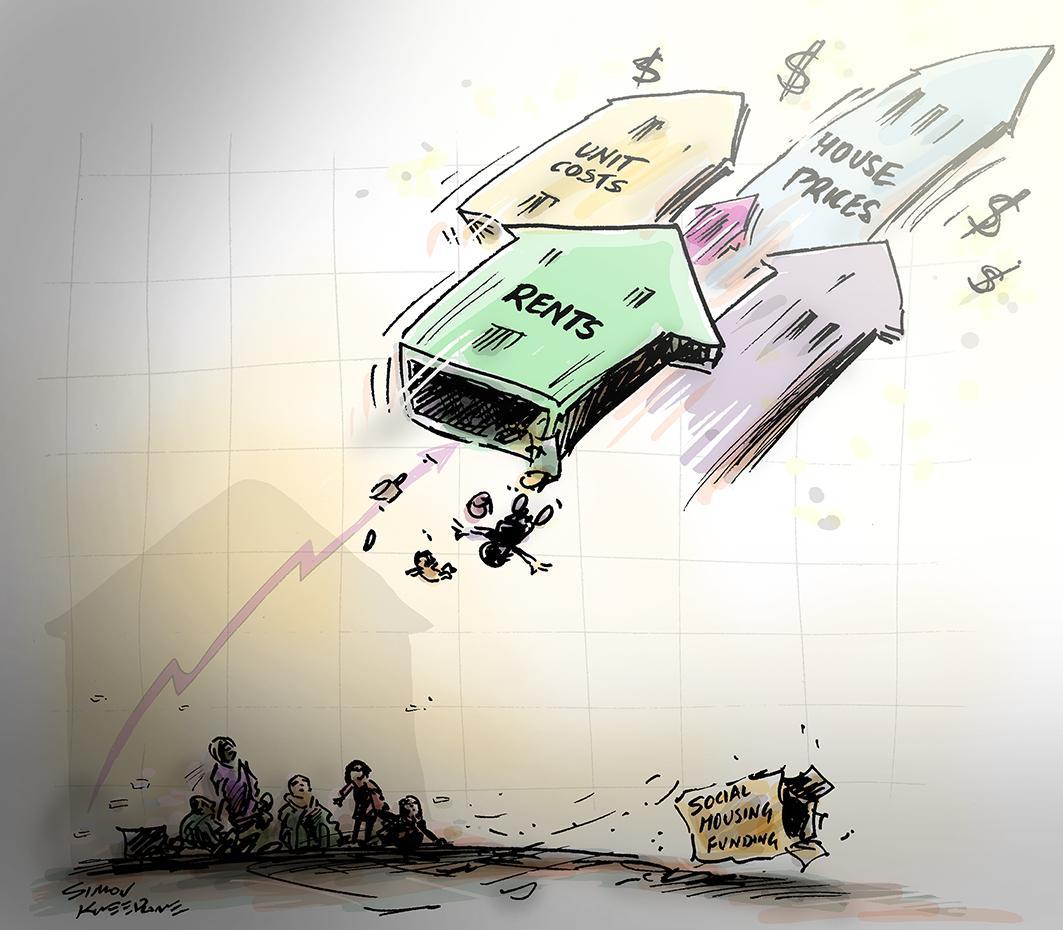

Challenges of Affordability and Supply in the Current Market

Australia’s housing market faces a dual crisis of affordability and supply, driven by structural inefficiencies and demographic pressures. With a record 715,000 migrants expected over the next two years, demand for housing is surging, yet the supply of new dwellings remains critically short. According to Domain’s Chief of Research, Dr. Nicola Powell, the rental market requires more than double the current listings to achieve balance, highlighting the acute mismatch between demand and availability.

A key factor exacerbating this issue is the rising cost of construction, which has increased by 6% year-on-year. This inflation, coupled with labor shortages, has stalled new developments, particularly in urban centers where zoning restrictions further limit expansion. The result is a market where affordability is increasingly out of reach; renters in some areas now spend over 50% of their income on housing, as reported by the ANZ CoreLogic Housing Affordability Report.

This imbalance resembles a clogged pipeline: even as demand intensifies, supply-side bottlenecks prevent relief, underscoring the need for systemic reforms targeting zoning, infrastructure, and construction efficiency.

Image source: simonkneebone.com

Persistent Supply Shortages and Rising Rents

The persistent supply shortages in Australia’s housing market are deeply rooted in systemic inefficiencies, particularly in urban centers where zoning laws and approval processes create significant delays. These constraints have led to a chronic undersupply of rental properties, driving rents to unsustainable levels. For instance, in Sydney and Melbourne, gross rental yields have begun to rise from historic lows, but this increase is insufficient to offset the financial strain on tenants, many of whom allocate over 50% of their income to housing.

A critical factor exacerbating this issue is the interplay between construction costs and labor shortages. According to the State of the Housing System 2024 report, rising material prices and a lack of skilled workers have eroded profit margins for developers, reducing their capacity to deliver new projects. This dynamic is particularly acute in regional areas, where higher construction costs and lower property values deter private investment.

“Injecting demand-side incentives without addressing supply bottlenecks only worsens affordability challenges,”

— Dr. Brendan Coates, Economics Program Director, Grattan Institute

To mitigate these challenges, a shift toward streamlined zoning reforms and incentivized high-density developments is essential. However, without addressing the financial viability of new projects, these measures risk perpetuating the current crisis.

The Shift Towards Units and Regional Properties

The increasing preference for units and regional properties reflects a strategic adaptation to Australia’s entrenched urban housing constraints. Units, often positioned as a solution to affordability, also offer a practical advantage: faster approval processes compared to detached housing. This efficiency stems from their alignment with high-density zoning policies, which bypass many of the delays associated with greenfield developments. Regional properties, meanwhile, capitalize on lifestyle-driven migration and relative affordability, creating a dual pathway for addressing housing demand.

A critical factor driving this shift is the interplay between regulatory frameworks and market dynamics. Urban zoning restrictions, particularly in Sydney and Melbourne, have made detached housing projects less viable, pushing developers toward unit construction. In regional areas, local councils have begun to streamline approval processes to attract investment, a move that has bolstered supply in high-demand regions. However, these efforts are uneven, with some councils still grappling with resource limitations.

“Streamlined approvals and targeted incentives are essential for unlocking the potential of regional and unit markets,”

— Dr. Nicola Powell, Chief of Research, Domain

Despite these advantages, challenges persist. Units often face oversupply risks in less desirable locations, while regional markets struggle with infrastructure gaps. Addressing these issues requires a coordinated approach that balances regulatory reform with strategic investment in supporting amenities.

FAQ

How will the 2025 federal election impact housing affordability in Australia’s major cities?

The 2025 federal election is poised to influence housing affordability in Australia’s major cities through competing policies addressing supply and demand. Labor’s $10 billion Housing Australia Future Fund aims to construct 1.2 million homes over five years, targeting supply shortages, while the Coalition’s superannuation access policy could increase buyer liquidity but risks inflating prices. Population growth, driven by immigration, intensifies urban demand, exacerbating affordability challenges. Regulatory reforms, such as zoning adjustments and infrastructure investments, are critical to mitigating these pressures. The election’s outcome will shape affordability by determining whether structural barriers or short-term incentives dominate the housing policy landscape.

What are the key differences between Labor and Coalition housing policies for the 2025 election?

Labor’s housing policies emphasize supply-side solutions, including the $10 billion Housing Australia Future Fund to build 1.2 million homes and expanded shared equity schemes like Help to Buy. In contrast, the Coalition focuses on demand-side measures, such as allowing first-home buyers to withdraw up to $50,000 from superannuation and offering tax deductions on mortgage repayments for new builds. Both parties propose a two-year ban on foreign property purchases, but their approaches diverge on addressing structural supply issues. Labor prioritizes long-term construction initiatives, while the Coalition leans on immediate financial incentives, potentially exacerbating affordability challenges in high-demand urban markets.

How do proposed changes to negative gearing and superannuation access affect first-home buyers?

Proposed changes to negative gearing remain absent in 2025 policies, avoiding investor disruptions but leaving structural affordability issues unaddressed. The Coalition’s superannuation access policy, allowing withdrawals of up to $50,000, boosts first-home buyers’ purchasing power but risks inflating property prices in supply-constrained markets. This measure disproportionately benefits wealthier individuals with higher super balances, sidelining low-income renters. Historical data, such as New Zealand’s KiwiSaver scheme, suggests such policies primarily benefit sellers, driving up prices. Without complementary supply-side reforms, these initiatives may exacerbate affordability challenges, limiting their effectiveness in enabling sustainable homeownership for first-time buyers in Australia’s urban centers.

What role does population growth and migration play in shaping Australia’s property market during the election year?

Population growth and migration are pivotal in shaping Australia’s property market during the 2025 election year, driving demand in urban hubs like Sydney, Melbourne, and Brisbane. Net overseas migration, projected to exceed 400,000 annually, intensifies rental shortages as new migrants predominantly rent before purchasing. This demand surge exacerbates affordability challenges, particularly in supply-constrained cities. Policies addressing housing supply, such as Labor’s construction initiatives, aim to mitigate these pressures, while the Coalition’s focus on reducing migration levels seeks to ease competition. The interplay between demographic trends and policy responses will significantly influence market dynamics and affordability outcomes in the election year.

How can voters evaluate the long-term implications of housing policies on supply and demand dynamics?

Voters can assess long-term housing policy implications by analyzing their impact on supply-demand equilibrium. Policies like Labor’s Housing Australia Future Fund address supply bottlenecks through large-scale construction, fostering sustainable affordability. Conversely, demand-side measures, such as the Coalition’s superannuation access policy, may temporarily boost purchasing power but risk inflating prices without parallel supply growth. Evaluating zoning reforms, infrastructure investments, and construction incentives is crucial to understanding supply-side effectiveness. Additionally, voters should consider demographic trends, such as migration-driven demand, and whether policies align with these pressures. A balanced approach integrating supply expansion and demand management ensures enduring market stability and affordability.