Early Retirement With An SMSF In Australia: Key Insights

In a world where retirement often feels like a distant mirage, what if the key to unlocking it early lies in taking control of your superannuation? Here’s the twist: while many Australians rely on traditional super funds, an SMSF (Self-Managed Super Fund) offers a unique pathway to financial independence—one that’s as empowering as it is complex.

But is the promise of early retirement with an SMSF too good to be true, or is it simply misunderstood? As we navigate this financial frontier, we’ll uncover how SMSFs can transform not just your retirement timeline, but your entire approach to wealth creation.

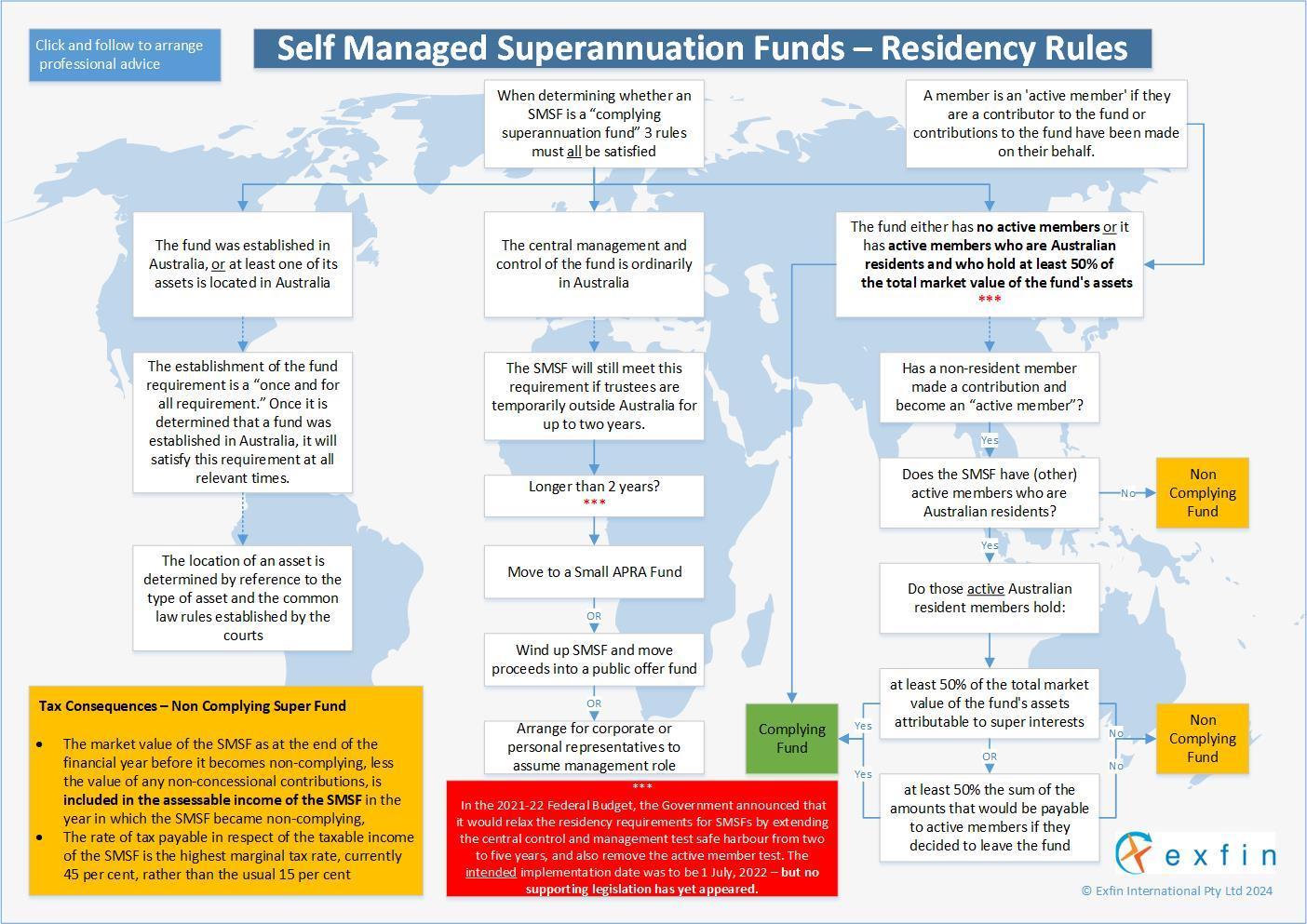

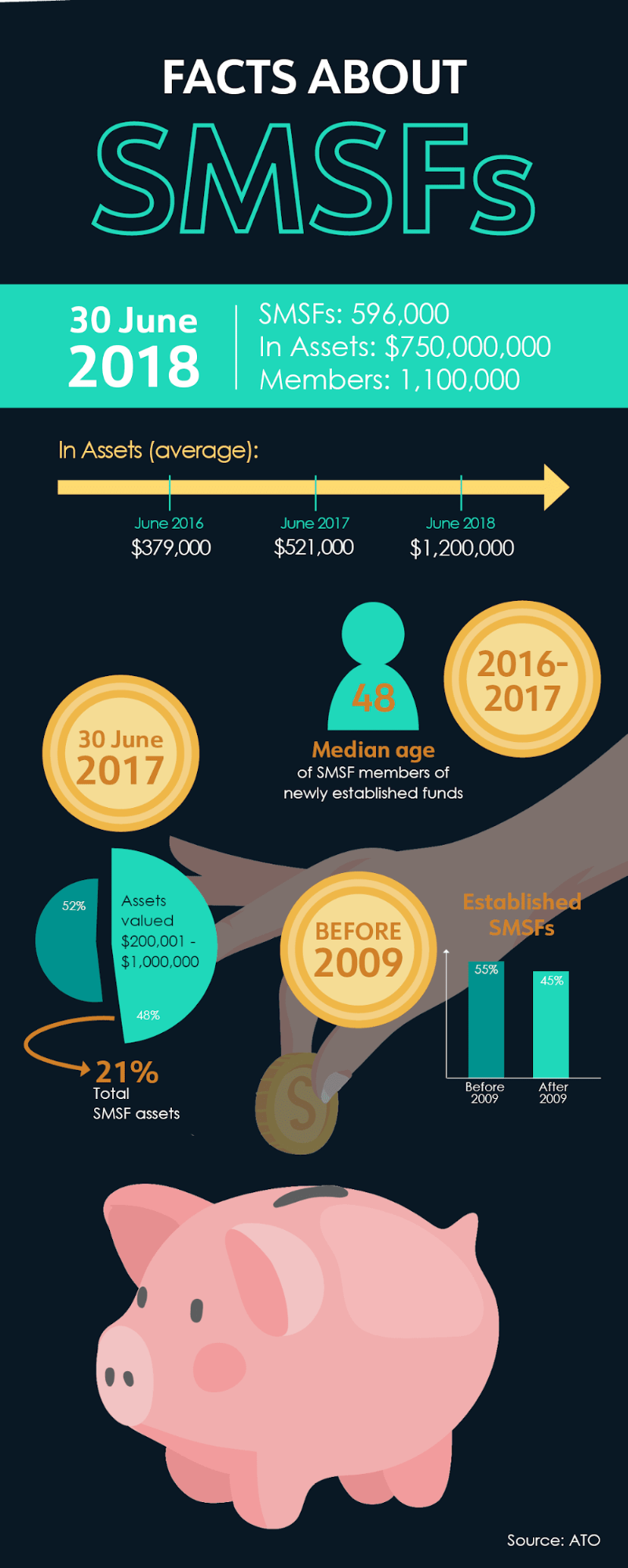

Image source: exfin.com

The Growing Interest In Early Retirement

The allure of early retirement is no longer confined to high-income earners or the financially elite. Increasingly, Australians from diverse economic backgrounds are exploring strategies like SMSFs to fast-track their financial independence. This shift is driven by a desire for greater autonomy, amplified by the casualisation of the workforce and rising housing costs, which have reshaped traditional retirement savings trajectories.

Interestingly, the FIRE (Financial Independence, Retire Early) movement has introduced a mindset shift—prioritising aggressive saving, diversified investments, and lifestyle design. For SMSF trustees, this means leveraging tailored investment strategies, such as direct property or alternative assets, to outpace conventional super funds.

The question remains: how can SMSFs balance flexibility with the discipline required for sustainable early retirement? This tension underscores the need for innovative planning and ongoing adaptability.

Why SMSFs Are A Popular Choice

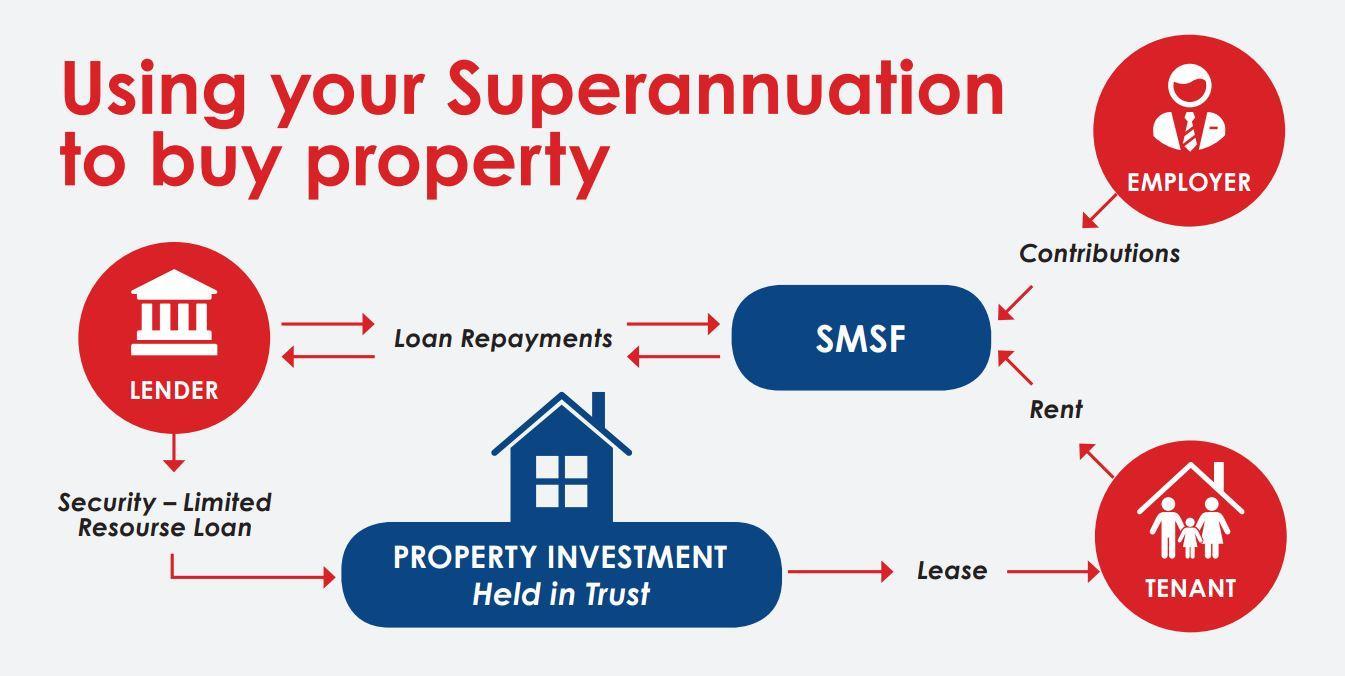

One standout reason SMSFs are gaining traction is their ability to invest in alternative assets like direct property, unlisted shares, or even collectibles. This flexibility empowers Australians to align investments with personal interests or market opportunities, creating a sense of ownership over their financial future.

Additionally, SMSFs offer tax advantages when structured strategically, such as reduced capital gains tax in pension phase. Lesser-known factors, like the ability to pool resources with family members, amplify investment potential while sharing costs.

Looking ahead, SMSFs could redefine retirement planning by blending personalisation with financial innovation, challenging the dominance of traditional super funds.

SMSF Fundamentals For Early Retirement

An SMSF is like a financial toolkit, offering unmatched control over your retirement savings. For early retirement, the key lies in crafting a tailored investment strategy. For instance, investing in high-growth property can generate rental income and long-term capital gains, while alternative assets like infrastructure provide diversification.

A common misconception is that SMSFs are only for the wealthy. In reality, pooling resources with family members can make it accessible and cost-effective. Expert advice is crucial—missteps in compliance or strategy can derail your goals. Think of your SMSF as a dynamic roadmap, evolving with your life and market shifts.

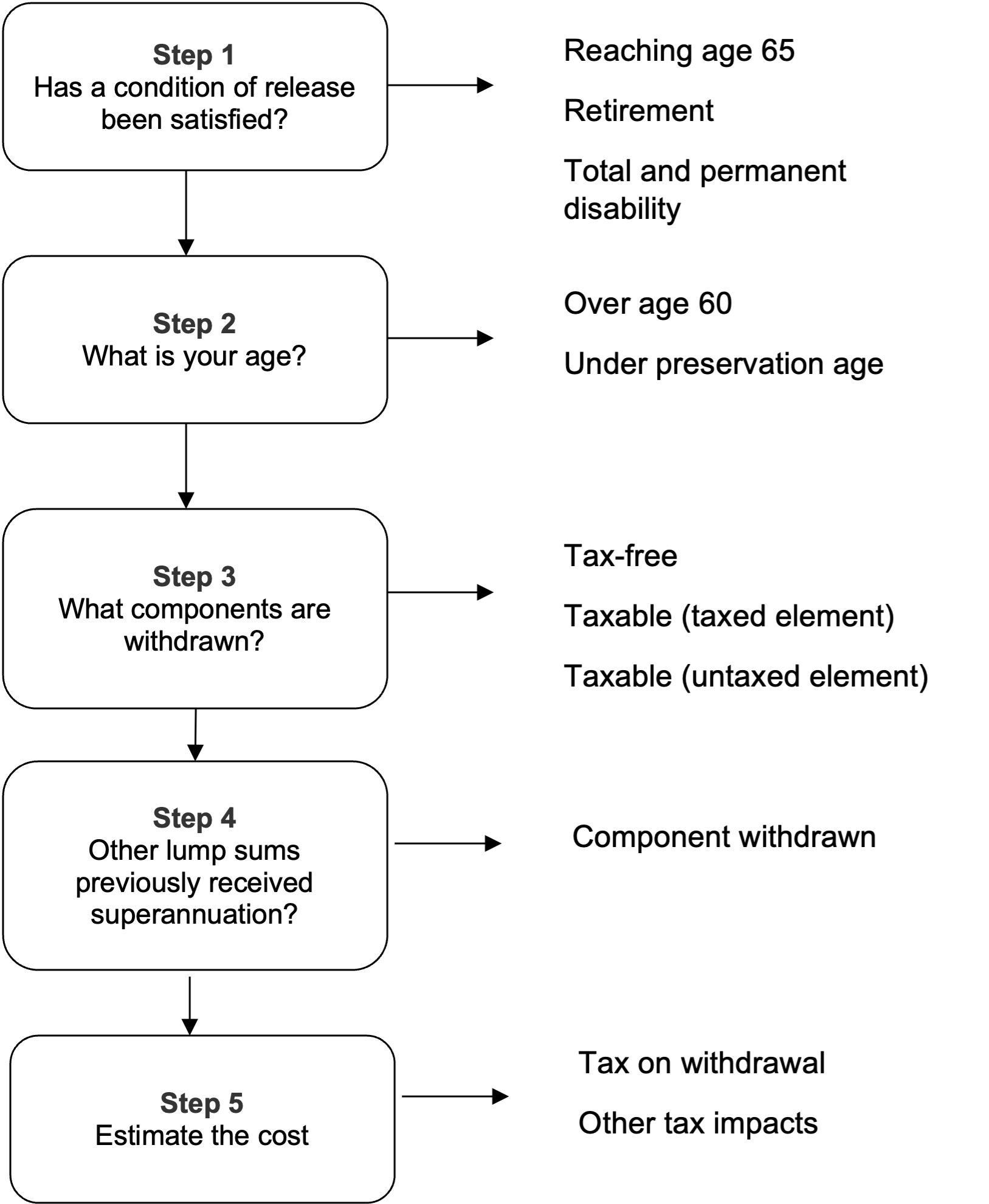

Image source: sfadvisory.com.au

Understanding Preservation Age And Conditions Of Release

Preservation age is the gateway to accessing your super, but it’s not a one-size-fits-all milestone. For example, reaching age 60 and ceasing gainful employment unlocks unrestricted access, even if you plan to work casually later. This flexibility can be a game-changer for early retirees designing phased retirement plans.

However, timing is everything. With preservation age now set at 60 from July 2024, aligning your SMSF strategy with this shift is critical. Overlooking conditions like permanent incapacity or transition-to-retirement options could mean missed opportunities. Pro tip: consult experts to navigate these nuances and maximise your SMSF’s potential.

SMSF Setup, Structure, And Regulatory Overview

A critical yet overlooked aspect of SMSF setup is the trustee structure. Choosing between individual or corporate trustees can significantly impact long-term flexibility and compliance. Corporate trustees, while costlier upfront, simplify asset ownership changes and reduce administrative headaches when members join or leave.

Additionally, regulatory compliance hinges on maintaining accurate records and adhering to the fund’s trust deed. Missteps, like failing to lodge annual tax returns, can lead to severe penalties.

Actionable tip: Engage a specialist early to ensure your SMSF structure aligns with your retirement goals and remains adaptable to future legislative changes or personal circumstances.

Key Conditions For Accessing Super Early

Accessing super early is tightly regulated, but exceptions exist for severe financial hardship, terminal illness, or compassionate grounds. For instance, a member facing foreclosure may withdraw funds to save their home, provided they meet strict criteria.

A surprising connection? Early access can erode long-term savings due to lost compounding growth—think of it as pulling bricks from a growing wall. Misconception alert: SMSFs don’t offer loopholes; trustees must comply with the same laws as retail funds.

Expert tip: Always consult a financial advisor to weigh short-term relief against long-term impacts, ensuring decisions align with your retirement strategy.

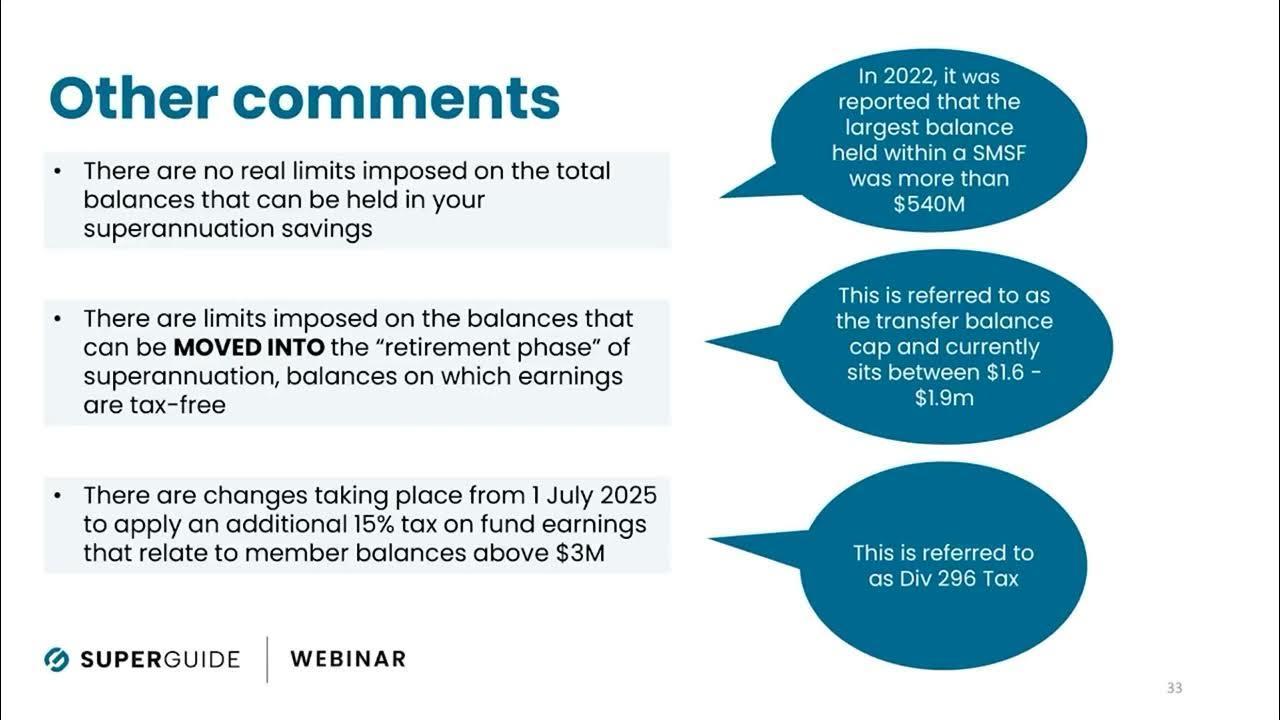

Image source: progressivefs.com.au

Special Circumstances: Severe Financial Hardship And Permanent Incapacity

Severe financial hardship and permanent incapacity offer pathways to early super access, but the process demands precision. For example, hardship claims require proof of 26 weeks of government income support and inability to meet basic living expenses. Permanent incapacity, on the other hand, hinges on medical certification confirming inability to work.

Here’s the catch: accessing funds early can significantly reduce retirement savings. Think of it as draining fuel from a long-haul journey.

Actionable insight: Pair early withdrawals with a robust financial recovery plan to mitigate long-term impacts. Expert advice ensures compliance while safeguarding your future financial stability.

Navigating The Preservation Age Spectrum

The preservation age spectrum isn’t just a timeline—it’s a strategic tool. For instance, aligning your SMSF investments with your preservation age can optimise liquidity when access is unlocked. Lesser-known factors, like transitioning to part-time work post-60, allow phased access without full retirement, blending income streams for stability.

Challenging the norm, some retirees leverage transition-to-retirement pensions to reduce work hours while maintaining cash flow. This approach balances lifestyle changes with financial security.

Actionable tip: Regularly review your SMSF strategy as you approach preservation age. Market shifts and legislative updates can redefine opportunities, ensuring your plan remains agile and effective.

Planning And Managing SMSF Investments

Effective SMSF investment planning is like crafting a bespoke suit—it must fit your goals, risk tolerance, and timeline perfectly. For example, diversifying into alternative assets like infrastructure or private equity can boost returns but requires careful liquidity management to cover unexpected costs.

A common pitfall? Overconcentration in property, which can limit flexibility. Instead, blending high-growth assets with stable income streams, such as ETFs, creates balance.

Expert tip: Regularly review your strategy, especially during market shifts or life changes. Think of it as tuning an engine—small adjustments keep your SMSF running smoothly toward early retirement success.

Image source: legalconsolidated.com.au

Establishing An Investment Strategy

A standout approach in SMSF investment strategy is leveraging risk profiling to align asset allocation with member goals. For instance, younger members might prioritise high-growth assets like international equities, while older members may favour defensive options like bonds for stability.

Lesser-known factors, such as liquidity planning, are critical—ensuring cash flow for unexpected expenses avoids forced asset sales. Additionally, incorporating ethical investing (e.g., ESG-focused funds) can align financial goals with personal values, a growing trend among Australians.

Actionable insight: Use technology tools to model scenarios and stress-test your strategy. This proactive step ensures resilience against market volatility and legislative shifts.

Balancing Growth And Stability

Striking the right balance between growth and stability in an SMSF often hinges on dynamic asset allocation. For example, blending high-growth assets like equities with stable options such as fixed income ensures both capital appreciation and risk mitigation.

A lesser-known tactic? Barbell strategies—allocating heavily to both low-risk and high-risk assets while avoiding the middle ground. This approach maximises returns while safeguarding against volatility.

Real-world application: During market downturns, stable assets can fund cash flow needs, avoiding forced sales of growth investments.

Actionable insight: Regularly reassess allocations based on market trends and member life stages to maintain optimal balance.

Transition To Retirement (TRIS) Strategies

A Transition to Retirement Income Stream (TRIS) can be a game-changer for Australians aiming to ease into retirement while maintaining financial stability. For instance, a TRIS allows you to reduce work hours without sacrificing income by supplementing earnings with SMSF withdrawals.

Unexpected benefit? It can also boost super savings through salary sacrifice strategies, reducing taxable income while increasing contributions. However, misconceptions persist—TRIS earnings are taxed at 15% unless in the retirement phase.

Actionable tip: Pair TRIS with a tailored investment strategy to balance liquidity and growth, ensuring your SMSF supports both current needs and long-term goals.

Image source: youtube.com

How TRIS Works: Practical Steps

To kick off a Transition to Retirement Income Stream (TRIS), start by confirming you’ve hit your preservation age—currently 60 for most Australians. Next, calculate how much income you’ll need, keeping in mind TRIS limits: withdrawals must be between 4% and 10% of your super balance annually.

Here’s the twist: while drawing income, your remaining super continues to grow, but earnings are taxed at 15% until full retirement. Pairing TRIS with salary sacrifice can supercharge your savings by reducing taxable income.

Pro tip: Regularly review your strategy to adapt to market shifts and evolving retirement goals.

Aligning TRIS With Work And Lifestyle Adjustments

A smart TRIS strategy can seamlessly blend reduced work hours with financial stability. For example, transitioning to part-time work while supplementing income through TRIS allows you to maintain your lifestyle without overburdening your super.

Lesser-known factor? Flexible payment schedules—fortnightly or monthly TRIS payments—can align with your cash flow needs, reducing financial stress. Additionally, combining TRIS with salary sacrifice boosts super contributions while lowering taxable income, creating a win-win scenario.

Actionable insight: Use TRIS to fund lifestyle upgrades, like travel or hobbies, while still growing your super. Regularly reassess your plan to adapt to evolving goals and market conditions.

Tax Implications And Compliance

Managing SMSF tax obligations is like fine-tuning an engine—precision is key. For instance, concessional contributions are taxed at just 15%, but exceeding caps triggers hefty penalties. A surprising twist? In the pension phase, investment earnings can become tax-free, offering a massive boost to retirement savings.

Misconception alert: SMSFs don’t offer tax loopholes; strict compliance with ATO rules is non-negotiable. Case in point: failing to lodge annual returns can lead to fines or fund disqualification.

Actionable tip: Leverage expert advice to optimise tax strategies while staying compliant. Think of it as building a safety net for your financial future.

Image source: hailstonco.com.au

Account-Based Pensions And Tax-Free Withdrawals

Account-Based Pensions (ABPs) offer retirees unmatched flexibility, but their real magic lies in tax-free withdrawals for members over preservation age. Here’s the kicker: earnings on assets supporting ABPs are also tax-free, amplifying long-term savings.

A lesser-known factor? The Transfer Balance Cap (currently $1.9 million) limits how much can enter the tax-free pension phase, requiring strategic planning to avoid excess tax. For example, splitting super balances with a spouse can optimise tax outcomes.

Actionable insight: Regularly review your ABP strategy to align with legislative changes and market conditions, ensuring your SMSF remains a powerful tool for wealth preservation.

Updating Trust Deeds And Adhering To ATO Requirements

Keeping your SMSF trust deed up-to-date is like maintaining a car—neglect it, and you risk breakdowns. Legislative changes, like the Transfer Balance Cap or downsizer contributions, can render outdated deeds non-compliant. A modern trust deed ensures flexibility, allowing strategies like pooling resources or leveraging new tax concessions.

Lesser-known insight? Restrictive deeds can block innovative investment options, limiting growth potential. For example, failing to update for the six-member rule could exclude family members from joining.

Actionable tip: Schedule annual reviews with a legal expert to future-proof your deed, ensuring it aligns with evolving ATO regulations and your retirement goals.

Pitfalls And Considerations For Early Retirement

Early retirement with an SMSF can feel like a dream, but hidden challenges often derail plans. For instance, overestimating investment returns can lead to a shortfall in later years, especially during market downturns. A common misconception? That SMSFs offer shortcuts to access funds early—strict regulations prove otherwise.

Unexpected twist: Longevity risk—outliving your savings—is amplified when retiring early. Balancing growth and stability becomes critical. Expert advice highlights the importance of liquidity planning; without it, forced asset sales during emergencies can erode wealth.

Actionable insight: Regularly stress-test your SMSF strategy against worst-case scenarios to ensure long-term sustainability and adaptability.

Image source: legalwiseseminars.com.au

Common Misconceptions And Unexpected Costs

One major misconception is that SMSFs inherently reduce costs compared to traditional super funds. While SMSFs offer control, hidden expenses like compliance fees, audit costs, and investment management can quickly add up. For example, failing to meet minimum pension payments can trigger tax penalties, eroding savings.

Unexpected costs? Market downturns often force asset sales at a loss, especially if liquidity isn’t planned. Overconcentration in property amplifies this risk, leaving funds vulnerable.

Actionable insight: Build a liquidity buffer and diversify investments to handle unforeseen expenses. Regularly review costs with a financial advisor to ensure your SMSF remains cost-effective and sustainable.

Safeguarding Retirement Savings For Long-Term Security

A critical yet overlooked strategy is integrating dynamic asset rebalancing to protect against market volatility. By periodically adjusting your SMSF portfolio, you can maintain the ideal mix of growth and defensive assets, ensuring stability without sacrificing returns.

Lesser-known factor? Inflation risk. Ignoring it can erode purchasing power over time. Including inflation-linked bonds or assets like infrastructure can hedge against this.

Real-world tip: Use scenario modelling tools to stress-test your portfolio against economic shifts. This proactive approach ensures your SMSF remains resilient, adapting to market changes while safeguarding your retirement savings for decades to come.

FAQ

What are the key benefits of using an SMSF for early retirement in Australia?

SMSFs offer unparalleled control over investments, enabling tailored strategies like high-growth property or alternative assets. Tax advantages, such as reduced rates during accumulation and tax-free income in retirement, amplify savings. Additionally, SMSFs allow resource pooling with family, enhancing investment potential while fostering a personalised, flexible approach to achieving early retirement goals.

How can SMSF trustees effectively balance growth and stability in their investment strategy?

SMSF trustees can balance growth and stability by adopting dynamic asset allocation, blending high-growth investments like equities with stable options such as bonds. Incorporating barbell strategies—combining low-risk and high-risk assets—mitigates volatility. Regular portfolio reviews and scenario modelling ensure alignment with market conditions and evolving retirement goals, safeguarding long-term financial security.

What are the legal and regulatory requirements for accessing superannuation early through an SMSF?

Accessing superannuation early through an SMSF is strictly regulated, requiring compliance with ATO conditions such as severe financial hardship, terminal illness, or compassionate grounds. Trustees must adhere to preservation age rules and avoid illegal withdrawals, as breaches result in penalties, disqualification, and long-term financial and reputational consequences.

How does the preservation age impact early retirement planning with an SMSF?

The preservation age determines when SMSF members can access superannuation benefits, influencing retirement timelines. From July 2024, it is set at 60, aligning with phased retirement strategies like Transition to Retirement Income Streams (TRIS). Planning around this milestone ensures liquidity, compliance, and optimised investment strategies for sustainable early retirement.

What are the common pitfalls SMSF trustees should avoid when planning for early retirement?

Common pitfalls include overestimating investment returns, neglecting diversification, and failing to plan for liquidity needs. Ignoring inflation risks and longevity concerns can deplete savings prematurely. Additionally, non-compliance with regulations or inadequate tax planning may lead to penalties. Regular reviews and expert advice are essential to avoid these costly mistakes.