High Population Density’s Effect on Housing Trends

According to CoreLogic research director Tim Lawless, the population growth in Australia is reshaping housing trends significantly. “With Australia’s population moving through the fastest rate of growth since the 1950s, our cities and towns are naturally densifying,” Lawless said. He said that despite Australia’s overall low population density of 3.5 people per square kilometer, the majority resides in major cities, leading to a skewed representation of density and its effects. You may read the whole article here:https://tinyurl.com/yc2wfa3r

High Population Density Hampering Unit Value Growth: Corelogic

Areas with high population density have been found to dampen value growth in units, CoreLogic’s research director has said. CoreLogic’s latest Property Pulse research has indicated that there is a significant relationship between unit values and population density. This data comes as CoreLogic (in collaboration with ANZ) found that the latest estimate of median annual household income nationally is $100,244 before taxes and assuming 30 percent of this income is used on mortgage repayments at current average variable rates (around 6.3 percent), an affordable dwelling purchase would be around $503,000. However, as home values continue to climb, this affordable purchase price is below most actual dwelling values as the median Australian unit price sits around $640,000, while the median house price is around $834,000. You may read the whole article here:https://shorturl.at/bkmq9

Australian Housing Crisis Set to Intensify

According to Deloitte Access Economics, Australia’s ongoing housing crisis is projected to intensify before any improvement is seen, putting pressure on the federal government to address these issues in the upcoming May budget. “The cost of land, materials, and labour will stay at higher levels, while recent insolvency rates suggest builders will need bigger profit margins if they are to deliver the significant lift in dwellings that governments and the community are crying out for,” said Stephen Smith, partner at Deloitte Access Economics, in the firm’s latest business outlook report. Building challenges and economic pressuresSmith expressed concern that achieving the national goal of constructing 1.2 million new homes from mid-2024 may not be feasible due to the current construction pace, hindered by sluggish new dwelling starts and a backlog of unfinished homes plaguing builders, according to an NCA Newswire report. “The correcting [of] the housing crisis will take years and will get quite a lot worse before it gets better,” Smith said. You may read the whole article here:https://bit.ly/3Qct4V6

Seeking Solutions for Housing Affordability

Richard Yetsenga, chief economist at ANZ, challenged the notion that increasing housing supply is the silver bullet for Australia’s affordability issues, arguing that a market-based supply response alone is insufficient. “Much of the discussion around Australia’s worsening housing affordability challenges offers a market-based supply response as the ideal solution,” Yetsenga said in a recent analysis. “But responding to these challenges with new supply, in the absence of pushing just as hard on other policies, is unlikely to materially improve affordability, even in the medium term.” Economic and market dynamics complicate new buildsThe complexities of the housing market, including diseconomies of scale and speculative behaviours, contribute to the difficulty in addressing affordability through new construction alone. You may read the whole article here:https://bit.ly/4aLmUn0

Australian Company Failures Surge – ASIC

There is a concerning rise in the number of failing Australian companies, latest insolvency data from the Australian Securities & Investments Commission (ASIC) has shown. During the nine-month period from July 2023 to March 2024, a total of 7,742 companies entered external administration, marking a 36.2% increase compared to the same period in the previous year. The construction sector, with 2,142 companies, and the accommodation and food services industries, with 1,174 failures, were the hardest hit, accounting for approximately 27.7% and 15.2% of the total, respectively. You may read the whole article here:https://bitly.ws/3ijFS

HIA-COLORBOND® Steel Housing 100 Report 2021-2022

On September 21st, the HIA-COLORBOND® steel Housing 100 Report was released, which ranks Australia’s largest 100 residential builders based on the number of homes commenced each year. HIA Chief Economist, Tim Reardon stated, “For the seventh consecutive year, Metricon Homes was revealed as the nation’s largest residential builder. Metricon Homes reported a total of 5,969 home starts, marginally lower than the 6,052 starts the previous year. These starts were across Victoria, Queensland, New South Wales and South Australia.” MJH Group (NXT Building Group) takes the second spot with 4,143 starts, and Hutchies came in third with 3,829. According to Mr. Reardon, “The supply of building materials has improved significantly in recent months. Shipping costs are declining and the rise in building material costs on the ground is slowing. In some cases, prices have fallen. The cost of building will continue to increase in 2022/23, but at a slower rate than last year.” The key highlights from this report show that the largest 100 residential builders: Reduced their share of the new home building market from 44 per cent (all-time high) in 2020/21 to 36 per cent in 2021/22. Accounted for 77 per cent of the detached homes built in Australia in 2021/22. Built 15.0 per cent fewer homes, from 88,215 home starts in 2020/21 to 74,973 in 2021/22. Built 4.0 per cent fewer detached houses compared to the previous year, 21.3 per cent more multi-units. Despite this fall in the number of homes, earned 8.8 per cent more revenue from home construction, up to $34.7 billion in 2021/22 due to the rise in the cost of construction. Your next investment property can be built by the country’s largest builder with whom we are proud partners! Talk to our property investment specialist now.

What is FIRB Approval?

If you don’t have the Permanent Resident visa yet but don’t want to miss the investment opportunities in Australia? It’s the first & most important step in buying a property in Australia as a non-resident. This application process is compulsory & must be made before any binding contract for the purchase of property or businesses can be entered into. Simply Wealth will offer you free assistance in FIRB applications. The Foreign Investment Review Board (FIRB) is an Australian Government agency that helps administer the foreign investment policy. The FIRB advises the Australian Government on applications from foreign persons to invest in Australia.

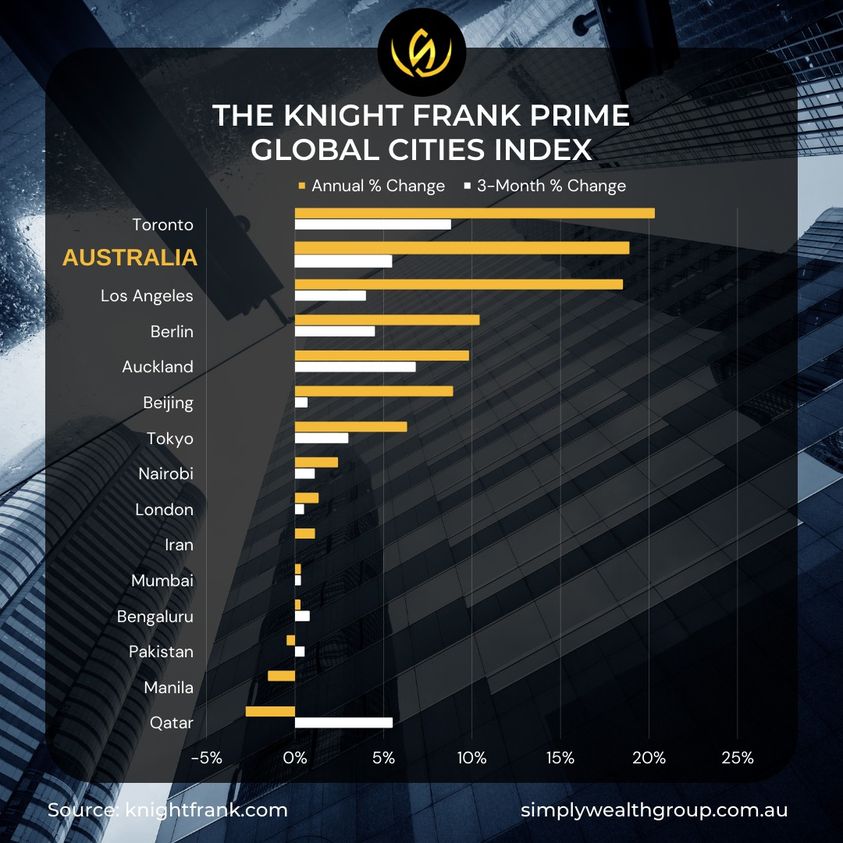

Knight Frank Prime Global Cities Index

Australia’s demonstrated economic resilience, adaptability, and record of steady growth provide a safe, low-risk environment in which to do business. Now in its 26th year of consecutive annual economic growth, the Australian economy is underpinned by strong institutions, an exceptional services sector, and an ability to respond to global changes. Australia’s economy is: * the world’s 13th largest rated AAA by all three global rating agencies * forecast to realize average annual real GDP growth of 2.9 percent over the next five years – the highest among major advanced economies * characterized by high productivity levels, with 15 out of 20 industries rating above the global average. Check out our next post for the reasons why do you need to invest in Australia and not in other countries. Come along to find out exactly how, so that we can get an understanding of your current situation!

Why Purchase Property in Australia?

There are many great reasons to purchase property in Australia. Whether you’re a first home buyer, an investor, a downsizer, or wanting to relocate and looking for a stable country to raise a family, Australia ticks all of these boxes. Now is the great and right time to purchase a property! Following are some of the major factors driving Investors, First Home Buyers, and Immigrants to buy property in Australia: Record low-interest rates and government incentivesConsistent growth performanceLong-term securityEasy to investTax AdvantageStrong Real Estate MarketAccessible for ForeignersLiving StandardConsistent GDP GrowthPopular Tourist DestinationEye-catching InfrastructureInnovation and Entrepreneurial HubStriking EconomyFlourishing Industries It’s clear to see that investment in Australia offers a wide range of benefits, long-term security and easy access to one of the most supportive environments for capital growth potential

Do you know what’s great about Australia?

Do you know what’s great about Australia? Just about everything, really. But a few things, in particular, stand out: the beautiful natural environment, the multicultural society, and the fact it’s one of the most progressive countries on earth. All these factors make Australia one of the world’s most livable cities. With its wealth of outdoor attractions, excellent liveability, and the sheer number of opportunities, it is as good a time as ever to consider Australia as a potential location for your new life abroad. Stay tuned and check out our next post for more reasons why investing in Australia is the best idea! Come along to find out exactly how, so that we can get an understanding of your current situation!